Automated Optical and Semiconductor Inspection Sector M&A Transactions and Valuations

Automated Optical and Semiconductor Inspection Sector M&A Transactions and Valuations

The automated optical and semiconductor inspection sector encompasses advanced metrology, imaging, and machine vision platforms that enable precision manufacturing, yield optimization, and quality assurance across semiconductor, electronics, and industrial production lines. Core technologies include optical and X-ray metrology, 3D packaging inspection, PCB and laser inspection, and AI-driven vision systems. Growth is fueled by the adoption of AI and high-performance computing, increasingly complex semiconductor architectures, and the global shift toward Industry 4.0 automation.

This report analyzes M&A trends, valuation dynamics, and capital flows in the sector from Q3 2020 to Q2 2025, highlighting the widening spread in valuation multiples, the role of proprietary IP and scalable platforms, and consolidation strategies by both strategic acquirers and financial sponsors. It emphasizes intangible assets such as advanced imaging IP, integration into mission-critical production lines, and global distribution networks that drive premium valuations.

Key transactions include MiddleGround Capital’s acquisition of Stemmer Imaging, PPF Group’s acquisition of Vitronic, and Atlas Copco’s acquisition of ISRA Vision, illustrating how buyers pursue platform-scale consolidation to secure differentiated inspection technologies and strengthen competitive positioning.

Key Trends in the Automated Optical and Semiconductor Inspection Sector

The automated optical and semiconductor inspection sector is being reshaped by technology innovation and market dynamics, with inspection tools at the center of semiconductor, electronics, and automation growth.

AI and High-Performance Computing (HPC)

- Rapid adoption of AI and HPC workloads is driving demand for advanced logic and memory chips.

- These applications require highly precise inspection systems to ensure reliability, pushing investment in both optical and X-ray metrology platforms.

3D Advanced Packaging

- The shift toward high-bandwidth memory and gate-all-around nodes is reshaping semiconductor manufacturing.

- Multi-layer packaging increases inspection complexity, accelerating the need for advanced 3D inspection tools capable of validating interconnects and fine geometries.

Machine Vision and Sensors

- Integration of AI with machine vision enables predictive defect detection, automated process control, and yield optimization.

- Adoption is expanding beyond semiconductors into industrial electronics, supporting double-digit growth for smart inspection platforms.

PCB Equipment Expansion

- Rising complexity in PCB design, from AI servers to next-generation consumer devices, is creating new demand for optical and laser inspection tools.

- Domestic capacity expansions in Asia, combined with redesign cycles in consumer electronics, are reinforcing long-term demand for PCB inspection solutions.

Source: HSBC Global Research, Koh Young Technology Sector Note (May 2025); Baptista Research, Teledyne Technologies Equity Research Report (Jul 2025); PitchBook, Comet Holding Q2 2025 Earnings Transcript (Jul 2025); HSBC Qianhai Securities, Han’s Laser Equity Research Report (Aug 2025); Morningstar Equity Research, Keyence Corporation Company Report (Sep 2025).

Source: HSBC Global Research, Koh Young Technology Sector Note (May 2025); Baptista Research, Teledyne Technologies Equity Research Report (Jul 2025); PitchBook, Comet Holding Q2 2025 Earnings Transcript (Jul 2025); HSBC Qianhai Securities, Han’s Laser Equity Research Report (Aug 2025); Morningstar Equity Research, Keyence Corporation Company Report (Sep 2025).

