Multi-Site Enterprise Technology Rollout Services Sector M&A Transactions and Valuations

Multi-Site Enterprise Technology Rollout Services Sector M&A Transactions and Valuations

From Q1 2021 through Q4 2025, sustained enterprise investment in network modernization, infrastructure upgrades, and large-scale, multi-location technology deployments supported M&A activity in the multi-site enterprise technology rollout services sector. As enterprises expanded across increasingly distributed footprints, demand increased for specialized service providers capable of executing complex rollouts with speed, consistency, and reliability.

Strategic and financial acquirers targeted platforms offering national field-service coverage, repeatable deployment processes, and entrenched enterprise customer relationships, viewing rollout execution as a critical layer of the enterprise technology lifecycle. Acquisition strategies focused on expanding geographic reach, increasing exposure to recurring services, and building integrated delivery platforms that combine program management, field execution, and ongoing support. This report examines M&A activity and valuation dynamics in the sector, including capital flows, strategic priorities, and valuation benchmarks such as EV/revenue and EV/EBITDA multiples, while highlighting transactions that reflect consolidation and scale-driven platform formation.

Multi-Site Enterprise Technology Rollout Services: Sector Definition and Key Trends

EXHIBIT 1

Sector Definition

The multi-site enterprise technology rollout services sector includes companies that design, coordinate, deploy, and support technology infrastructure across large, geographically distributed enterprise locations. These providers manage complex, multi-location rollouts, including network installations, hardware refreshes, structured cabling, unified communications, security systems, and related IT infrastructure—typically under national or multi-regional master service agreements.

Sector participants differentiate through national field-services coverage, robust program and project management capabilities, execution reliability, and the ability to deliver large-scale, time-sensitive deployments across hundreds or thousands of sites. Offerings often span the full deployment lifecycle, including site assessments, staging, installation, integration, testing, decommissioning, and ongoing support, with increasing emphasis on recurring managed services and long-term enterprise contracts.

The sector encompasses both execution-led service providers that deliver hands-on deployment and integration and platform-oriented providers that orchestrate rollouts and lifecycle management across distributed enterprise environments. Customers primarily include large enterprises, retailers, financial institutions, healthcare systems, logistics operators, and public sector organizations that require standardized technology environments and coordinated execution across multiple locations.

Source: WEI rollout services overview; ServiceNetwork.org IT infrastructure services definitions; STL Tech managed services guide; GDCI Solutions IT infrastructure article.

EXHIBIT 2

Key Trends Supporting the Multi-Site Enterprise Technology Rollout Services Sector

- Rising Demand for End-to-End Rollout Partners:

Enterprises continue to consolidate IT vendors to reduce complexity and improve accountability, driving demand for service providers that deliver end-to-end rollout execution, integration, and lifecycle support across distributed, multi-site environments.

- Customer Relationships as a Core Value Driver:

Long-standing enterprise customer relationships support repeat deployment activity, increase switching costs, and generate recurring project pipelines. These relationships allow providers to embed within customer operations, enhance service continuity, and support premium valuation outcomes in M&A transactions.

- Increasing Complexity of Multi-Site Enterprise Environments:

The expansion of geographically dispersed locations, heterogeneous infrastructure, and evolving technology standards has increased reliance on specialized rollout and field services providers with national coverage and repeatable deployment frameworks.

- Convergence of Consulting, Integration, and Execution:

Enterprise customers increasingly favor partners that combine upfront advisory capabilities with hands-on deployment and execution, shifting demand away from fragmented point solutions toward integrated rollout service models.

- M&A as a Primary Scaling Mechanism:

Strategic acquirers continue to use M&A to accelerate geographic expansion, broaden enterprise customer access, and add specialized deployment capabilities, reinforcing consolidation trends across the sector.

- Standardized Processes and Embedded IP Increase Stickiness:

Providers that leverage proprietary methodologies, tools, and standardized rollout frameworks increase customer retention, improve revenue visibility, and reduce execution risk, key attributes supporting valuation premiums.

Source: WEI rollout services overview; ServiceNetwork.org IT infrastructure services definitions; STL Tech managed services guide; GDCI Solutions IT infrastructure article.

