B2B Non-Food Consumables Sector M&A Transactions and Valuations

Investor activity in B2B non-food consumables—including janitorial supplies, safety equipment, packaging materials, and facility maintenance products—increased steadily from 2020 to 2024. Buyers focused on acquiring scalable distribution networks, expanding into new regions, and diversifying product categories. M&A activity responded to consistent demand from healthcare, education, foodservice, hospitality, and industrial sectors, which rely on robust supply chains and procurement processes governed by compliance and operational requirements.

From Q1 2020 to Q4 2024, buyers and investors executed transactions that altered competitive positioning and market structure. This report examines trends in deal volume, valuation multiples, and capital deployment. It includes key transactions such as Bunzl’s acquisition of Miracle Sanitation Supply, BradyPLUS’s acquisition of Envoy Solutions, and Advent International’s investment in Imperial Dade, assessing each for strategic fit, valuation levels, and competitive impact.

The report provides data on EV/revenue and EV/EBITDA multiples to outline pricing trends, investor preferences, and indicators of future growth. It identifies common transaction drivers such as geographic expansion, product category depth, and customer retention supported by value-added services. Additionally, it highlights key trends shaping customer behaviors, sector dynamics, and operational priorities within the B2B non-food consumables industry. This analysis offers investors, corporate strategists, and financial advisors a structured overview of the B2B non-food consumables sector, highlighting its consolidation trends, valuation benchmarks, and long-term role in supporting institutional and commercial operations.

Key Trends Shaping the B2B Non-Food Consumables Sector

This section analyzes the evolving customer behaviors, market dynamics, and sector drivers influencing growth, competition, and consolidation trends across the B2B non-food consumables industry.

Purchasing decisions among institutional and commercial buyers are primarily driven by operational efficiency and cost management priorities. Survey data highlights time efficiency (42%), cost savings (37%), delivery reliability (30%), and accessibility outside standard hours as the top decision factors. These dynamics reinforce the competitive advantage of distributors offering integrated, responsive, and cost-effective solutions.

The emphasis on time and cost efficiency points to opportunities for distributors to adopt technology such as automated ordering, real-time inventory management, and digital procurement platforms. Operational excellence—delivering speed, reliability, and cost control—is critical to meeting customer demands without eroding margins. Distributors that invest in scalable systems, resilient logistics, and value-added services like 24/7 ordering and flexible deliveries will strengthen customer loyalty, enhance competitiveness, and sustain pricing power in a market increasingly defined by efficiency and service quality.

Revenue in the non-food consumables and wholesale distribution sector remains concentrated in defensive industries, with healthcare, foodservice, cleaning and hygiene, and grocery collectively representing approximately 75% of total end-customer revenue. These sectors demonstrate consistent demand resilience across economic cycles. In contrast, retail and industrial sectors, which comprise the remaining 25%, are more cyclical and sensitive to fluctuations in consumer sentiment and industrial activity.

