Durable Medical and Home Health Equipment Sector M&A Transactions and Valuations

The durable medical and home health equipment sector encompasses devices, consumables, and service platforms designed for long-term or recurring patient use outside of traditional hospital settings. This includes respiratory therapy, sleep apnea treatment, wound care, mobility aids, and other home-based clinical solutions. Growth is fueled by aging demographics, rising chronic conditions, and payer-driven shifts toward cost-effective, value-based care delivery in the home.

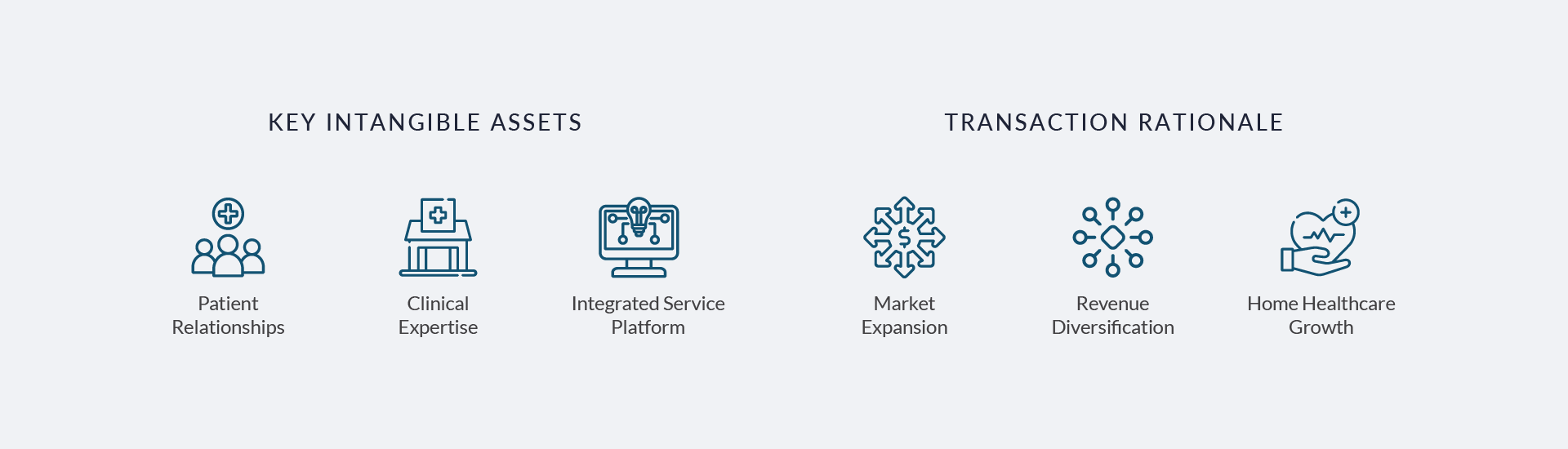

This report examines M&A transaction trends, valuation dynamics, and regional investment flows in the sector from Q3 2020 to Q2 2025. It highlights recurring revenue models, payer reimbursement expansion, and consolidation across fragmented providers. The analysis emphasizes intangible assets such as patient relationships, clinical expertise, and scalable data platforms that underpin premium valuations, while benchmarking EV/revenue and EV/EBITDA multiples.

Representative case studies include Owens & Minor’s acquisition of Apria, VieMed’s acquisition of Home Medical Products, and Quipt Home Medical’s acquisition of Access Respiratory Homecare. Each transaction is evaluated for strategic rationale, synergies, and valuation outcomes. The report also assesses how mega-cap consolidators, private equity roll-ups, and regional tuck-ins are redefining competitive positioning and shaping the trajectory of long-term sector growth.

Sector Trends, Intangible Assets, and Capital Markets Drivers in Durable Medical and Home Health Equipment Sector

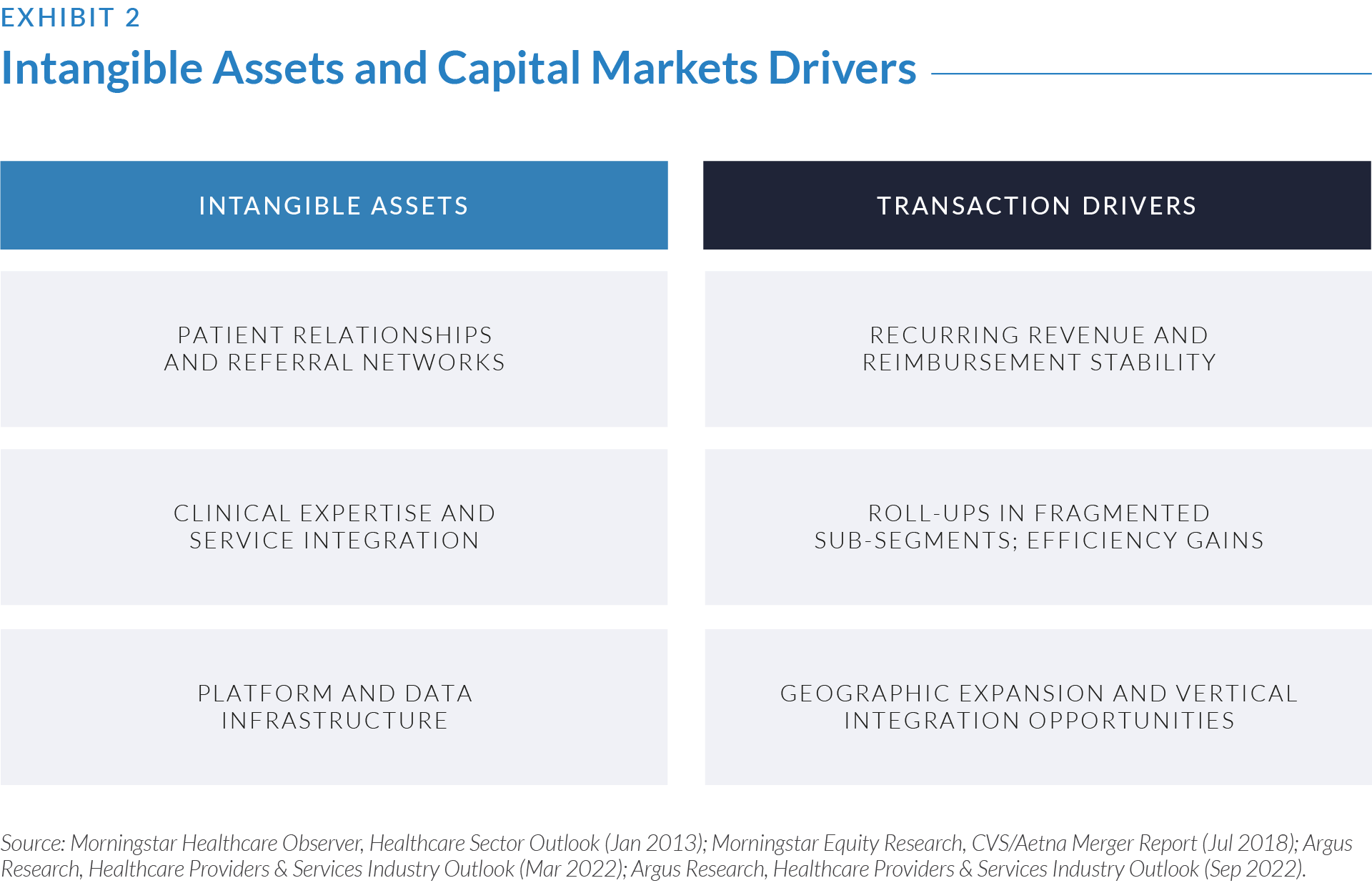

This section examines the sector through three lenses: market trends reshaping care delivery, intangible assets that drive premium valuations, and capital markets activity that reflects buyer strategies across consolidation, scale, and integration.

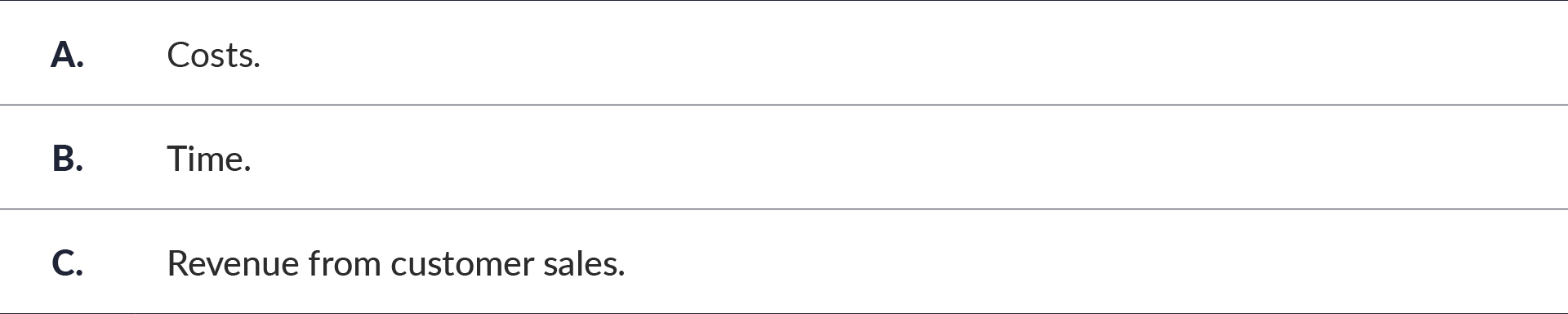

Shift to Home-Based Care: Chronic disease management and post-acute treatment are increasingly transitioning from hospitals to home settings, driven by payer cost-containment pressures and patient preference for at-home recovery. This shift expands demand for durable medical equipment and related service platforms.

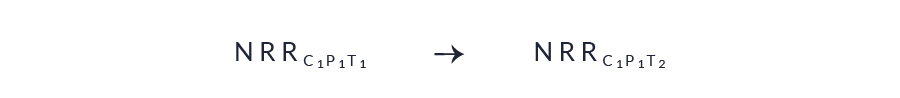

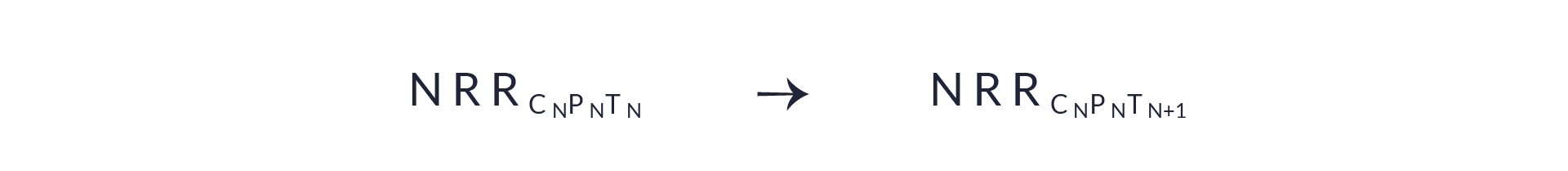

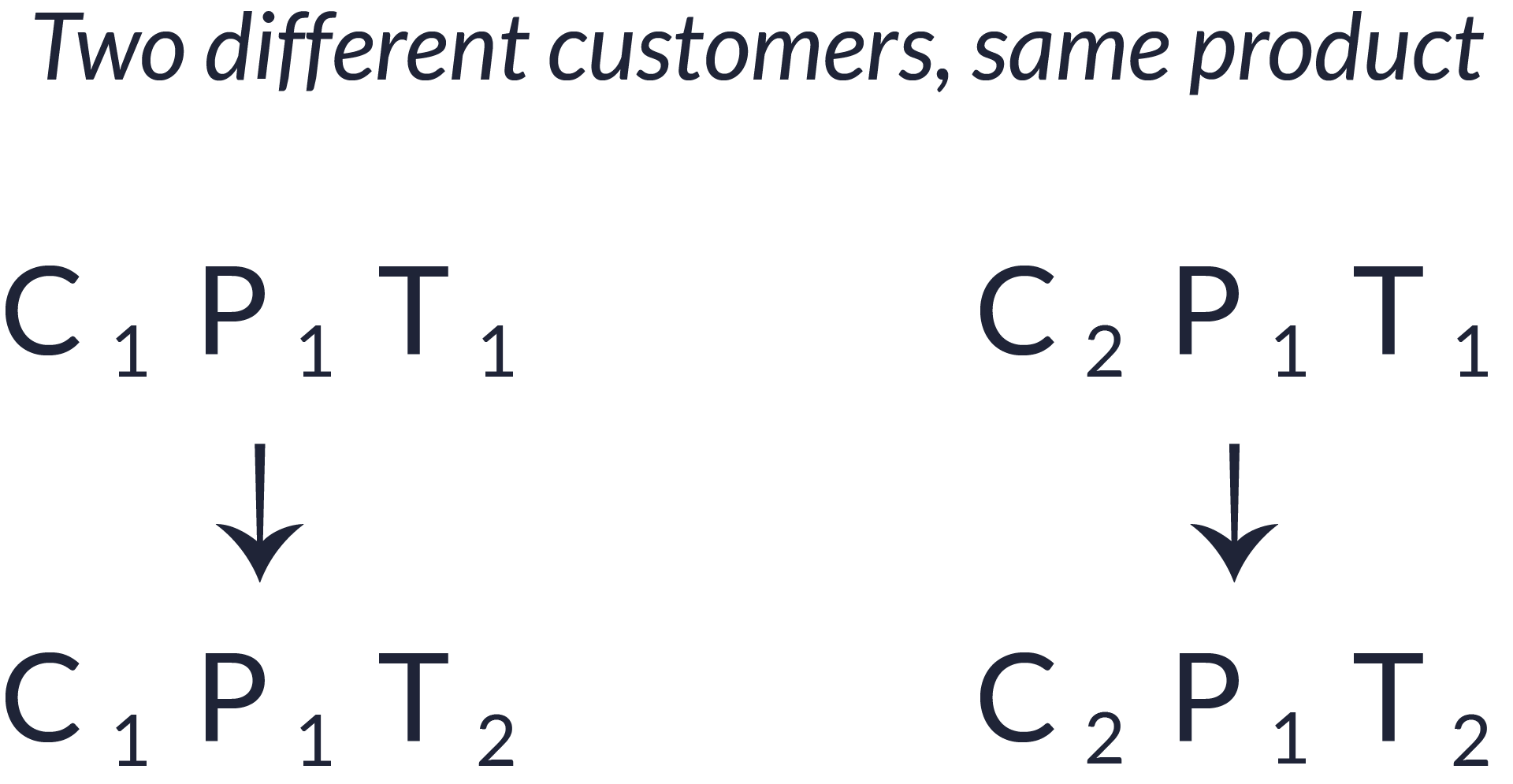

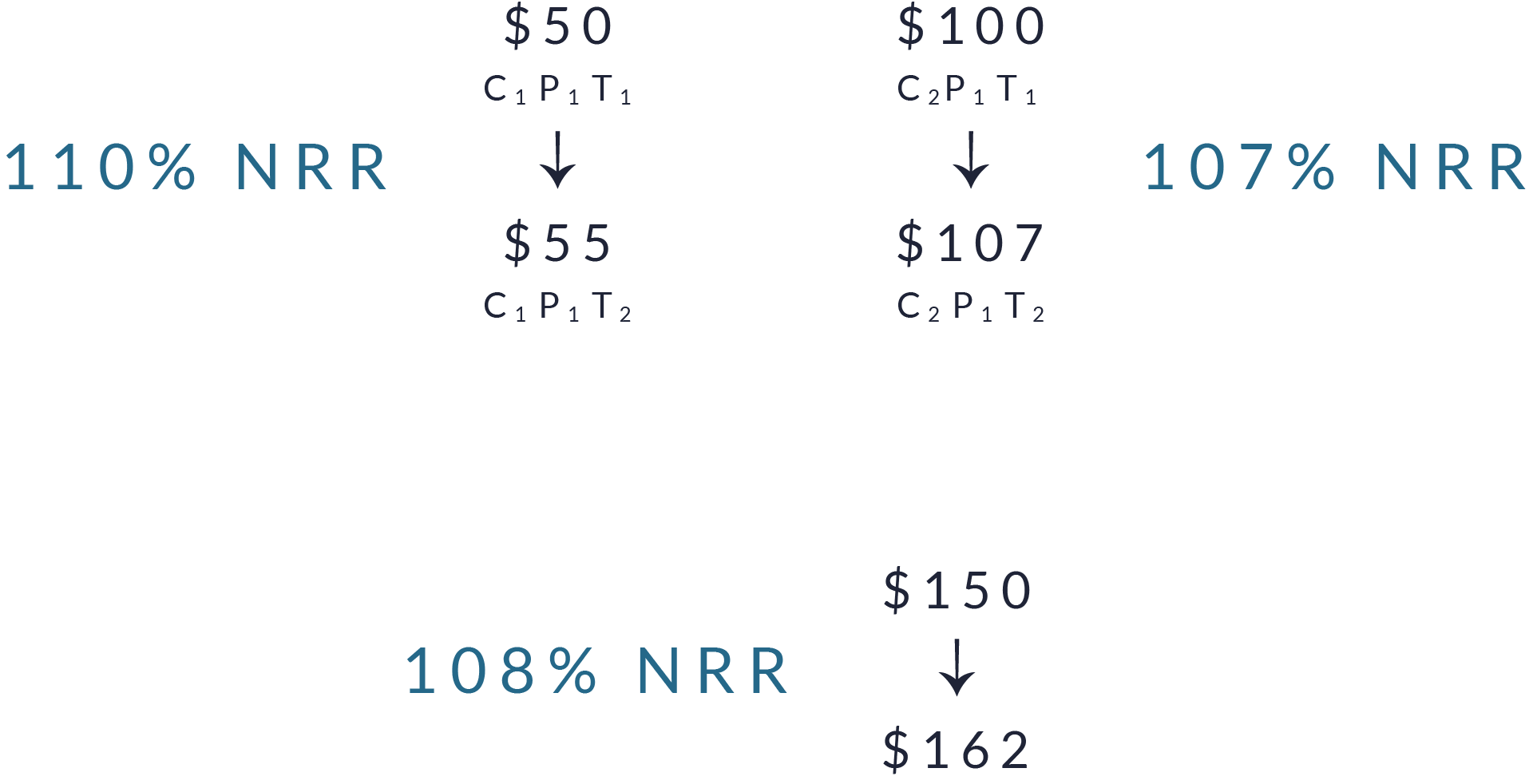

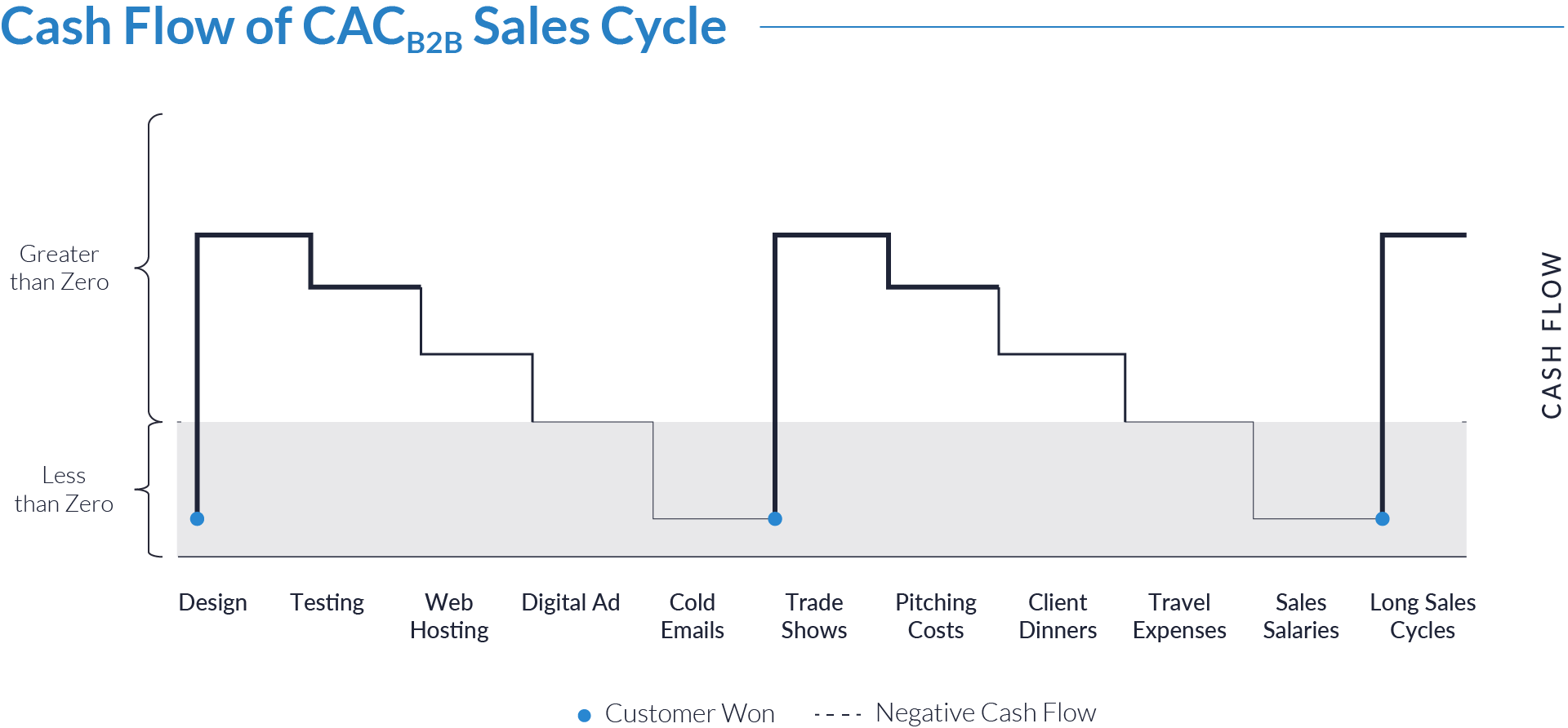

Recurring Revenue Models: Equipment rentals, supply replenishment, and capitation contracts with payors are strengthening recurring revenue streams. These models provide stable, predictable cash flows that underpin premium valuations.

Medicare and Medicaid Expansion: Rising enrollment in Medicare advantage and Medicaid programs continue to enlarge the addressable patient base, sustaining long-term demand for home medical equipment and service providers.

M&A and Consolidation: Strategic buyers and consolidators are pursuing acquisitions to broaden geographic reach, diversify service lines, and strengthen direct-to-patient platforms, accelerating market concentration.

Staffing and Workforce Pressures: Persistent shortages of skilled clinicians and respiratory therapists are compressing margins, prompting investment in operational efficiency, digital monitoring, and remote patient support solutions.

Technology, Regulation and ESG: Expanding digitization of patient data and equipment enables greater efficiency but heightens cybersecurity and regulatory risks. ESG commitments are also shaping operational standards, influencing acquirer preferences.

These intangible assets form the foundation of valuation in the sector. Patient relationships, clinical expertise, and scalable platforms differentiate targets, anchoring recurring revenue models and enhancing reimbursement stability. Buyers, both strategic consolidators and financial sponsors pursue these capabilities to accelerate market entry, diversify service offerings, and capture operational synergies. As a result, companies that demonstrate strength across these assets generate competitive tension in M&A processes and consistently achieve premium valuation outcomes.

