Hyperspectral Imaging and Remote Sensing Sector M&A Transactions and Valuations

Hyperspectral Imaging and Remote Sensing Sector M&A Transactions and Valuations

From 2020 to early 2025, buyers significantly increased activity in the hyperspectral imaging and remote sensing sector, driven by advances in sensor miniaturization, AI-enabled analytics, and the integration of multi- and hyperspectral capabilities into broader geospatial intelligence platforms. Strategic and financial acquirers targeted companies with proprietary imaging hardware, spectrum-wide sensing technologies, and analytics platforms capable of converting complex datasets into real-time operational intelligence. Acquisition strategies focused on expanding into dual-use defense and commercial markets, capturing recurring data-as-a-service revenue, and enhancing platform interoperability across aerospace, environmental, industrial, and agricultural applications.

This report analyzes M&A activity and valuation trends in the sector from Q2 2020 to Q1 2025, covering strategic priorities, capital flows, and valuation benchmarks, including EV/revenue and EV/EBITDA multiples. Key transactions in defense-grade imaging, satellite-based Earth observation, and drone-deployed sensing solutions highlight trends in vertical integration, hardware–software convergence, and global market expansion. The findings outline pricing patterns and strategic themes critical to buyers navigating this rapidly evolving intelligence and monitoring ecosystem.

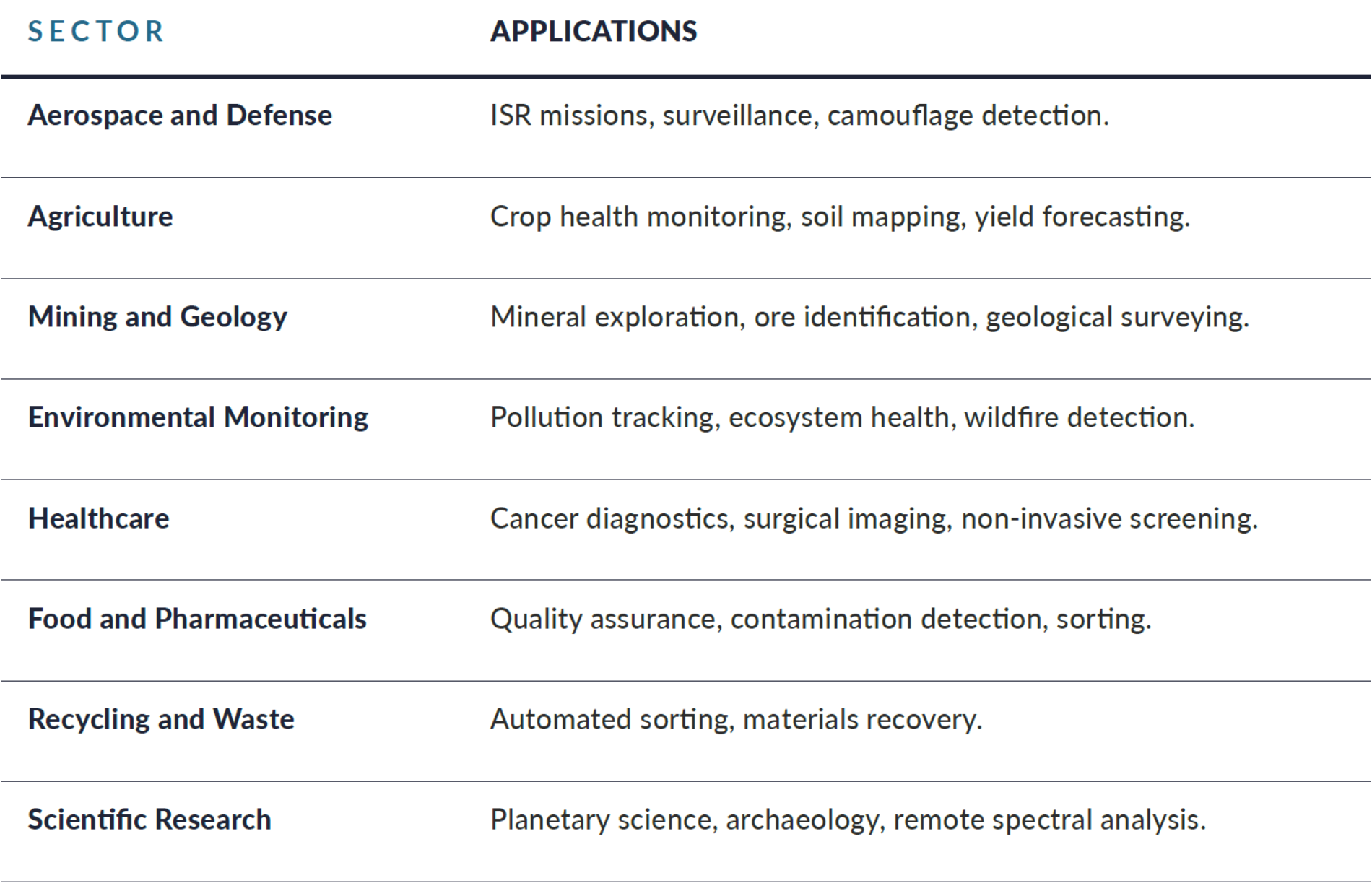

Sector Overview, Applications, and Key Trends in Hyperspectral Imaging and Remote Sensing

This section defines the sector, outlining core applications in defense, environmental monitoring, industrial inspection, and agriculture. It highlights key trends driving growth, including sensor miniaturization, AI-enabled analytics, and the integration of multi- and hyperspectral capabilities into unified geospatial intelligence platforms.

