Promotional Products and Branded Merchandise Sector M&A Transactions and Valuations

Promotional Products and Branded Merchandise Sector M&A Transactions and Valuations

The promotional products and branded merchandise sector includes companies that design, source, decorate, and distribute customized goods, primarily apparel, textiles, and hard goods, used to enhance brand visibility, customer loyalty, and employee engagement. Growth is driven by e-commerce integration, sustainable materials, premium product design, and recurring corporate spending on marketing, events, and recognition programs.

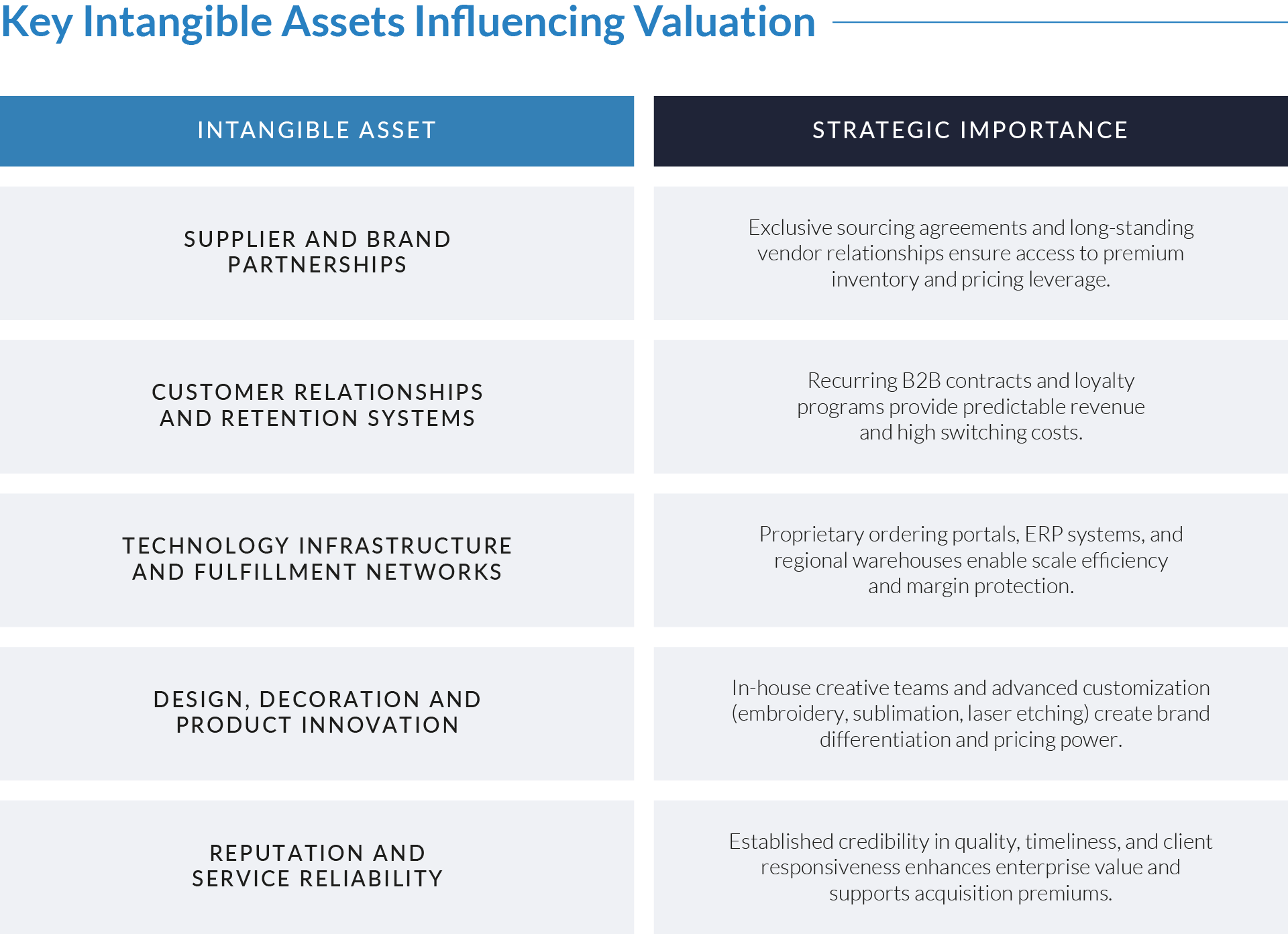

M&A activity from Q4 2020 to Q3 2025 reflects the sector’s shift toward digital enablement, automation, and vertical integration. Valuation dispersion continues to widen between commodity distributors and premium, tech-enabled suppliers. Intangible assets such as supplier relationships, digital fulfillment systems, and brand equity remain key drivers of premium transaction multiples.

Key transactions include S&S Activewear’s acquisition of Alphabroder, HALO Branded Solutions’ acquisition of Think It Then Ink It, and Pro Towels’ acquisition of Kanata Blanket, illustrating how acquirers pursue scale, product diversification, and service differentiation to strengthen market leadership.

