Post Service Recovery in the Customer Experience Sector M&A Transactions and Valuations

Post Service Recovery in the Customer Experience Sector M&A Transactions and Valuations

The post service recovery segment within the customer experience (CX) sector sits at the intersection of customer experience management, workflow automation, and data analytics. It brings together software platforms, technology developers, and enterprise service providers focused on restoring satisfaction and trust following service disruptions or operational failures. Core activities include digital claims management, lost-and-found tracking, automated communication, and real-time feedback analysis, transforming service recovery from a reactive process into a strategic driver of loyalty and retention.

The segment integrates software vendors, omnichannel CX platforms, and AI-enabled analytics providers that automate recovery workflows and generate actionable insights from post-interaction data. Growth is supported by the convergence of automation, predictive analytics, and cloud infrastructure, reflecting rising demand for seamless engagement and data-driven service excellence.

This report examines M&A activity, valuation dynamics, and strategic transformation across the post service recovery ecosystem from Q4 2020 to Q3 2025, highlighting the expansion of digital recovery platforms across service-intensive verticals.

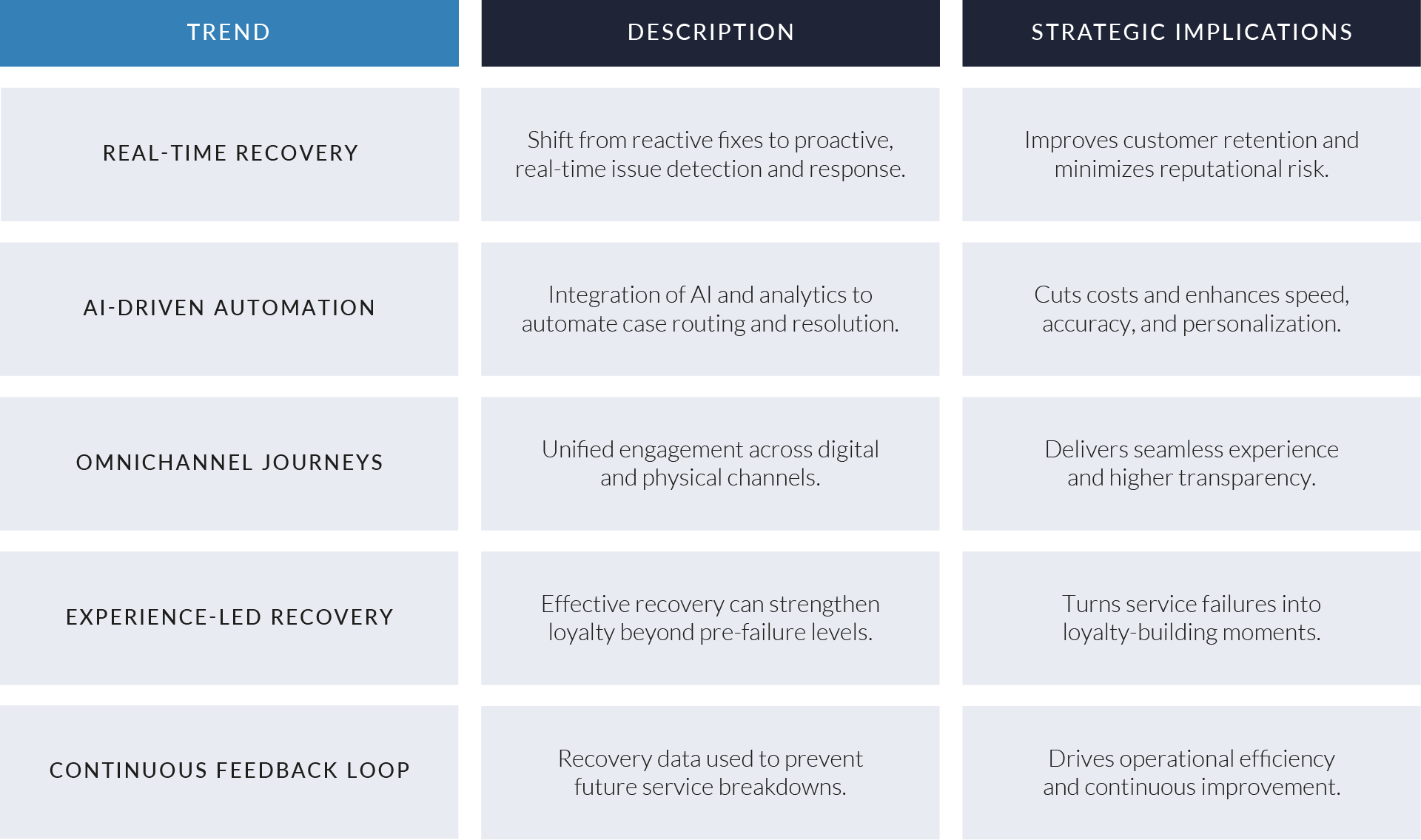

EXHIBIT 1

Key Trends in the Post Service Recovery Customer Experience Sector