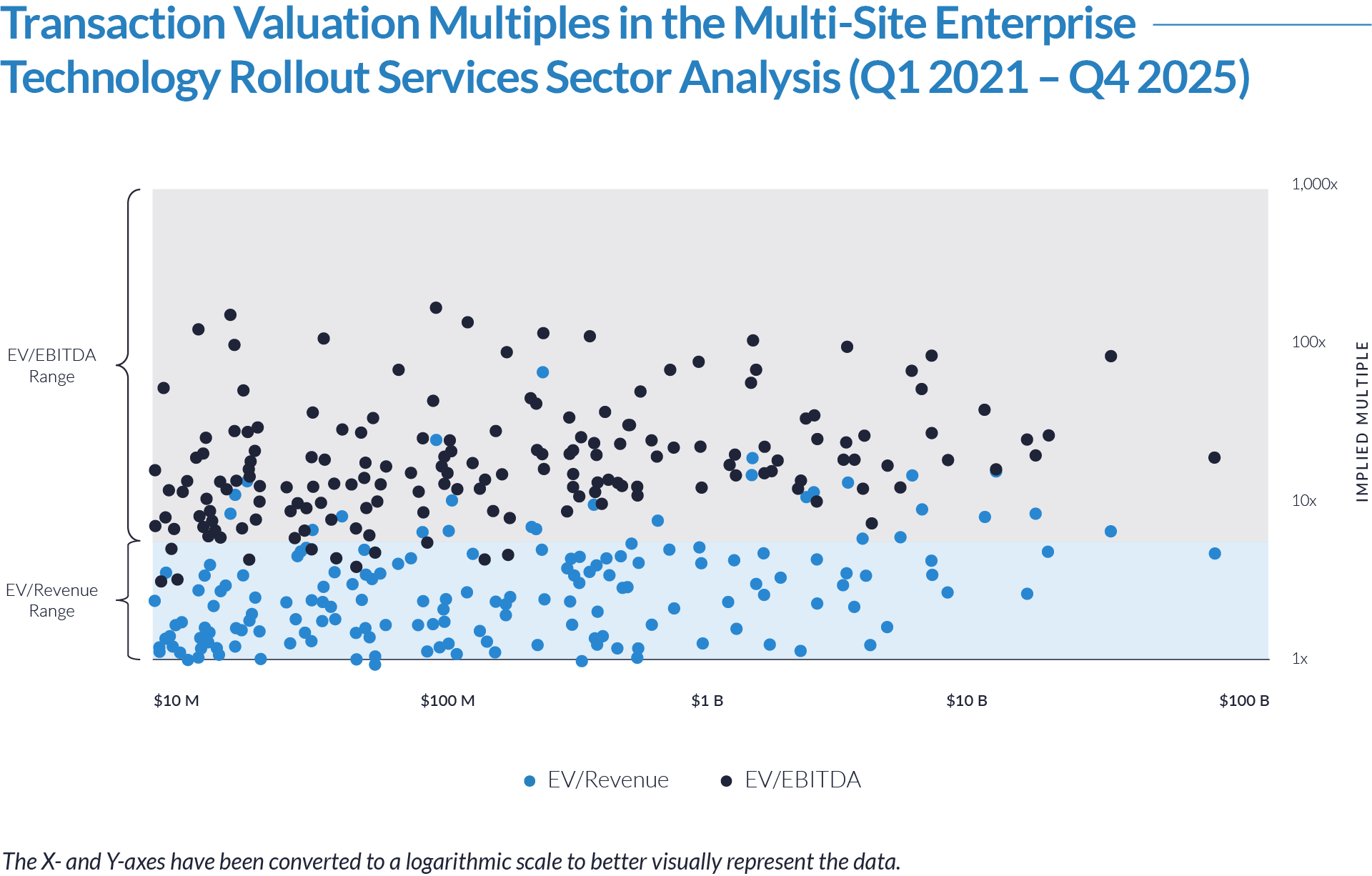

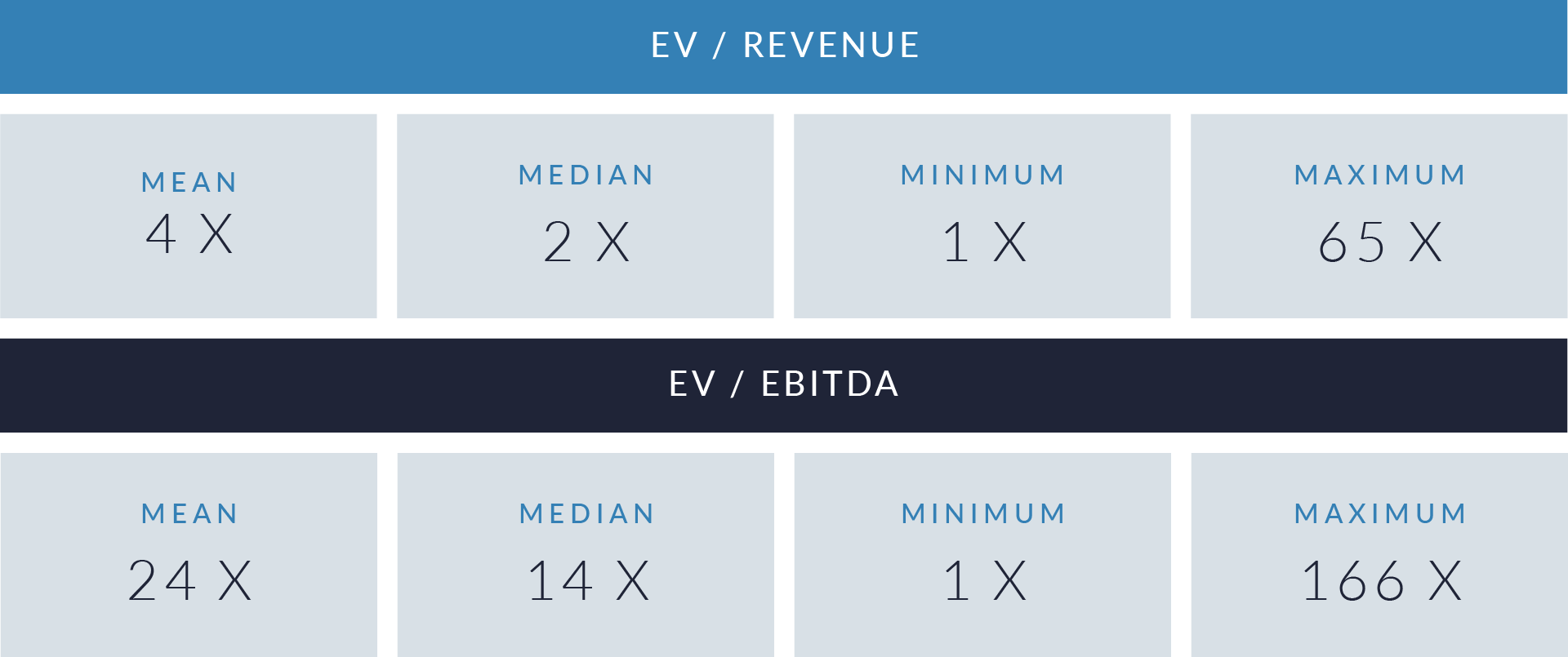

- Valuation multiples are derived from a representative sample of completed M&A transactions in the sector, based on data available as of January 12, 2026.

- EV/revenue multiples exhibit a clear inverse relationship with scale: smaller and mid-cap providers frequently transact at mid-to-high single-digit revenue multiples, while larger, scaled platforms typically cluster in the 1–4x EV/revenue range. This dynamic reflects the sector’s labor-intensive cost structure and acquirer focus on execution reliability, contract durability, and delivery capacity rather than headline growth rates.

- EV/EBITDA multiples display significant dispersion, particularly among smaller and less profitable companies, driven by margin volatility, project-based revenue recognition, and uneven utilization. As a result, acquirers often place greater emphasis on revenue scale, customer concentration, backlog visibility, and service mix than on standalone EBITDA multiples when determining transaction value.

- Scaled platforms with diversified enterprise customer bases and meaningful recurring services exposure demonstrate more stable and defensible valuation profiles, reinforcing the view that national footprint, integrated program management, and managed services attach rates drive valuation resilience and support premium outcomes in both strategic and sponsor-led transactions.