EXHIBIT 1

Sector Definition and End-Market Segmentation

Sector Definition

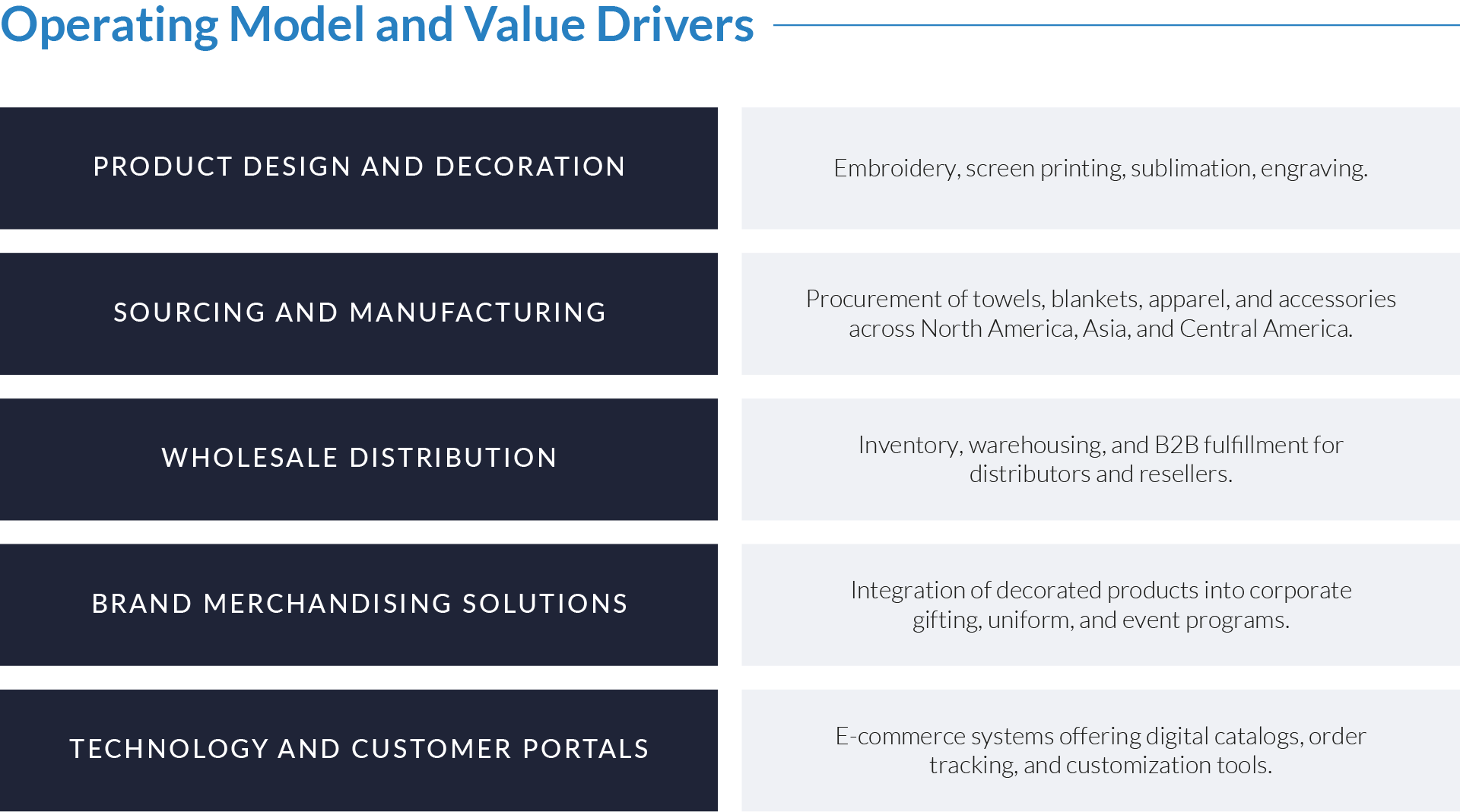

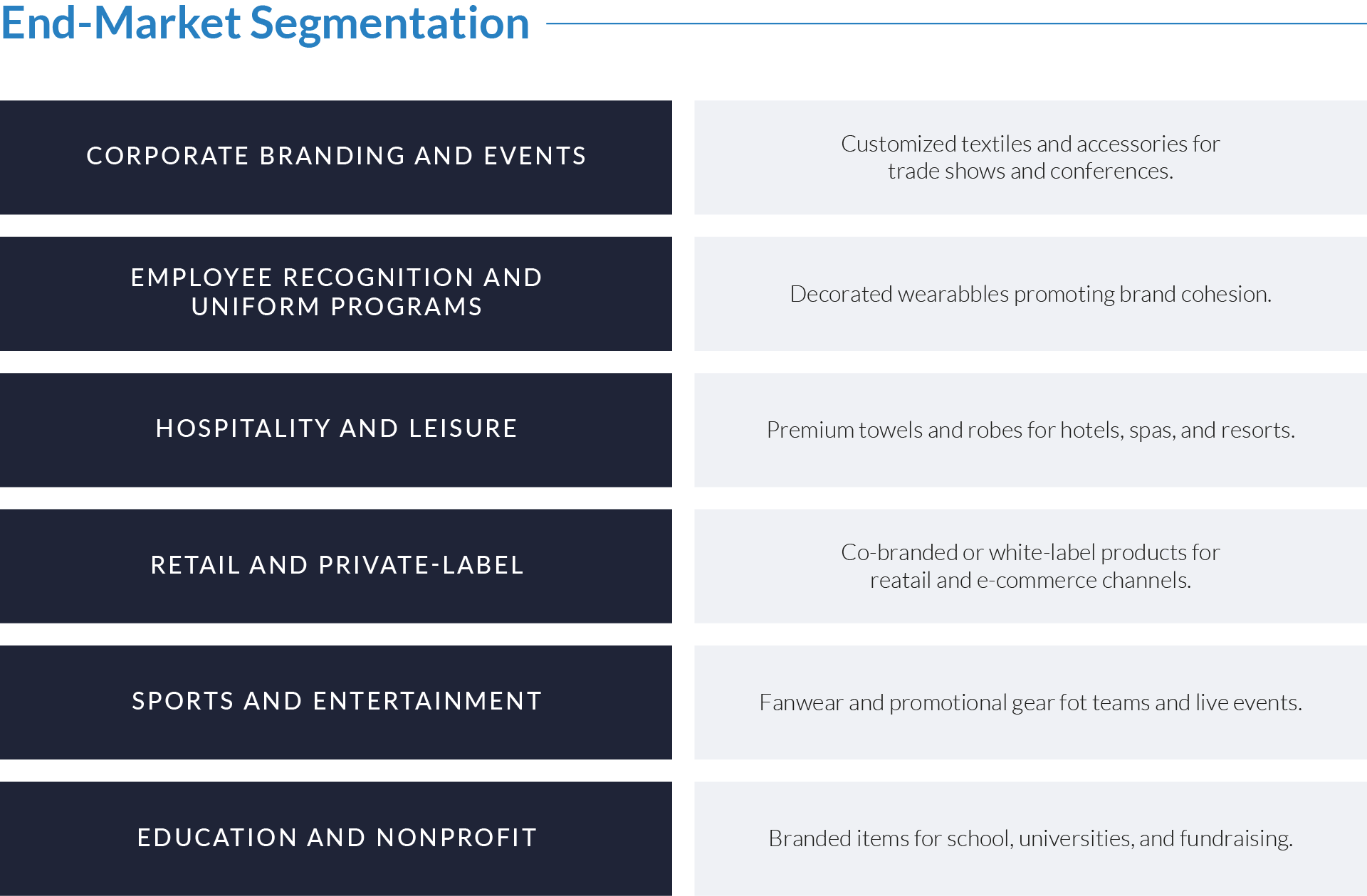

The sector comprises suppliers, wholesalers, and distributors of logoed goods that support corporate identity, customer engagement, and employee programs. Participants range from vertically integrated manufacturers to creative distributors and technology-enabled brand solution providers. Most operate through B2B channels serving corporate, institutional, and event-driven clients, emphasizing speed, customization, product quality, and reliable fulfillment.

Source: PPAI, 2024 U.S. Promotional Products Sales Volume Report (Feb 2025); IBISWorld, Promotional Products in the U.S. Industry Report (Jun 2025); Advertising Specialty Institute (ASI), Promotional Products Industry Sales Report (Apr 2025); Grand View Research, Global Promotional Products Market Outlook (May 2025).

EXHIBIT 2

Key Trends and Intangible Assets

Key Trends Driving Sector Performance

- Consolidation and Private Equity Participation

M&A activity continues to reshape the sector as private equity sponsors and major distributors pursue horizontal integration and operational synergies, leveraging procurement scale, shared technology infrastructure, and integrated logistics to enhance margins and build multi-brand, end-to-end service platforms.

- Premiumization and Lifestyle Positioning