The exhibit highlights the structural and technological shifts shaping the post service recovery landscape. Advancements in automation, data integration, and omnichannel systems are redefining service failure detection and resolution. Effective recovery has evolved from a reactive cost center to a strategic differentiator driving loyalty, retention, and brand equity

Source: Medallia, How to Win Customers Back After a Negative Experience (Mar 2024); Qualtrics, Customer Service Recovery and Loyalty Building (Jan 2024); Zendesk, Building Effective Service Recovery Programs (Feb 2024); KPMG, Global Customer Experience Excellence Report (2023); Kayako, Customer Service Trends 2025 (Jul 2024).

EXHIBIT 2

Industry Applications of Post Service Recovery Solutions

The exhibit outlines key industries where post service recovery solutions enhance satisfaction, operational resilience, and brand reputation. Demand is concentrated in service-intensive sectors such as travel, hospitality, and retail, where rapid incident response and transparent communication directly influence loyalty and retention. Adoption is expanding across enterprise and infrastructure-driven markets as automation and AI improve accuracy, efficiency, and personalization.

Source: CX Network, How CX Can Boost Recovery in Travel and Hospitality (2024); ReverseLogix, The Customer Experience (CX) Cost of Getting Returns Wrong (2024); Bain & Company, Powering Up the Customer Experience in Utilities (2024); DHL, Customer Service Improvement Strategies for E-Commerce Businesses (2024); ResearchGate, The Service Failure and Recovery Strategies in Logistics Service Sector (2016).

