M&A Value in IoT: How Semiconductors, Sensors, and Spectrum Drive Transactions

M&A Value in IoT: How Semiconductors, Sensors, and Spectrum Drive Transactions

Introduction

The Internet of Things (IoT) is transforming industries and redefining how value is created and acquired. From logistics and energy to healthcare and manufacturing, connected technologies are driving a continuous wave of technology transformation. For business owners exploring an exit, or investors seeking new strategic opportunities, knowing where to find value in this evolving stack is not optional.

This article introduces a framework that dissects the IoT landscape into three foundational technology categories: Semiconductors, Sensors, and Spectrum. It further distinguishes between Enterprise-Driven and Consumer-Driven IoT ecosystems and how each use case of IoT impacts valuations and M&A.

Whether a company designs edge-processing hardware, integrates smart sensors, or builds compliant communication networks, this analysis reveals where acquirers are focused and what capabilities command premium valuations. Included are real-world examples from major players like Cisco, Qualcomm, NVIDIA, and Honeywell. This overview can help clarify how to best position assets for strategic interest and the most successful M&A outcome.

Semiconductors

In the Internet of Things (IoT) ecosystem, semiconductors serve as the foundational layer that powers automation, autonomy, and advanced analytics across both enterprise and consumer applications.

This value is captured through a layered stack that begins with semiconductor manufacturing in foundries, materials, and chips. This encompasses the physical fabrication of semiconductors using advanced materials and global foundry services. Building on this foundation, the edge AI and processing layer integrates capabilities like on-chip AI accelerators, analytics, and multi-sensor input handling, which enables low-latency computing at the device level. This is essential for smart factories, robotics, and connected consumer devices. Integrated Device Manufacturers (IDMs) such as Intel and Samsung control the entire semiconductor lifecycle, from design to fabrication and distribution. As IoT demand rises, semiconductors are shifting from passive controllers to strategic assets powering differentiation and intelligence.

SEMICONDUCTOR TRANSACTIONS

Major acquisitions in the semiconductor space reveal a broader trend: Acquirers are buying more than revenue. They are securing control, IP, and integrated capabilities.

NVIDIA acquired Mellanox in April 2020 for $6.9 billion total enterprise value, paying approximately 6.3X EV/Revenue and 32X EV/EBITDA, to combine GPU performance with high-speed networking vital for AI in autonomous machines.

Qualcomm acquired Nuvia in March 2021, strategically enhancing its chip design capabilities. While specific multiples were not disclosed, this premium was justified by anticipated $1.4 billion per annum savings on licensing fees and improved performance for IoT-edge and AR platforms. This strengthened Qualcomm’s dominance in consumer IoT chips for devices like AR glasses, smart speakers, and connected appliances.

Intel’s acquisition of Mobileye in March 2017 for $13.7 billion total enterprise value, paying ~38X EV/Revenue and ~110X EV/EBITDA, brought in advanced vision systems for autonomous driving, marking a shift toward AI-enhanced mobility hardware.

These deals demonstrate how companies are consolidating their control over key layers of IoT infrastructure from raw silicon to vertical applications, positioning themselves as end-to-end enablers of intelligent, connected systems.