The market is shifting from commodity-style promotional goods toward premium, design-led, and lifestyle-oriented merchandise, as corporate clients demand higher-quality, sustainable products that align with brand identity and deliver differentiation through craftsmanship and design.

- Sustainability and Ethical Sourcing

Environmental and social governance priorities are now mainstream, with buyers favoring suppliers that offer recycled fabrics, water-efficient dyeing, and verified ethical sourcing, features increasingly viewed as competitive requirements rather than optional add-ons.

- Technology-Enabled Fulfillment and Personalization

Automation, digital storefronts, and real-time order tracking enable faster turnaround and reduced inventory exposure. Distributors leveraging connected e-commerce systems, print-on-demand tools, and AI-driven personalization platforms achieve stronger client retention and recurring order flow.

- Corporate Gifting and Employee Engagement Growth

The resurgence of workplace recognition and remote-employee gifting programs has created a durable demand base, sustaining order volumes beyond traditional event cycles and embedding promotional spending within HR and marketing budgets.

Source: PPAI, 2024 U.S. Promotional Products Sales Volume Report (Feb 2025); IBISWorld, Promotional Products in the U.S. Industry Report (Jun 2025); Advertising Specialty Institute (ASI), Promotional Products Industry Sales Report (Apr 2025); Grand View Research, Global Promotional Products Market Outlook (May 2025).