Capital Markets Activities

The data highlights transaction activity, capital deployment patterns, and geographic concentration trends within the sector. Sustained enterprise demand for nationwide technology deployments, network refresh programs, and multi-location infrastructure modernization continues to fuel M&A across field services providers, systems integrators, and end-to-end rollout platforms. Acquirers increasingly target scaled operators with national footprints, entrenched enterprise customer relationships, and integrated program management and lifecycle support capabilities, prioritizing geographic density, execution reliability, and the ability to deliver complex, multi-site deployments across large customer bases.

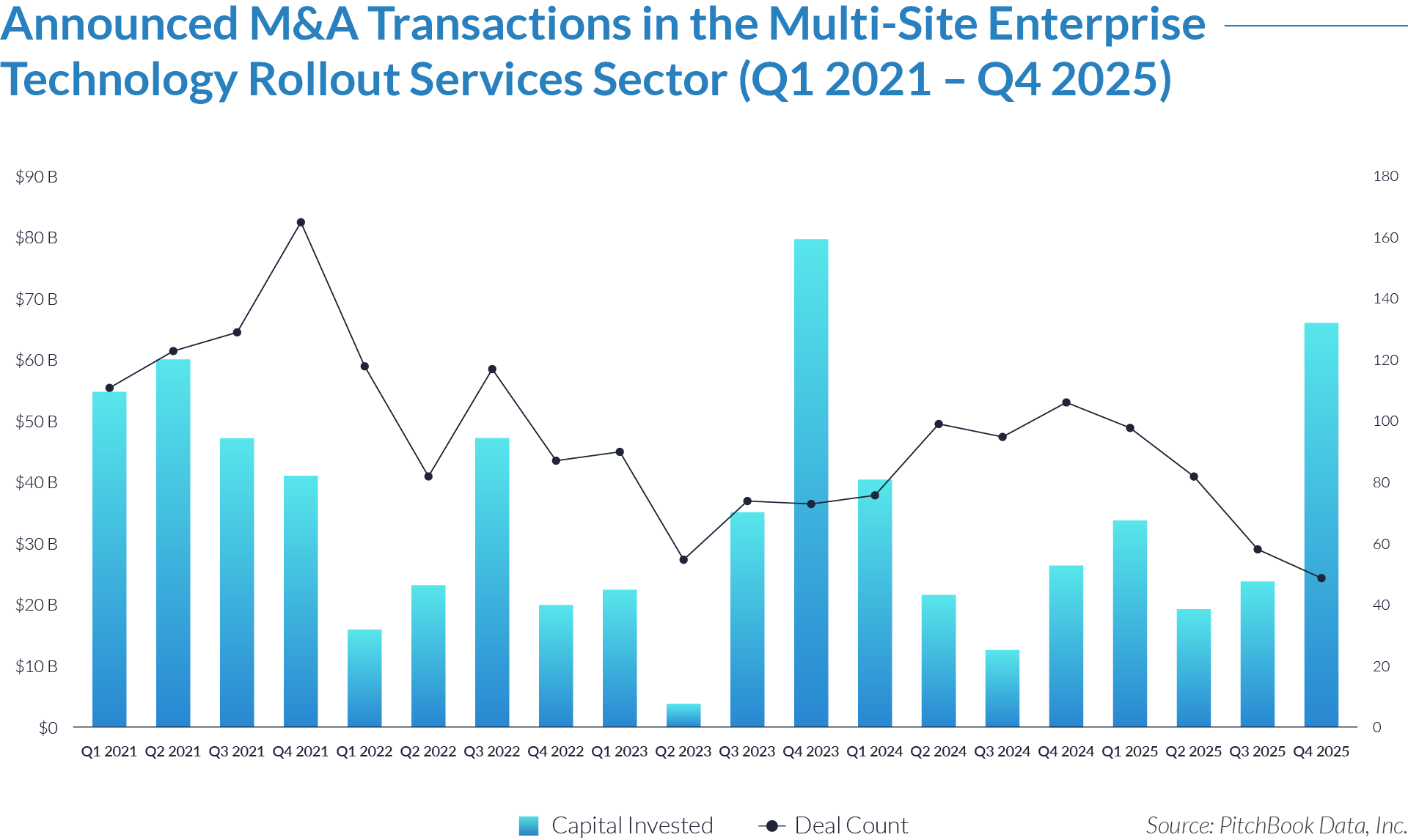

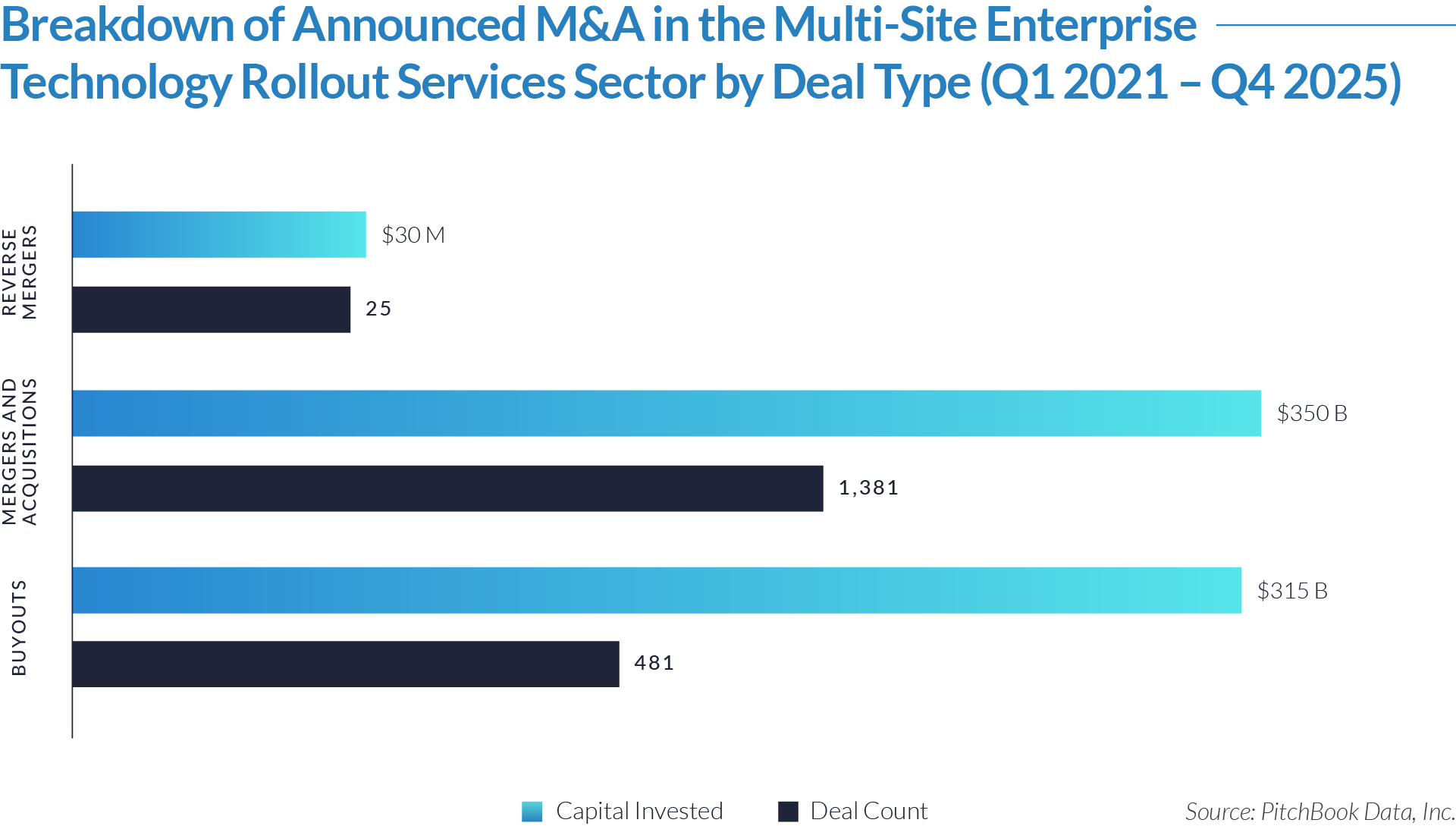

- From Q1 2021 through Q4 2025, the sector attracted approximately $695 billion of invested capital across 1,887 completed transactions, underscoring sustained strategic and financial sponsor interest in scaled enterprise deployment and field services platforms.