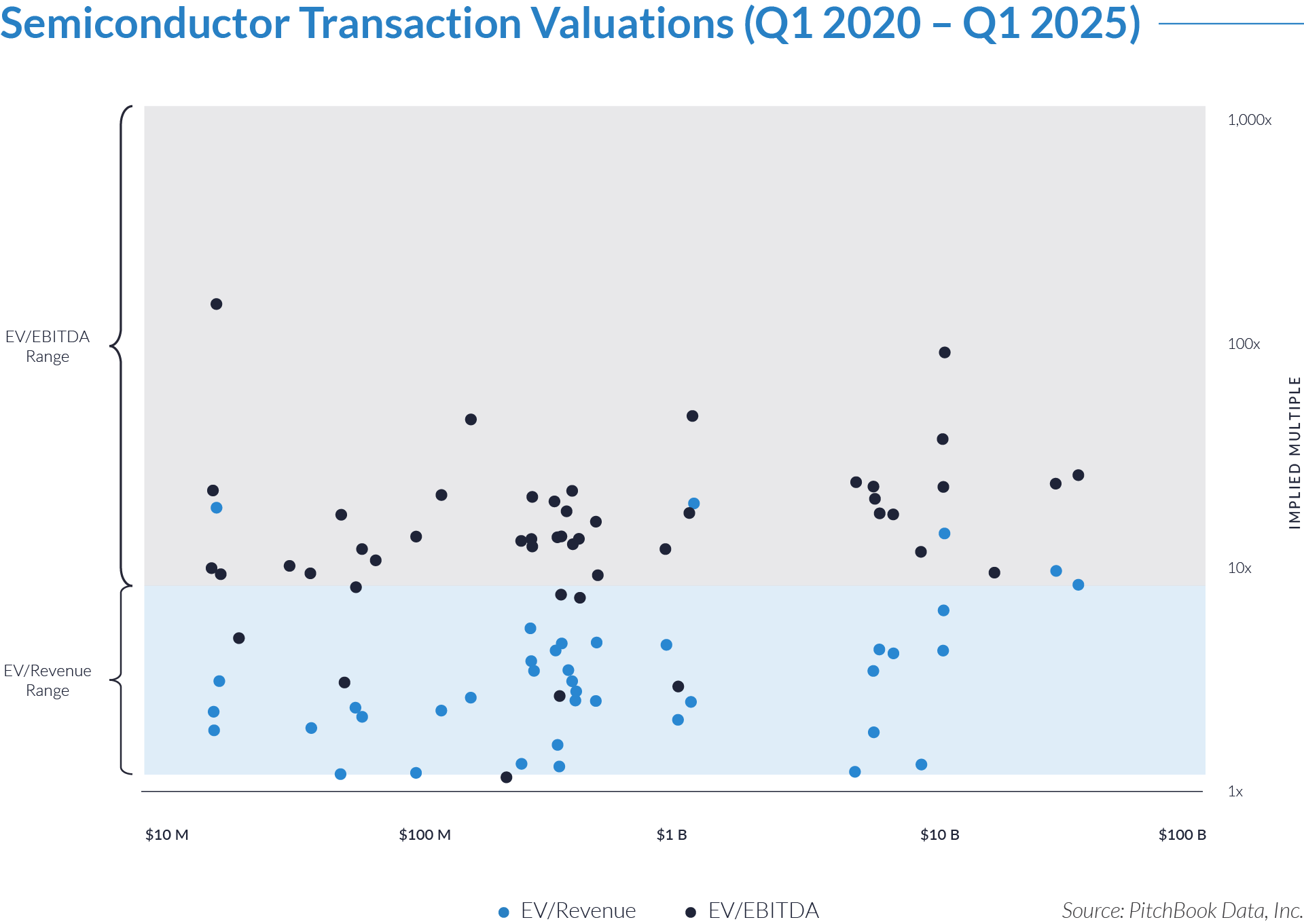

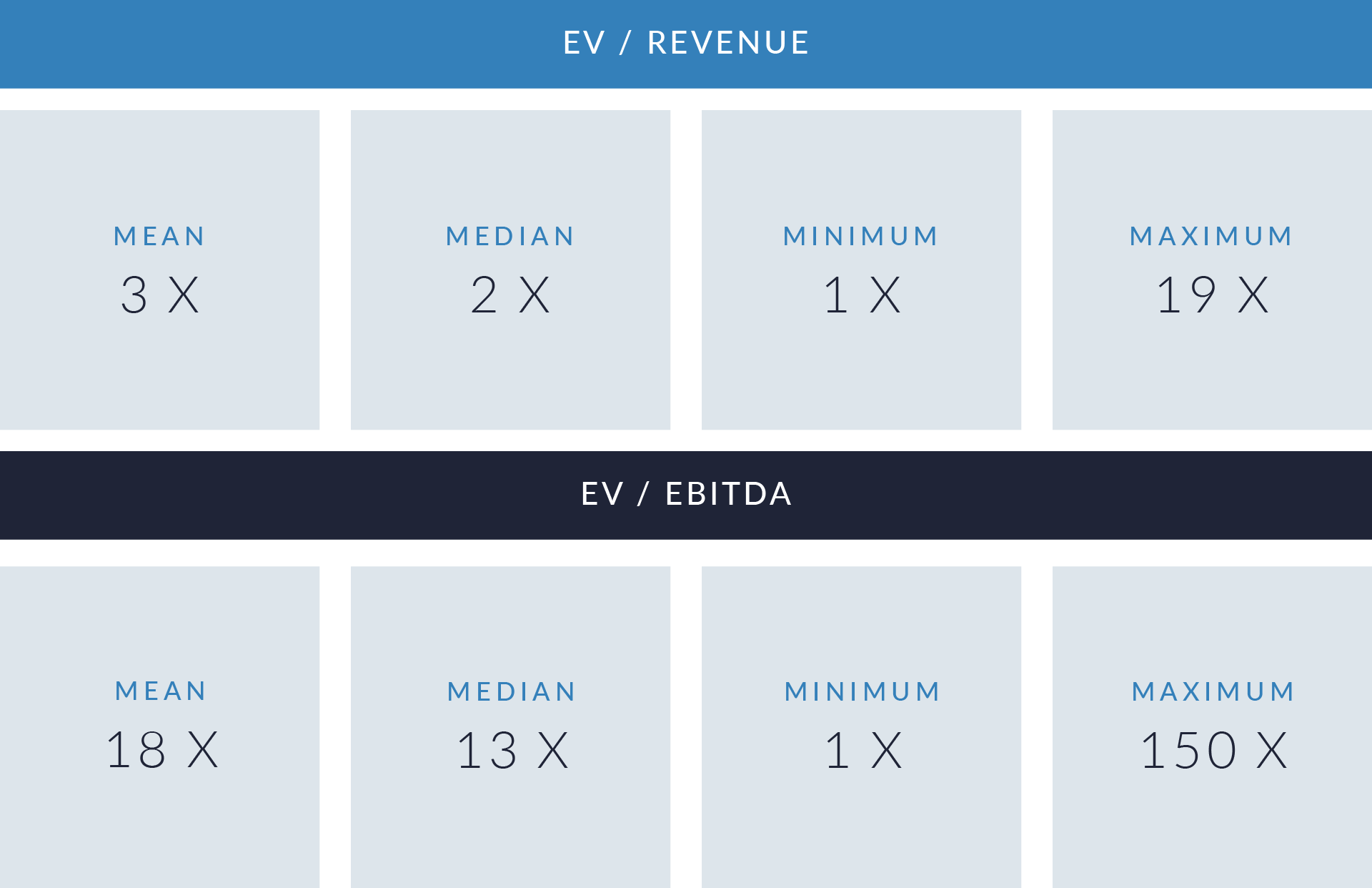

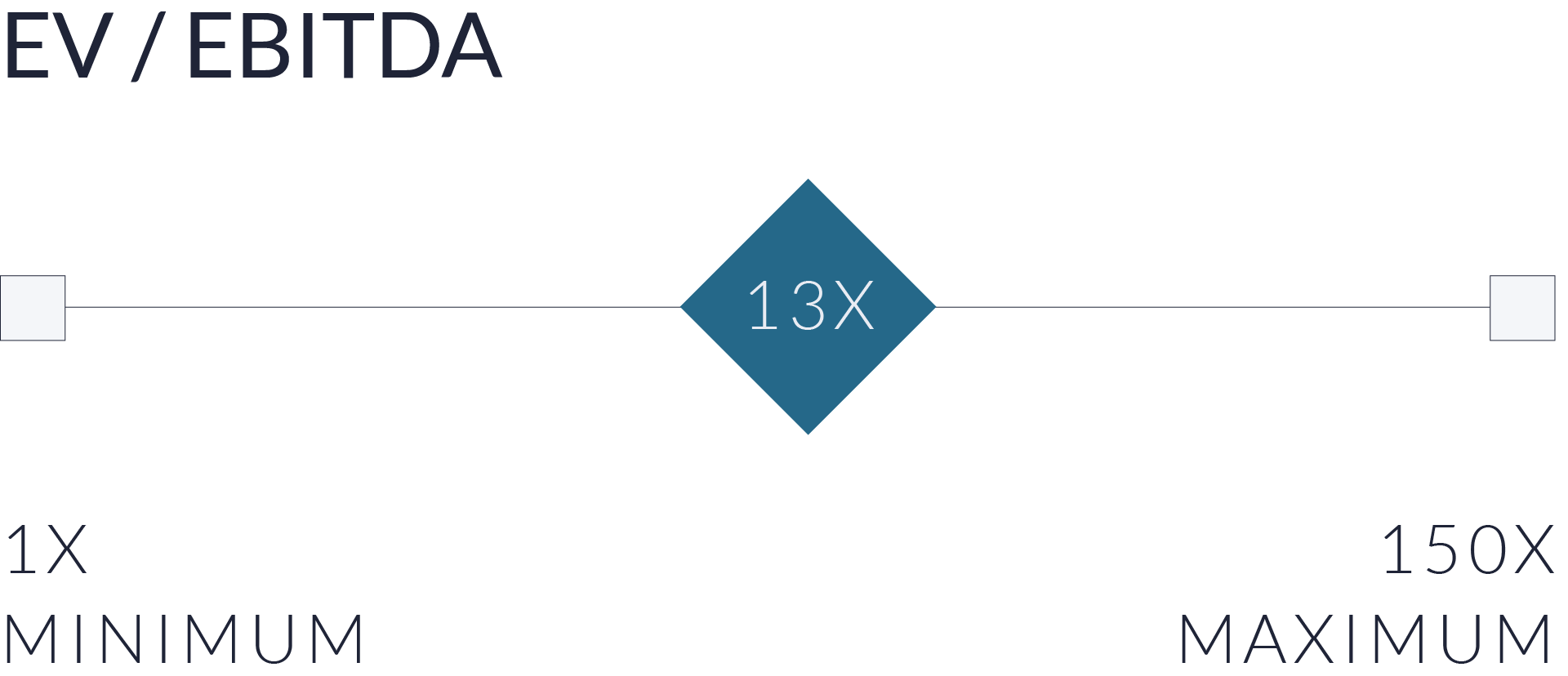

The semiconductor sector has seen a wide range of transaction valuation multiples between Q1 2020 and Q1 2025, as reflected in the analysis of EV/Revenue and EV/EBITDA ratios. On average, deals closed at 3X EV/Revenue and 18X EV/EBITDA, with median values at 2X and 13X, respectively. However, the spread tells a deeper story.

At the high end, EV/Revenue multiples reached 19X, and EV/EBITDA soared to 150X. These are levels rarely seen in mature industries. These elevated valuations are often the result of strategic acquisitions, where buyers are targeting differentiated technology, essential IP, or hard-to-replicate capabilities. In such cases, valuation is driven not by current earnings, but by a company’s future role in the buyer’s broader platform or value chain.

Conversely, the minimum observed multiples of 1X (both revenue and EBITDA) highlight that some transactions reflected more conservative bets often tied to distressed assets, legacy businesses, or companies with commodity-like offerings and limited strategic differentiation.

These valuation ranges underscore a central truth in IoT-related semiconductor M&A: buyers don’t just acquire revenue, they acquire relevance. The highest multiples are not paid for financial performance alone, but for strategic fit, technological edge, and control of critical layers in the IoT value chain.

Sensors

In the Internet of Things (IoT), sensors are the interface between the physical and digital worlds capturing environmental, spatial, and other data that powers intelligent operations.

