Enterprise IoT Device Solutions Sector M&A Transactions and Valuations

Enterprise IoT Device Solutions Sector M&A Transactions and Valuations

Between 2020 and early 2025, investors increased their activity in the enterprise IoT device solutions sector, responding to advancements in device intelligence, connectivity, and edge-to-cloud integration. Strategic and financial acquirers focused on companies that offer embedded systems, scalable platforms, and real-time analytics capabilities for industrial automation, energy, healthcare, transportation, and smart infrastructure. These acquirers pursued M&A opportunities to expand device portfolios, enhance platform interoperability, and address rising enterprise demand for secure, connected solutions.

This report analyzes transaction activity and valuation dynamics in the sector from Q2 2020 to Q1 2025. It assesses strategic trends, capital deployment, and pricing benchmarks such as EV/revenue and EV/EBITDA multiples. Key transactions—such as Semtech’s acquisition of Sierra Wireless, TSC Auto ID’s purchase of Bluebird, and Dura Software’s acquisition of Moki—highlight strategic priorities including vertical integration, SaaS-device convergence, and mobile edge computing. The analysis presents core themes and valuation patterns relevant to acquirers and investors operating in this fast-evolving market.

Key Market Trends in the Enterprise IoT Device Solutions Sector

This section presents market trends and strategic factors that contribute to growth, acquisition activity, and valuation changes in the sector. It outlines enterprise spending patterns, adoption of AI and advanced connectivity, and operational drivers influencing consolidation and post-transaction outcomes.

Several key trends currently drive M&A activity in the sector. As enterprise IoT spending increases, acquirers target scalable platforms and hardware providers to meet rising market demand. The integration of AI into IoT (AIoT) has intensified interest in companies delivering intelligent, data-driven solutions—particularly for predictive maintenance, real-time analytics, and automation. Advancements in 5G, satellite, and long-range wireless connectivity have increased the attractiveness of companies with robust communication capabilities. Firms that offer both embedded hardware and integrated cloud systems are emerging as preferred acquisition targets due to their ability to deliver end-to-end enterprise solutions. Consolidation has also accelerated in response to strong demand from industrial and infrastructure sectors, including energy, transportation, and utilities. In addition, acquirers favor companies with interoperable, standards-compliant platforms that support integration across complex enterprise environments.

Strategic shifts in the sector continue to shape M&A activity. Acquirers pursue targeted transactions to broaden product offerings and access new markets, while delivering increasingly diversified portfolios that integrate embedded hardware with full system solutions. The drive to expand gross margins motivates efficiency-oriented acquisitions, particularly among companies focused on high-growth enterprise verticals such as energy, healthcare, and industrial automation. Many firms also diversify revenue streams by reducing reliance on single large customers. Post-acquisition, transactions often enhance revenue and strengthen competitive positioning within the sector.

- Valuation multiples are based on a sample set of M&A transactions in the enterprise IoT device solutions sector using data collected on July 1, 2025.