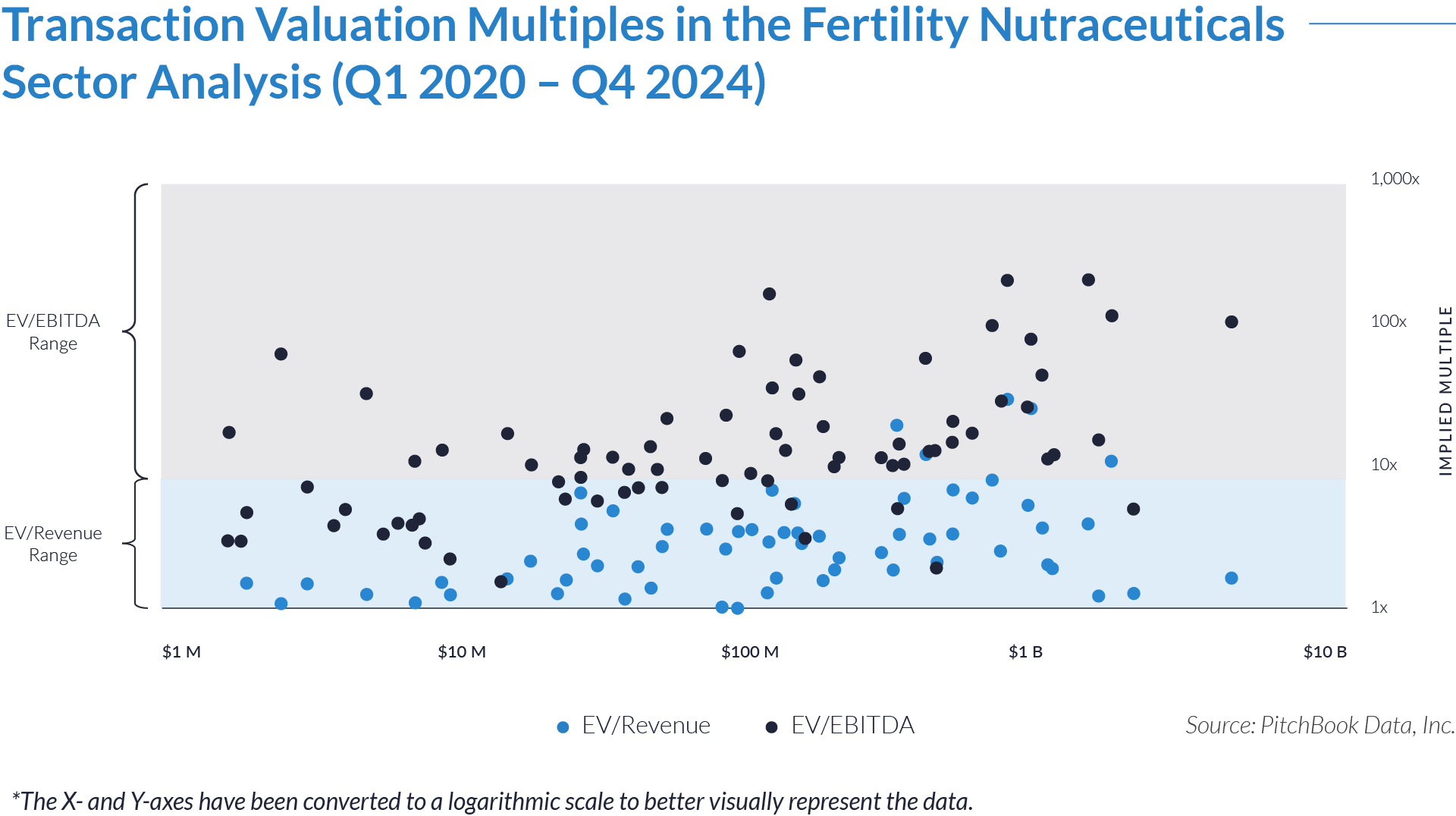

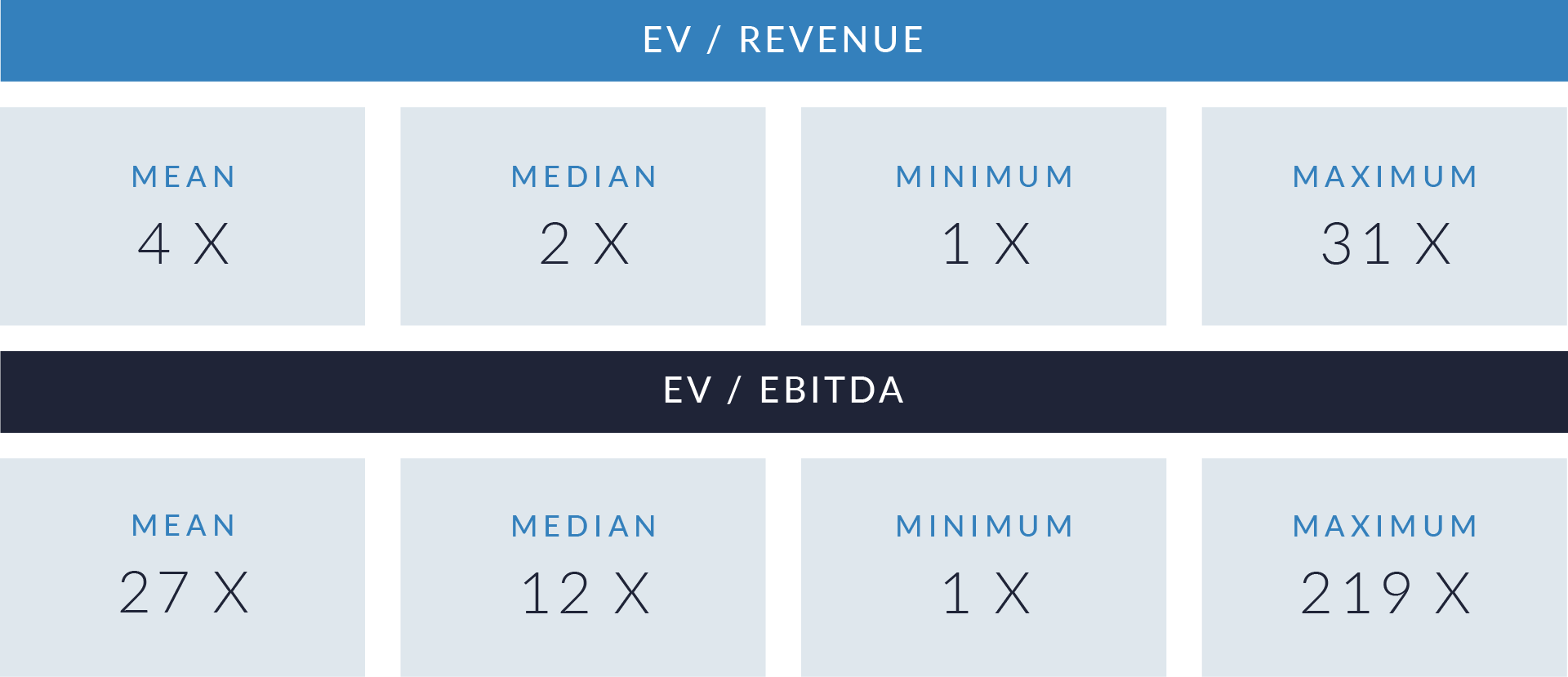

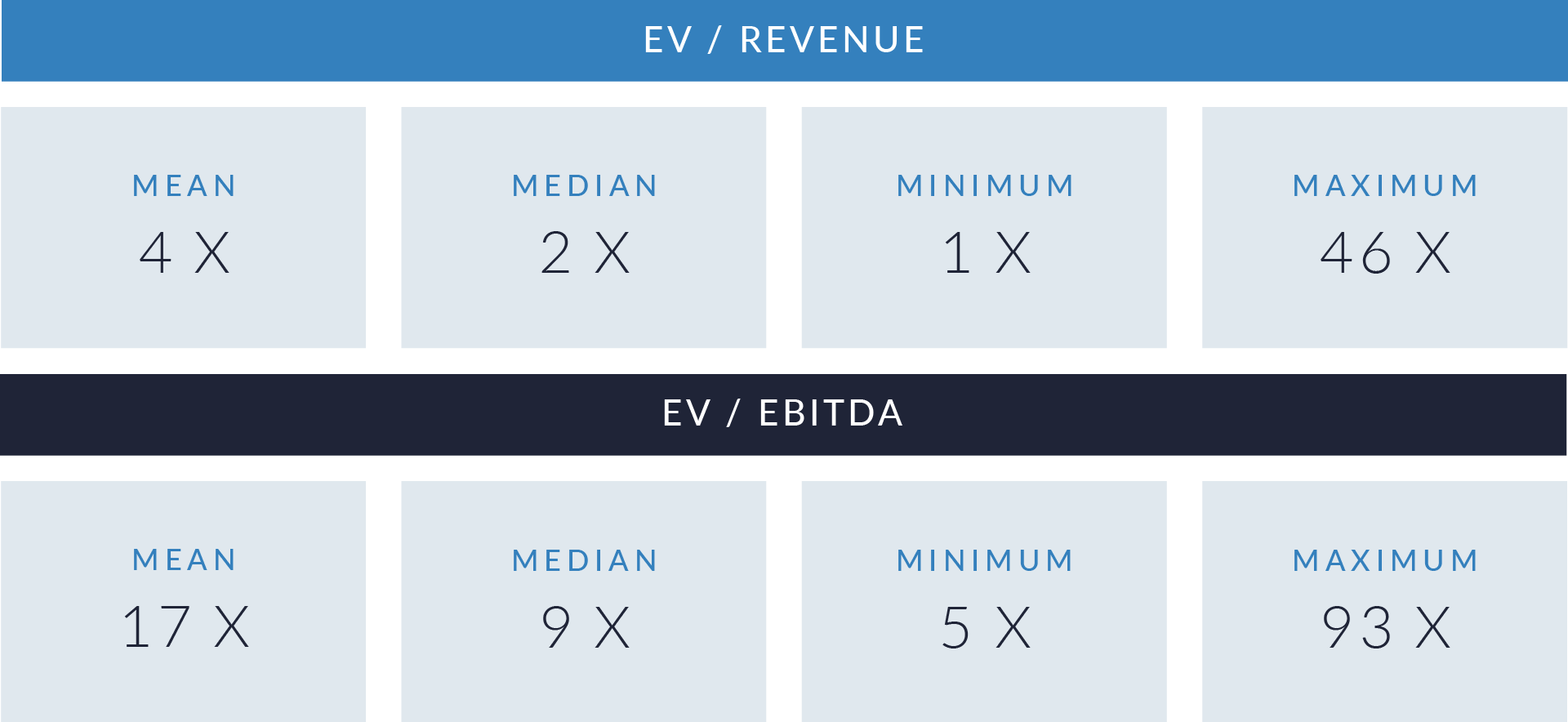

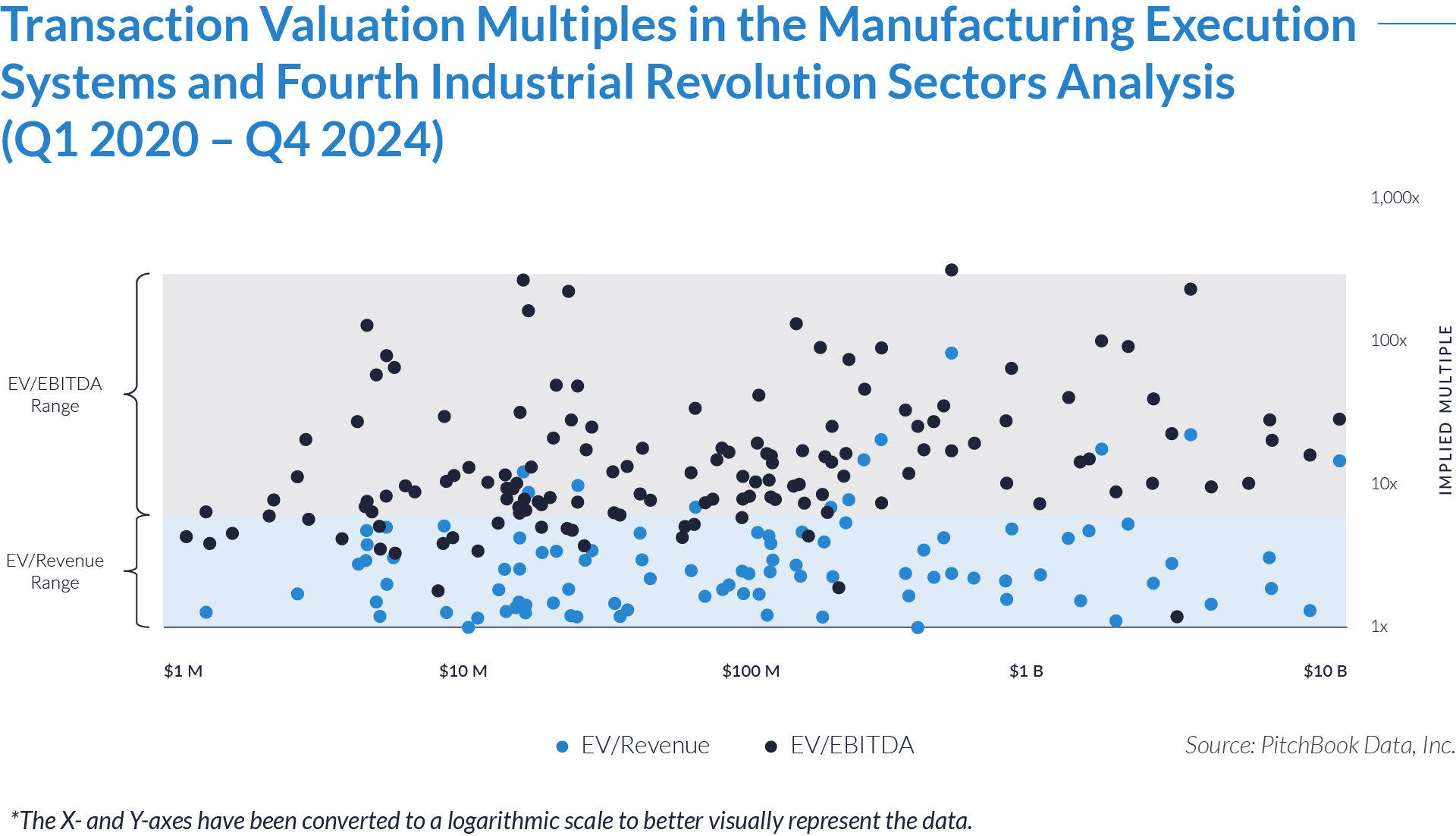

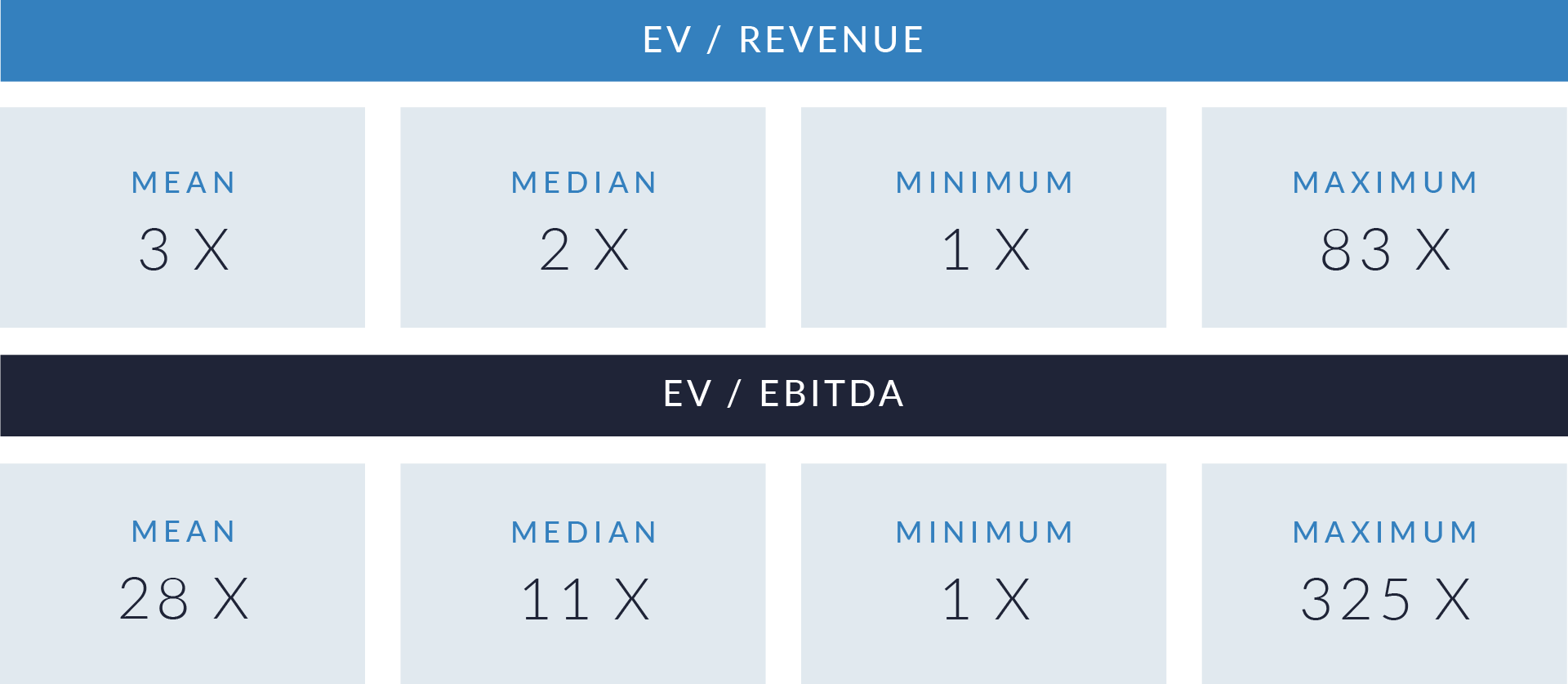

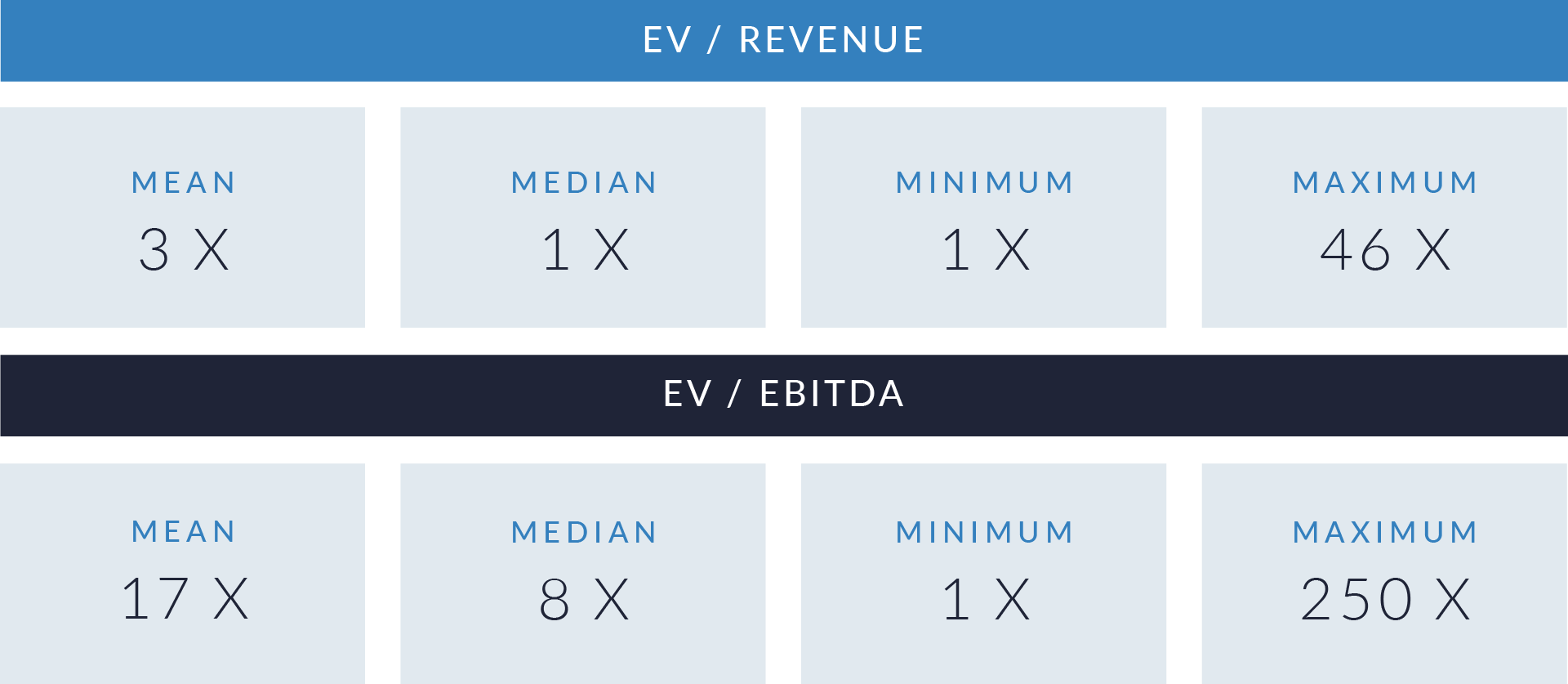