- Transaction activity remained consistently elevated over the 20-quarter period, averaging approximately 94 deals per quarter, reflecting ongoing consolidation within a highly fragmented provider landscape and continued enterprise demand for national and multi-regional service capabilities.

- Capital deployment fluctuated materially by quarter, with pronounced spikes in Q4 2023 and Q4 2025, reflecting the execution of large, platform-level acquisitions that disproportionately increased invested capital relative to deal count.

- In the most recent period (2024–2025), deal volume moderated while capital invested rebounded meaningfully, signaling a shift toward fewer, larger, and more strategic transactions focused on national scale, enterprise customer access, and expanded end-to-end rollout capabilities.

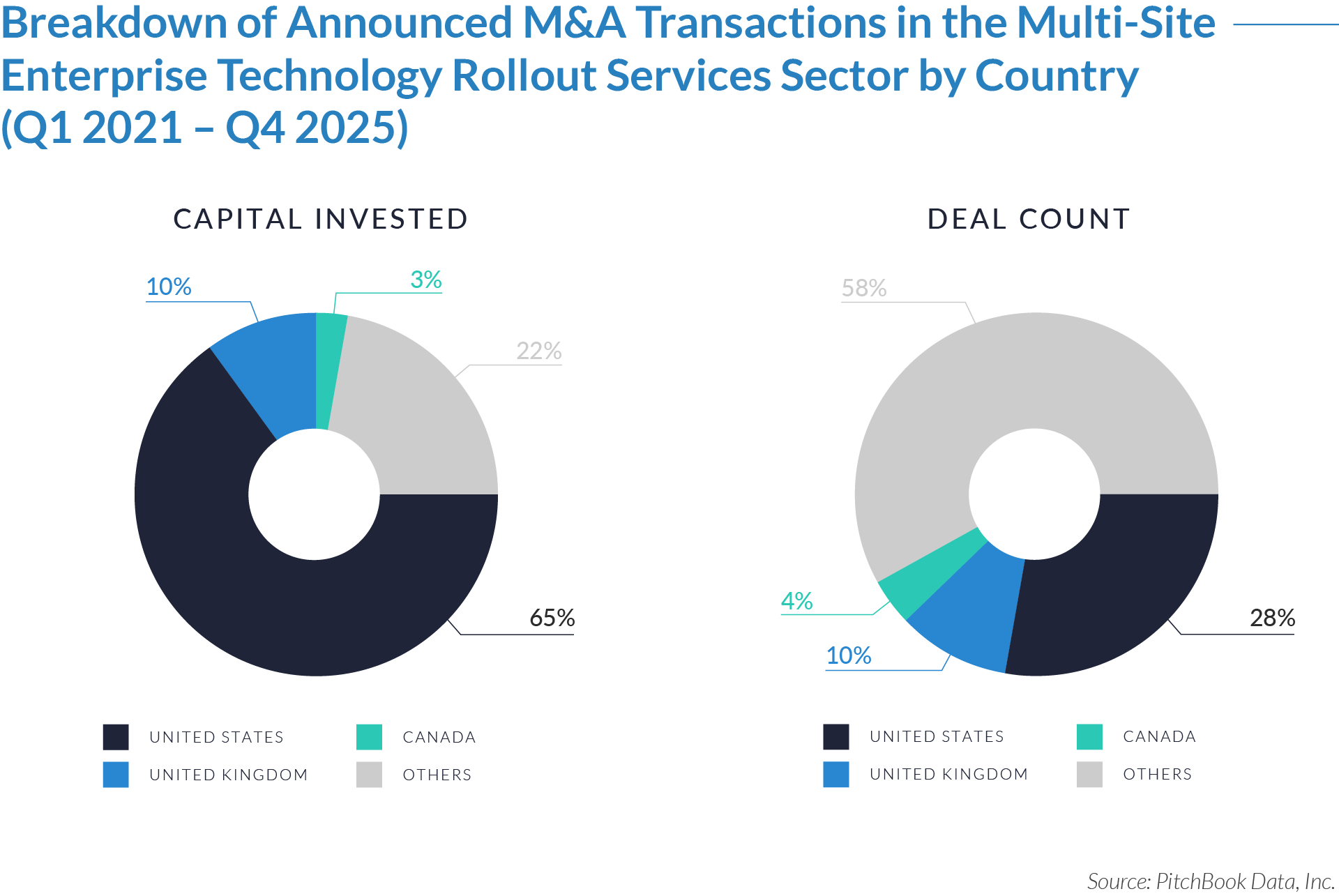

- The United States accounted for a disproportionate share of capital invested 65% despite representing only 28% of total deal volume, indicating that US-based transactions skew materially larger on average. This reflects the importance of the sector within the US enterprise IT ecosystem, where nationwide footprints, large-scale technology refresh cycles, and long-term master service agreements drive demand for scaled rollout platforms capable of supporting complex, multi-site deployments.

- The United Kingdom represented a balanced share of activity, comprising 10% of capital invested and 9% of total deal count, suggesting a market characterized by mid-sized platform consolidation. The sector plays a critical role in supporting enterprise modernization across dense, multi-location environments, with demand driven by regulated industries, national retailers, and infrastructure-intensive service providers operating within a mature but more compact market.

- Canada contributed a modest share of capital invested 3% and deal activity 4%, reflecting selective consolidation among regional providers. In Canada, the sector primarily supports geographically dispersed enterprise and public-sector customers, where rollout providers enable consistent technology standards across wide operating territories but with fewer opportunities for large, capital-intensive platform transactions.

- Other international and emerging markets accounted for the majority of deal volume 58% but only 23% of total capital invested, underscoring the fragmented and localized nature of the sector outside core markets. In these regions, rollout services remain operationally important for enterprise expansion and infrastructure modernization, but transactions tend to focus on smaller, tuck-in acquisitions rather than scaled platform formation.

- Mergers and acquisitions represented the dominant transaction structure, accounting for approximately $350 billion of invested capital across 1,381 deals, as strategic acquirers pursued consolidation to expand national footprints, broaden service capabilities, and deepen enterprise customer relationships across multi-site deployment and lifecycle services.

