High-Performance and Luxury Automotive Electrification Sector M&A Transactions and Valuations

High-Performance and Luxury Automotive Electrification Sector M&A Transactions and Valuations

The high-performance and luxury automotive electrification sector brings togetherunites legacy manufacturers and emerging technology developers advancing electrified sports cars, grand tourers, and premium performance vehicles. Core activities include next-generation powertrain engineering, lightweight design, and software-defined vehicle platforms that blend heritage craftsmanship with modern mobility.

Participants include heritage performance marques transitioning from internal combustion to hybrid and fully electric architectures, alongside emerging EV specialists developing proprietary battery, drivetrain, and control technologies. Sector growth is driven by rising demand for sustainable performance, tightening global emissions standards, and accelerating capital investment in electric mobility innovation.

This report analyzes M&A activity, valuation dynamics, and strategic transformation from Q4 2020 to Q3 2025, highlighting the widening valuation gap between legacy OEMs adapting to electrification and new entrants commercializing breakthrough EV technologies. It emphasizes the intangible assets that underpin premium transaction multiples and long-term value creation.

Key transactions including Rimac Group’s acquisition of Bugatti, Investindustrial’s buyout of Morgan Motor Company, and Lotus Technology’s reverse merger with L Catterton Asia Acquisition Corp. illustrate how acquirers pursue scale, technological innovation, and brand revitalization to strengthen leadership in the luxury-performance EV segment.