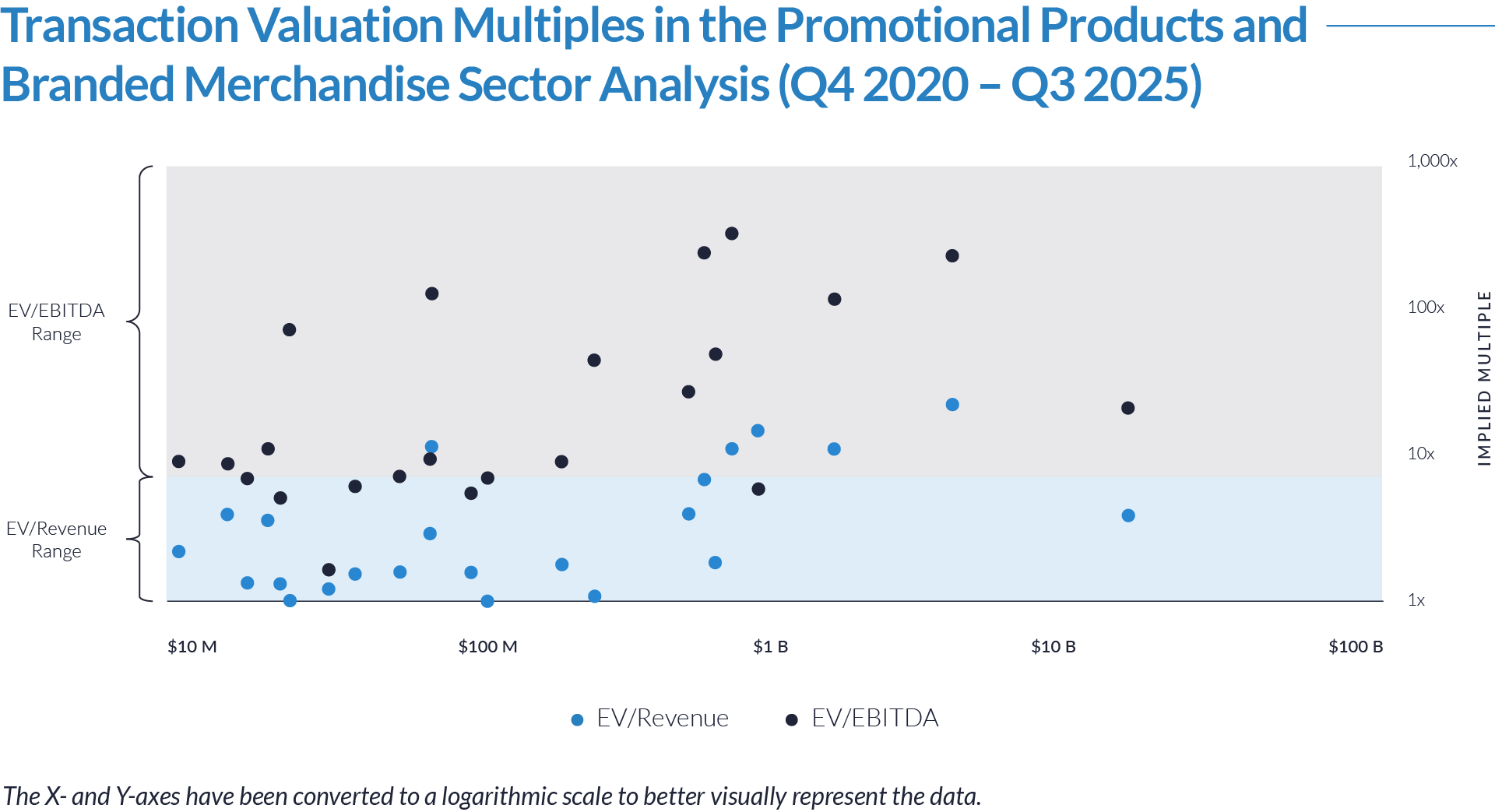

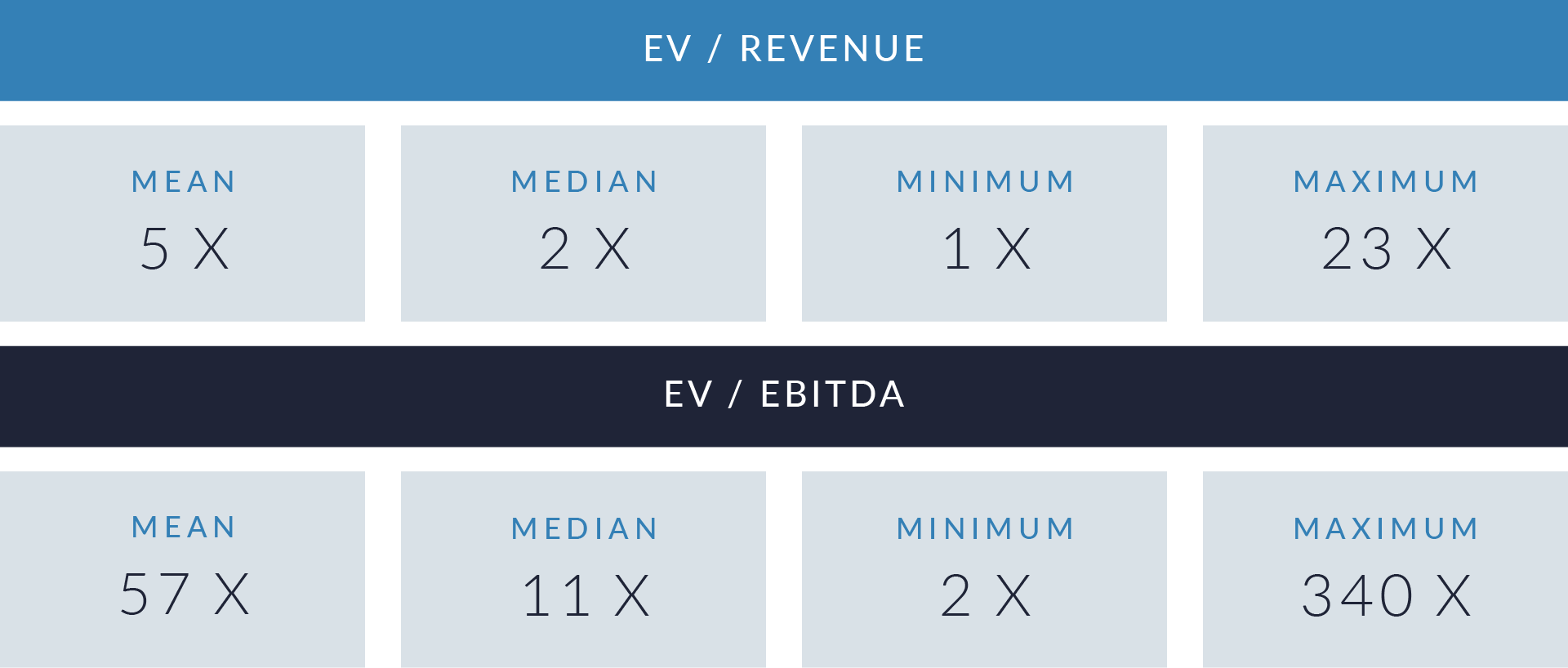

- Valuation multiples are based on a sample set of M&A transactions in the promotional products and branded merchandise sector using data collected on October 9, 2025.

