Mobile Power and Battery Solutions Sector M&A Transactions and Valuations

Mobile Power and Battery Solutions Sector M&A Transactions and Valuations

The mobile power and battery solutions sector covers advanced portable energy systems, including battery packs, charging platforms, and related components designed for professional, industrial, and mission-critical applications. These systems leverage lithium-ion and next-generation chemistries to enable electrification, resilient power infrastructure, and mobile connectivity. Growth is supported by OEM-integrated supply chains, modular product architectures, and the adoption of service-based business models across diverse end markets.

This report examines M&A transaction trends, valuation metrics, and regional investment flows in the sector from Q3 2020 to Q2 2025, with focus on capital deployment, consolidation dynamics, and strategic acquisitions. The analysis emphasizes intangible assets driving valuations, including proprietary chemistries, integration expertise, OEM partnerships, and customer relationships, while reviewing valuation patterns across EV/revenue and EV/EBITDA multiples.

Case studies include Komatsu America’s acquisition of American Battery Solutions, Solid State’s acquisition of Custom Power, and Ultralife’s acquisition of Excell Battery Group. Each transaction is evaluated in terms of strategic rationale, valuation outcomes, and synergies. The report also assesses the impact of mega-cap consolidation, sponsor-led roll-ups, and regional innovation hubs on competitive positioning and long-term investment opportunities.