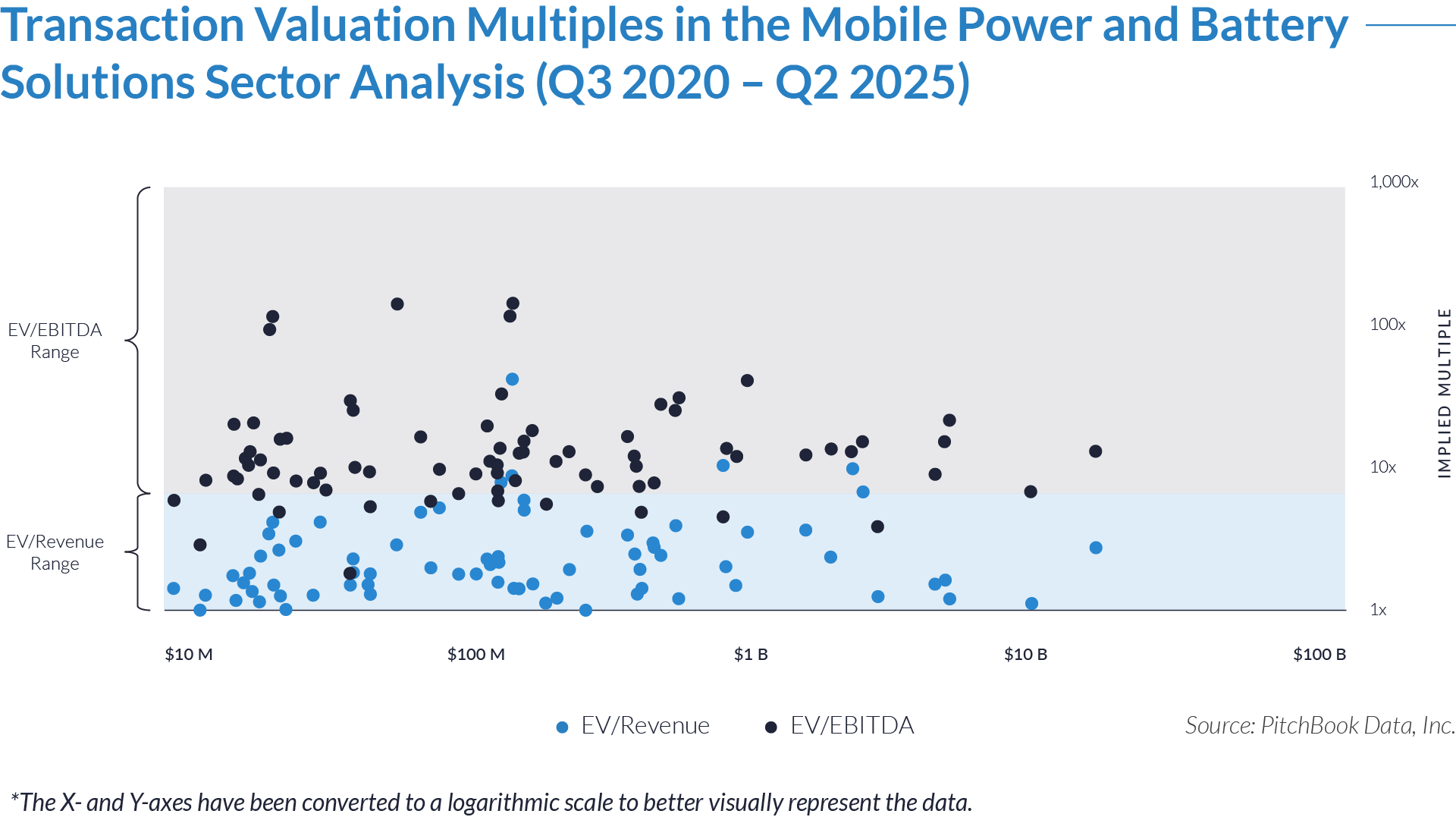

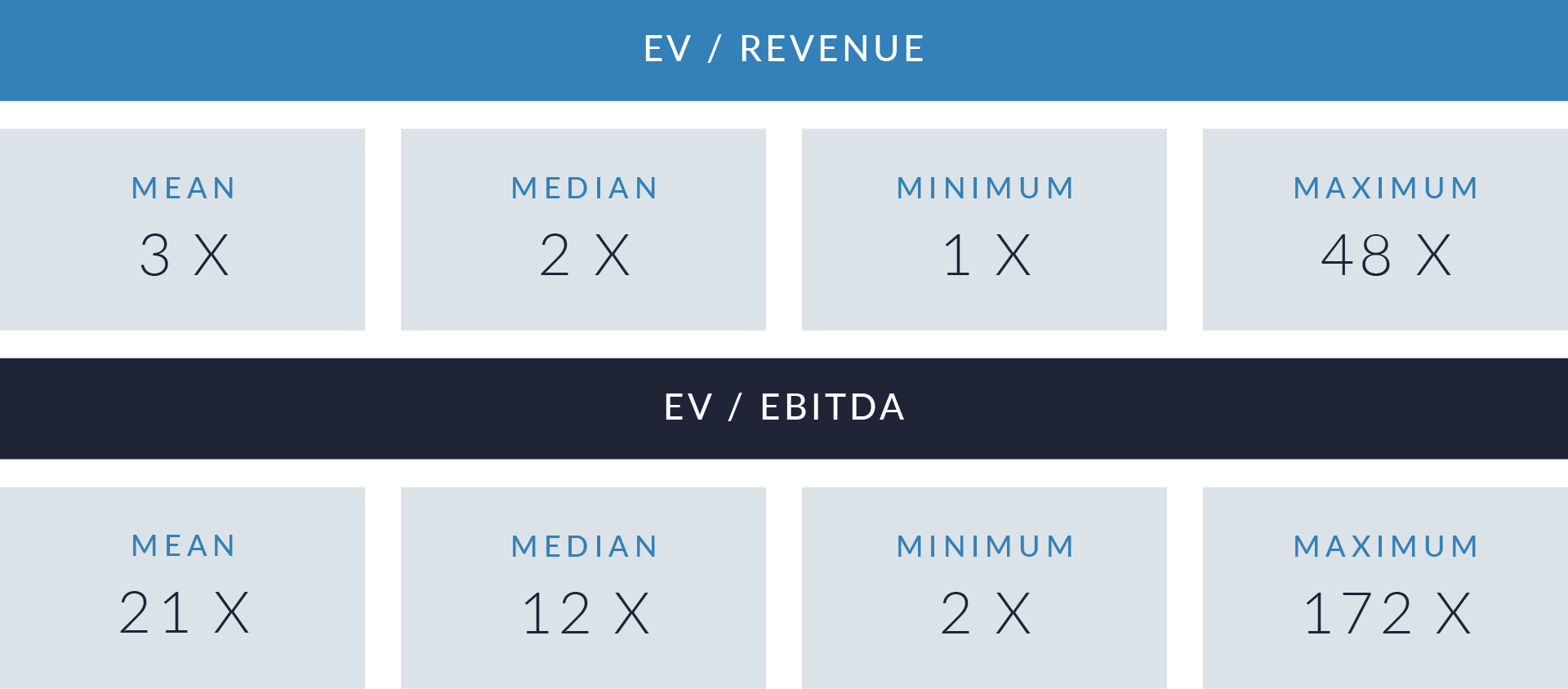

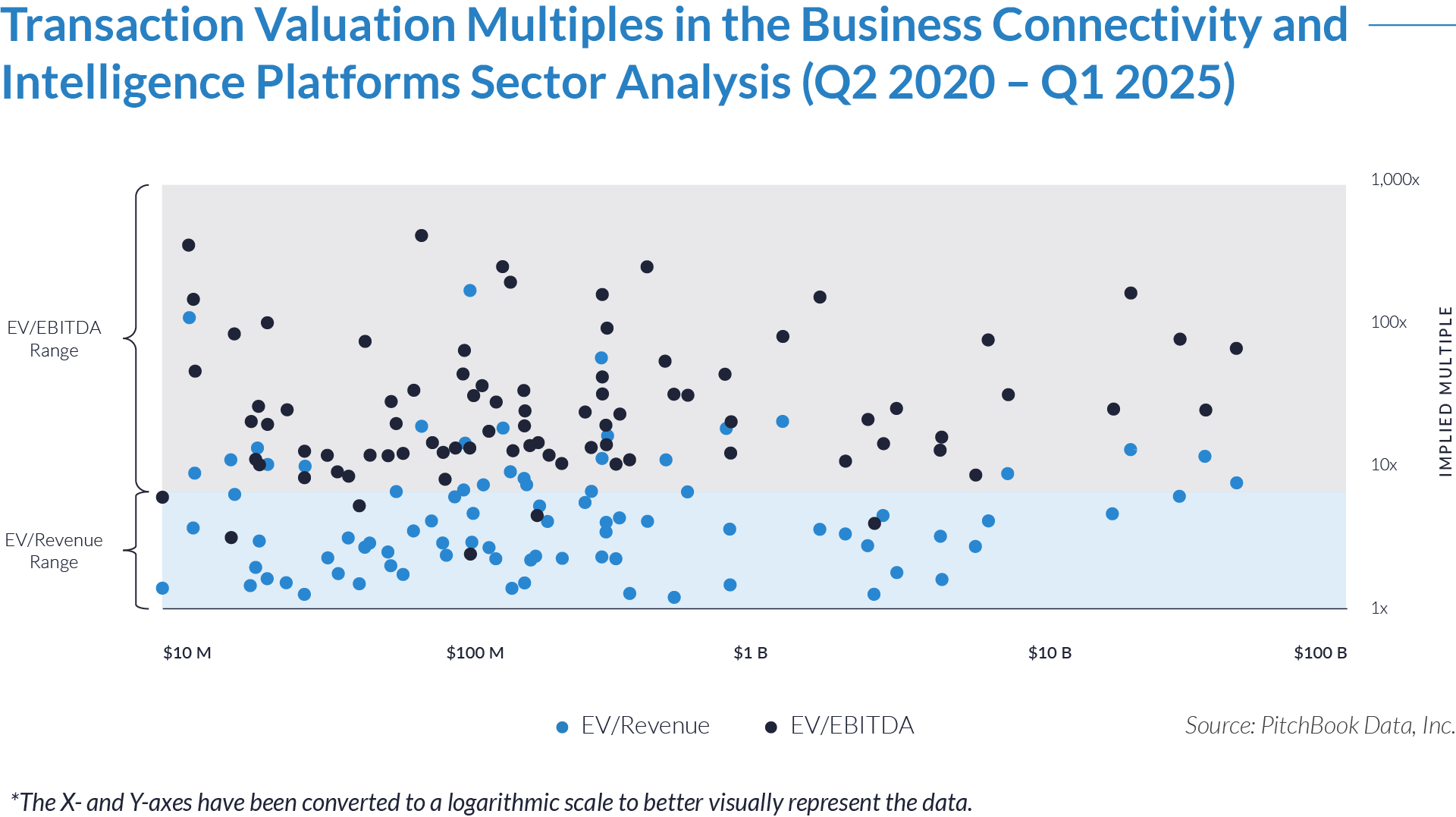

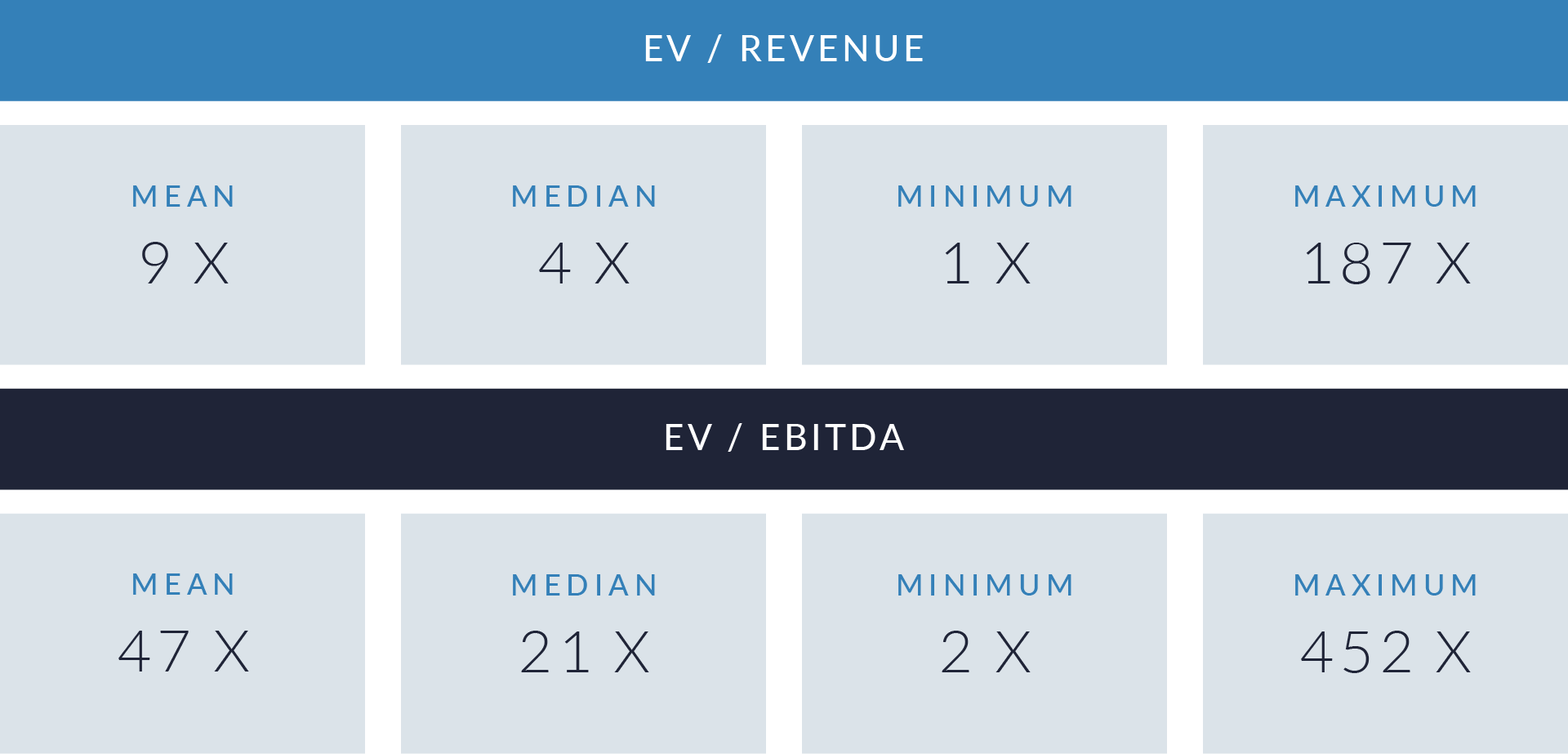

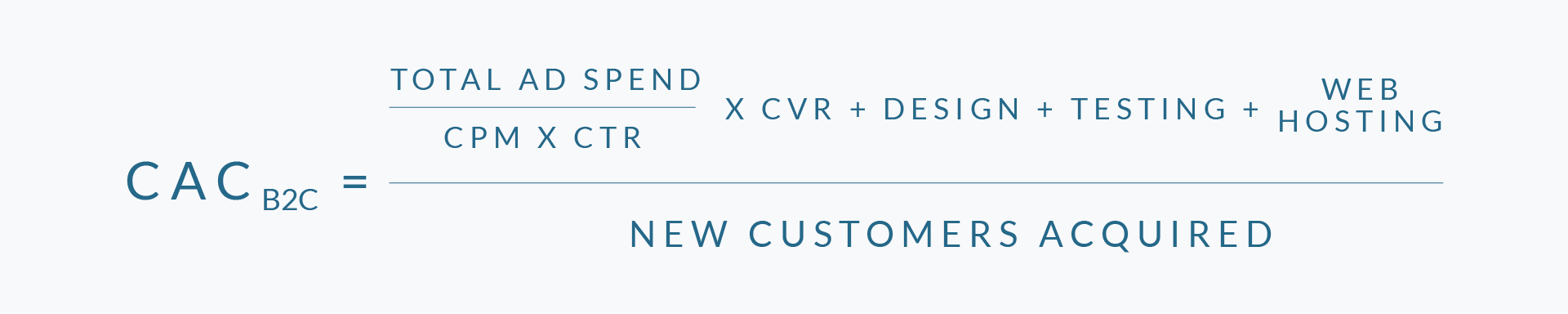

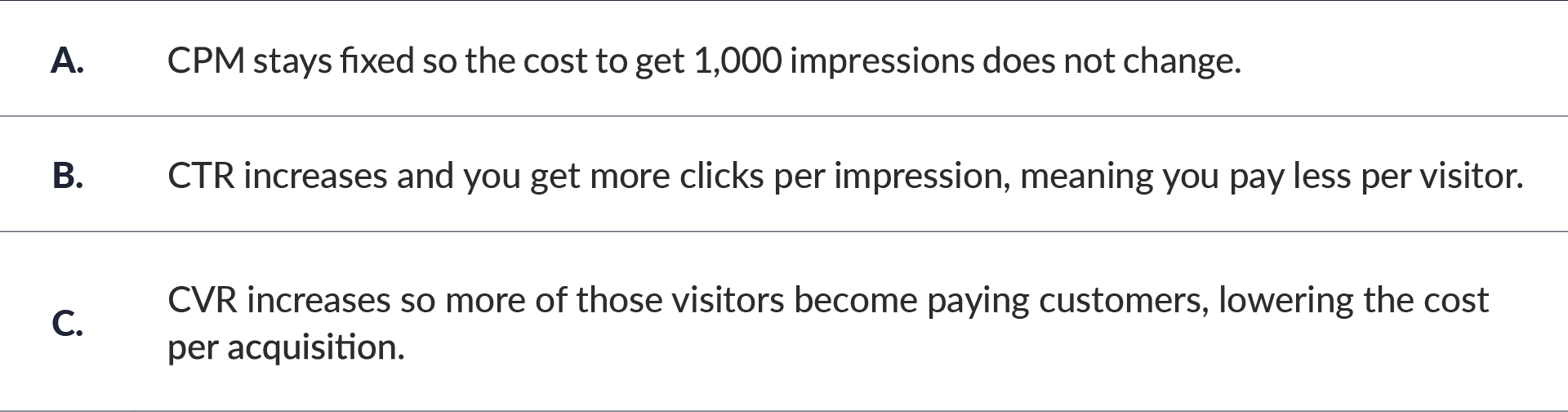

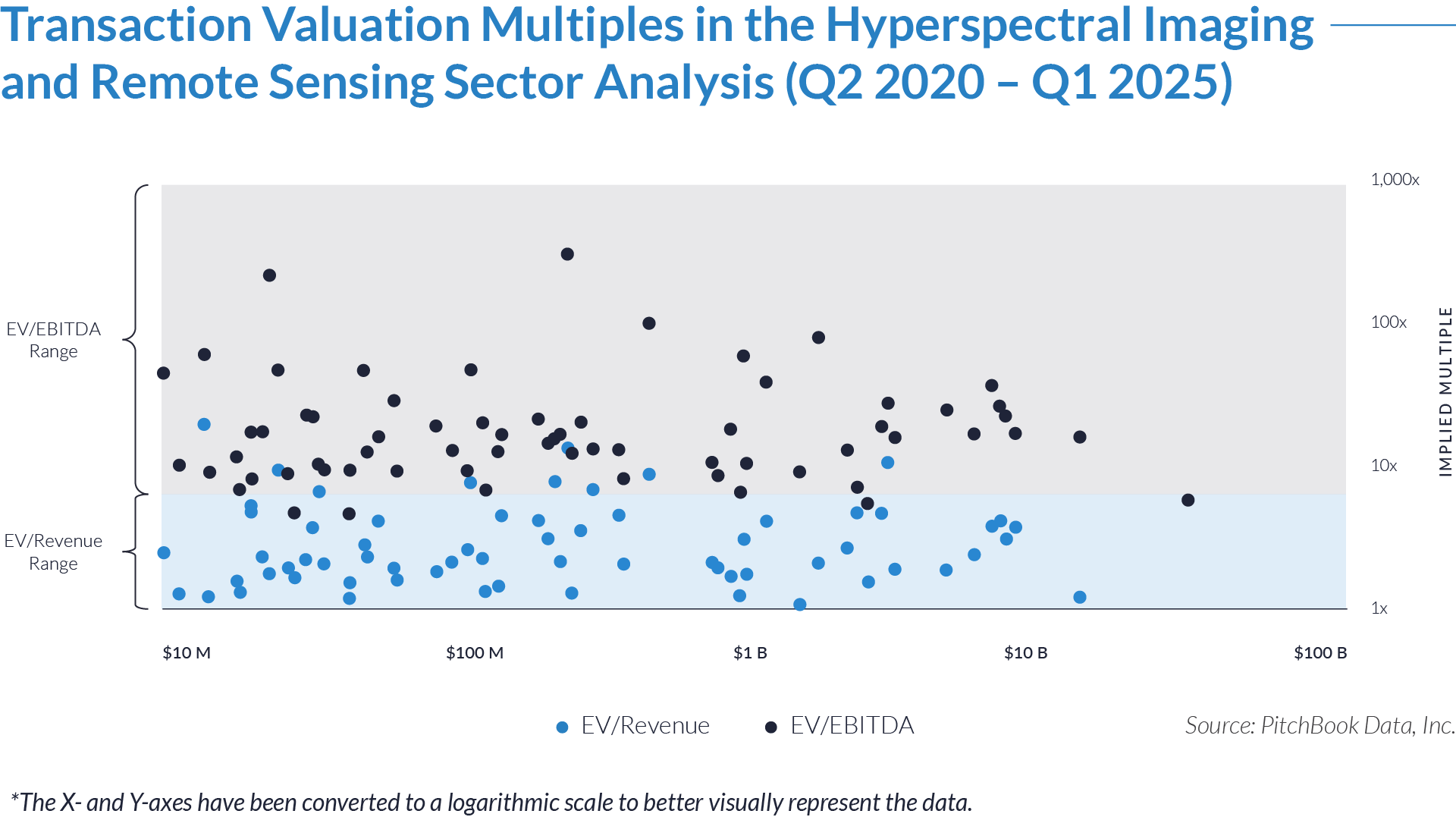

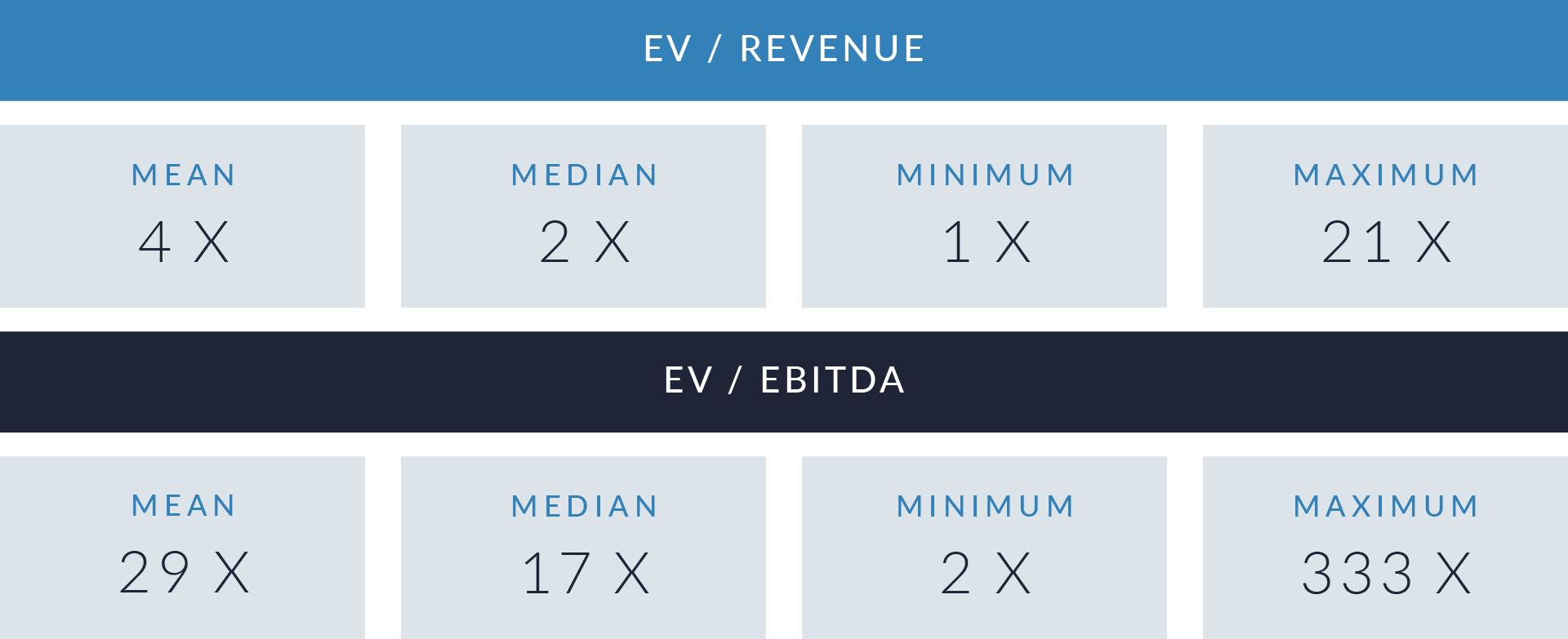

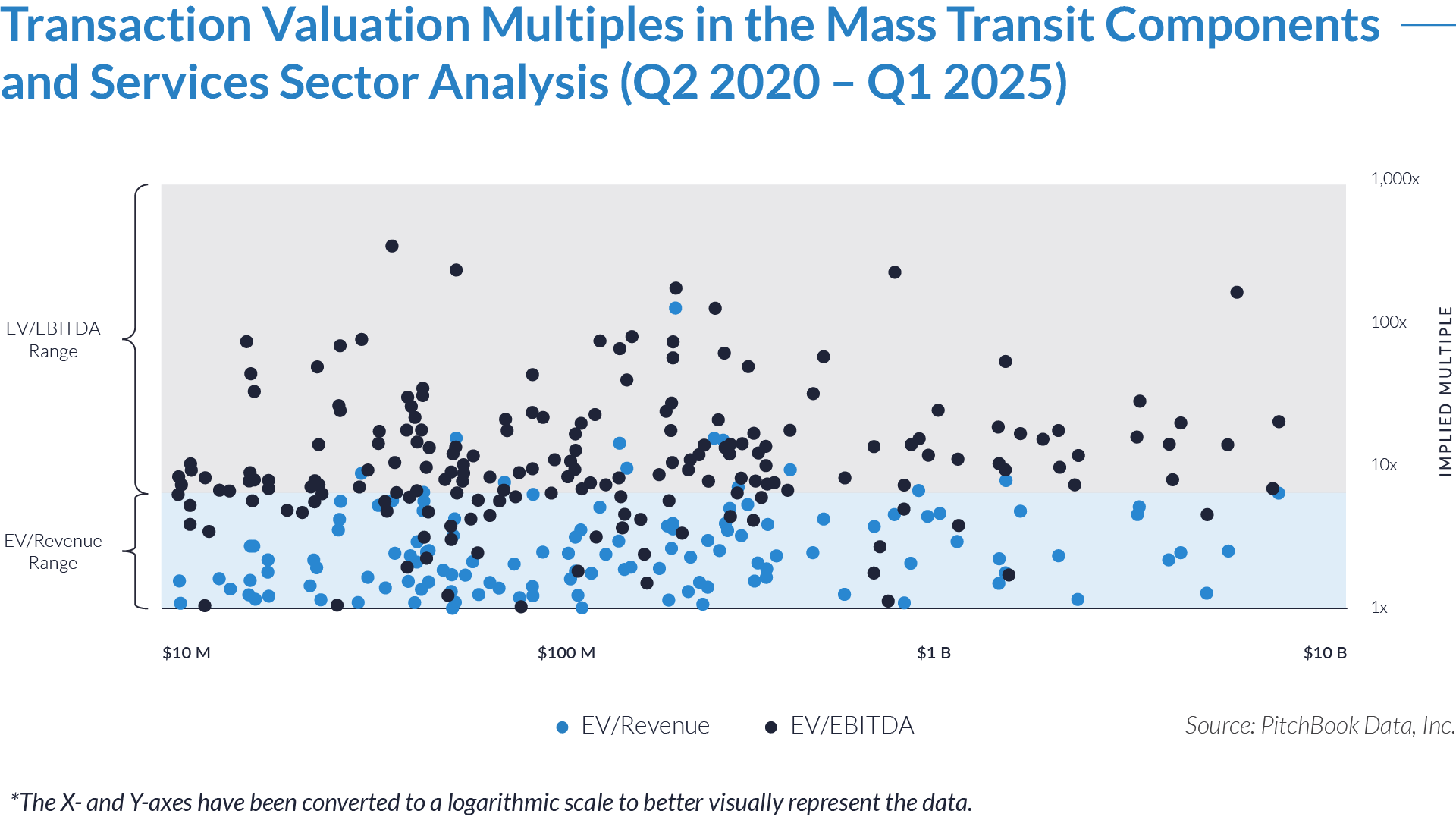

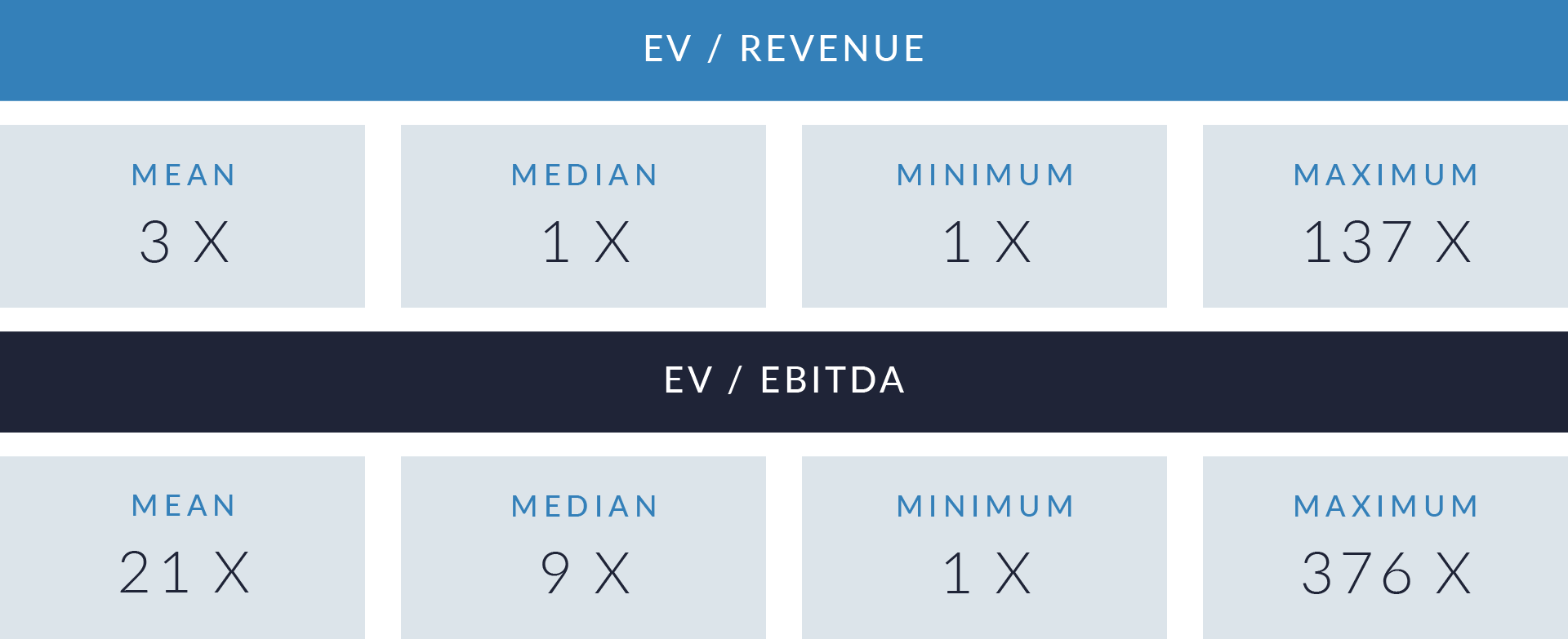

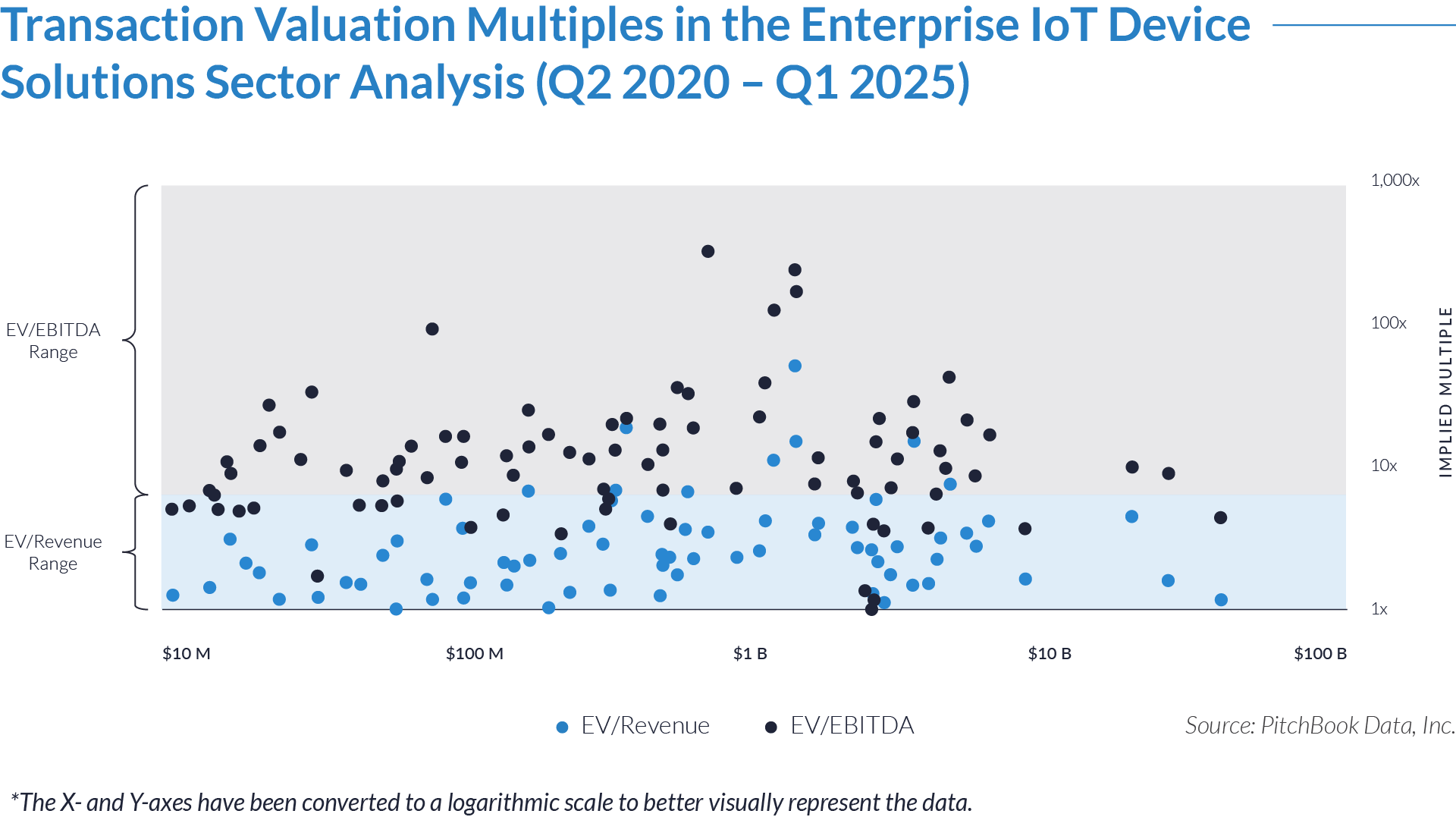

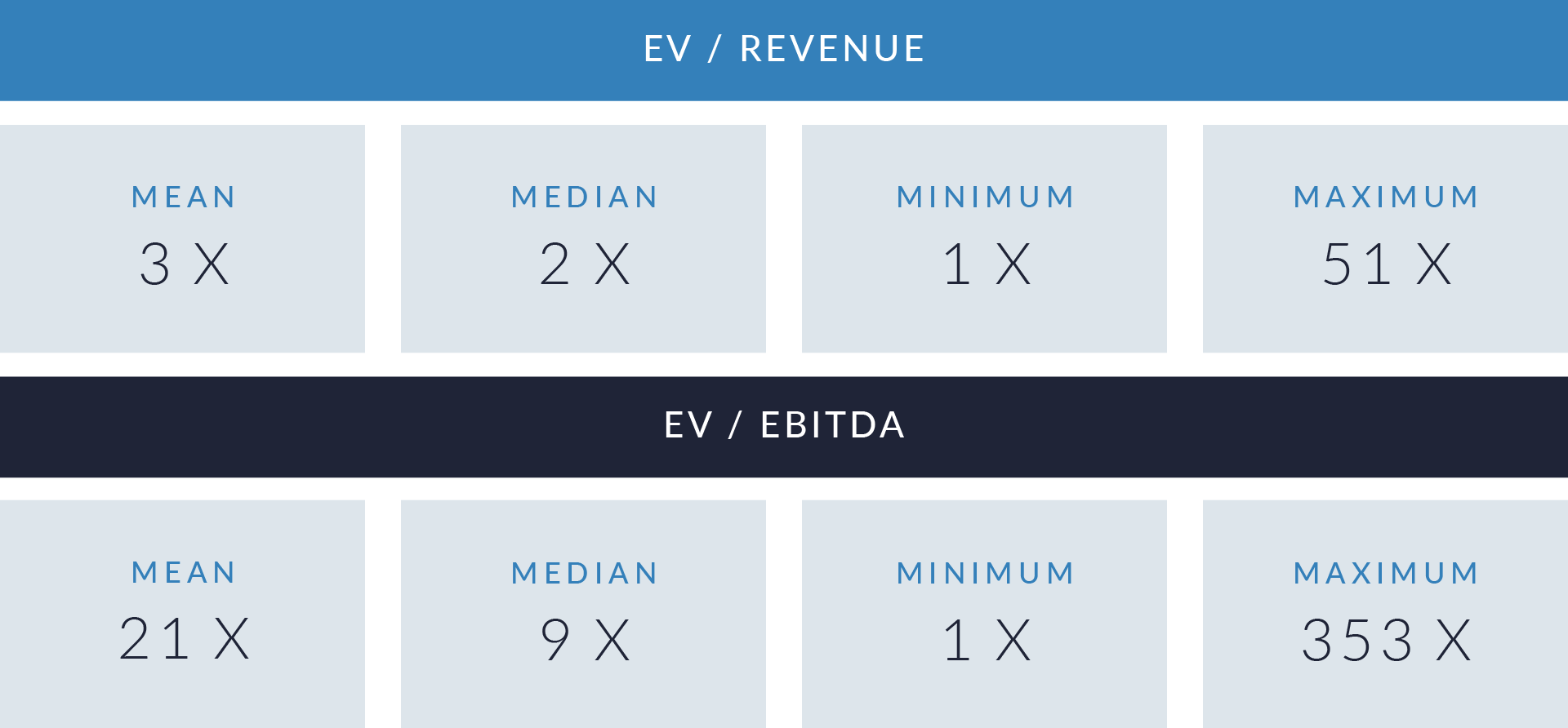

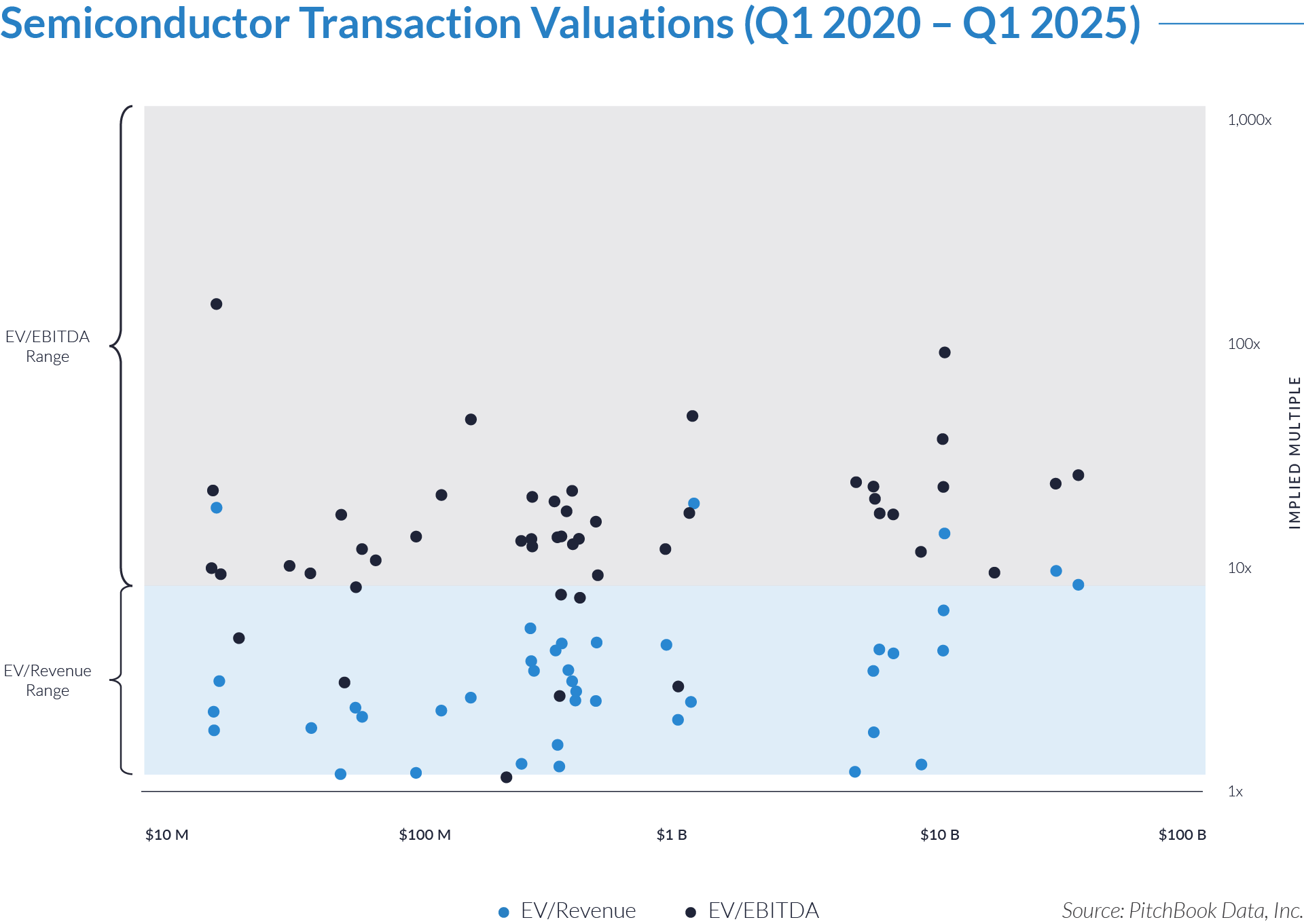

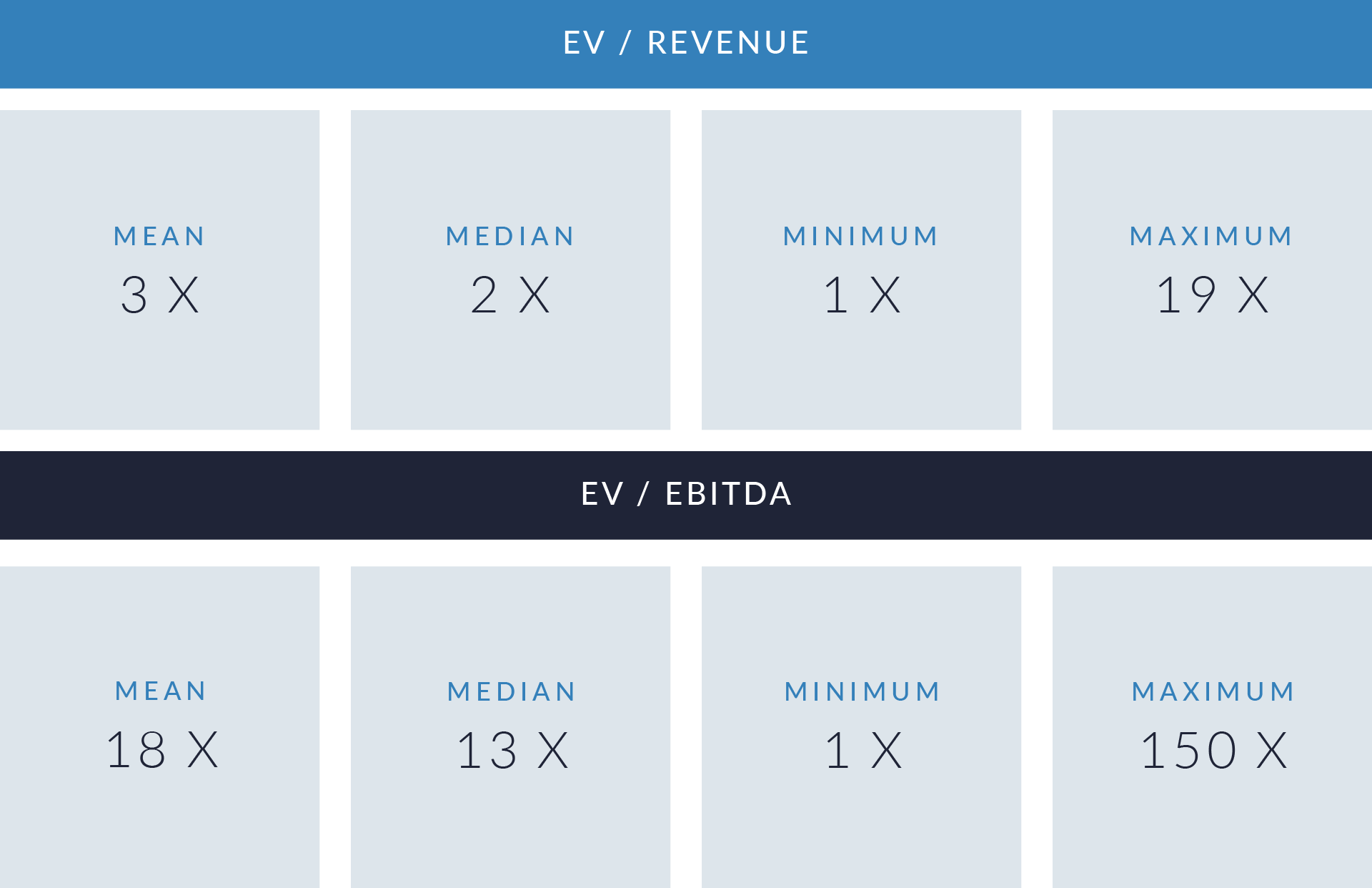

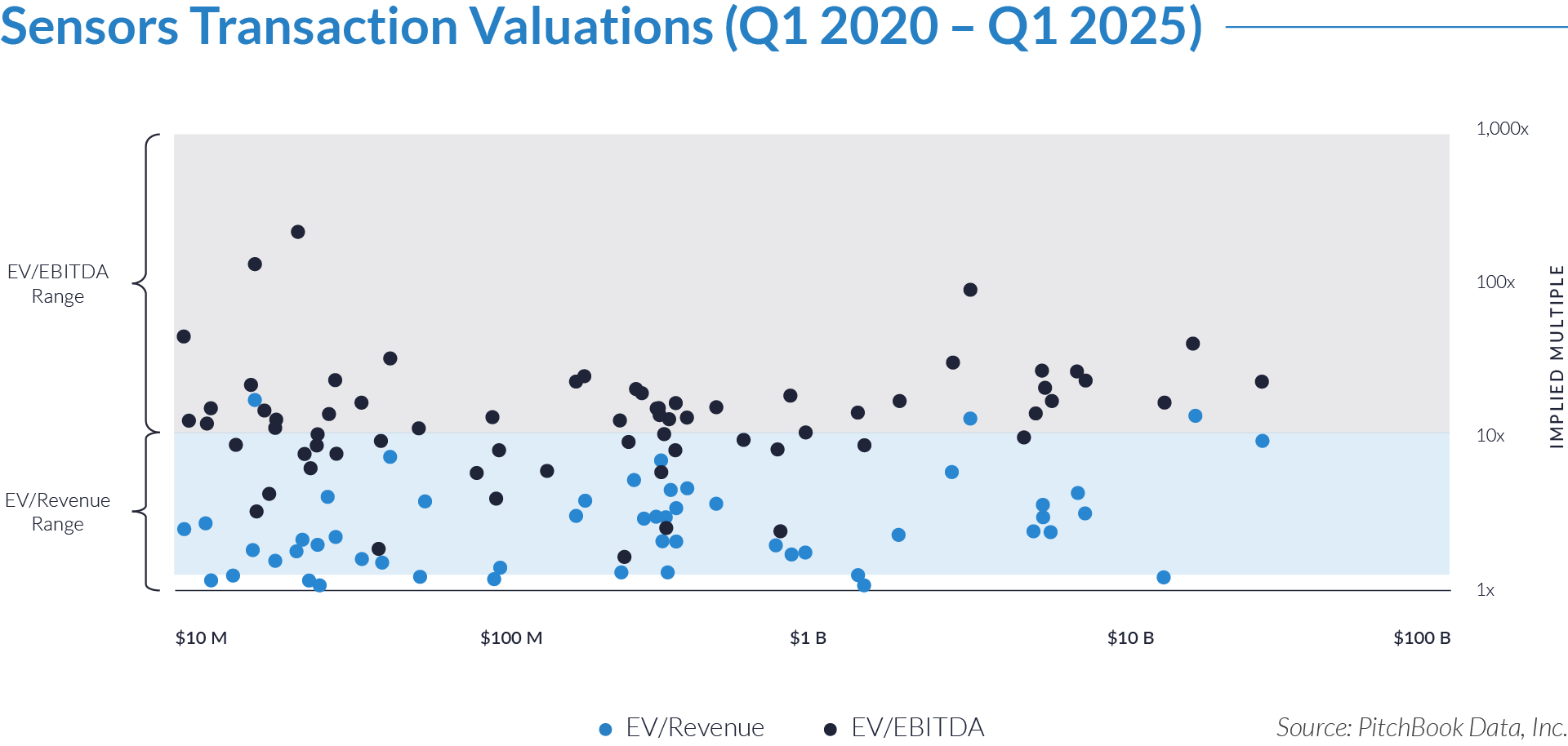

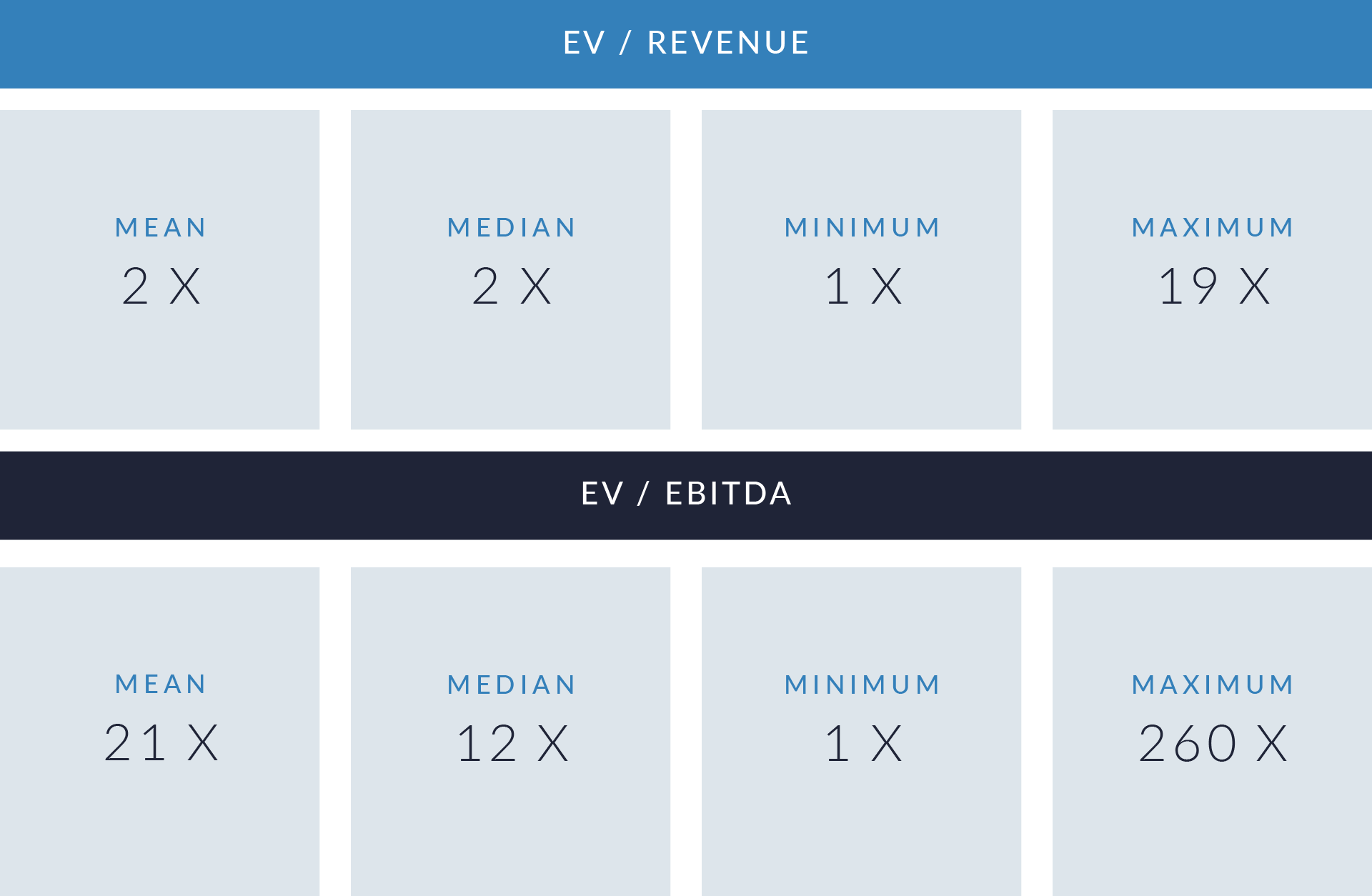

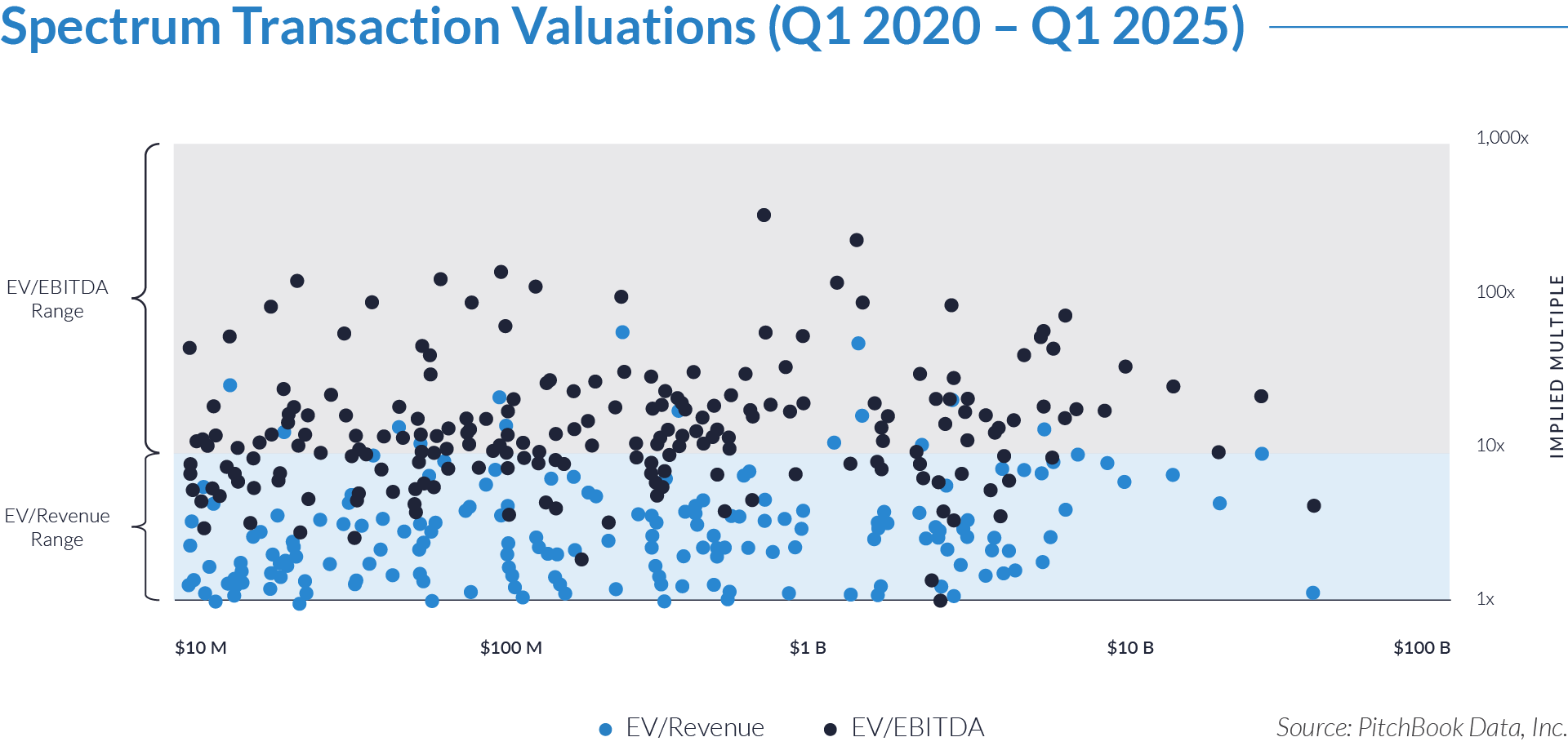

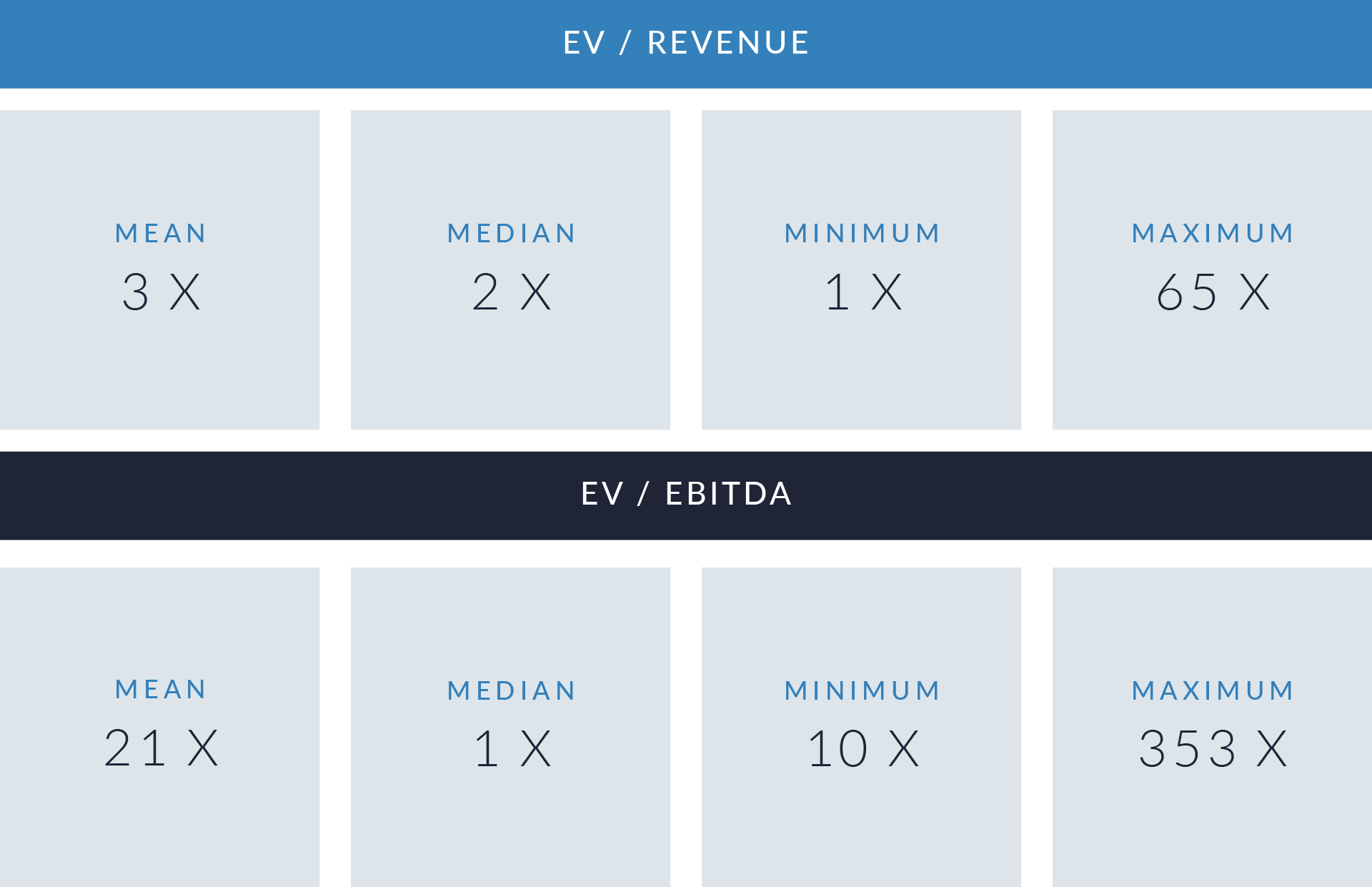