EXHIBIT 1

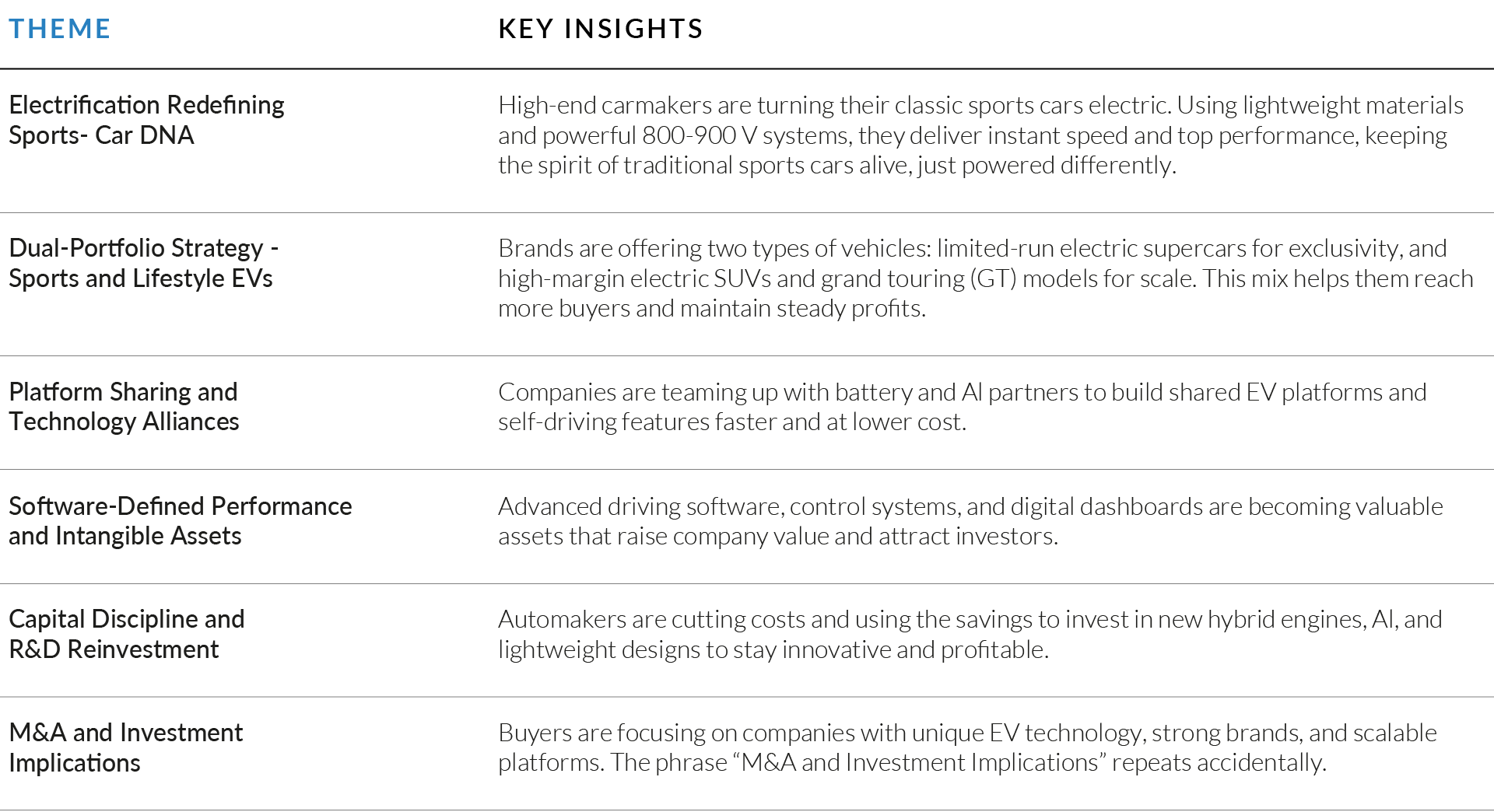

Key Trends in the High-Performance and Luxury Automotive Electrification Sector

The sector is converging around dual identity, heritage sports-car performance and electrified innovation. Through advanced powertrains, intelligent software, and modular architectures, luxury OEMs preserve exclusivity while scaling globally, sustaining investor interest and elevating M&A valuations.

EXHIBIT 2

Intangible Assets and Technology Value Drivers in the Sector

Source: HSBC Equity Research, Aston Martin Lagonda: A Legend Reborn (Nov 2018); PitchBook, Lotus Cars Q2 2025 Earnings Conference Call Transcript (Aug 2025); J&A Analysis, High Performance and Luxury Automotive Electrification Sector M&A Dataset (Q3 2025); Bloomberg Intelligence, Global Luxury and Performance EV Market Outlook (Jul 2025).