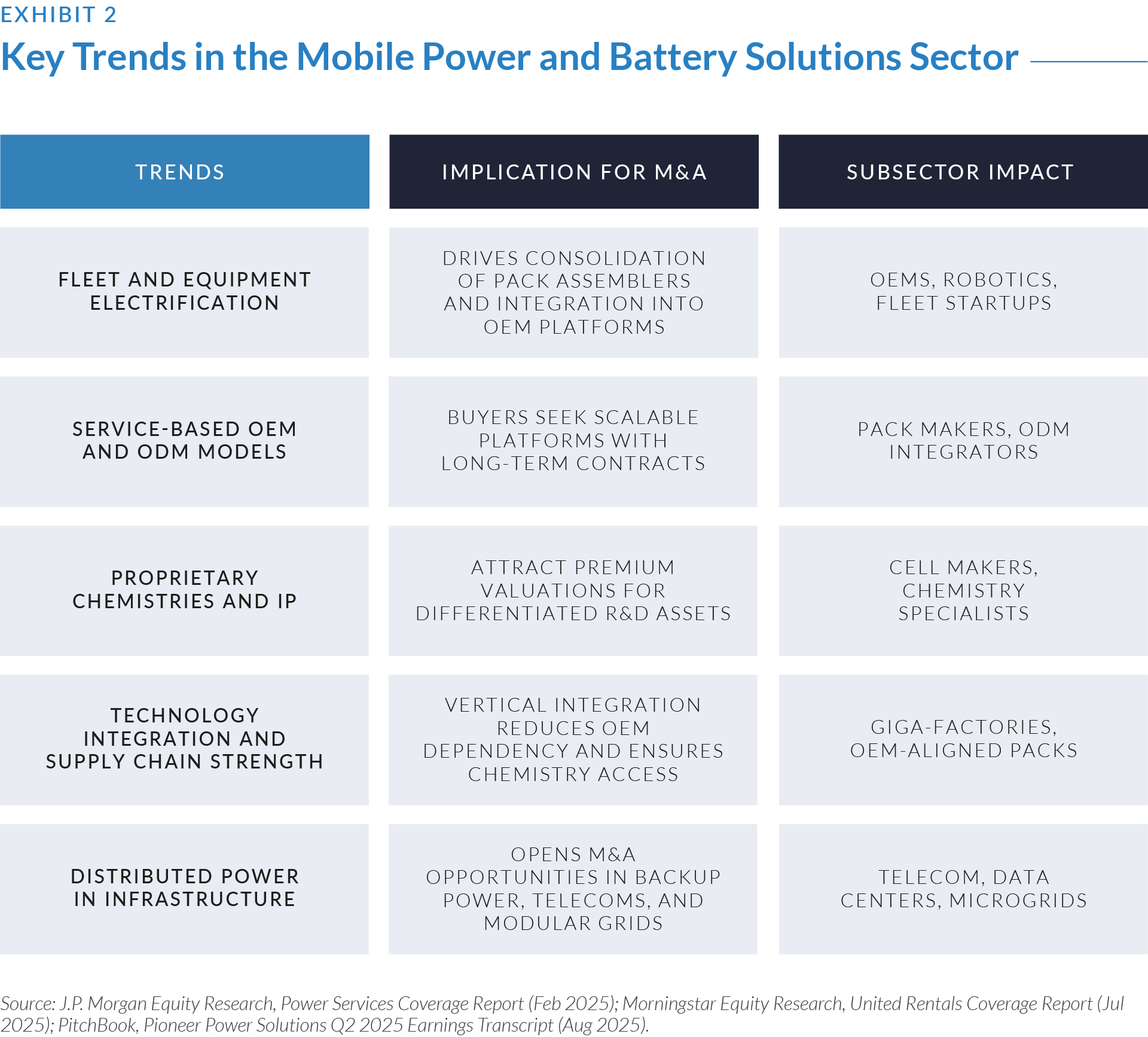

Sector Definition, Applications, and Key Trends in Mobile Power and Battery Solutions Sector

This section outlines the scope of the mobile power and battery solutions sector and highlights the key trends driving its growth. These include the integration of distributed power into core infrastructure, rapid fleet and equipment electrification, the rise of service-based OEM and ODM partnership models, and competitive differentiation through technology integration and supply chain resilience.

Sector Definition:

The sector comprises companies that design and manufacture mobile energy systems such as battery packs, charging equipment, and related components for industrial, professional, and mission-critical applications. Positioned in the midstream of the energy value chain, these firms specialize in packaging and system integration, applying advanced chemistries to deliver scalable, high-performance solutions.

Applications:

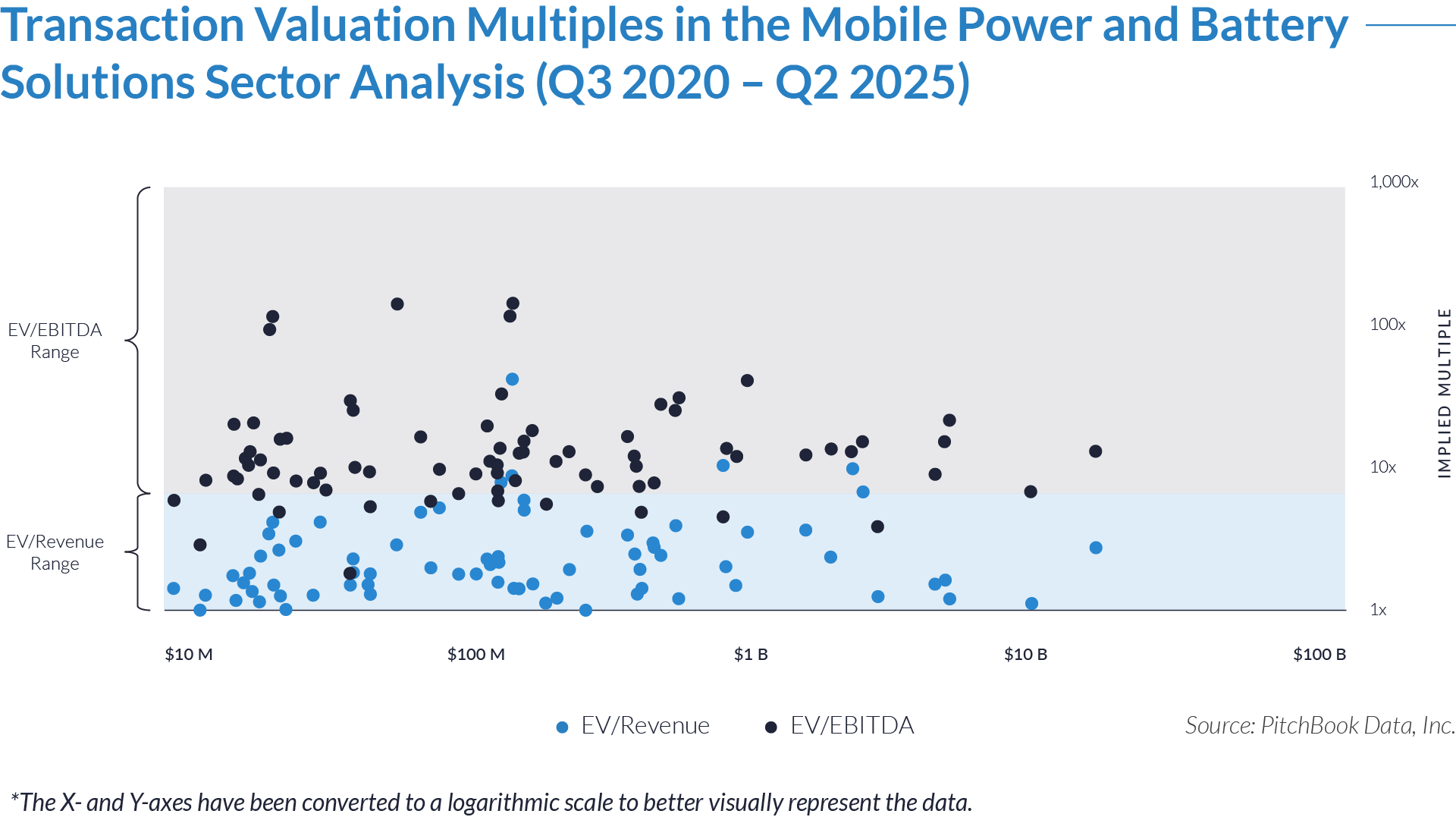

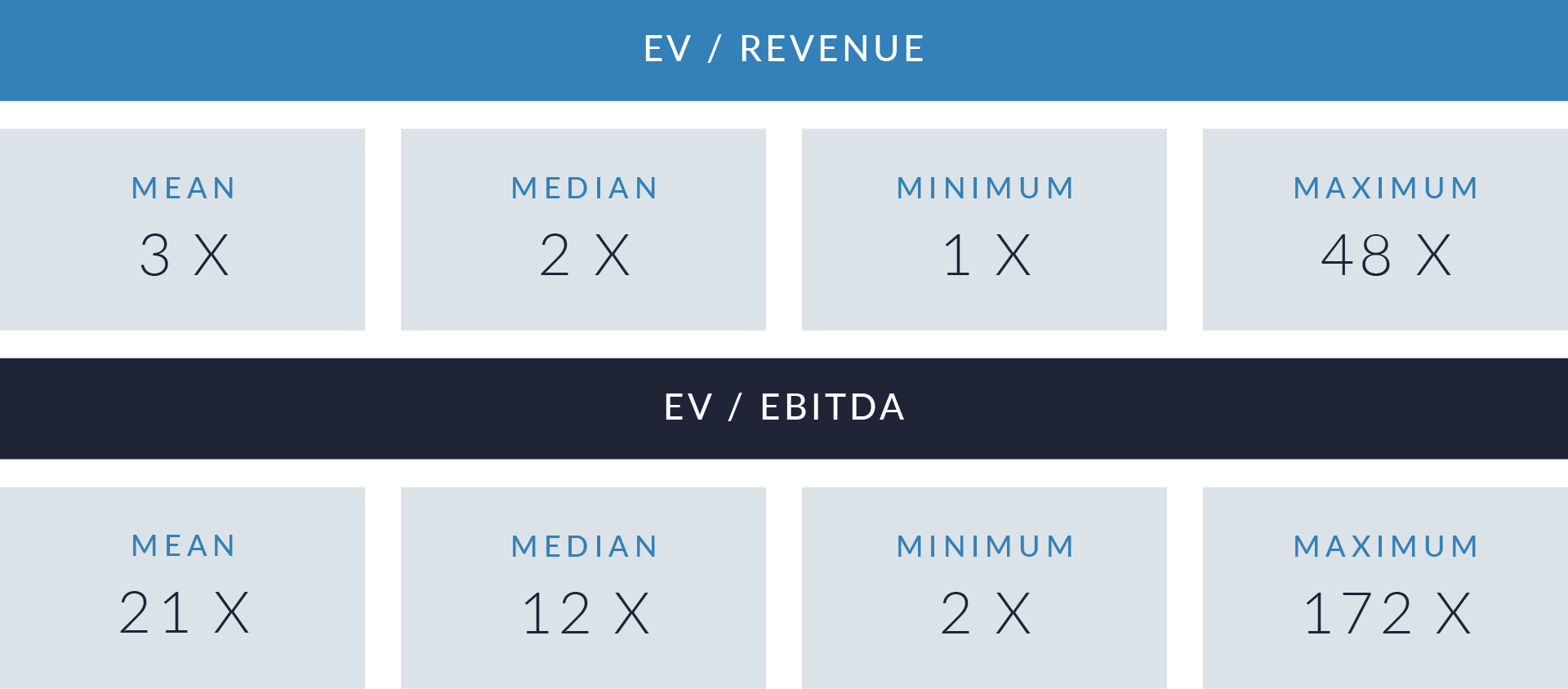

- Valuation multiples are based on a sample set of M&A transactions in the mobile power and battery solutions sector using data collected on August 28, 2025.

- Companies with enterprise values between $100 million and $200 million frequently trade at revenue multiples above 5x, with some exceeding 40x EV/revenue. These elevated valuations typically apply to businesses with proprietary IP, high R&D intensity, or advanced chemistries considered long-term strategic assets. Profitability does not justify these valuations, with EV/EBITDA often exceeding 100x.

- Transactions exceeding $10 billion dominate capital deployment in the sector. These deals cluster in the lower band of the valuation spectrum, with EV/revenue multiples between 1x and 3x and EV/EBITDA multiples in the 7x–15x range. This reflects how scale players secure stability and supply chain control while receiving valuations aligned with mature industrial assets.

- Companies valued between $200 million and $800 million represent the densest activity, with EV/revenue multiples concentrated around 2x–4x and EV/EBITDA multiples between 8x and 20x. This segment includes pack assemblers, technology integrators, and component suppliers, where valuations balance commodity exposure against differentiation potential.

Capital Markets Activities

M&A activity in the mobile power and battery solutions sector is driven by sustained capital inflows, mega-cap consolidation, and selective investment in proprietary technology platforms. Buyers emphasize scale manufacturing and next-generation chemistry, while financial sponsors pursue efficiency-driven roll-ups. The sector reflects a dual focus on scale and technological differentiation, with transactions clustering around companies that offer both technological depth and scalable commercial models.