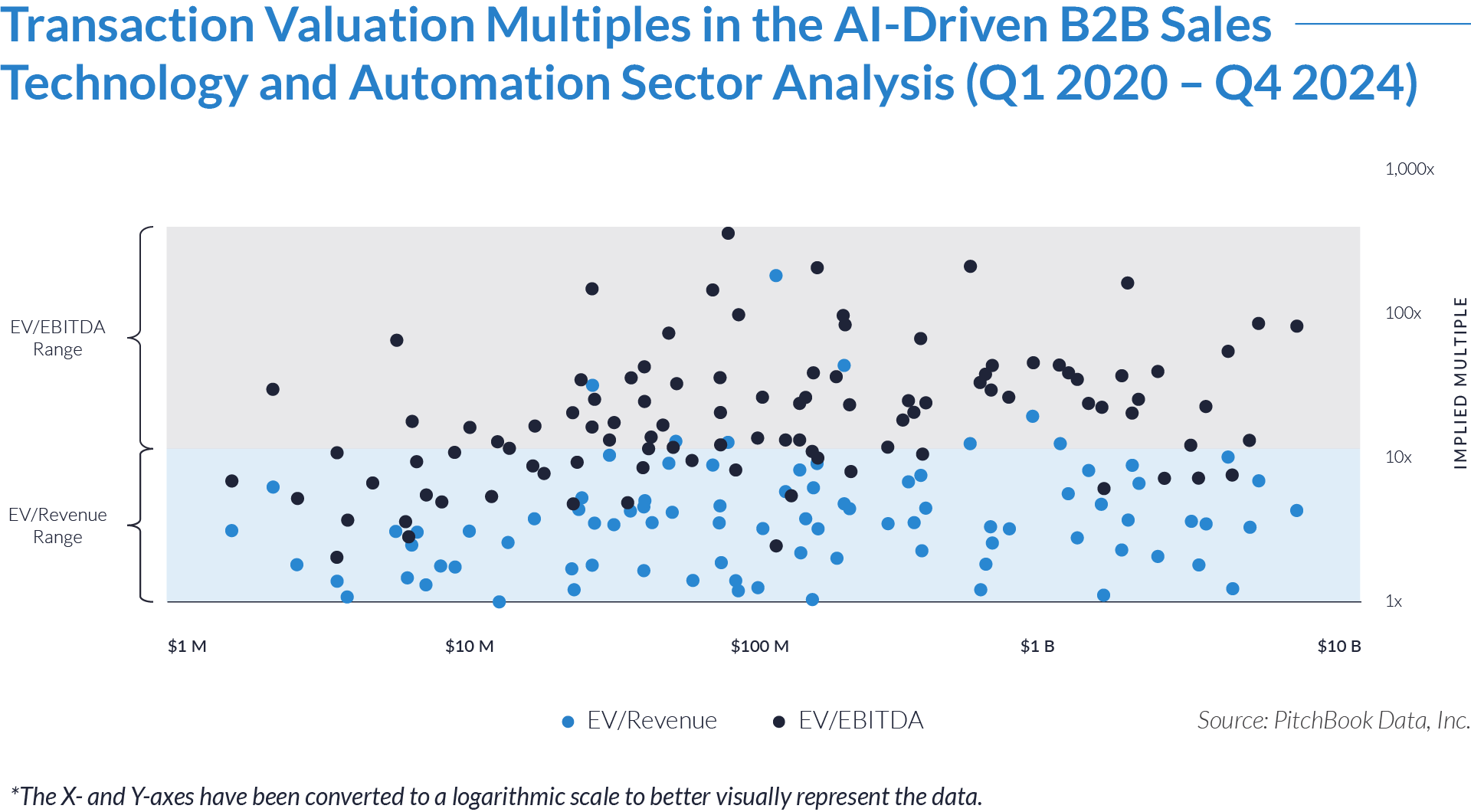

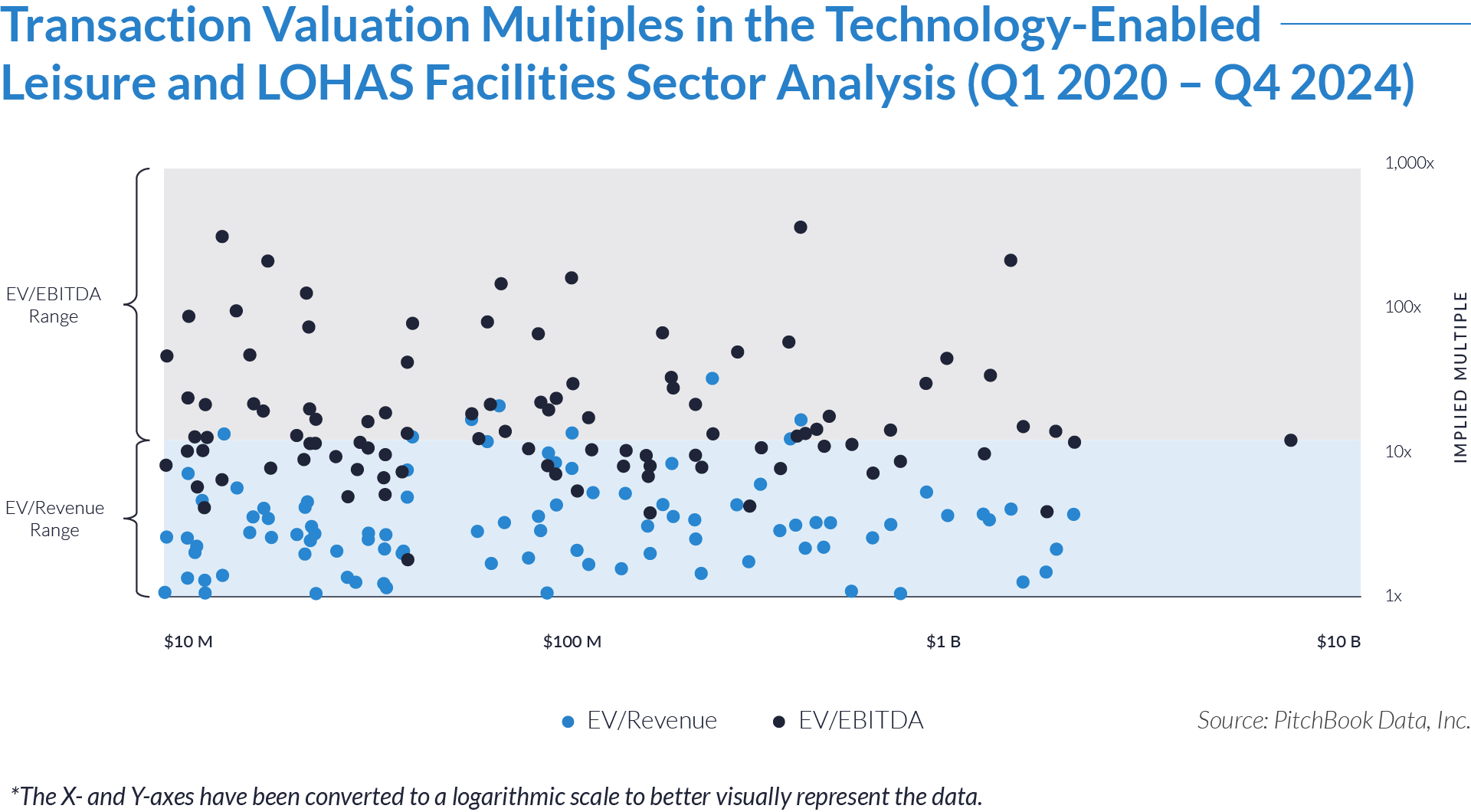

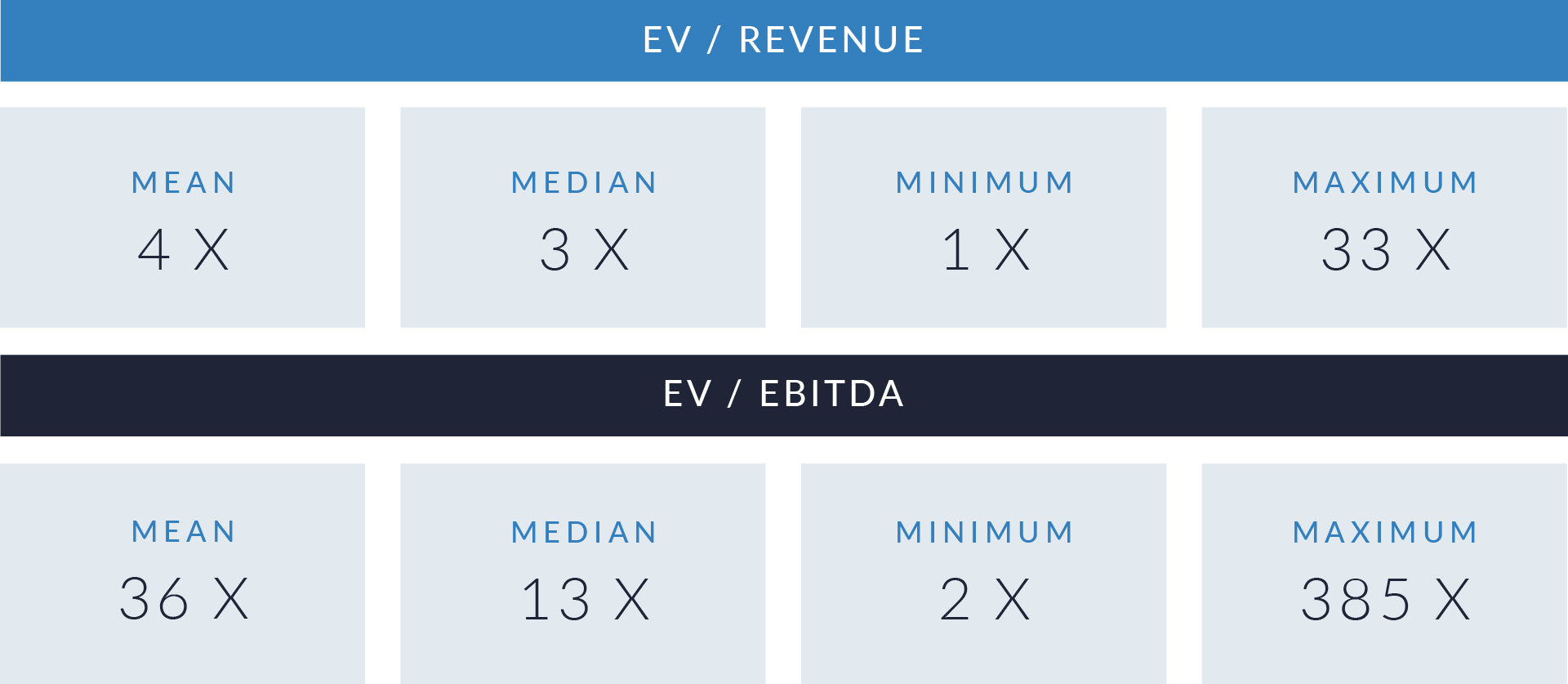

- Valuation multiples are based on a sample set of M&A transactions in the B2B non-food consumables sector, using data collected on April 3, 2025.

