ESG and Gamification M&A Transactions and Valuations

The environmental, social, and governance (ESG) and gamification sector drives changes in corporate sustainability, consumer engagement, and impact-driven strategies. Companies integrate sustainability, corporate social responsibility (CSR), and ethical governance, while gamification applies behavioral science, digital incentives, and interactive experiences to promote ecoconscious actions. This convergence influences corporate culture, consumer behavior, and investment trends, supporting long-term value creation and competitive differentiation through interactive challenges, real-time tracking, and sustainability awareness.

This report analyzes M&A transaction trends, valuation metrics, and regional investment dynamics in the ESG and gamification sector from Q1 2020 to Q4 2024. It examines capital flows, market consolidation, and strategic acquisitions that have shaped sector growth, particularly in technology-driven ESG solutions and gamification platforms for corporate sustainability and employee engagement. The analysis covers key transactions, including Bonterra’s acquisition of WeSpire, Benevity’s acquisition of Alaya, and Carimus’s acquisition of JouleBug, assessing strategic rationale, valuation trends, and market impact.

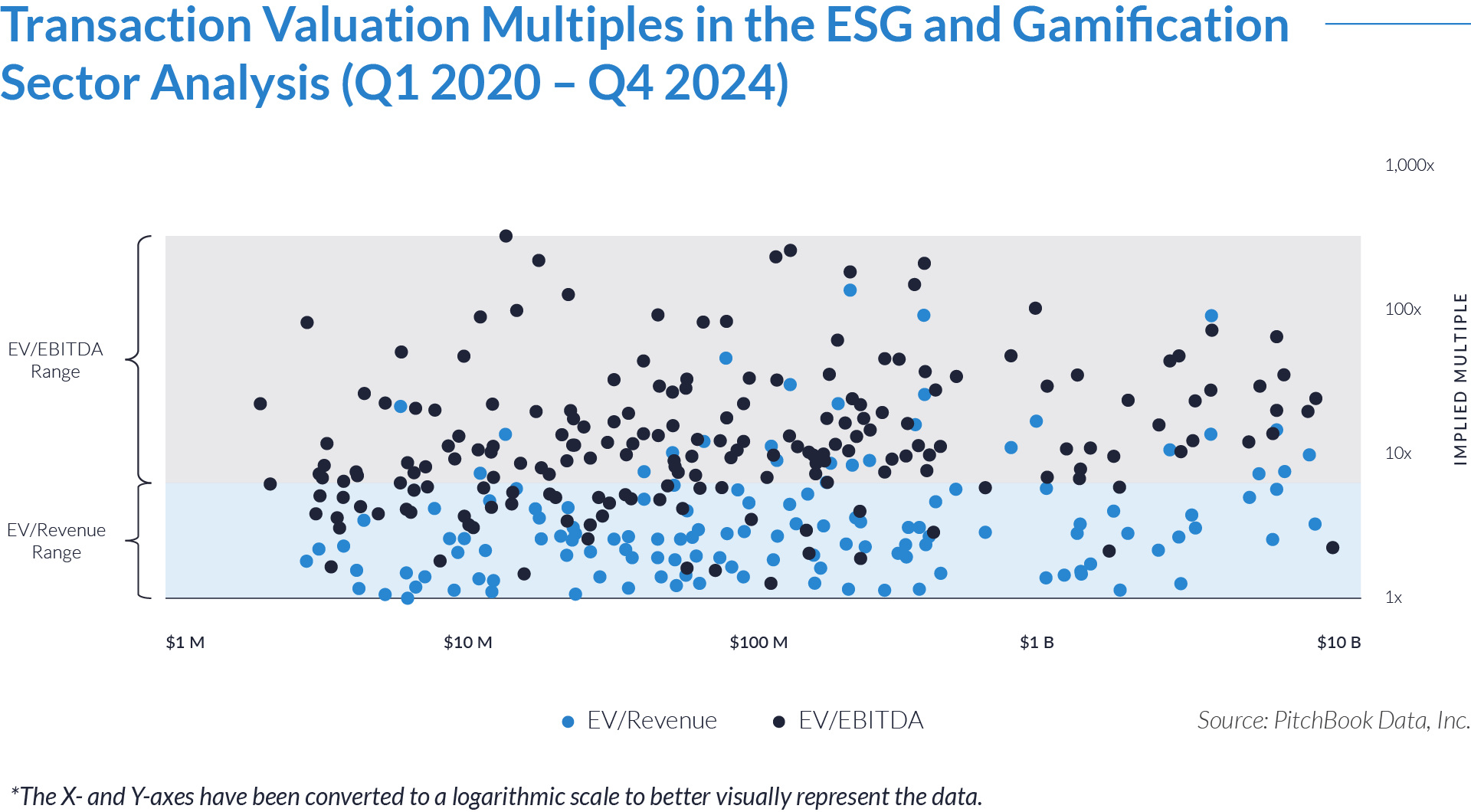

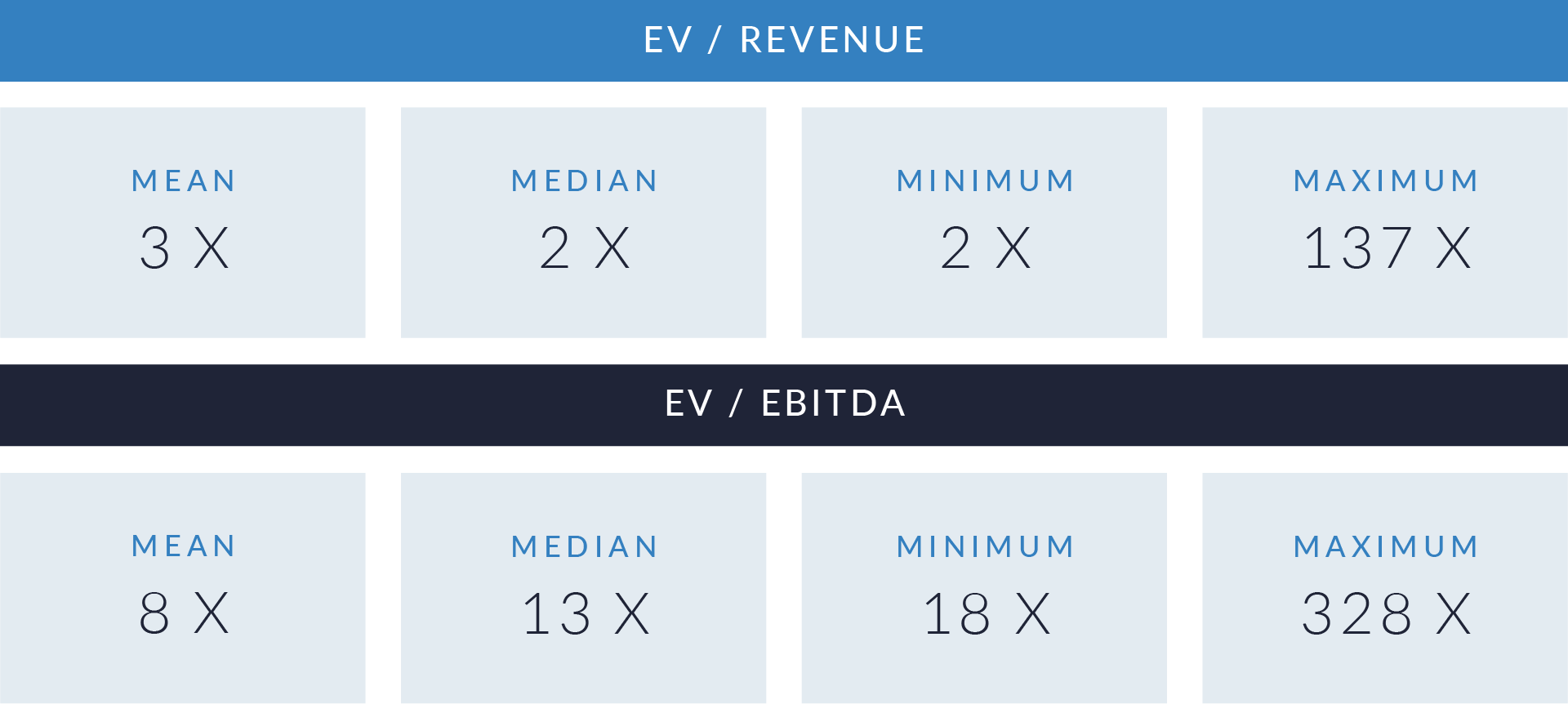

The report also reviews M&A valuation multiples, including EV/revenue and EV/EBITDA, to identify market trends and pricing patterns. Targeting financial advisors, investors, corporate executives, and sustainability leaders, it provides actionable insights into ESG investment opportunities, gamification adoption in corporate engagement, and broader trends shaping the future of sustainable business practices.

