Smart Office and Audio-Visual Solutions Sector M&A Transactions and Valuations

Smart Office and Audio-Visual Solutions Sector M&A Transactions and Valuations

Smart office and audio-visual solutions combine professional AV systems, unified communications, collaboration devices, and intelligent workspace platforms that modernize communication across corporate, education, healthcare, commercial, and public-sector environments. Core capabilities span video conferencing, meeting-room hardware, digital signage, workspace sensing, control-system integration, and cloud-managed platforms that deliver consistent, high-performance collaboration across distributed teams and connected physical spaces.

The sector includes global AV integrators expanding into managed and unified-communications services, device manufacturers introducing AI-enabled room systems, and software providers delivering orchestration, automation, and analytics. Hybrid-work adoption, workplace modernization, and cloud-communication growth continue to accelerate overall market expansion.

This report examines M&A activity, valuation trends, and strategic shifts from Q4 2020 to Q3 2025, highlighting the widening valuation gap between traditional integration- and hardware-centric providers and next-generation platforms offering AI-driven capabilities, recurring managed-services revenue, and cloud-orchestrated device ecosystems. Key transactions, including 26North Partners’ acquisition of AVI-SPL, Econocom Group’s acquisition of Image Supply Systems, and Kinly’s acquisition of AVM Impact—illustrate how buyers are scaling platform capabilities, deepening enterprise and public-sector exposure, and strengthening recurring revenue through integrated digital-workplace infrastructure.

Sector Dynamics and Competitive Value Creation in the Smart Office and Audio-Visual Solutions Market

The sector is undergoing rapid transformation driven by the acceleration of hybrid work, advances in AI-powered collaboration, and modernization of meeting environments worldwide. Organizations are adopting intelligent devices, software-defined room systems, and cloud-managed platforms to enhance productivity and streamline communication. Competitive positioning increasingly depends on providers’ ability to deliver integrated solutions, improve operational efficiency, and deploy scalable platforms across diverse customer environments. These dynamics establish the core growth drivers and value-creation themes shaping investment and strategic expansion.

EXHIBIT 1

Growth Drivers in the Smart Office and Audio-Visual Solutions Sector

AI-Enhanced Collaboration and Intelligent Workspace Automation

AI capabilities are reshaping conferencing systems, headsets, and room devices by enabling automated framing, noise optimization, content generation, and self-adjusting room behavior. As meeting environments shift toward software-defined functionality, organizations adopt automated rooms that improve communication quality and reduce manual setup.

Expanding Enterprise and Education Investment in Hybrid-Work Infrastructure

Corporate, commercial, and education customers continue increasing investment in modern AV systems and workspace devices. Demand is reinforced by hybrid-work requirements, frequent technology refresh cycles, and the need to maintain consistent collaboration experiences for both in-person and remote participants.

Platform Scaling Supported by Regional Execution and Global Standardization

Providers are extending their platforms into new markets by combining regional delivery capabilities with globally consistent device and software architectures. This approach strengthens international penetration and accelerates adoption of smart-office solutions across varied customer environments.

Source: Baptista Research, Logitech International S.A. Fundamental Equity Research Report (Jan 2025); Morningstar, Acuity Inc. Equity Analyst Note & Valuation Model (Oct 2025).

EXHIBIT 2

Competitive Positioning and Value Creation Themes

Source: Baptista Research, Logitech International S.A. Fundamental Equity Research Report (Jan 2025); Morningstar, Acuity Inc. Equity Analyst Note & Valuation Model (Oct 2025).