- Mid-market valuations cluster within a narrow band, reflecting the sector’s recurring B2B demand and predictable cash-flow profile. Most transactions trade between 1x–2x EV/revenue and 7x–11x EV/EBITDA, consistent with the asset-light, contract-driven models of promotional merchandise suppliers and distributors. The tight dispersion between mean and median multiples underscores investor confidence in reorder stability and low cyclicality across corporate branding, gifting, and event-driven programs.

- Premium valuations are concentrated among large, digitally enabled consolidators achieving vertical integration and technology-driven synergies. Transactions exceeding 10x EV/revenue and 100x EV/EBITDA typically involve global apparel and fulfillment platforms with proprietary e-commerce systems, automated decoration lines, and private-label manufacturing capacity. These companies command software-like valuation premiums due to their supply-chain control, scalable logistics infrastructure, and high customer retention.

- Lower-quartile multiples highlight the sector’s resilient fundamentals and buy-and-build potential among regional operators. Deals near 1x EV/revenue and 6x–8x EV/EBITDA generally involve smaller suppliers, importers, and decorators with limited integration but consistent cash generation. Such transactions reinforce the sector’s defensive nature and ongoing consolidation opportunity, as acquirers unlock margin expansion and valuation uplift through cross-selling, scale efficiencies, and recurring distributor relationships.

Capital Markets Activities

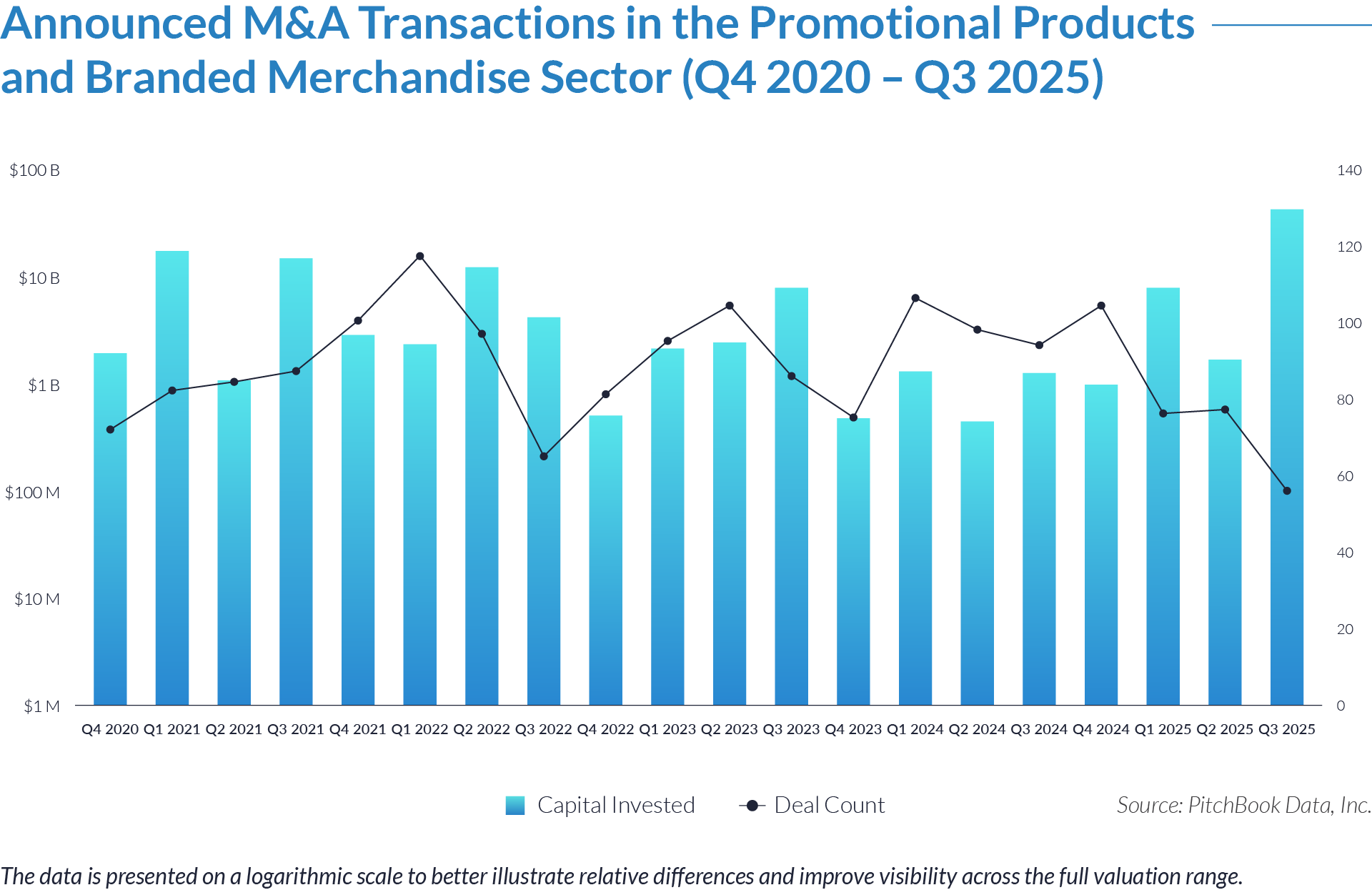

The data underscores transaction activity, valuation trends, and capital flows within the sector. Ongoing demand for customization, rapid fulfillment, and sustainable sourcing continues to fuel M&A among suppliers, decorators, and distributors. Acquirers are targeting asset-light, recurring B2B models with integrated decoration, logistics, and private-label capabilities that strengthen client retention and margin stability. Overall, recent transactions reflect a maturing, scale-driven market, where investors emphasize operational efficiency, cross-selling potential, and durable customer relationships as key value drivers.