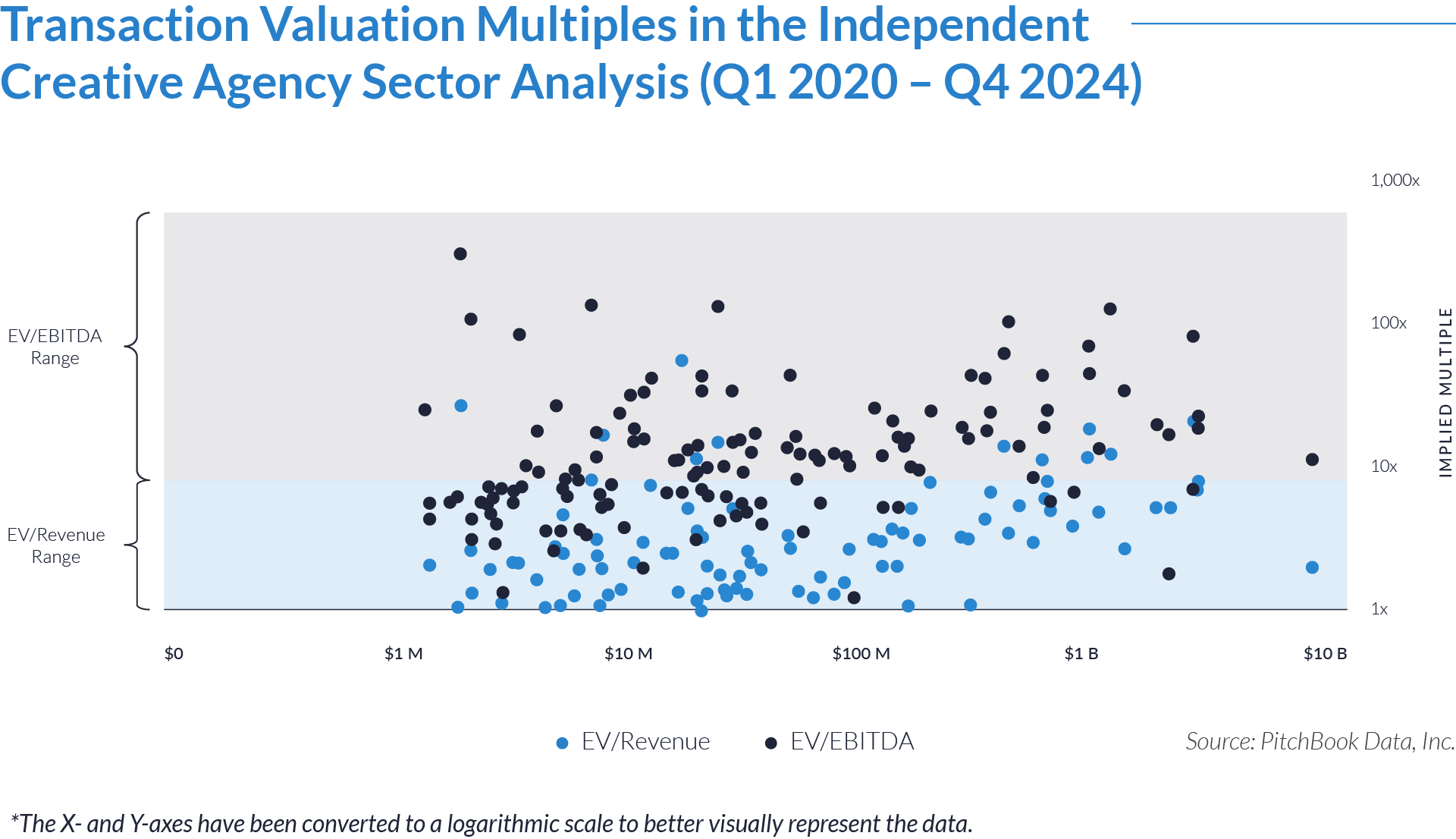

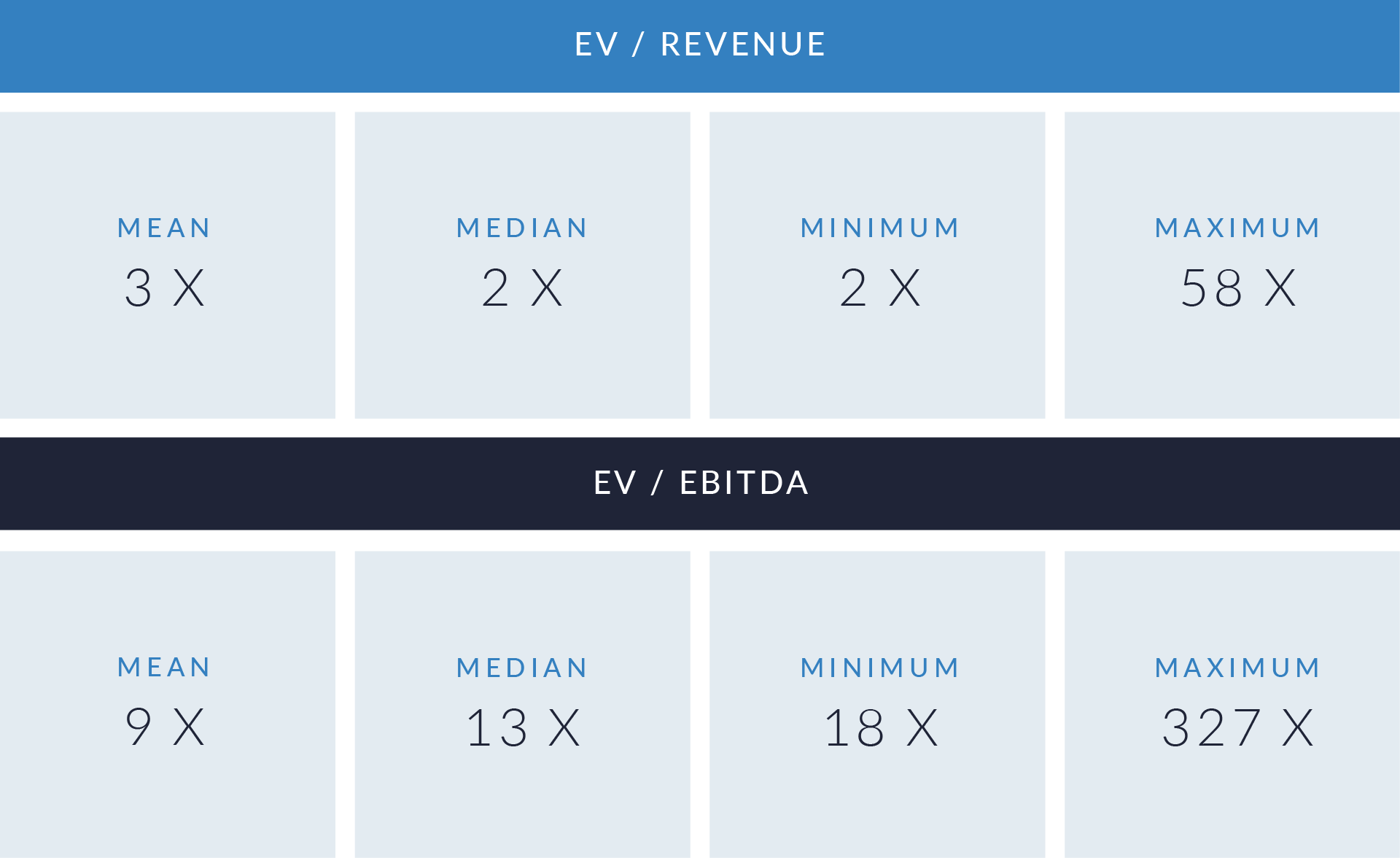

- Valuation multiples are based on a sample set of M&A transactions in the ESG and gamification and related sectors, using data collected on February 6, 2025.

- EV/revenue multiples range from 2x to 137x, while EV/EBITDA multiples vary from 18x to 328x. High-growth, technology-driven, and ESG-focused firms typically receive premium valuations, whereas traditional, low-growth companies show lower revenue and profitability multiples, reflecting investor preference for scalable, high-margin businesses with strong growth potential.

- EV/revenue multiples exceeding 50x or EV/EBITDA surpassing 100x indicate speculative investments, aggressive growth expectations, or firms with unique intellectual property advantages. Such valuations frequently appear in AI-driven businesses, fintech, ESG technology, sustainability-focused platforms, and gamification-driven engagement solutions, where demand for innovation, impact-driven business models, and digital transformation justifies exceptionally high pricing multiples.

- Most firms fall within an EV/revenue range of 2x to 10x and an EV/EBITDA range of 10x to 30x, aligning with historical industry benchmarks for established yet growing companies. This distribution suggests that investors balance risk and return by favoring companies with predictable cash flows, strong fundamentals, and moderate growth trajectories, particularly in digital transformation, enterprise SaaS, and sustainable business models.

Capital Markets Activities

The data highlights transaction trends, valuation metrics, and regional dynamics in the ESG and gamification sector. Rising demand for sustainability-driven business models, corporate engagement solutions, and impact-focused technologies have fueled M&A activity and shaped valuations. Investors are leveraging strategic acquisitions, private equity investments, and digital transformation initiatives to scale ESG solutions and gamification platforms. These trends are driving market consolidation, innovation, and the integration of sustainability and behavioral science into corporate strategies.