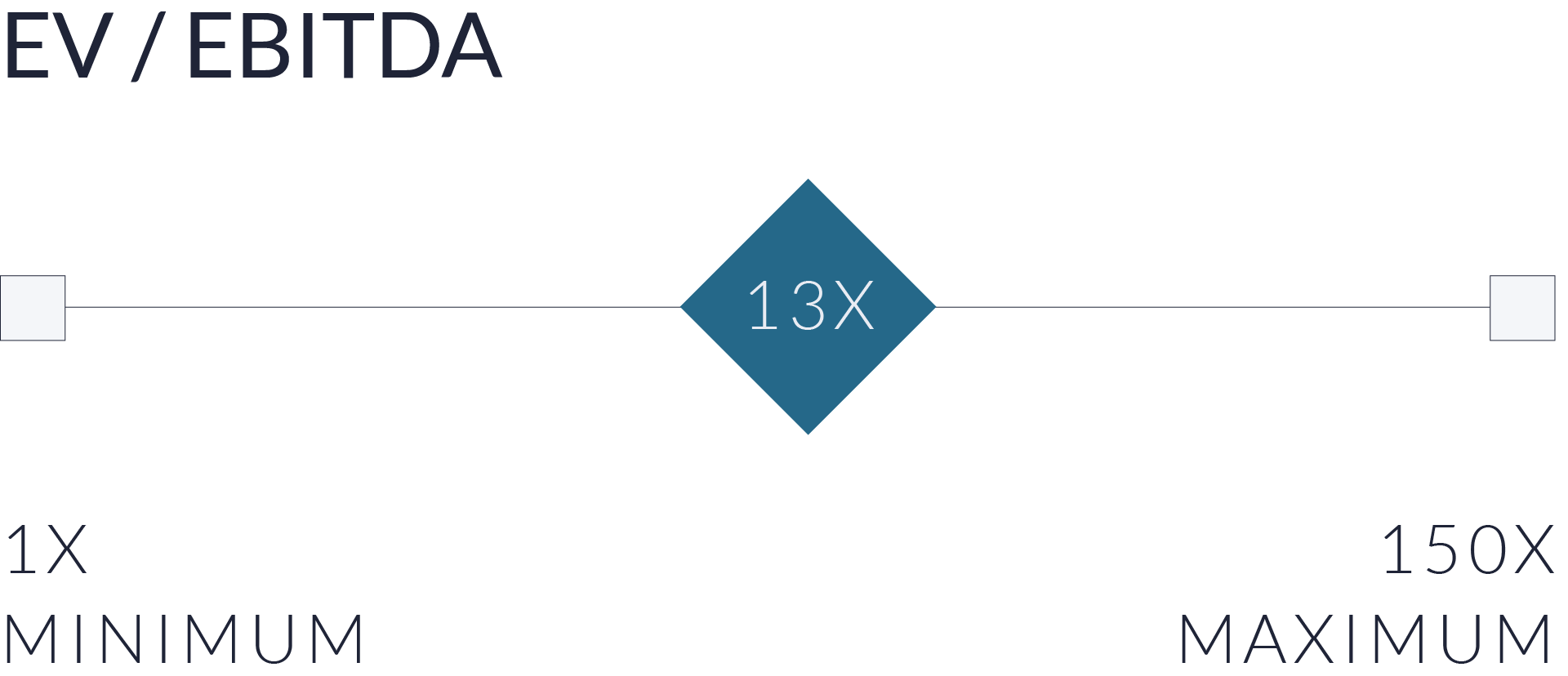

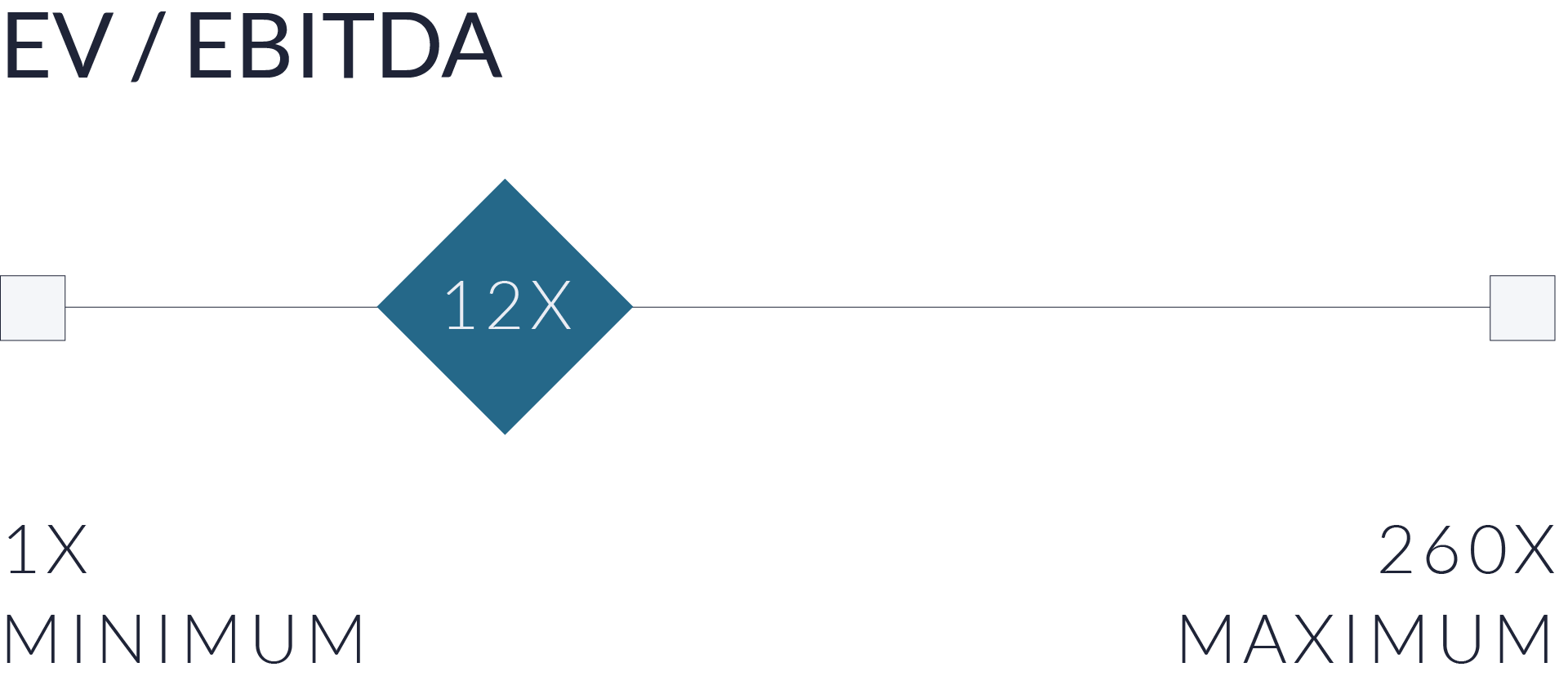

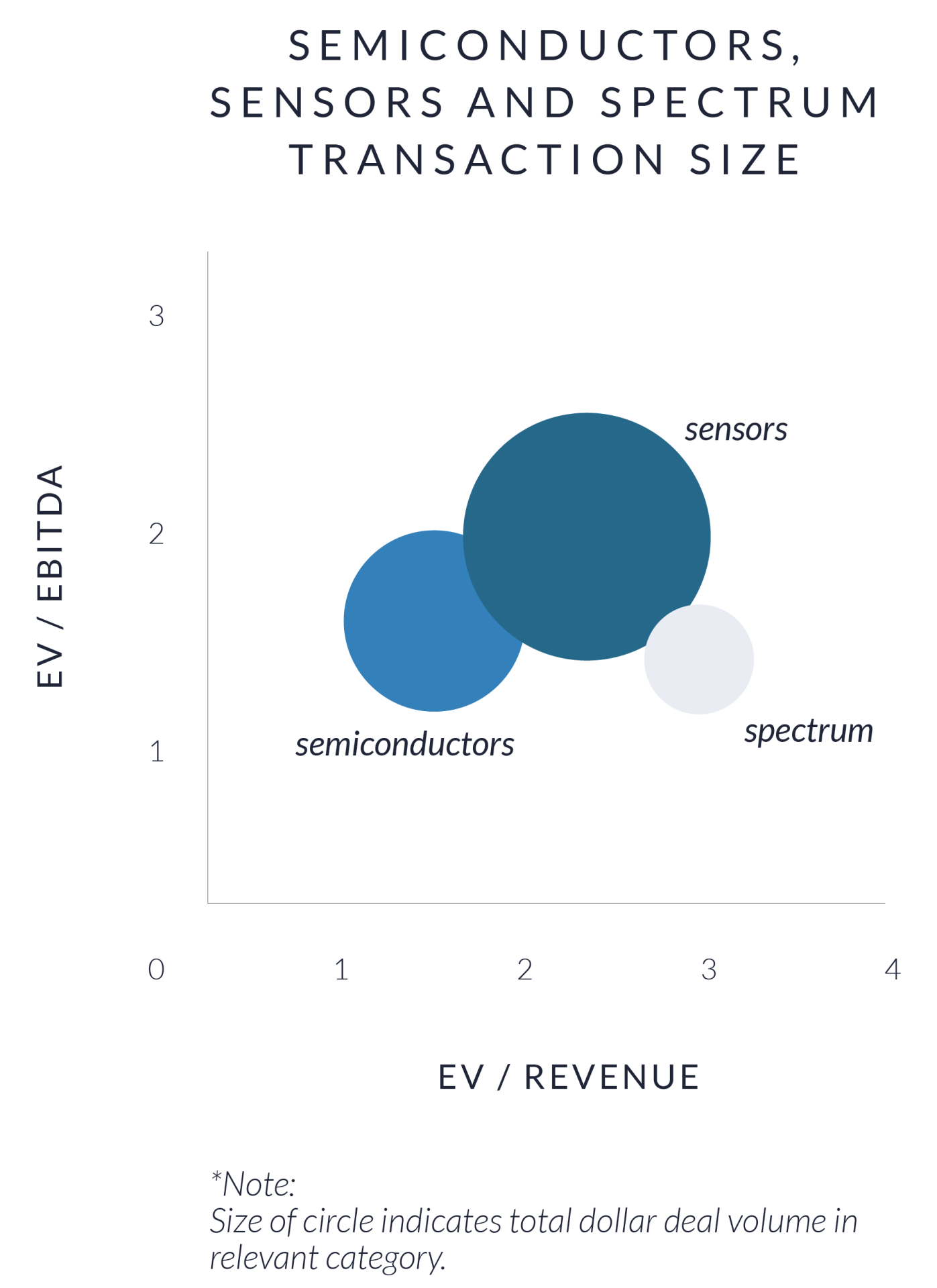

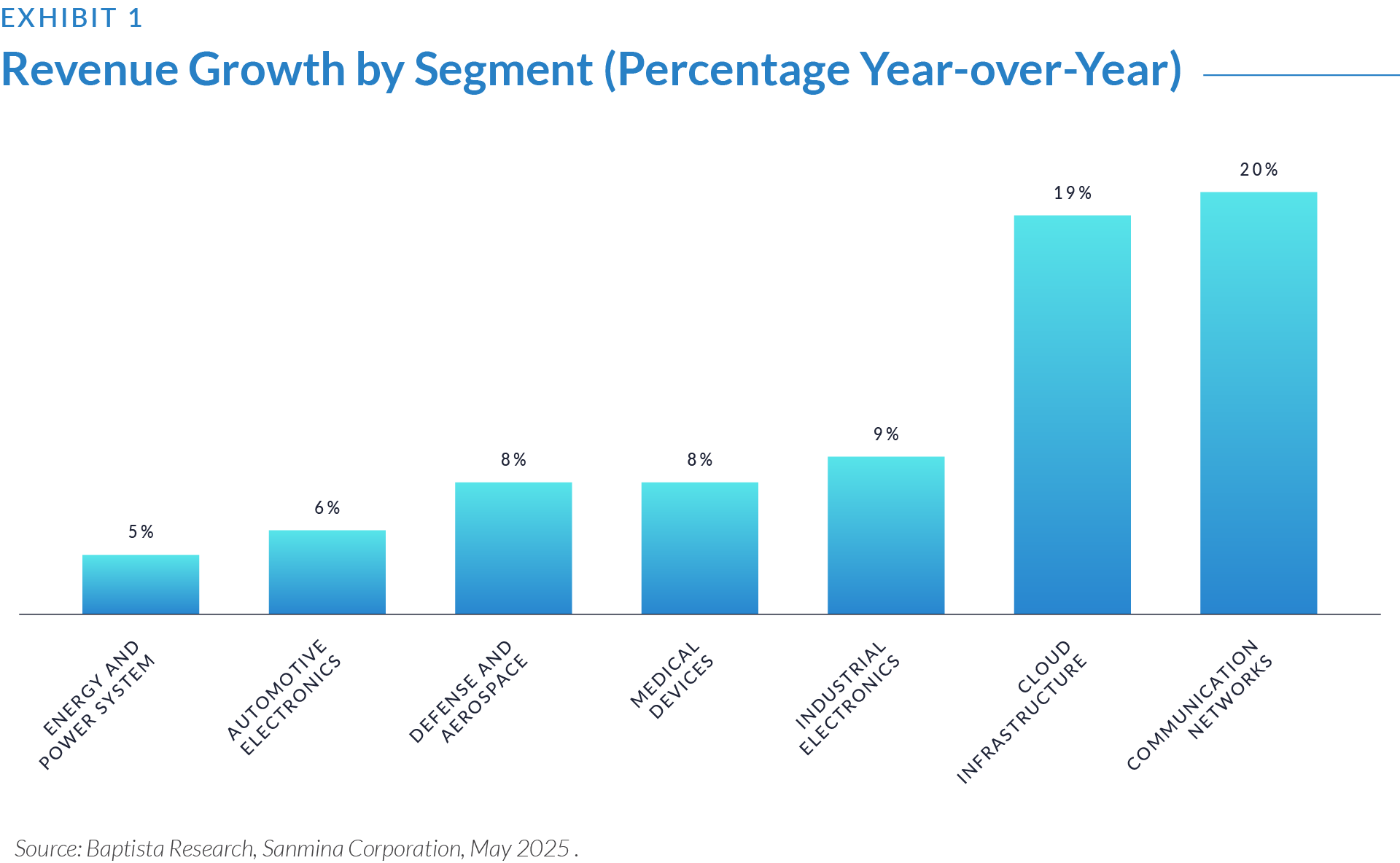

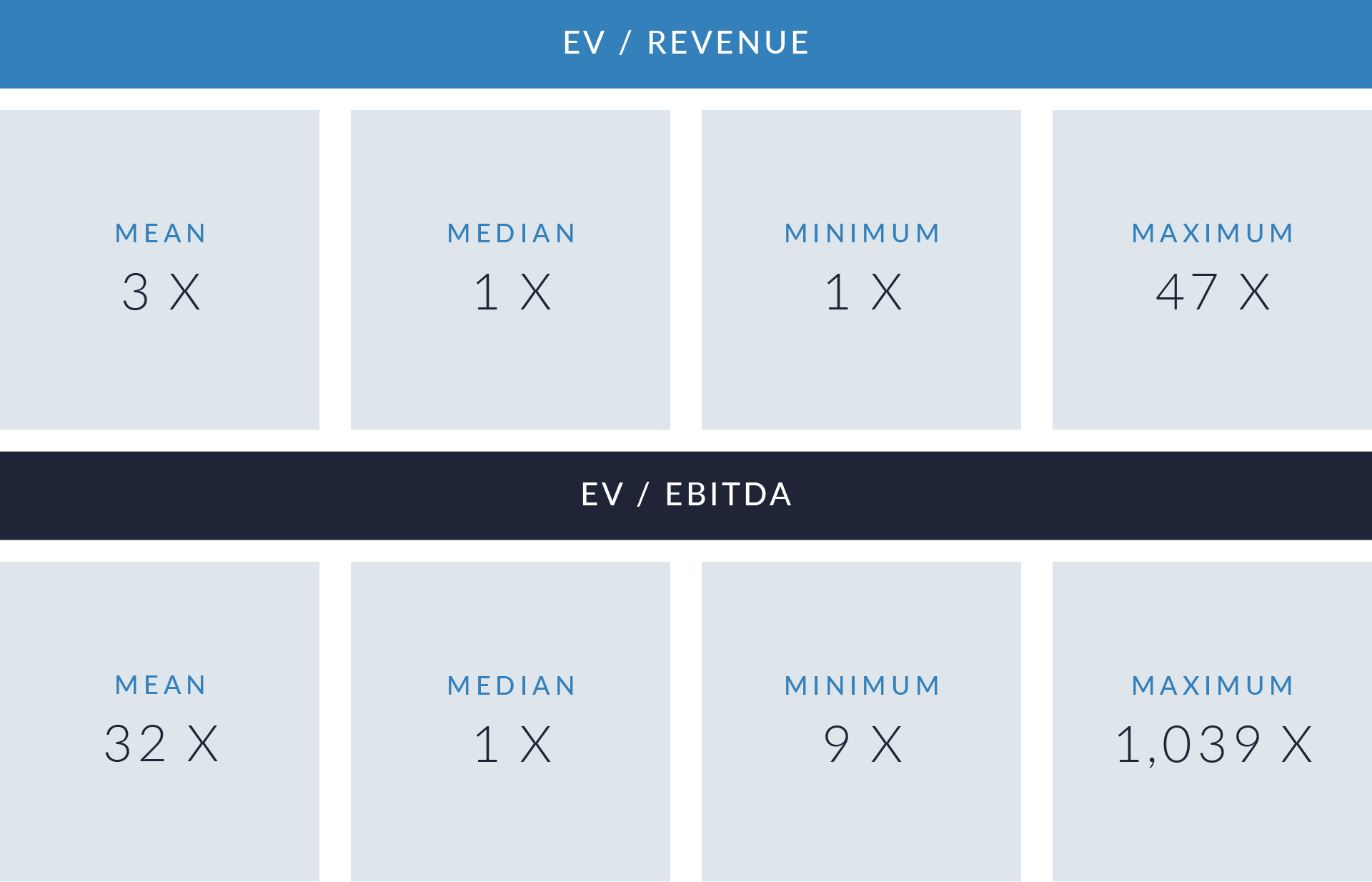

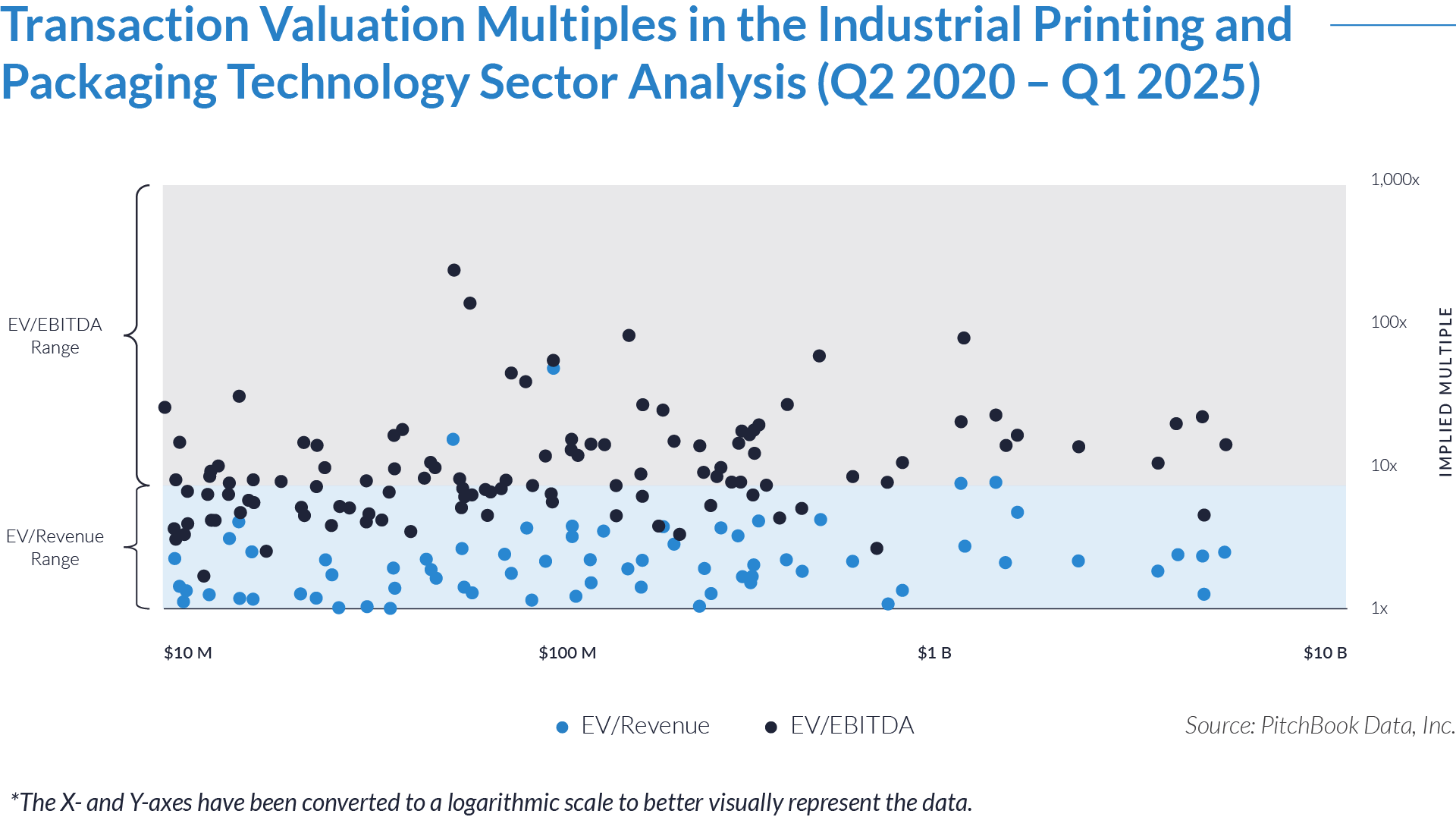

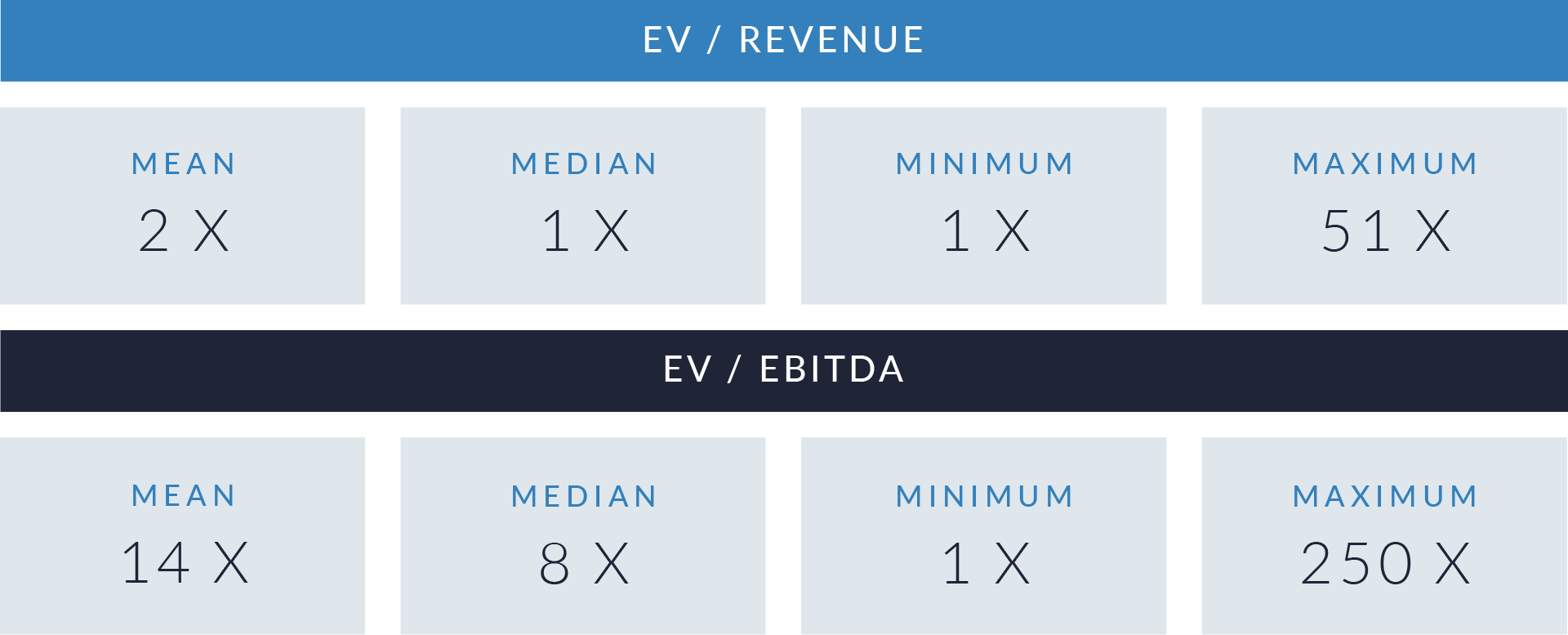

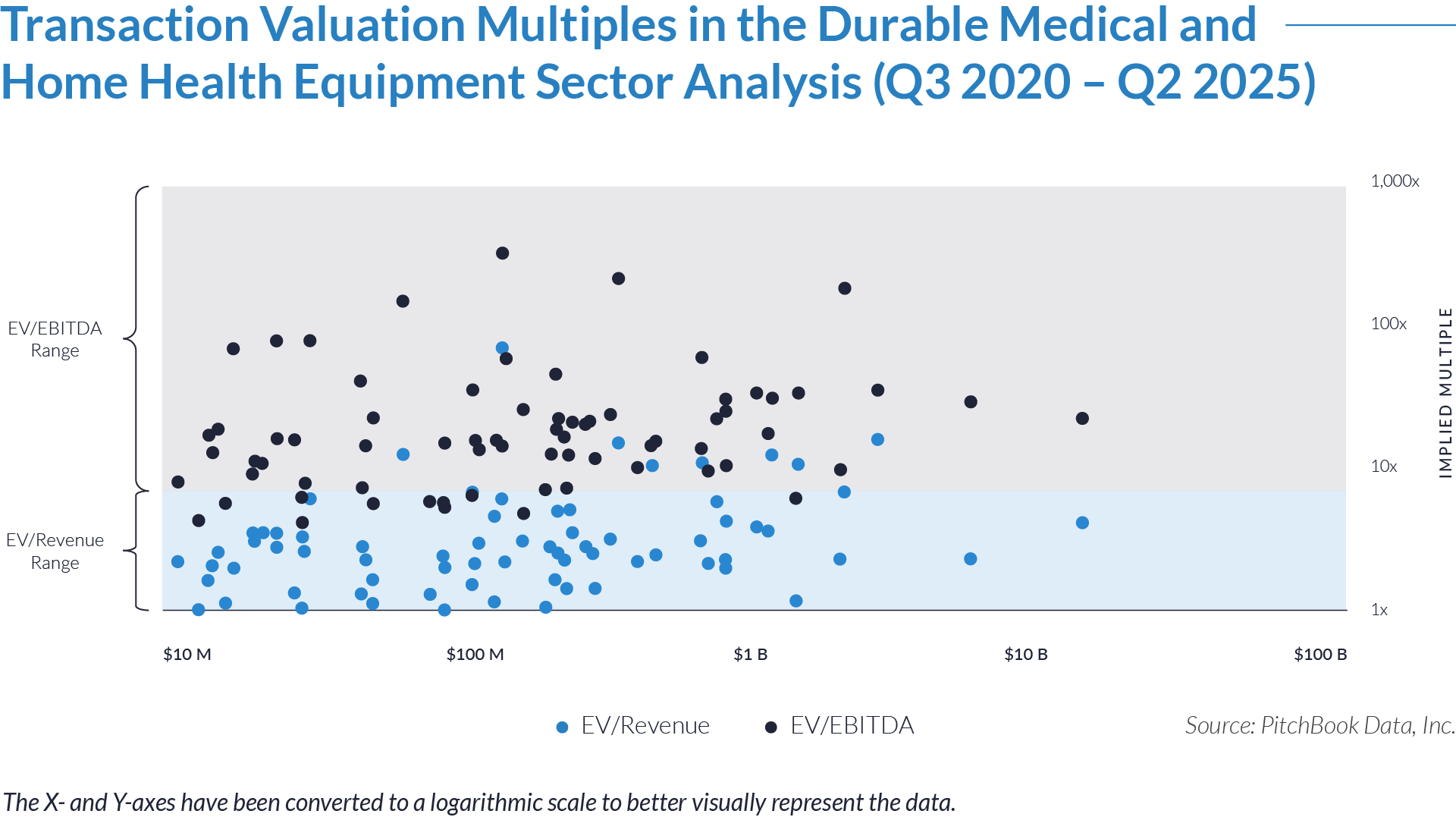

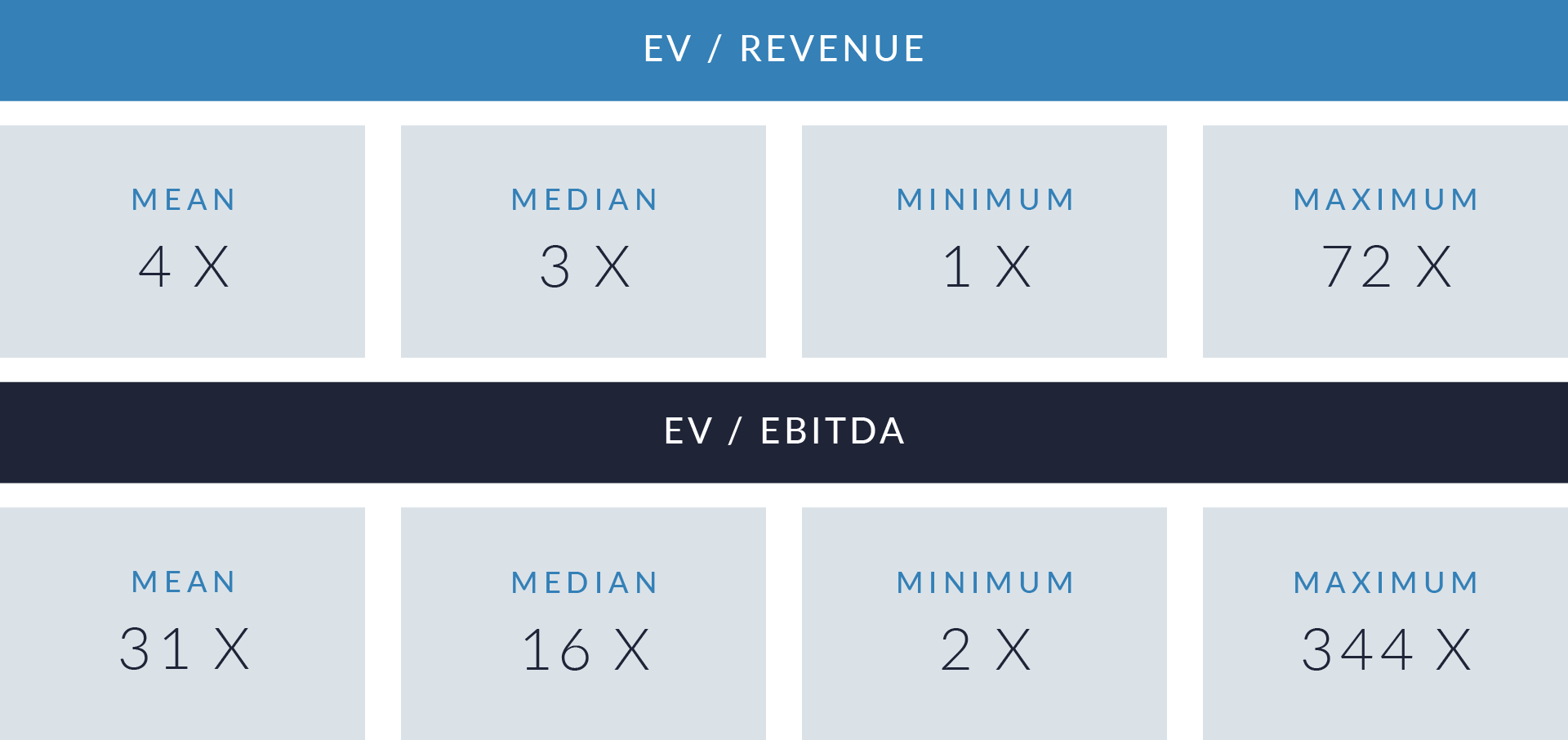

- Valuation multiples are based on a sample set of M&A transactions in the durable medical and home health equipment sector using data collected on September 9, 2025.

- Transactions above 10x EV/revenue and 150x EV/EBITDA show acquirers rewarding consumable-driven, recurring revenue models with strong reimbursement certainty. These outliers demonstrate how resupply-based platforms achieve premium valuations compared to traditional equipment-focused providers.