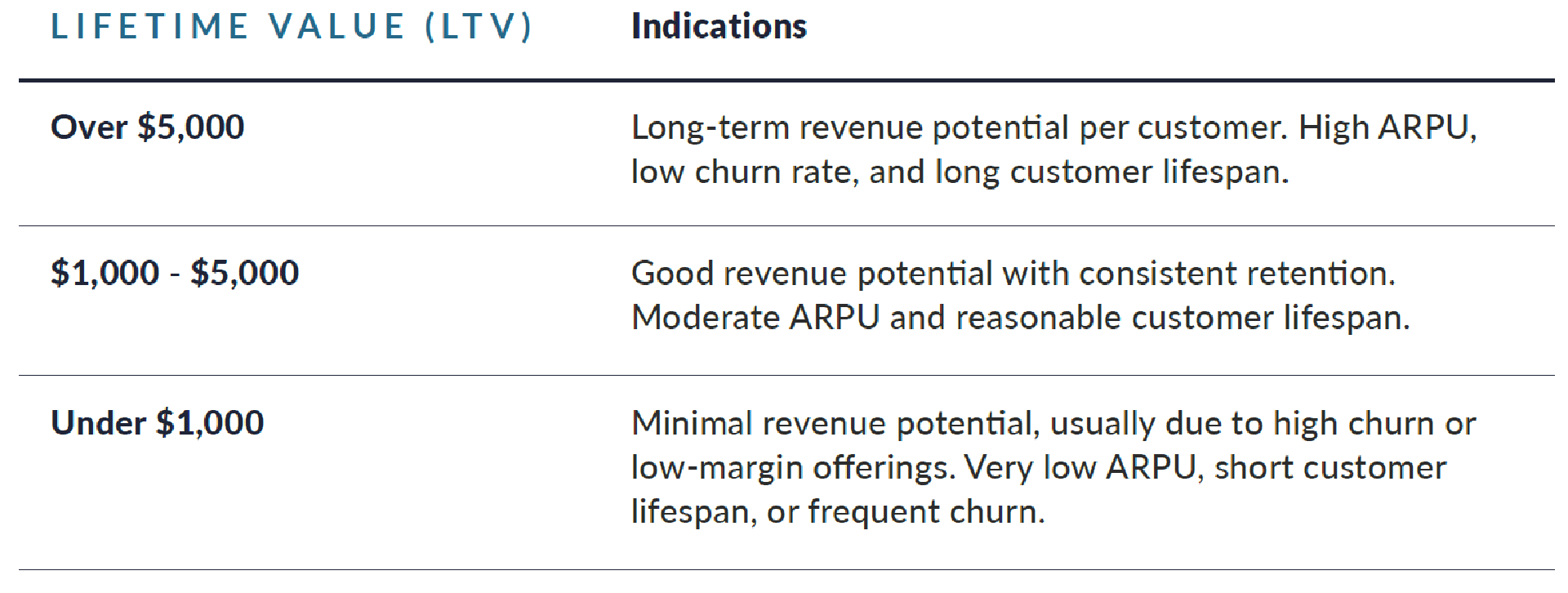

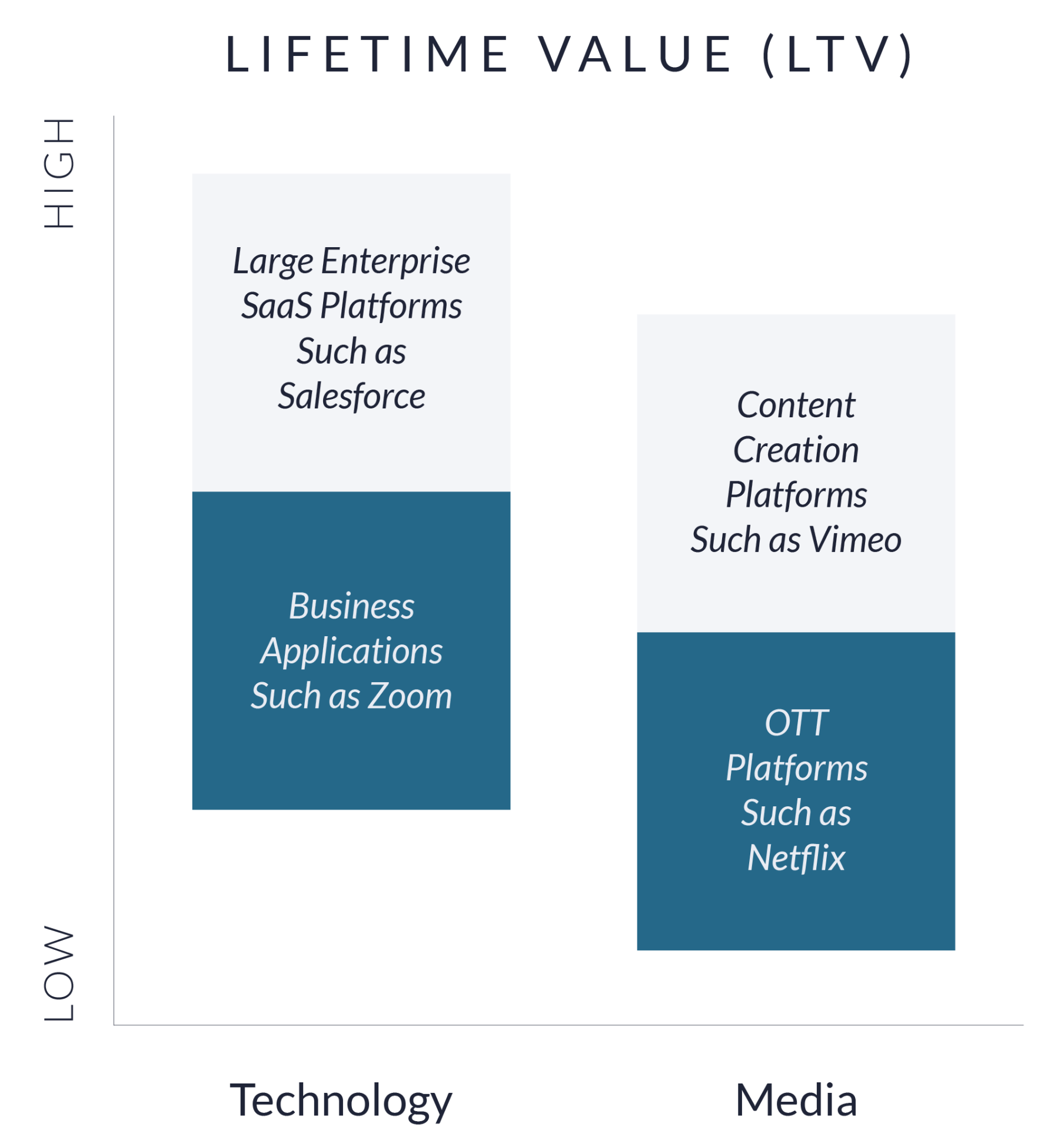

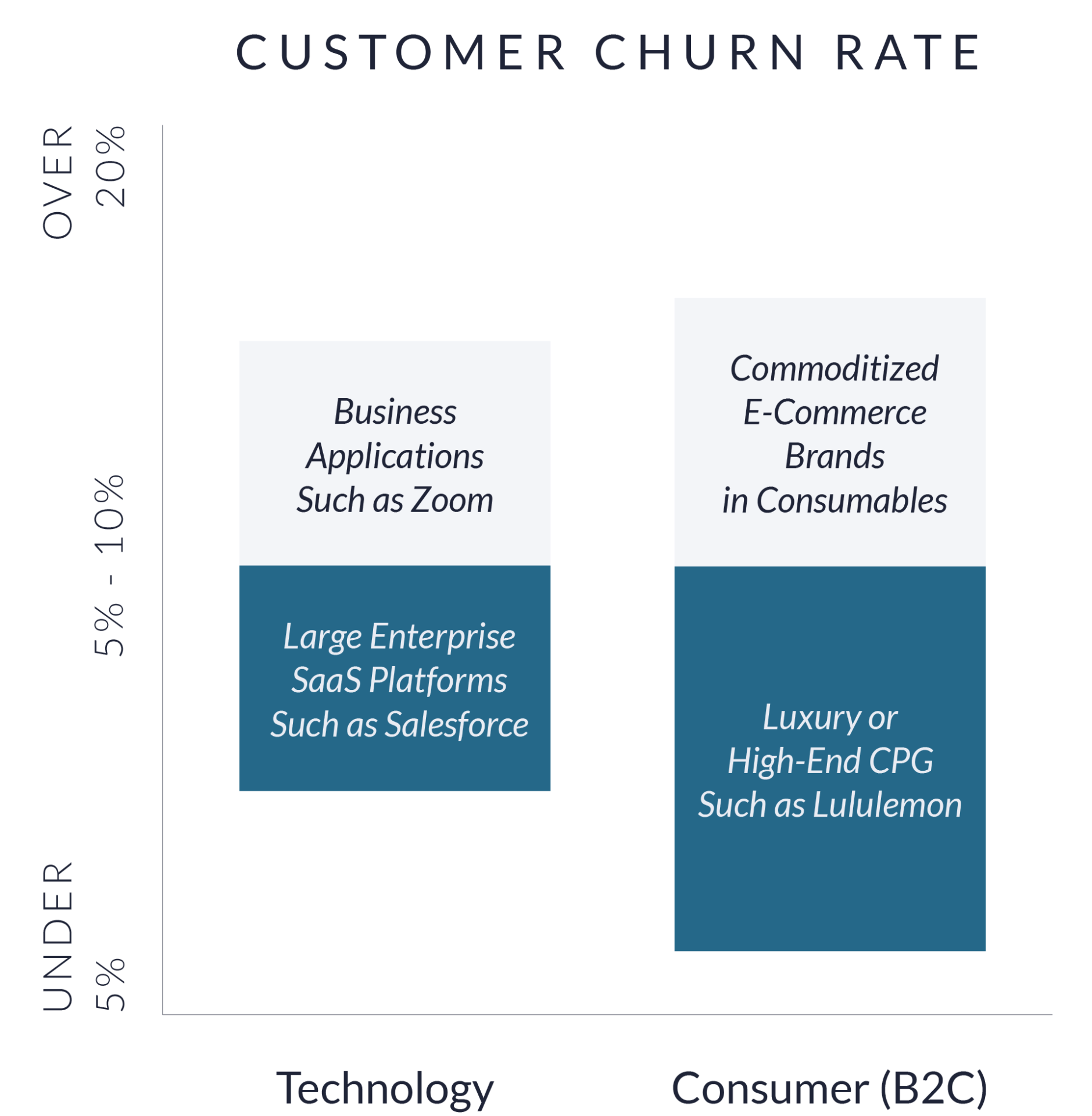

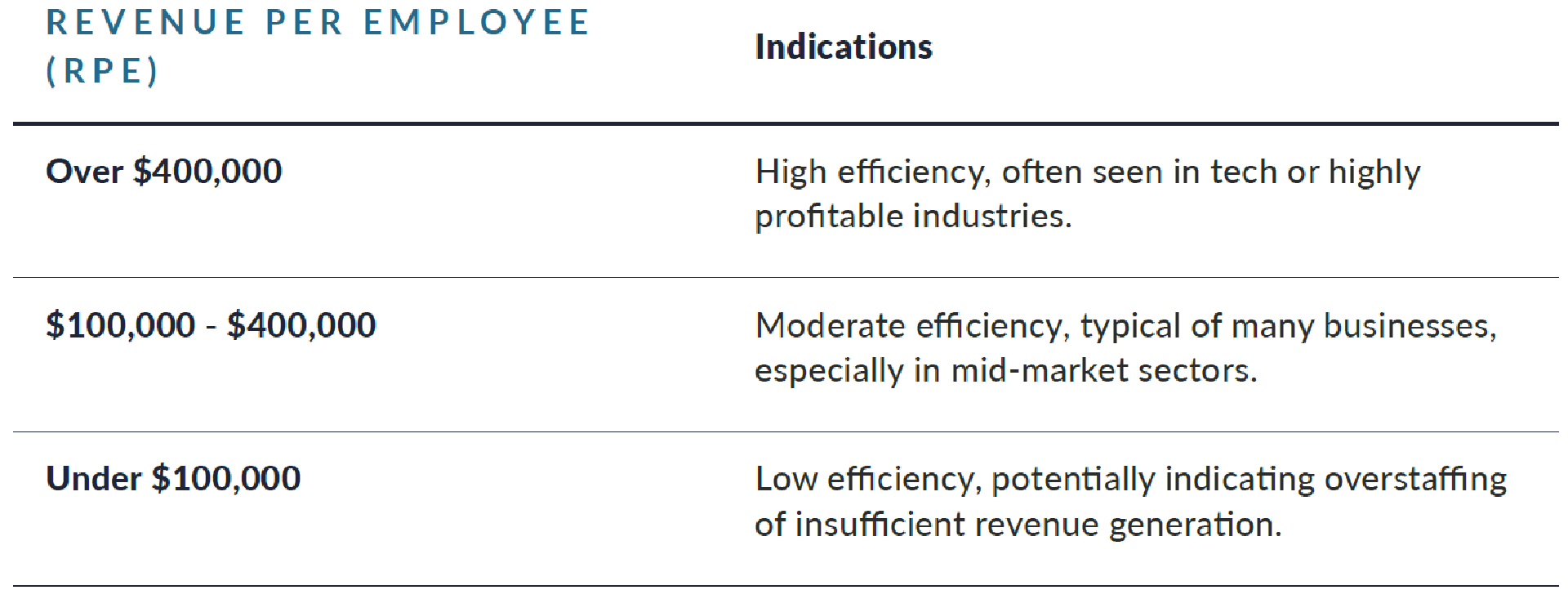

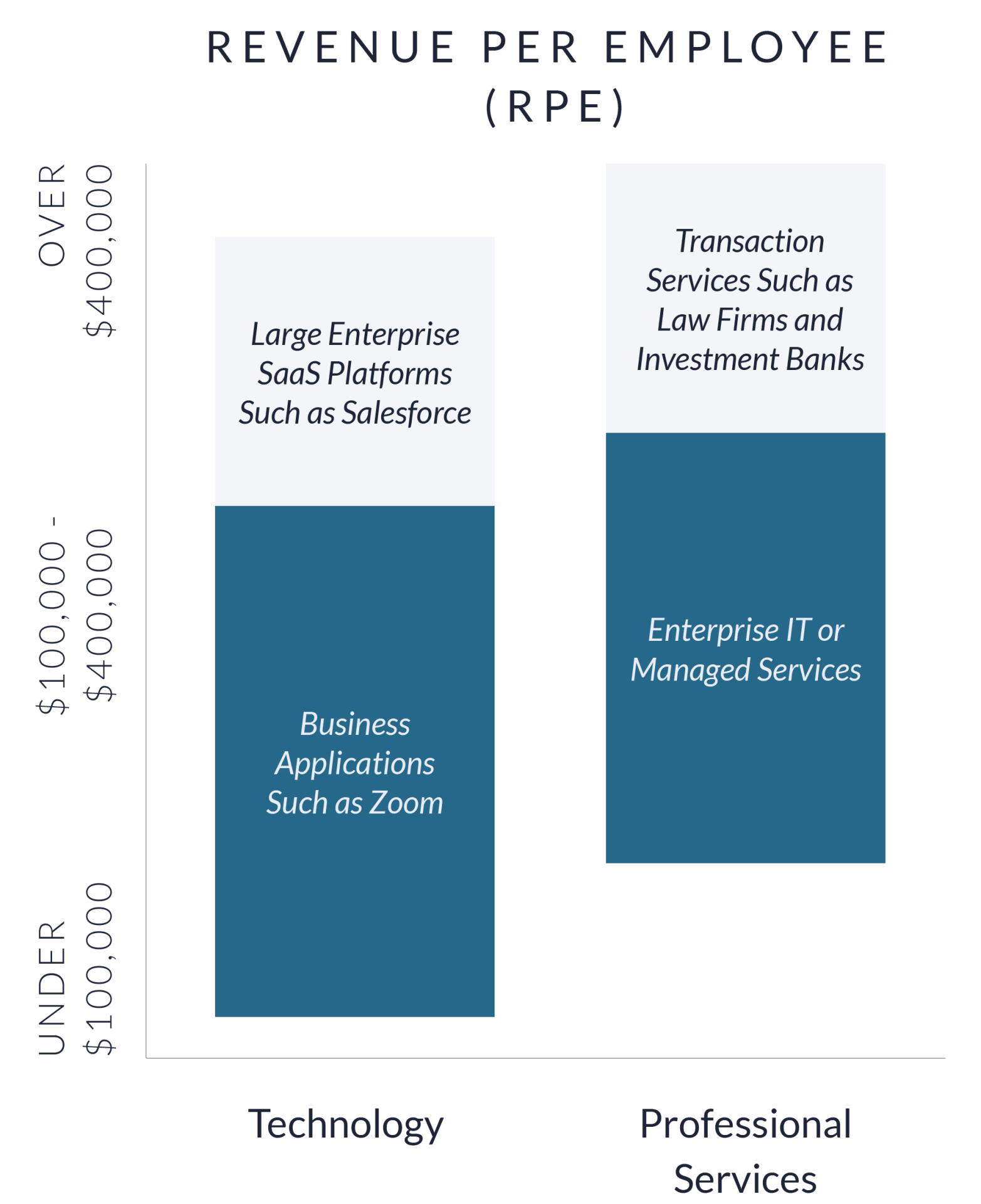

- Investors pay higher valuation multiples for larger, more established distributors, who benefit from scale in procurement, logistics, and customer access. Companies in the top enterprise value quartile average 7x EV/revenue and 24x EV/EBITDA, while those valued below 100 million dollars average 3x and 19x, respectively.

- Buyers assign higher EV/EBITDA multiples – rising from a 13x median to over 23x in the upper quartile – to distributors with stable margins, recurring revenue, or strong positions in compliance-driven categories such as hygiene and safety.

- A small number of buyers have paid extreme multiples, exceeding 20x EV/revenue and 100x EV/EBITDA, to acquire distributors with embedded automation, proprietary systems, or high-margin service models that strengthen retention and operational performance.

Capital Markets Activities

The data highlights transaction trends, valuation metrics, and investment patterns in the B2B non-food consumables sector. Consistent demand for hygiene, safety, packaging, and facility maintenance products has driven increased M&A activity and private equity investment. Strategic acquisitions and buyouts are consolidating distributors, enhancing supply chain efficiency, and expanding product portfolios across institutional end markets. These trends are accelerating market consolidation, operational scale, and the integration of value-added services such as inventory management, compliance support, and digital procurement solutions.