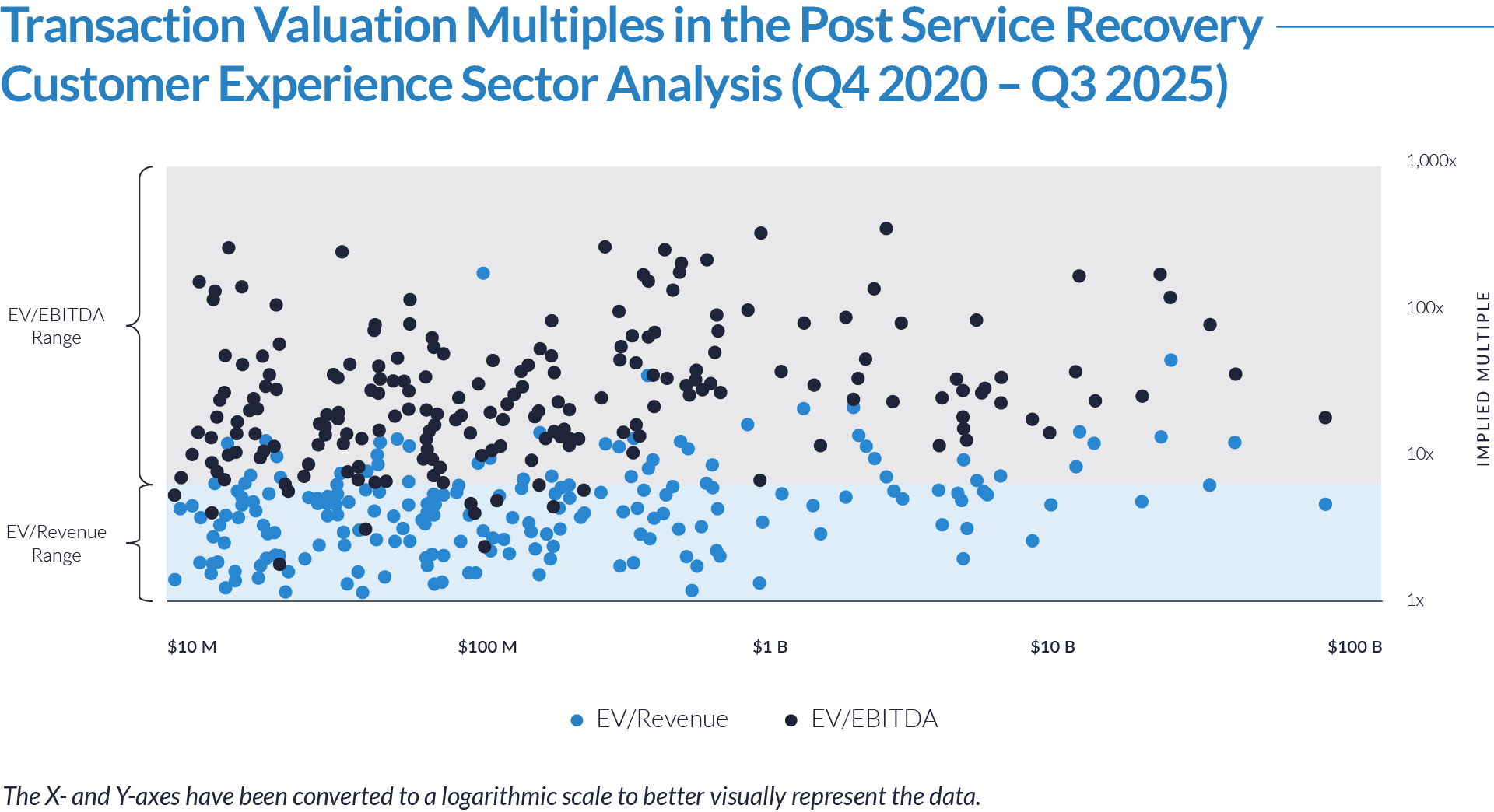

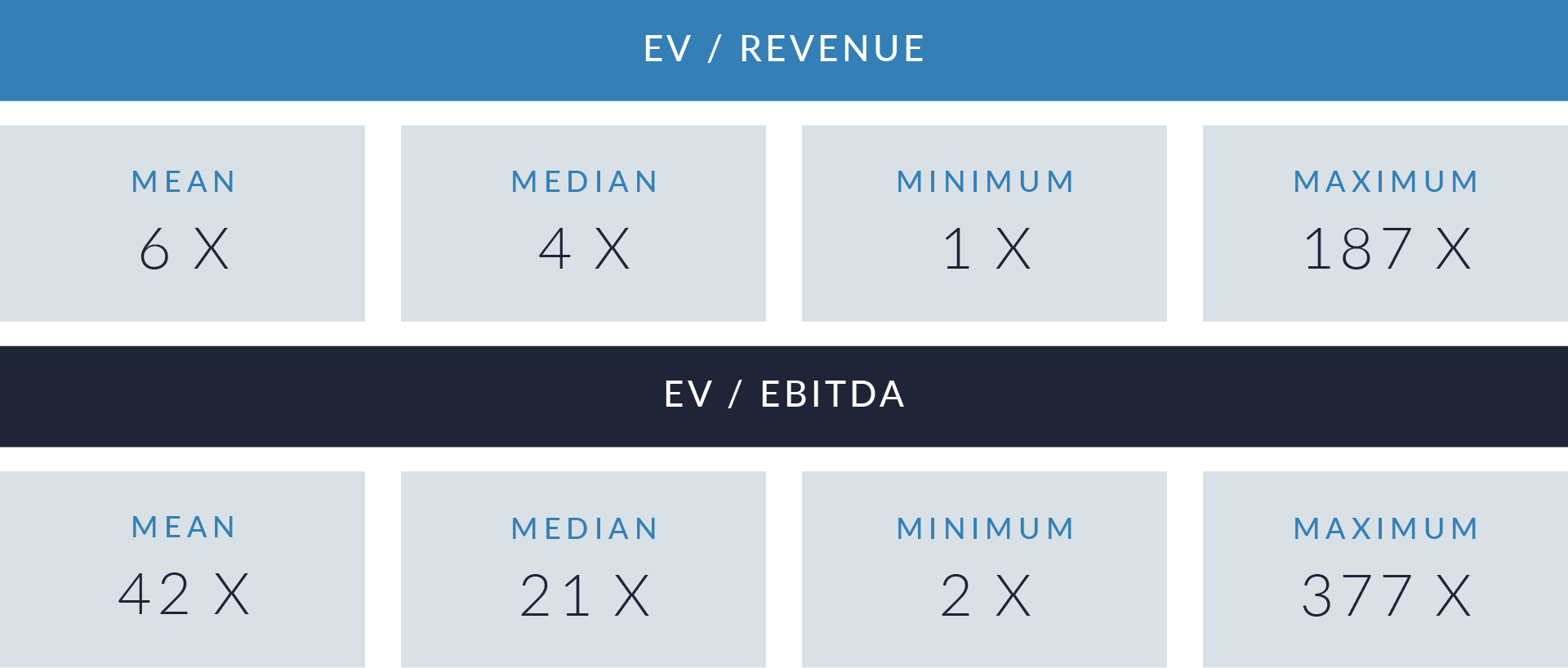

- Valuation multiples are based on a sample set of M&A transactions in the post service recovery segment of the customer experience sector using data collected as of October 30, 2025.