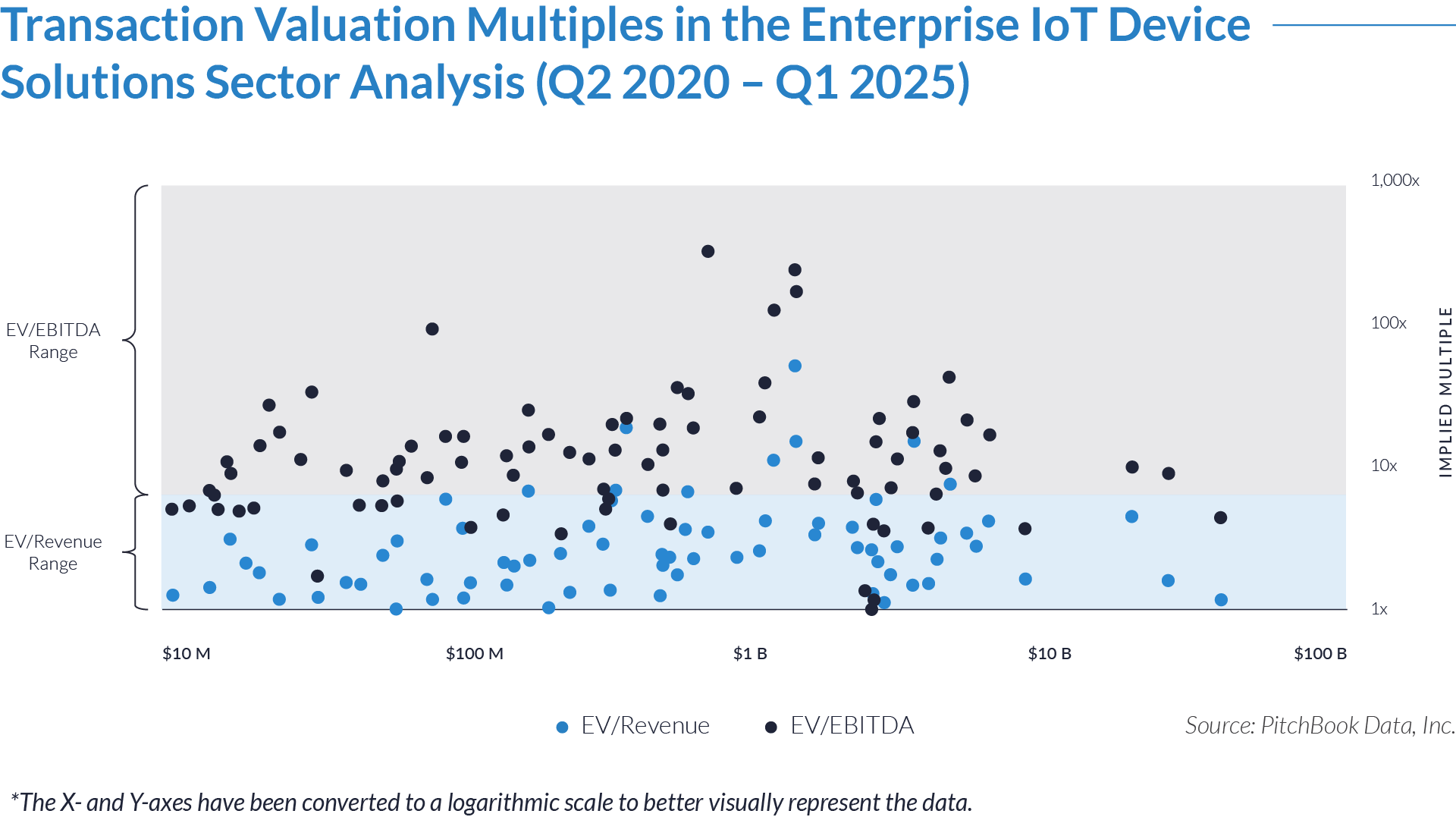

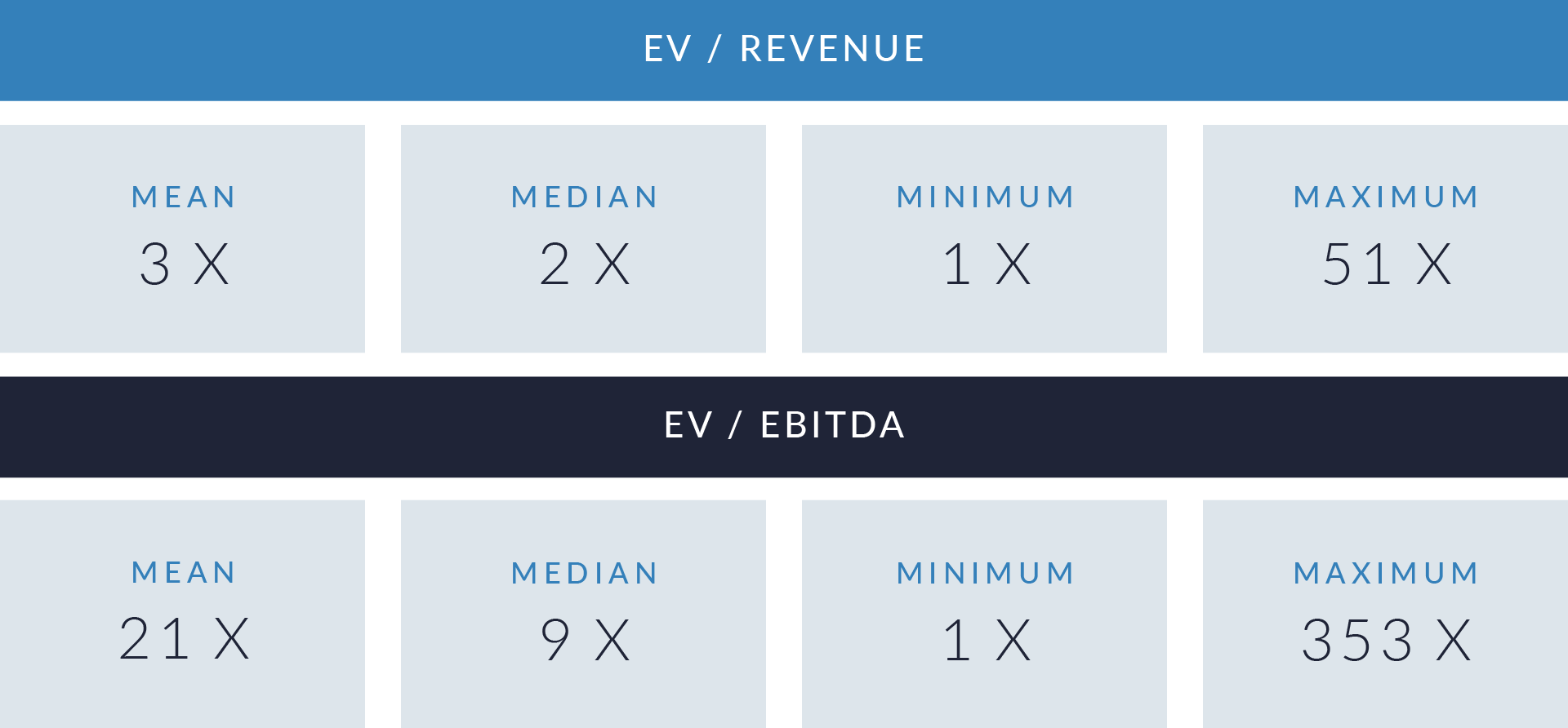

- EV/revenue multiples range from 1x to 51x, and EV/EBITDA multiples span from 1x to 353x. This wide dispersion reflects buyers’ willingness to pay high premiums for targets with strong recurring revenue, high scalability, or strategic ecosystem fit, even when profitability remains limited.

- A small number of large transactions—each exceeding $10 billion—represent a significant portion of total sector value. These mega-deals typically show lower EV/revenue multiples (1x–5x), consistent with mature revenue profiles and consolidation strategies. In contrast, smaller transactions often trade at higher multiples (10x–55x) to reflect growth and innovation potential.

- While many targets remain in early monetization stages—as seen in numerous deals with EV/EBITDA multiples below 10x—select companies achieve premium valuations when scalable revenue aligns with even moderate profitability (e.g., 55x revenue / 266x EBITDA). These cases show that strong margins still drive valuation upside for high-impact strategic assets.

Capital Markets Activities

The data highlights transaction trends, valuation metrics, and investment activity in the enterprise IoT device solutions sector. Rising demand for connected devices and enterprise IoT infrastructure drives M&A in smart device management, sensor technologies, and IoT-enabled asset tracking. Buyers target scalable platforms, embedded security, real-time analytics, and device interoperability to enhance digital transformation. Transactions facilitate integration across hardware, software, and cloud connectivity, supporting applications in smart buildings, industrial automation, and predictive maintenance.