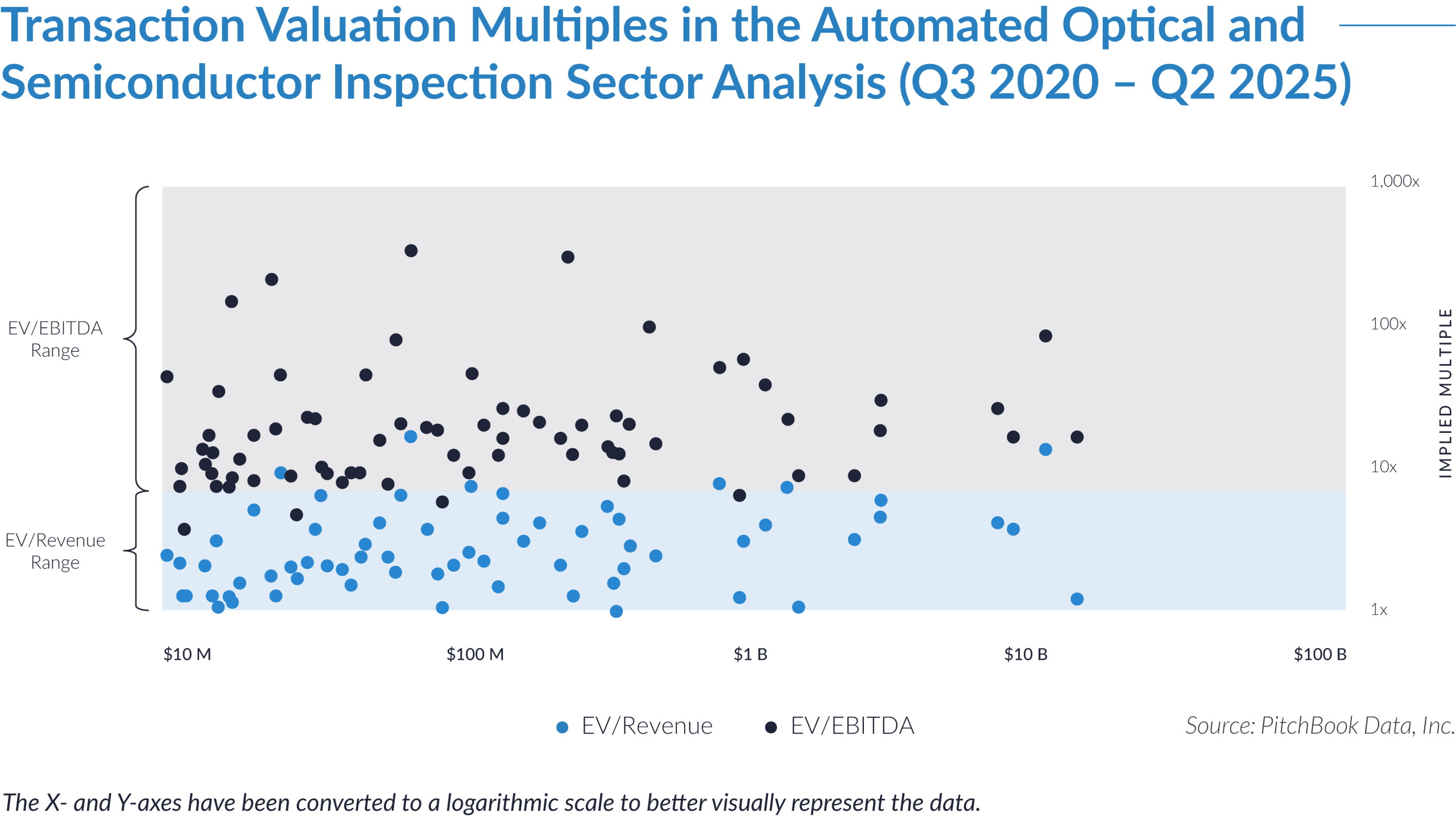

- Valuation multiples are based on a sample set of M&A transactions in the automated optical and semiconductor inspection sector using data collected on September 15, 2025.