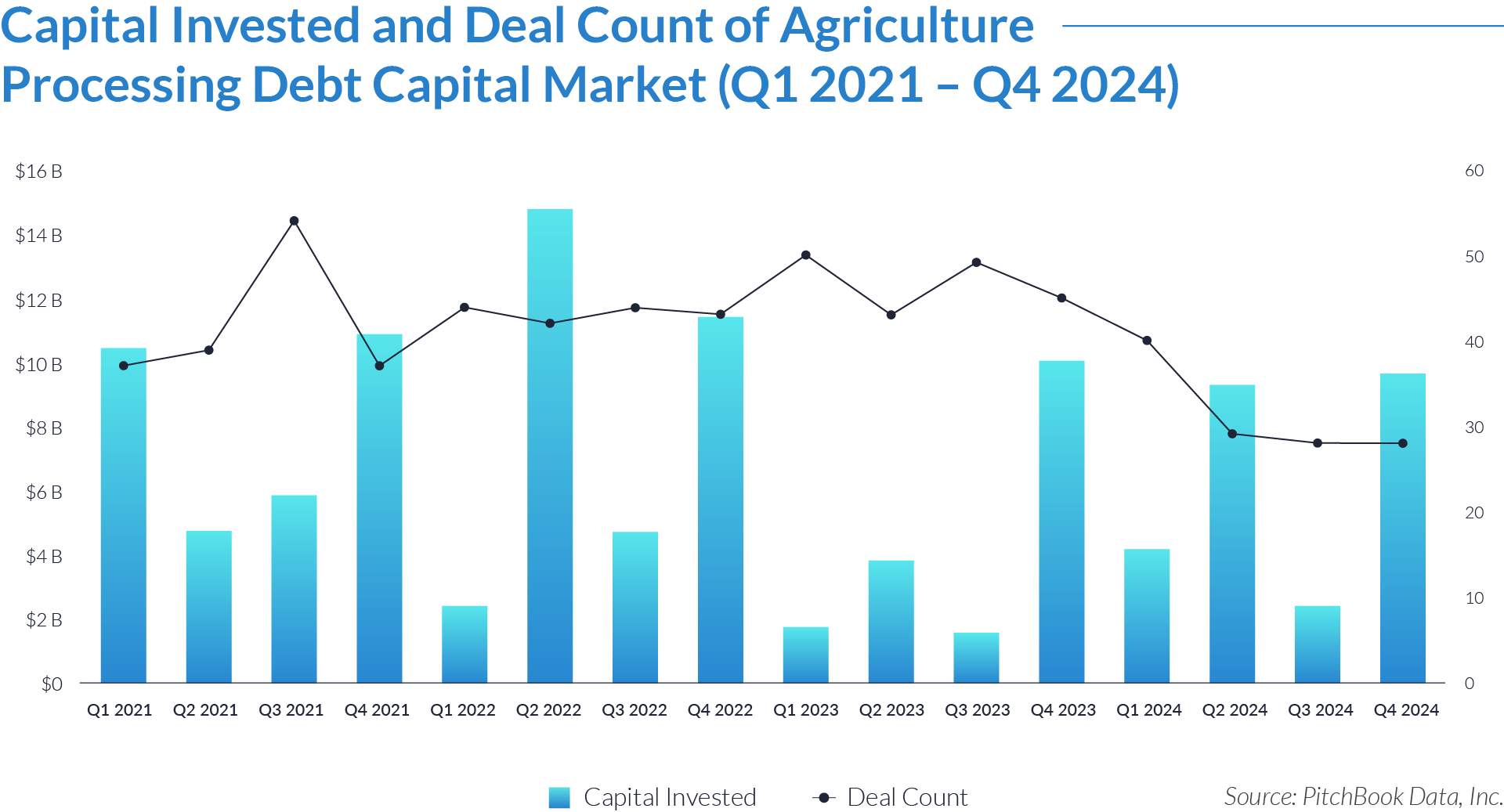

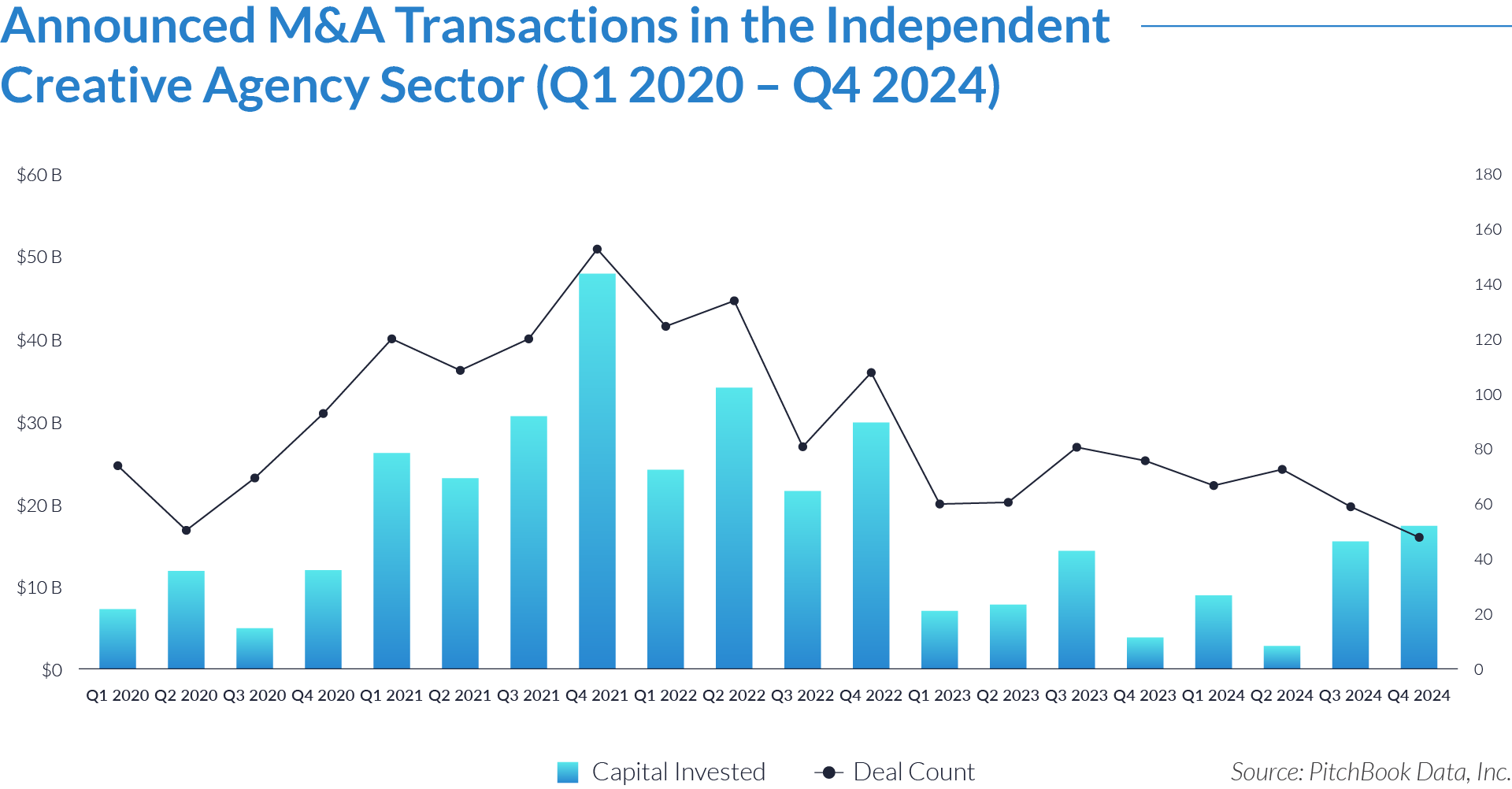

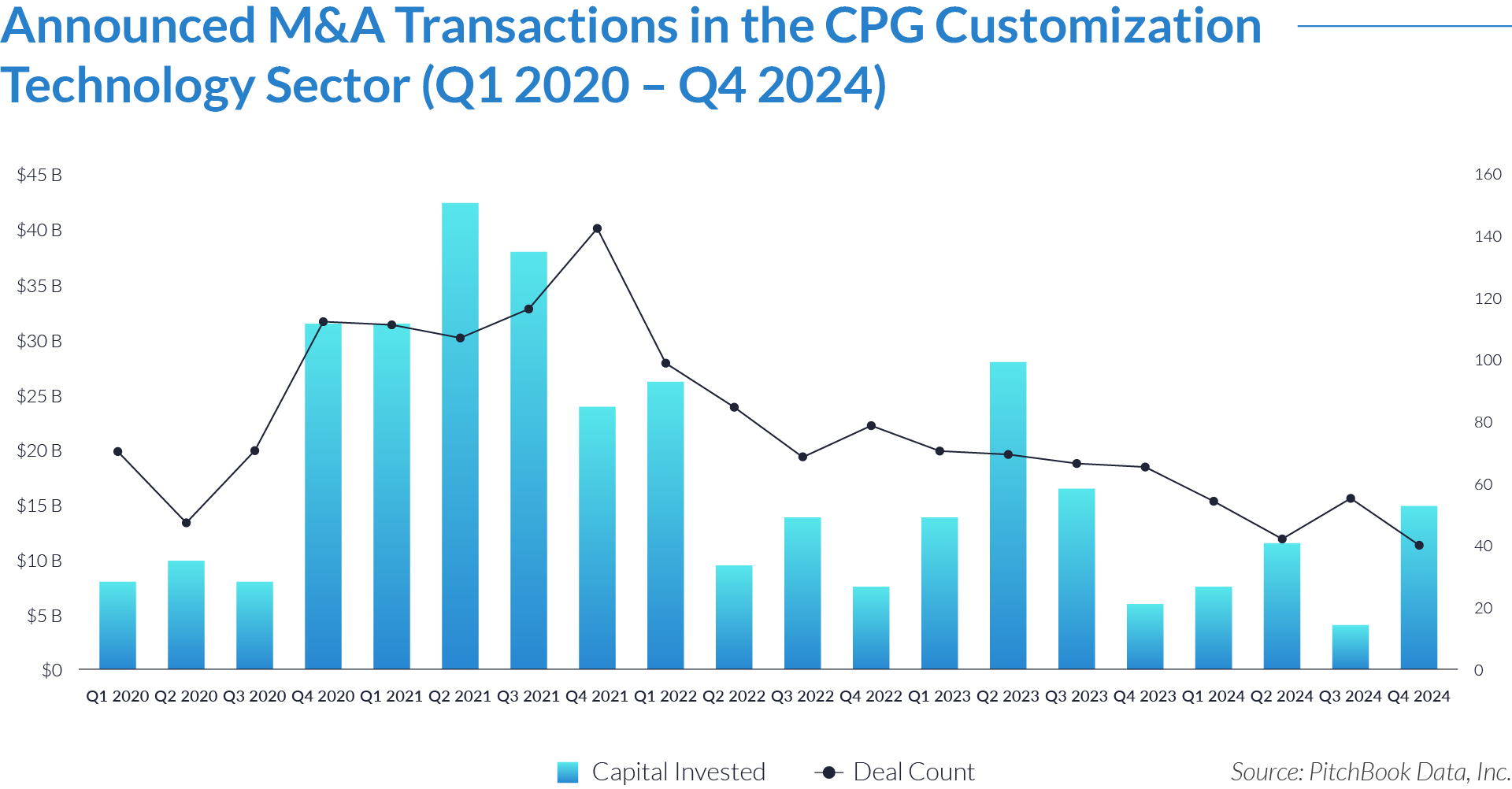

- Investors deployed $541 billion across 2,058 deals, demonstrating strong, long-term M&A activity in the ESG and gamification sector. Despite economic fluctuations, consistent deal flow reflects investor confidence, with private equity firms and strategic buyers driving market consolidation, technological integration, and sustainability-focused expansion. The sector remains attractive due to the rising demand for scalable, engagement-driven ESG solutions.

- Investment and deal count peaked in 2021 and early 2022, with Q4 2021 reaching $58 billion across 202 deals. Post-pandemic recovery, digital transformation, and sustainability-driven initiatives fueled acquisitions as buyers sought innovative platforms to enhance ESG engagement, behavioral science applications, and corporate sustainability strategies.

- Capital investment moderated in 2023, with Q3 reaching $9 billion across 79 deals as investors exercised caution amid macroeconomic uncertainty. However, 2024 saw renewed momentum, with Q3 and Q4 reaching $16 billion and $30 billion, driven by corporate confidence, private equity capital deployment, and strategic acquisitions in high-growth areas like AI, gamification, and sustainability solutions.