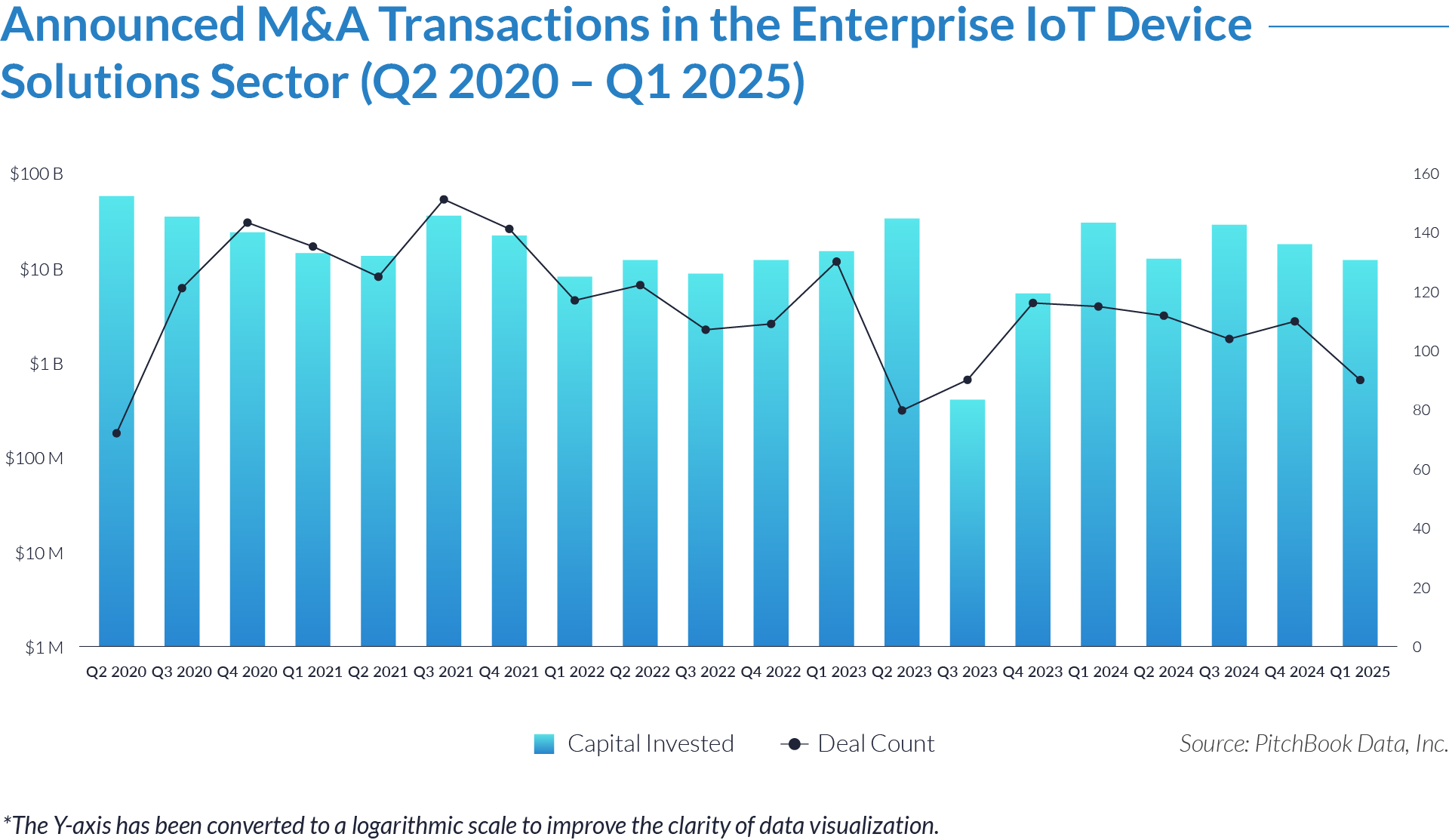

- Over the 20-quarter period analyzed, companies invested approximately $376 billion across 2,290 transactions, reflecting a consistently active M&A environment in the Enterprise IoT Device Solutions sector and sustained strategic engagement from both corporate and financial buyers.