- Premium valuation multiples reflect the sector’s hybrid composition, combining scalable SaaS platforms, workflow automation, and technology-enabled service delivery. Scalable subscription models, recurring enterprise contracts, and data-driven value creation underpin strong revenue visibility and high gross margins. Median EV/revenue multiples range from 5x to 7x, while top-quartile performers exceed 10x, consistent with automation, CX analytics, and digital engagement benchmarks.

- Outliers with EV/EBITDA ratios above 100x are typically early-stage or high-growth platforms in expansion mode, including AI-enabled case management systems, customer feedback analytics, or cloud-based recovery ecosystems. These valuations prioritize long-term growth and defensible IP over near-term profitability, underscoring investor confidence in data ecosystems, automation depth, and cross-platform scalability.

- The widening dispersion across valuation multiples underscores segmentation between scaled enterprise platforms achieving profitability and specialized vendors commanding strategic premiums. This split reflects continued consolidation as acquirers target platforms that unify customer data, streamline resolution workflows, and strengthen loyalty across hospitality, transport, and enterprise service markets.

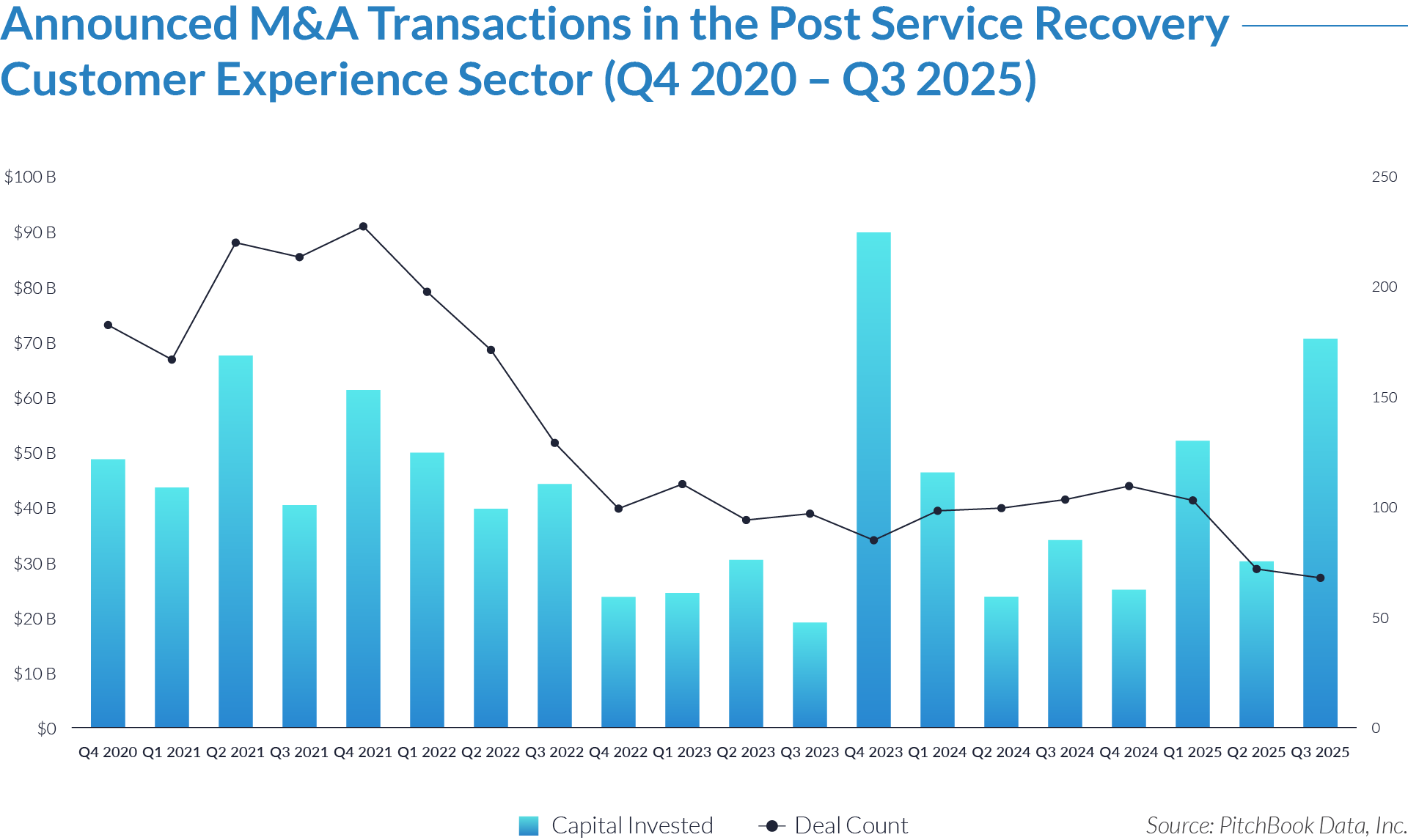

Capital Markets Activities

The data highlights transaction activity, capital deployment, and consolidation trends within the post service recovery segment of the customer experience sector. Rising demand for automation, AI-driven resolution, and cloud-based engagement continues to drive M&A across workflow technology providers, hospitality systems, and customer intelligence platforms. Acquirers target scalable, data-rich platforms that enhance efficiency, satisfaction, and retention, with transactions emphasizing integration, automation depth, and recurring-revenue visibility.

- Total recorded investment reached $859 billion across 2,640 transactions between Q4 2020 and Q3 2025, reflecting sustained investor confidence in customer experience technologies and workflow automation platforms. The scale of cumulative capital deployment reflects ongoing consolidation and consistent funding across SaaS-enabled engagement, service recovery, and hospitality technology solutions.

- Peak activity occurred in 2021, with quarterly investment exceeding $60 billion and more than 200 deals per quarter, coinciding with the post-pandemic digitization surge as enterprises prioritized cloud-based engagement and recovery platforms.

- Deal volume moderated through 2023 as macroeconomic tightening and valuation recalibration slowed investment momentum. Despite fewer transactions, strategic and late-stage deals dominated, reflecting continued focus on scalable revenue models and proven customer analytics infrastructure.

- 2024–2025 show signs of rebound and selective growth, driven by AI integration, automation maturity, and recurring-revenue visibility. Capital concentration in Q1 and Q3 2025 ($52 billion and $70 billion, respectively) signals renewed strategic investment in data orchestration and workflow intelligence platforms.