- Buyouts accounted for approximately $315 billion of invested capital across 481 transactions, reflecting strong private equity interest in platform formation, scale-driven margin expansion, and recurring revenue growth through increased managed services penetration and disciplined add-on acquisition strategies.

- Reverse mergers remained immaterial, with approximately $30 million of invested capital across 25 transactions, underscoring their limited relevance in a sector where operational execution, scale, and customer relationships outweigh the benefits of public market access or complex transaction structures.

M&A Transactions Case Studies

Three transactions in the multi-site enterprise technology rollout services sector illustrate how both strategic and financial acquirers are investing in scaled, execution-led platforms that support complex enterprise technology deployments. Buyers are targeting providers with national field-service coverage, repeatable rollout and integration capabilities, and deep enterprise customer relationships, viewing deployment execution and lifecycle support as critical layers within the enterprise IT value chain. These transactions highlight continued emphasis on platform formation, geographic expansion, and the ability to deliver consistent, large-scale technology implementations across distributed customer environments.

Case Study 01

PRESIDIO

Presidio is a US-based provider of enterprise IT infrastructure, technology deployment, and integration services. The company supports large enterprise and public-sector customers through rollout execution, systems integration, and managed services across networking, security, cloud, and data center environments. Presidio is recognized for its ability to execute repeatable, large-scale technology deployments in complex, multi-site enterprise environments.

Acquirer

Clayton, Dubilier & Rice is a global private equity firm focused on acquiring and scaling market-leading, cash-generative services and infrastructure platforms, with an emphasis on operational improvement and long-term value creation.

Transaction Structure

Clayton, Dubilier & Rice is a global private equity firm focused on acquiring and scaling market-leading, cash-generative services and infrastructure platforms, with an emphasis on operational improvement and long-term value creation.

Market and Customer Segments Combination

The transaction aligned CD&R’s experience in scaling complex services businesses with Presidio’s enterprise-focused technology deployment and integration platform. Under CD&R ownership, Presidio continues to serve large commercial enterprises and public-sector customers requiring mission-critical, multi-site technology rollouts, benefiting from additional capital support and strategic resources to expand service depth and geographic reach.