- Most deals cluster at 2–4x EV/revenue and 10–20x EV/EBITDA, reflecting disciplined pricing tied to scale, reimbursement reliability, and operational efficiency. This range aligns with consolidators’ strategies to build regional density, streamline logistics, and optimize payer contracts without stretching on multiples.

- Multiples at the far ends, from 1x EV/revenue and 2x EV/EBITDA to 72x EV/Revenue and 344x EV/EBITDA, highlight strategic motivations. Buyers on the low end pursue distressed assets, while those on the high-end target niche technology, high-margin product lines, or regulatory positioning. This market split underscores the divide between disciplined consolidation plays and selective premium bets.

Capital Markets Activities

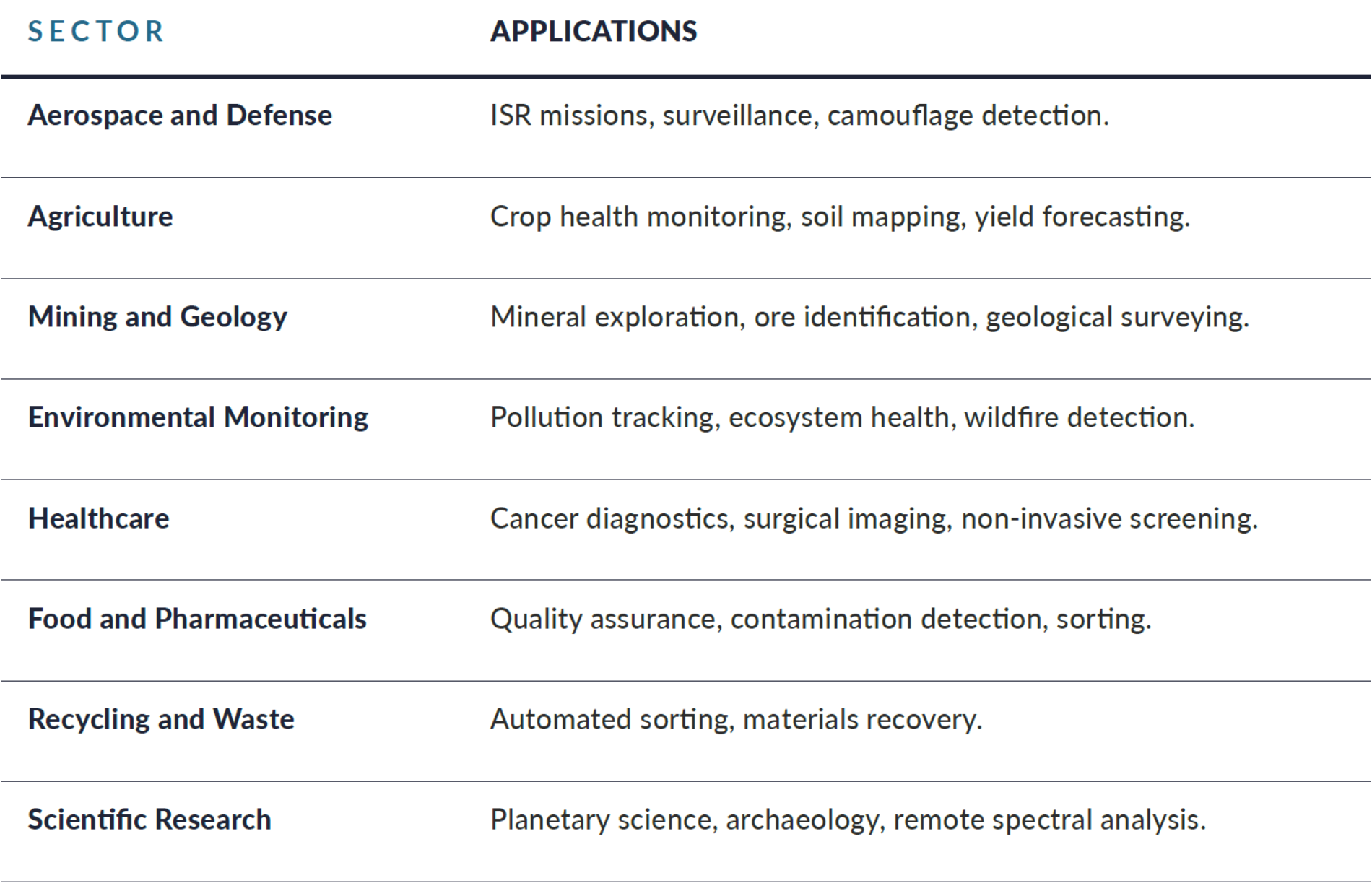

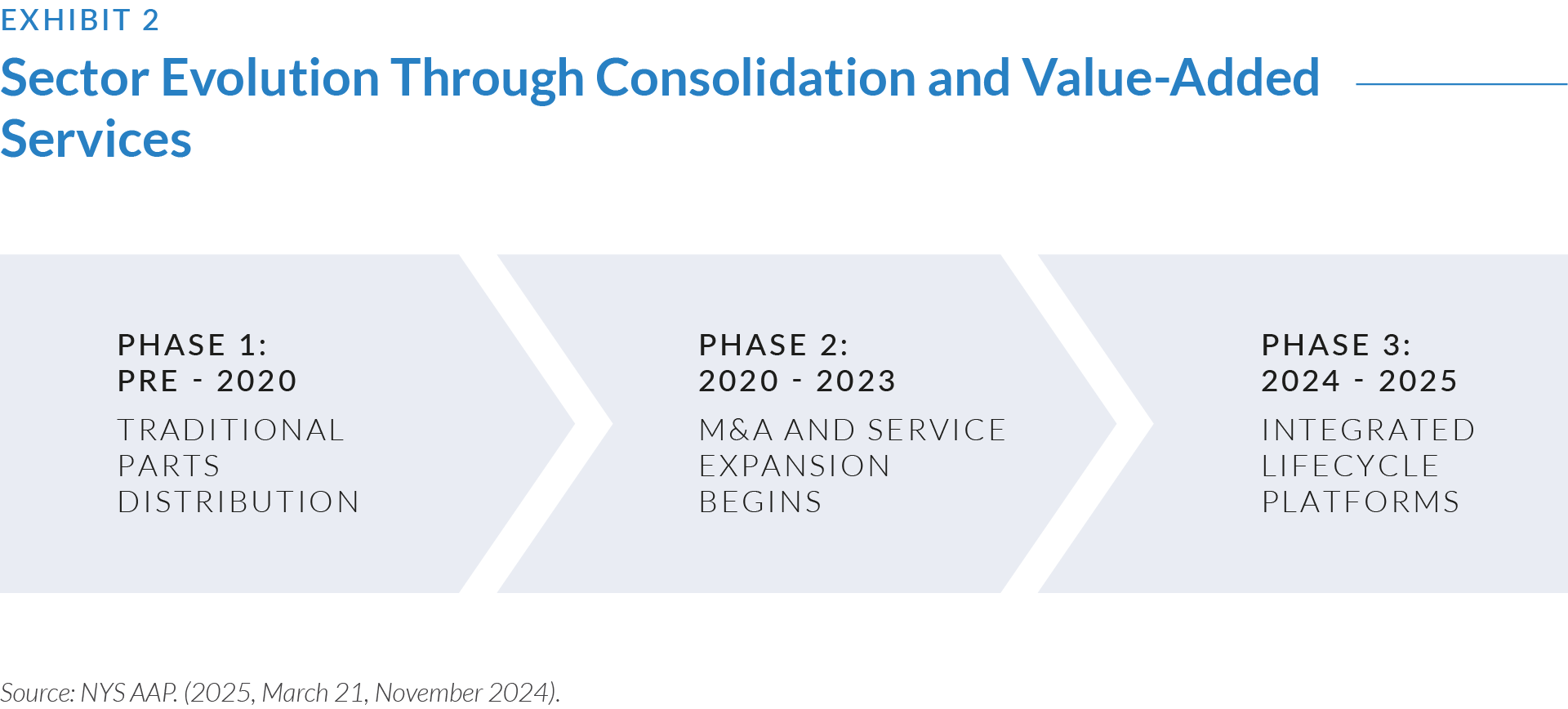

The data highlights transaction trends, valuation dynamics, and capital flows in the sector. Rising demand for home-based care and reimbursement-backed service models drives M&A in respiratory therapy, CPAP (Continuous Positive Airway Pressure) resupply, oxygen delivery, and mobility equipment. Acquirers target EBITDA-positive operators with scalable platforms, payer contracting strength, and geographic coverage. Transactions focus on building national platforms and executing disciplined add-on acquisitions, reinforcing reimbursement resilience while expanding service lines across fragmented regional markets.