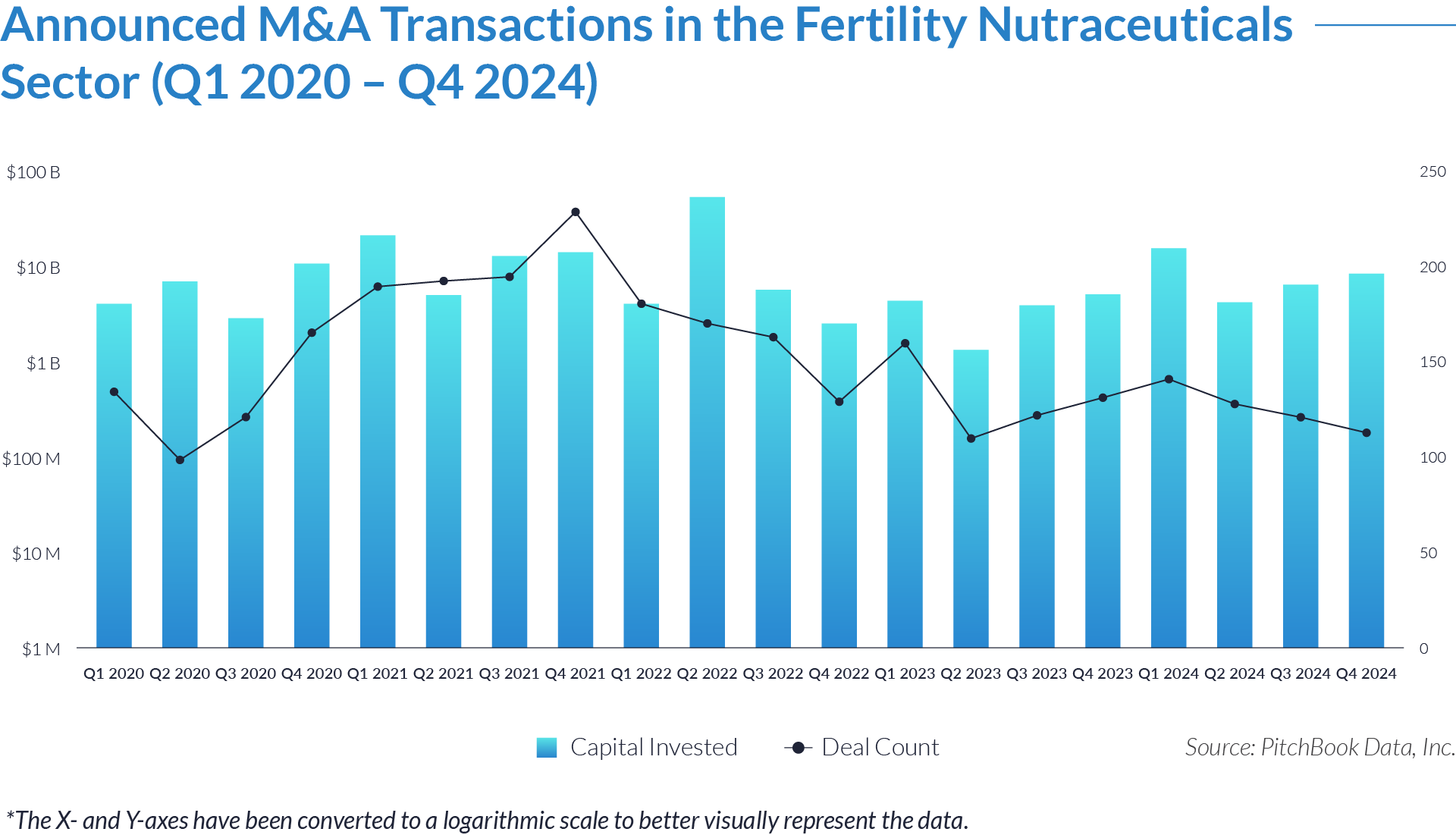

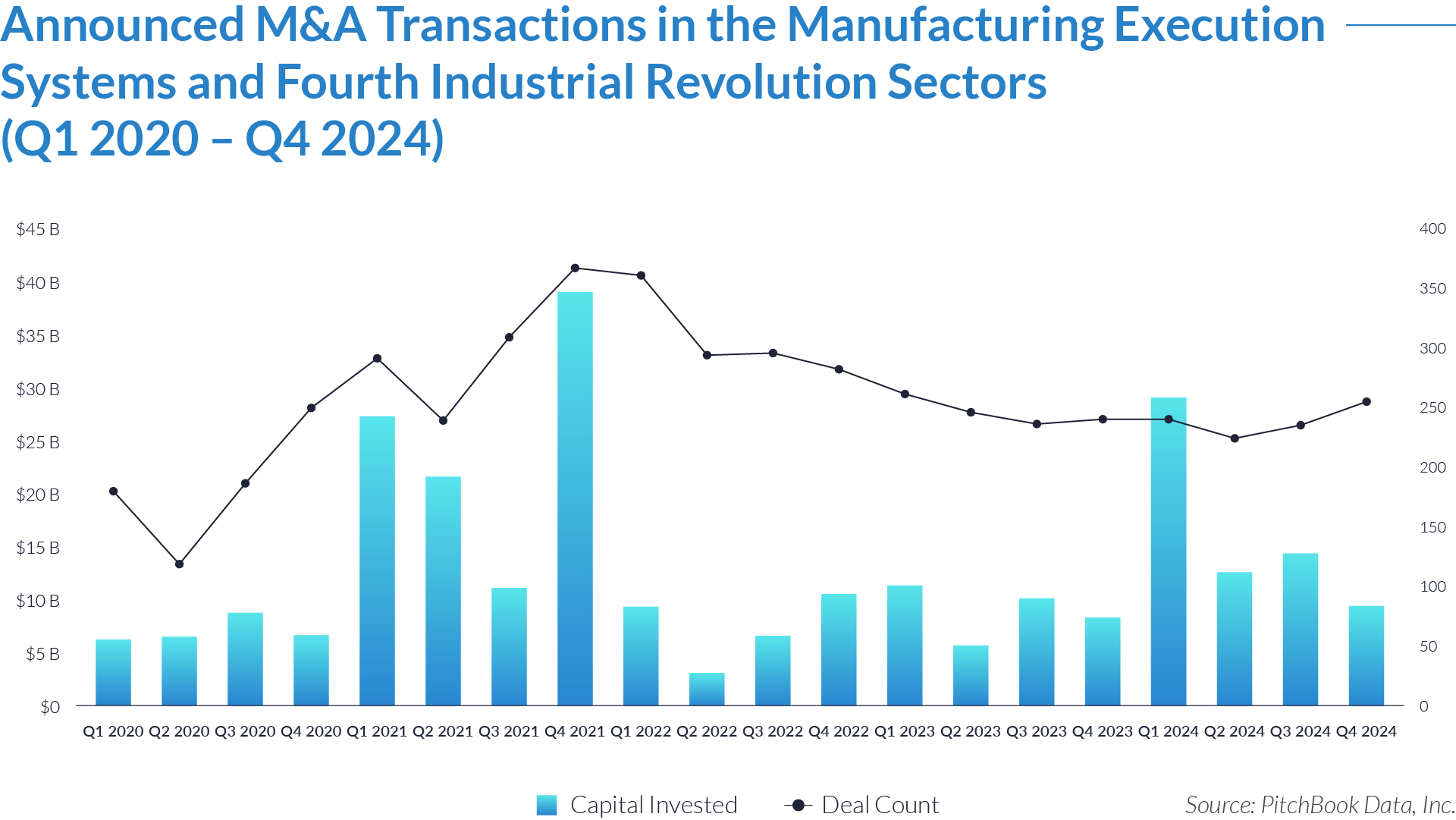

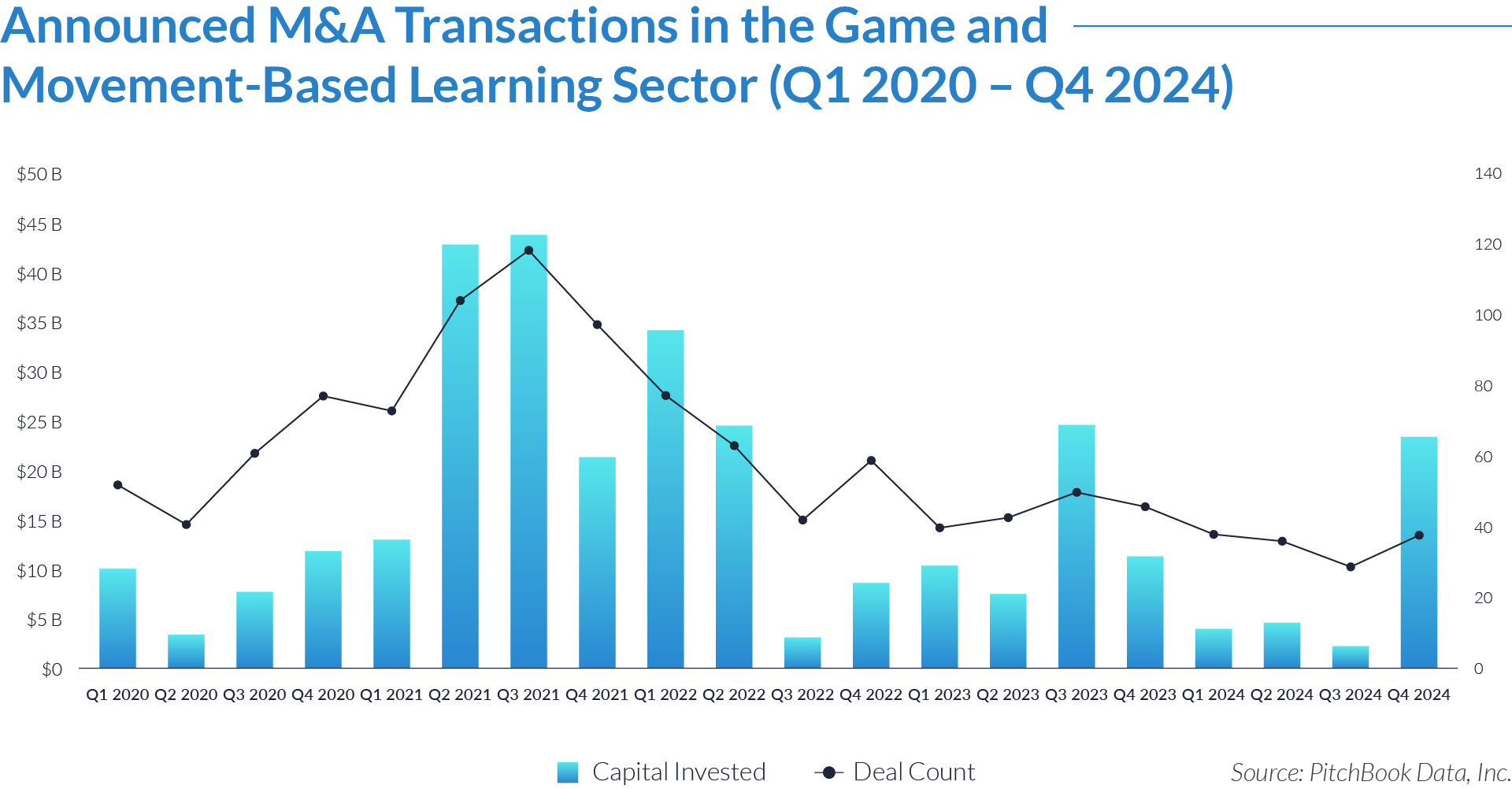

- Investors deployed $440 billion across 2,272 deals over 20 quarters, averaging $22 billion in capital and 114 transactions per quarter. This consistent activity reflects strong and sustained interest in non-food consumables distribution businesses that deliver recurring demand, defendable margins, and essential products to institutional and commercial markets.

- Capital deployment reached its peak in Q3 2021, when investors allocated $42 billion – nearly double the quarterly average. This surge likely resulted from a post-pandemic rebound, as buyers focused on strengthening supply chain resilience, expanding regional distribution, and acquiring scalable platforms in a competitive landscape.

- In Q4 2021, buyers executed 155 transactions-the highest quarterly deal count during the period. This volume reflected heightened strategic and private equity interest, as well as a concerted effort to close deals before year-end under favorable credit conditions and valuation outlooks.

- During 2023 and 2024, investors maintained steady deal activity, committing between $13 billion and $31 billion in capital each quarter and completing over 100 deals consistently. This indicates a shift toward selectivity, with buyers targeting companies that offer pricing power, operational scale, and exposure to compliance-driven categories such as PPE, janitorial supplies, and industrial safety products.