Acquisition Strategic Rationale

The transaction aligned CD&R’s experience in scaling complex services businesses with Presidio’s enterprise-focused technology deployment and integration platform. Under CD&R ownership, Presidio continues to serve large commercial enterprises and public-sector customers requiring mission-critical, multi-site technology rollouts, benefiting from additional capital support and strategic resources to expand service depth and geographic reach.

Case Study 02

SIRIUS COMPUTER SOLUTIONS

Sirius Computer Solutions is a US-based provider of enterprise IT infrastructure, technology deployment, and systems integration services. The company supports large commercial and public-sector customers through rollout execution, implementation, and optimization of complex technology environments across hybrid infrastructure, cloud, security, data center, and digital platforms. Sirius is recognized for executing customer-selected technology solutions at enterprise scale.

Acquirer

CDW (NASDAQ: CDW) is a leading multi-brand provider of IT solutions and services to business, government, education, and healthcare customers across North America, with a strategic focus on combining product distribution with value-added services.

Transaction Structure

CDW (NASDAQ: CDW) is a leading multi-brand provider of IT solutions and services to business, government, education, and healthcare customers across North America, with a strategic focus on combining product distribution with value-added services.

Market and Customer Segments Combination

The transaction combined CDW’s broad customer reach and product-centric IT solutions platform with Sirius’s deep enterprise services, deployment execution, and integration capabilities. The combined organization enhanced its ability to serve large enterprise and public-sector customers requiring complex, multi-site technology implementations, strengthening CDW’s services mix across hybrid infrastructure, cloud, security, and managed services.

Acquisition Strategic Rationale

The acquisition accelerated CDW’s strategy to expand higher-margin services and solutions capabilities, reduce reliance on product-only revenue, and scale execution-led offerings. Sirius’s deployment expertise, enterprise customer relationships, and repeatable implementation model enabled CDW to deepen customer engagement, improve profitability, and position the combined platform as a more comprehensive provider of end-to-end enterprise technology solutions.

Case Study 03

BLACK BOX CORPORATION

Black Box Corporation was a US-based global provider of enterprise technology deployment, systems integration, and rollout execution services. The company specialized in managing and delivering large-scale, multi-site technology rollouts across networking, communications, audio-visual, and IT infrastructure environments. Black Box served enterprise and government customers worldwide, with a strong reputation for programmatic deployment, vendor-agnostic execution, and mission-critical field delivery.

Acquirer

AGC Networks is a global IT infrastructure and technology services provider focused on networking, collaboration, and enterprise communications solutions, serving large corporate and public-sector customers across multiple regions.

Transaction Structure

AGC Networks acquired 100% of Black Box Corporation on January 7, 2019, for $17 million, completing a full acquisition of the business and taking the company private.

Market and Customer Segments Combination

The transaction combined AGC Networks’ global IT infrastructure and communications capabilities with Black Box’s established enterprise rollout execution and multi-site deployment platform, significantly expanding AGC’s operational footprint in North America. The combined entity enhanced its ability to deliver end-to-end enterprise technology programs, from solution integration through field deployment, for large, geographically distributed customers.

Acquisition Strategic Rationale

The acquisition enabled AGC Networks to strengthen its presence in the North American market while adding a scaled, execution-led technology rollout platform with deep expertise in enterprise and government deployments. Black Box’s programmatic rollout capabilities, field execution infrastructure, and long-standing customer relationships complemented AGC’s existing services portfolio, supporting geographic expansion, service diversification, and increased participation in complex, multi-site enterprise technology programs.

As enterprise technology environments grow more complex, multi-site rollout services have evolved from one-time project support into a persistent execution layer within the enterprise IT stack. This shift elevates the strategic importance of providers positioned closest to deployment, coordination, and operational continuity across distributed footprints.

Looking ahead, acquirers are likely to favor platforms that transform rollout execution into durable, embedded customer relationships, using delivery as a gateway to broader lifecycle and recurring services. Providers that demonstrate scalability, disciplined execution, and the ability to deepen customer integration over time should remain well positioned as consolidation across the sector continues.

Source: CD&R, Reuters, Presidio, SEC GOV (1), (2), NASDAQ, Black Box, Pitchbook Data.