Climate Control Systems and Solutions Sector M&A Transactions and Valuations

Climate Control Systems and Solutions Sector M&A Transactions and Valuations

The climate control systems and solutions sector brings together established industrial manufacturers and specialized technology providers advancing heating, ventilation, air conditioning, liquid cooling, and environmental control systems across industrial, commercial, residential, and digital infrastructure markets. Core activities include thermal management, air handling, energy-efficient cooling, humidity regulation, and integrated control platforms that regulate temperature and air quality across both physical and digital environments. Applications span data centers, power and utility infrastructure, transportation systems, telecommunications enclosures, and industrial automation.

Participants include heating, ventilation, and air-conditioning original equipment manufacturers expanding into advanced cooling and sustainability-driven solutions, alongside emerging specialists developing proprietary liquid-cooling technologies, modular systems, and software-enabled thermal platforms. Sector growth is driven by artificial-intelligence-driven data center expansion, electrification of infrastructure, industrial automation, and tightening global energy-efficiency and environmental regulations.

This report analyzes mergers and acquisitions activity, valuation dynamics, and strategic transformation from Q4 2020 to Q3 2025, highlighting the valuation gap between traditional mechanical climate-control providers and next-generation thermal-management platforms serving mission-critical environments. It highlights how technology differentiation, software-enabled capabilities, and global distribution scale support premium transaction multiples and long-term value creation.

Key transactions include Schneider Electric’s acquisition of Motivair Corporation, Modine Manufacturing’s acquisition of L.B. White, and nVent Electric’s acquisition of Vynckier Enclosures, illustrating how buyers pursue platform-scale expansion to secure advanced thermal technologies, broaden end-market exposure, and strengthen competitive positioning across mission-critical industrial and digital infrastructure environments.

Market Drivers and Technology Trends in the Climate Control Systems and Solutions Sector

This industry is being reshaped by powerful structural demand drivers and rapid technological advancement. Growth is increasingly supported by artificial-intelligence-driven data center expansion, electrification of infrastructure, and tightening global requirements for energy efficiency and environmental compliance. At the same time, innovation in liquid cooling, modular system design, and software-enabled monitoring is transforming climate control from a traditional mechanical function into a mission-critical, technology-driven platform. The following exhibits summarize the core demand drivers and the key technology and investment trends shaping this market.