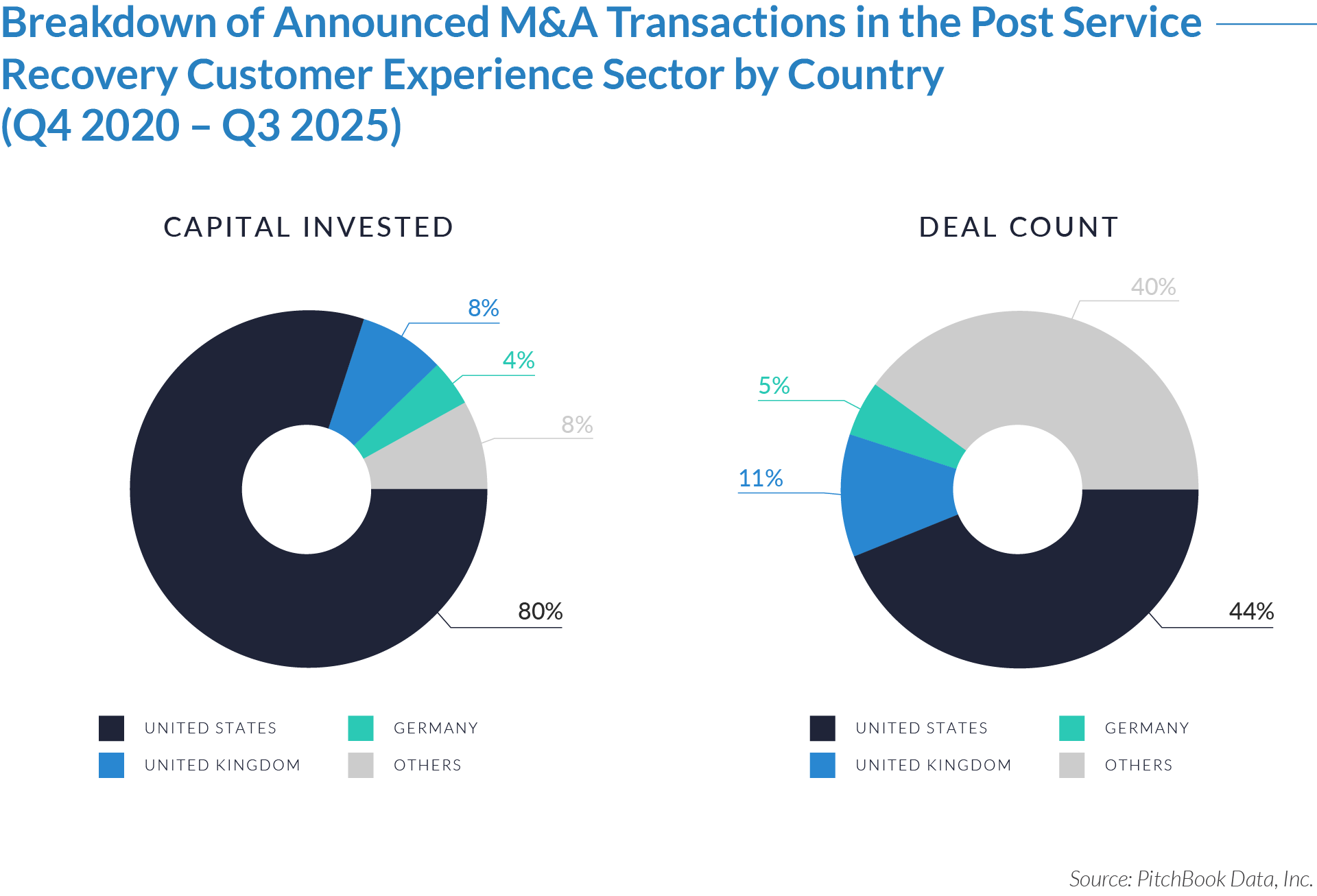

- The United States dominates sector investment, accounting for 80% of total capital deployed and 44% of deal volume, driven by its leadership in enterprise SaaS, workflow automation, and customer experience infrastructure. US-based investors and acquirers continue to integrate niche post service recovery and engagement platforms into broader CX ecosystems.

- The UK and Germany capture 12% of total capital, emphasizing Europe’s growing role in AI-driven service optimization. Transactions in these markets often prioritize regulatory compliance, data protection, and localized customer engagement.

- Other international and emerging markets represent 8% of invested capital but 40% of total deals, highlighting the rise of smaller, innovation-led transactions across Asia-Pacific, the Middle East, and Latin America. These deals typically involve early-stage platforms focused on verticalized recovery automation, multilingual engagement, and scalable SaaS deployment models.