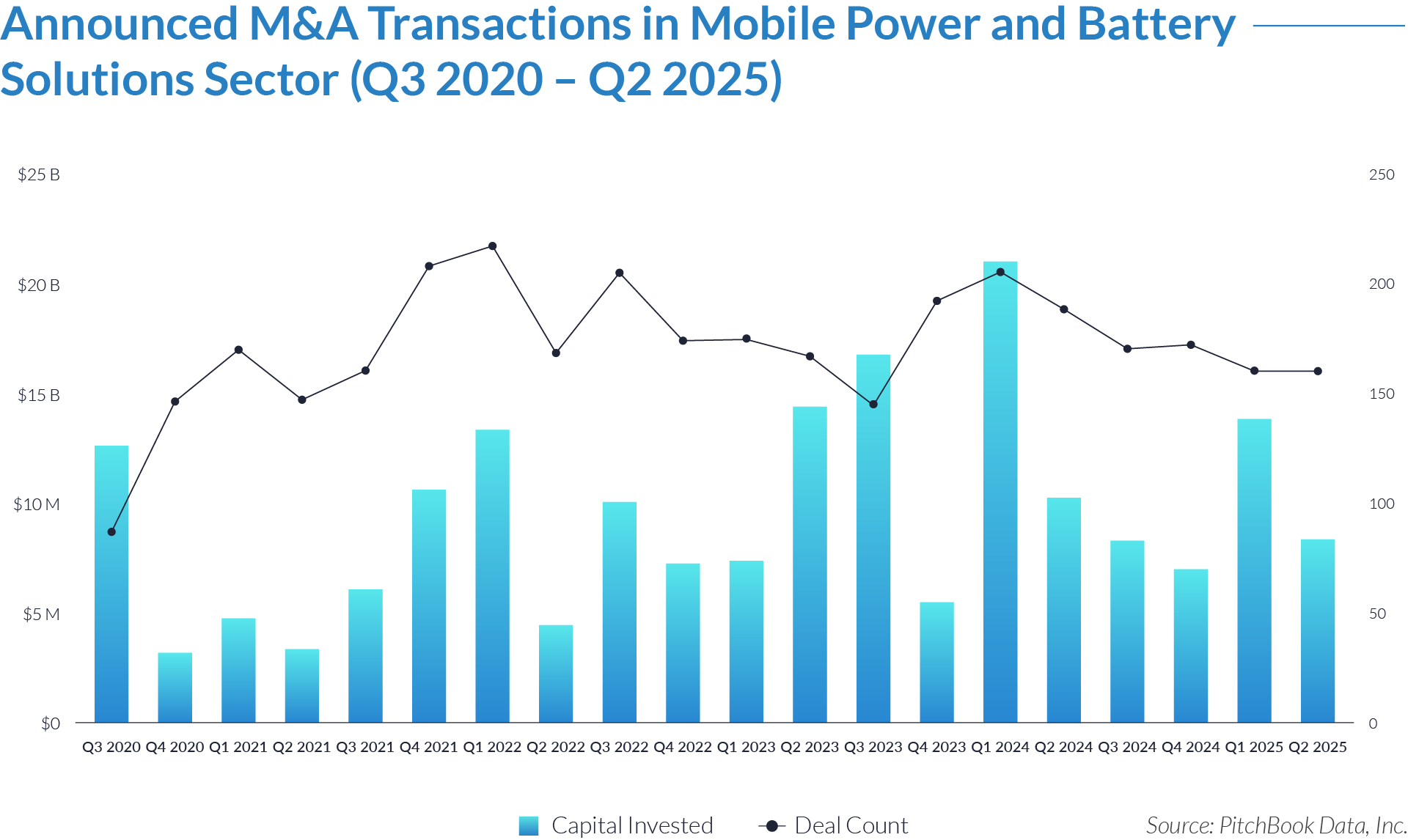

- Between Q3 2020 and Q2 2025, the sector attracted approximately $188 billion across 3,416 deals. This volume positions mobile power solutions as a core frontier of energy transition investment, comparable to renewables and grid modernization. Consistent inflows across cycles demonstrate investor confidence in long-duration growth despite macroeconomic volatility.

- Quarterly deal counts held steady at 160–210, while capital invested peaked at $21 billion in Q1 2024, reflecting a shift toward larger, capital-intensive transactions.

- Following 2022 volatility ($4–13 billion per quarter), average deal sizes expanded in 2023 onward, with $17 billion deployed across only 145 deals in Q3 2023, reflecting a pivot to giga-factories, OEM platforms, and vertical integration.

- Capital flows spiked in Q1 2022, mid-2023, and in early 2024 and 2025, driven by regulatory incentives and OEM supply agreements, confirming that deployment occurs in concentrated waves rather than steady growth.