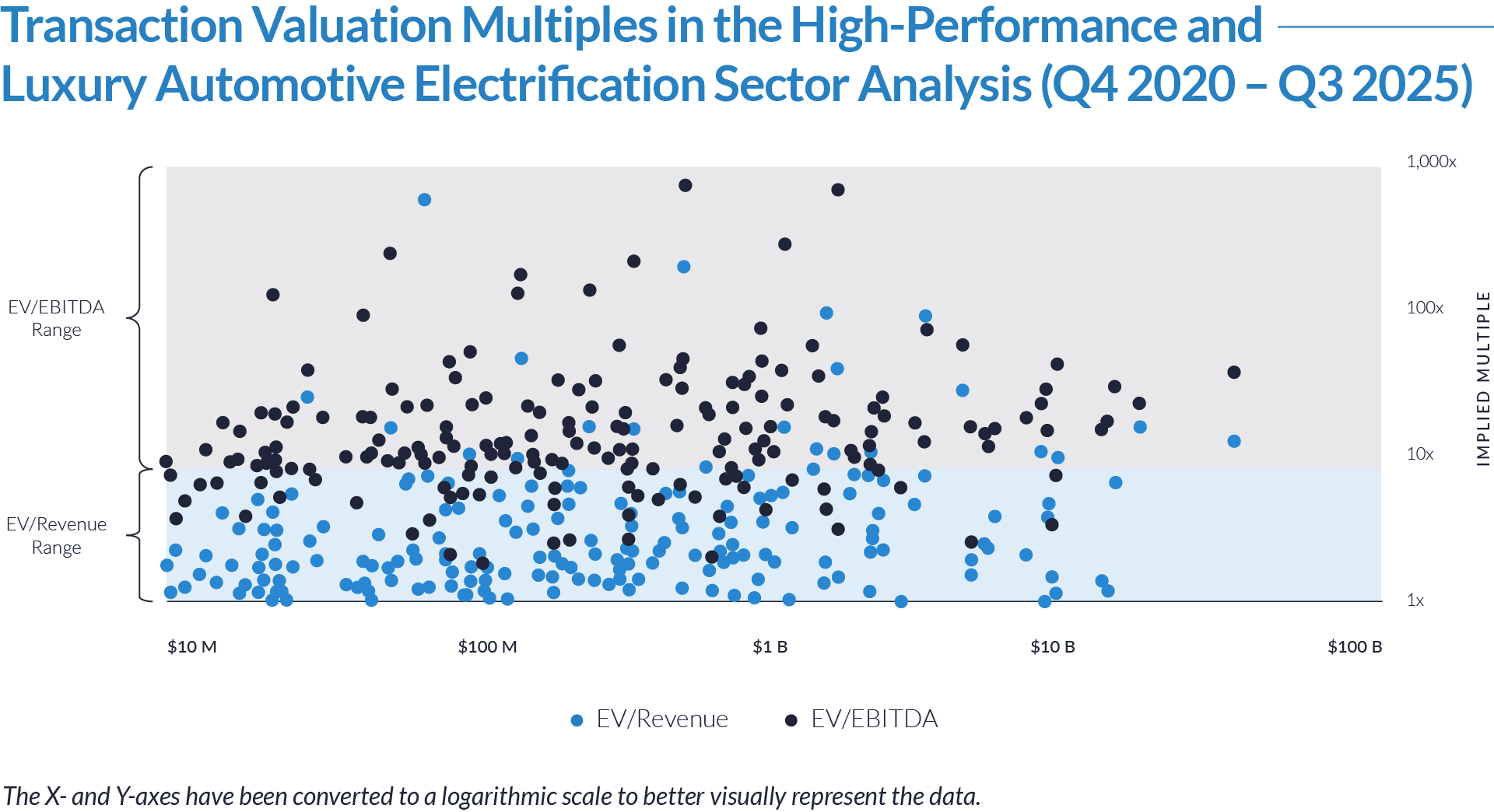

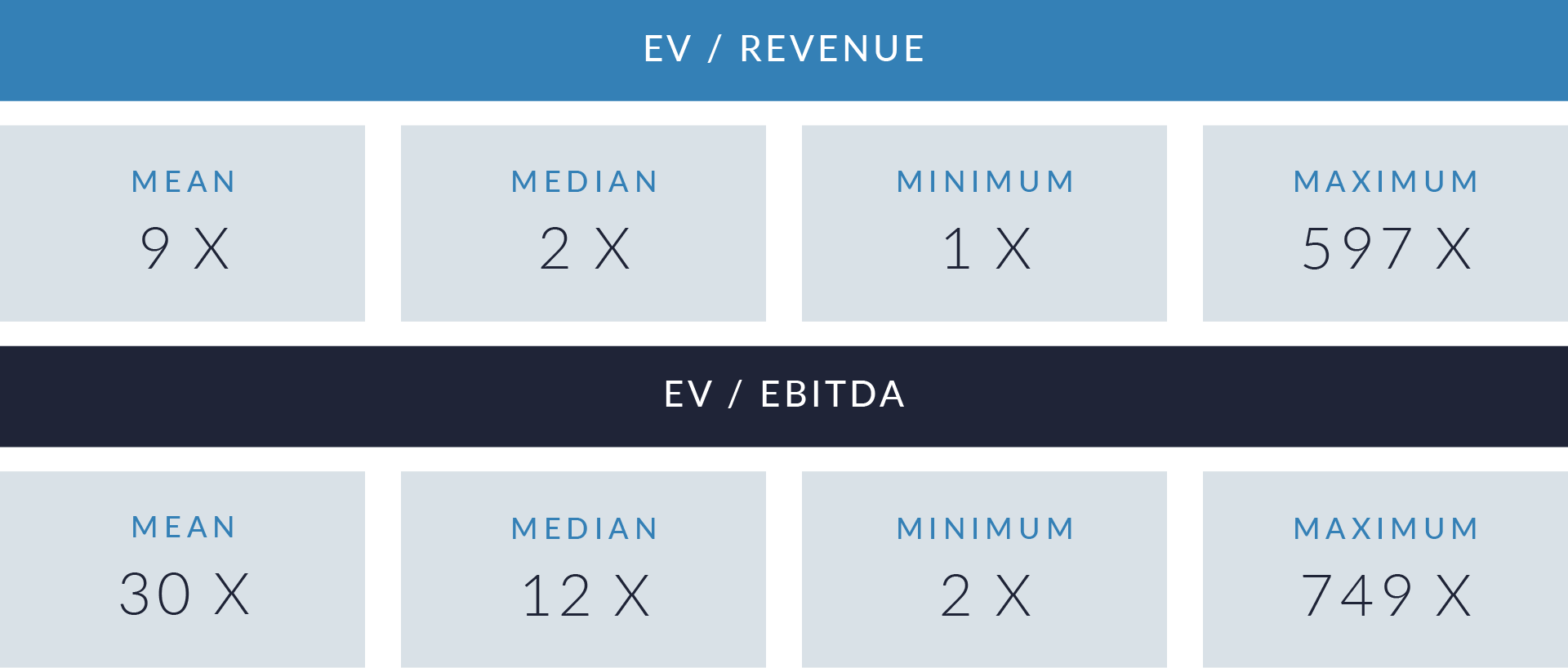

- Valuation multiples are based on a sample set of M&A transactions in the high-performance and luxury automotive electrification sector using data collected on October 20, 2025.