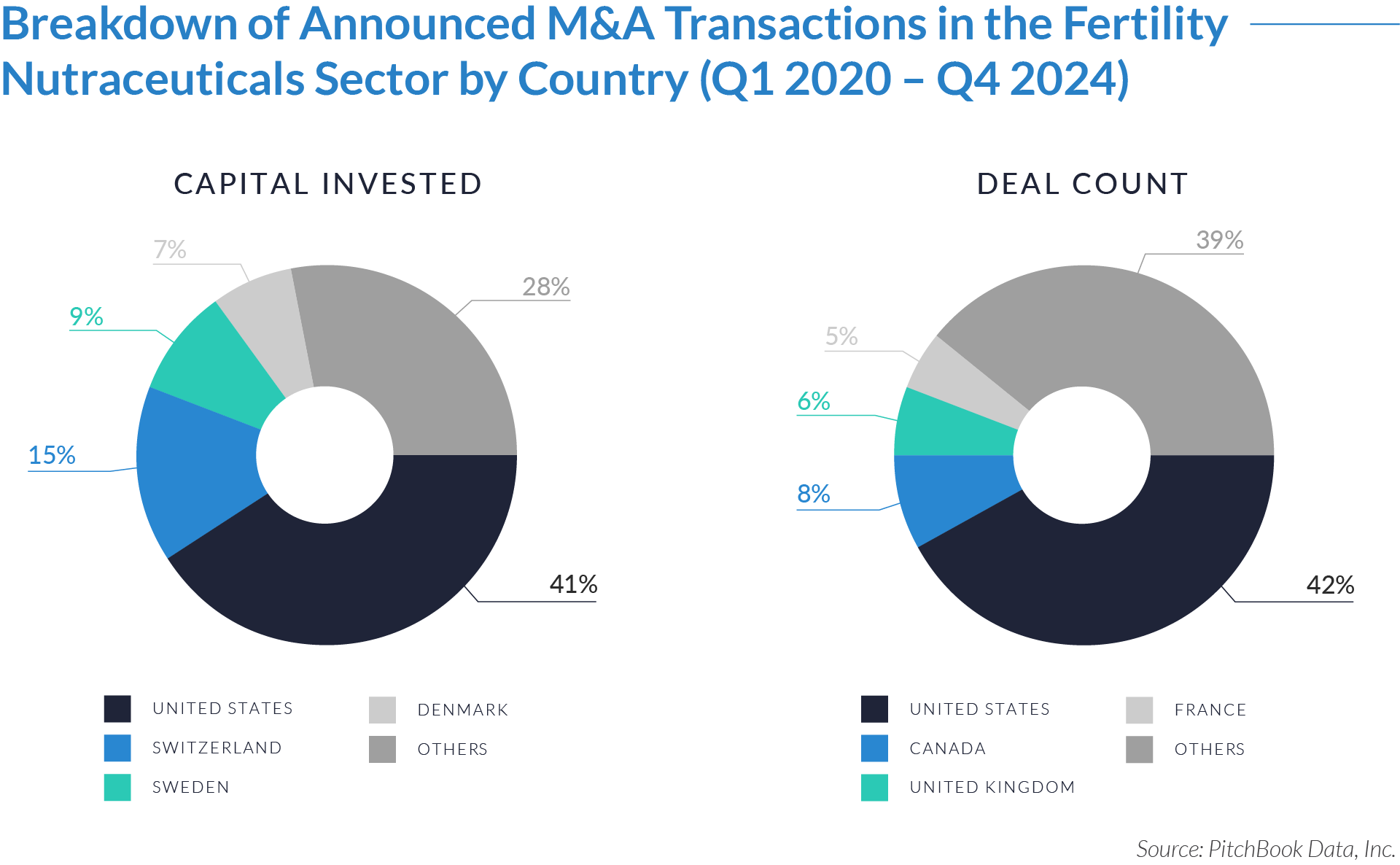

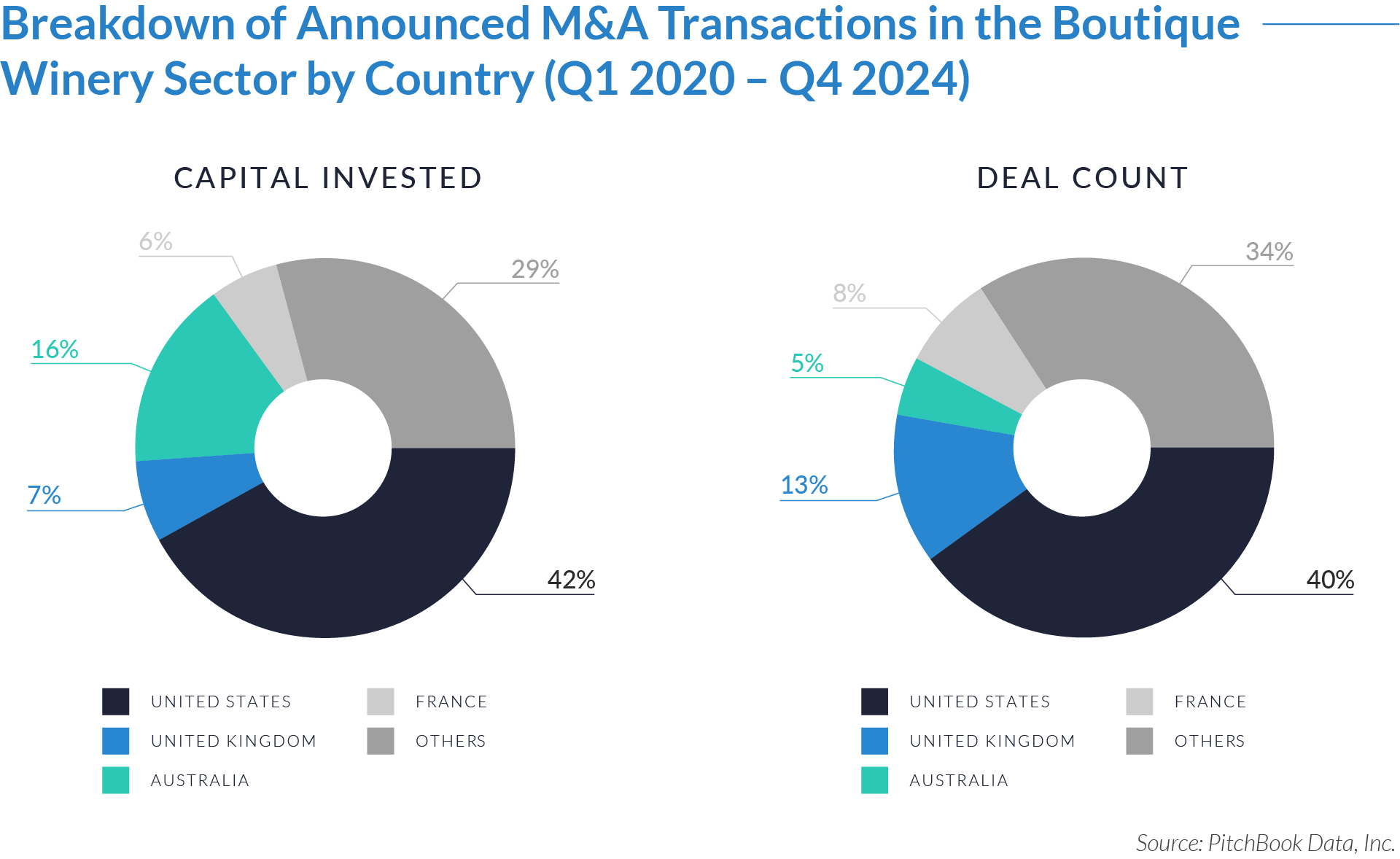

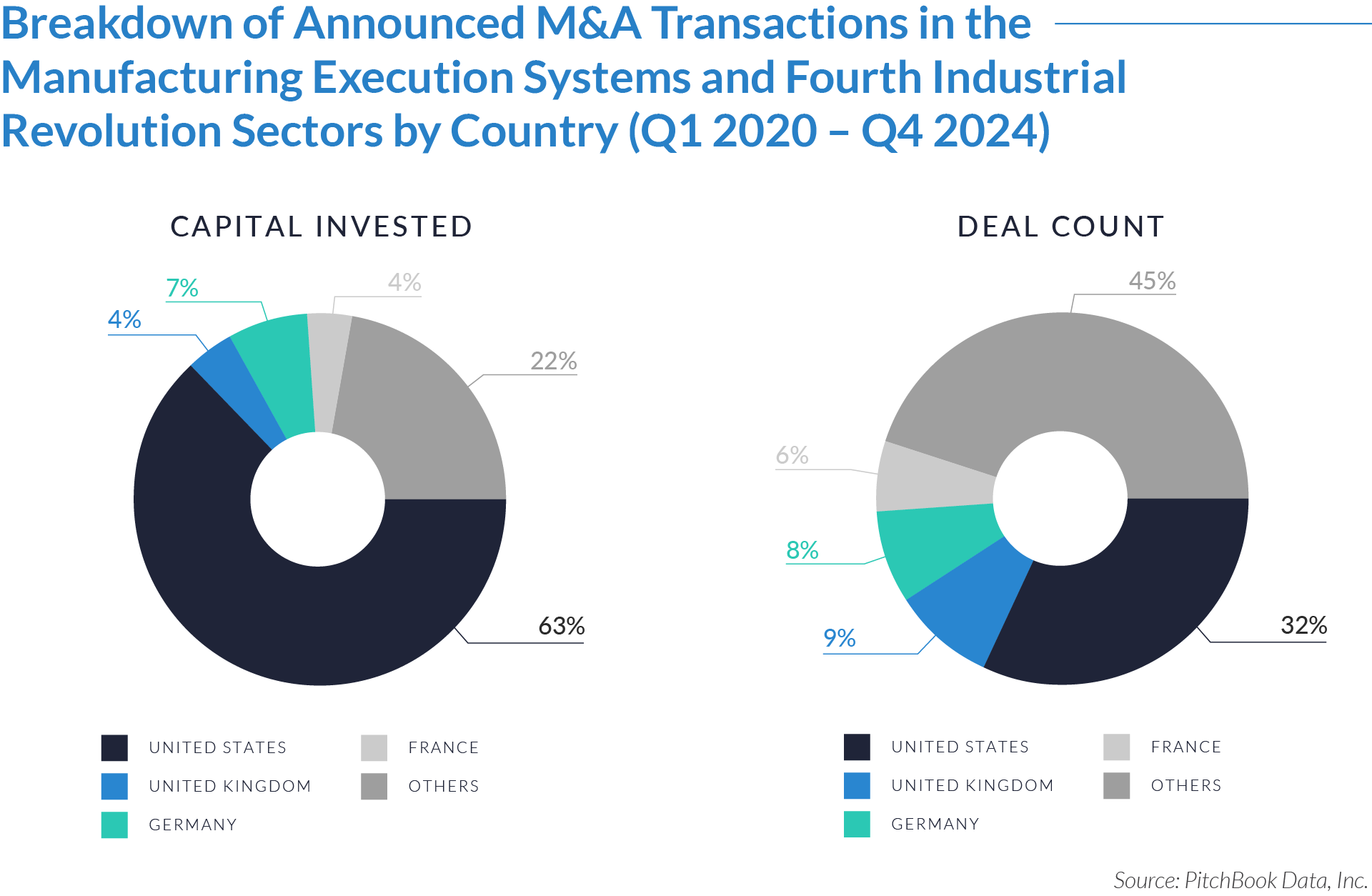

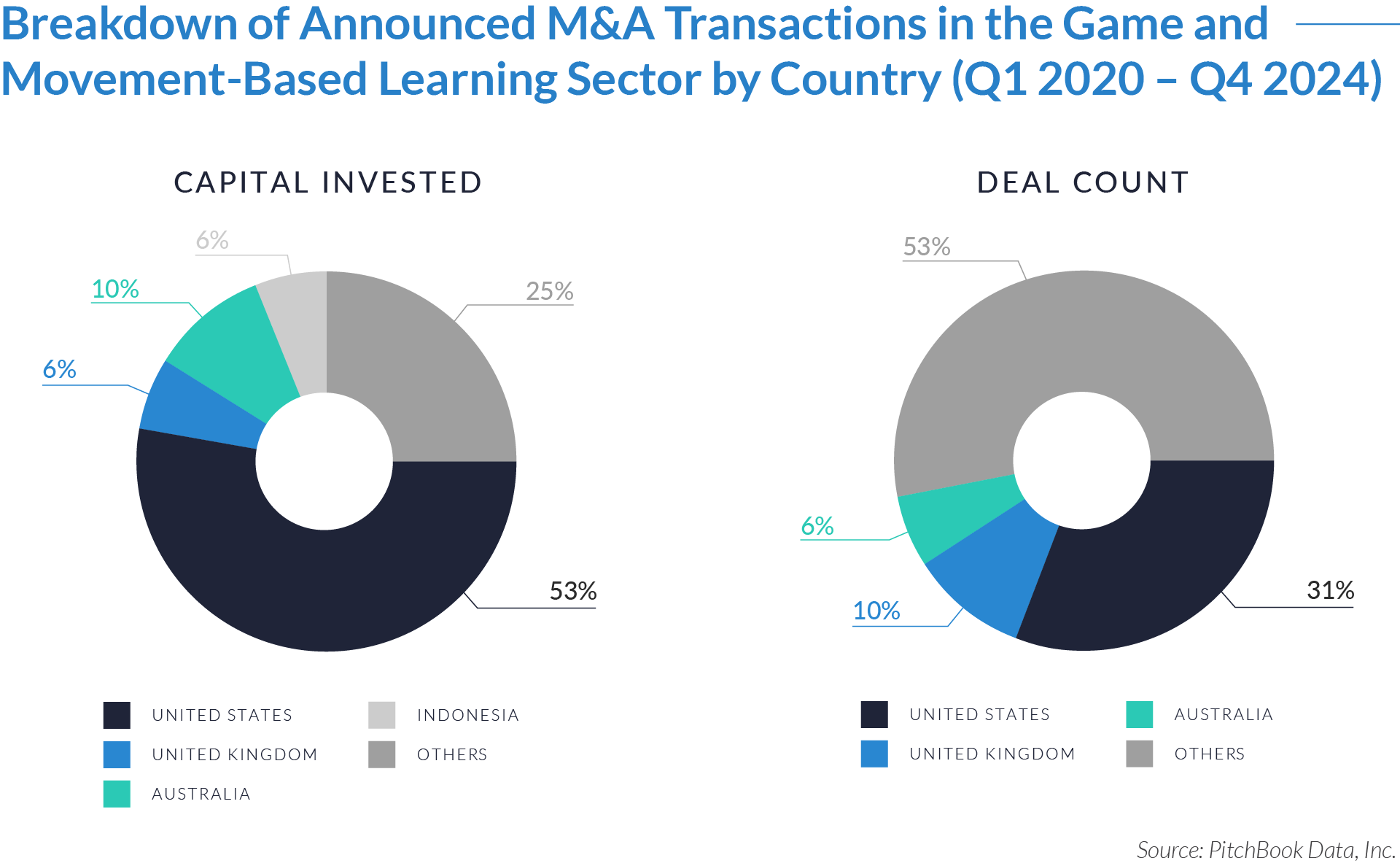

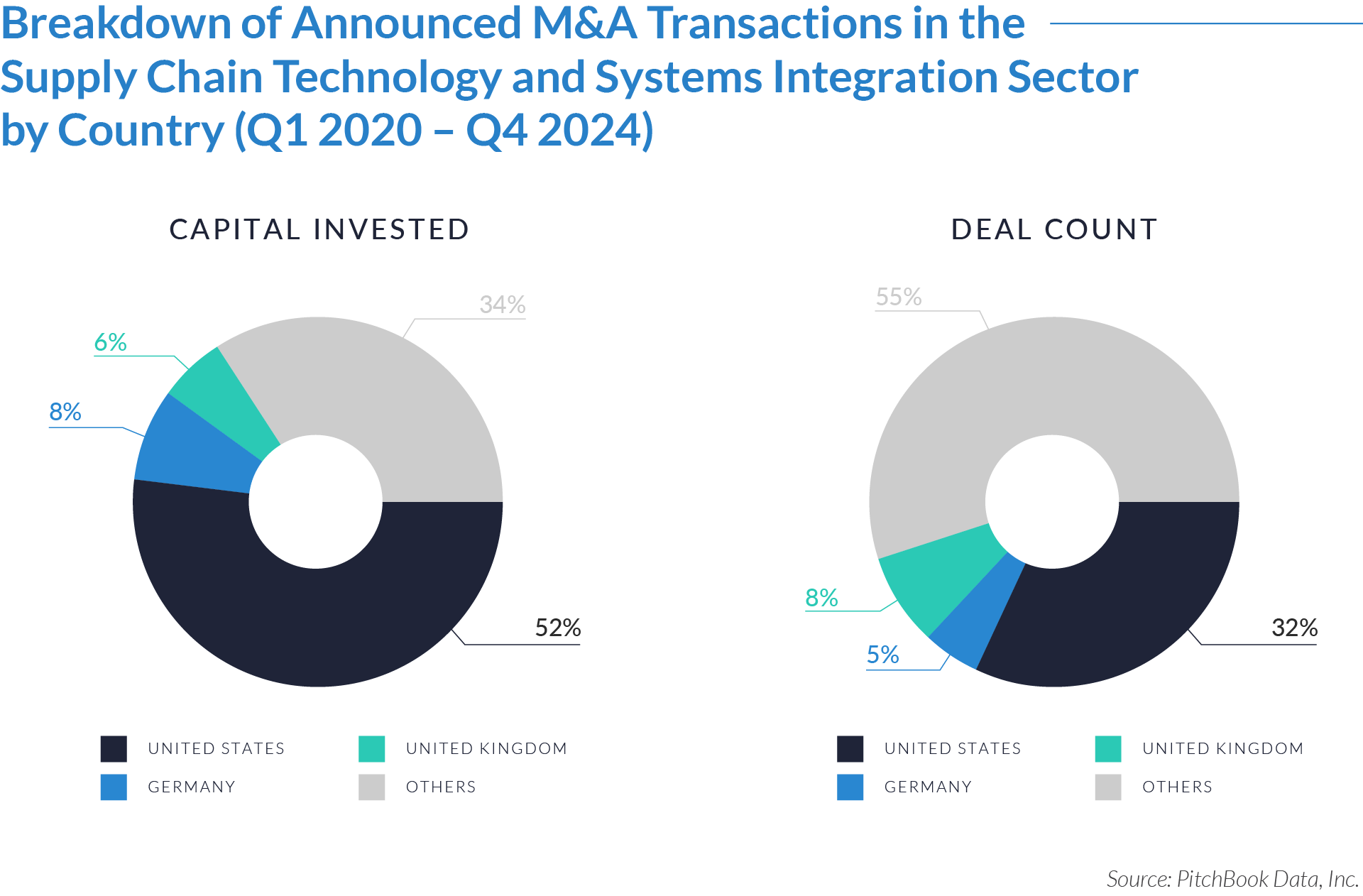

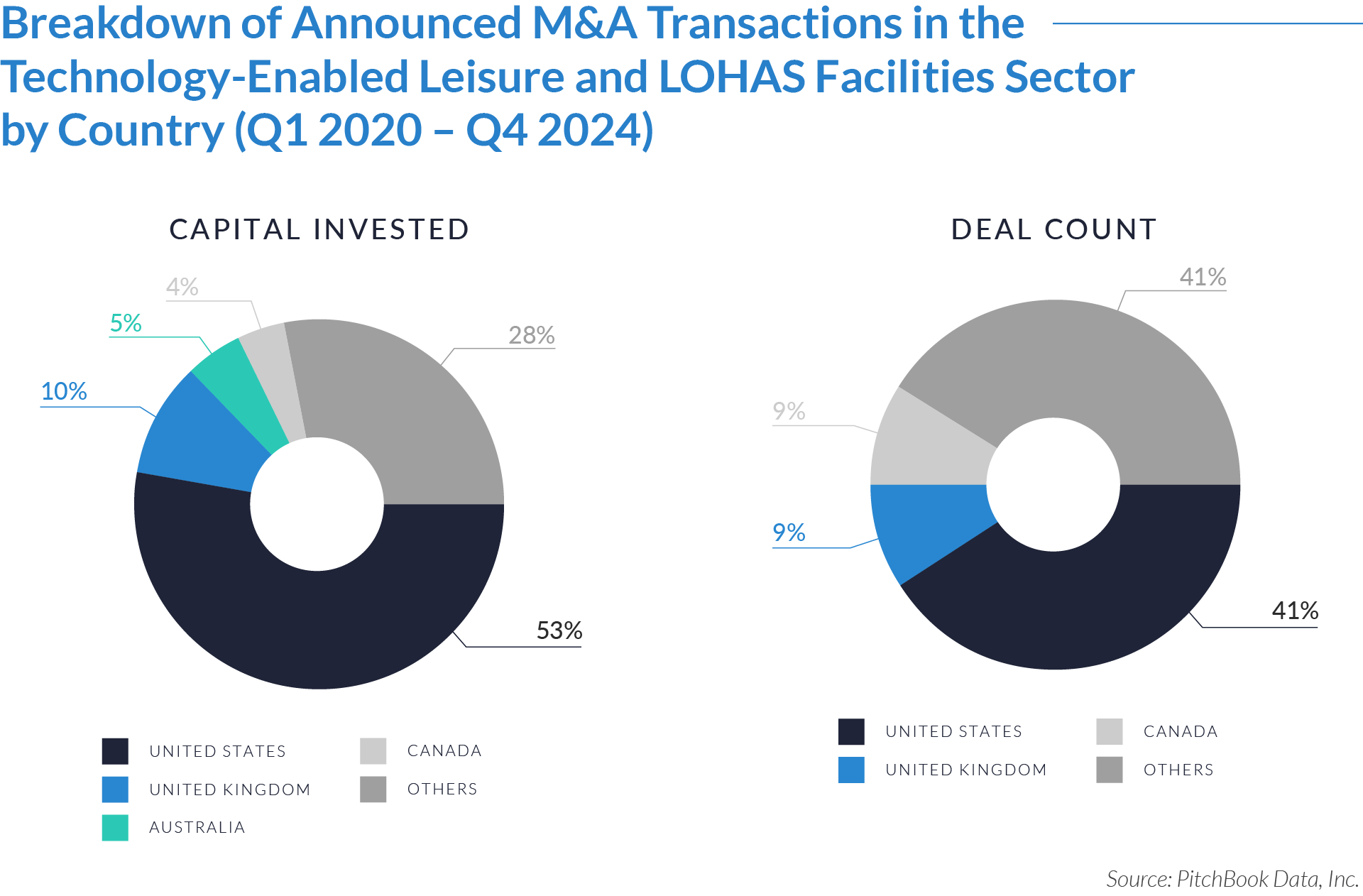

The graphs below present the geographic distribution of transactions, providing additional detail on regional trends and investment dynamics.