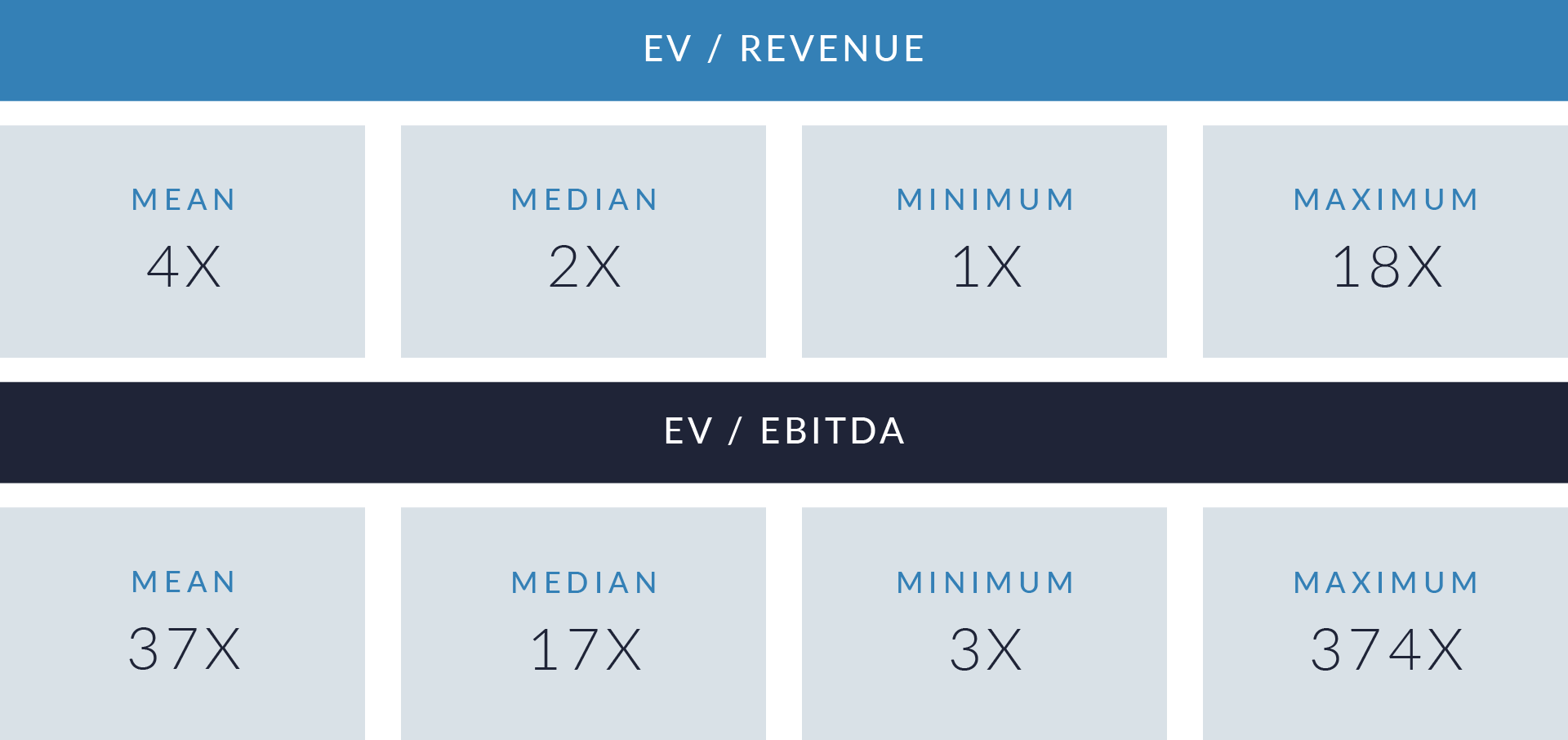

- Median valuations remain modest at 2x EV/revenue and 17x EV/EBITDA, but outliers reaching up to 18x revenue and 374x EBITDA demonstrate that buyers pay sharply higher premiums for differentiated technology and IP-rich assets.

- Transactions with double-digit EV/revenue multiples frequently carry unsustainably high EV/EBITDA ratios (90x–370x). Buyers emphasize long-term revenue scalability and defensible market positioning over short-term profitability, as inspection technologies underpin semiconductor yield, precision, and supply chain resilience.