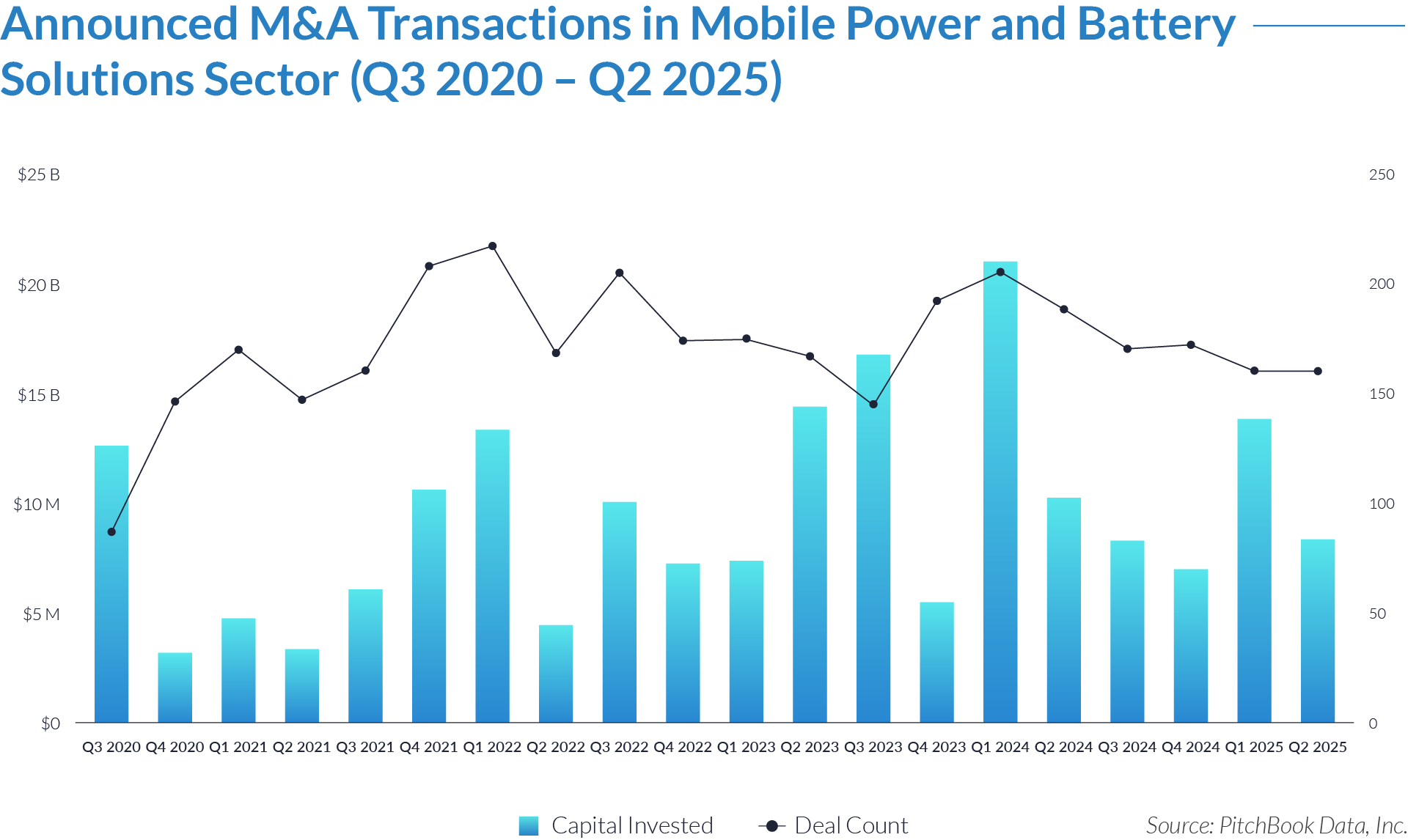

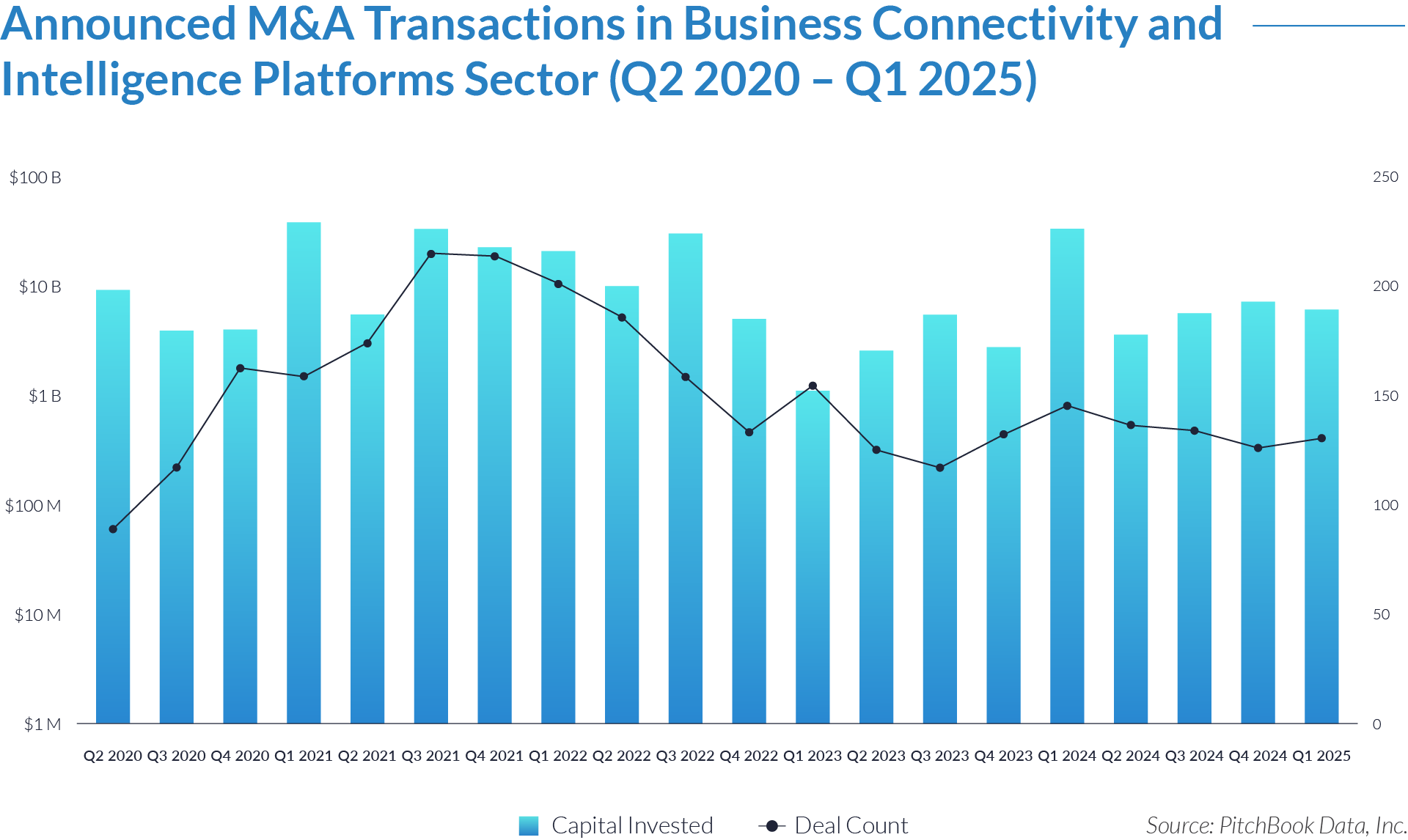

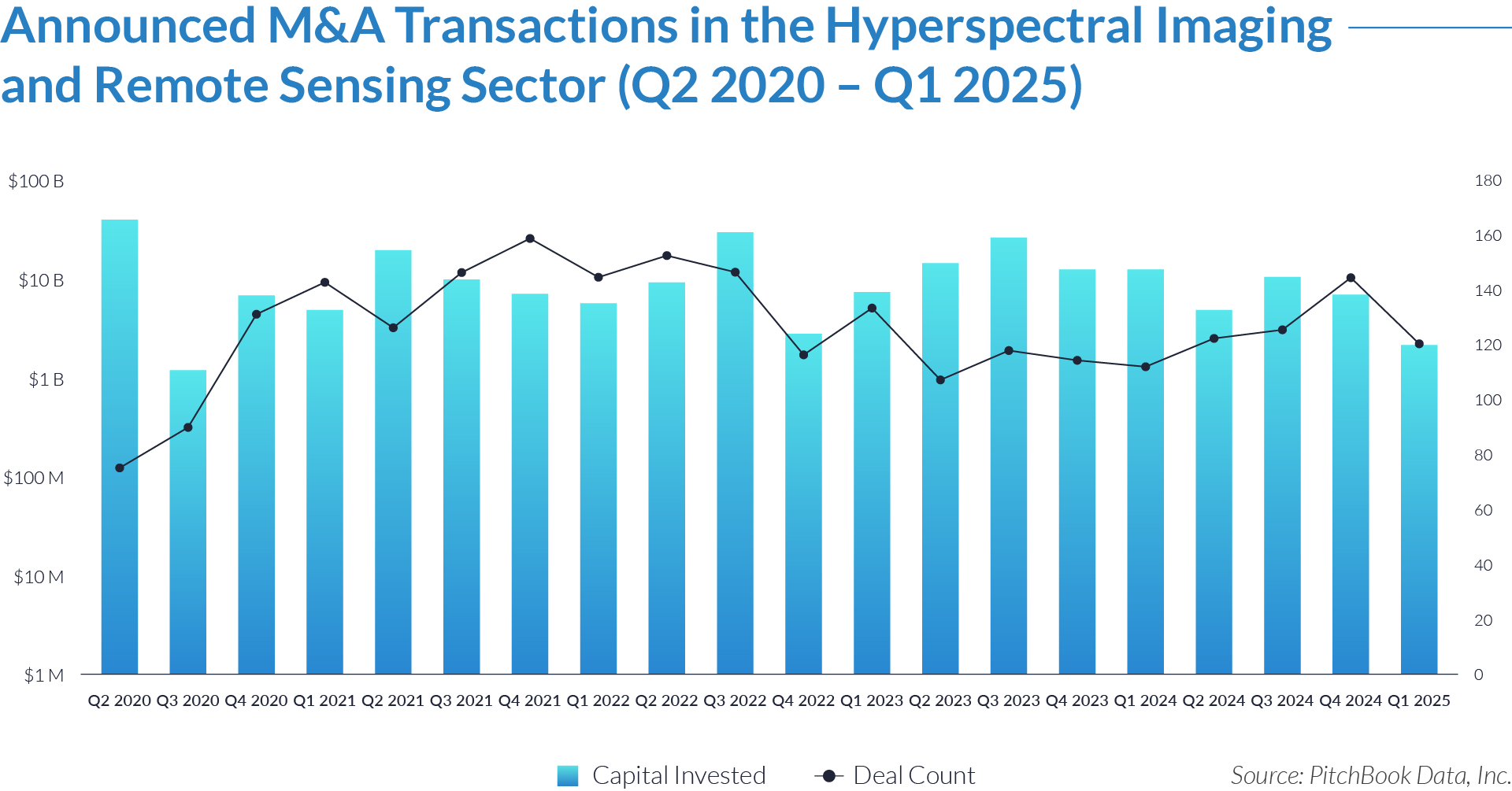

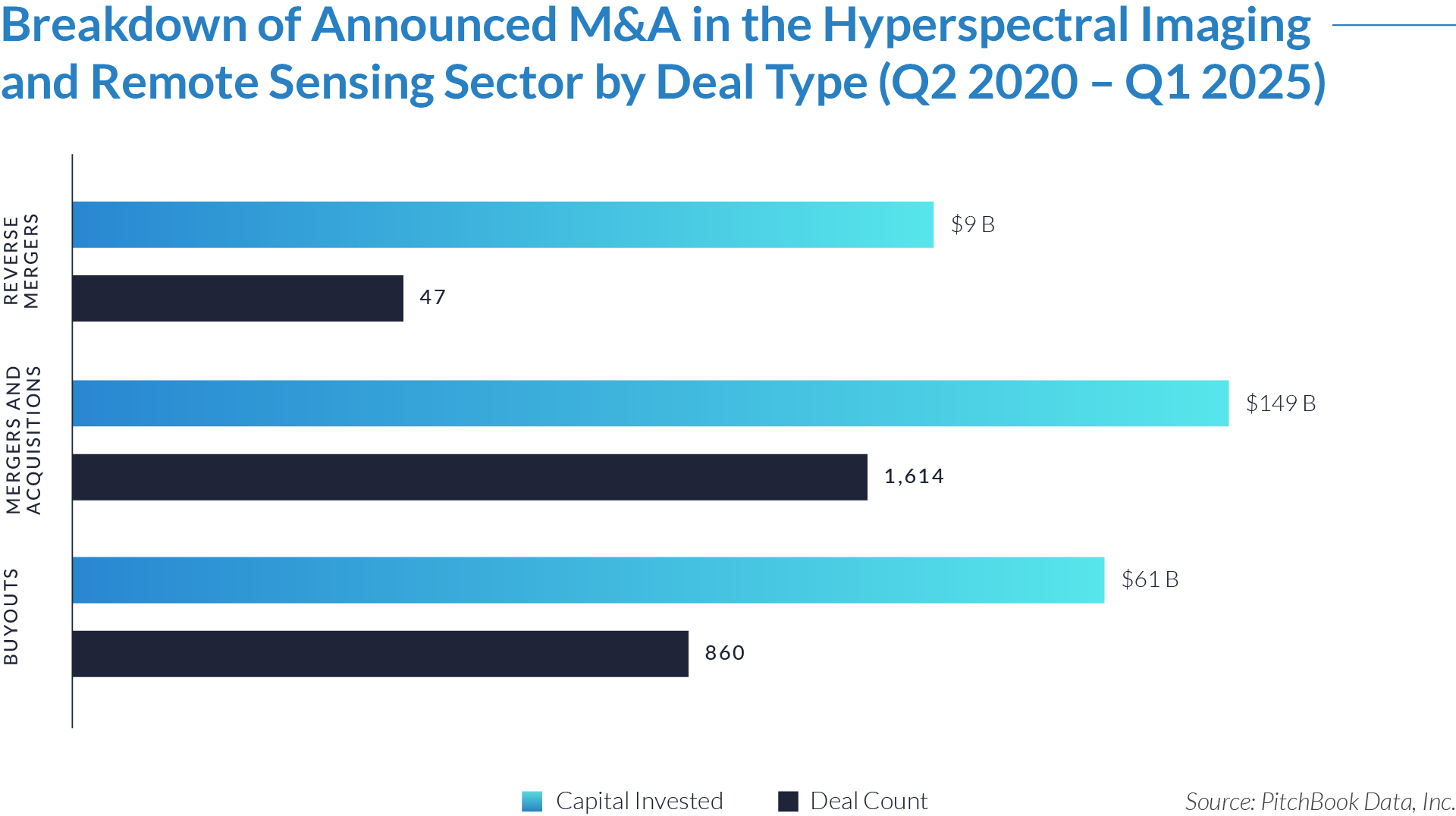

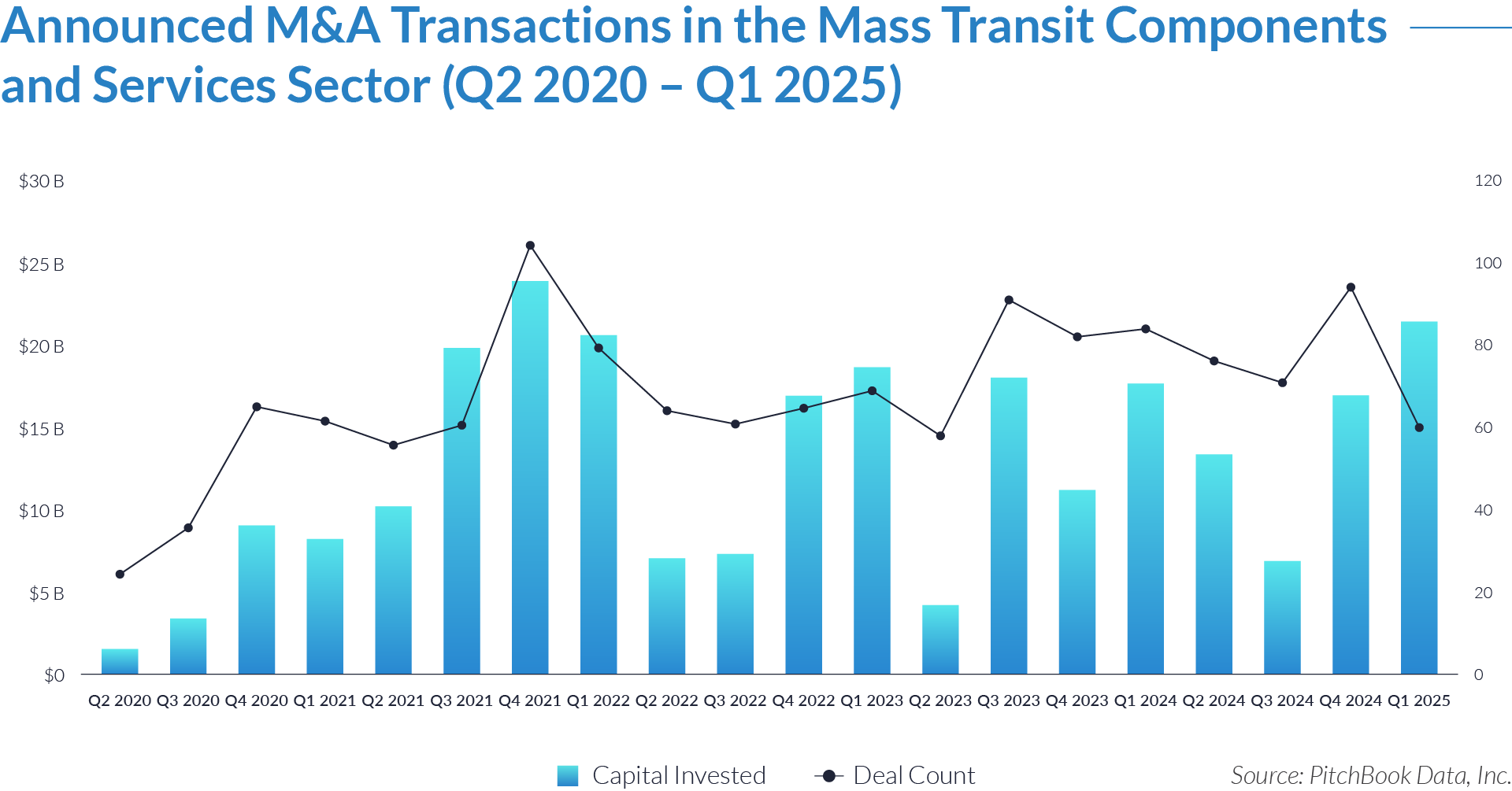

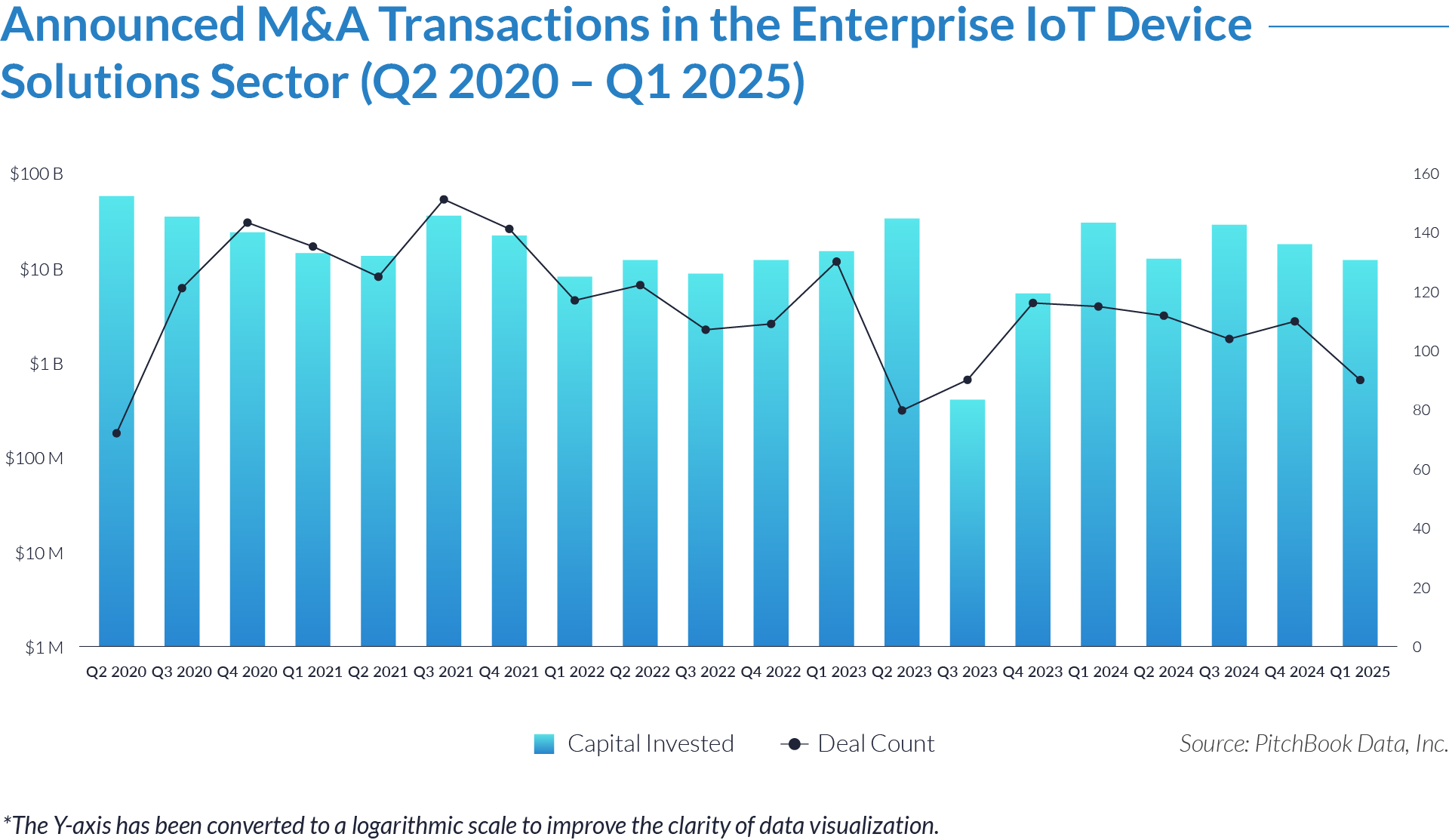

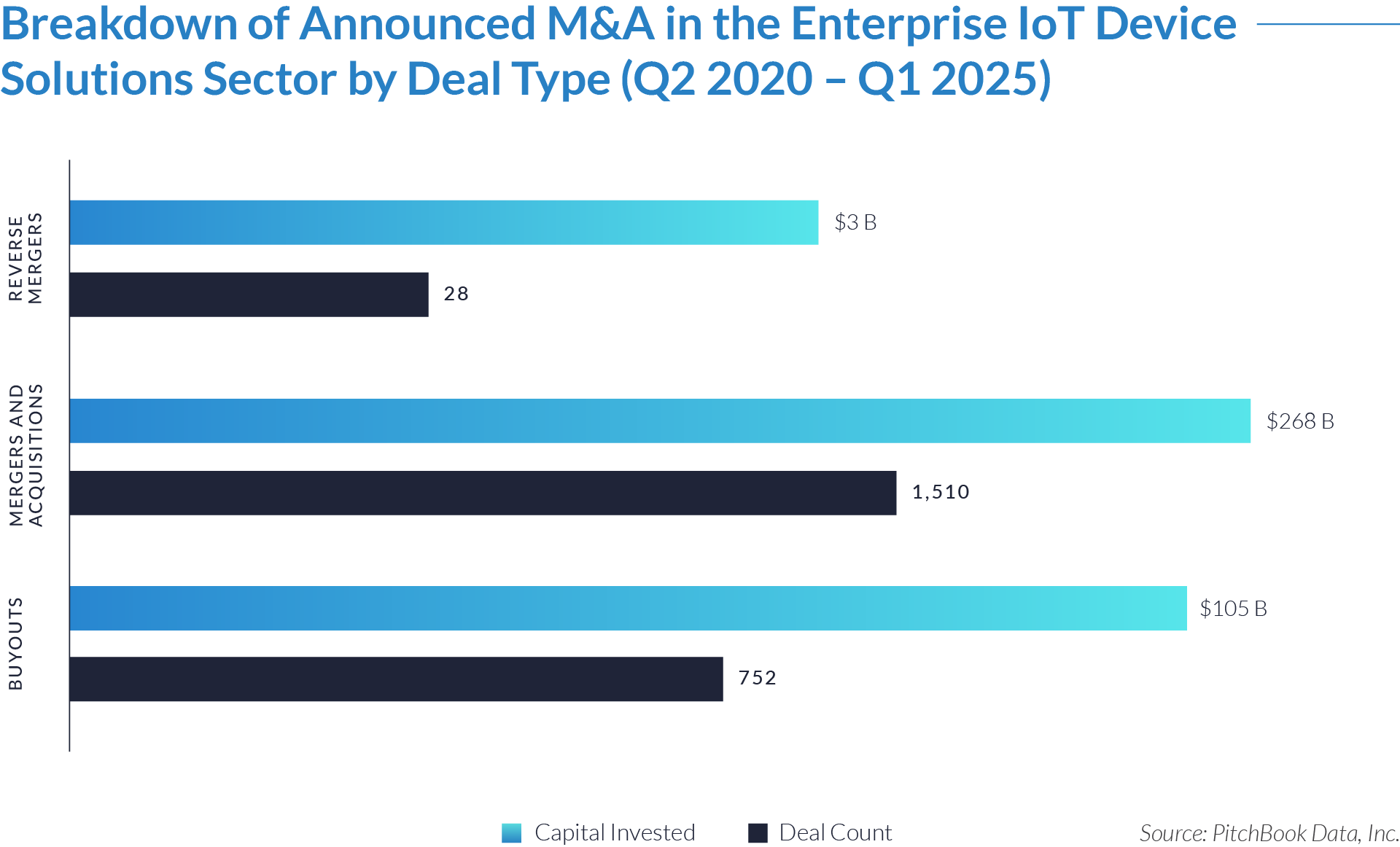

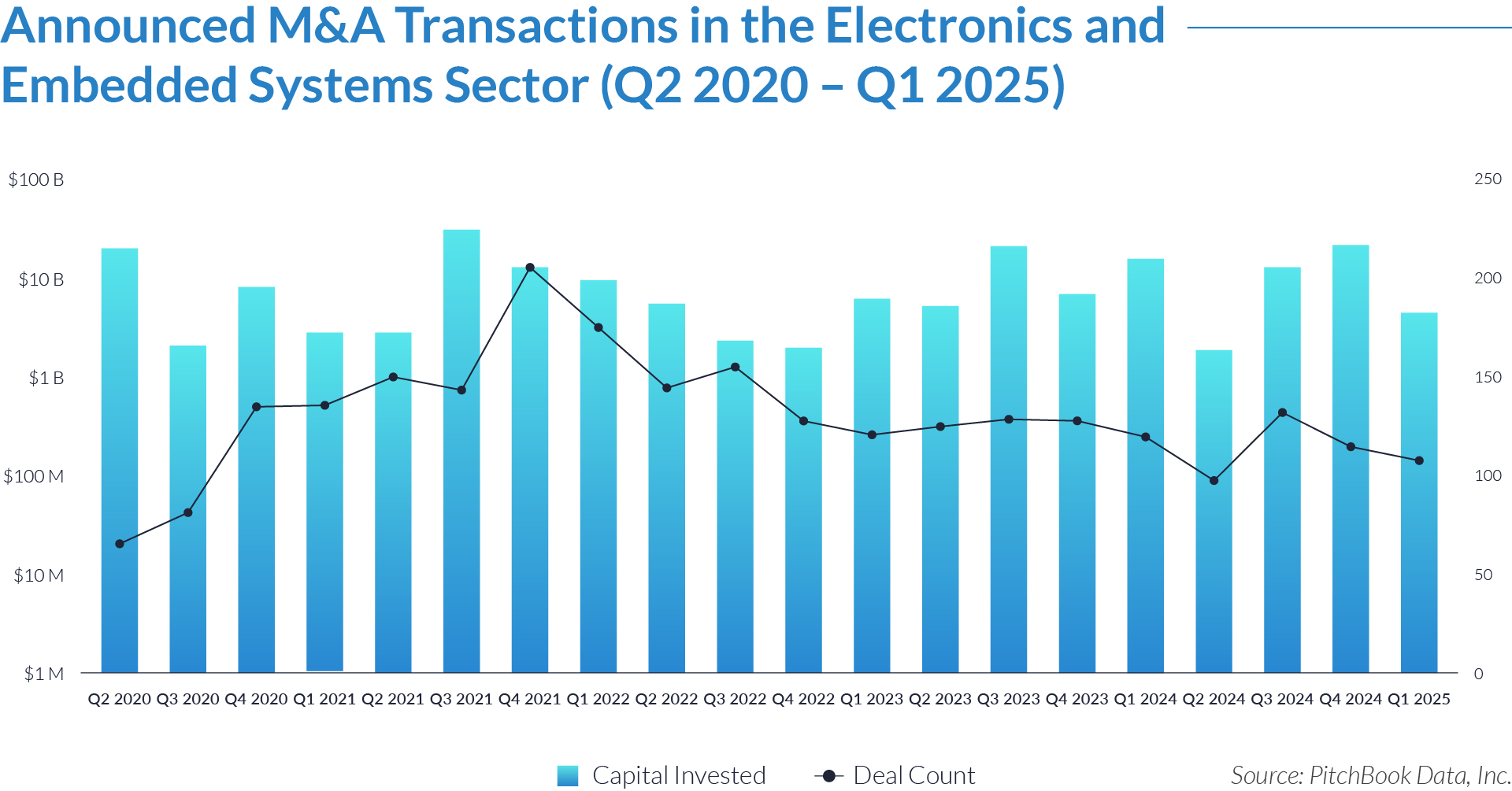

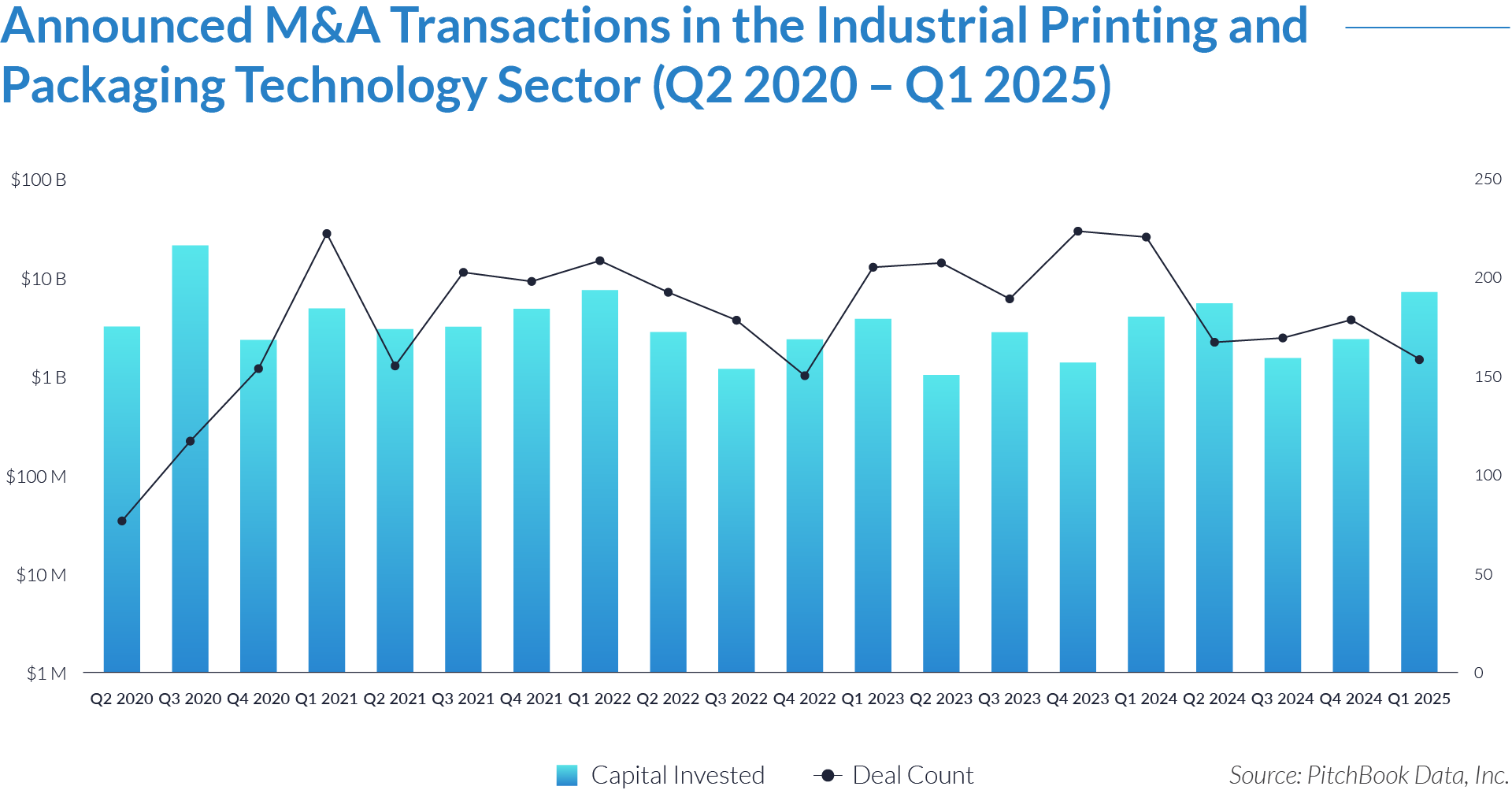

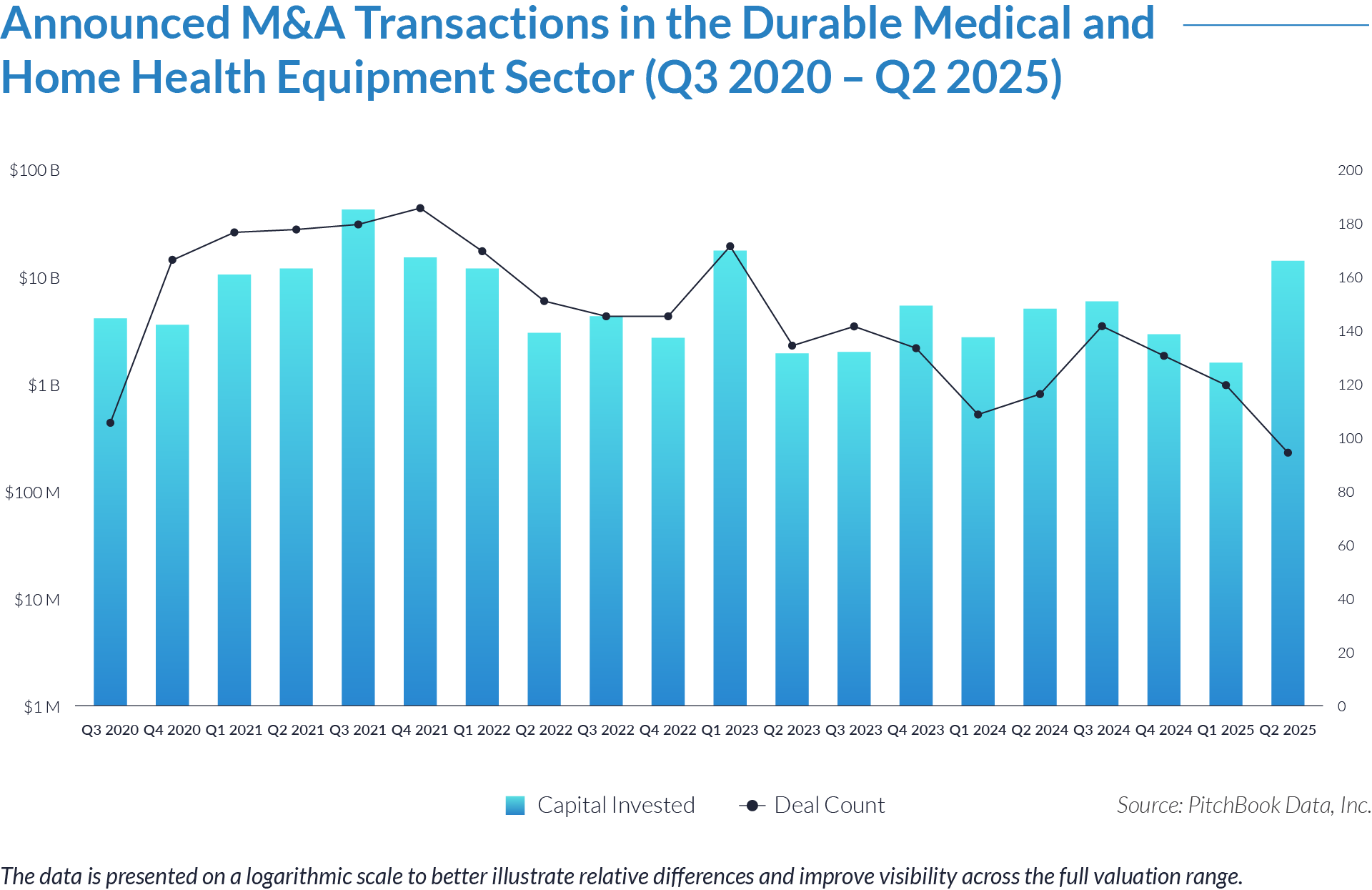

- The sector attracted approximately $169 billion across 2,903 deals over 20 quarters, underscoring its role as a consistent magnet for investment. This scale highlights durable demand for home-based care solutions and shows how both strategics and financial sponsors deployed capital across platform-scale consolidations and steady mid-market acquisitions.

- Transaction activity held firm even as invested dollars swung sharply. Quarterly deal counts fell below 130 only twice, while capital deployment ranged from a peak of $42 billion in Q3 2021 to a trough of $2 billion in Q1 2025. This divergence illustrates how mega-deals slowed under interest-rate pressure and valuation resets, but consolidators maintained steady momentum through tuck-ins that expanded geographic density and service offerings.

- The 2023–2024 moderation marked a shift from growth-at-any-price toward disciplined acquisitions. With higher capital costs, acquirers targeted EBITDA-positive, operationally efficient assets over high-multiple growth plays. Capital deployment averaged $4 to 6 billion per quarter in this period, down sharply from 2021 peaks, though deal counts remained stable. The rebound in Q2 2025 ($14 billion across 95 deals) signals renewed platform-level consolidation, particularly in respiratory therapy, CPAP resupply, and home oxygen, segments that continue to command valuation premiums.