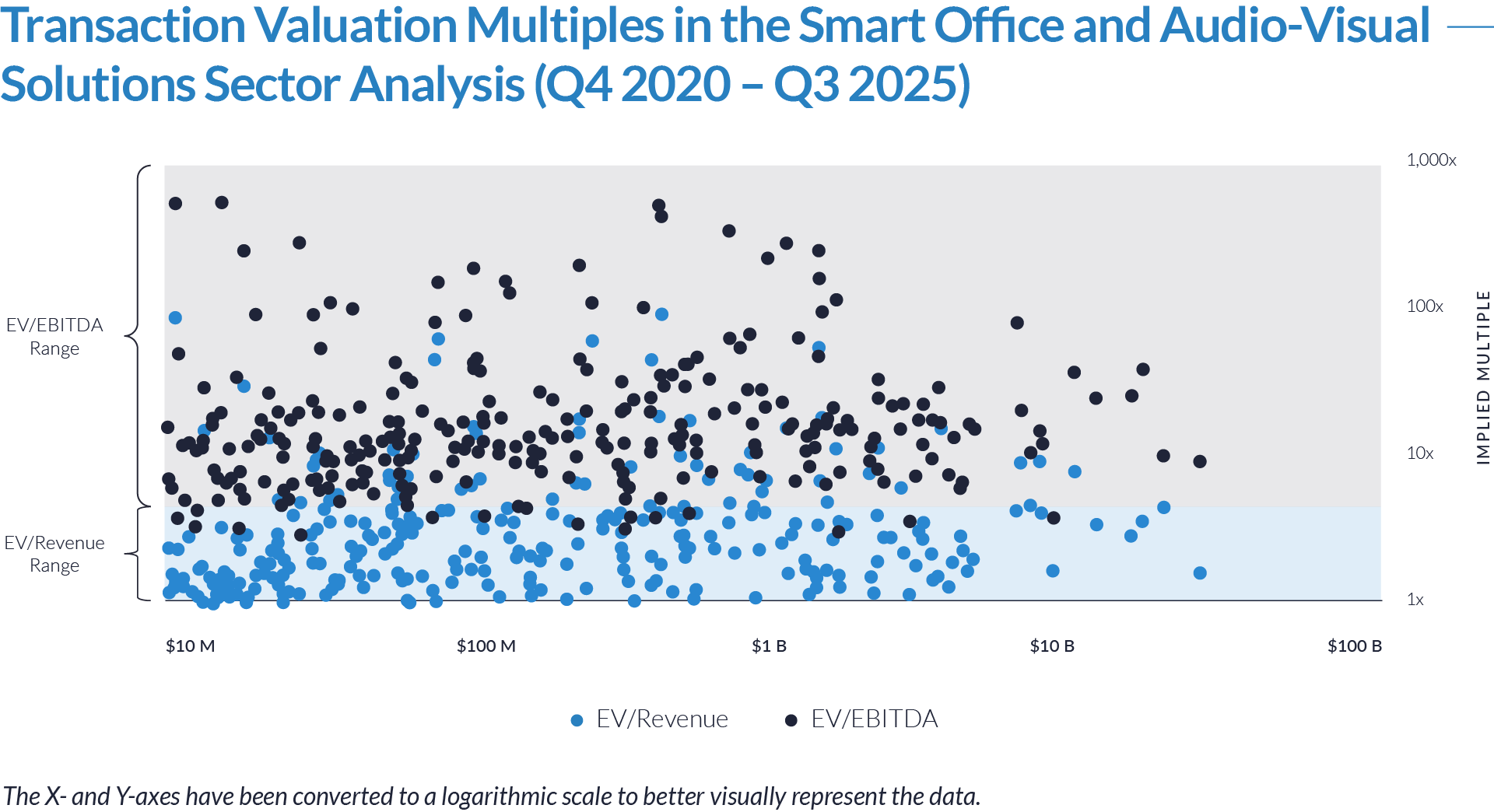

- Valuation multiples are based on a sample set of M&A transactions in the smart office and audio-visual solutions sector using data collected as of December 9, 2025.

- Valuations reveal a distinctly divided market as most companies trade at 2x–5x EV/revenue, while a small group of AI-enabled, software-centric collaboration platforms command extreme premiums of 20x–95x. This spread underscores the performance gap between recurring software ecosystems and traditional hardware or integration models.

- EV/EBITDA multiples vary widely from 3x to over 500x as profitability profiles diverge. Unified Communications as a Service (UCaaS), workflow-automation, and managed-services providers secure premium multiples, while equipment-resale and installation-driven businesses cluster at lower, margin-compressed levels.