- Quarterly capital deployment varied significantly, ranging from a peak of $54 billion in Q2 2020 to a low of $403 million in Q3 2023. This fluctuation likely reflects changes in macroeconomic conditions, strategic priorities, and transaction sizes.

- High transaction volume did not always coincide with high investment totals. For example, Q4 2020 recorded 143 deals but only $22 billion in capital invested, while Q2 2020 saw just 72 deals yet attracted the highest investment of $54 billion. These discrepancies indicate a diverse transaction landscape with both smaller tactical acquisitions and larger strategic deals.

- After a temporary dip in capital deployment during Q3 and Q4 2023, investment levels rebounded to $29 billion in Q1 2024 and remained strong in subsequent quarters. This upward trend reflects renewed strategic focus and sustained buyer confidence in the sector.

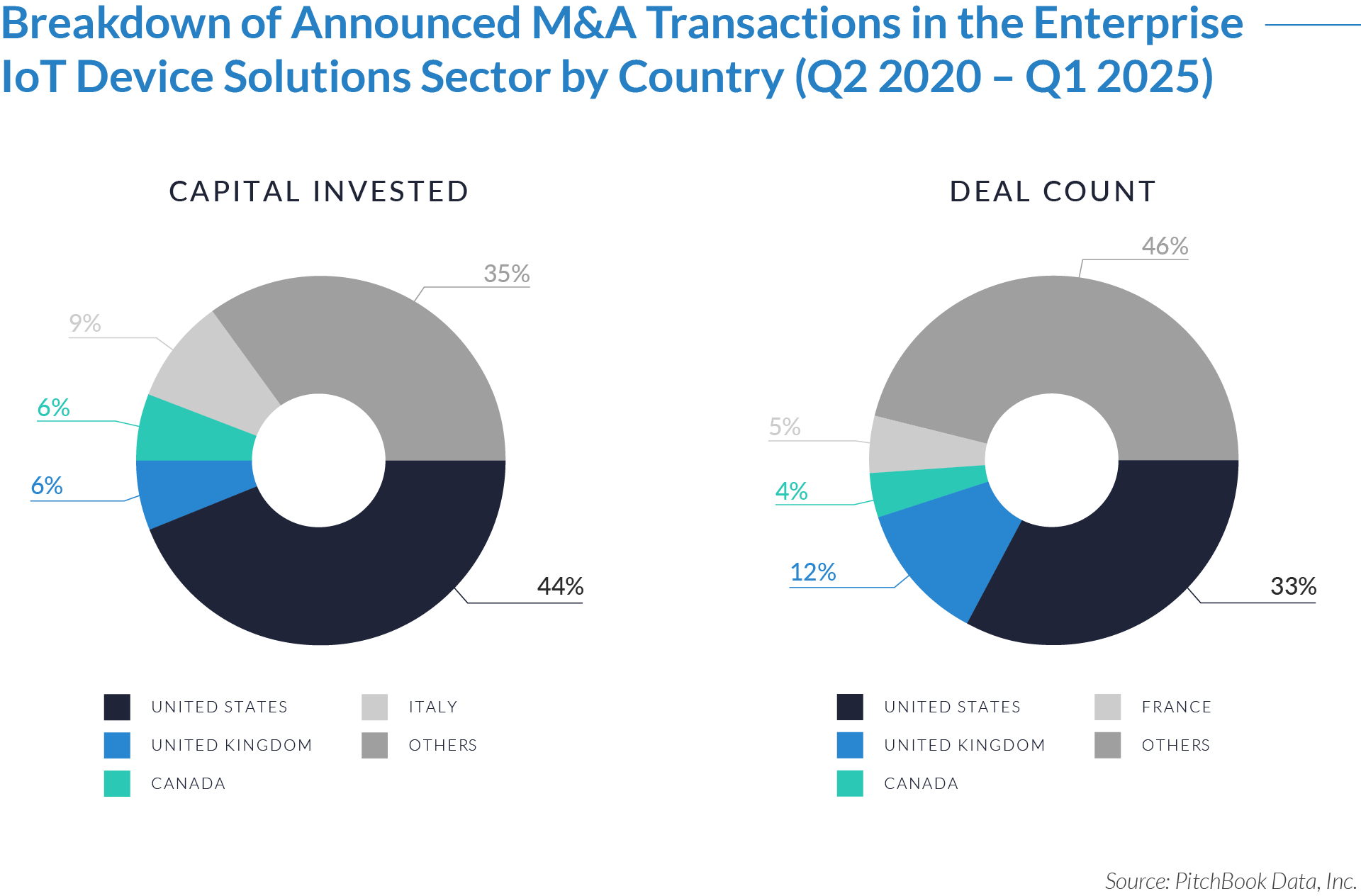

The graphs below present the geographic distribution of transactions, providing additional detail on regional trends and investment dynamics.

- The United States accounts for the largest share of investments, originating 44% of total capital and receiving 33% of total deals. This concentration reflects strong domestic investment activity and reinforces the US role as a key driver of the global market.

- Italy, the United Kingdom, France, and Canada contribute notable portions of both capital origination and deal activity. Italy accounts for 9% of capital, while the UK and Canada each contribute 6%. On the deal side, the UK represents 11% of transactions, followed by France (5%) and Canada (4%). These countries continue to attract investment based on their industrial strength, technological infrastructure, and favorable regulatory conditions.

- Investors executed 46% of the deals in international and emerging markets, with 34% of total capital also originating from these regions. This distribution reflects a growing investor focus on geographic diversification and interest in strategic opportunities beyond traditional markets.