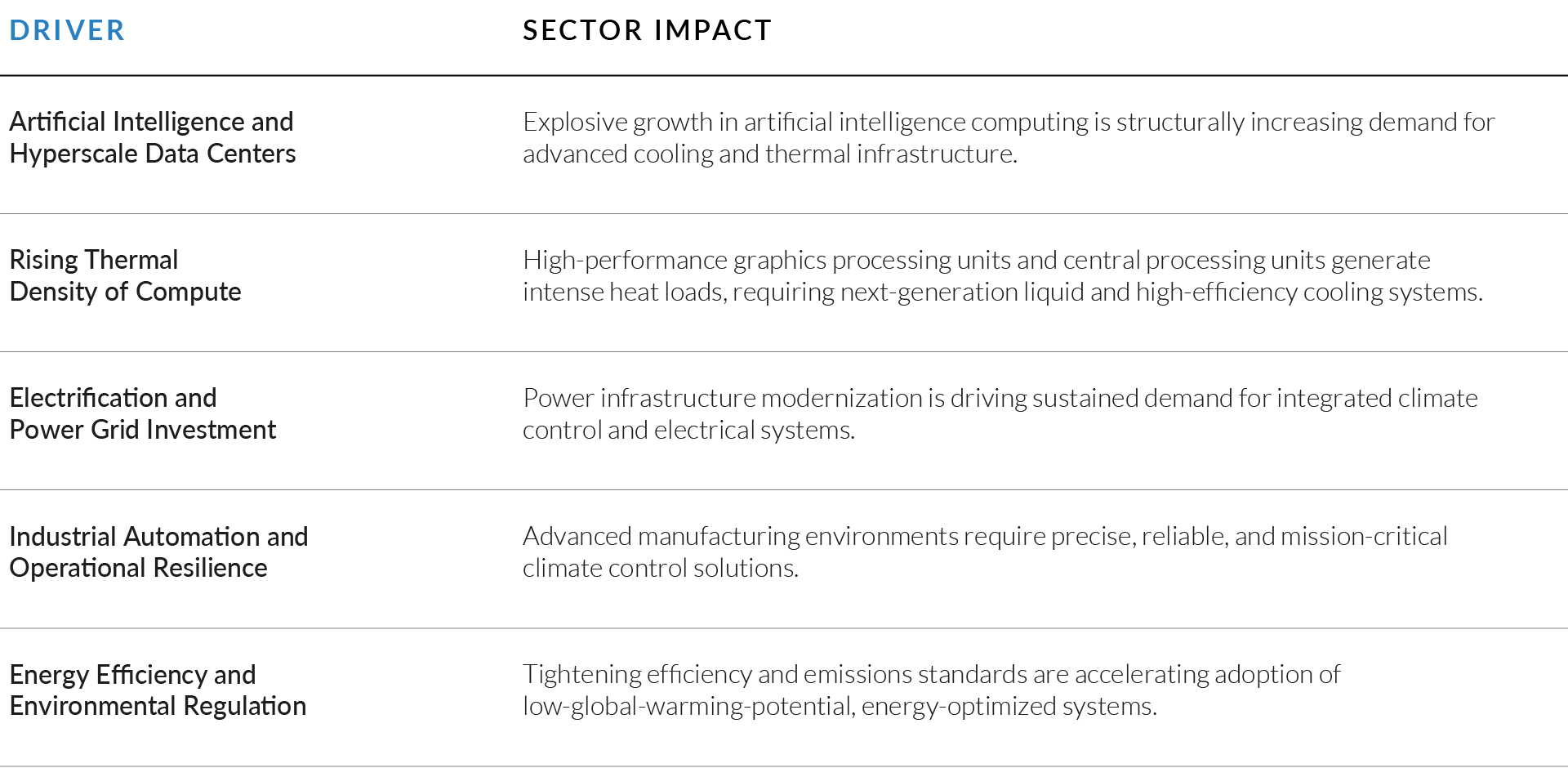

EXHIBIT 1

Core Demand Drivers in the Climate Control Systems & Solutions Sector

Source: nVent Electric, Q3 2025 Earnings Conference Call (Oct 2025); Morningstar, nVent Electric Equity Research Report (Nov 2025); Modine Manufacturing Company, Institutional Equity Research – Bullish on MOD Following SC25 (Nov 2025); Schneider Electric, Q3 2025 Earnings Conference Call (Oct 2025); Morningstar, Schneider Electric Equity Analyst Note (Oct 2025).

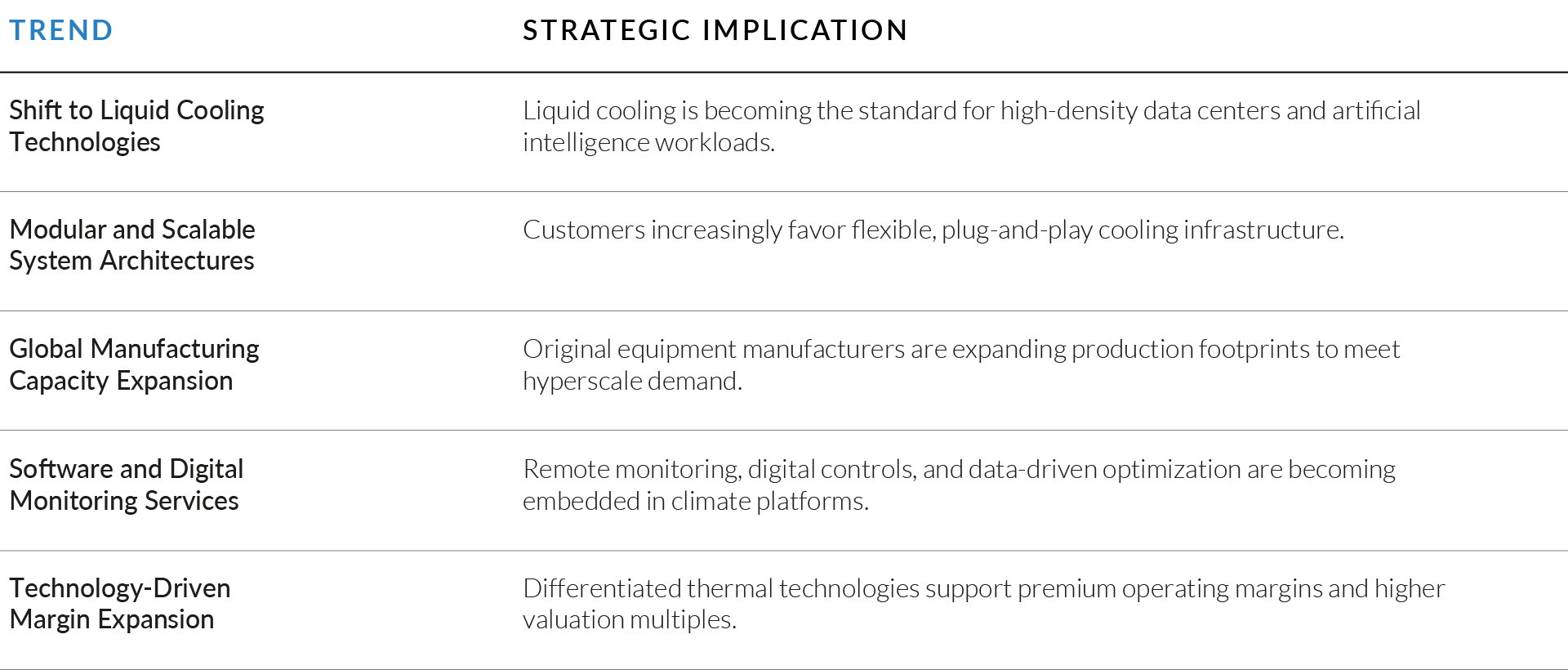

EXHIBIT 2

Key Technology and Investment Trends in Climate Control System

Source: nVent Electric, Q3 2025 Earnings Conference Call (Oct 2025); Morningstar, nVent Electric Equity Research Report (Nov 2025); Modine Manufacturing Company, Institutional Equity Research – Bullish on MOD Following SC25 (Nov 2025); Schneider Electric, Q3 2025 Earnings Conference Call (Oct 2025); Morningstar, Schneider Electric Equity Analyst Note (Oct 2025).