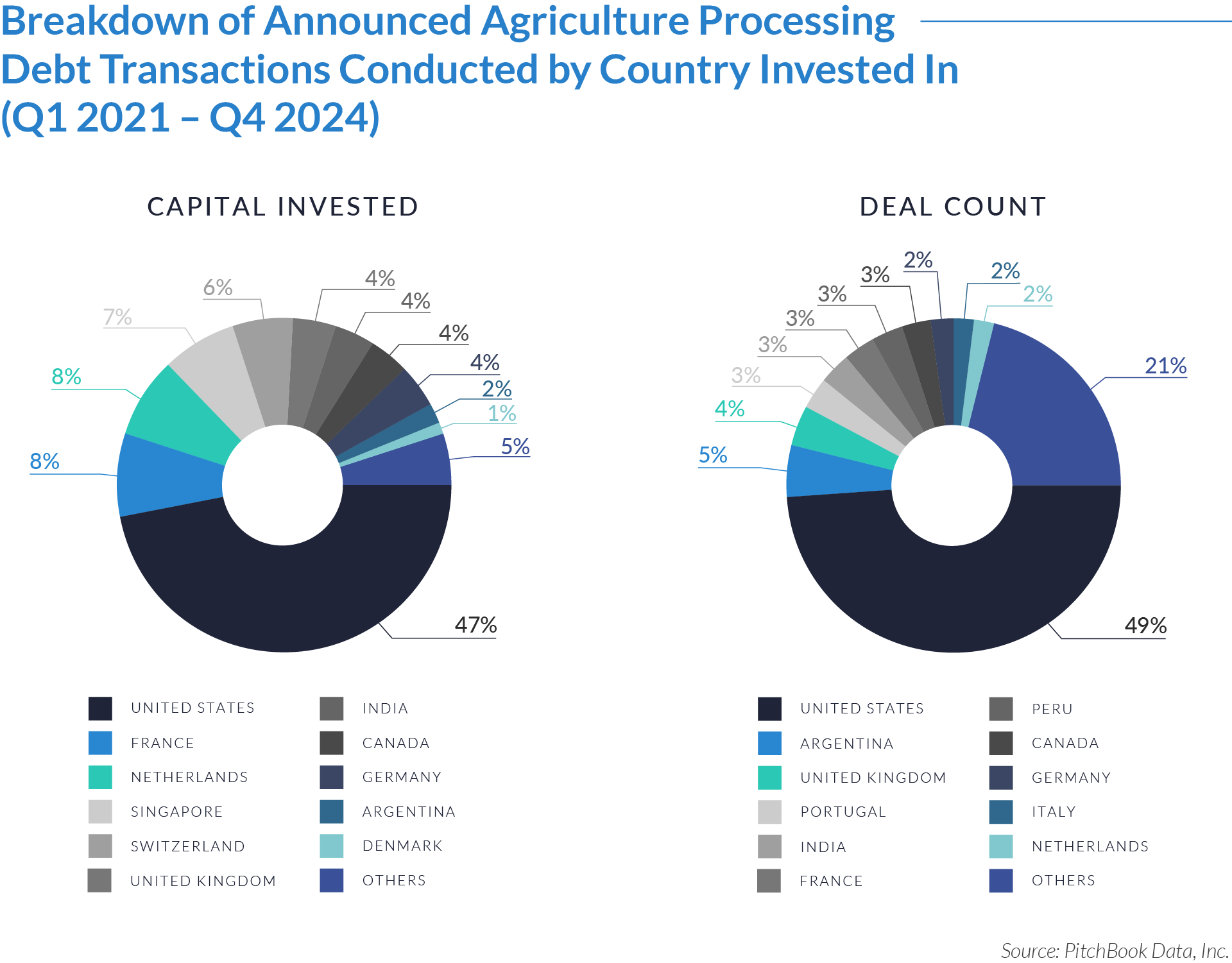

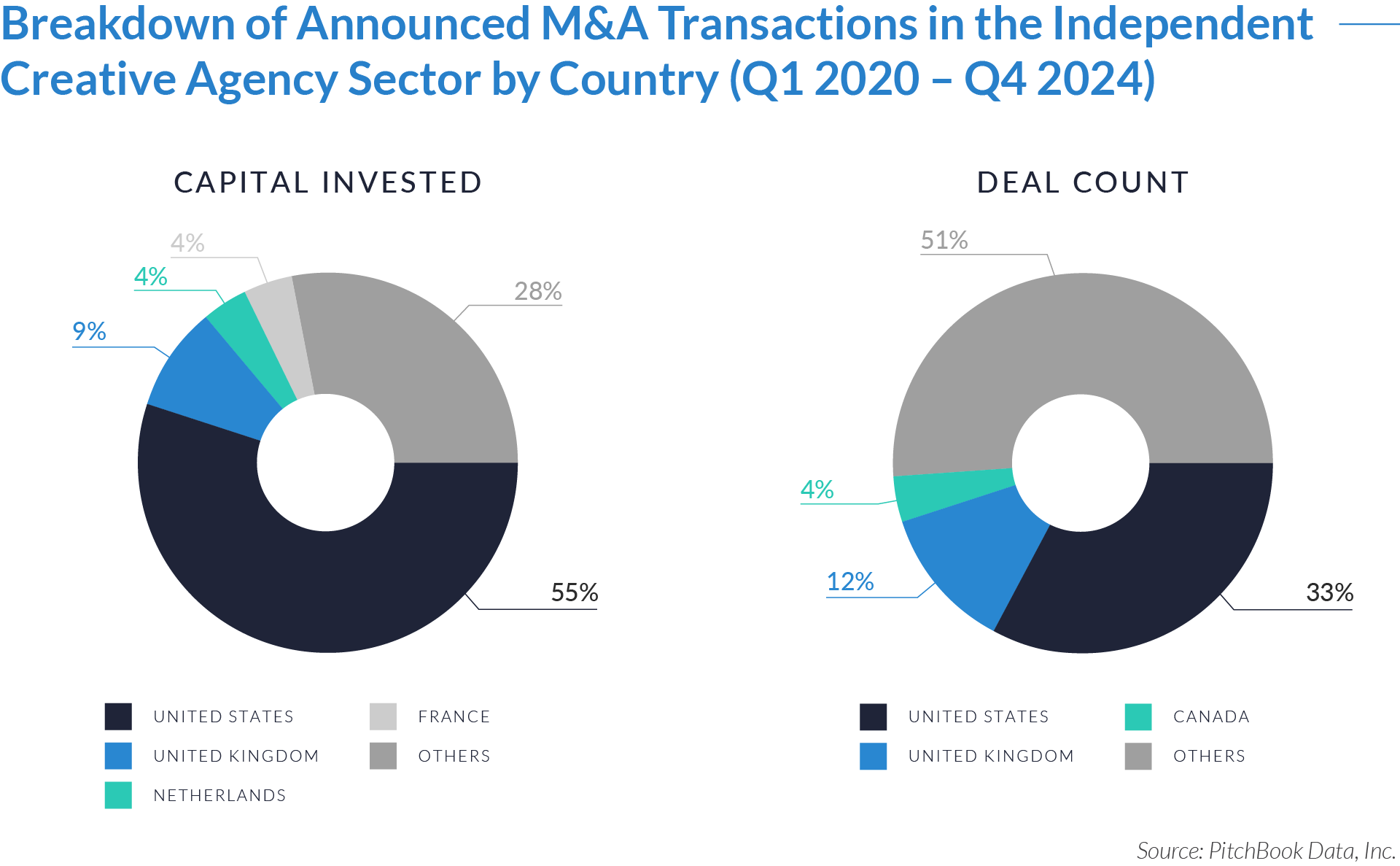

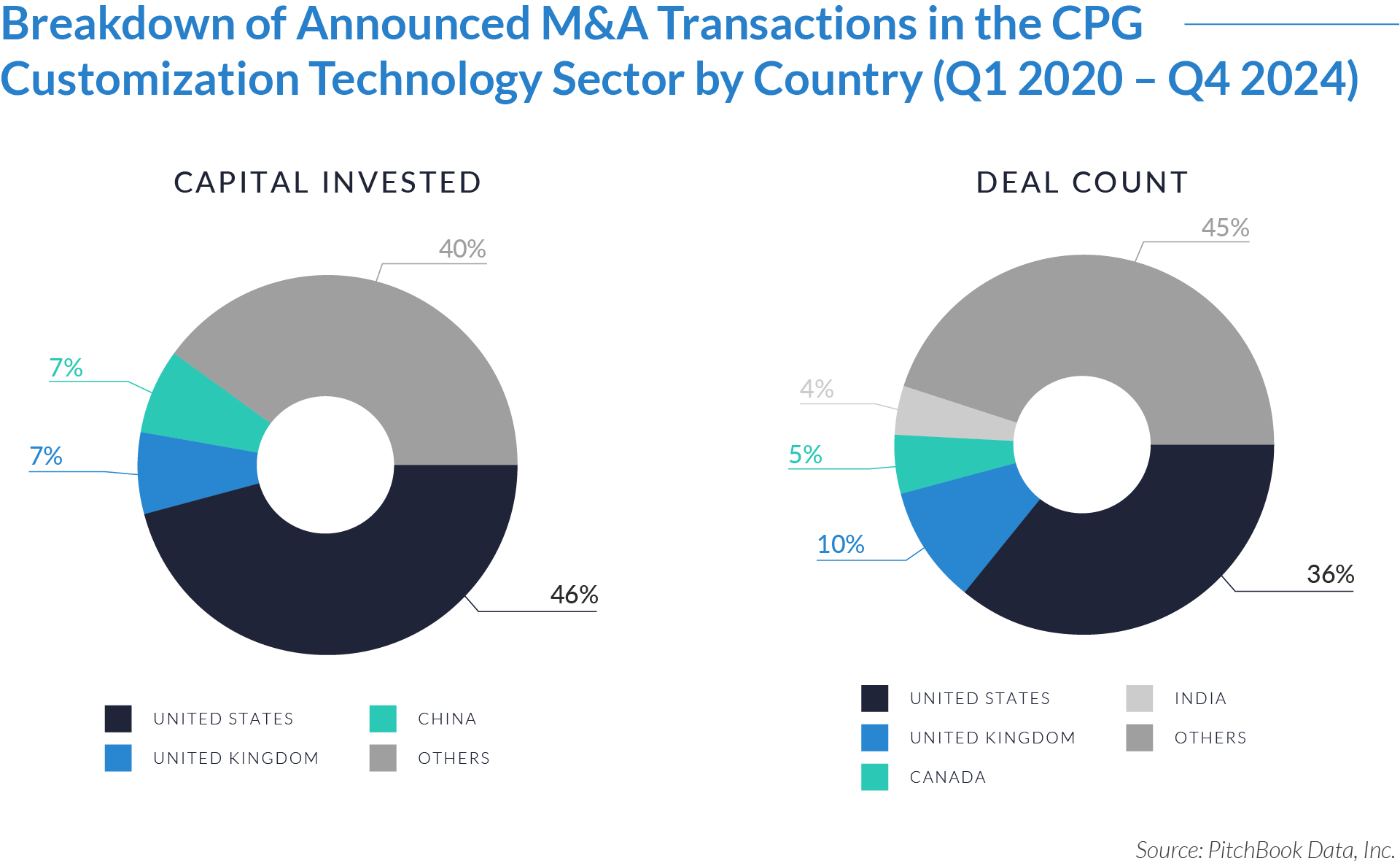

The graphs below present the geographic distribution of transactions, providing additional detail on regional trends and investment dynamics.

- US investors provided 40% of total capital, the highest share among all regions. However, they executed only 31% of total deals, indicating that they deployed a significant portion of their capital internationally, particularly in high-growth ESG and gamification markets.