- Investors deployed over $120 billion across 1,756 transactions during the 20-quarter period, reflecting persistent capital inflows despite macroeconomic headwinds. Recurring B2B demand and tangible asset bases continue to attract acquirers even as broader markets soften.

- Deal flow sustained steady mid-market momentum, averaging roughly 90 transactions per quarter and signaling operational resilience rather than cyclicality. Spikes in Q1 2021 and Q3 2025 stem from major strategic consolidations, while the continuity of smaller trades underscores enduring interest in regional decorators and distributors pursuing incremental growth.

- Post-2022 capital deployment shifted from expansionary to efficiency-driven investment, as buyers favored cash-generative suppliers with established sourcing, decoration, and logistics platforms. The moderation in deal values through 2023–2024 reflects tighter underwriting discipline and a renewed focus on profitability and working-capital optimization over volume-led expansion.

- The Q3 2025 surge to $40 billion marks renewed strategic repositioning, as corporate acquirers consolidate control of fulfillment and branding supply chains. This late-cycle acceleration suggests investors anticipate valuation recovery and are securing upstream production and distribution assets to reinforce long-term margin stability.

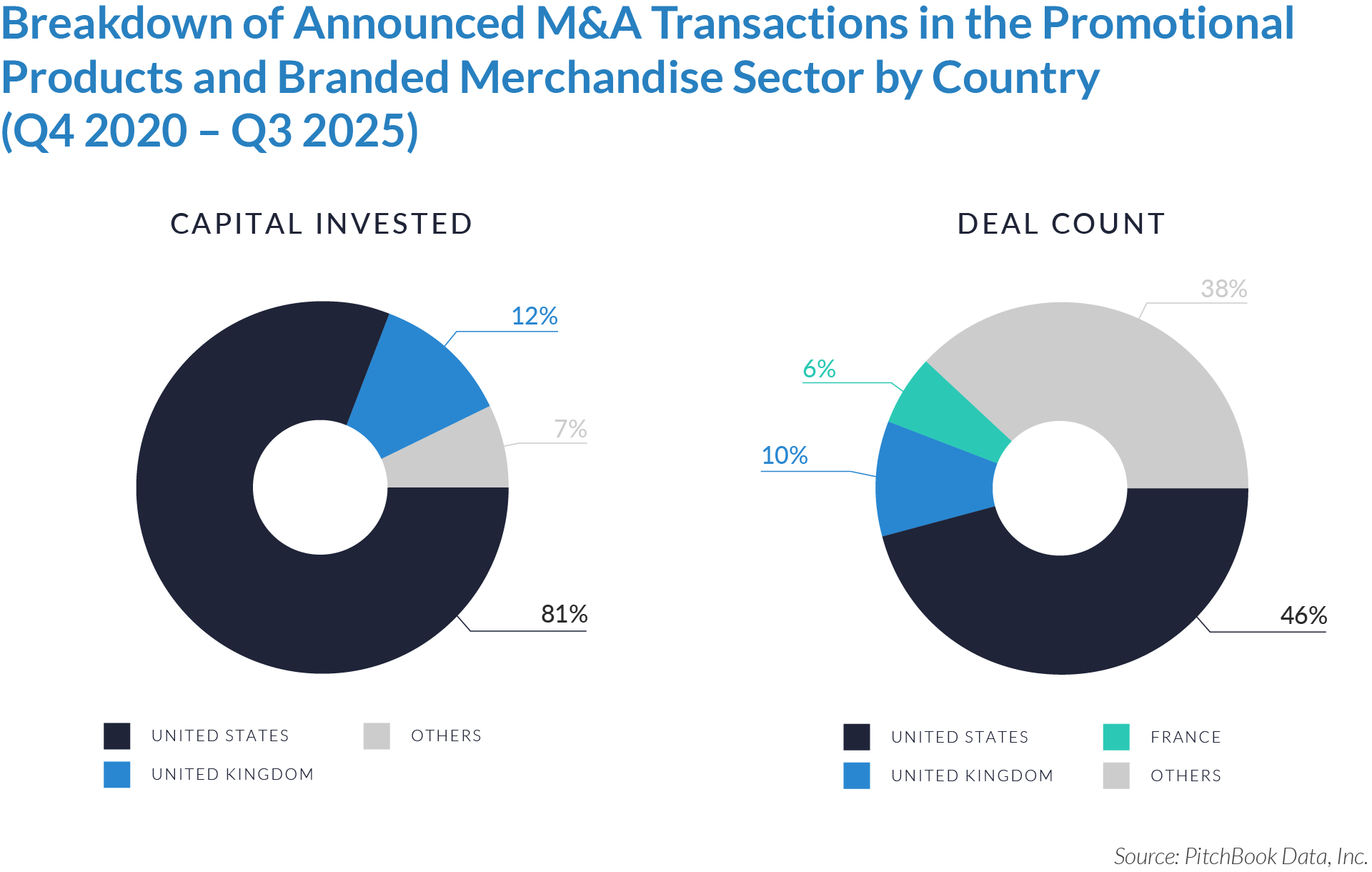

The graphs below present the geographic distribution of transactions, providing additional detail on regional trends and investment dynamics.

- The United States captured 81% of total capital and 46% of global deal activity, reaffirming its role as the sector’s primary consolidation hub. US acquirers executed larger, higher-value transactions focused on national distribution networks, vertical integration, and private equity-backed roll-ups. Strong domestic consumption and corporate marketing spend continue to anchor valuations and position the US as the benchmark market for sector multiples.