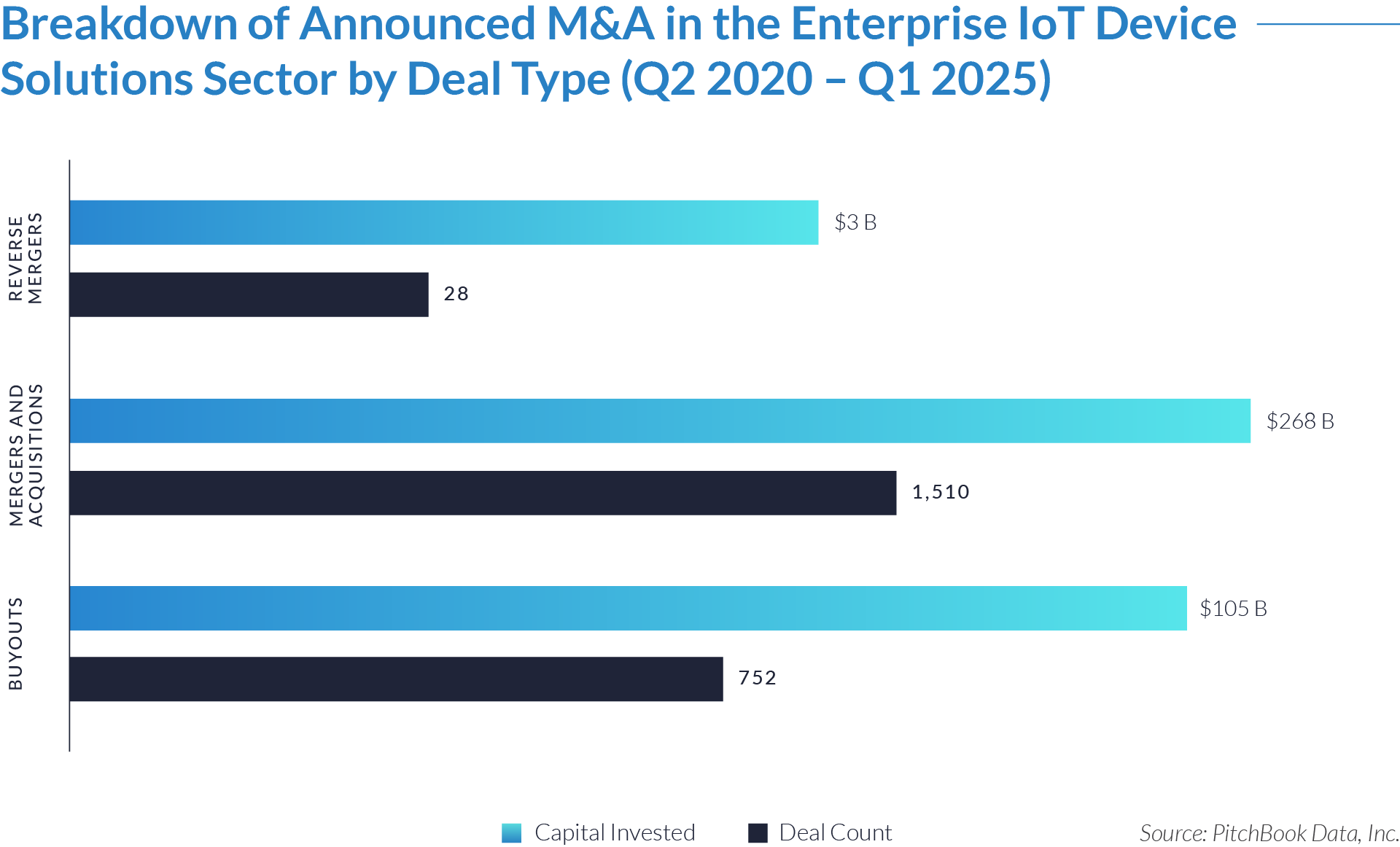

The deal-type dynamics below set the stage for understanding how capital flows and strategic priorities shape the enterprise IoT device solutions sector growth and landscape.

- Companies completed 1,510 mergers and acquisitions, deploying $268 billion—the largest share of both capital and deal volume. These transactions demonstrate active consolidation and strategic efforts to expand scale and integrate technologies across the IoT sector.

- Strategic and financial buyers executed 752 buyouts, investing $105 billion. These buyouts align with targeted investment strategies, particularly by private equity firms and financial sponsors aiming to enhance operational performance or capture growth opportunities in high-potential IoT assets.

- Buyers conducted 28 reverse mergers, totaling $3 billion. These transactions represent a focused use of reverse mergers to achieve quicker public listings or streamlined market entry, rather than indicating a broader trend.

M&A Transactions Case Studies

Three strategic transactions in the sector highlight growing demand for integrated platforms, scalable connectivity, and device management. The acquired companies offered enterprise-grade hardware, mobile computing, and cloud-based orchestration, along with strong customer bases and recurring revenue. Acquirers used these deals to expand solution portfolios, improve interoperability across networks, and strengthen positions in high-growth verticals such as logistics, healthcare, and smart infrastructure. These transactions reflect broader trends in platform unification, service monetization, and convergence within the IoT ecosystem.

Case Study 01

SIERRA WIRELESS

Sierra Wireless, now a subsidiary of Semtech, provides end-to-end cellular IoT solutions that integrate hardware, global connectivity, and cloud-based device management. The company manufactures embedded wireless modules, rugged routers, and gateways, along with SIM services that enable secure connections across 2G, 3G, 4G, 5G, and LPWAN networks. Its cloud platforms allow enterprises to onboard, configure, and monitor IoT devices at scale. Sierra Wireless serves industries such as automotive, industrial, utilities, public safety, and healthcare, enabling efficient deployment and management of large connected device fleets.

Transaction Structure

Semtech Corporation acquired Sierra Wireless in an all-cash transaction for more than $1 billion.

Market and Customer Segments Combination

The acquisition combined complementary market segments and customer bases. Sierra Wireless brought strong capabilities in enterprise cellular IoT hardware, fleet and industrial device deployments, and managed connectivity services. Semtech contributed its established LoRa ecosystem, extending the combined portfolio into low-power, wide-area IoT applications. The integration enabled the company to serve a wider range of customers, including enterprises, OEMs, utilities, and municipalities seeking scalable connectivity solutions across both high-bandwidth cellular and low-power networks.