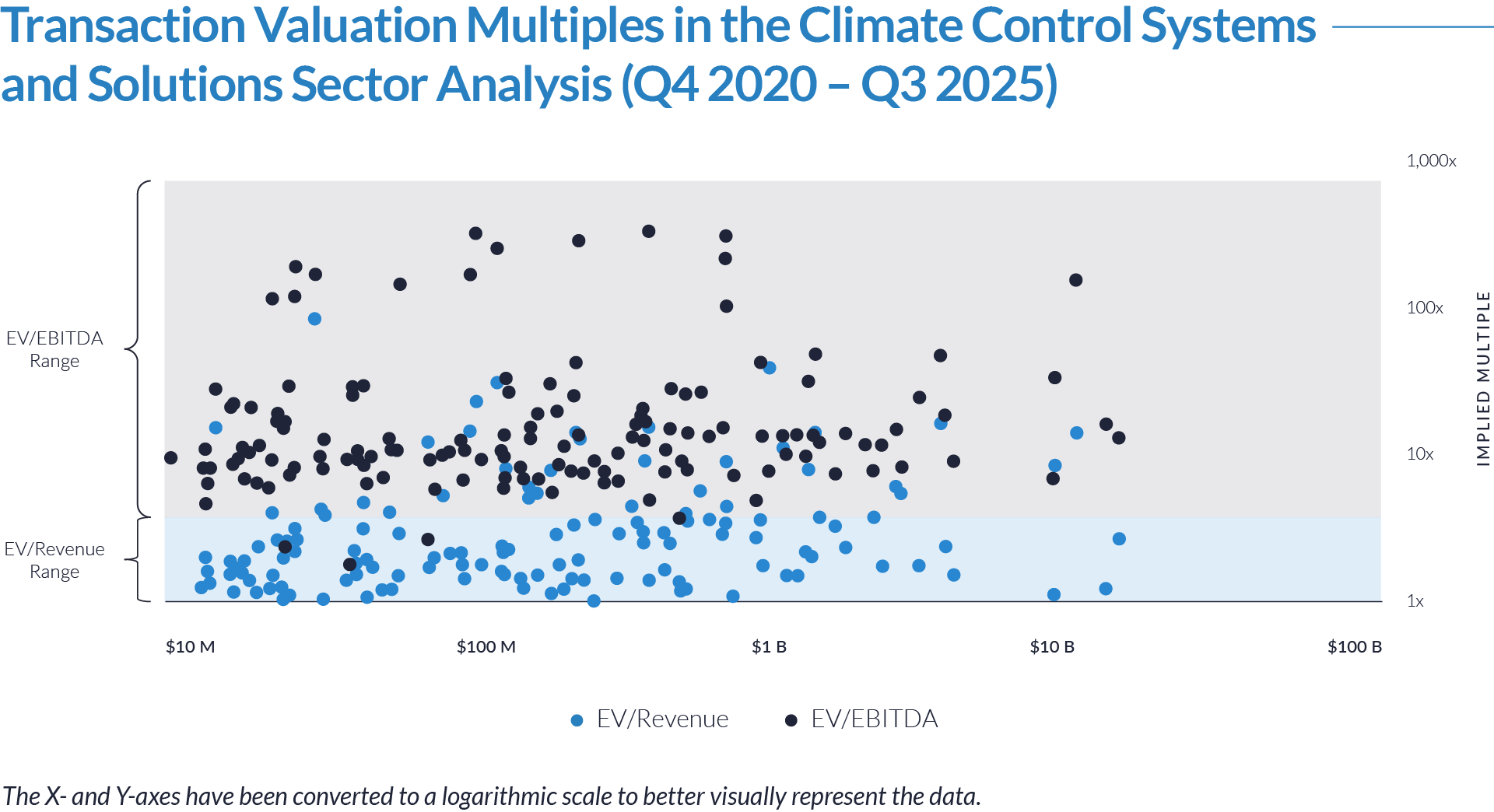

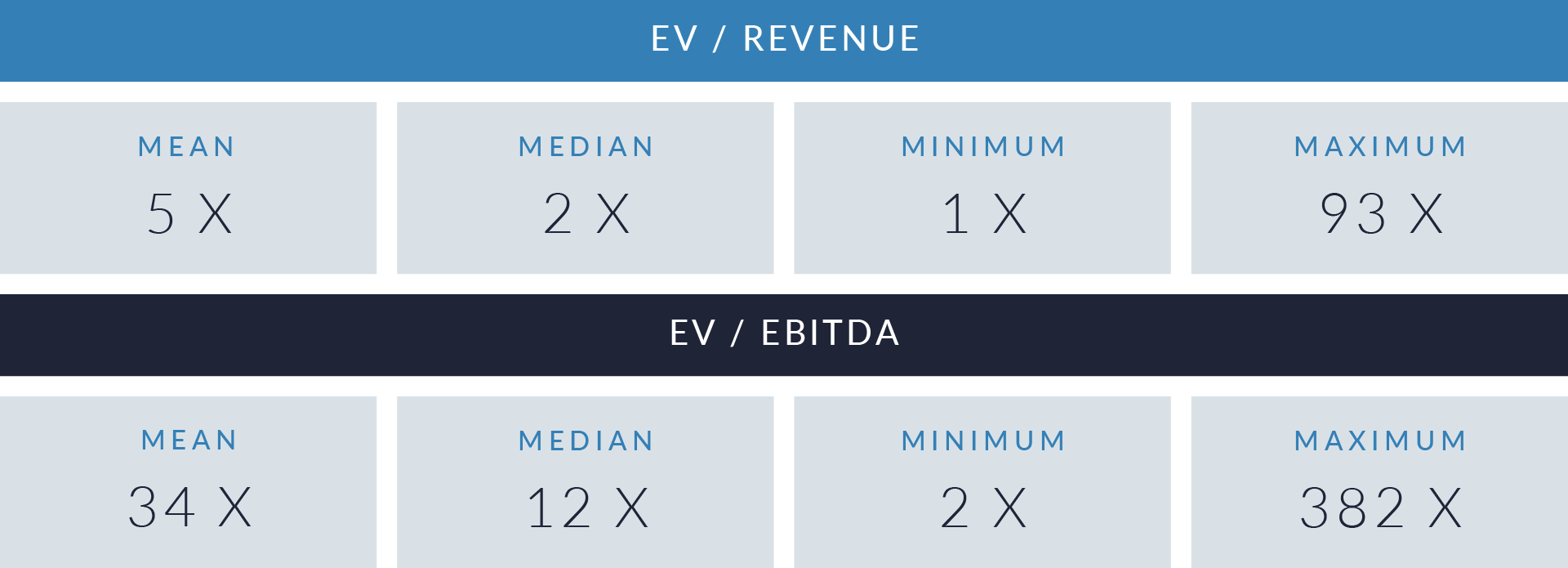

- Valuation multiples are based on a sample set of M&A transactions in the climate control systems and solutions sector using data collected as of November 19, 2025.

- The wide dispersion in valuation multiples, ranging from 1x to 93x EV/revenue and 3x to 382x EV/EBITDA, reflects a sector experiencing strong technological divergence. Traditional heating, ventilation, and air-conditioning manufacturers typically transact closer to the mid-range of 9x–17x EV/revenue, generating steady, asset-backed returns, while advanced thermal-management companies, particularly those serving data centers and artificial intelligence compute, command premium prices. Higher-end multiples are associated with businesses offering differentiated cooling technologies and software-enabled monitoring, underscoring the evolution from mechanical systems to integrated, intelligent platforms.

- The most expensive transactions, reaching as high as 93x EV/revenue and 382x EV/EBITDA, highlight strong investor appetite for energy-efficient and sustainability-driven cooling technologies. As global regulations tighten and data-center heat loads continue to rise, high-performance thermal solutions are becoming strategically essential. Companies that materially reduce power consumption, improve heat-dissipation efficiency, or help customers meet environmental targets consistently receive valuation premiums, demonstrating the growing importance of climate-control assets in operational resilience and environmental, social, and governance compliance.

- The clustering of mid-range multiples reflects a stable foundation of traditional climate-control and industrial-cooling businesses supported by replacement cycles, regulatory safety standards, and well-established distributor networks. These companies trade within consistent valuation bands due to predictable cash-flow profiles, but limited differentiation and slower innovation cycles constrain upside, reinforcing the widening valuation gap between conventional climate systems and next-generation cooling technologies aligned with data-center and automation markets.

Capital Markets Activities

The data highlights transaction activity, capital deployment, and consolidation trends within the climate control systems and solutions sector. Rising demand for energy-efficient cooling, liquid thermal management, and infrastructure-grade environmental control continues to drive M&A across original equipment manufacturers, component suppliers, and system integrators serving industrial and digital infrastructure end markets. Acquirers target scalable platforms with differentiated thermal technologies, strong distribution networks, and exposure to data center, electrification, and sustainability-driven demand, with transactions emphasizing vertical integration, manufacturing scale, and technology defensibility.