- Enterprise values exceeding $5 billion – $25 billion demonstrate the dominance of global AV integrators and digital-workplace infrastructure leaders. Their scale, multi-region delivery, and lifecycle-service platforms reinforce consolidation momentum and sustain strong investor interest in platform-building strategies.

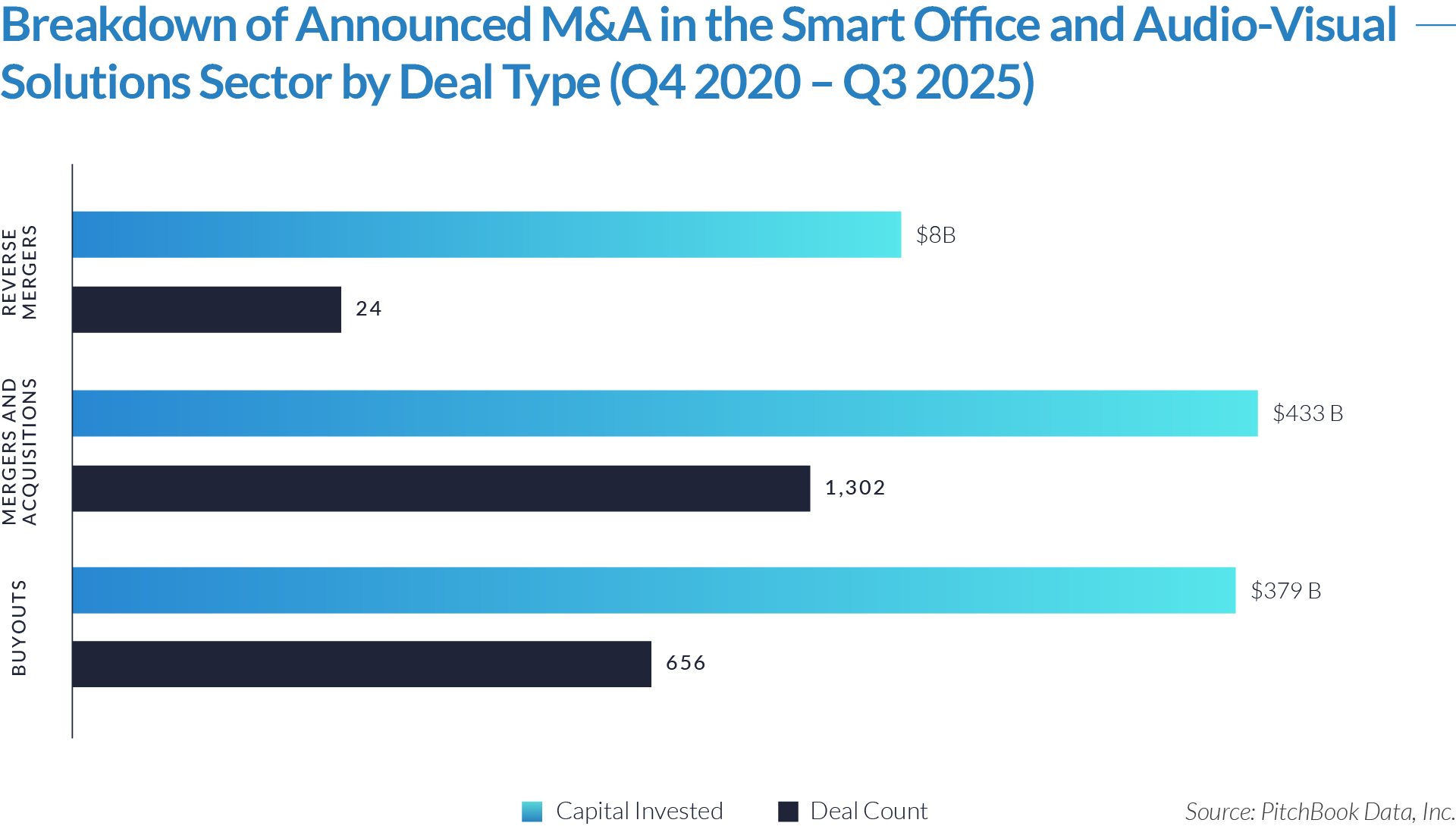

Capital Markets Activities

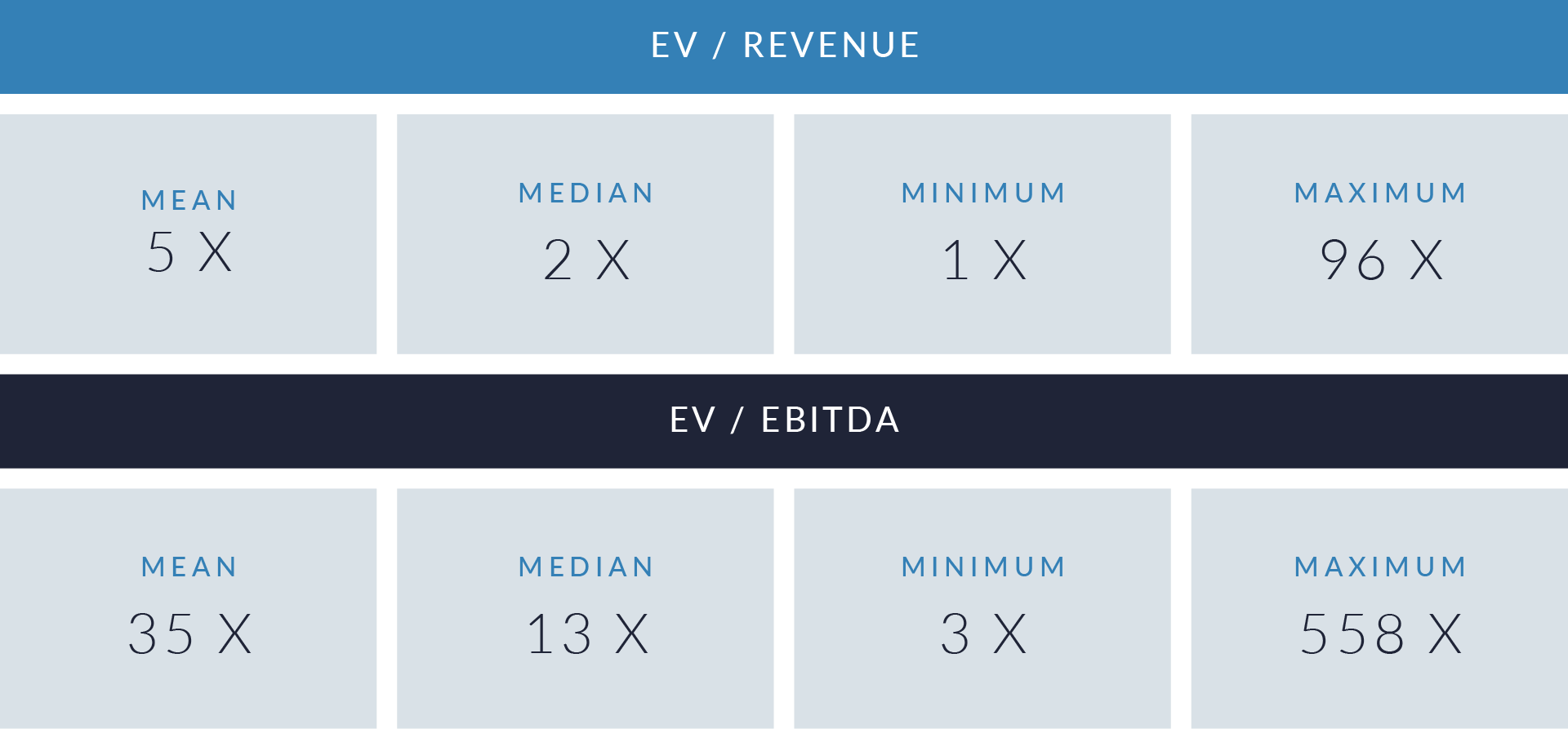

The data highlights strong and sustained M&A activity across the smart office and audio-visual solutions sector, supported by ongoing investment in digital-workspace infrastructure and unified-communications technologies. Strategic buyers and private equity continue to target scalable AV integration platforms, software-enabled collaboration providers, and managed-services models that offer recurring revenue and global delivery capabilities. Activity remains broad-based across the United States, key secondary markets, and international regions, reflecting widespread adoption of smart-office automation, cloud-managed AV systems, and continuous modernization of enterprise and education environments.