Acquisition Strategic Rationale

The acquisition aimed to establish a unified IoT platform by integrating device hardware, cloud services, and diverse connectivity technologies under a single provider. The combination allowed Semtech to cross-sell LoRa and cellular solutions, expand its global footprint, and support innovation in edge-to-cloud services. The deal positioned Semtech to meet growing IoT demand in sectors such as smart infrastructure, logistics, and industrial automation. Additionally, the deal was expected to generate operational synergies and enhance Semtech’s recurring revenue through managed services and subscription-based models.

Case Study 02

BLUEBIRD

Bluebird Inc. is a global provider of rugged mobile computing and IoT solutions with over 25 years of experience. The company designs and manufactures enterprise-grade devices such as industrial handheld computers, rugged tablets, mobile payment terminals, barcode and RFID readers, and interactive kiosks. Bluebird serves a broad range of sectors, including retail, logistics, transportation, manufacturing, healthcare, finance, and government. It also offers its proprietary BOS™ software suite, which supports secure device provisioning, fleet management, push-to-talk communication, and payment processing—enabling streamlined deployment and management of large mobile device fleets.

Transaction Structure

TSC Auto-ID Technology Co. acquired approximately 96% of Bluebird for approximately $85 million.

Market and Customer Segments Combination

The acquisition combined TSC’s capabilities in barcode printers, label solutions, and auto-ID systems with Bluebird’s expertise in rugged mobile computing and enterprise mobility. This integration allowed the companies to serve a wider customer base across industries such as retail, transportation, field services, logistics, and manufacturing. Together, they offered comprehensive hardware and software solutions for asset tracking, workforce automation, and payment processing.

Acquisition Strategic Rationale

The transaction expanded TSC’s product portfolio, strengthened its position in the enterprise mobility segment, and created new cross-selling opportunities. By incorporating Bluebird’s rugged device platforms and software suite into its global distribution network, TSC enhanced its capacity for innovation and broadened its market reach.

Case Study 03

MOKI

Moki, LLC (formerly MokiMobility) provides a cloud-based mobile device management (MDM) platform that enables organizations to convert iOS, Android, and BrightSign devices into dedicated kiosks, point-of-sale terminals, or digital signage. The platform supports remote deployment, configuration, lockdown, and monitoring of large device fleets, ensuring secure, single-purpose use across sectors such as retail, hospitality, healthcare, and transportation.

Transaction Structure

Dura Software acquired MokiMobility through an all-cash transaction. The purchase price was not disclosed. The acquisition resulted in full ownership transfer, and Moki now operates as a wholly owned subsidiary of Dura.

Market and Customer Segments Combination

The acquisition combined Moki’s expertise in kiosk and single-purpose device management with Dura Software’s portfolio of specialized enterprise SaaS companies. This integration enabled Dura to expand its reach across retail, restaurant, and healthcare sectors, serving customers that required secure device control and large-scale operational efficiency.

Acquisition Strategic Rationale

The transaction aimed to increase recurring subscription revenue, create cross-selling opportunities for complementary SaaS offerings, and strengthen Dura’s presence in the enterprise device management space by leveraging Moki’s established platform and customer base.

M&A activity in the enterprise IoT device solutions sector remained strong over the past five years, driven by sustained investment in intelligent hardware, device management platforms, and integrated connectivity. Strategic buyers targeted companies with recurring revenue models, embedded AI capabilities, and diversified customer bases. Financial sponsors pursued scalable platforms with strong unit economics and potential for margin expansion. Valuation multiples varied significantly, influenced by company maturity, growth outlook, and relevance within the broader IoT ecosystem. Looking ahead, rising demand for real-time data, automation, and cross-platform integration is expected to maintain M&A momentum as buyers seek strategic assets to accelerate digital transformation across enterprise sectors.

Source: Semtech, Startups San Antonio, TSC, Bluebird, Pitchbook Data.