- Investors outside the top three markets contributed 40% of total capital and executed 53% of deals, highlighting the global reach of ESG and gamification investments. This broad distribution suggests that investors from diverse regions are funding sustainability-driven businesses while directing capital into both emerging and established markets.

- UK investors contributed 12% of total capital and executed 11% of deals, showing a balanced investment approach. French investors provided 8% of capital but executed fewer deals, suggesting larger but less frequent transactions. Meanwhile, Canadian investors accounted for 5% of deals but did not appear among the top capital investors, indicating a focus on smaller-scale transactions.

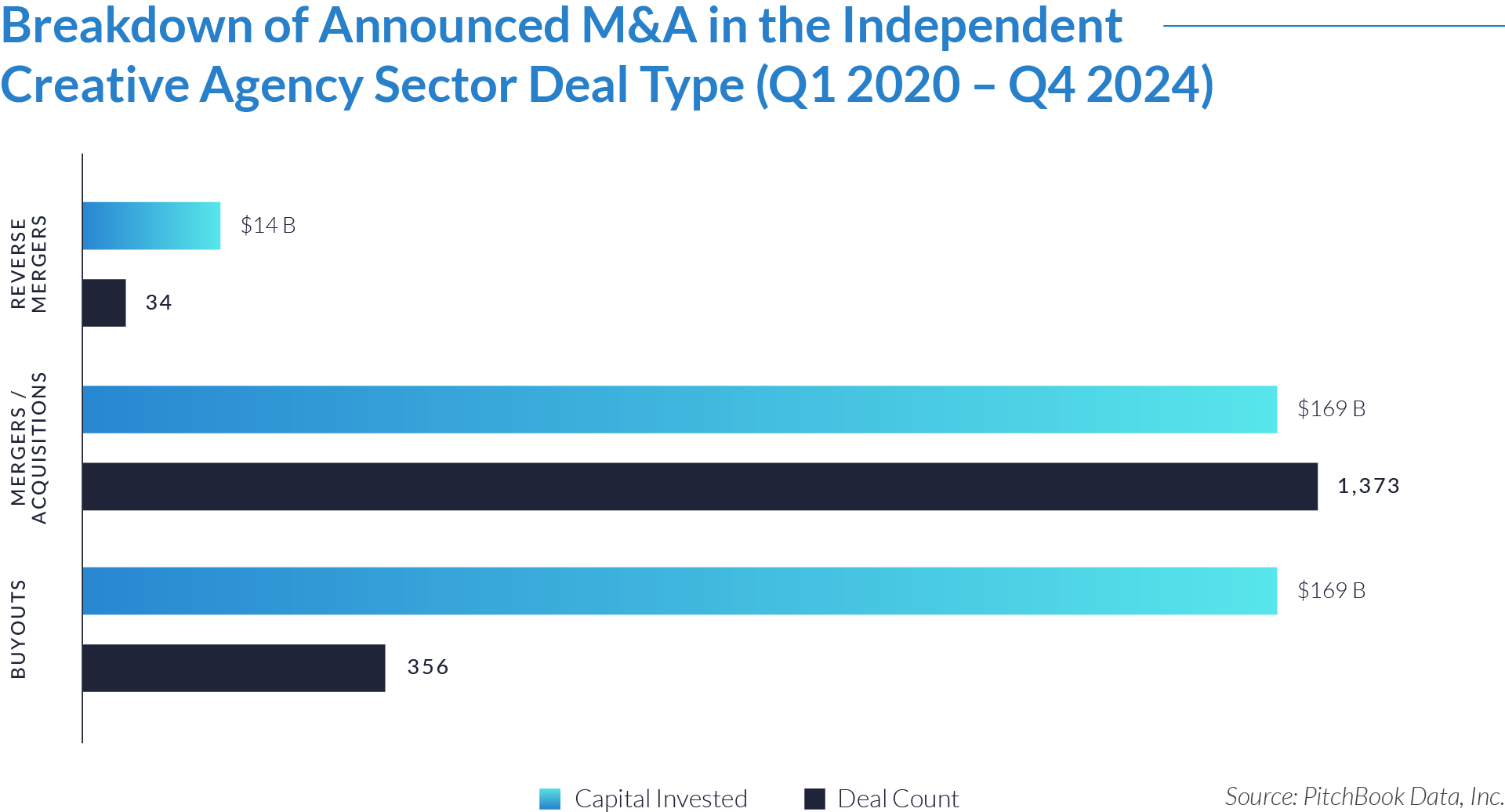

The deal-type dynamics below set the stage for understanding how capital flows and strategic priorities shape the ESG and gamification sector’s growth and landscape.