- Large-scale transactions above $1 billion typically show more restrained multiples, while smaller, IP-driven targets command significant premiums. Buyers expand scale through major platform acquisitions and invest heavily in breakthrough technologies such as AI-enabled defect detection, hyperspectral imaging, and edge-computing inspection systems.

Capital Markets Activities

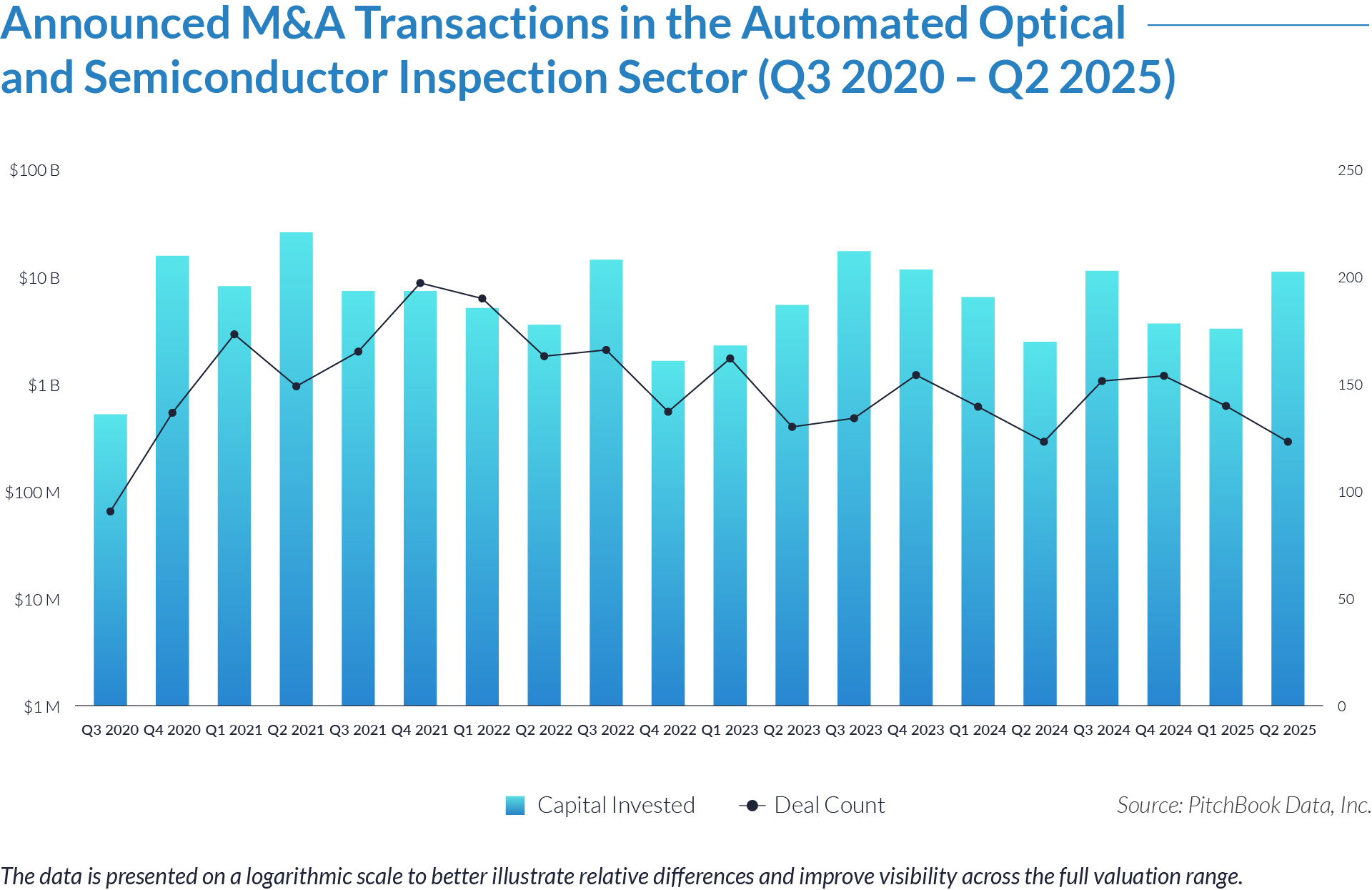

The data highlights transaction trends, valuation dynamics, and capital flows in the automated optical and semiconductor inspection sector. Demand for advanced inspection systems, yield optimization, and next-generation semiconductor manufacturing drives M&A across the value chain. Acquirers prioritize technology-rich targets with proprietary IP, scalable platforms, and integration into mission-critical production lines. Transactions emphasize consolidating global leadership positions while securing niche innovators, reflecting both scale-driven consolidation and selective bolt-on strategies across fragmented regional markets.

- Acquirers executed 2,979 transactions over 20 quarters, deploying approximately $160 billion. This sustained activity underscores the sector’s appeal for both strategic buyers and financial sponsors despite quarterly fluctuations.

- Capital deployment shows significant volatility, with peaks such as Q2 2021 ($25 billion) and Q3 2023 ($17 billion) contrasting with troughs like Q3 2020 ($524 million) and Q4 2022 approximately ($2 billion). These swings indicate that a few mega-deals drive quarterly totals while the underlying deal count remains relatively stable.

- Deal count demonstrates resilience, averaging about 150 per quarter and rarely dropping below 120. This stability signals persistent buyer interest in acquiring inspection technologies, with capital intensity flexing around larger transactions rather than overall market participation.

- Acquirers accelerated activity in 2021, pulled back through late 2022, and renewed deal flow in 2023–2025. These shifts show buyers aligning capital deployment with swings in semiconductor demand and broader industry drivers such as supply chain constraints, reshoring, and the build-out of next-generation chip manufacturing capacity.