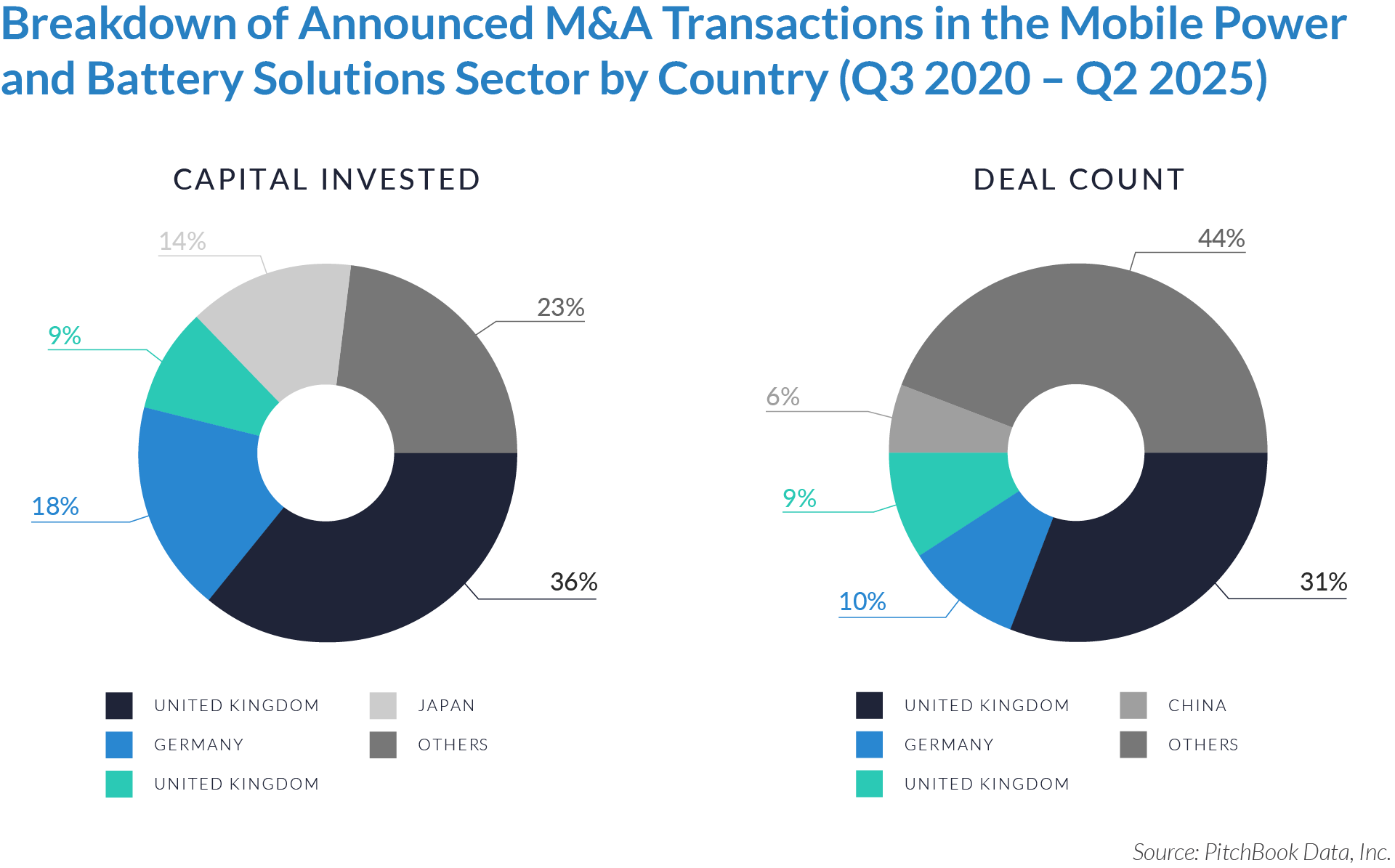

The graphs below present the geographic distribution of transactions, providing additional detail on regional trends and investment dynamics.

- The US accounts for 36% of capital invested but only 31% of deal count, highlighting larger, more capital-intensive transactions. Activity is concentrated in giga-factory buildouts, vertically integrated supply chains, and large-scale OEM partnerships, positioning the US as the sector’s capital anchor.

- The international and emerging markets category represents 44% of global deal flow but at smaller average deal sizes. This indicates fragmented growth across emerging markets in Southeast Asia, Eastern Europe, and Latin America, where localized supply chain resilience and regional infrastructure projects drive investment.

- Germany (18%), Japan (14%), and the UK (9%) capture 41% of total capital deployed but a smaller share of deal count. Activity is concentrated in fewer, innovation-driven transactions, including advanced chemistries, OEM-integrated platforms, and commercialization initiatives. These markets serve as strategic hubs for next-generation technology development.