Hyperspectral imaging is a remote sensing technology that captures hundreds of narrow, contiguous spectral bands per pixel, enabling precise material identification, chemical analysis, and object classification. Unlike traditional imaging, HSI provides detailed spectral data revealing properties invisible to standard sensors. Remote sensing, acquired via satellites, drones, or aircraft, becomes significantly more powerful when paired with HSI, enabling detailed detection and monitoring over vast or inaccessible areas.

Adoption of HSI and remote sensing is accelerating as industries embrace precision, data-driven decision-making. These technologies now underpin automated analysis for complex monitoring, anomaly detection, and regulatory compliance. Mature use cases in defense, agriculture, environmental monitoring, healthcare, and food safety highlight their convergence with AI to deliver real-time, actionable intelligence. Falling costs and advances in edge processing are opening new applications in logistics, infrastructure, and smart city systems.

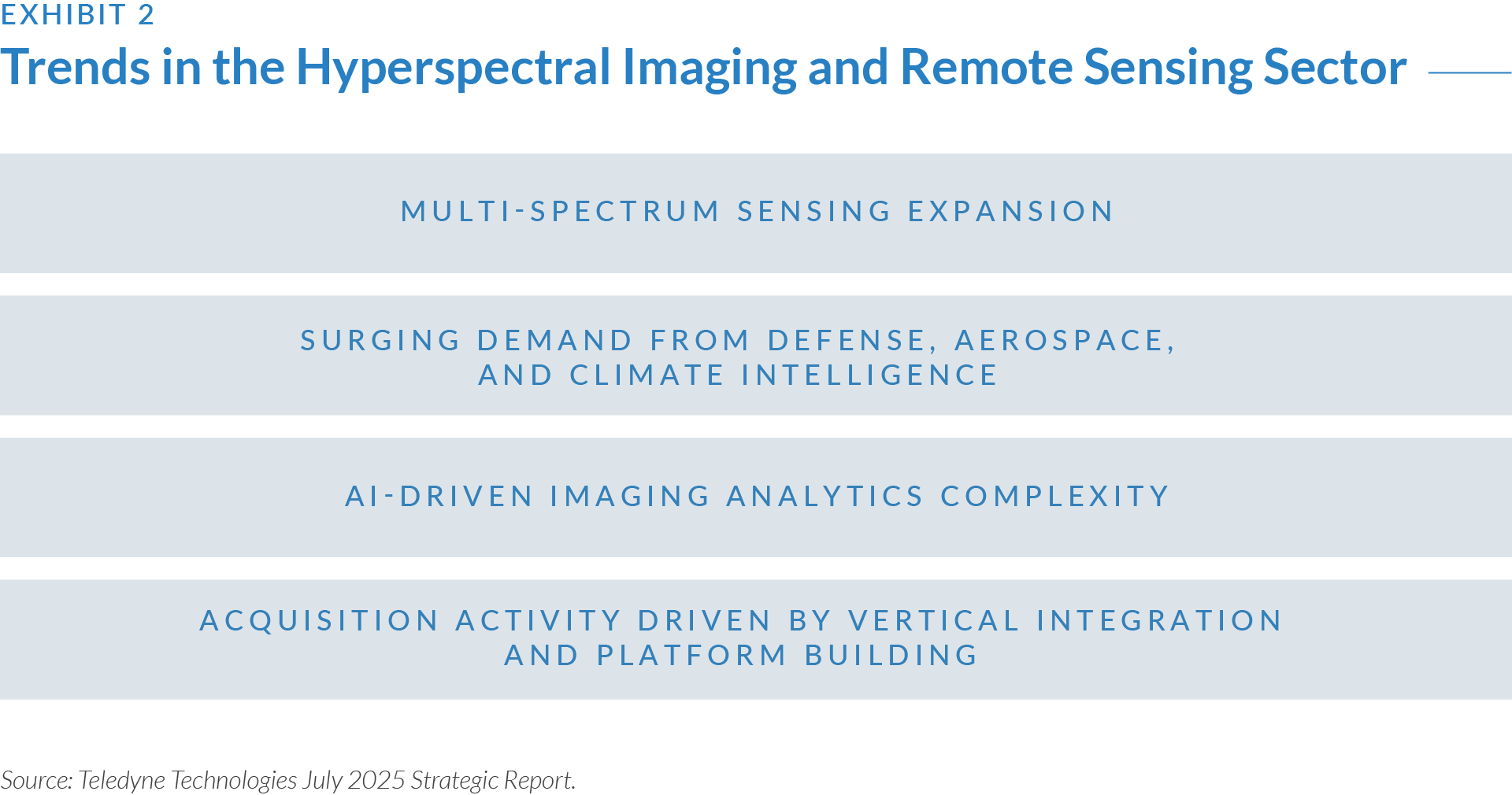

- Consolidation and Vertical Integration: Sector players are moving beyond traditional visible-light imaging to multi- and hyperspectral systems covering infrared, ultraviolet, thermal, and X-ray bands. These capabilities enable precise material identification, anomaly detection, and non-destructive inspection, driving adoption in defense, agriculture, mining, environmental monitoring, and space.