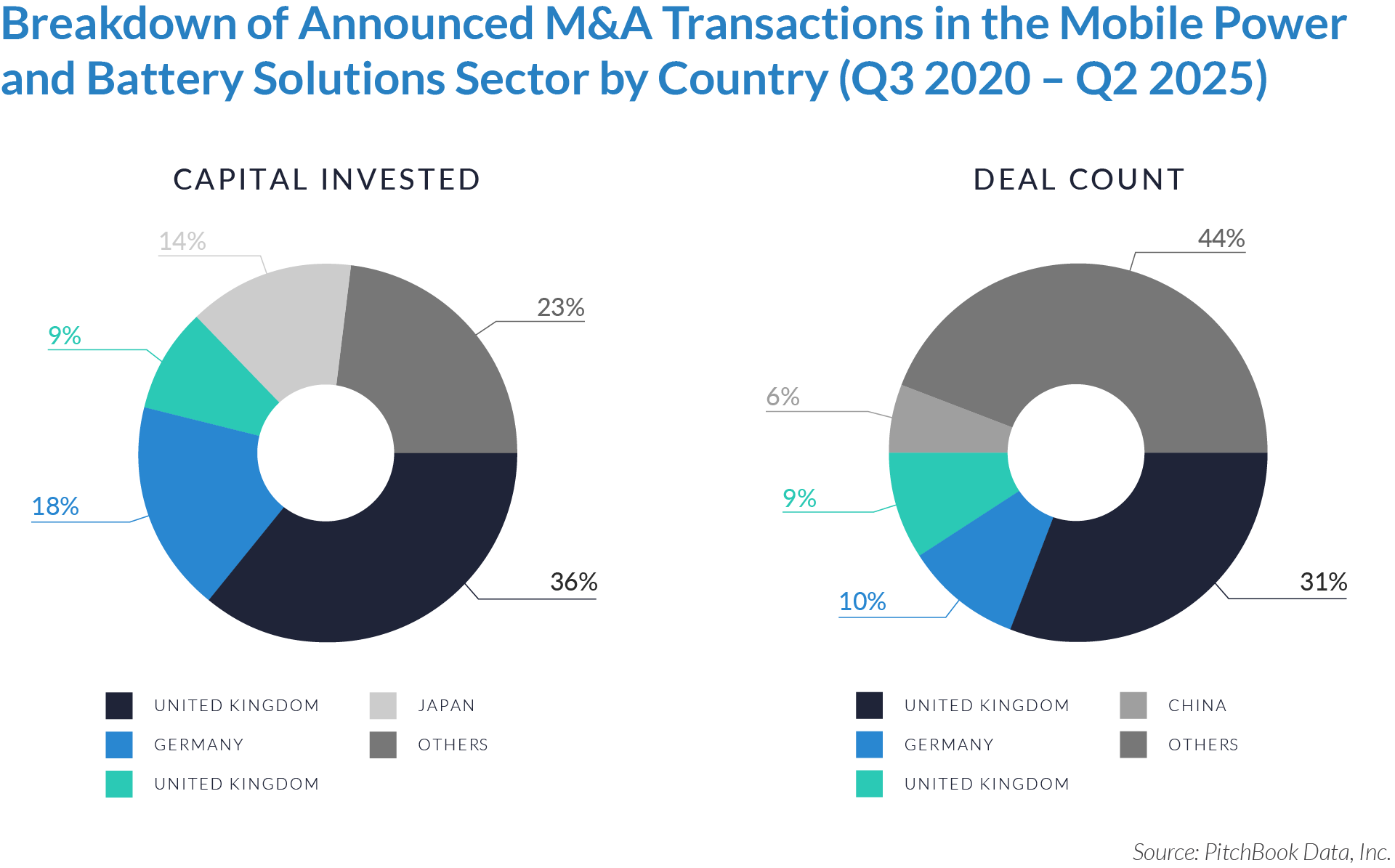

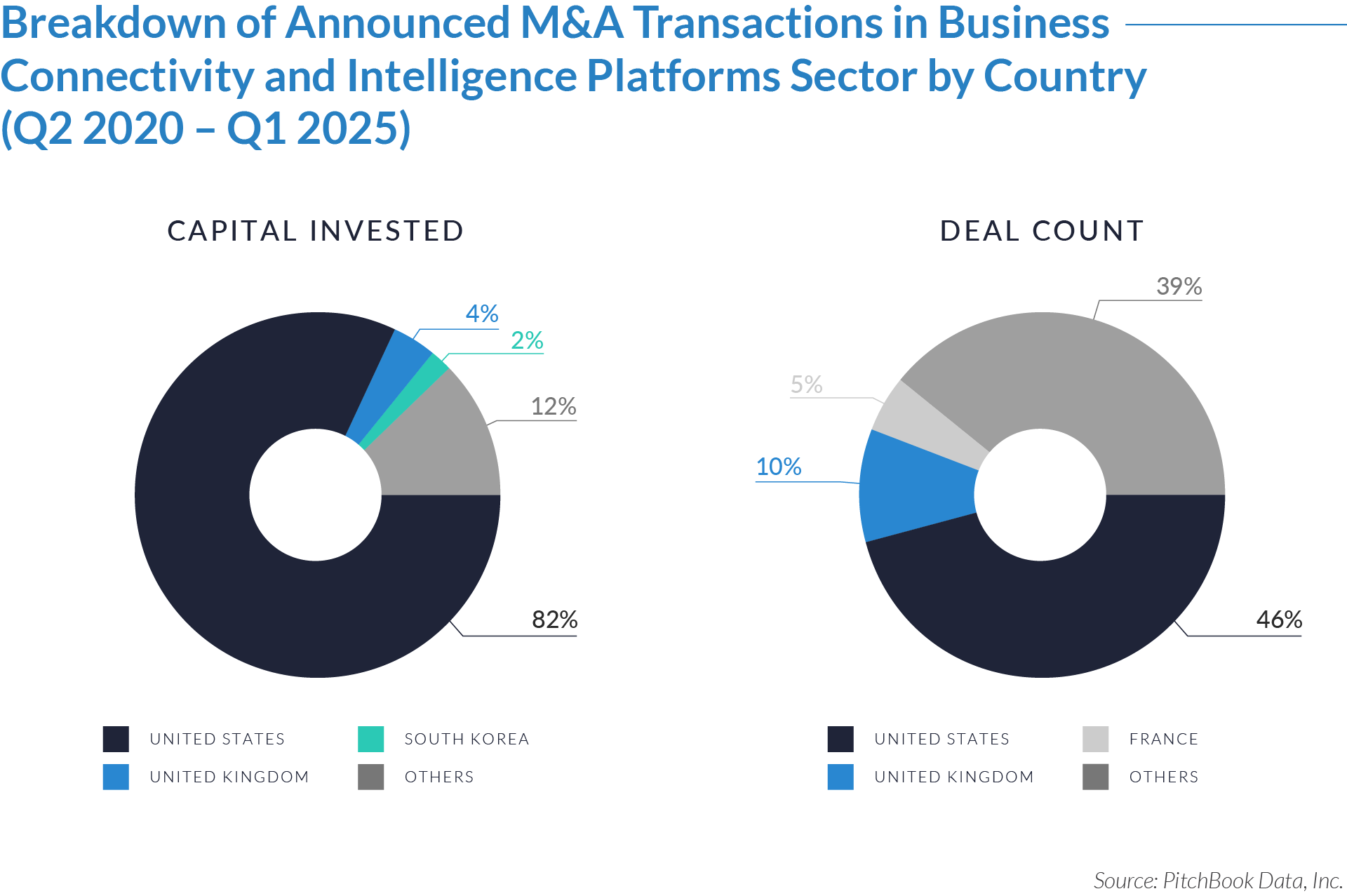

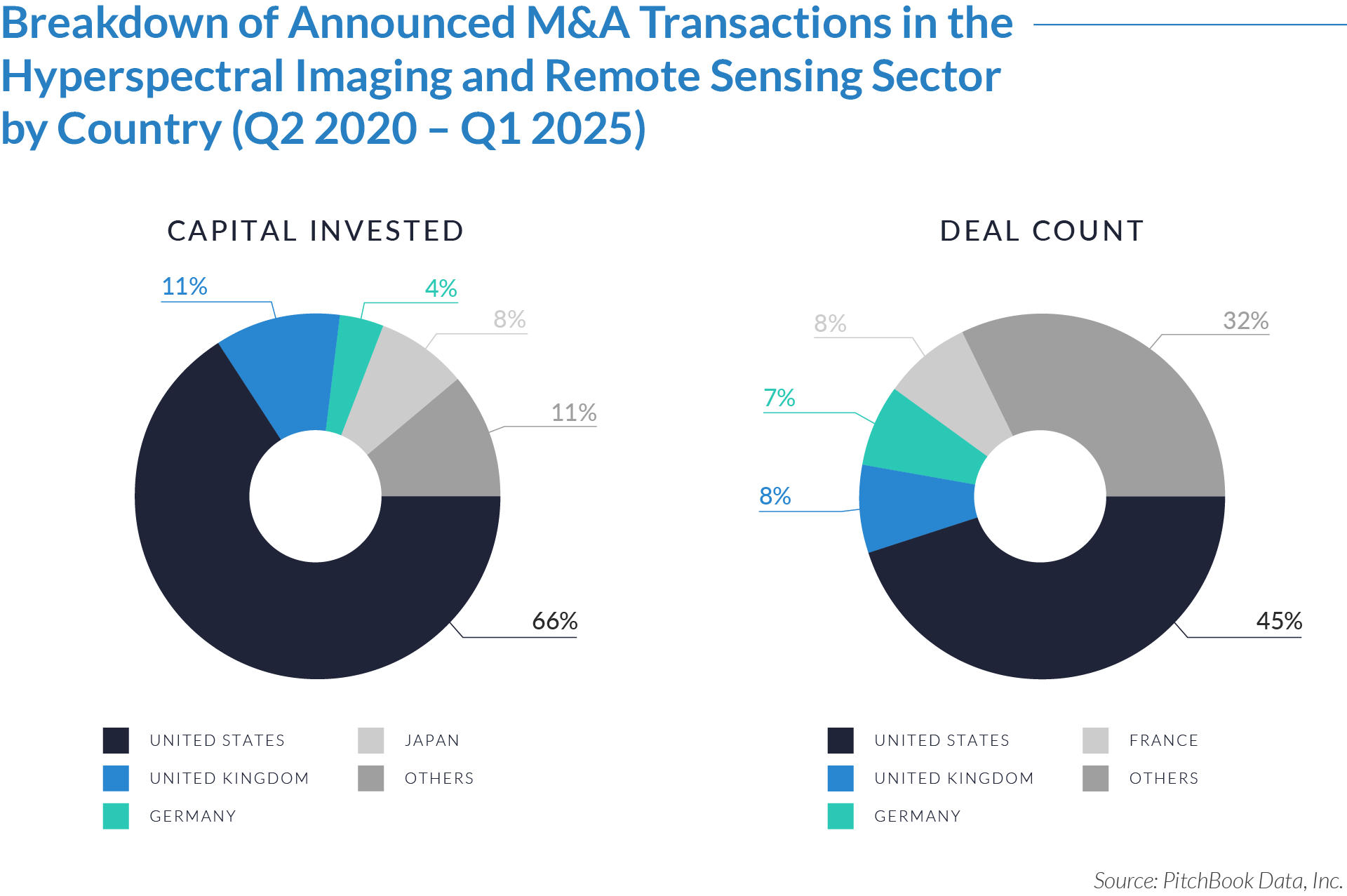

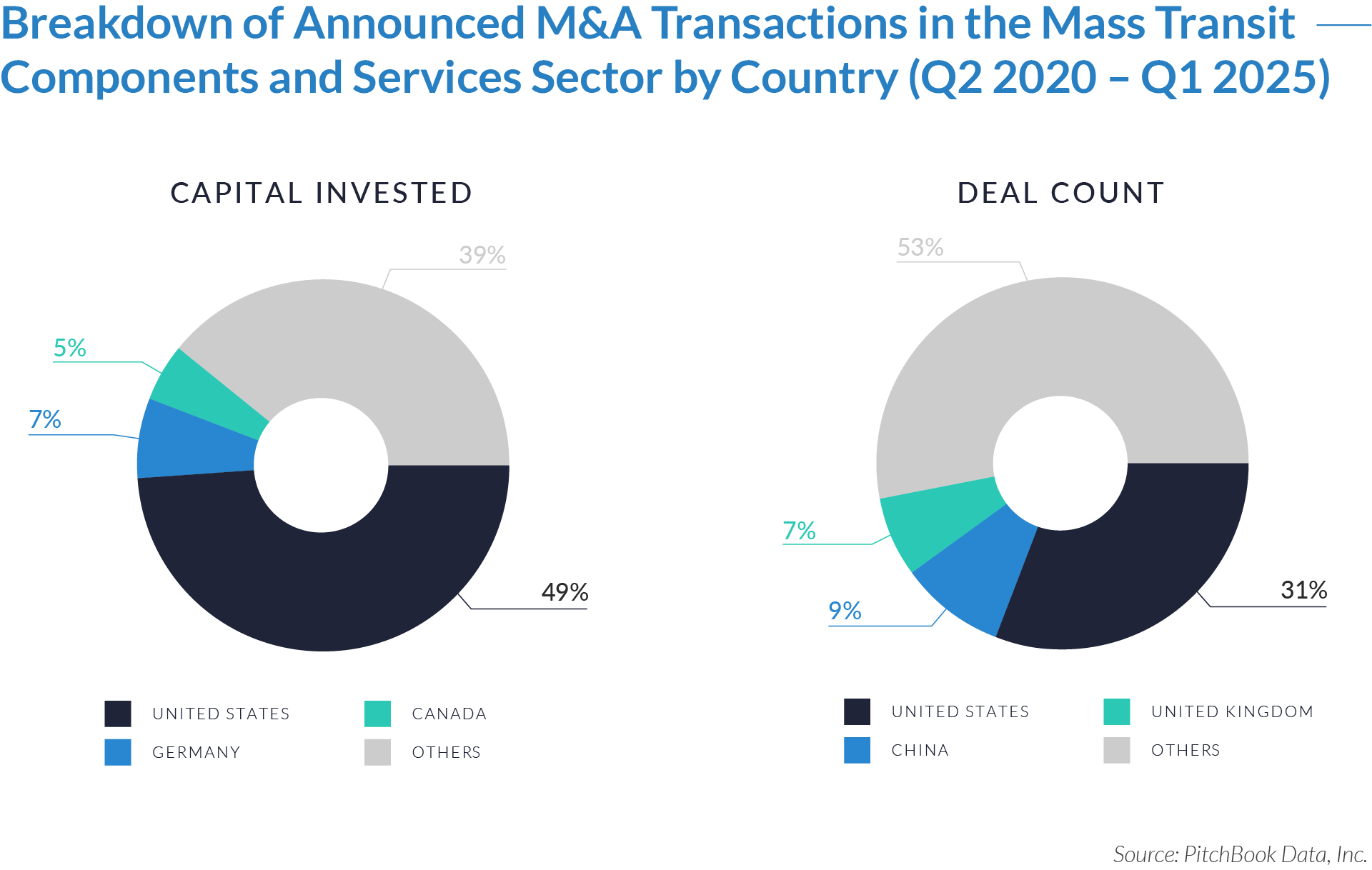

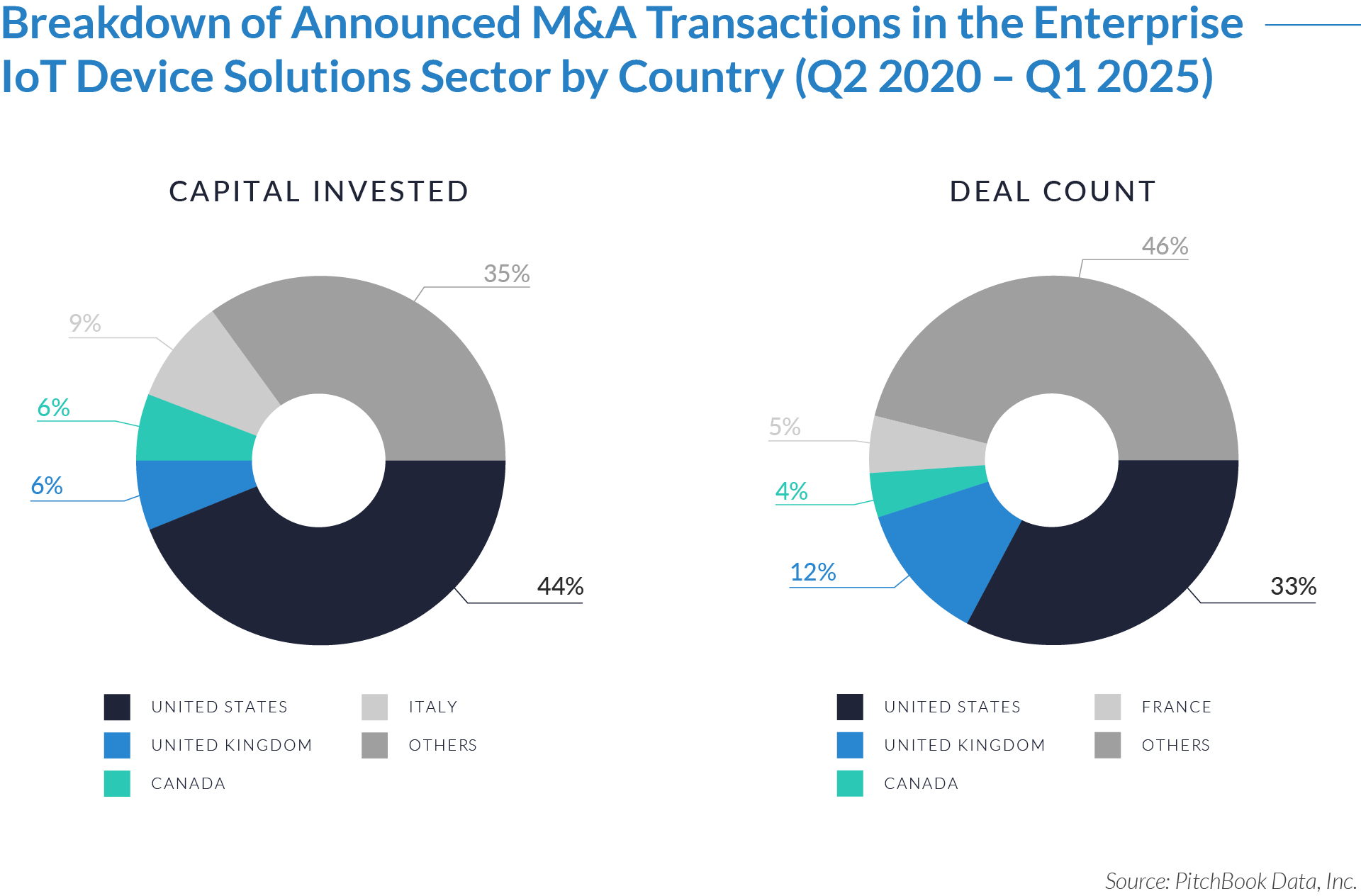

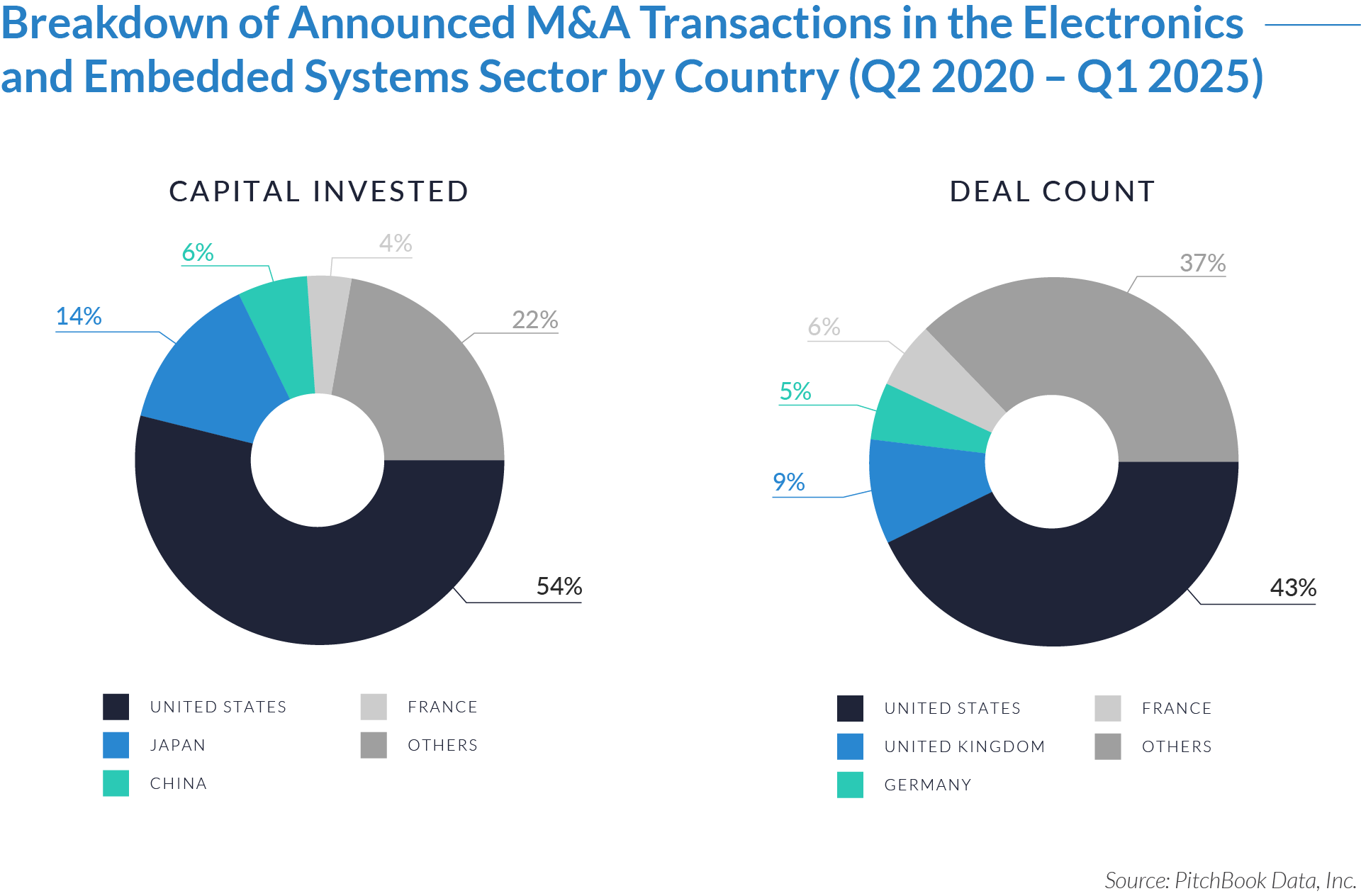

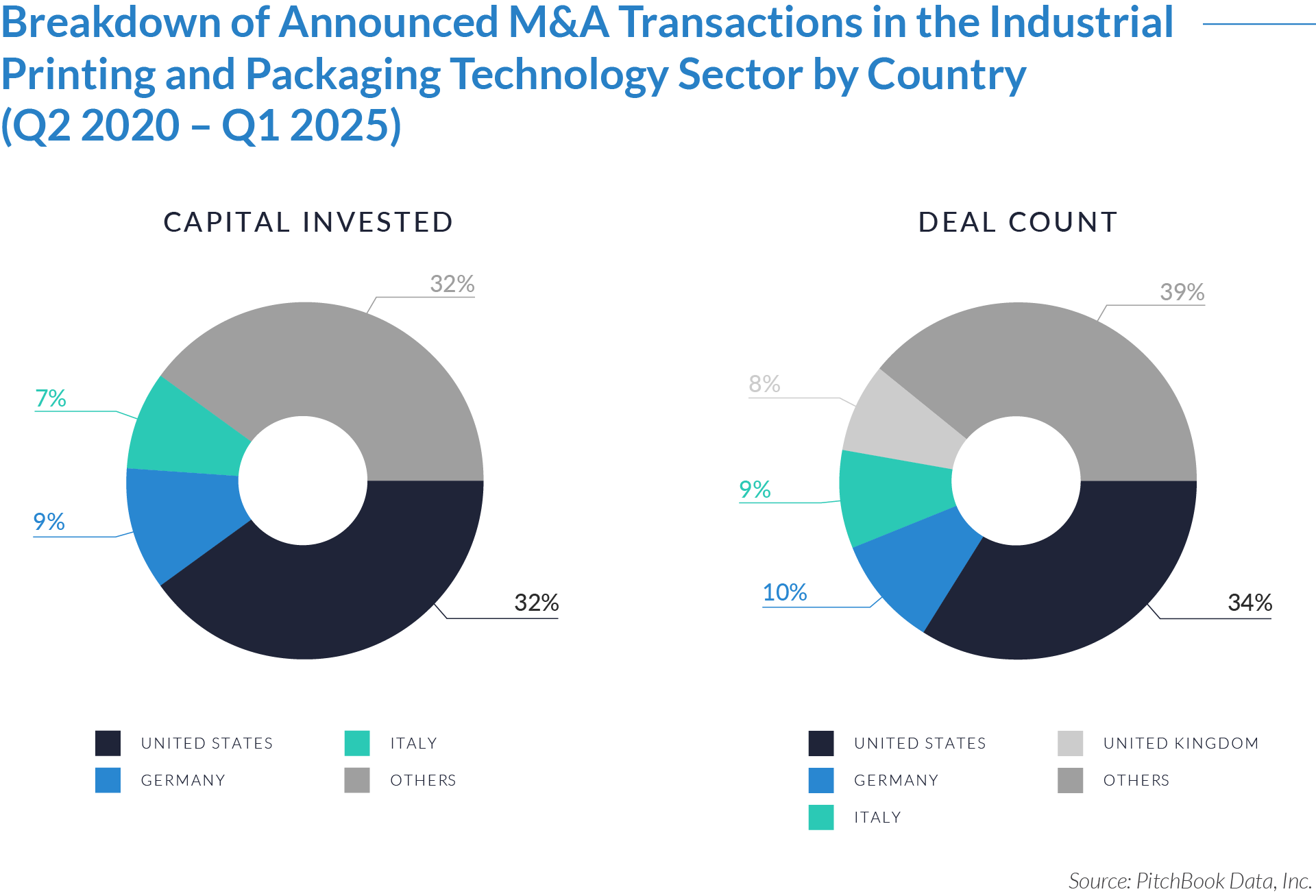

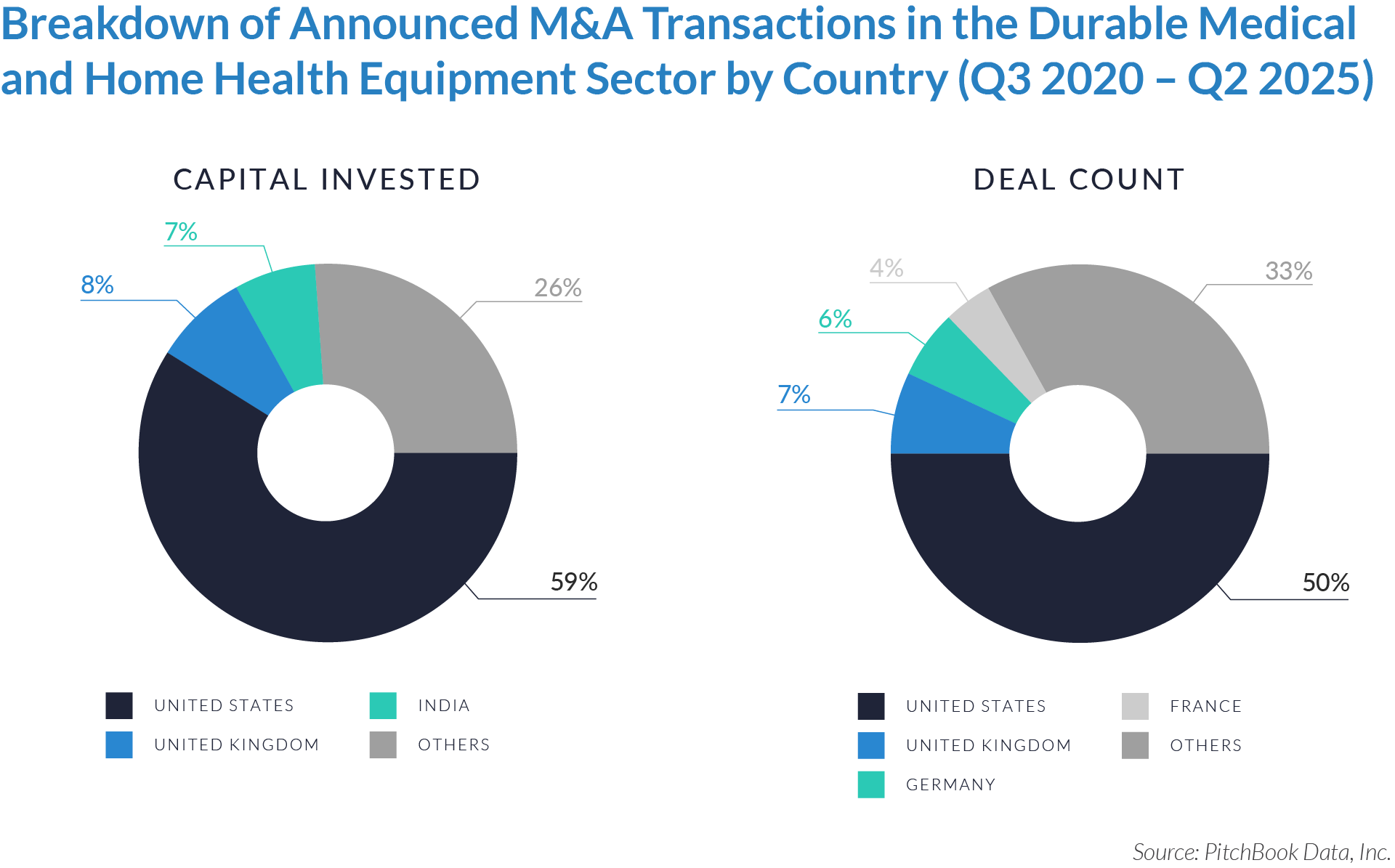

- US-based acquirers captured 59% of capital invested and 50% of deal flow, cementing the country’s role as the anchor of the Durable Medical and Home Health Equipment sector. Consolidators leveraged Medicare and Medicaid reimbursement, mature payer networks, and a fragmented operator base to build scale and capture premium valuations.