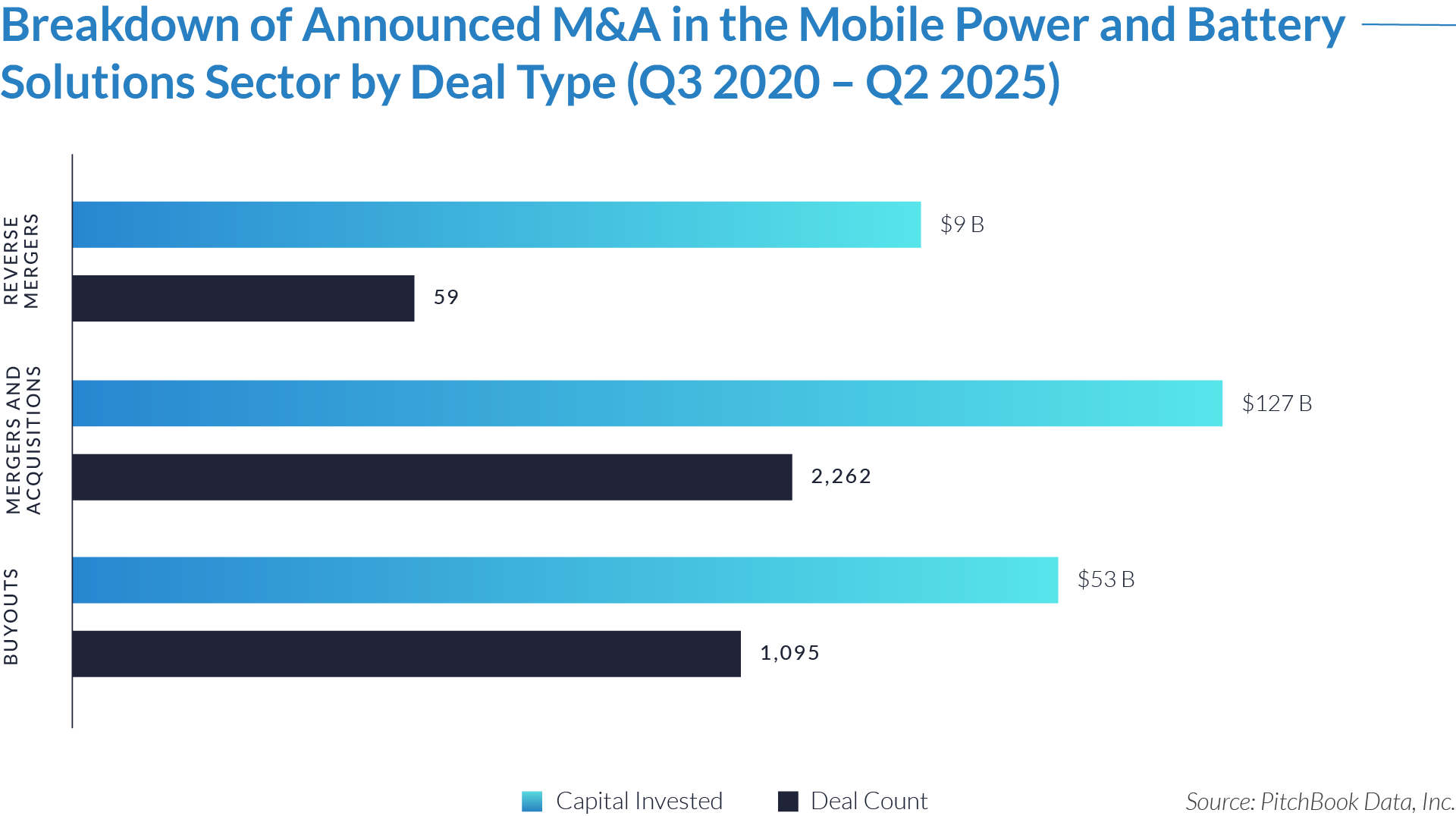

- M&A accounted for $127 billion across 2,262 deals, representing nearly two-thirds of deployed capital and most of the transaction volume. This dominance reflects ongoing strategic consolidation, as scale players and OEMs acquire technology, manufacturing capacity, and supply chain access rather than relying on organic growth.

- Sponsors executed $53 billion across 1,095 transactions, underscoring strong appetite for scalable platforms with operational efficiency potential. Buyout activity centers on roll-ups, efficiency gains, and exit positioning, reinforcing a two-step consolidation dynamic where sponsor-backed platforms are later absorbed by corporates.

- Reverse mergers totaled just $9 billion across 59 deals yet signal ongoing sector appeal to public capital markets. These transactions primarily support early-stage or pre-revenue firms without IPO access. Their small share relative to M&A and buyouts shows that while investors back novel chemistries and mobile energy technologies, sustained capital deployment remains anchored heavily in established private-market and corporate-led dealmaking.