- Surging Demand from Defense, Aerospace, and Climate Intelligence: Governments and commercial operators are expanding investments in hyperspectral technologies for border surveillance, tactical intelligence, environmental monitoring, and climate risk assessment. Earth observation and geospatial intelligence remain core growth engines, with satellite-based and drone-mounted sensors now standard for monitoring terrain, vegetation, pollution, and thermal signatures.

- AI-Driven Imaging Analytics: Companies are integrating hyperspectral hardware with AI, computer vision, and advanced analytics to convert massive spectral datasets into real-time, actionable intelligence. This integration is fueling demand for end-to-end imaging platforms that combine sensors, edge computing, and cloud orchestration, particularly in autonomous systems, smart agriculture, and industrial diagnostics.

- Acquisition Activity Driven by Vertical Integration and Platform Building: Acquirers are targeting assets with hardware–software convergence, proprietary imaging IP, and recurring data-as-a-service revenue. The market is experiencing a wave of platform-building transactions aimed at unifying sensing, analytics, and decision-making capabilities, enabling cross-sector deployment at scale.

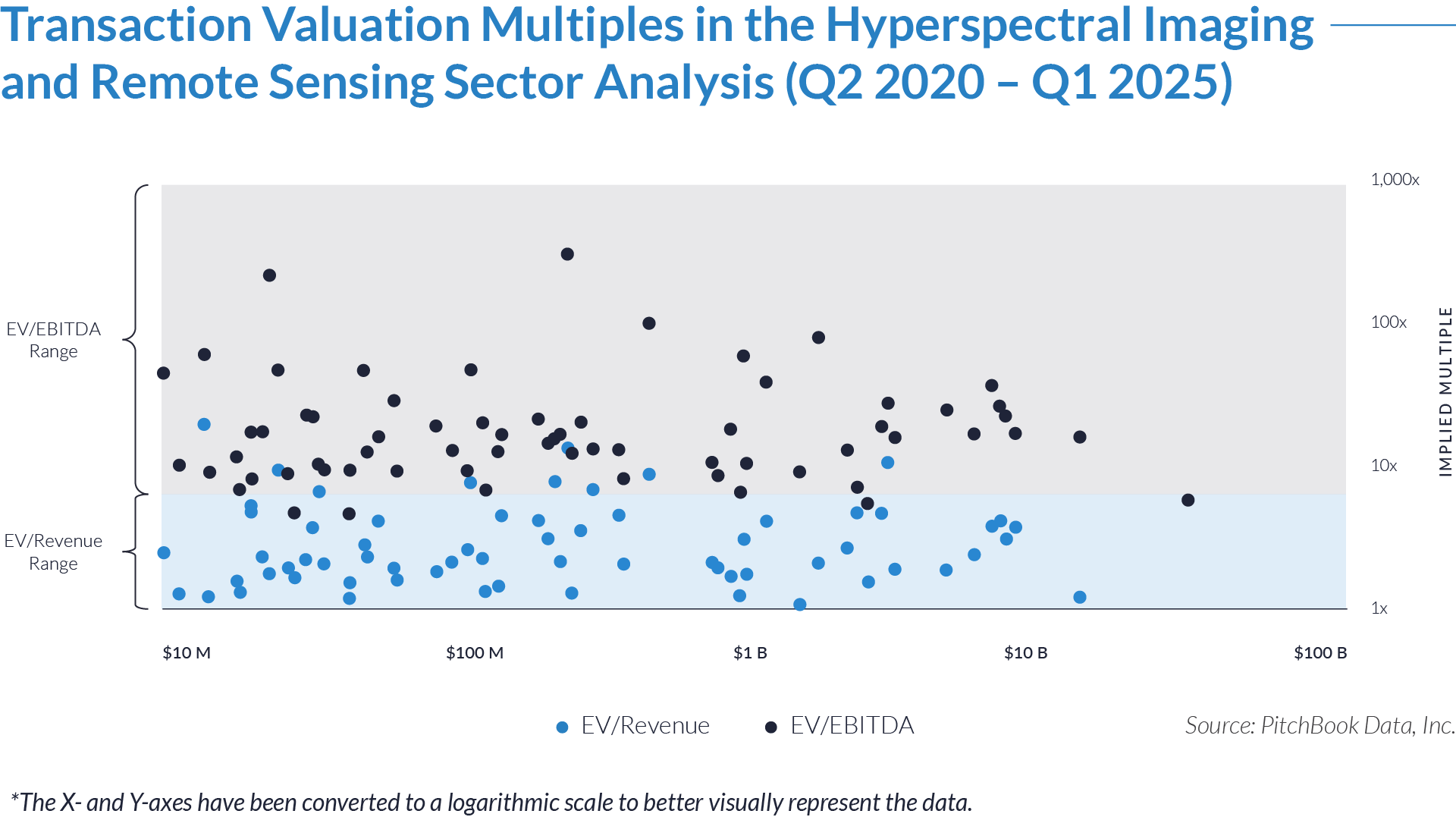

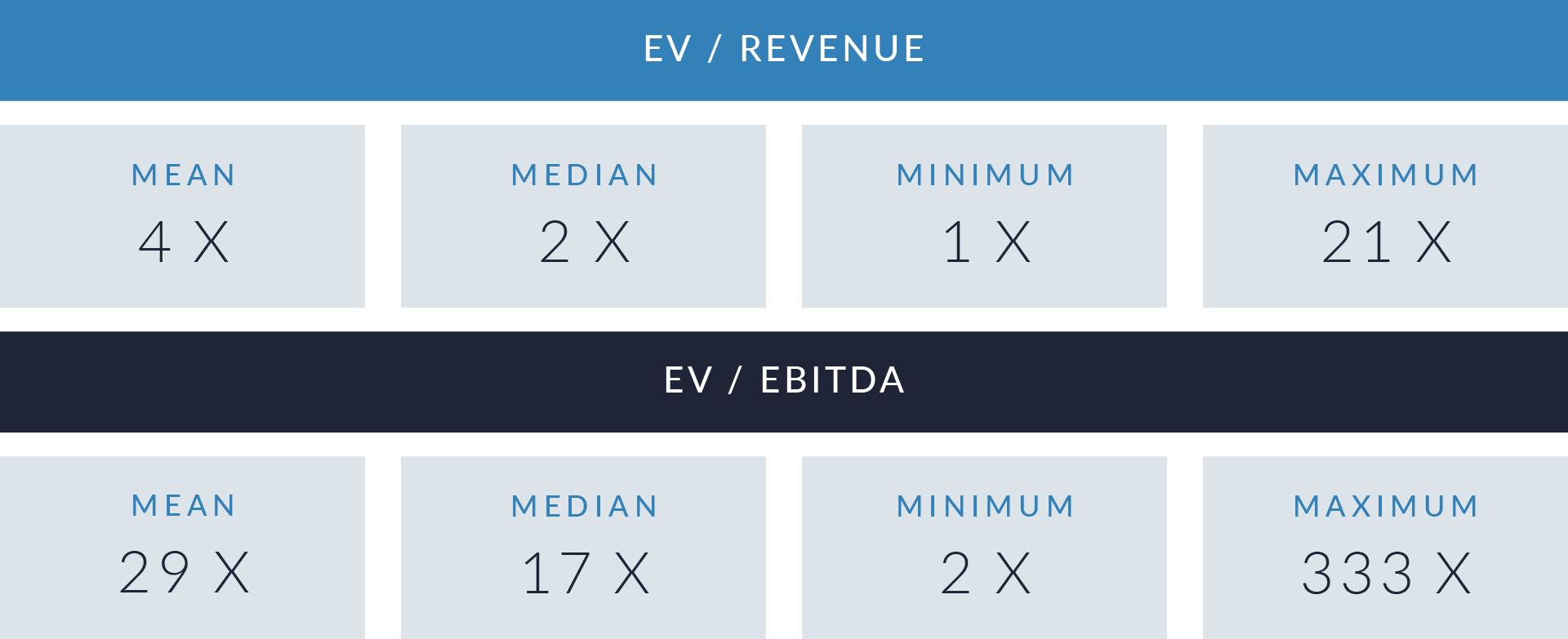

- Valuation multiples are based on a sample set of M&A transactions in the hyperspectral imaging and remote sensing sector using data collected on August 6, 2025.

- Valuation multiples in the sector range widely—from 1x to 21x EV/revenue and 2x to 333x EV/EBITDA—indicating that acquirers price targets based on scalability, IP strength, and revenue predictability, with premium valuations reserved for firms offering embedded analytics, government contracts, or SaaS-like business models.

- Buyers paid over 10x revenue and 100x EBITDA for strategic platforms exceeding $100 billion in value, reflecting strong buyer appetite for end-to-end imaging and analytics companies that combine hardware, software, and proprietary data across defense and environmental applications.

- In the $25–250 million enterprise value range, buyers consistently paid 2–5x revenue and 10–25x EBITDA for mid-market targets, showing a preference for niche leaders with stable cash flows, commercial traction, and integration potential in platform roll-up strategies.

Capital Markets Activities

M&A activity in the hyperspectral imaging and remote sensing sector is being shaped by demand for high-resolution, multi-band data capture and the ability to process information at scale. Buyers focus on assets that strengthen sensing capabilities, expand spectral coverage, and integrate analytics into operational workflows. Recent transactions emphasize platform scalability, cross-sector deployment potential, and the consolidation of complementary technologies to enhance market reach and long-term revenue streams.