- Across the 20-quarter period, investors deployed approximately $818 billion across 1,982 transactions, demonstrating a consistently active market supported by recurring demand for digital-workspace infrastructure and enterprise collaboration technologies.

- Capital deployment surged to historic highs in 2021, reaching $70 billion – $77 billion in Q2 and Q3, as enterprises accelerated post-pandemic modernization and scaled cloud-enabled AV and unified-communications platforms. This period represents the sector’s most aggressive expansion cycle.

- Despite macroeconomic tightening in 2023, quarterly deal volumes remained stable within the 67 – 96 range, reflecting the sector’s depth and resilience. Middle-market integration activity and ongoing collaboration-technology refresh cycles sustained deal flow even as capital availability contracted.

- The renewed upswing beginning in 2024, with Q3 and Q4 capital inflows rebounding to approximately $51 billion and $60 billion, signals rising investor conviction in smart-office automation, hybrid-work orchestration, and managed-services platforms. This upward momentum reestablished growth conditions and set the stage for continued platform expansion.

- Early 2025 trends show a moderated yet stable investment environment, with quarterly capital deployment ranging from $30 billion – $42 billion and deal volumes stabilizing between 58 – 74 transactions. These levels indicate a shift from post-rebound acceleration toward a more normalized market rhythm, where strategic buyers focus on targeted consolidation, software-driven differentiation, and lifecycle-service expansion.