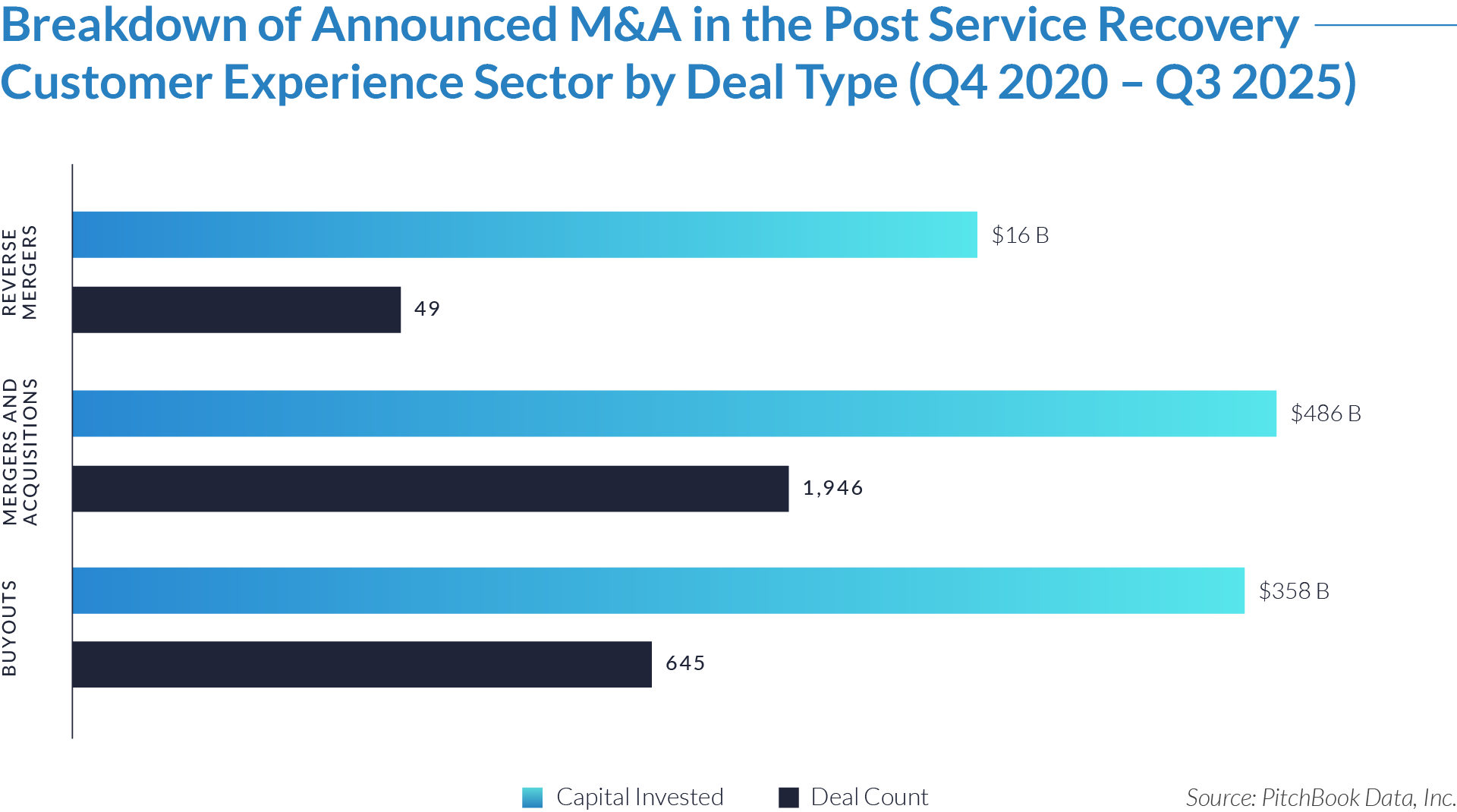

- M&A transactions dominate sector activity, accounting for 74% of total deal volume and 57% of invested capital, reflecting continued consolidation as strategic acquirers expand platform capabilities, integrate automation, and strengthen post service recovery and customer lifecycle management solutions across industries.

- Buyouts represent $358 billion across 645 transactions, underscoring sustained private-equity interest in scalable SaaS, cloud-based, and data-enabled recovery platforms. These deals target recurring revenue, automation depth, and data leverage, demonstrating investor confidence in profitable integration and long-term scalability across the customer experience value chain.

- Reverse mergers remain limited yet strategically significant, totaling $16 billion across 49 transactions, often serving as capital-access mechanisms for late-stage technology and service-automation platforms pursuing public-market liquidity or accelerated expansion within high-growth segments of customer experience intelligence and post service recovery.

Illustrative Transaction Business Cases

The following illustrative case studies highlight companies at the forefront of post service recovery in customer experience. Each example demonstrates how AI-driven and cloud-based solutions are transforming lost-and-found and recovery operations into scalable, data-enabled processes that enhance efficiency, satisfaction, and brand reputation.

Illustrative Case 01

BOOMERANG

AI-Driven Post Service Recovery Platform

Boomerang is a US-based developer of an AI-driven lost-and-found automation platform used by hotels, airlines, entertainment venues, and other guest-intensive environments. The platform digitizes the full recovery lifecycle, from item intake and classification to customer communication and fulfillment, reducing manual workload and standardizing high volume recovery operations.

Strategic Relevance

Boomerang addresses a major operational challenge in hospitality and travel: high-volume item recovery requiring speed and accuracy. By embedding intelligent matching and automated communication into daily operations, the platform strengthens guest trust and reduces the administrative load on frontline teams.

Intangible Assets and Defensibility

Boomerang’s defensibility is rooted in its proprietary AI-matching models trained on extensive recovery data, as well as its integrations with property management systems (PMS) , ticketing, and airline systems. The platform’s automation depth and multi-location support create efficiency gains that are difficult for competitors to replicate, reinforcing its position within enterprise hospitality and travel networks.

M&A Rationale and Synergy Potential

Boomerang is highly complementary to hospitality-tech providers, CX automation platforms, and travel-technology consolidators seeking to expand workflow coverage. Acquirers benefit from enhanced analytics, improved retention metrics, and strengthened cross-property engagement, while gaining a scalable SaaS engine that supports recurring revenue and multi-market deployment.