These devices are structured across a value stack that begins with materials, interfaces, and real-time integration and processing of data from multiple sensors directly within embedded systems, which define the physical sensing elements, integration methods, and the early merging of multiple data types. The next layer packaging, sensing, connectivity, edge processing, and analytics encompasses the engineering of sensors to be compact, power-efficient, and intelligent, allowing them to collect and filter, interpret, and analyze data in real time. This is especially critical in enterprise environments such as smart grids and industrials, where precision and low-latency performance are essential. Finally, sensors achieve full value through integration into platforms, where they become embedded in broader IoT systems whether in automated factories, connected health devices, or smart homes, enabling autonomous responses and predictive capabilities. As trends like AI at the edge, self-calibrating miniature sensors, and sensor data fusion continue to advance, sensors are no longer passive input tools but active, intelligent nodes in the IoT landscape.

SENSORS TRANSACTIONS

Recent M&A in the sensor space reflects a race to integrate sensing capabilities more deeply into hardware and software ecosystems.

In August 2015, Qualcomm acquired CSR for approximately $2.4 billion in total enterprise value, paying an estimated 19× EV/EBITDA multiple. The deal brought low-power sensor fusion into its Bluetooth chips, enhancing smart home and automotive offerings.

Bosch’s acquisition of Arioso Systems in April 2022 added advanced microspeakers for ultracompact audio output, opening new applications in wearables and consumer electronics.

Apple acquired Primesense in November 2013 for $360 million and used their tech to build Face ID and motion tracking that are essential for unlocking privacy-aware and hands-free interaction in consumer IoT.

Sensor control means data control. These deals show sensors are no longer components, they are strategic enablers of intelligent systems, and companies that control sensing inputs are increasingly controlling the entire data value chain.