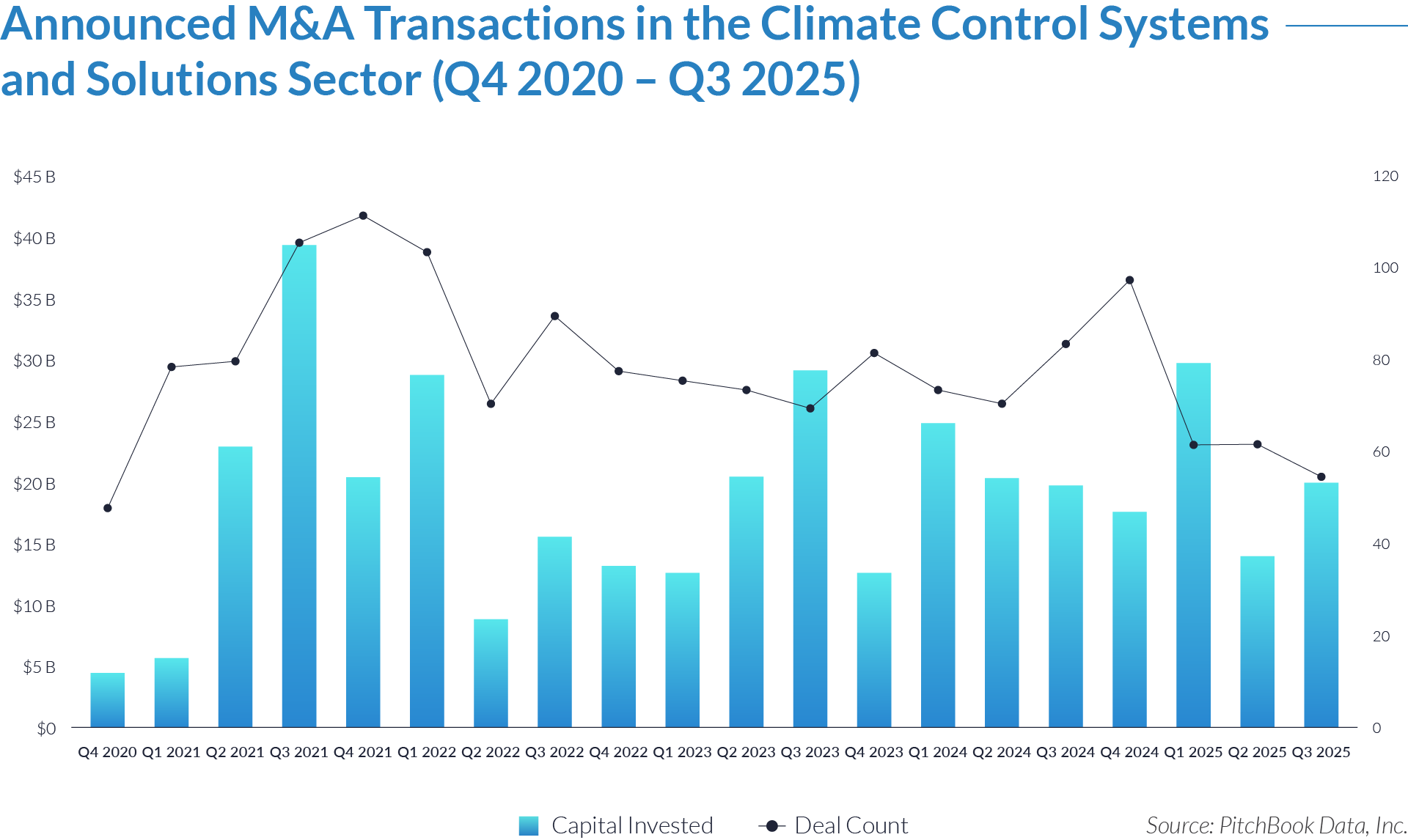

- Total capital deployed across the 20-quarter period exceeded $383 billion across 1,576 transactions, underscoring consistent long-term investment activity in the sector. The scale of cumulative deployment reflects sustained demand for thermal-management, cooling, and environmental-control technologies across both industrial and digital-infrastructure markets.

- Capital investment shows pronounced surges aligning with rapid data-center expansion and supply-chain recovery, most notably in Q3 2021 ($39 billion) and Q1 2024 ($25 billion). These peaks correspond to cycles of large-scale acquisitions and infrastructure upgrades, especially in advanced cooling and electrification systems.

- Deal volume remains resilient even during quarters of reduced capital flow, suggesting a market characterized by steady mid-market transactions and strong appetite for strategic bolt-ons. Periods such as Q3 2024 (84 deals) and Q4 2024 (98 deals) demonstrate that acquirers continued to pursue smaller, operationally strategic assets despite fluctuations in mega-deal activity.

- Late-period capital trends in 2025 reflect selective, high-value investment rather than broad-based expansion, with Q1 2025 showing elevated capital $30 billion despite lower deal count of 62. This shift signals increasing emphasis on high-impact technologies, such as energy-efficient cooling, liquid-cooling platforms, and advanced climate systems, driving fewer but more substantial investments.