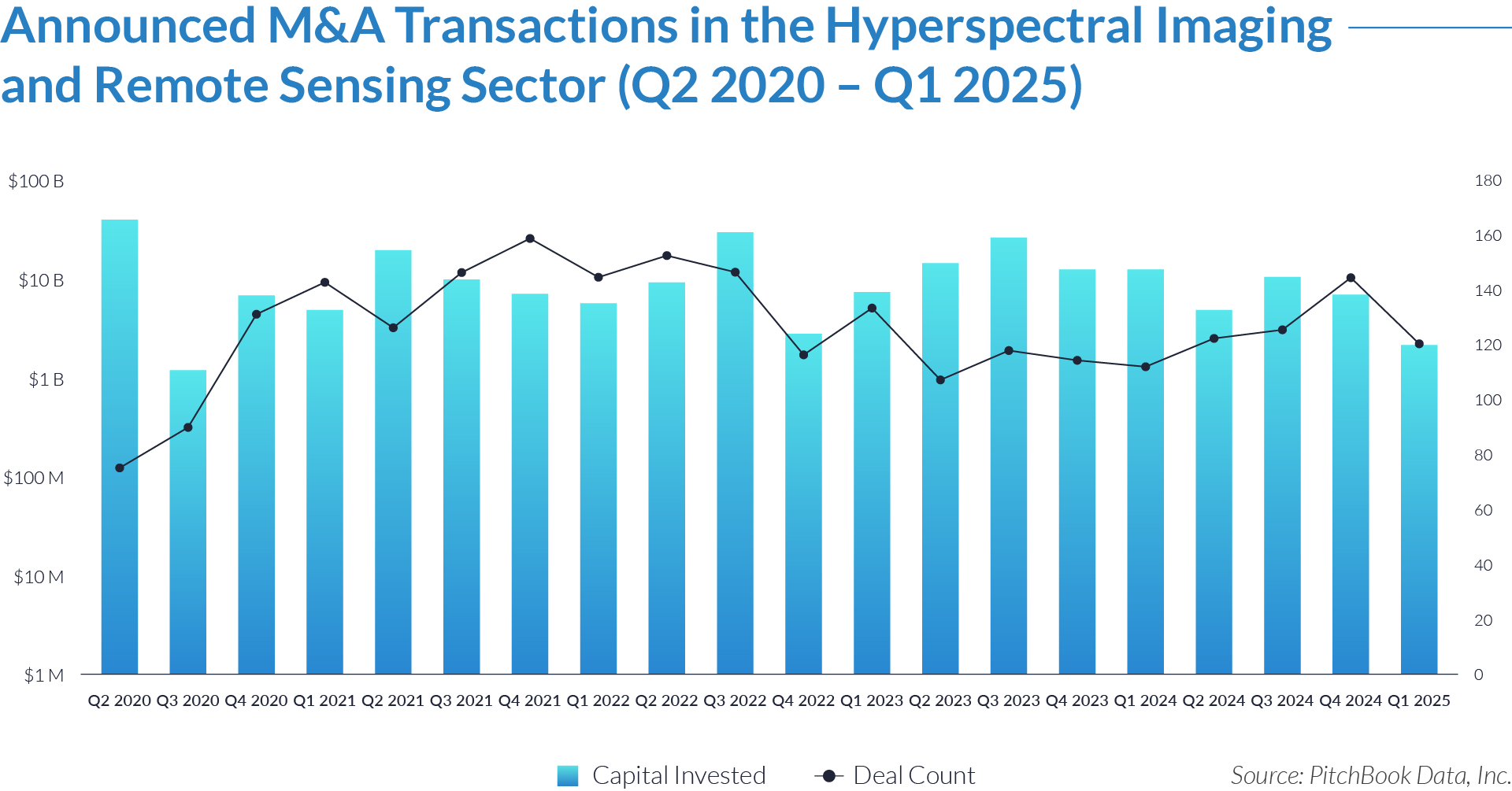

- Buyers completed 2,521 transactions over 20 quarters, deploying $218 billion in total and averaging 126 deals per quarter, underscoring sustained M&A activity in the hyperspectral imaging and remote sensing sector.

- Acquirers deployed peak capital in Q2 2020, $37 billion, and Q3 2022, $27 billion, reflecting periods of large-scale strategic acquisitions and government-backed procurement initiatives.

- Buyers set a record with 158 transactions in Q4 2021, highlighting strong demand for scalable sensing platforms, AI-enabled analytics, and vertically integrated solutions for defense and commercial markets.

- Acquirers continued to target strategic assets at a steady pace in the most recent quarters, focusing on niche technologies, hardware–software integration, and recurring data-as-a-service models.

