The Rise of Saudi Arabia: Travel, Tourism, and Hospitality

Part 2 of 2

![The Rise of Saudi Arabia [Travel, Tourism and Hospitality] The Rise of Saudi Arabia [Travel, Tourism and Hospitality]](https://jahaniandassociates.com/wp-content/uploads/2021/06/KSAboxes-18-1024x211.png)

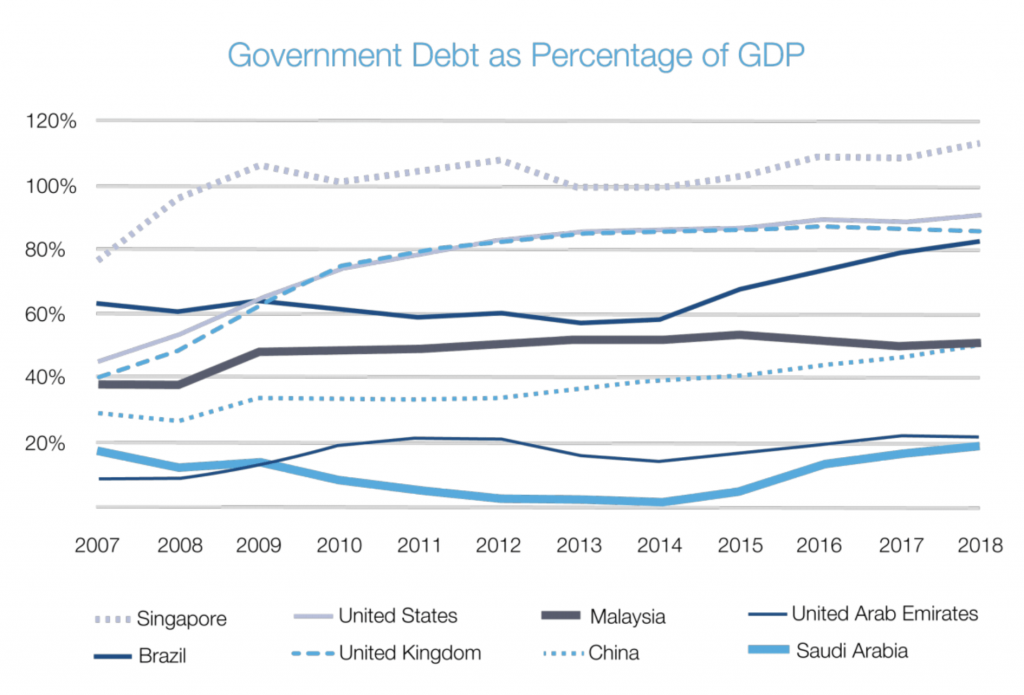

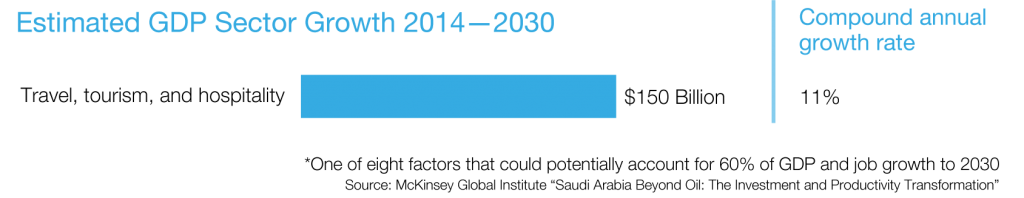

There are eight sectors that are expected to account for the majority of KSA’s economic growth into 2030. The travel, tourism, and hospitality industries are expected to account for 11% of total GDP growth in that time period. This part of the series will take a closer look at these sectors and their expected changes over time. The sectors’ growth will slow due to the COVID-19 pandemic, but they will likely remain a key growth area well into 2030. Even during the pandemic, domestic tourism is on the rise while international tourism has slowed.

Saudi Arabia is home to Makkah, the holiest Islamic religious site, in addition to several natural tourist locations such as beaches, mountains, and valleys. The kingdom is taking active steps to make tourism and hospitality more accessible. This includes the privatization of certain tourism services and the preservation of important cultural and historic sites.

Rising International Tourism in the Kingdom

- International tourists have more than doubled in KSA since 2005; this is largely due to the easing of restrictions for tourist visas to enter the country.

- About 10 to 13 million Muslims visit the holy sites of Makkah and Medina every year, including more than two million during the annual Hajj pilgrimage period.

- The kingdom possesses a wealth of archaeological sites such as UNESCO world heritage site Mada’in Saleh and areas of natural beauty like coasts and mountains; therefore, J&A sees an opportunity for thriving profit-driven tourism.

Domestic Tourism Is a Large Opportunity for Growth

- Domestic tourism presents a significant opportunity for economic growth, as locals prefer to vacation and travel outside the region.

- The Ministry of Tourism launched the Saudi Summer campaign to encourage domestic tourism during the COVID-19 pandemic.

- The Saudi Summer led to a $1.6 billion consumer spend, 26% more than the same period in 2019.

- As tourism sites become more developed, J&A expects domestic tourism spending to increase and compete with locations such as Dubai, UAE.

In the next part of our series we will review steps the KSA government is taking to grow business lending and trade.

Source: IAGS | The World Bank | IMF GCC Banking | IMF GCC Markets | IMF Trade and Foreign Investment | Saudi Arabia Vision 2030 | UAE Ministry of Finance