- The UK, Germany, and France together accounted for less than 20% of global deal activity, reflecting steady but fragmented participation. Acquirers executed mostly mid-market add-on acquisitions or private equity-backed national roll-ups, rather than transformational consolidations, leaving Europe positioned as a regional rather than global growth driver.

- Other international and emerging markets deployed 26% of capital and 33% of deal flow, underscoring acquirer interest in fragmented ecosystems outside the US and Western Europe. While most transactions remained modest in size due to reimbursement uncertainty and infrastructure gaps, India’s 7% share highlights appetite for scalable, low-cost homecare platforms in high-population markets.

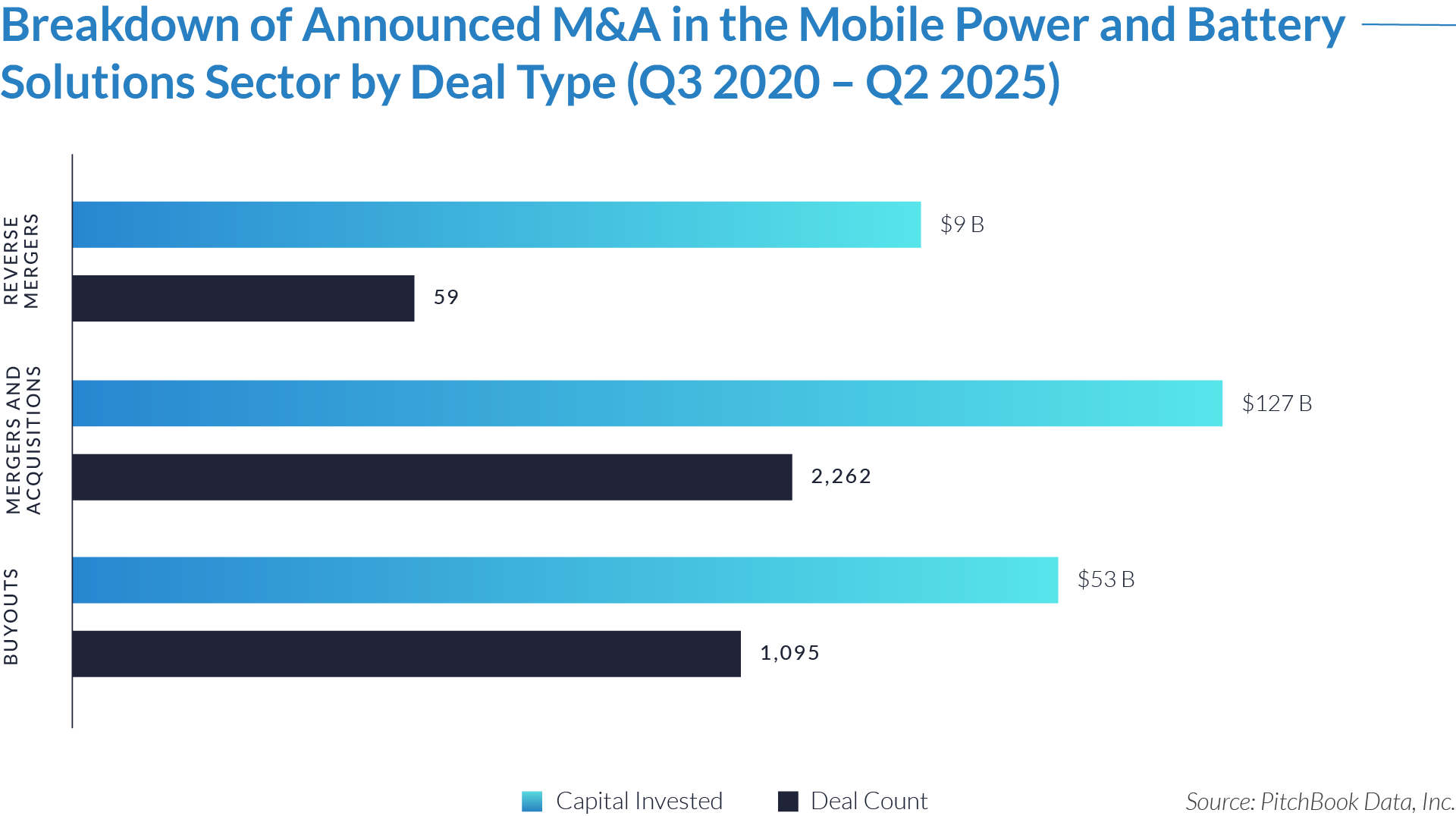

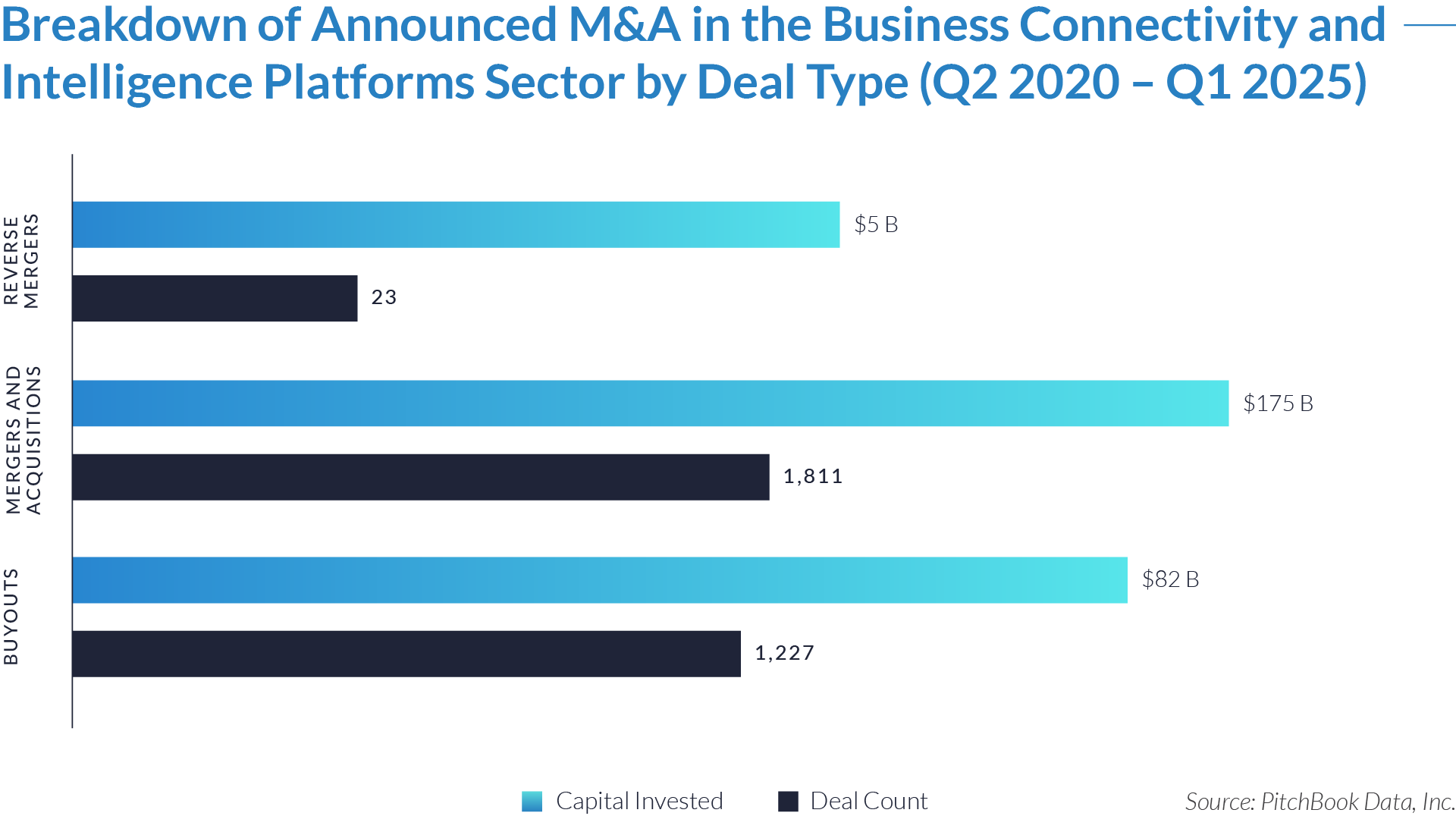

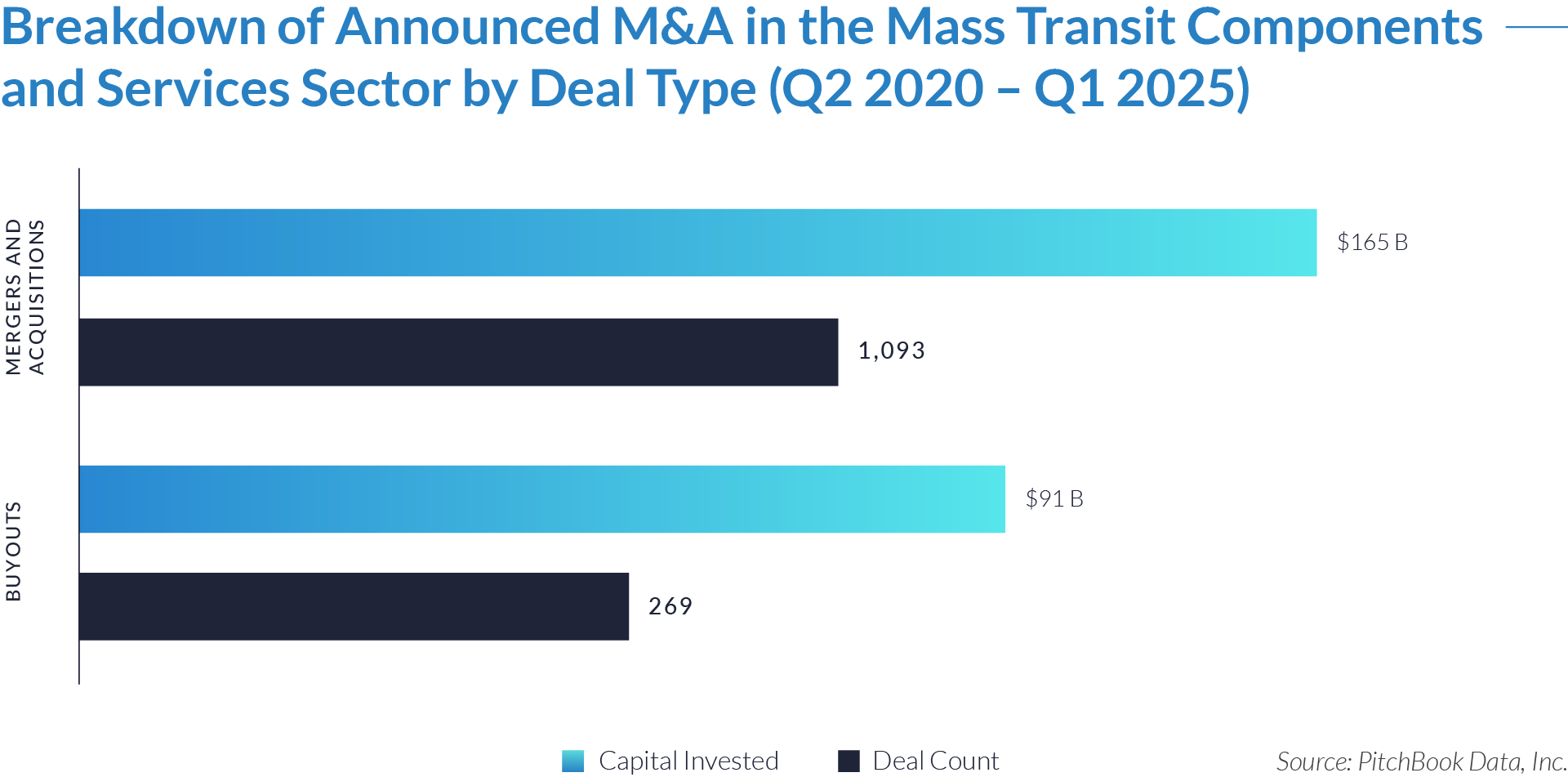

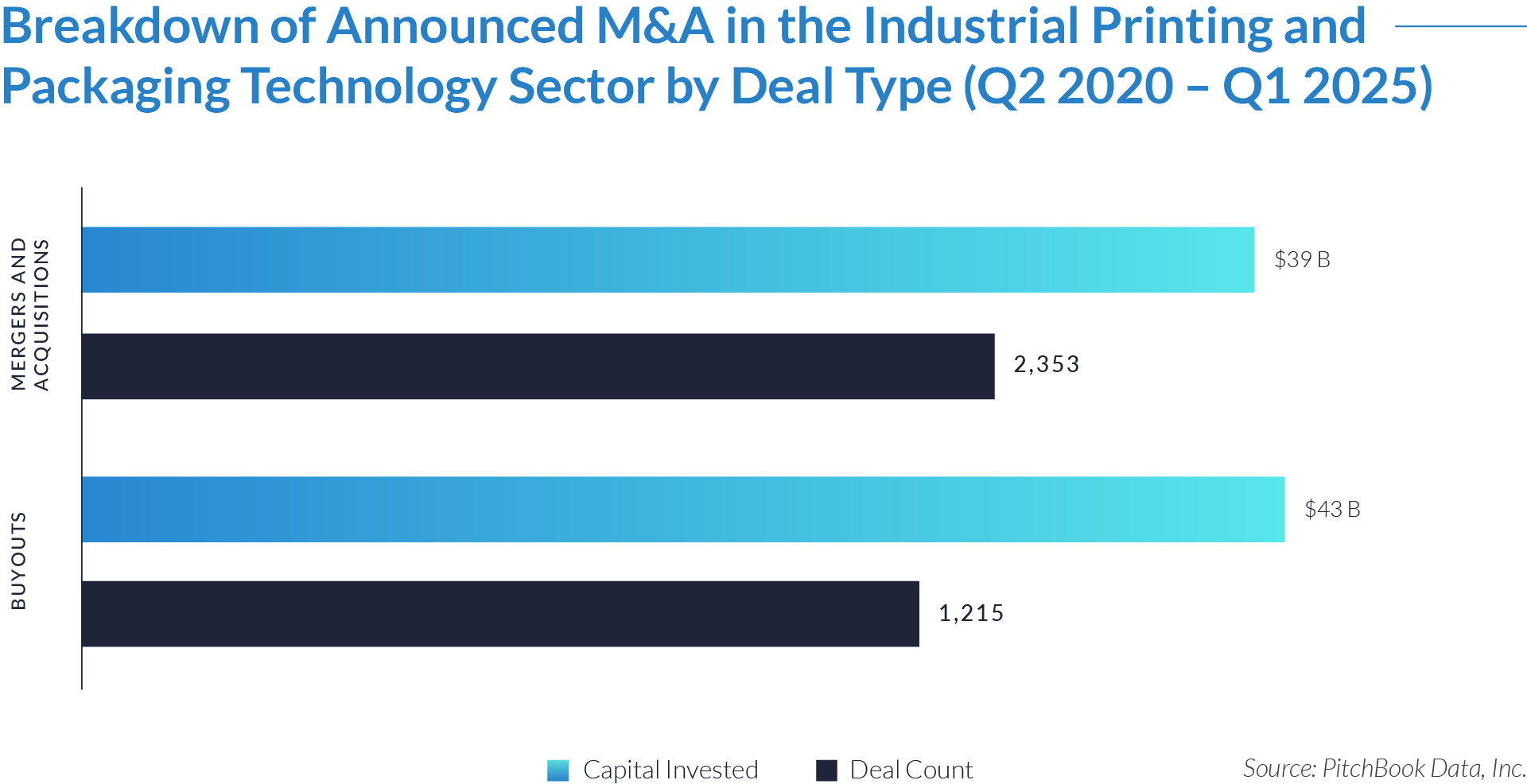

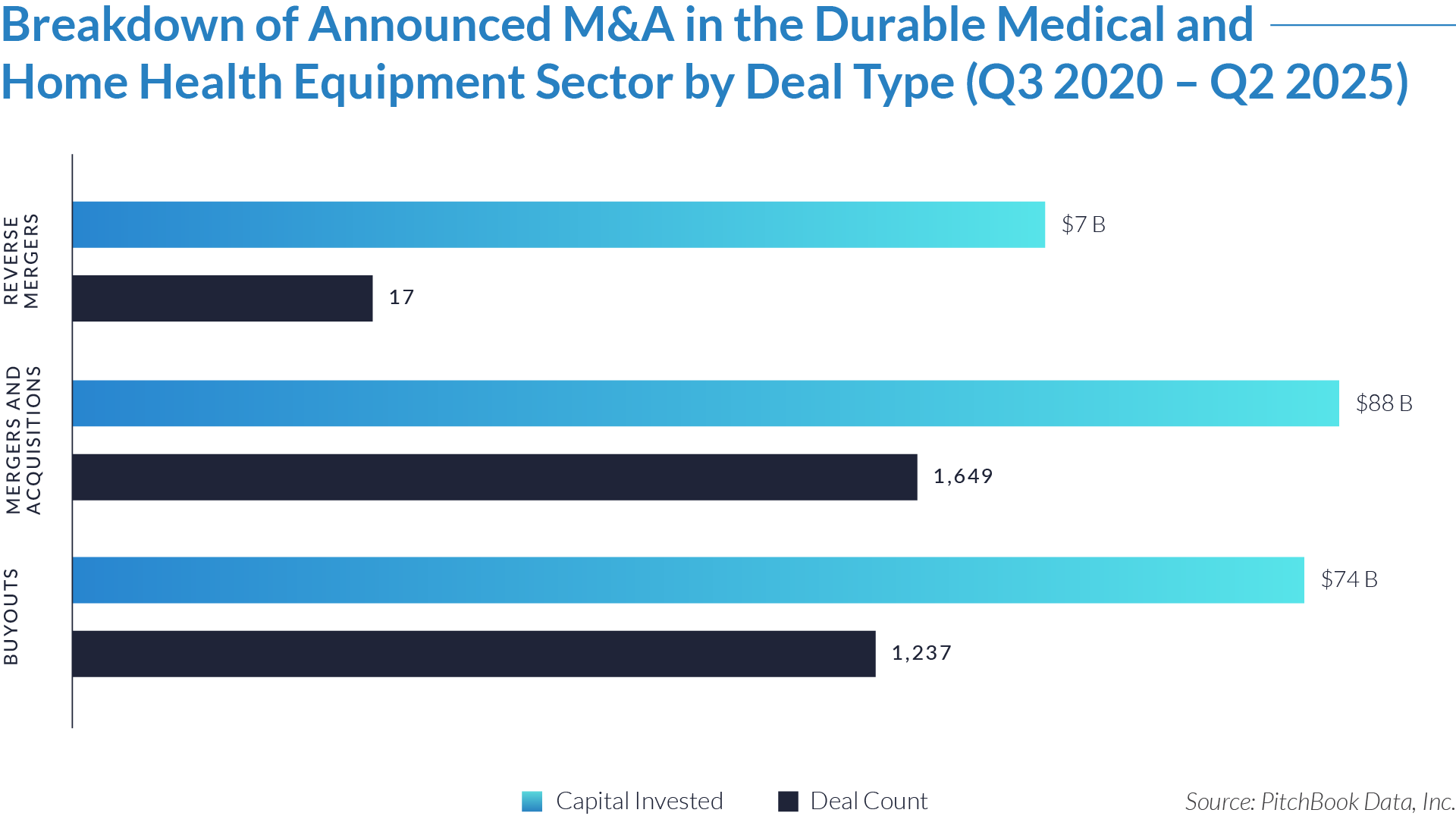

- Acquirers deployed $88 billion across 1,649 transactions, making M&A the largest share of both capital and deal volume. The activity reflects a structurally fragmented sector where scale, geographic reach, and payer contracting power are most efficiently achieved through add-on acquisitions and horizontal integration rather than greenfield expansion.

- Acquirers committed $74 billion across 1,237 buyout transactions, underscoring confidence in recurring revenue streams from CPAP resupply, oxygen therapy, and mobility equipment rentals, assets that provide reimbursement-backed cash flows capable of supporting leveraged acquisition structures.

- Only $7 billion across 17 reverse mergers occurred, showing that capital markets view the sector more as a consolidation play than a pathway for speculative public listings. Their limited use reinforces that growth depends on disciplined acquisitions of scaled or niche operators rather than public-shell entry.

M&A Transactions Case Studies

Three transactions in the sector illustrate buyer priorities in expanding direct-to-patient platforms, strengthening regional market coverage, and diversifying service offerings. Strategic acquirers and consolidators are pursuing deals that enhance recurring revenue streams, deepen provider and payor relationships, and position them to capture long-term growth driven by chronic disease management and the shift toward cost-effective care in the home.

Case Study 01

HOME MEDICAL PRODUCTS

Home Medical Products (HMP Inc.) provides home medical equipment and patient care solutions, with services spanning respiratory therapy, sleep therapy, bracing, mobility aids, and wound care. The company partners with physicians to fulfill prescriptions across multiple locations and employs licensed clinical staff, including respiratory therapists, to deliver home visits, remote monitoring, and patient education. HMP focuses on improving outcomes and quality of life by helping patients manage chronic conditions safely and effectively at home.

Transaction Structure

VieMed Healthcare acquired Home Medical Products, Inc. for approximately US $29 million in cash.

Market and Customer Segments Combination

The acquisition extended Viemed’s national footprint by adding HMP’s regional presence in Tennessee, Alabama, and Mississippi, expanding access to a base of roughly 45,000 active patients. HMP’s established relationships with physicians, hospitals, and payors complemented Viemed’s core strength in respiratory therapy, while broadening its service mix into mobility aids, wound care, and bracing. The combination enhanced geographic reach, diversified revenue streams, and strengthened Viemed’s ability to engage directly with patients and providers across multiple care pathways.

Acquisition Strategic Rationale

Viemed pursued the acquisition to accelerate growth through regional expansion, diversify beyond core respiratory services, and unlock cross-selling opportunities across complementary product lines. The deal aligned with long-term healthcare trends emphasizing home-based management of chronic conditions, enabling Viemed to scale operations, capture synergies in logistics and clinical services, and deepen payor relationships in the southeastern US.

Case Study 02

ACCESS RESPIRATORY HOMECARE

Access Respiratory Homecare is a locally owned provider of respiratory care and home medical equipment, serving patients, physicians, and care providers. Its product portfolio includes oxygen concentrators, CPAP devices, nebulizers, cough assist machines, mobility scooters, lift chairs, orthopedic bracing, and bathroom safety equipment. By combining personalized service with licensed respiratory expertise, the company helps patients manage respiratory conditions and improve quality of life at home and on the go.

Transaction Structure

Quipt Home Medical Corp. acquired Access Respiratory Homecare for approximately $5 million in a cash transaction.

Market and Customer Segments Combination

The acquisition added more than 6,000 active patients and 1,000 referring physicians to Quipt’s platform, strengthening its network in respiratory care and home medical equipment. Access’s established presence in New Orleans and Lafayette expanded Quipt’s footprint into Louisiana, diversified its geographic coverage, and broadened its referral base across hospitals, clinics, and physician groups.

Acquisition Strategic Rationale

Quipt pursued the acquisition to accelerate growth through geographic expansion, leverage Access’s physician relationships, and increase recurring revenue from respiratory therapy and equipment rentals. The deal aligned with Quipt’s strategy of scaling infrastructure in high-potential regional markets, enhancing payor and provider relationships, and driving long-term value through the shift toward cost-effective, home-based patient care.

Case Study 03

APRIA

Apria Inc. is a US-based provider of home healthcare equipment and services, with core offerings in respiratory therapy, sleep apnea treatment, and wound care. The company generates revenue through fee-for-service and capitation contracts with payors for equipment, supplies, and patient support. As part of Owens & Minor, Apria enables patients to manage chronic conditions at home, improving outcomes while reducing hospital dependence.

Transaction Structure

Owens & Minor acquired Apria Inc. in an all-cash transaction valued at approximately $2 billion, financed through a mix of cash on hand and debt.

Market and Customer Segments Combination

The acquisition brought together Apria’s strong presence in respiratory therapy, sleep apnea treatment, and wound care with Owens & Minor’s established healthcare supply business, which includes diabetes, ostomy, and incontinence products. The combination created the Patient Direct segment, expanding Owens & Minor’s reach into the home healthcare market and broadening its service offerings for hospitals, physicians, and payors, while deepening direct engagement with patients across the United States.

Acquisition Strategic Rationale

Owens & Minor pursued the acquisition to strengthen its position in the fast-growing home healthcare sector, diversify revenue streams, and capture synergies across distribution, logistics, and patient services. By integrating Apria’s expertise in respiratory and sleep therapy with Byram’s supply portfolio, Owens & Minor advanced its ability to serve patients across the continuum of care, from hospital to home. The deal expanded recurring revenue through fee-for-service and capitation models, while positioning the company to benefit from long-term drivers including aging demographics, rising prevalence of chronic conditions, and the healthcare system’s shift toward cost-effective home-based care.

M&A in the durable medical and home health equipment sector will remain active as providers adapt to home-based care, reimbursement-driven growth, and rising cost pressures. Premium valuations will concentrate on respiratory therapy, consumables, and scalable platforms, while consolidation of regional operators creates selective opportunities. Acquirers will prioritize recurring revenues, strong referral networks, and clinical capabilities as core levers for long-term competitive advantage.

Source: Mass Device, Sec.gov (1), (2), VieMed (1), (2), Quipt, Pitchbook Data.