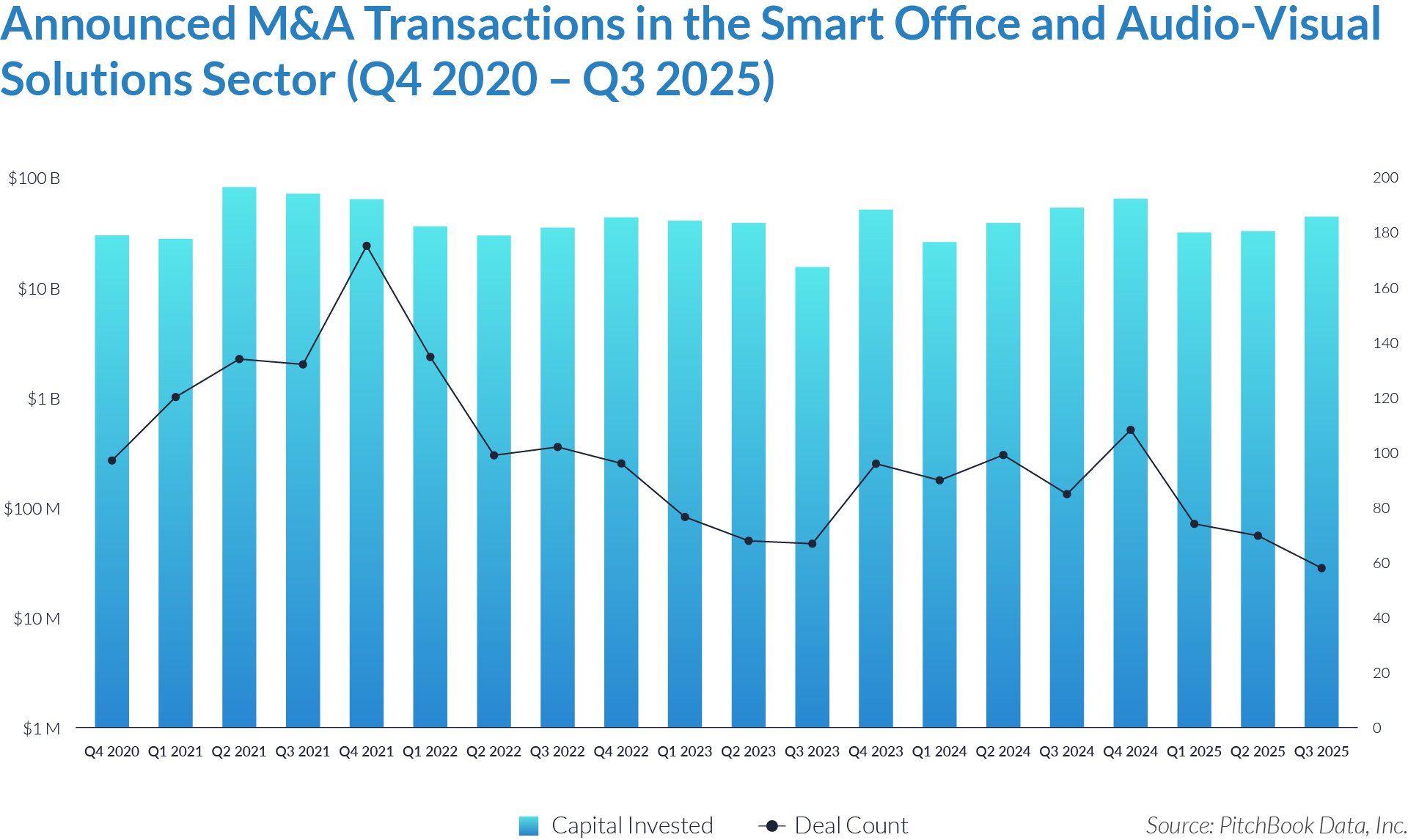

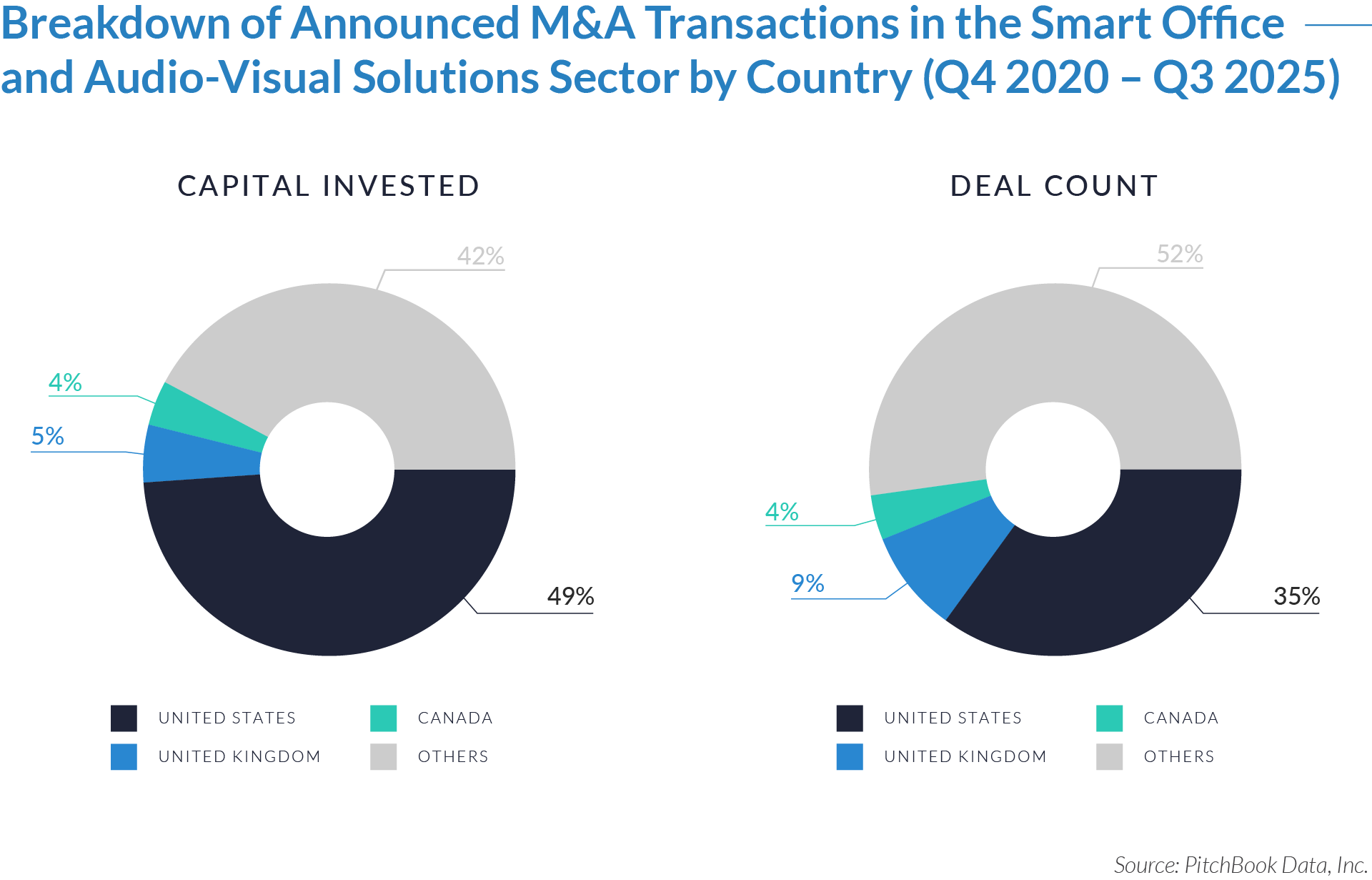

- The United States remains the sector’s primary investment hub, capturing 49% of total deployed capital and 35% of global deal activity. Its scale of enterprise buyers, concentration of AV integrators, and continued leadership in unified communications and digital-workspace technologies reinforce its central position in the market.

- The United Kingdom and Canada together represent 9% of capital and 13% of deal volume, positioning them as secondary yet strategically significant markets. Enterprise modernization cycles and strong adoption of hybrid-work technologies continue to support steady activity in both regions.

- International and emerging markets account for 42% of capital and 52% of deal activity, reflecting the sector’s broad global expansion across Europe, APAC, and the Middle East. Rising demand for smart-office infrastructure and collaboration technologies is accelerating cross-border consolidation and strengthening international investment momentum.

- Traditional M&A remains the sector’s dominant transaction channel, accounting for $433 billion in deployed capital and more than 1,300 deals. This activity reflects a highly engaged ecosystem of strategic consolidators and cross-platform integrations across the smart-office and AV-solutions landscape.

- Buyouts continue to drive a substantial share of sector investment, with private equity deploying $379 billion across 656 transactions. These levels demonstrate strong sponsor conviction in scalable integration platforms, recurring managed-services models, and cross-portfolio roll-up strategies.

- Reverse mergers represent only a marginal portion of activity, $8 billion across 24 deals, indicating limited reliance on public-market entry pathways and reinforcing that value creation in this sector is primarily realized through strategic M&A and PE-backed buyout structures.

M&A Transactions Case Studies

Three transactions in the smart office and audio-visual solutions sector highlight how strategic acquirers are scaling collaboration platforms, expanding AV-integration capabilities, and strengthening managed-services offerings across enterprise and public-sector environments. Buyers are targeting companies with strong engineering expertise, unified-communications integration, and recurring digital-workplace services to drive platform consolidation, deepen customer exposure, and accelerate long-term value creation in a rapidly modernizing collaboration-technology market.

Case Study 01

AVI-SPL

AVI-SPL is a global provider of professional audio-visual, unified communications, and digital-workplace solutions. The company designs, installs, and manages video-conferencing systems, collaboration platforms, digital signage, and enterprise AV infrastructure for corporate, education, healthcare, and government customers worldwide.

Acquirer

26North Partners is a private-equity investment firm focused on control investments in middle-market and upper-middle-market companies across technology, services, and industrial sectors.

Transaction Structure

26North Partners acquired 100% of AVI-SPL through a leveraged buyout for an undisclosed amount.