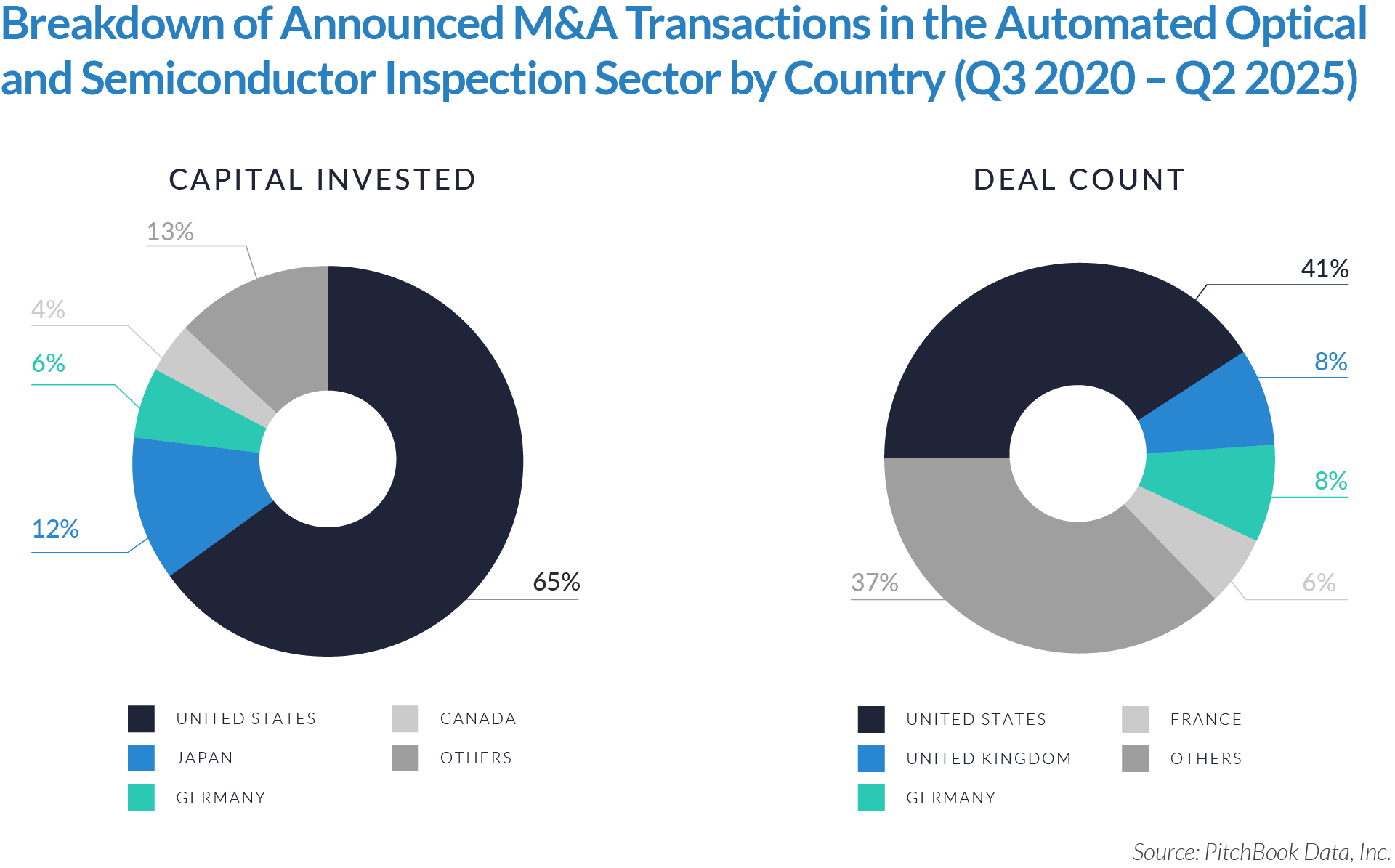

The graphs below present the geographic distribution of transactions, providing additional detail on regional trends and investment dynamics.

- The United States anchors the sector, accounting for 65% of total deal value and 41% of transactions. US acquirers favor larger-scale deals, using consolidation to reinforce leadership in the global semiconductor and electronics market.

- International and emerging markets capture 13% of deal value and 37% of transactions, with France and other regional players sustaining active participation. Acquirers target these fragmented ecosystems to secure specialized technologies and region-specific capabilities.

- Japan, Germany, and the UK collectively stand out as strategic hubs. Japan contributes 12% of global deal value but a smaller share of transactions, reflecting acquirers’ focus on deploying larger checks into advanced semiconductor inspection champions. Germany and the UK generate steady deal flow, positioning Europe as a critical market for innovation-driven acquisitions despite smaller average deal sizes.