- The United Kingdom accounted for 12% of invested capital and 10% of transactions, reflecting a mature but fragmented ecosystem of regional decorators and fulfillment specialists. Most deals involved mid-sized suppliers broadening product lines or integrating decoration capacity, supported by resilient B2B demand and robust logistics infrastructure. The UK’s mix of local specialization and export reach cements its status as Europe’s most active promotional goods hub.

- Continental Europe and emerging markets, including France and select regional clusters, represented 7% of capital and 38% of deal volume. Activity remains centered on family-owned suppliers and niche textile decorators, where acquirers pursue geographic diversification, low-cost sourcing, and sustainable production capabilities. These markets offer incremental expansion channels for global consolidators seeking regional manufacturing depth and cross-border customer access.

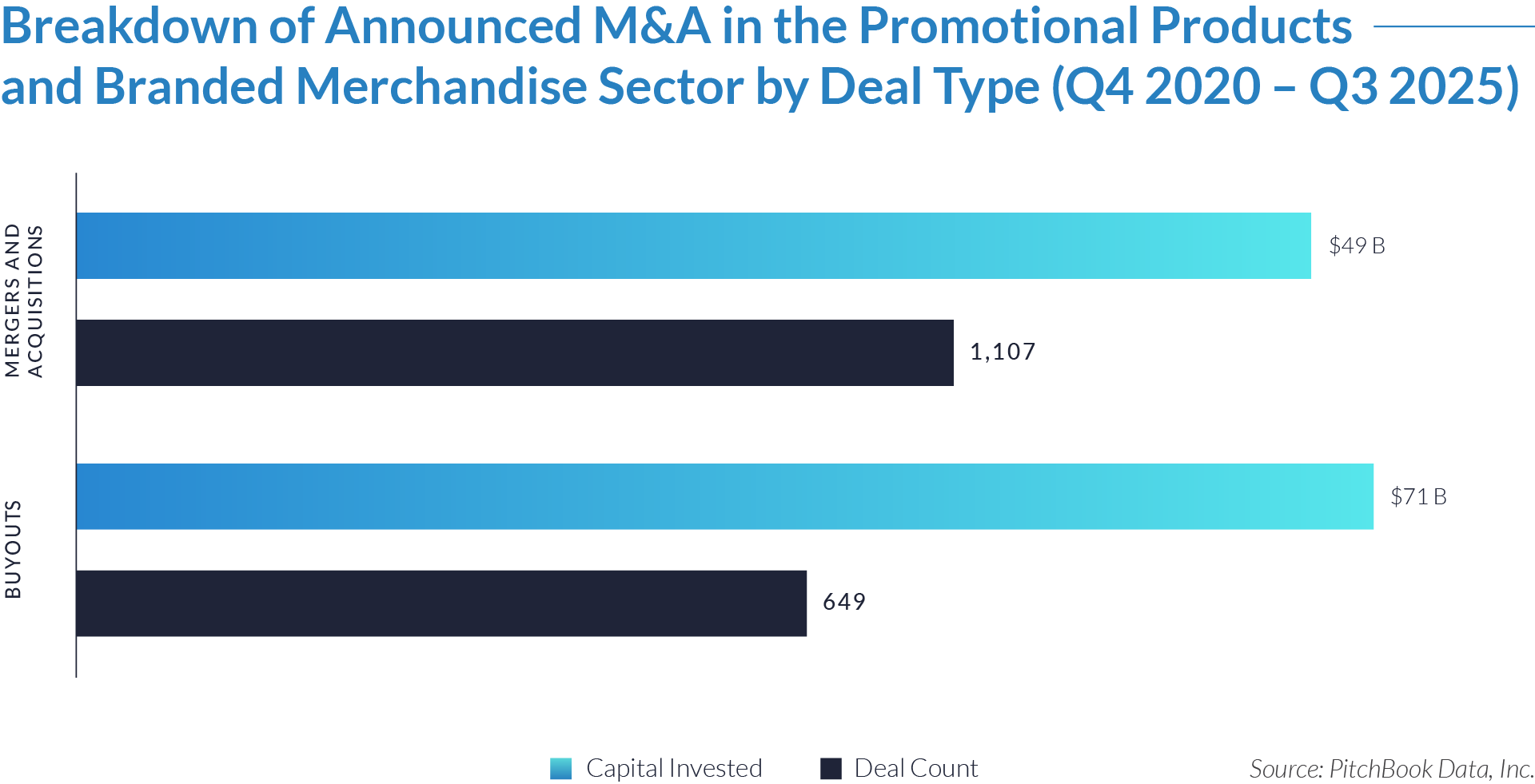

- Buyouts represented $71 billion across 649 transactions, underscoring private capital’s focus on control investments in scalable, cash-generative platforms. Value creation centered on supply-chain integration, cost optimization, and margin expansion, rather than growth-dependent volatility.

- Strategic and corporate M&A totaled $49 billion across 1,107 deals, reflecting broad participation from incumbents seeking distribution reach, product diversification, and decoration capability. Transaction frequency points to steady structural consolidation rather than episodic large-cap activity.

- Private equity remained the dominant funding source, deploying larger check sizes to secure stable yield and leverage recurring order volumes. Sponsors prioritized operational discipline, integration synergies, and balance-sheet efficiency, reinforcing the sector’s evolution into a mature, service-oriented asset class.

- Strategic buyers maintained high deal volume with smaller average valuations, signaling disciplined capital allocation toward channel control, customer retention, and sustainable sourcing. The balance between sponsor-led buyouts and targeted corporate acquisitions defines a dual growth path—scale through efficiency and integration through brand alignment.