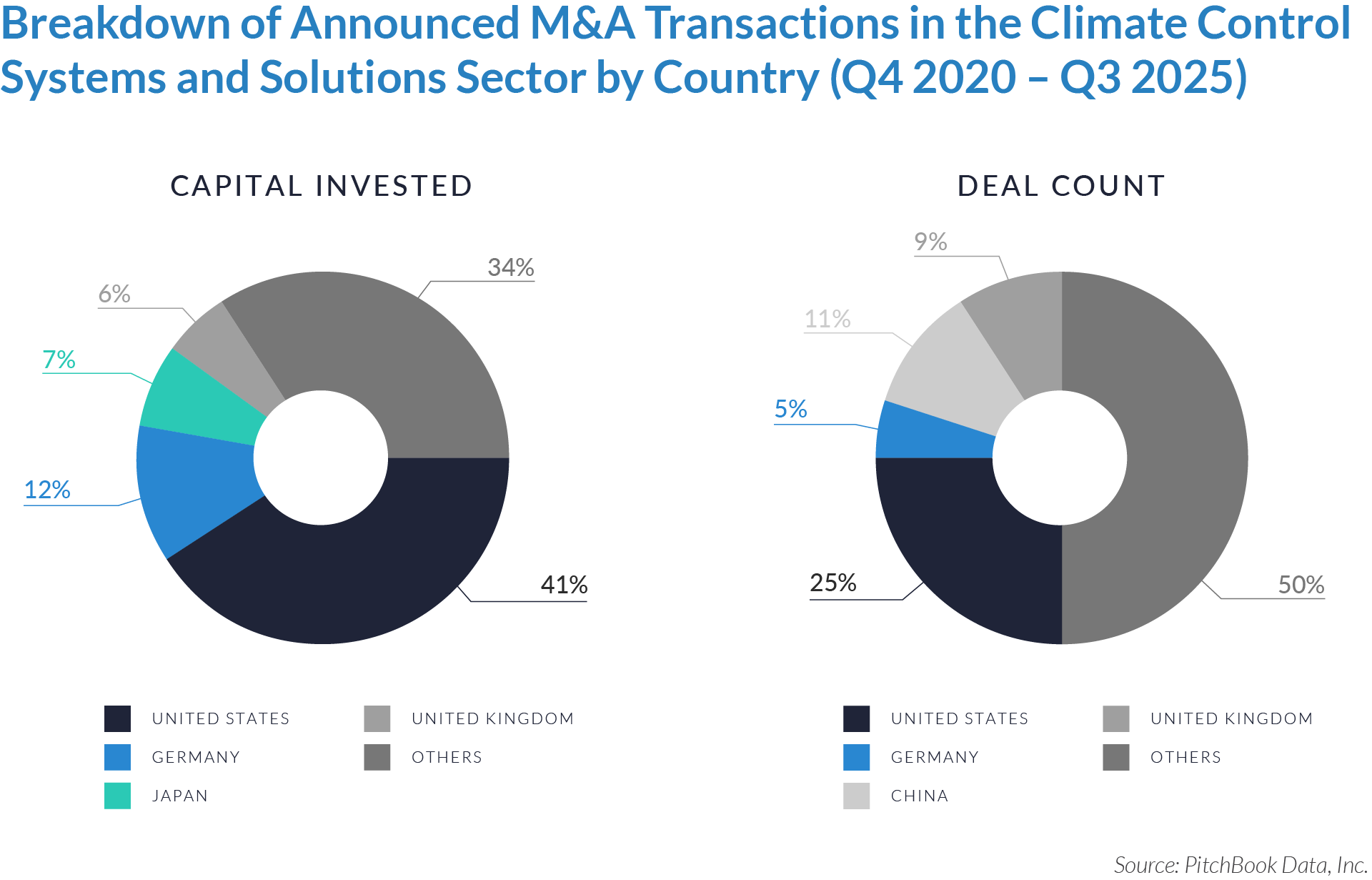

- The United States leads the sector in both capital invested (41%) and deal activity (25%), reflecting its dominant role in climate-control innovation, data center infrastructure expansion, and industrial HVAC modernization. The US continues to attract large-scale transactions supported by strong private equity presence, advanced thermal-technology demand, and government-backed energy-efficiency initiatives.

- Europe exhibits a meaningful but more fragmented contribution, with Germany (12% of capital and 5% of deals) and the United Kingdom (6% of capital and 9% of deals) showing steady investment tied to industrial upgrading, electrification requirements, and sustainability regulation. However, the relatively lower deal counts underscore a market driven by fewer but higher-value transactions compared to the US.

- The other international and emerging markets category accounts for a substantial share, 34% of capital and 50% of deal volume, indicating broad global participation outside major economies, especially in Asia-Pacific, the Middle East, and emerging industrial markets. This distribution highlights climate control as a globally relevant sector, where smaller regional transactions collectively play a major role in driving adoption of energy-efficient and advanced cooling technologies.