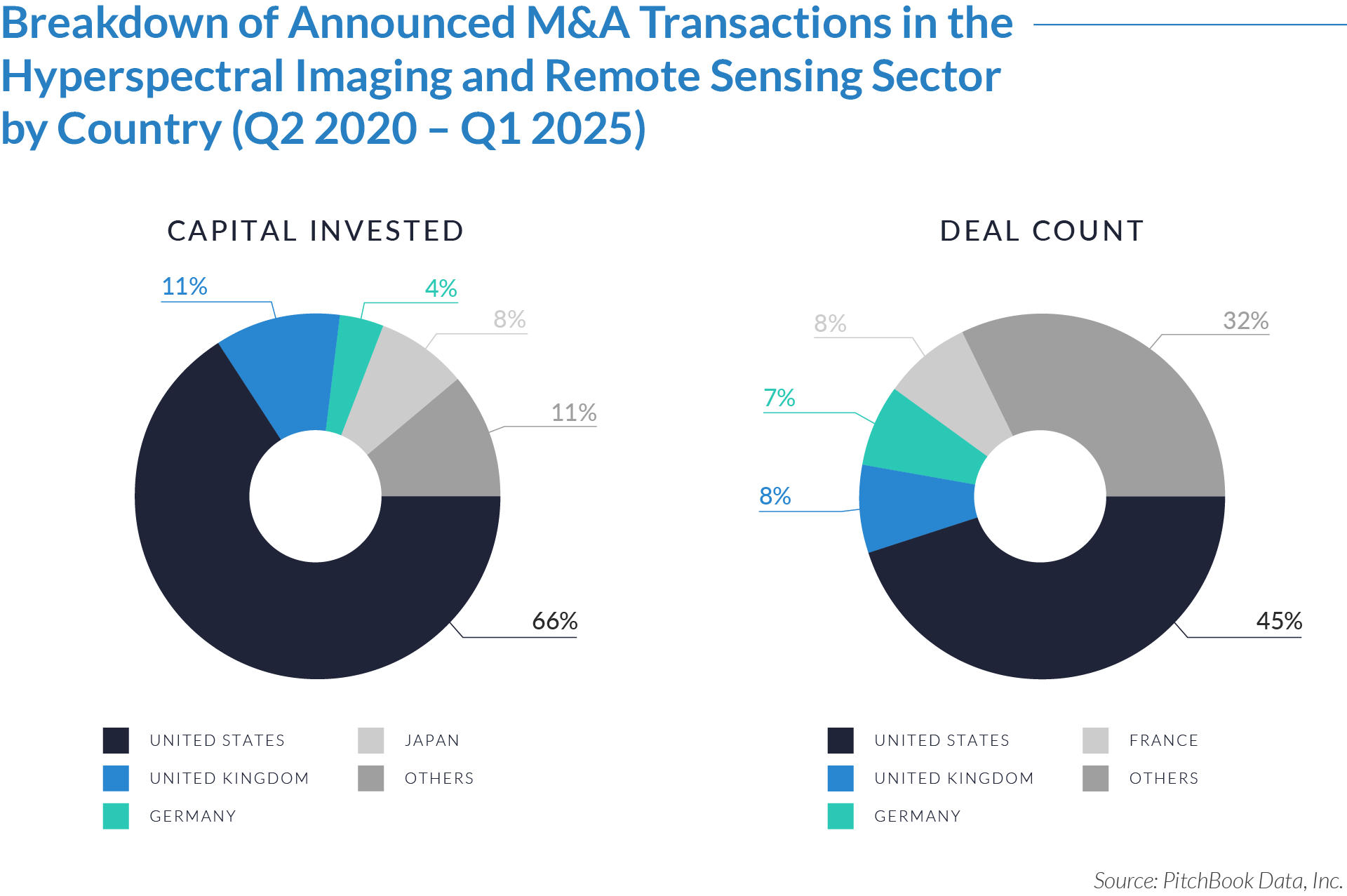

The graphs below present the geographic distribution of transactions, providing additional detail on regional trends and investment dynamics.

- US-based buyers deployed 66% of total capital while accounting for only 45% of deal count, reflecting a clear focus on high-value strategic acquisitions and platform-scale investments. This underscores the dominance of North American acquirers in shaping global hyperspectral imaging and remote sensing M&A activity.

- Buyers from the United Kingdom, Japan, and Germany contributed 23% of capital yet appeared in only two of the top five destination markets, indicating that much of their capital flowed into cross-border deals—often targeting U.S.-based companies with concentrated IP, defense contracts, and scalable platforms.

- France and other international markets accounted for 39% of total deal volume as target geographies but attracted a disproportionately smaller share of total capital. This indicates that while many acquisitions occurred in these regions, average deal sizes were smaller, often involving earlier-stage, niche technology assets. These transactions were attractive for small strategic add-on acquisitions but did not command premium valuations, and much of the capital originated from buyers outside these regions.

- These geographic capital flow patterns set the stage for understanding how deal type, strategic priorities, and buyer profiles are shaping growth trajectories in the hyperspectral imaging and remote sensing sector.