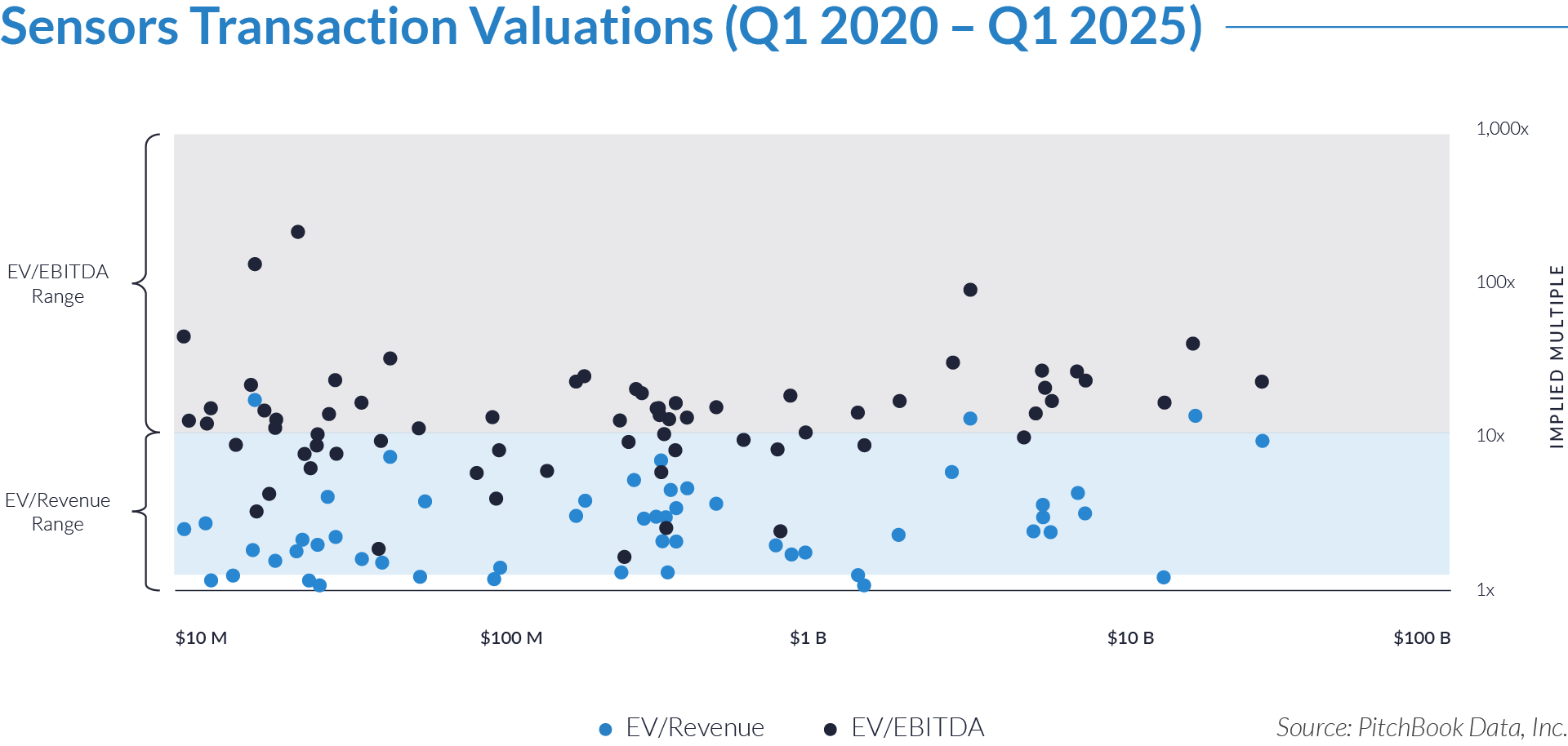

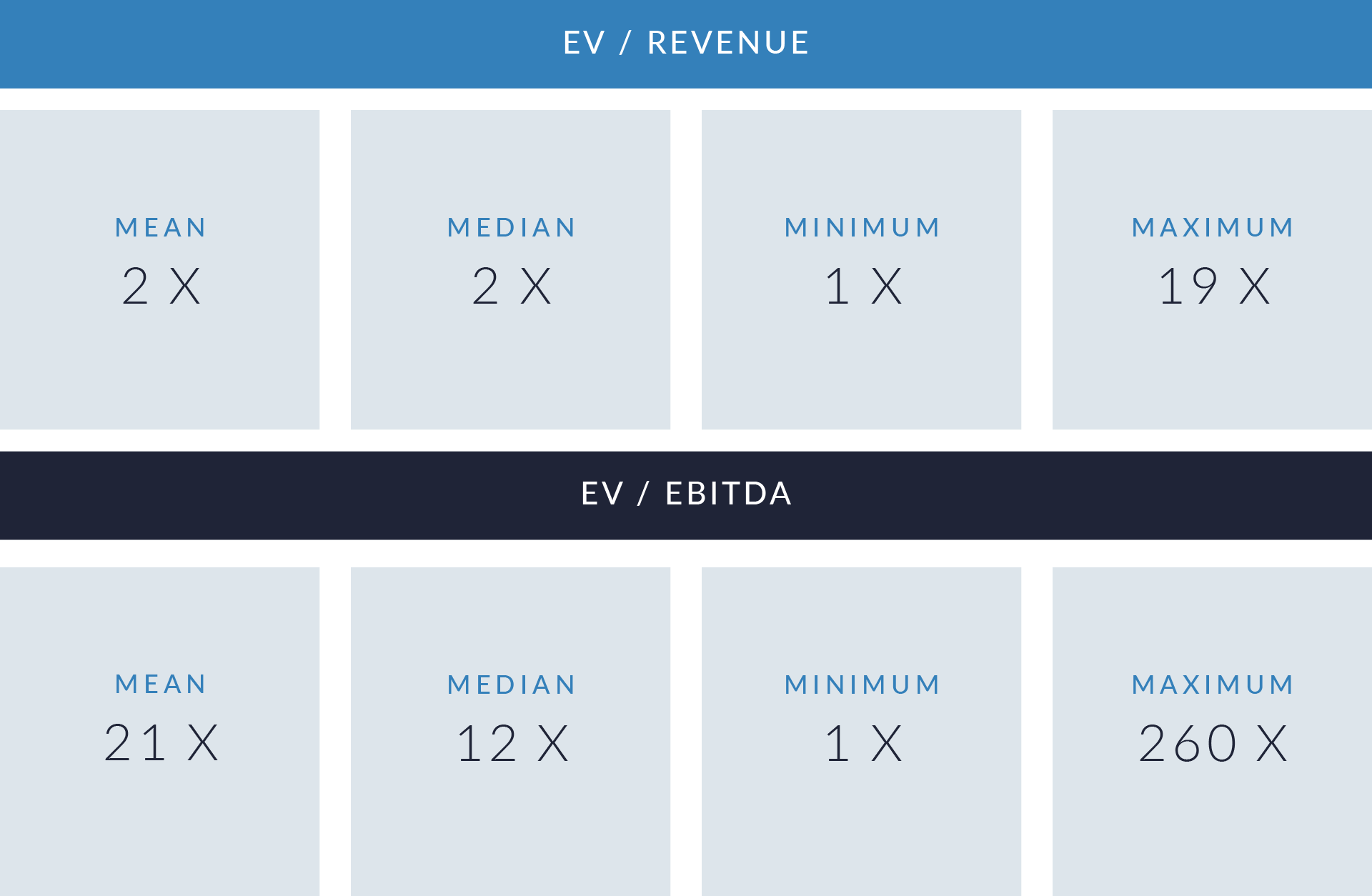

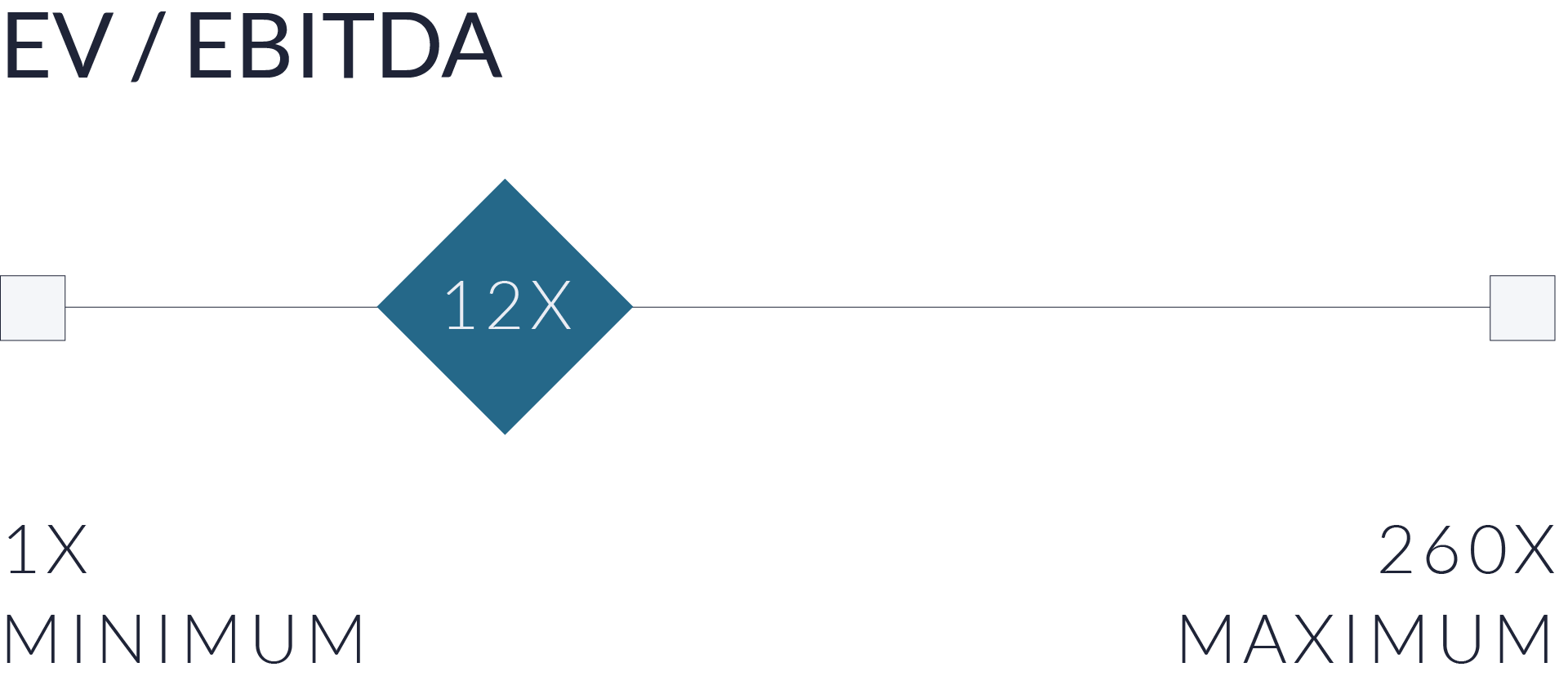

The valuation analysis for the sensors sector over the period from Q1 2020 to Q1 2025 reveals a notable spread in transaction multiples, especially in EV/EBITDA figures. On average, companies were acquired at 2X their revenue and 21X their EBITDA, with the median revenue multiple also at 2X but the median EBITDA multiple lower at 12X. This indicates a fairly consistent valuation relative to revenue, while profitability varied more widely across transactions. The highest EV/Revenue multiple was 19X, suggesting some premium deals, and the EV/EBITDA multiple spiked to a remarkable 260×, likely due to deals involving either low-EBITDA companies or highly strategic acquisitions. The minimum for both metrics was 1X, representing baseline or distressed valuations.

Spectrum

In the IoT ecosystem, spectrum represents the communication layer that underpins connectivity across all semiconductors and sensors, governing how data flows through the network.

This layer begins with communication infrastructure and data flow, covering technologies like private 5G and Long Range Wide Area Network (LoRaWAN) that enable secure, low-latency, and high-throughput transmission of data across industrial and consumer environments. At the next level, network protocols and application enablement define how data is structured, prioritized, and acted upon, translating raw communication into usable services across smart factories, vehicles, homes, and cities. Finally, licensing and regulation govern access to spectrum bands, influencing not only who can operate in which frequencies but also how spectrum is monetized and protected. In enterprise IoT, control over spectrum ensures reliability and data sovereignty in mission-critical operations, while in consumer IoT, public networks prioritize scalability and coverage. As access to high-value spectrum tightens, ownership and intelligent utilization of this layer become strategic differentiators, transforming spectrum from a technical dependency into a core competitive asset in the industrial digital era.