Market and Customer Segments Combination

The transaction combined 26North’s financial sponsorship and growth-capital resources with AVI-SPL’s global AV-integration, unified-communications, and managed-services platform. AVI-SPL continues to serve enterprise, education, healthcare, and government customers requiring mission-critical collaboration and digital-workplace infrastructure.

Acquisition Strategic Rationale

The buyout provides AVI-SPL with capital support for organic growth and tuck-in acquisitions, while allowing 26North to establish a platform position in the fragmented AV-integration and digital-workplace services market. The transaction is intended to scale managed-services revenue, strengthen recurring cash flows, and support international expansion across enterprise collaboration and hybrid-work infrastructure.

Case Study 02

IMAGE SUPPLY SYSTEMS

Prior to the acquisition, Image Supply Systems was a UK- and Ireland-based professional audio-visual (ProAV) systems integrator specializing in enterprise AV integration, unified communications, digital signage, and smart-workplace solutions. The business served corporate, education, healthcare, and public-sector customers across the UK and Ireland, delivering end-to-end AV design, installation, and managed services.

Acquirer

Econocom Group is a pan-European provider of IT services, digital-workplace infrastructure, and technology-financing solutions supporting enterprise customers across the full digital-technology lifecycle.

Transaction Structure

Econocom acquired 100% of the company for an undisclosed amount on July 8, 2025, in a strategic bolt-on acquisition to its ProAV integration platform.

Market and Customer Segments Combination

The transaction combined Econocom’s pan-European IT-services and digital-workplace platform with the target’s strong ProAV presence in the UK and Ireland. The combined business expands Econocom’s exposure to enterprise, education, healthcare, and public-sector AV customers and strengthens its regional delivery and managed-services capabilities.

Acquisition Strategic Rationale

The acquisition strengthens Econocom’s audio-visual capabilities in the UK and Ireland, accelerates growth in the ProAV integration market, expands engineering capacity, increases access to enterprise customers, supports Econocom’s European consolidation strategy, and enhances recurring managed-services revenue across its digital-workplace platform.

Case Study 03

AVM IMPACT

Prior to the acquisition, AVMI was a UK-based professional audio-visual integrator specializing in enterprise AV systems, unified communications, digital signage, meeting-room solutions, and managed services. The company served corporate, education, financial services, and government customers across the UK and international markets.

Acquirer

Kinly is a global provider of video collaboration, unified communications, and professional AV-integration services. The company delivers design, installation, integration, and managed services for enterprise customers across Europe, the United States, and Asia. Kinly is backed by Avedon Capital Partners.

Transaction Structure

Kinly acquired 100% of AVMI through a leveraged buyout supported by Avedon Capital Partners.

Market and Customer Segments Combination

The transaction combined Kinly’s global collaboration and managed services platform with AVMI’s UK and international enterprise footprint. Together, the combined business serves multinational and domestic enterprise customers across corporate, education, finance, public-sector, and commercial environments. The deal expands Kinly’s delivery capacity in the UK and Europe and broadens its managed service portfolio.

Acquisition Strategic Rationale

The acquisition enables Kinly to accelerate global expansion, enhance its position in the unified-communications market, and deepen exposure to recurring managed-services revenue. AVMI’s engineering capabilities, customer base, and integration expertise strengthen Kinly’s platform, creating one of the largest international AV and digital-workplace services providers. The deal also supports scale efficiencies, improves competitive positioning in hybrid-work environments, and advances the private-equity sponsor’s buy-and-build strategy.

The smart office and audio-visual solutions sector remains positioned for sustained expansion as hybrid-work adoption endures, workplace modernization accelerates, and AI becomes embedded across collaboration environments. M&A activity continues to demonstrate strong interest from strategic acquirers and financial sponsors, with buyers prioritizing scalable AV-integration platforms, intelligent software-enabled capabilities, and exposure to mission-critical enterprise and institutional markets. As smart-office technology solidifies its role as a core layer of digital-workplace infrastructure, valuation premiums are expected to concentrate around platforms that combine ecosystem integration, managed-services scale, and software-driven automation across global deployment footprints.

Source: AVI SPL, AVNetwork, Kinly, Avedon Capital, Econocom, Pitchbook Data.