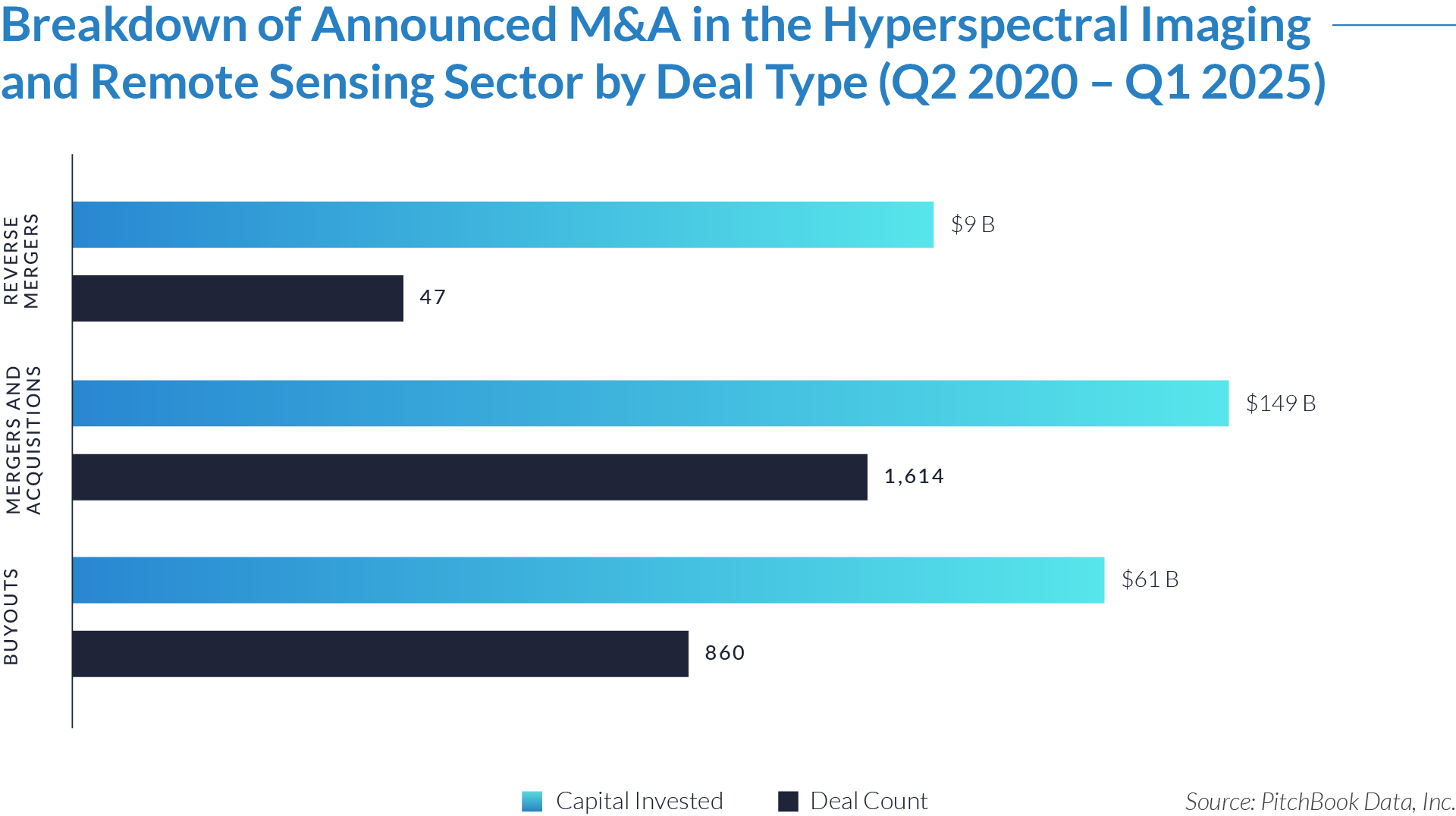

- Strategic acquirers accounted for 66% of total deal volume, deploying $149 billion through traditional M&A to consolidate imaging platforms, analytics providers, and adjacent sensing technologies.

- Private equity firms executed 860 buyouts worth $61 billion, targeting recurring-revenue businesses with scalable IP and advancing roll-up strategies in defense, agriculture, and geospatial analytics.

- Buyers completed 47 reverse mergers totaling $9 billion, primarily enabling capital-intensive startups, particularly satellite imaging firms, to access public markets and accelerate growth.

- The sector’s M&A activity reflects a dual-track dynamic—strategic buyers pursue integration and cross-platform synergies, while financial sponsors focus on scalable platforms, recurring revenue, and long-term value creation.

M&A Transactions Case Studies

Three strategic transactions in the sector—spanning geospatial intelligence, thermal imaging, and hyperspectral sensing—underscore accelerating buyer interest in high-resolution data, dual-use technologies, and spectrum-wide sensing capabilities. The acquired companies, each with differentiated imaging platforms and strong institutional customer bases, enabled buyers to strengthen their positions in government contracting, industrial automation, and environmental intelligence. These deals reflect a growing emphasis on multi-sensor integration, mission-critical analytics, and data-driven decision-making across defense and commercial applications.

Case Study 01

MAXAR TECHNOLOGIES

Maxar Technologies is a US-based provider of space infrastructure and Earth intelligence solutions. The company delivers high-resolution satellite imagery, geospatial data, and advanced analytics for applications in national defense, environmental monitoring, disaster response, mapping, and navigation. Maxar designs, builds, and operates Earth observation satellites, including the WorldView series, and supplies critical intelligence to agencies such as the US Department of Defense, NASA, and the National Reconnaissance Office (NRO). Beyond imagery and analytics, it manufactures satellites and develops space robotics, supporting programs like NASA’s lunar exploration. Maxar operates at the intersection of aerospace, defense, and geospatial intelligence.

Transaction Structure

Maxar Technologies was acquired by private equity firm Advent International and the British Columbia Investment Management Corporation (BCI) in a $6 billion public-to-private leveraged buyout (LBO). The transaction resulted in Maxar being delisted from the New York Stock Exchange and operating as a privately held company.