Spectrum is wireless transmission between two points of power and can be used to transfer a variety of data based on what kind of light waves it is emitting. Spectrum is short for electromagnetic spectrum, which includes radio waves, microwaves, infrared, visible light, ultraviolet, X-rays, and gamma rays. Different frequencies within the electromagnetic spectrum are used for various purposes, such as radio and television broadcasting, mobile phone communication, and medical imaging.

SPECTRUM TRANSACTIONS

Major acquisitions in the spectrum space show how connectivity is increasingly seen as infrastructure-level IP, something to be owned, optimized, and monetized.

Amazon acquired Eero at US $31 per share amounting to approximately $1.2 billion in enterprise value, which was announced in February 2019, but completed shortly after to own the last-mile connectivity layer for smart homes, making sure Alexa, Ring, and other devices stay reliably connected. It helped Amazon build a vertically integrated home IoT platform, from device to cloud, improving its growing smart home portfolio.

Semtech’s acquisition of Sierra Wireless, which was completed January 2023 with a deal size of $1.2 billion, created a full-stack solution by combining LoRa-based semiconductors with cellular modules, bridging the gap between long-range and high-throughput IoT.

Google acquired Nest in 2014 for $3.2 billion as it wanted a vertical IoT platform (hardware + OS + connectivity). The price tag represented a significant premium over earlier valuations (approximately $2 billion). Nest helped build the Google Home ecosystem and influenced the Matter protocol which is now used by Apple and Amazon. This enabled Google to compete with Amazon/Alexa in smart homes.

These moves signal a clear trend: spectrum is no longer just a medium it is a platform. Buyers are seeking control over both physical spectrum assets and the software layers that enable its commercial use.