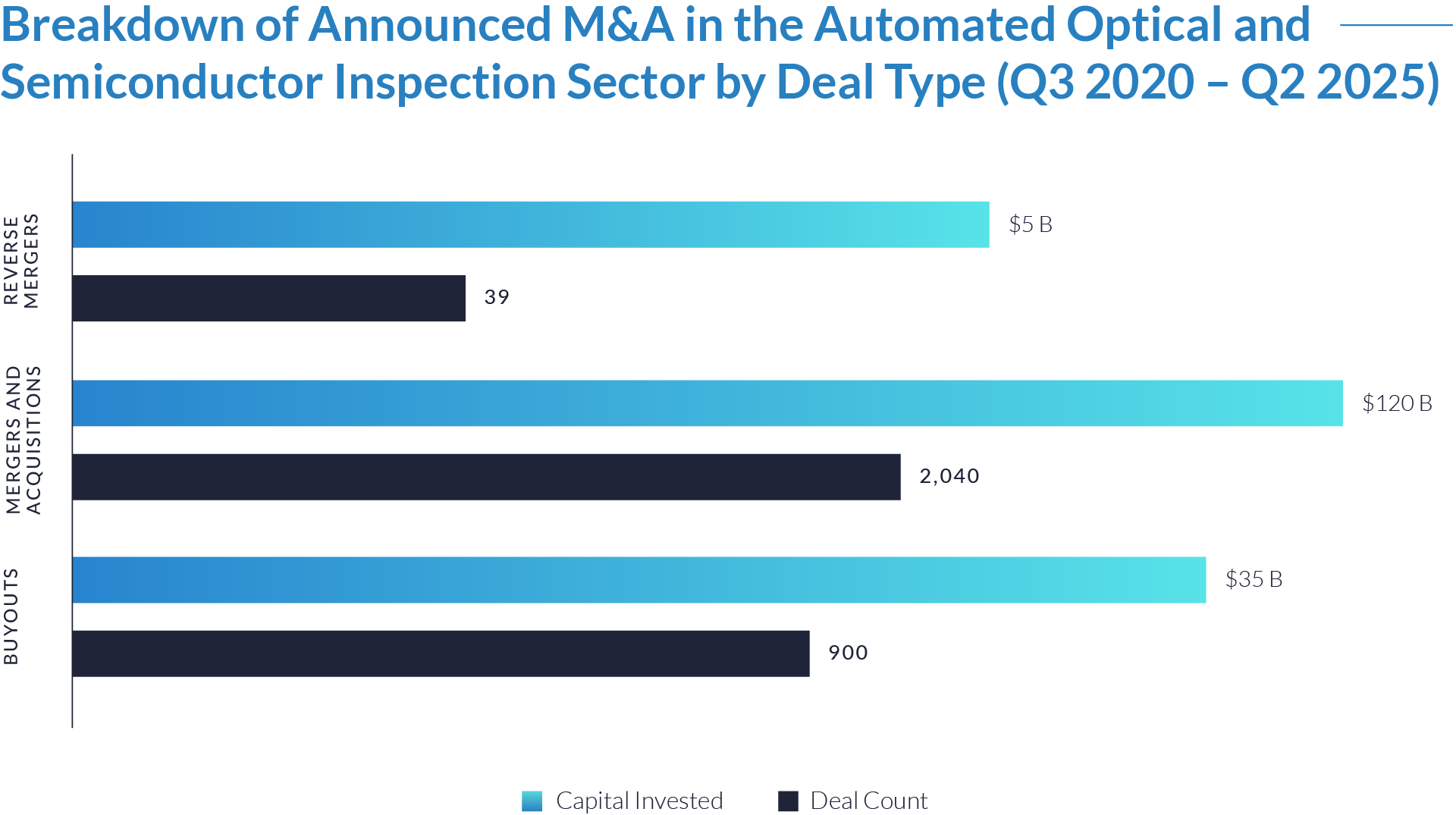

- Mergers and acquisitions accounted for $120 billion across 2,040 transactions, representing more than 75% of total deal value and two-thirds of all activity. Acquirers clearly favor strategic consolidation and technology-led scaling over financial structuring.

- Buyouts totaled $35 billion across 900 transactions, highlighting private equity’s continued role in building inspection technology platforms. Sponsors view the sector as a strong cash-flow generator with clear operational value-creation levers.

- Reverse mergers remained marginal, with just $5 billion across 39 transactions. Their limited use shows that growth-stage inspection companies overwhelmingly prefer strategic sales or private capital over alternative public-market entry routes.

M&A Transactions Case Studies

Three transactions in the automated optical and semiconductor inspection sector illustrate how strategic acquirers and investors are accelerating growth through advanced imaging, precision metrology, and automation platforms. Buyers are prioritizing targets with proprietary vision technologies, software-driven inspection systems, and diversified industrial applications across semiconductors, electronics, automotive, and logistics. These deals reflect strong capital interest in assets that enable Industry 4.0 integration, enhance manufacturing quality, and deliver scalable recurring revenue through equipment, integration, and data analytics solutions.

Case Study 01

STEMMER IMAGING

Stemmer Imaging headquartered in Germany, is a leading European provider of machine vision technology, components, and integration services. Its portfolio includes cameras, optics, illumination, software, and subsystems used in automated optical inspection (AOI), semiconductor inspection, and industrial quality control. The company serves a diverse set of industries, including electronics, automotive, food and beverage, pharmaceuticals, and logistics, and employs over 300 people across Europe. Backed by MiddleGround Capital, Stemmer Imaging leverages its distribution network and engineering expertise to deliver a broad range of inspection and automation solutions.