- Sector valuation dynamics reveal a clear divide between established luxury OEMs transitioning to electrification and emerging performance brands commercializing proprietary technologies. EV/revenue multiples range from 1x–597x (median 2x) and EV/EBITDA from 2x–749x (median 12x), underscoring investor focus on engineering IP, software integration, and lightweight design as the defining intangible assets of next-generation competitiveness rather than production scale.

- Premium valuation clusters center on hybrid-transition and halo-EV programs, where brand exclusivity meets defensible electrification technology. Transactions above 10x revenue or 25x EBITDA typically feature low-volume, high-margin platforms with innovation in battery architecture, e-powertrain, and aerodynamics. Such assets attract strategic acquirers aiming to preserve performance identity while meeting sustainability mandates, reinforcing long-term brand equity in a decarbonizing mobility landscape.

- Lower-multiple transactions indicate vertical integration and capability expansion rather than luxury growth. Deals below 3x revenue or 10x EBITDA often target component suppliers, materials specialists, and electrification enablers focused on cost control, scalability, and supply-chain resilience. These acquisitions highlight a shift in value creation from consumer prestige to technical and operational leverage within the performance-EV ecosystem.

Capital Markets Activities

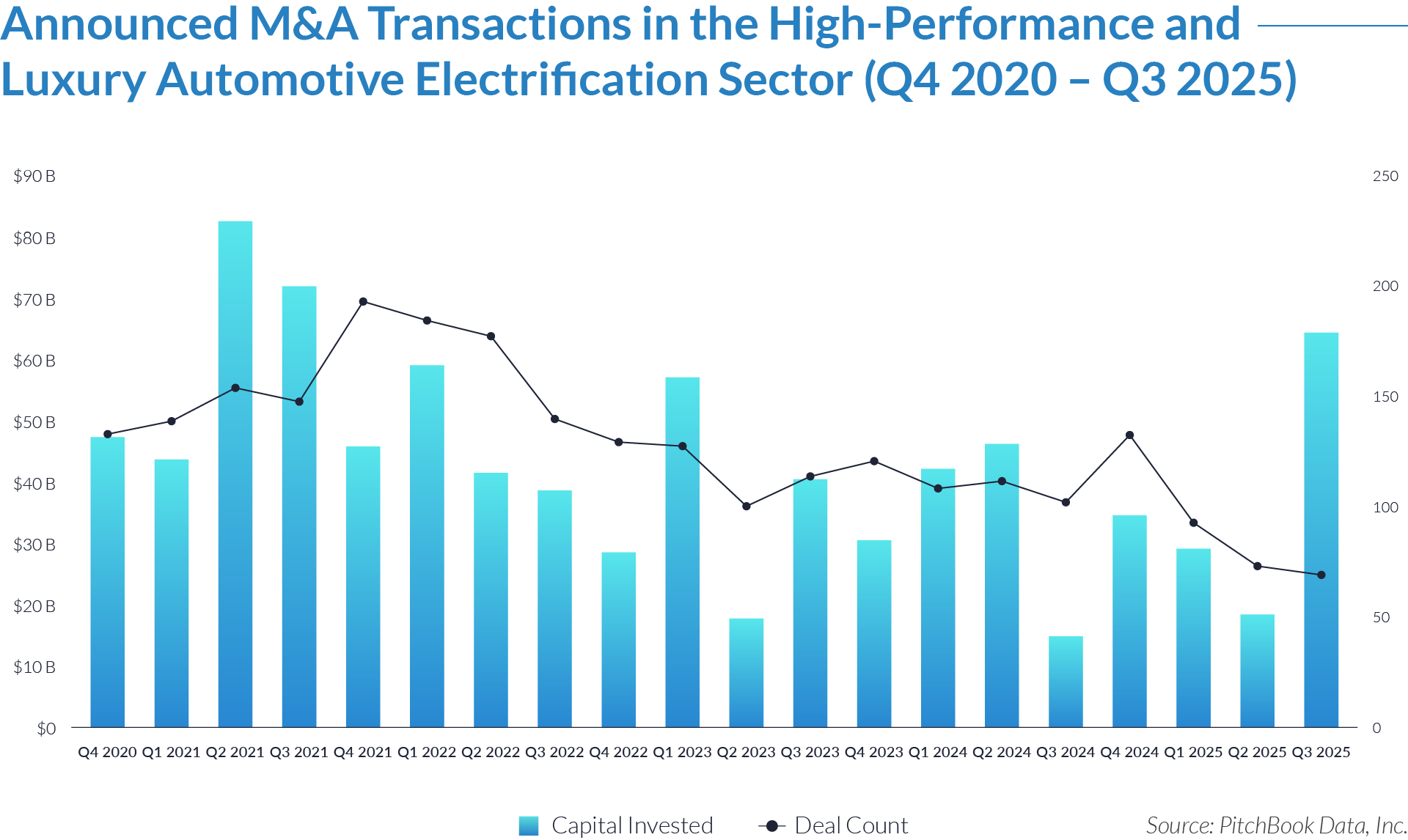

The data reveals shifting capital flows and rising consolidation as performance-EV manufacturers and technology firms pursue scalable electrification platforms. Advances in powertrain design, battery systems, and lightweight engineering continue to drive M&A focused on vertical integration, technology defensibility, and long-term value creation.

- A total of $849 billion was invested across 2,536 deals from Q4 2020 to Q3 2025. Both strategic and financial acquirers remained highly active, with capital inflows during 2021–2022 as OEMs and investors accelerated electrification strategies before moderating in subsequent years.

- The sector’s peak occurred in Q2 2021, reaching $82 billion across 153 deals, fueled by OEM-led initiatives and SPAC activity targeting battery systems, e-powertrains, and ICE-to-EV conversions. Investment levels declined by roughly 65% by Q4 2022, reflecting tighter capital markets and more disciplined deployment by acquirers.

- From 2023 through mid-2024, quarterly investment stabilized at an average of $37 billion across approximately 115 deals, as strategic buyers concentrated on vertical integration in software, lightweight materials, and proprietary EV architectures.

- In Q3 2025, investment rebounded to $64 billion despite a deal count of only 69, the lowest in the period. This uptick indicates a renewed wave of large-ticket strategic transactions and capital inflows into premium EV platforms, high-performance brands, and advanced battery technologies. The graphs below illustrate geographic distribution and regional investment trends supporting this rebound.