- US-based investors invested 55% of total capital and executed 31% of all transactions, demonstrating strong domestic participation in a mature and highly consolidated distribution market. They drove large-scale deals involving janitorial supply chains, industrial PPE distributors, and facility maintenance wholesalers.

- Investors from Germany and the United Kingdom contributed 6% and 5% of total capital, respectively. UK-based firms completed 10% of all transactions, focusing their activity on acquiring or supporting mid-sized distributors of safety products, packaging materials, and hygiene consumables across Western Europe.

- Global and regional investors allocated 34% of capital and completed 55% of transactions in emerging and international markets, where distribution networks remain fragmented and underdeveloped. They frequently targeted local distributors in Southeast Asia, Latin America, and Central and Eastern Europe through acquisitions that expanded existing platforms or enabled market entry. This elevated deal volume highlights a coordinated push to build scale and capture first-mover advantages in underserved regions.

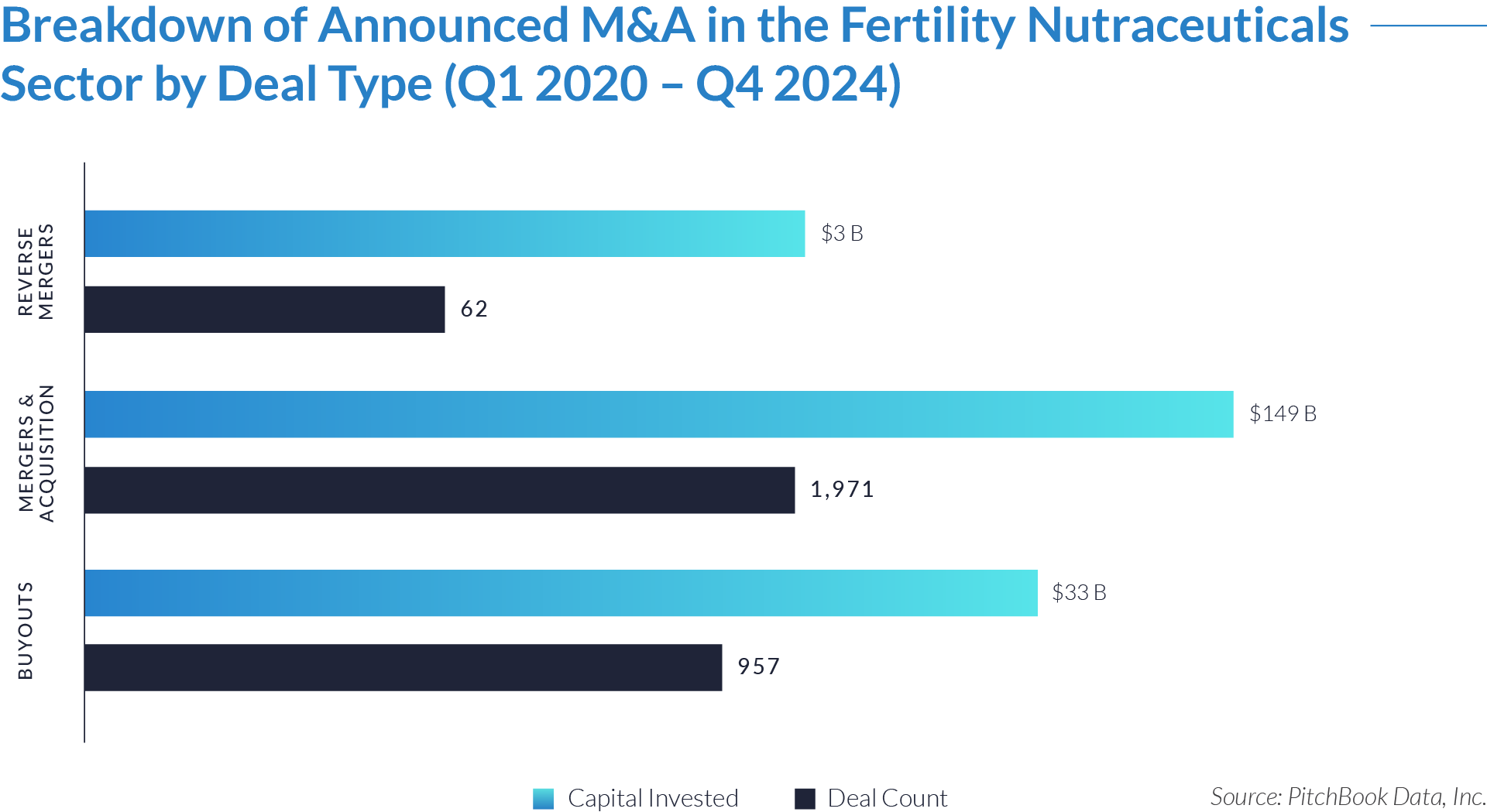

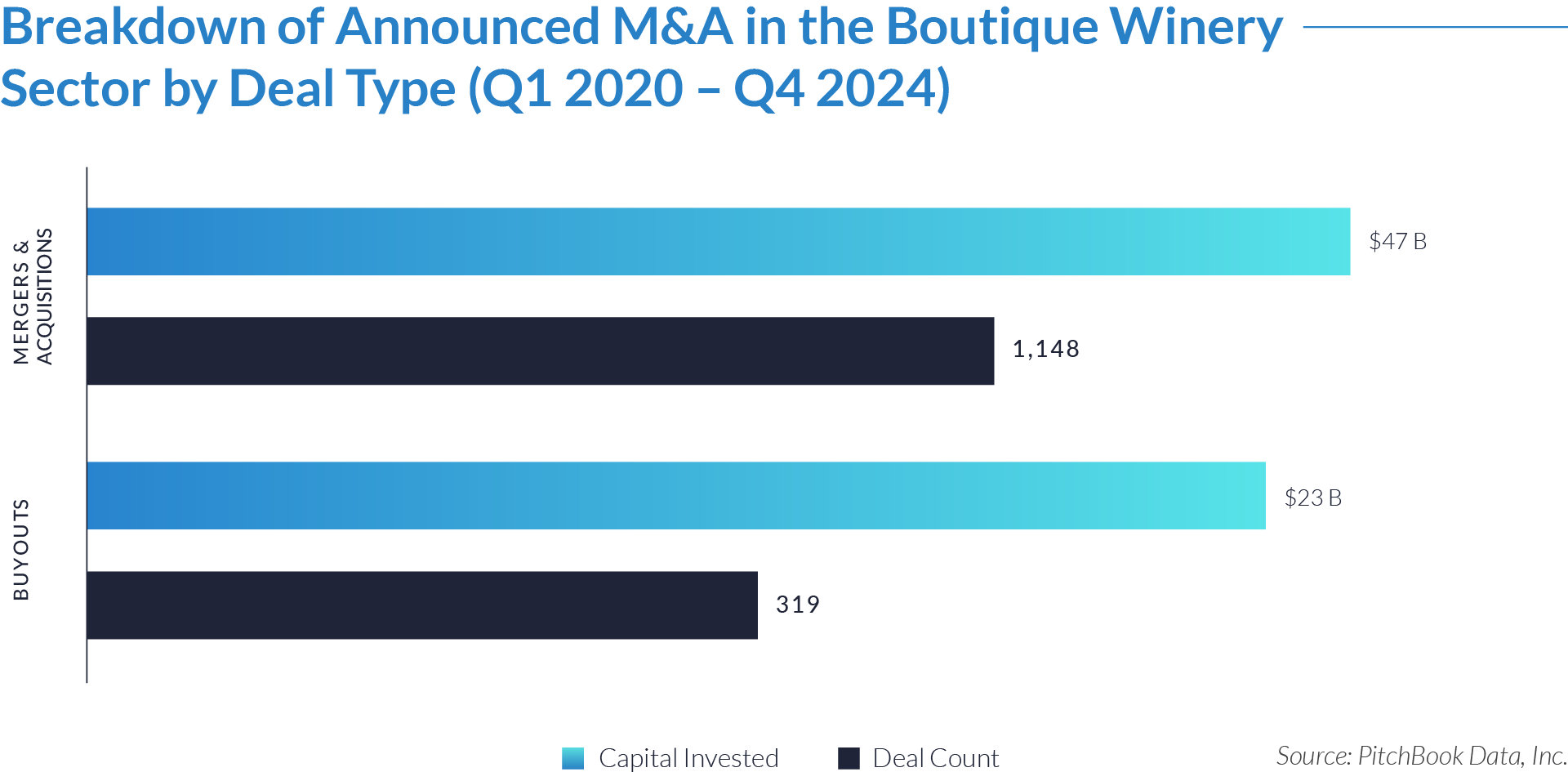

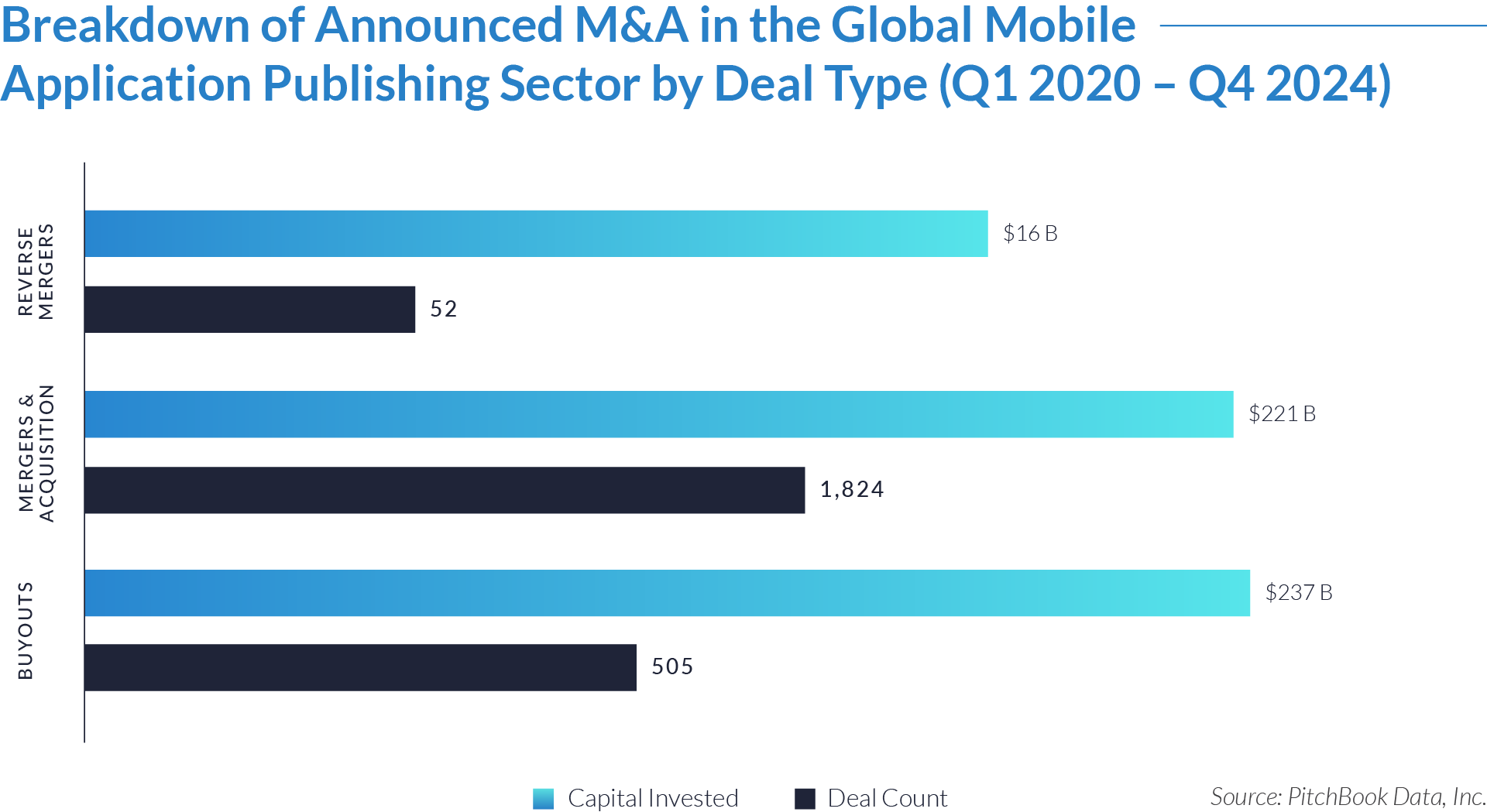

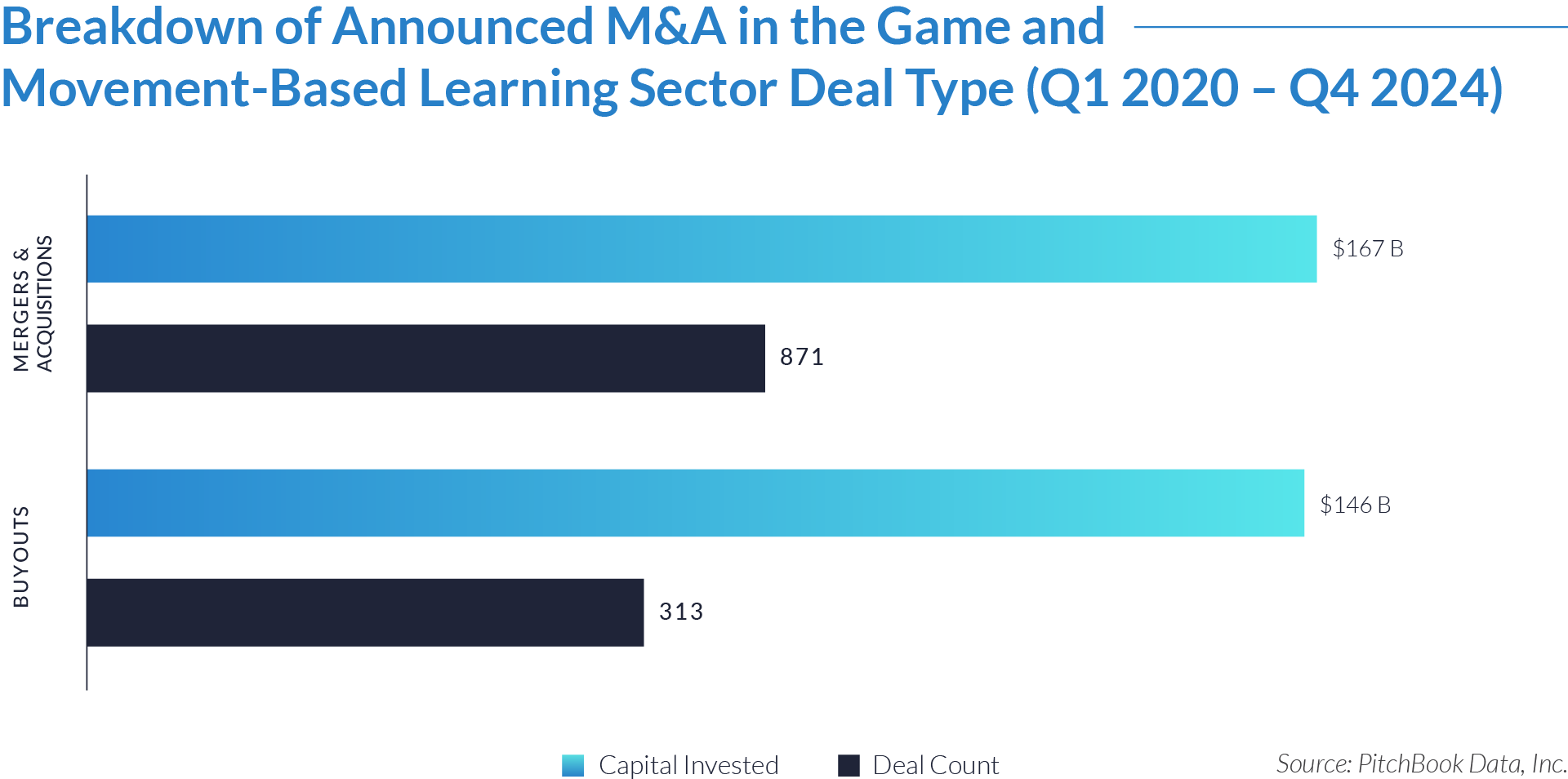

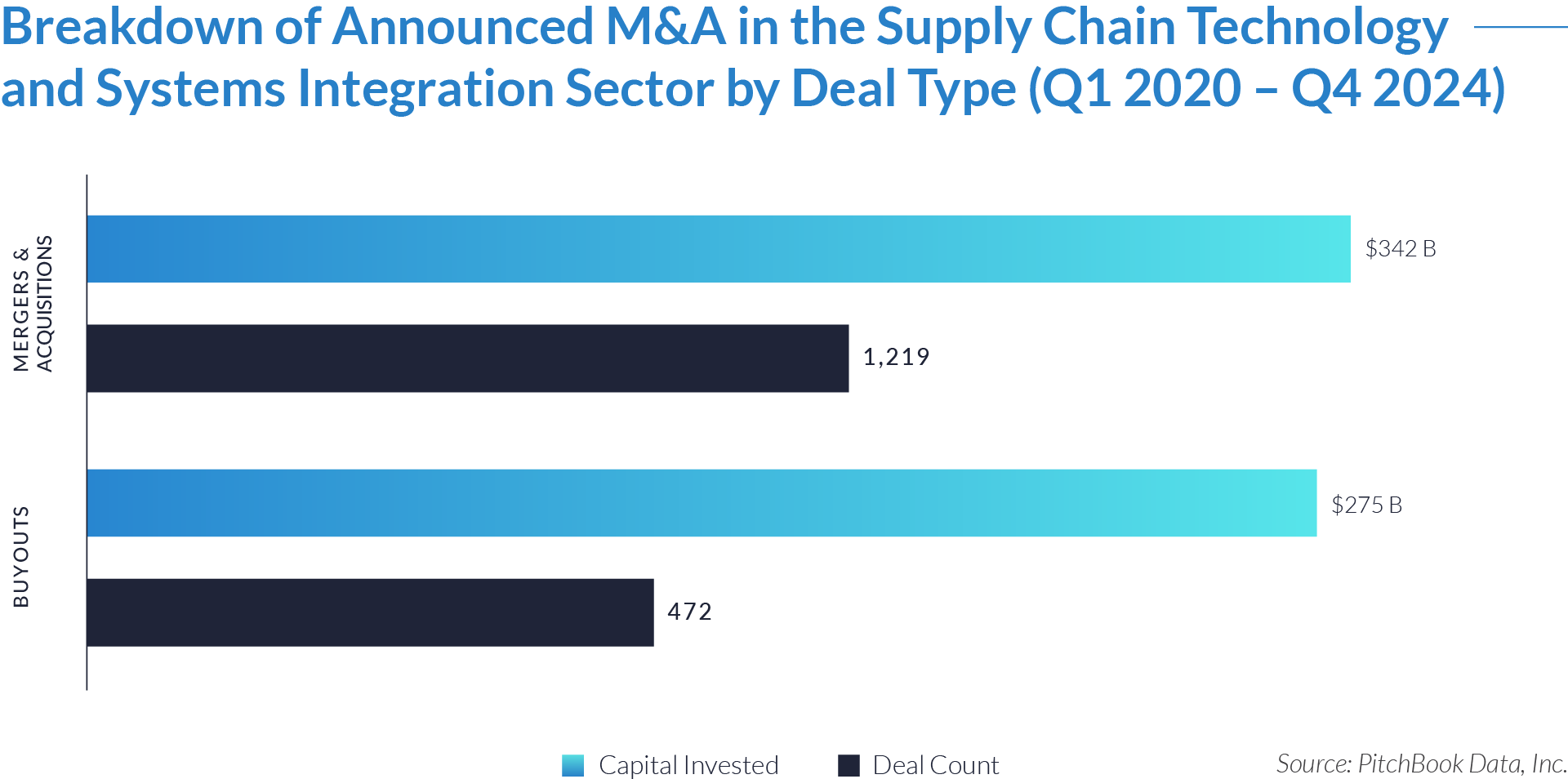

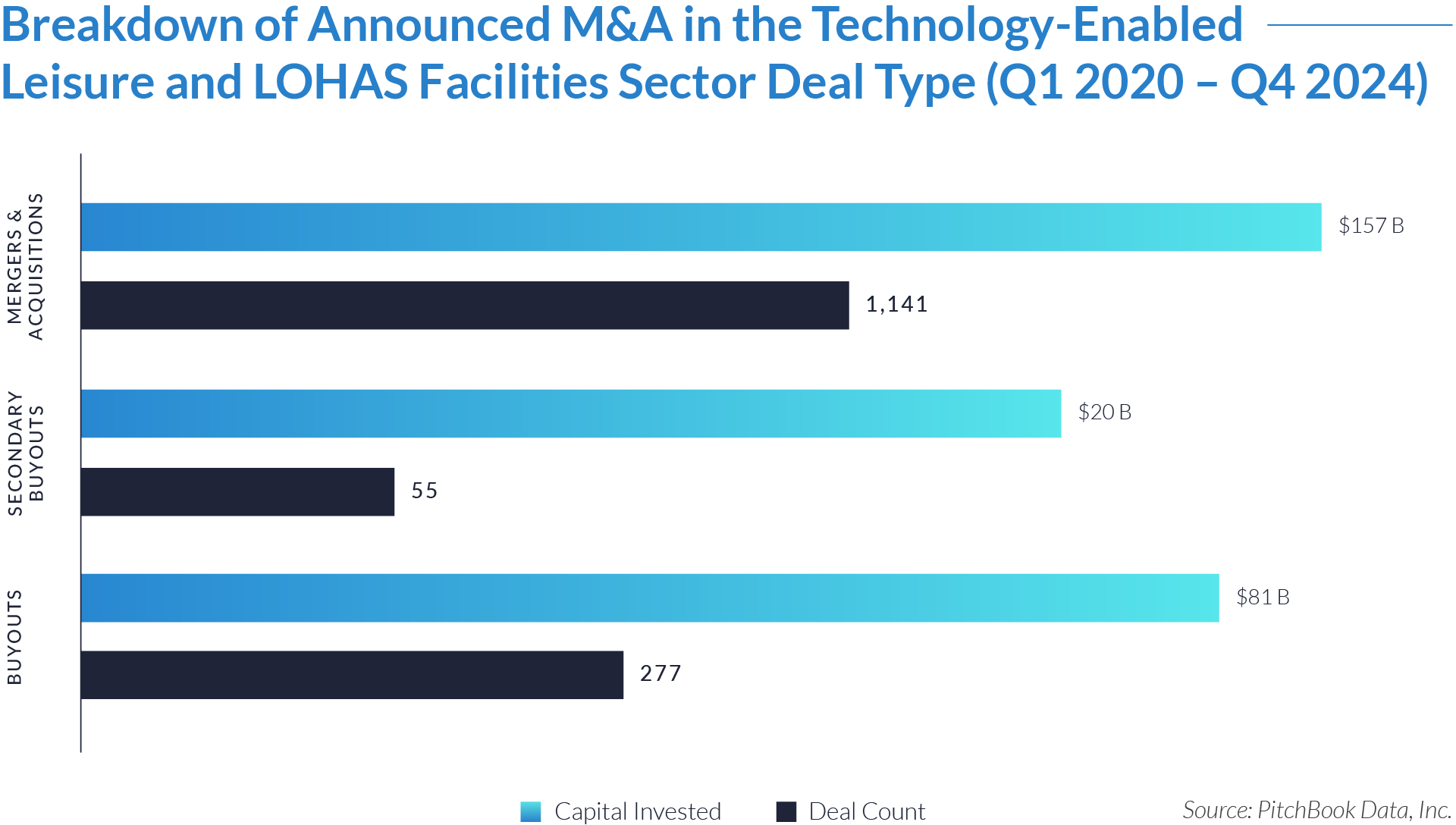

The deal-type dynamics below set the stage for understanding how capital flows and strategic priorities shape the B2B non-food consumables sector’s growth and landscape.

- Strategic buyers and consolidators drove most mergers and acquisitions, completing 1,848 transactions and deploying $297 billion. They pursued these deals to scale operations, expand product lines, and reach new customer segments.

- Private equity firms executed 410 buyouts, investing $137 billion in distribution businesses with stable cash flows and potential for operational improvements and geographic expansion.

- Investors completed only 14 reverse mergers, representing $6 billion in total capital. They favored traditional acquisition structures over reverse mergers, as most privately held, operationally focused distributors rarely pursued public listing strategies.

M&A Transactions Case Studies

Three strategic transactions in the B2B non-food consumables sector highlight a broader trend of platform consolidation, regional expansion, and category depth across hygiene, safety, and facility supply chains. These deals reflect sustained investor interest in stable, margin-accretive distribution businesses that serve essential industries such as healthcare, education, and hospitality. Each transaction underscores the strategic value of customer loyalty, geographic reach, and operational scalability, reinforcing the long-term attractiveness of multi-category distributors in a fragmented but mission-critical supply landscape.

Case Study 01

MIRACLE SANITATION SUPPLY

Miracle Sanitation Supply is a Canada-based distributor of janitorial and sanitation products, serving commercial, institutional, and industrial customers. Its product portfolio includes cleaning chemicals, paper goods, equipment, waste management solutions, and related consumables. With a strong reputation for customer service and regional logistics, the company supports clients across sectors such as healthcare, education, building services, and foodservice.

Transaction Structure

Bunzl acquired Miracle Sanitation in December 2023 for an undisclosed amount.

Market and Customer Segments Combination

The acquisition added a well-established regional customer base in Canada to Bunzl’s platform, particularly within the healthcare, facilities management, and foodservice sectors. It also strengthened Bunzl’s ability to serve mid-sized institutional and commercial clients by improving localized distribution, product accessibility, and service responsiveness.

Acquisition Strategic Rationale

The transaction aligned with Bunzl’s ongoing strategy to consolidate independent distributors across key product categories and geographic markets. Miracle Sanitation offered Bunzl a strategic opportunity to expand its footprint in Canada, diversify its product offering, and enhance service delivery in high-volume, compliance-driven segments such as sanitation, safety, and facility maintenance.