Illustrative Case 02

ILOST

Digital Lost and Found Management Platform

iLost is a Netherlands-based cloud platform that centralizes lost-and-found operations for transport networks, municipalities, retailers, and public venues. Its SaaS interface enables item logging, automated matching, customer communication, and standardized workflows across multi-site organizations and cross-border environments.

Strategic Relevance

iLost plays an important role in Europe’s fragmented regulatory and operational environment, where operators must manage recovery across varying languages, jurisdictions, and compliance requirements. The platform’s general data protection regulation (GDPR) aligned infrastructure and multi-language capabilities enable consistent recovery experiences across borders, addressing the rising expectation for transparent and reliable service delivery.

Intangible Assets and Defensibility

The company’s defensibility stems from its multilingual architecture, GDPR-compliant technology base, and structured recovery dataset that powers standardized automation. These assets position iLost as a trusted solution for organizations operating across multiple European markets, where regulatory alignment and interoperability are critical.

M&A Rationale and Synergy Potential

iLost offers significant value for acquirers seeking European expansion in CX, logistics, or workflow automation. Its ability to operate seamlessly across markets provides immediate scalability and strengthens an acquirer’s compliance, customer-engagement, and operational capabilities. Integrating iLost into broader platforms accelerates cross-market deployments and enhances visibility across transport, retail, and public-sector environments.

Illustrative Case 03

NOTLOST

Cloud-Based Lost Property Automation Platform

NotLost is a UK-based developer of a cloud-native lost property management system serving universities, transport authorities, councils, and event venues. The platform automates item logging, matching, customer communication, and reporting, replacing manual recovery processes with structured digital workflows.

Strategic Relevance

NotLost represents digital transformation in public-sector and institutional customer service. Government agencies, educational institutions, and public transport operators increasingly require transparent, efficient, and auditable recovery processes. The company demonstrates how cloud-based automation strengthens compliance, speeds response times, and enhances citizen and customer experience across high-volume environments.

Intangible Assets and Defensibility

NotLost’s key intangible assets include proprietary automation algorithms, configurable APIs, cloud-native architecture, and standardized reporting tools. These assets support rapid deployment, strong interoperability, and operational visibility, positioning the platform as a scalable solution for both public- and private-sector ecosystems.

M&A Rationale and Synergy Potential

The platform aligns naturally with government-tech, education-tech, facility-management, and CX operators seeking to expand into high-volume institutional environments. Acquirers gain access to a stable customer base, scalable multi-site contracts, and opportunities to layer additional analytics, compliance, or engagement modules across institutional networks.

Illustrative Case 04

BOUNTE

AI-Enabled Hospitality Lost and Found Software

BOUNTE is a US-based AI-enabled lost-and-found software platform designed for hotels, resorts, and hospitality groups. Its image-recognition capabilities automate item documentation, tagging, categorization, guest communication, and workflow tracking, enabling faster and more accurate recovery outcomes.

Strategic Relevance

BOUNTE highlights the integration of AI and satisfaction metrics within hospitality operations. Timely and reliable recovery is a core driver of guest loyalty and brand perception, particularly for multi-property hotel groups. The platform demonstrates how sector-specific automation can reduce operational burden, improve service consistency, and enhance post-stay engagement.

Intangible Assets and Defensibility

Primary intangible assets include proprietary image-recognition models, hospitality-CRM integrations, workflow automation logic, and structured recovery datasets. These assets create strong defensibility by improving accuracy, reducing human error, and enabling data-driven service optimization across hotel portfolios.

M&A Rationale and Synergy Potential

The platform offers attractive bolt-on potential for hospitality management systems, CX automation platforms, and hotel-tech consolidators. Integrating BOUNTE expands analytics depth, unifies operational dashboards, and accelerates SaaS adoption across global hotel portfolios, ultimately improving loyalty and post-stay engagement metrics.

The post service recovery sector is positioned for sustained expansion, driven by rising customer expectations, accelerating digital transformation, and the increasing strategic importance of data-driven service management. Consolidation and capital inflows remain strong as technology providers and enterprise platforms pursue scale, automation depth, and ownership of customer experience infrastructure. The convergence of automation, analytics, and real-time engagement positions post service recovery among the most dynamic and resilient segments of the global customer experience market.

Source: Seventy Six Capital, BOUNTE, NotLost, iLost, Pitchbook Data.