Market and Customer Segments Combination

Maxar’s core customer base included US government agencies, particularly defense and intelligence organizations, alongside commercial clients in sectors such as telecommunications, infrastructure, and environmental monitoring. The acquisition by Advent and BCI positioned Maxar to strengthen relationships with these institutional clients and operate with greater flexibility as a private company. The buyers leveraged Maxar’s embedded role in long-term government contracts to pursue growth in high-demand areas such as climate surveillance, border security, and global mapping. The transaction also created opportunities for cross-sector integration with adjacent portfolio assets in aerospace, defense, and AI-enabled data analytics.

Acquisition Strategic Rationale

The acquisition provided Advent and BCI with a scalable platform in the high-growth space and geospatial intelligence sector. Maxar’s proprietary imaging capabilities, vertically integrated satellite infrastructure, and multi-year government contracts offered a strong base for value creation through innovation, contract expansion, and targeted bolt-on acquisitions. As a private company, Maxar became better positioned to commit to long-term R&D, modernize its satellite fleet, and pursue strategic growth across public- and private-sector markets. The deal also reflected broader buyer interest in dual-use technologies serving both defense and civilian needs, driven by heightened geopolitical tensions and rising demand for real-time Earth observation.

Case Study 02

FLIR SYSTEMS

FLIR Systems, now part of Teledyne Technologies, is a global leader in thermal imaging, infrared camera technology, and advanced sensor systems. The company designs solutions that detect heat, motion, and environmental changes beyond the range of human vision. Its products serve defense, public safety, industrial, and commercial markets, with applications spanning military surveillance, border security, firefighting, industrial inspection, autonomous vehicles, and environmental monitoring. By delivering critical situational awareness and non-contact diagnostic capabilities, FLIR supports safety, operational efficiency, and informed decision-making in high-impact environments.

Transaction Structure

Teledyne Technologies acquired FLIR Systems for $8 billion through a combination of cash and stock.

Market and Customer Segments Combination

The acquisition combined Teledyne’s strength in digital imaging sensors and instrumentation with FLIR’s expertise in thermal imaging and surveillance systems. The merged company now serves a broad spectrum of end markets, including defense and intelligence, public safety, industrial automation, transportation, and environmental monitoring. Its customer base includes government agencies, military contractors, first responders, manufacturers, and technology developers, creating ongoing opportunities for cross-selling and integrated sensing solutions.

Acquisition Strategic Rationale

The transaction was designed to expand Teledyne’s capabilities across the full electromagnetic spectrum—from X-ray to infrared—by integrating FLIR’s market-leading thermal imaging technologies. It broadened Teledyne’s portfolio of sensing solutions, strengthened its positioning in defense and industrial markets, and unlocked operational synergies through integration and global scale. The deal also positioned the company to capture long-term demand for multi-sensor systems in security, automation, and autonomous platforms.

Case Study 03

HEADWALL PHOTONICS

Headwall Photonics is a US-based company specializing in hyperspectral imaging systems and optical instrumentation. It designs and manufactures high-performance sensors for remote sensing, machine vision, and scientific research in sectors including agriculture, defense, environmental monitoring, and industrial inspection. Its solutions capture spectral data beyond visible light, enabling precise material identification and analysis. Headwall serves commercial and government clients with airborne, handheld, and lab-based platforms supporting applications from crop health assessment to tactical surveillance and mineral exploration.

Transaction Structure

Arsenal Capital Partners acquired Headwall Photonics through a leveraged buyout for an undisclosed amount.

Market and Customer Segments Combination

The acquisition brought together Headwall’s specialized hyperspectral imaging capabilities with Arsenal Capital’s portfolio focus on science- and technology-driven businesses. Headwall’s customer base includes research institutions, defense contractors, agricultural firms, and environmental agencies. This continues to align with Arsenal’s strategic interest in advanced materials, diagnostics, and analytical instrumentation, creating ongoing opportunities to expand Headwall’s reach into adjacent industrial, life sciences, and government-funded markets.

Acquisition Strategic Rationale

The transaction provided Arsenal with a scalable platform in the growing field of hyperspectral sensing and optical imaging. With demand continuing to rise for high-resolution spectral data across precision agriculture, defense intelligence, and industrial inspection, Headwall’s technology remains well positioned for accelerated growth. The acquisition enabled investment in R&D, global expansion, and operational scaling, while also positioning Arsenal to pursue complementary acquisitions and drive innovation across its imaging and diagnostics portfolio.

M&A activity in the hyperspectral imaging and remote sensing sector remained strong over the past five years, fueled by investment in spectrum-wide sensing, AI-enabled analytics, and integrated geospatial platforms. Strategic buyers targeted proprietary sensor technologies, recurring analytics revenue, and positions in defense, environmental monitoring, and precision agriculture, while financial sponsors pursued scalable platforms with defensible IP and global expansion potential. Valuation multiples varied with technology differentiation, market exposure, and revenue visibility. Rising demand for high-resolution, real-time intelligence—driven by geopolitical risk, climate monitoring, and industrial automation—is expected to sustain momentum as buyers seek mission-critical, cross-sector assets.

Source: Maxar, Arsenal Capital, DefenseNews, Teledyne FLIR, Pitchbook Data.