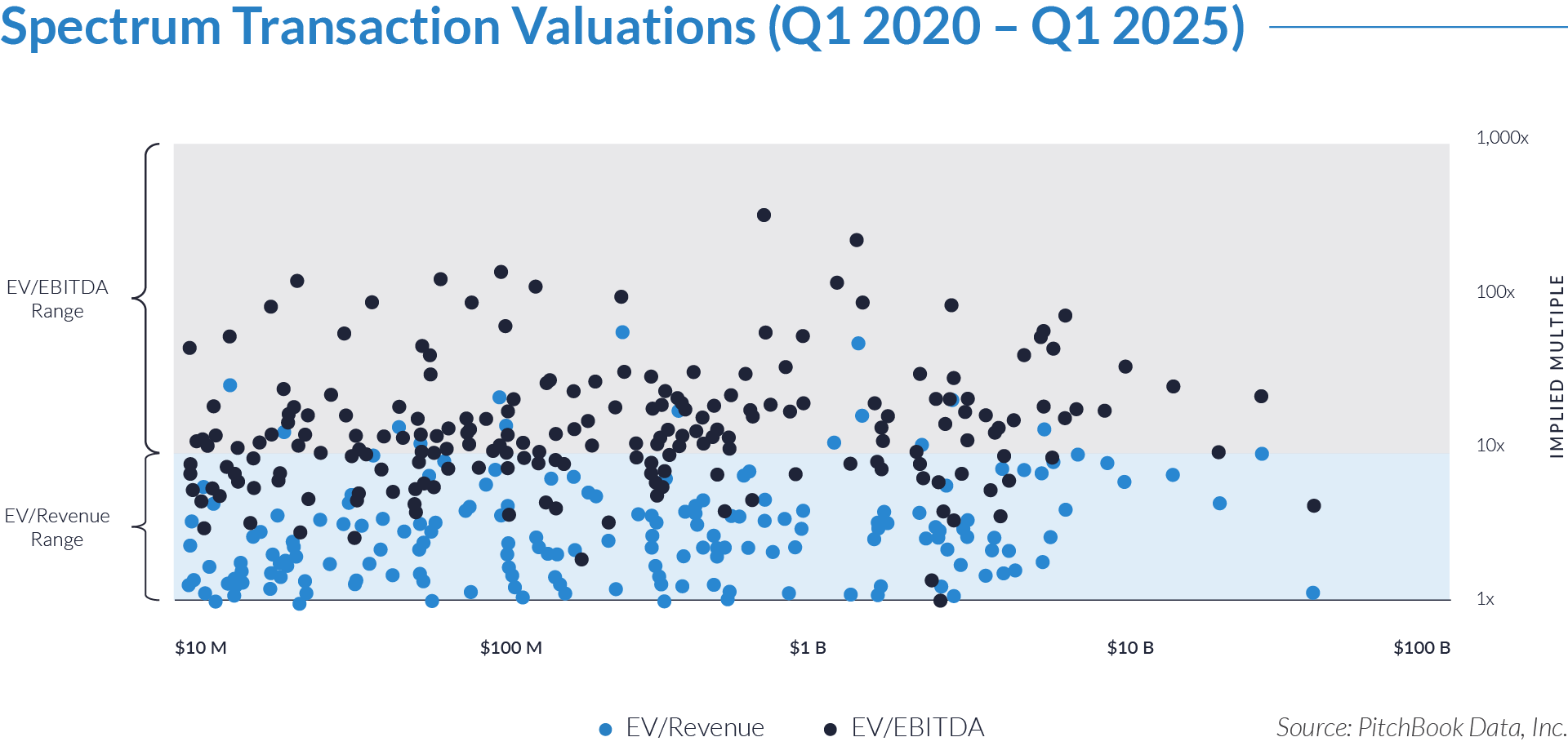

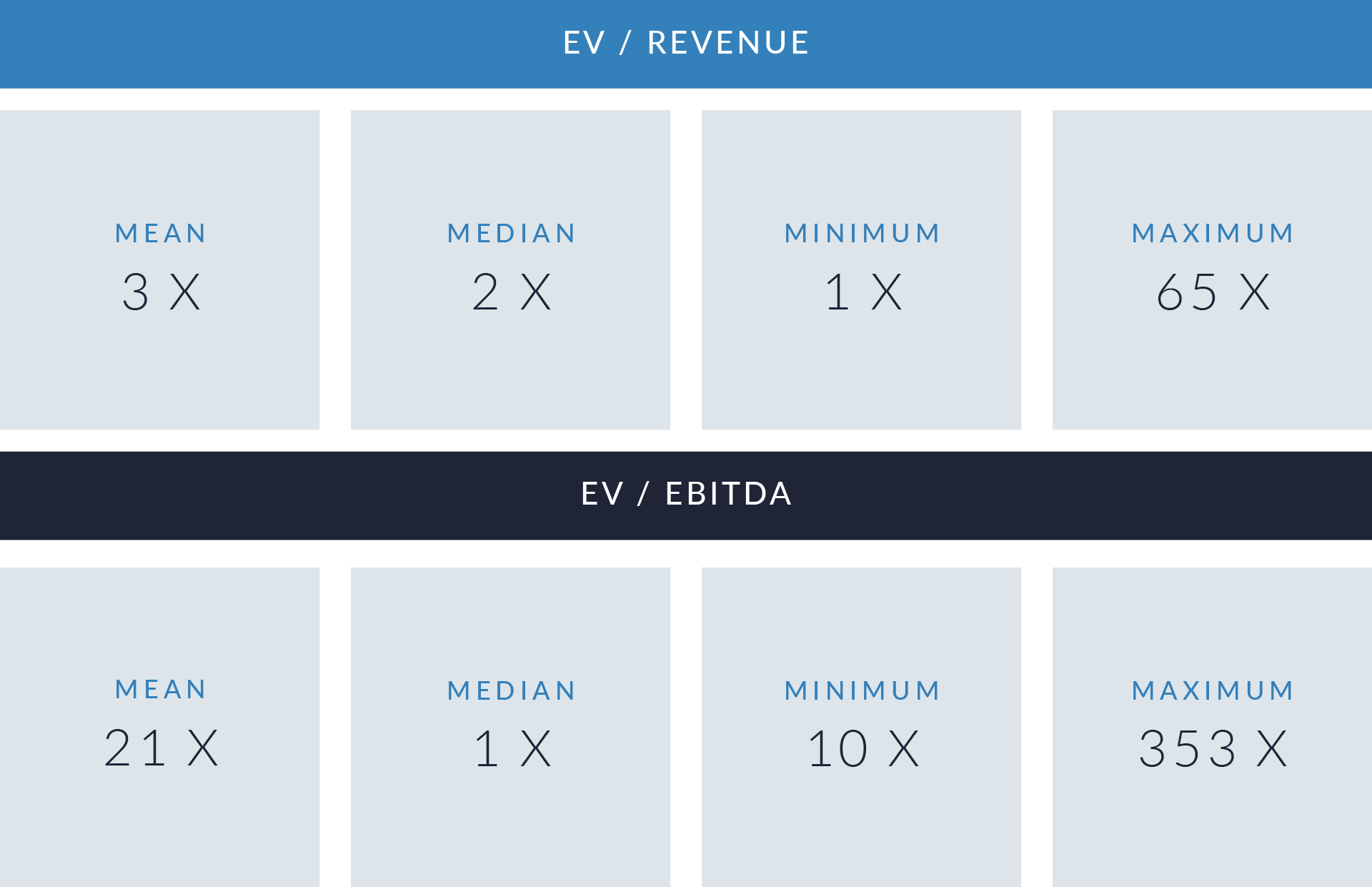

The valuation analysis for the spectrum sector from Q1 2020 to Q1 2025 shows a highly varied range of transaction multiples, particularly in terms of profitability. On average, spectrum-related companies were acquired at 3X their revenue and 21X their EBITDA, with median values of 2X revenue and 10X EBITDA. While revenue-based valuations remained consistent, the EBITDA multiples display much wider dispersion. The maximum EV/Revenue multiple hit 65X, and the maximum EV/EBITDA soared to 353X, indicating the presence of outlier transactions likely driven by strategic spectrum assets with long-term value or minimal current earnings. The minimum for both multiples was 1X likely reflecting distressed sales or early-stage companies.