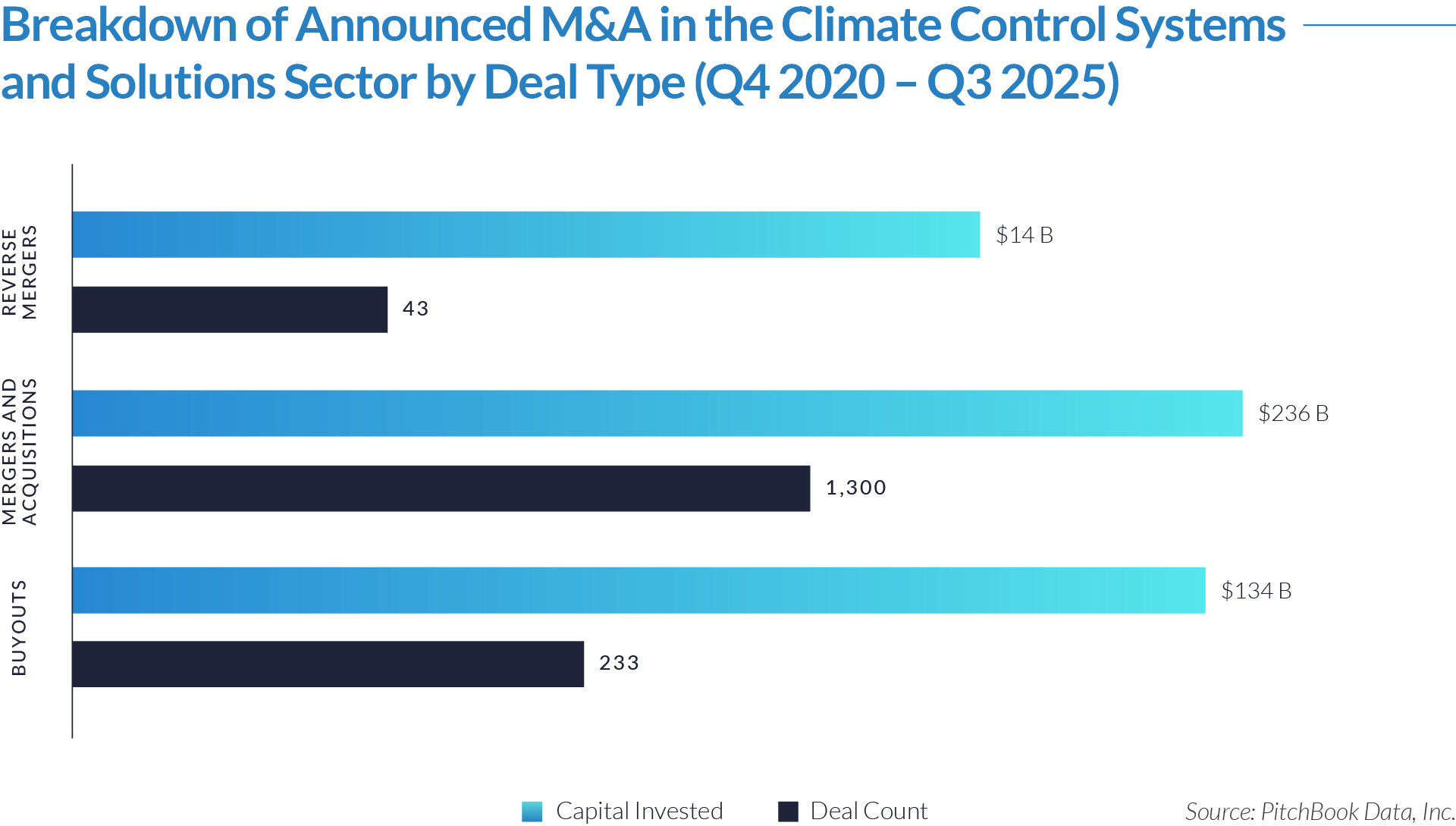

- Mergers and acquisitions dominate activity with $236 billion deployed across 1,300 transactions, indicating that strategic consolidators and corporate buyers are driving most capital formation in the sector. This reflects a market where scale, integration, and technology expansion remain top priorities.

- Buyouts represent a smaller but still substantial share with $134 billion across 233 deals, showing robust private-equity interest in climate-control assets with predictable cash flow, strong replacement cycles, and opportunities for operational improvement. The higher capital-per-deal ratio suggests targeted investments in mature, asset-heavy platforms.

- Reverse mergers remain limited at $14 billion and 43 transactions, underscoring their niche role in the sector. These deals typically reflect selective paths to public-market access or strategic restructuring rather than mainstream growth or consolidation strategies.

M&A Transactions Case Studies

Three transactions in the climate control systems and solutions sector demonstrate how strategic acquirers are expanding capabilities in advanced cooling, thermal management, and environmental-control technologies, targeting companies with specialized engineering, energy-efficient systems, and strong distribution channels to drive portfolio diversification, operational synergies, and long-term value creation across mission-critical markets.

Case Study 01

MOTIVAIR CORPORATION

Motivair Corporation is a US-based specialist in advanced liquid-cooling and thermal-management solutions for high-density compute environments, including AI systems, hyperscale data centers, and enterprise IT. Its portfolio spans direct-to-chip cooling, in-rack distribution, industrial chillers, and monitoring platforms that help operators address rising heat loads and efficiency requirements.

Acquirer

Schneider Electric is a global leader in energy management, automation, and digital infrastructure solutions serving industrial, commercial, and data center markets. Its platform integrates electrical distribution, precision cooling, power management, and software-defined automation, positioning the company at the forefront of large-scale compute-infrastructure modernization.

Transaction Structure

Schneider Electric acquired a 75% controlling interest in Motivair for $36 million, with a commitment to purchase the remaining 25% minority stake in 2028, completing full integration into its Secure Power division.

Market and Customer Segments Combination

The combination brings together Schneider’s global data center footprint with Motivair’s specialized cooling expertise and customer relationships across AI compute, hyperscale operators, enterprise IT, and colocation facilities. Schneider benefits from Motivair’s OEM and integrator partnerships, while Motivair gains expanded distribution channels, international reach, and access to Schneider’s enterprise and public-sector clients.

Acquisition Strategic Rationale

The acquisition strengthens Schneider Electric’s thermal-management portfolio as cooling demands escalate with the growth of AI and high-density compute. Motivair’s liquid-cooling technology enhances Schneider’s precision-cooling and digital-infrastructure offerings, enabling a more efficient and sustainable solution stack. The deal supports Schneider’s strategy to lead in AI-ready infrastructure, accelerate adoption of liquid-cooling systems globally, and deliver fully integrated power-and-cooling ecosystems for hyperscale, enterprise, and HPC environments.

Case Study 02

L.B. WHITE

L.B. White is a US-based manufacturer of premium climate-control solutions, specializing in heating, cooling, and ventilation systems for agricultural, industrial, and commercial environments. The company offers forced-air heaters, radiant heating systems, and evaporative cooling units used in livestock housing, greenhouses, construction sites, and temporary event structures. Its products are recognized for durability, efficiency, and performance in high-demand, harsh-environment applications.

Acquirer

Modine Manufacturing (NYSE: MOD) is a global leader in thermal-management systems for transportation, data centers, HVAC, and industrial applications. The company provides engineered heating and cooling technologies that support energy efficiency, climate resilience, and environmental performance across multiple end markets.

Transaction Structure

Modine acquired 100% of L.B. White for $111 million in an all-cash transaction.