Transaction Structure

MiddleGround Capital acquired Stemmer Imaging through a voluntary public takeover offer valued at approximately $339 million, with the amount paid in cash.

Market and Customer Segments Combination

The acquisition integrated Stemmer Imaging’s machine vision distribution and integration capabilities with MiddleGround Capital’s industrial and automation portfolio, broadening customer reach across electronics, semiconductors, automotive, and logistics.

Acquisition Strategic Rationale

MiddleGround Capital aimed to scale a leading European machine vision platform by providing capital and operational backing for geographic expansion and future acquisitions. The transaction positions Stemmer Imaging to accelerate growth in inspection and quality-control applications and reinforce its role as a key technology partner to OEMs and integrators.

Case Study 02

VITRONIC

Vitronic Machine Vision, headquartered in Wiesbaden, Germany, is a global specialist in machine vision systems and automated optical inspection (AOI). Its industrial division provides solutions for electronics and battery inspection, automotive quality control, and process automation, while other business units focus on logistics automation and traffic enforcement systems. With subsidiaries in the United States, China, and the Middle East, Vitronic combines proprietary imaging technology with application-specific expertise to deliver scalable inspection and automation solutions worldwide.

Transaction Structure

ITIS Holding, a subsidiary of PPF Group, acquired Vitronic Group in a transaction valued at approximately $160 million. The deal was structured as a 100% equity purchase settled in cash.

Market and Customer Segments Combination

The acquisition integrated Vitronic’s AOI and machine vision platforms in electronics, automotive, and industrial quality assurance with ITIS Holding’s expertise in intelligent transport systems (ITS), logistics, and mobility infrastructure. This combination created a more comprehensive offering across industrial automation and smart mobility markets.

Acquisition Strategic Rationale

ITIS Holding pursued the acquisition to build a global ITS and automation leader, combining Vitronic’s advanced imaging IP with PPF’s financial strength and international reach. The deal enabled expanded R&D, increased production capacity in Germany, and improved access to global markets through PPF’s portfolio network.

Case Study 03

ISRA VISION

ISRA Vision headquartered in Germany, is a global leader in industrial machine vision and surface inspection systems. The company develops hardware and software for defect detection, metrology, and robot guidance, serving industries such as automotive, semiconductors, glass, metals, and packaging. With approximately 1,200 employees and thousands of systems installed worldwide, ISRA Vision leverages strong R&D capabilities and a global sales network to deliver advanced automation and quality-assurance solutions.

Transaction Structure

Atlas Copco acquired ISRA Vision through a voluntary public cash offer valued for more than $1 billion.

Market and Customer Segments Combination

The acquisition integrated ISRA’s optical inspection, surface vision, and metrology platforms with Atlas Copco’s broader industrial automation portfolio. This expanded Atlas Copco’s access to customers in automotive, semiconductor, electronics, glass, and packaging, complementing its established base in industrial equipment and tools.

Acquisition Strategic Rationale

Atlas Copco pursued the acquisition to strengthen its position in Industry 4.0 and smart manufacturing by adding ISRA’s software-driven, high-margin inspection technologies. The deal enhanced cross-selling opportunities through Atlas Copco’s global distribution network, broadened its automation and quality-assurance capabilities, and supported long-term growth in precision manufacturing and digital factory solutions.

M&A in the automated optical and semiconductor inspection sector will remain active as technology complexity and yield demands rise. Premium valuations will focus on IP-rich assets, AI-enabled platforms, and inspection tools critical to advanced packaging. Consolidation by global leaders, alongside targeted acquisitions of niche innovators, will shape long-term competitive positioning and sustain capital inflows into the sector.

Source: MiddleGround Capital, Vitronic, ITIS Holding, Atlas Copco Group, Reuters, Pitchbook Data.