M&A Transactions Case Studies

Three transactions in the promotional products and branded merchandise sector illustrate how acquirers are driving consolidation, efficiency, and market differentiation through integrated fulfillment, technology-enabled customization, and premium product design. Buyers are targeting distributors and suppliers with scalable B2B platforms, proprietary decoration capabilities, and strong regional customer networks. These deals highlight sustained investor confidence in assets that combine brand reach, operational agility, and recurring corporate demand across apparel, textiles, and lifestyle merchandise channels.

Case Study 01

ALPHABRODER

Alphabroder is a leading North American distributor of promotional apparel and hard goods, offering a wide portfolio of blank and customizable products from major brands such as Adidas, Champion, Hanes, and Gildan. The company supplies screen printers, embroiderers, and promotional product distributors through an extensive US-Canada fulfillment network.

Acquirer

S&S Activewear, headquartered in Illinois, is a major distributor of imprintable apparel and accessories, featuring brands including Nike, Bella+Canvas, Adidas, and Next Level. Backed by Clayton, Dubilier & Rice, the company serves screen printers, promotional distributors, and e-commerce retailers through a national fulfillment platform. S&S focuses on technology-enabled distribution, product diversification, and targeted acquisitions to reinforce its market leadership.

Transaction Structure

S&S Activewear acquired Alphabroder from Littlejohn & Co. for an undisclosed amount. The deal was financed through term loans and senior secured notes, supporting the leveraged buyout and post-merger integration.

Market and Customer Segments Combination

The acquisition united two of the largest wholesale distributors in the promotional products sector, combining complementary customer bases across corporate, retail, and event-driven markets. The integration expanded North American reach, diversified product offerings, and enhanced fulfillment efficiency for resellers and decorators through shared infrastructure and technology platforms.

Acquisition Strategic Rationale

The acquisition strengthened S&S Activewear’s leadership in promotional apparel and branded merchandise, creating scale benefits in sourcing, inventory management, and logistics. Post-transaction, S&S invested in automation, expanded its sales network, and optimized supply-chain operations to improve speed, assortment, and customer experience. The combined company emerged as a market-defining consolidator, competing more effectively on price, service quality, and product availability in a rapidly consolidating industry.

Case Study 02

THINK IT THEN INK IT

Think It Then Ink It is a US-based distributor of branded merchandise and promotional products, specializing in creative design, customization, and fulfillment for corporate and regional clients. The company offers a diverse mix of apparel, accessories, and hard goods, emphasizing personalized service and quick turnaround. With a strong Midwestern presence, it built its reputation on responsive client service, creative campaign execution, and reliable supplier partnerships across the promotional value chain.

Acquirer

HALO Branded Solutions, headquartered in Illinois, is one of the largest US distributors of promotional products and corporate apparel, serving thousands of enterprise and regional customers nationwide. The company provides design, sourcing, technology, and logistics solutions that enhance brand visibility, recognition, and engagement. HALO operates through a national network of account executives and fulfillment centers, focusing on scalable marketing and branded merchandise programs.

Transaction Structure

In August 2024, HALO Branded Solutions acquired Think It Then Ink It for an undisclosed amount.

Market and Customer Segments Combination

The acquisition expanded HALO’s presence in regional and niche distributor channels across the Midwest, integrating Think It Then Ink It’s local customer relationships with HALO’s national scale and capabilities. The combination enhanced last-mile distribution, broadened service offerings, and improved fulfillment efficiency for existing clients.

Acquisition Strategic Rationale

The acquisition strengthened HALO’s market coverage through channel consolidation and regional network expansion. By leveraging its sourcing, technology, and back-office infrastructure, HALO enhanced operational efficiency while deepening customer retention through a broader, more integrated product and service portfolio.

Case Study 03

KANATA BLANKET

Kanata Blanket is a premium Canadian home textiles brand specializing in blankets, throws, towels, and lifestyle accessories. The company combines high-quality materials with contemporary and heritage-inspired designs across its Home, Adventure, and Indigenous Artists collections. Serving both retail and promotional markets, Kanata is known for its craftsmanship, comfort, and cultural authenticity.

Acquirer

Pro Towels is a US-based supplier of high-quality towels, blankets, and promotional textiles, serving corporate, retail, and hospitality clients across North America. The company is recognized for its decoration capabilities, product quality, and customer service. Through its family of brands, including Superior, Neet Feet, and Kanata Blanket, Pro Towels offers a comprehensive textile portfolio spanning premium and value-oriented segments of the promotional products market.

Transaction Structure

Pro Towels acquired Kanata Blanket for an undisclosed amount.

Market and Customer Segments Combination

The acquisition brought together two established textile suppliers with complementary market focuses, Pro Towels’ strong US presence in the promotional and hospitality sectors and Kanata’s premium positioning in retail and corporate gifting. The integration broadened product offerings, enhanced geographic coverage across North America, and created cross-selling opportunities for both retail and promotional channels.

Acquisition Strategic Rationale

The acquisition strengthened Pro Towels’ leadership in the promotional textiles market by adding design-led, premium home products to its portfolio. It enabled greater product differentiation, improved sourcing efficiency, and brand diversification while positioning the combined entity to capture growth in the corporate gifting and lifestyle segments.

The sector remains resilient, supported by recurring corporate demand and scalable fulfillment models. Consolidation and technology adoption continue to enhance efficiency and margin stability, while premiumization and sustainability trends strengthen brand differentiation. Intangible assets, supplier relationships, digital infrastructure, and customer retention, remain central to valuation premiums as the sector evolves toward a more integrated, tech-enabled business model.

Source: S&S Activewear, Harris Williams, ASI Central, HALO, PPAI, UpstateSCAllinace, Pitchbook Data.