Market and Customer Segments Combination

The combination brings together Modine’s international footprint and engineering scale with L.B. White’s strong presence in agricultural and industrial climate-control markets. Modine gains access to L.B. White’s established customer base across livestock production, horticulture, construction, and commercial heating applications. L.B. White, in turn, benefits from Modine’s global distribution channels, manufacturing efficiencies, and deeper access to industrial and commercial infrastructure markets.

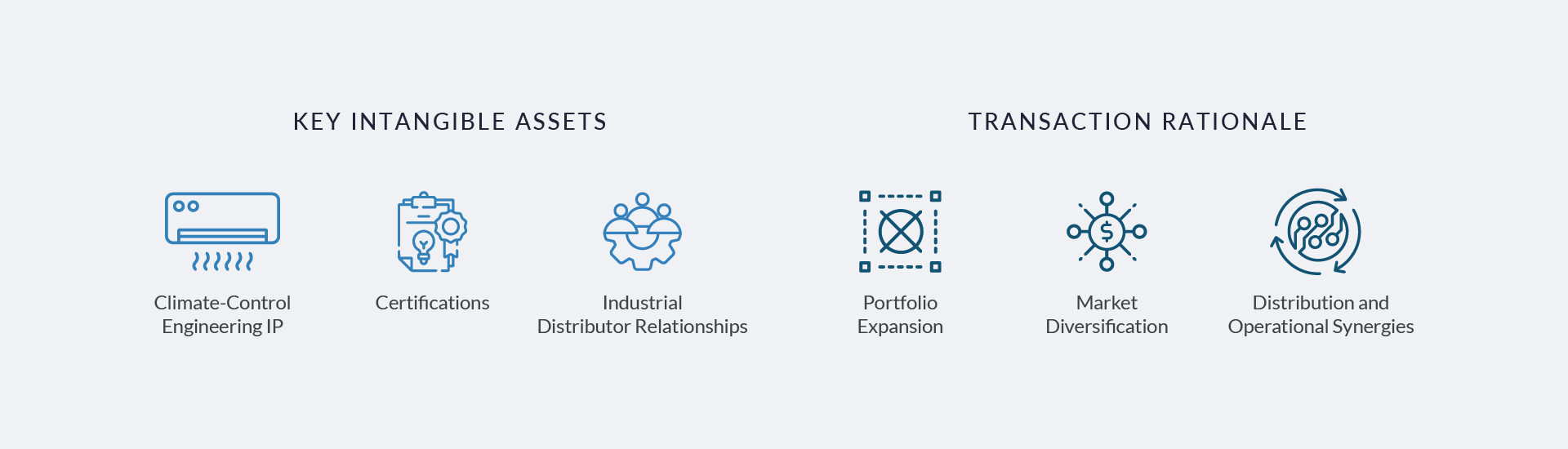

Acquisition Strategic Rationale

The acquisition strengthens Modine’s position in the climate-control sector by adding a portfolio of high-performance heating and cooling systems used in mission-critical environments. L.B. White’s specialized products complement Modine’s existing HVAC and thermal-management offerings, supporting energy-efficient solutions across expanding agricultural and industrial markets. The deal aligns with Modine’s strategy to diversify its climate solutions platform, expand into resilient end markets, and leverage cross-selling and operational synergies to accelerate growth.

Case Study 03

VYNCKIER ENCLOSURES

Vynckier Enclosures is a US-based manufacturer of non-metallic, fiberglass-reinforced enclosures used to protect electrical components in industrial, commercial, utility, and infrastructure applications. The company offers corrosion-resistant enclosures designed for harsh environments, supporting applications in power distribution, industrial automation, and outdoor electrical systems.

Acquirer

nVent Electric (NYSE: NVT) is a global provider of electrical connection, protection, and thermal-management solutions. The company serves industrial, commercial, energy, and infrastructure markets, offering enclosure systems, electrical fastening products, and engineered thermal-management technologies.

Transaction Structure

nVent acquired 100% of Vynckier Enclosures for $27 million in cash.

Market and Customer Segments Combination

The transaction brings together nVent’s global electrical infrastructure footprint with Vynckier’s expertise in non-metallic enclosures for industrial automation, utilities, commercial buildings, and outdoor electrical systems. nVent gains enhanced customization speed and greater flexibility in serving harsh-environment and corrosion-sensitive markets.

Acquisition Strategic Rationale

The acquisition strengthens nVent’s position in electrical protection and thermal-management solutions. Vynckier’s non-metallic enclosures complement nVent’s metallic enclosure portfolio, enabling broader product coverage and improved response times for custom orders. The deal supports nVent’s strategy to expand high-margin enclosure offerings, enhance its ability to serve industrial and infrastructure customers, and grow its presence in sectors requiring durable, corrosion-resistant electrical protection.

The climate control systems and solutions sector remains positioned for sustained growth, supported by structural demand from data center expansion, electrification of infrastructure, and tightening energy-efficiency regulations. M&A activity continues to reflect strong strategic and financial sponsor interest, with buyers prioritizing differentiated thermal technologies, manufacturing scale, and exposure to mission-critical end markets. As climate control evolves into a core layer of digital and industrial infrastructure, valuation premiums are expected to remain concentrated around technology-enabled and energy-efficient platforms.

Source: Motivair Corp, Schneider Electric, Modine, Wisconsin Public Radio, Nvent, United States Securities and Exchange Commission, Pitchbook Data.