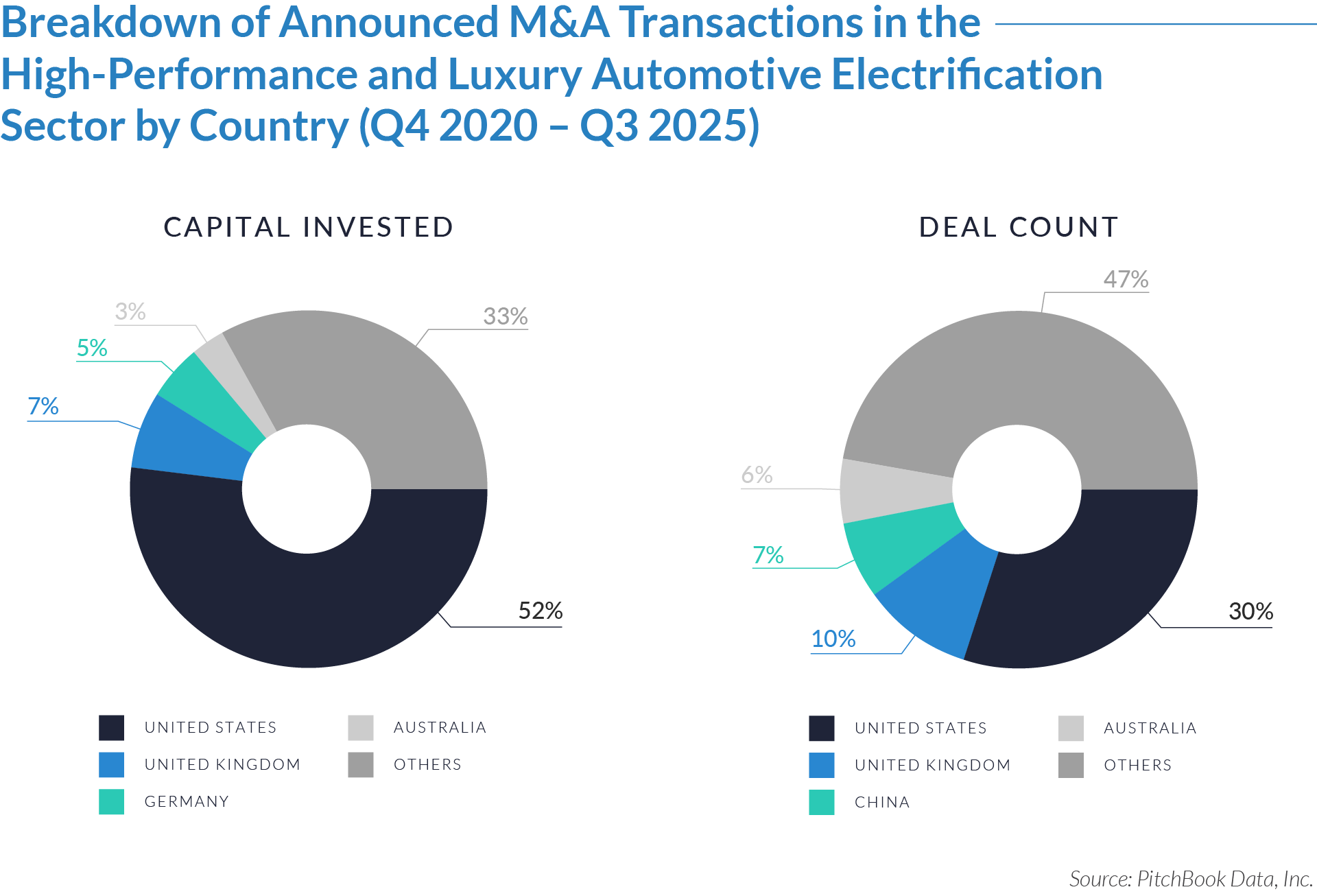

- US acquirers and investors remain the sector’s strategic center of gravity, capturing 52% of total capital invested but only 30% of deal volume. This disparity underscores larger, later-stage transactions within a mature, capital-intensive ecosystem, where major OEMs and private equity sponsors target platform-scale acquisitions in battery systems, high-performance EV design, and software integration.

- The UK, Germany, and Australia collectively account for 15% of global capital and roughly 20% of total transactions, reflecting a concentration of mid-market, engineering-driven deals. Activity in these markets is led by luxury and specialty performance OEMs acquiring R&D capabilities and supply-chain assets to localize production and secure intellectual property advantages.

- Emerging and international markets represent 33% of invested capital and nearly 47% of deal flow, signaling the global diffusion of electrification technology. Investment is increasingly directed toward emerging European, Asian, and Middle Eastern hubs, where acquirers pursue cost-efficient innovation partners, mineral-to-battery integration, and regional assembly capacity supporting next-generation performance EV platforms.