- Investors deployed $288 billion across 554 buyouts and $253 billion across 1,504 M&A transactions, applying a dual strategy of long-term operational control and market expansion. This approach demonstrates confidence in both financial restructuring and acquisition-driven growth within the ESG and gamification sector.

- PE firms concentrated buyout capital on businesses with strong cash flow, high margins, and long-term growth potential. These transactions enabled firms to optimize operations, enhance profitability, and drive value creation through strategic restructuring and efficiency improvements.

- Firms pursued 1,504 M&A deals, nearly three times the number of buyouts, to drive industry consolidation, integrate ESG-driven digital solutions, and expand sustainability initiatives. Companies leveraged acquisitions to enhance technology, broaden service offerings, and secure a competitive edge in the growing ESG and gamification market.

M&A Transactions Case Studies

Three key M&A transactions in the ESG and gamification sector highlight strategic expansion through technology integration, employee engagement, and sustainability-driven solutions. These acquisitions enhanced corporate social responsibility offerings, strengthened ESG engagement platforms, and leveraged gamification to drive behavioral change. Each transaction reflects the growing demand for purpose-driven business models, as investors and corporations prioritize scalable, high-impact solutions that align with sustainability goals and long-term value creation.

Case Study 01

WESPIRE

WeSpire is a US-based gamified employee engagement platform designed to support organizations in driving sustainability, social impact, and ESG initiatives. It enables companies to create interactive challenges, track employee participation, and promote sustainable behaviors through gamification, rewards, and behavioral science. Primarily used for corporate sustainability, DEI (diversity, equity, and inclusion), and well-being programs, WeSpire helps businesses measure, enhance, and optimize their ESG performance.

Transaction Structure

WeSpire was acquired by Bonterra, a social good software company that delivers technology solutions for nonprofits, corporations, and philanthropic organizations to advance social impact and corporate responsibility initiatives. The acquisition was structured as a leveraged buyout (LBO) by Apax Partners and Vista Equity Partners for an undisclosed amount.

Market and Customer Segments Combination

Bonterra’s acquisition of WeSpire expanded its presence in ESG, employee engagement, and social impact. Corporations gained access to gamified ESG solutions, while nonprofits benefited from behavioral science-driven engagement tools to enhance stakeholder participation. HR and sustainability leaders leveraged gamification and analytics to promote a sustainable corporate culture. This integration strengthened Bonterra’s position in the corporate sustainability market by offering a comprehensive ESG engagement platform.

Acquisition Strategic Rationale

The acquisition enhanced Bonterra’s ESG and sustainability solutions, reinforcing its CSR offerings and positioning it as a leader in sustainability engagement technology. WeSpire’s gamification tools improved employee engagement by driving behavioral change through challenges and rewards. The deal differentiated Bonterra in the ESG tech space, aligned with Apax and Vista’s SaaS investment strategy, and created cross-selling opportunities, supporting long-term growth.

Case Study 02

ALAYA

Alaya is a Swiss-based platform that enables organizations to engage employees in sustainability, social impact, and well-being initiatives through gamification. It provides customizable challenges, rewards, and tracking tools to encourage participation in activities such as volunteering, sustainability efforts, and charitable giving. Designed to enhance employee engagement, Alaya supports corporate social responsibility and ESG goals, fostering a positive workplace culture and measurable impact.

Transaction Structure

Benevity acquired Alaya through a leveraged buyout with financial backing from Hg Capital (UK), TPG, The Rise Fund, and other investors for an undisclosed amount.

Market and Customer Segments Combination

Benevity’s acquisition of Alaya expanded its ability to serve corporations and organizations focused on employee engagement in sustainability, social impact, and well-being initiatives. By integrating Alaya’s gamification and tracking tools, Benevity enhanced its corporate social responsibility and ESG solutions. The combined offering catered to global enterprises seeking to foster purpose-driven behaviors and workplace engagement.

Acquisition Strategic Rationale

The acquisition strengthened Benevity’s international presence and corporate-purpose solutions. Alaya’s gamified platform enhanced Benevity’s capabilities in employee engagement and sustainability, enabling companies to drive volunteering, sustainability initiatives, and charitable giving more effectively. The deal also positioned Benevity to meet the rising demand for comprehensive CSR and ESG tools across diverse markets.

Case Study 03

JOULEBUG

JouleBug is a US-based mobile app that gamifies sustainability by encouraging users to adopt eco-friendly habits through challenges and rewards. It helps individuals and organizations track and improve their environmental impact in an engaging and interactive way.

Transaction Structure

Carimus, a technology and creative services company, acquired JouleBug for $150,000.

Market and Customer Segments Combination

Carimus’s acquisition of JouleBug combined gamified sustainability with technology and creative services. JouleBug’s focus on promoting eco-friendly behaviors complemented Carimus’s expertise in engagement solutions. The integration expanded offerings for individuals, organizations, and businesses seeking to track and promote sustainability efforts through interactive and engaging experiences.

Acquisition Strategic Rationale

The acquisition enhanced Carimus’s sustainability-focused engagement tools by incorporating JouleBug’s gamified solutions for employee engagement and corporate sustainability. This expansion enabled Carimus to support businesses in fostering eco-friendly behaviors while strengthening its position in the growing sustainability market. With rising demand for green technology and sustainable practices, the acquisition positioned Carimus for growth across both consumer and enterprise sectors.

The ESG and gamification sector has seen strong M&A activity as demand for sustainability-focused solutions and engagement-driven technologies grows. Investors prioritize scalable, high-margin companies that integrate AI, behavioral science, and ESG principles. As the market evolves, strategic consolidations and cross-border investments will drive the next phase of growth, establishing ESG and gamification as essential to corporate innovation and long-term value creation.

Source: PR Newswire, The Non-Profit Times, Carimus, Benevity, GlobeNewswire, Pitchbook Data.