Case Study 02

ENVOY SOLUTIONS

Envoy Solutions was a US-based distributor specializing in janitorial and sanitation supplies, packaging, facility maintenance products, and foodservice disposables. The company served B2B clients across a range of sectors, including education, healthcare, commercial real estate, and industrial facilities. Through a national footprint and a series of acquisitions, Envoy Solutions had established itself as a prominent player in the non-food consumables distribution space.

Transaction Structure

BradyPLUS (formerly BradyIFS), backed by financial sponsors Kelso & Company and Warburg Pincus, acquired Envoy Solutions through a leveraged buyout valued at approximately $2 billion.

Market and Customer Segments Combination

The transaction combined two major US distributors with overlapping exposure to institutional sectors such as commercial cleaning, education, healthcare, and foodservice. Both companies operated in the janitorial and sanitation supplies, packaging, and disposable product categories. The merger extended BradyPLUS’s national footprint and deepened its presence in key regional markets, particularly in the Midwest and along the East Coast.

Acquisition Strategic Rationale

BradyPLUS completed the acquisition to accelerate its national consolidation strategy, expand cross-category selling opportunities, and improve operating scale. The transaction supported the private equity sponsors’ objective to build a category-leading distribution platform with broad geographic reach, diverse revenue channels, and optimized supply chain capabilities.

Case Study 03

IMPERIAL DADE

Imperial Dade is a leading North American distributor of non-food consumables, with a core focus on janitorial and sanitation supplies, packaging materials, and safety/PPE products. The company serves a broad B2B customer base across sectors including hospitality, healthcare, education, foodservice, and industry. Through its extensive product range and value-added services, Imperial Dade helps clients maintain clean, safe, and efficient facilities while streamlining supply chains and operational processes.

Transaction Structure

Advent International, ACE & Company, and Ergo Partners acquired Imperial Dade through a leveraged buyout. The deal was supported by $650 million in debt financing, the total purchase price was not publicly disclosed.

Market and Customer Segments Combination

The acquisition strengthened Imperial Dade’s position across several B2B end markets, including commercial cleaning, healthcare, education, and industrial segments. Its scalable distribution network and wide-ranging product portfolio allowed the company to serve both regional and national accounts with tailored, sector-specific solutions. Strong relationships with institutional clients and contract service providers further reinforced its role as a key supplier in the non-food consumables space.

Acquisition Strategic Rationale

The transaction aligned with Imperial Dade’s strategic objective of accelerating growth through acquisitions and geographic expansion across North America. The recapitalization by Advent and its partners provided capital and operational support to scale the company’s logistics infrastructure, digital platforms, and product capabilities. The deal reflected increasing demand for outsourced facility supplies and essential non-food consumables in institutional and commercial environments.

Investors continue to target the B2B non-food consumables sector due to its critical role in institutional operations and its resilience through economic cycles. M&A activity has concentrated on consolidating distribution networks, broadening geographic coverage, and enhancing operational efficiency. Private equity firms and strategic buyers actively seek scalable platforms with recurring demand and consistent margins. These dynamics position the sector for sustained growth and reinforce its appeal as a long-term investment and diversification opportunity.

Source: BUNZL, BradyPlus, PR Newswire, BAIRD, Businesswire, Pitchbook Data.