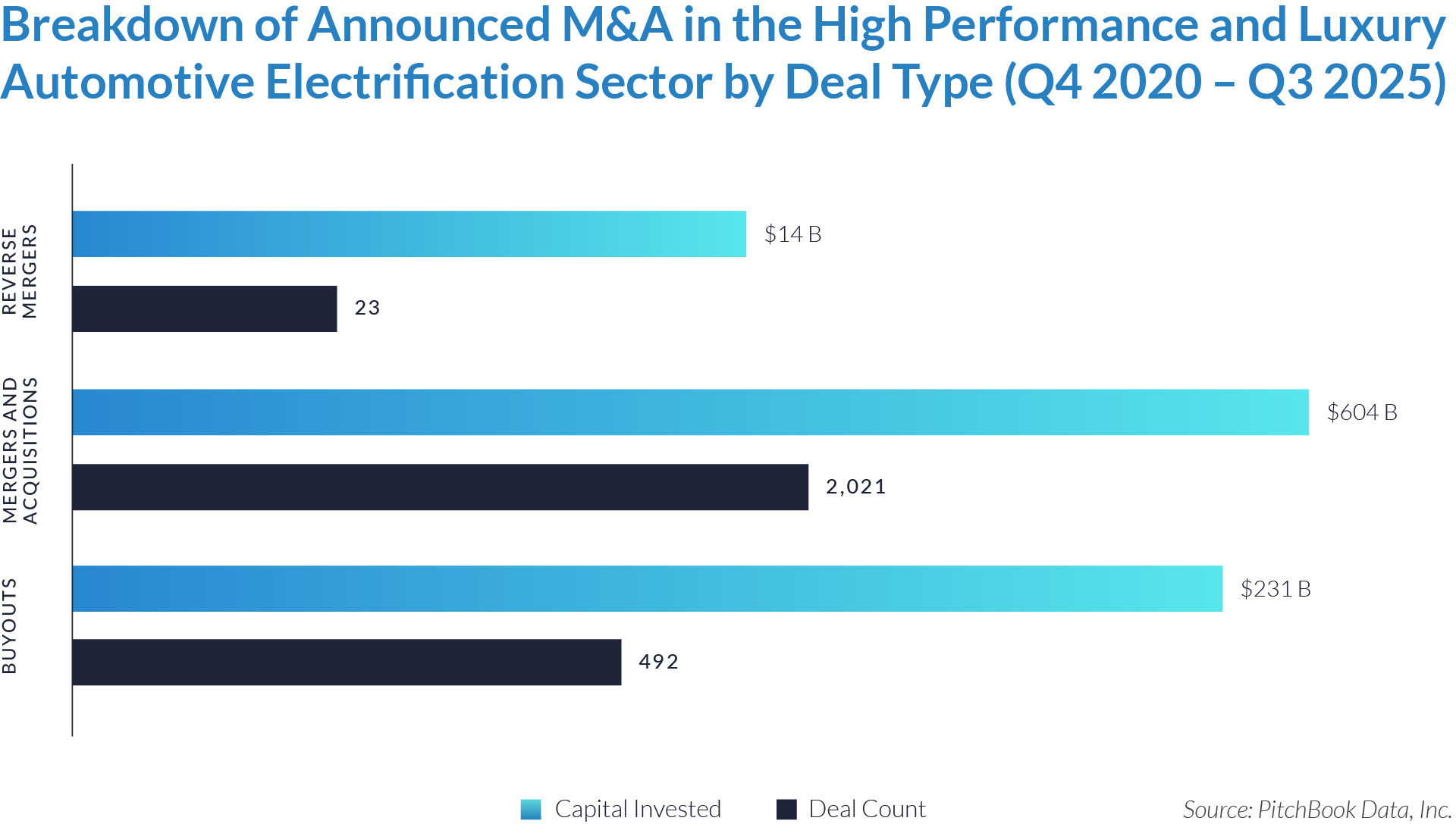

- Mergers and acquisitions (M&A) dominated sector activity, totaling $604 billion (71% of total capital) across 2,021 transactions, underscoring continued consolidation among performance EV manufacturers, component suppliers, and battery technology developers. Strategic acquirers led most high-value transactions to secure proprietary electrification assets and global distribution capabilities.

- Buyouts accounted for $231 billion across 492 deals (27% of capital), driven largely by private equity sponsors and sovereign funds targeting scalable performance EV platforms and Tier 1 suppliers with recurring revenue models and advanced R&D pipelines.

- Reverse mergers totaled $14 billion across 23 transactions, reflecting SPAC-led market entries and public listings concentrated during the 2020–2022 boom. Activity in this category has since declined, as investors favor traditional acquisitions and post-market integration strategies to achieve sustainable exposure to the sector.

M&A Transactions Case Studies

Three transactions in the high-performance and luxury automotive electrification sector demonstrate how strategic acquirers and investors are accelerating transformation through advanced engineering, proprietary powertrains, and brand modernization. Buyers are targeting assets that unite electrification expertise, lightweight design, and digital integration, bridging heritage craftsmanship with next-generation mobility. These deals reflect strong interest in scalable performance platforms, premium brand positioning, and sustainable innovation, as acquirers pursue technology-led growth and long-term value creation in an evolving automotive landscape.

Case Study 01

LOTUS TECHNOLOGY

Lotus Technology Inc. is the electric mobility subsidiary of Lotus Cars, specializing in advanced performance EV platforms, battery systems, and software-defined vehicle architectures. Building on Lotus’s heritage in lightweight performance design, the company develops premium electric vehicles that combine engineering innovation with luxury aesthetics, supporting the brand’s full transition from combustion to electrified sports and performance models.