Semiconductors, Spectrum, Sensors: M&A Value In Iot

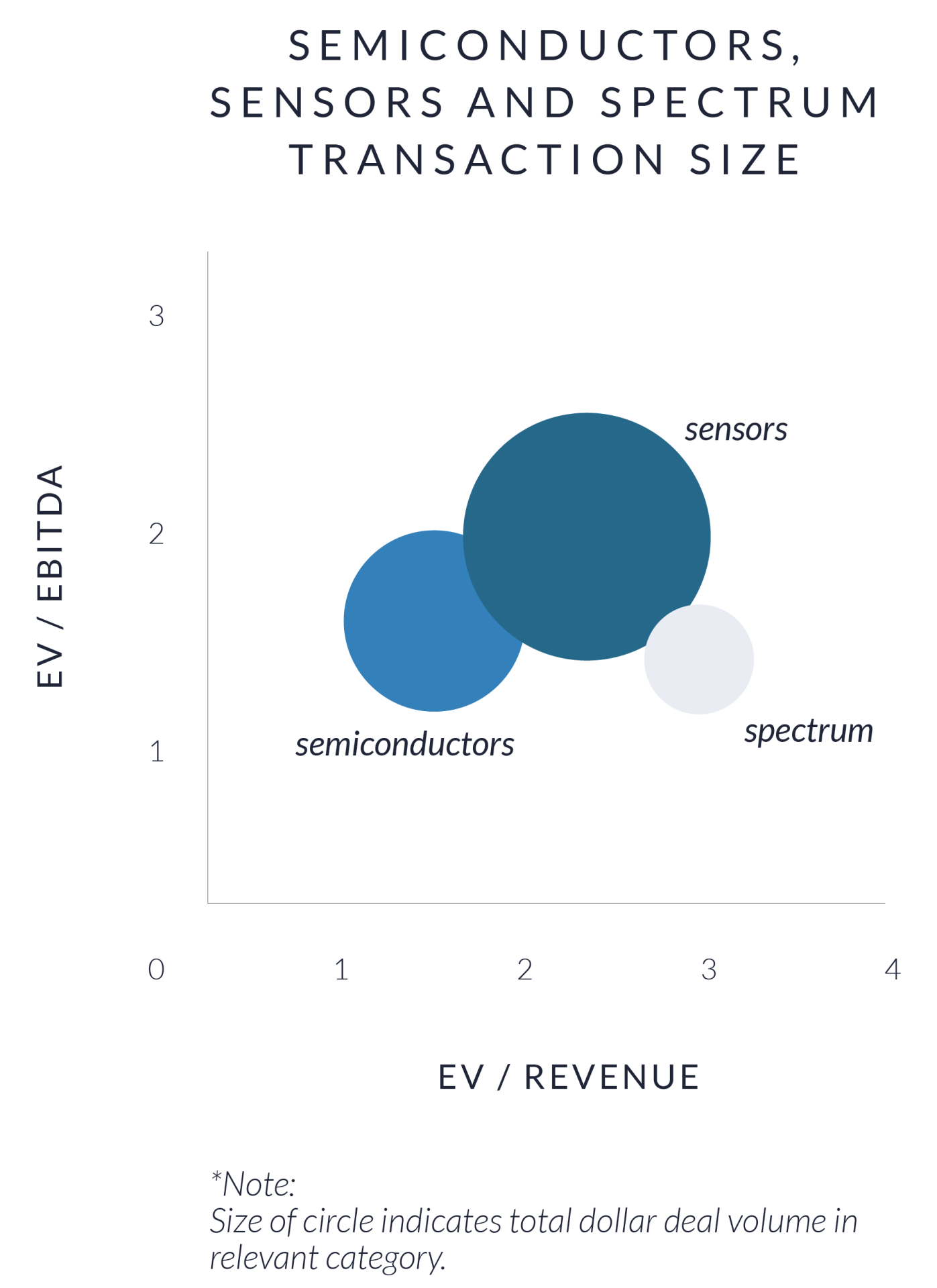

Across the industrial tech stack, valuation data from Q1 2020 to Q1 2025 reveals distinct patterns in how investors price transactions in the Semiconductors, Sensors, and Spectrum sectors. All three sectors share the same baseline EV/Revenue characteristics, with a median of 2x and a minimum of 1x, reflecting similar core expectations for revenue generation. However, the Spectrum sector stands out sharply, with a maximum EV/Revenue multiple of 65x more than triple that of the 19x seen in both Semiconductors and Sensors. This signals the presence of speculative or high-growth bets in spectrum-related deals, likely tied to infrastructure scarcity or forward-looking telecom strategies. Meanwhile, Semiconductors and sensors show more reasonable top-end revenue multiples compared to Spectrum. While some deals are priced for future potential, valuations are generally tied to strategic value and near-term earnings.

SEMICONDUCTORS

SENSORS

SPECTRUM

When analyzing EV/EBITDA multiples, the differences become even more pronounced. While Spectrum and Sensors share the highest means at 21x, their median multiples diverge, with Spectrum at 10x and Sensors at 12x, compared to Semiconductors’ more stable 13x. Notably, Spectrum’s maximum EV/EBITDA multiple surges to 353x, the highest among all, followed by Sensors at 260x and Semiconductors at 150x. This suggests Spectrum transactions are not only more volatile but also more prone to extreme valuations, likely fueled by scarcity and speculative promise. Semiconductors, by contrast, exhibit the narrowest gap between median and mean, implying a more consistent and reliable valuation range. Sensors occupy a middle ground, with signs of bifurcation between commoditized hardware and data-integrated, premium-valued platforms.

In summary, semiconductors represent the most stable and fundamentals-driven segment, sensors reflect a transitional category with selective high-premium deals, and spectrum emerges as the most speculative, with valuations reflecting both extreme scarcity and future-facing potential.

Iot Crosses Sectors and Therefore Value Definitions Have Greater Margins

ENTERPRISE DRIVEN IOT

CONSUMER DRIVEN IOT

Semiconductors

Foundries, Materials, and Chips:

Facilities that produce chips using specialized materials like silicon, gallium nitride, or silicon carbide.

Edge AI and Processing:

Chips designed to perform AI tasks locally, near the data source, enabling faster real-time decisions.

Integrated Device Manufacturing (IDM):

A business model where a company designs, manufactures, and sells its own semiconductor chips.

ENTERPRISE DRIVEN IOT

CONSUMER DRIVEN IOT

Sensors

Materials, Interfaces, and Embedded Fusion:

Advanced sensor materials and systems that combine inputs from multiple sensors for better accuracy.

Packaging, Sensing, Connectivity, Edge Processing and Analytics:

Complete sensor units with built-in data collection, transmission, and localized analysis capabilities.

Integration Into Platforms:

Embedding sensors into larger software or hardware systems for seamless industrial operations.

ENTERPRISE DRIVEN IOT

CONSUMER DRIVEN IOT

Spectrum

Communication Infrastructure and Data Flow:

The networks that enable IIoT devices to transmit and receive data efficiently.

Network Protocols and Application Enablement:

Standards and tools that let devices communicate and support IIoT applications and services.

Licensing and Regulation:

Legal frameworks governing radio frequency use, wireless transmission, and compliance.

As the Internet of Things (IoT) continues to reshape global industries, the technologies that underpin this transformation, semiconductors, sensors, and spectrum, are becoming increasingly central to acquisition strategies and investment priorities. By distinguishing between enterprise-driven and consumer-driven IoT ecosystems, business owners and stakeholders can better understand where strategic value is concentrated and how to align their capabilities with market demand.

Enterprise-driven IoT emphasizes high-performance, integrated systems that enable automation, real-time analytics, and industrial-scale reliability. Consumer-driven IoT, by contrast, demands scalable, standardized, and user-friendly technologies that thrive on connectivity and interoperability. Companies positioned at the intersection of these domains, especially those with proprietary hardware, robust communication infrastructure, or deeply embedded sensing capabilities, are well-placed to attract premium valuations.

Ultimately, this framework clarifies how innovation across the IoT stack translates into strategic interest from edge AI chips and multi-modal sensors to private 5G networks and compliant spectrum use. By understanding these dynamics, founders, executives, and investors can more effectively position their businesses for acquisition, growth, or competitive differentiation in the evolving industrial technology landscape.