M&A Transactions Case Studies

Three transactions in the mobile power solutions and battery solutions sector highlight buyer strategies in electrification, mission-critical applications, and OEM expansion. Komatsu advanced proprietary battery integration, Solid State expanded with custom power systems across defense and aerospace, and Ultralife strengthened its North American OEM footprint through Excell Battery. These acquisitions reflect sector consolidation, cross-market synergies, and the pursuit of advanced technologies for sustainable, high-performance equipment.

Case Study 01

AMERICAN BATTERY SOLUTIONS

American Battery Solutions (ABS), founded in 2019, is a US-based manufacturer of advanced lithium-ion battery systems. Headquartered in Lake Orion, Michigan, with a facility in Springboro, Ohio, ABS designs and produces fully integrated and custom battery packs for electric vehicles, fleets, robotics, construction, mining, and industrial equipment.

Transaction Structure

Komatsu America Corp. acquired American Battery Solutions for an undisclosed amount.

Market and Customer Segments Combination

The acquisition integrated ABS’s lithium-ion battery expertise with Komatsu’s established construction and mining equipment portfolio. ABS’s customer base in mobility, material handling, and industrial markets complemented Komatsu’s off-road machinery portfolio, creating opportunities to embed proprietary battery systems into large-scale equipment and diversify into adjacent sectors such as agriculture and robotics.

Acquisition Strategic Rationale

The transaction advanced Komatsu’s electrification strategy by internalizing battery design and manufacturing capabilities. By leveraging ABS as a center of excellence, Komatsu aimed to develop proprietary battery-powered machinery, reduce reliance on third-party suppliers, and strengthen its competitive position in the transition to sustainable, low-emission industrial equipment.

Case Study 02

CUSTOM POWER

Custom Power, founded in 1965, is a US-based provider of custom battery packs and power management systems. The company delivers design, assembly, and testing services across multiple chemistries, including primary lithium.

Transaction Structure

Solid State plc acquired Custom Power LLC for up to $45 million, structured as $30 million upfront cash, $10 million deferred, and up to $5 million in performance-based earn-out.

Market and Customer Segments Combination

The acquisition brought together Solid State’s expertise in specialist electronic components and rugged computing with Custom Power’s strengths in custom battery design and assembly. Custom Power’s established customer base in medical, defense, aerospace, and industrial markets extended Solid State’s North American presence, enabling it to better serve highly regulated, mission-critical applications.

Acquisition Strategic Rationale

The transaction created a more comprehensive solutions portfolio, aligning Solid State’s rugged computing platforms with Custom Power’s battery technologies. This strengthened the company’s competitive positioning in regulated industries, diversified its revenue base, and reinforced its strategy of expanding into high-reliability applications where long-term customer relationships and technical integration are key differentiators.

Case Study 03

EXCELL BATTERY GROUP

Excell Battery Group is a North American manufacturer of custom lithium and smart battery systems with more than 35 years of experience. With facilities in Vancouver, Calgary, Toronto, and Houston, the company serves medical, oil and gas, industrial instrumentation, robotics, and small EV markets.

Transaction Structure

Ultralife Corporation acquired Excell Battery Group for US $19 million in cash in December 2021.

Market and Customer Segments Combination

The acquisition reinforced Ultralife’s position in medical, industrial, and oil and gas instrumentation markets. Excell’s long-standing OEM relationships and specialization in rugged, application-specific battery packs complemented Ultralife’s defense, energy, and communications segments while expanding its footprint across North America.

Acquisition Strategic Rationale

By adding Excell’s engineering expertise and manufacturing capacity, Ultralife scaled its Battery & Energy Products business and strengthened OEM-focused offerings. The acquisition enhanced long-term customer value with engineered, application-specific packs and positioned Ultralife to capture operational synergies through regional manufacturing, shared supply chains, and cross-selling opportunities across its portfolio.

M&A in the mobile power and battery solutions sector will continue to accelerate as electrification reshapes industrial and commercial applications. Buyers are expected to consolidate fragmented midstream players, secure access to next-generation chemistries, and strengthen OEM-integrated supply chains. Premium valuations will remain concentrated in proprietary technology platforms, modular energy systems, and scalable service models, while legacy providers and niche specialists present selective acquisition opportunities.

Source: Ultralife, Yahoo Finance, Komatsu, IM, Globenewswire, Mercom Capital, Pitchbook Data.