Acquirer

L Catterton Asia Acquisition Corp. was a US-listed SPAC affiliated with L Catterton, a global consumer-focused private equity firm investing across premium, sustainable, and lifestyle sectors. The merger provided Lotus Technology with institutional capital access and a public listing, accelerating its evolution as a global performance EV brand.

Transaction Structure

In February 2024, Lotus Technology completed a reverse merger with L Catterton Asia Acquisition Corp. valuing the company at approximately $5 billion. The transaction raised $288 million in net proceeds.

Market and Customer Segments Combination

The merger positioned Lotus Technology as a publicly traded premium EV manufacturer, combining engineering legacy with global capital access. It supports expansion into North American and Asian luxury EV markets, strengthening distribution reach and brand competitiveness.

Acquisition Strategic Rationale

The transaction secured long-term funding for Lotus’s electrification and growth strategy while maintaining strategic control under Geely. It reflects investor demand for high-performance EV platforms and highlights how heritage manufacturers leverage public markets to scale innovation and international reach.

Case Study 02

BUGATTI

Bugatti Automobiles S.A.S. was a French manufacturer of ultra-luxury hypercars renowned for craftsmanship, engineering precision, and design exclusivity. Operating under the Volkswagen Group, Bugatti produced some of the world’s most powerful and expensive vehicles. As global mobility shifted toward electrification, the company faced pressure to integrate hybrid and electric technologies while maintaining its heritage performance identity.

Acquirer

Rimac Group, headquartered in Croatia, is an electric hypercar manufacturer and technology firm specializing in high-voltage battery systems, powertrains, and vehicle control software. Founded by Mate Rimac, the company evolved from a niche EV engineering firm into a global technology supplier for major automotive OEMs. Its acquisition of Bugatti marked Rimac’s transition to a fully integrated luxury-performance OEM, combining cutting-edge engineering with brand heritage at the top of the market.

Transaction Structure

In July 2021, Bugatti was acquired by Rimac Group through the formation of the Bugatti Rimac joint venture, with Rimac Group holding a controlling stake and Porsche AG retaining a minority interest. The transaction amount was undisclosed.

Market and Customer Segments Combination

The merger united Rimac’s electrification expertise with Bugatti’s global luxury brand and customer base, enabling the development of hybrid and full-electric hypercars that preserve heritage craftsmanship and design exclusivity. The platform targets ultra-high-net-worth clients seeking electrified performance with timeless prestige.

Acquisition Strategic Rationale

The transaction positioned Rimac as a global leader in high-performance electrification, expanding its role from technology supplier to OEM. For Porsche and Volkswagen Group, it preserved Bugatti’s legacy while aligning the brand with sustainable mobility trends.

Case Study 03

MORGAN MOTOR COMPANY

Morgan Motor Company is a British manufacturer of hand-crafted sports cars, blending traditional craftsmanship with modern performance engineering. Known for low-volume production and bespoke design, Morgan has gradually adopted hybrid and electric systems to meet regulatory and performance demands while preserving its artisanal identity.

Acquirer

Investindustrial is a European private equity firm specializing in premium industrial and consumer brands. The firm has a strong investment record in the luxury and mobility sectors, driving growth through product innovation, operational efficiency, and international expansion.

Transaction Structure

In April 2019, Investindustrial acquired a majority stake in Morgan Motor Company through a growth -capital-backed leveraged buyout for an undisclosed amount.

Market and Customer Segments Combination

The partnership combined Morgan’s boutique craftsmanship and loyal customer base with Investindustrial’s capital and operational expertise. This alignment provided Morgan with EV engineering capabilities, new distribution channels, and sustainability-focused materials sourcing to support its modernization.

Acquisition Strategic Rationale

The transaction aimed to preserve Morgan’s heritage appeal while advancing electrification and digital manufacturing initiatives. Investindustrial’s backing accelerated product diversification and international growth, strengthening brand equity and competitiveness without compromising exclusivity or design authenticity.

The sector is poised for sustained growth, supported by global demand for sustainable performance, tightening emissions standards, and advances in electrification technologies. Consolidation and capital inflows remain strong as OEMs and innovators pursue scale, efficiency, and proprietary control of electric platforms. The convergence of performance, innovation, and sustainability positions luxury-performance EVs among the most dynamic and resilient segments of the global automotive market.

Source: Investindustrial, BBC, RIMAC, Naples Motor Sports, LCatterton, Pitchbook Data.