Technology-Enabled Digital Asset Communications Services Sector M&A Transactions and Valuations

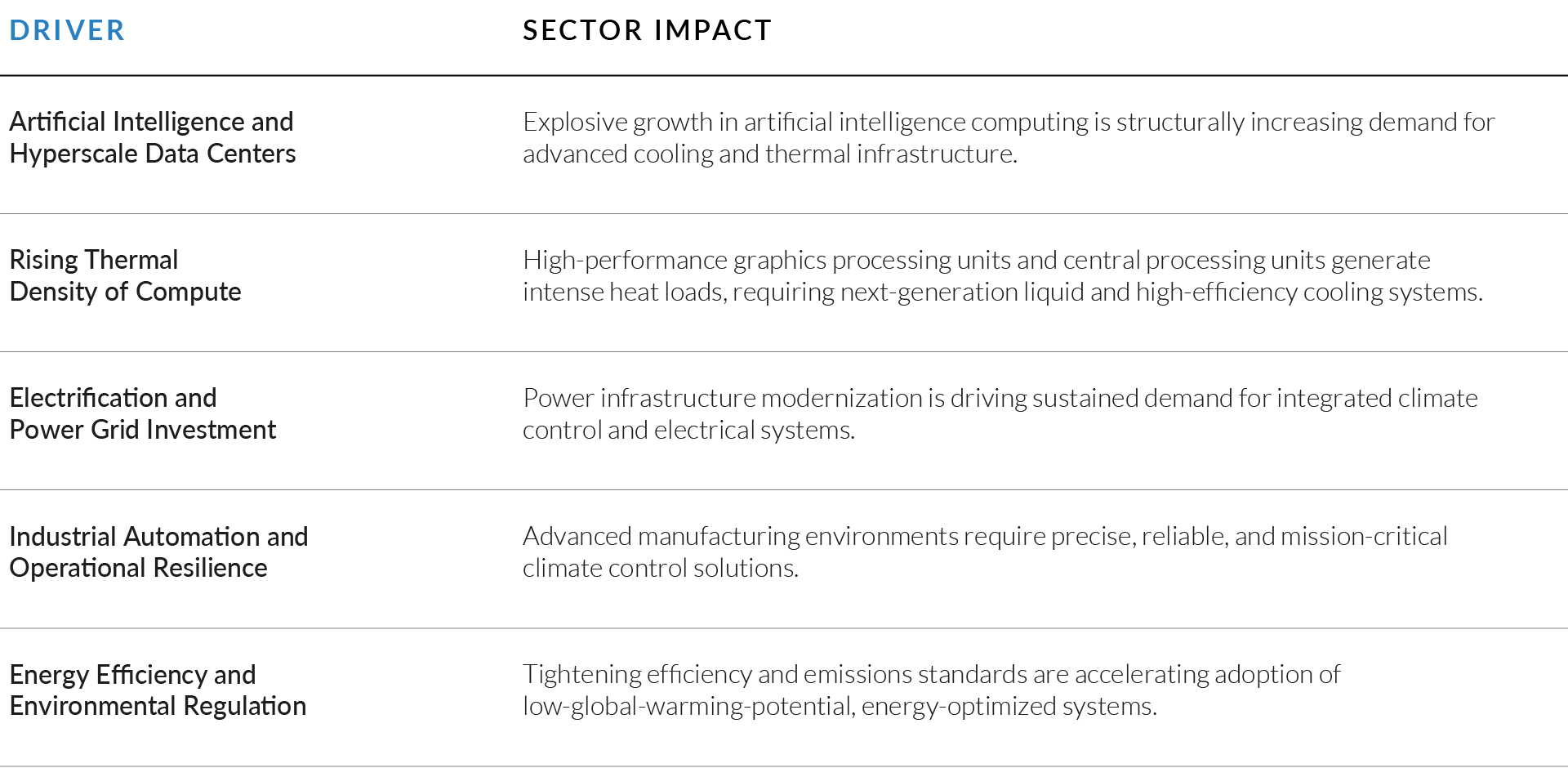

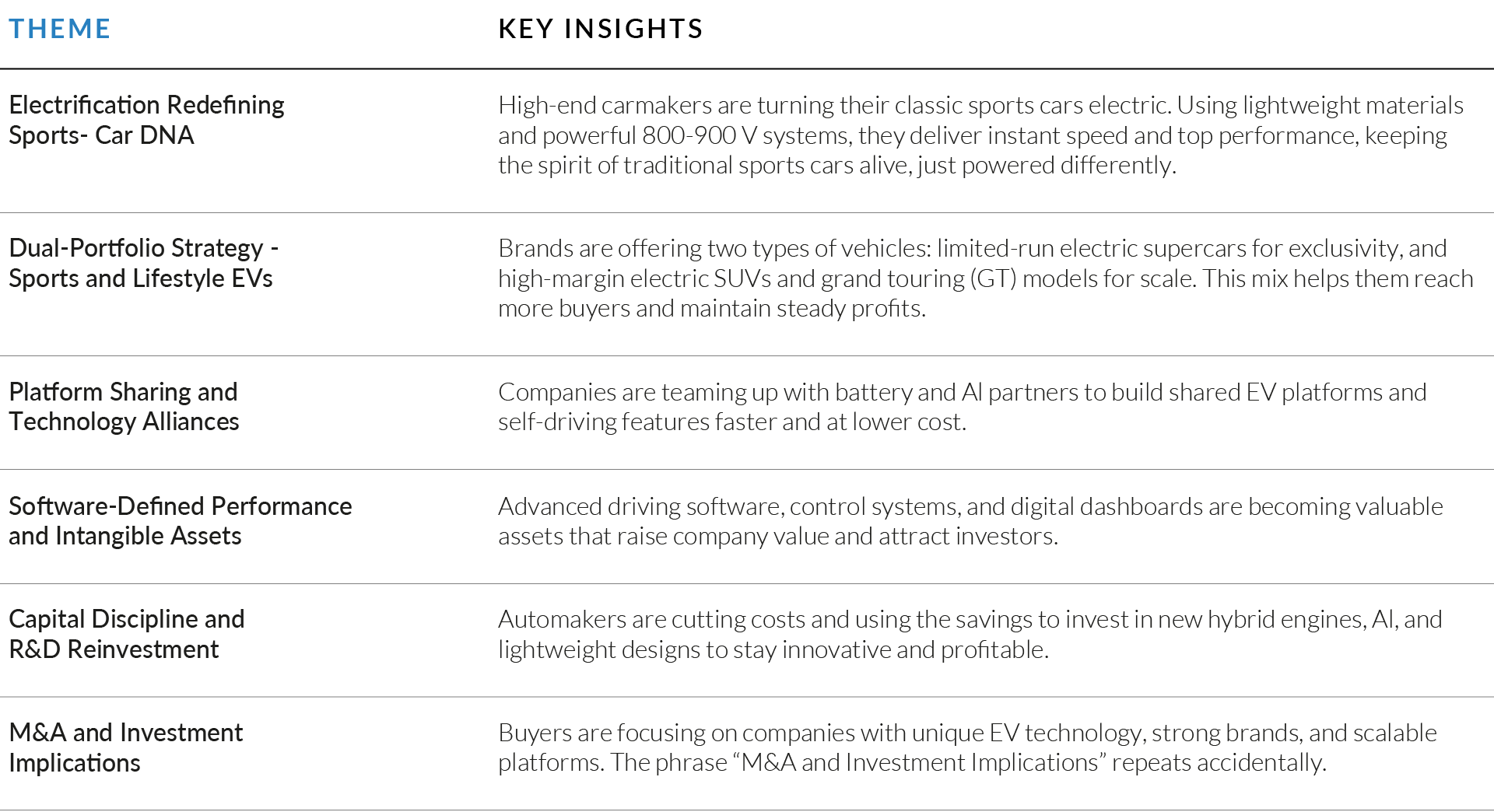

From Q1 2021 through Q4 2025, sustained growth in digital asset adoption, intensifying regulatory scrutiny, and elevated reputational risk across blockchain and Web3 markets underpinned robust M&A activity within the technology-enabled digital asset communications services sector. As digital asset companies, investors, and institutions navigated an increasingly complex and volatile operating environment, demand expanded for specialized communications and advisory providers capable of delivering strategic messaging, regulatory engagement, and reputation management with speed, credibility, and consistency.

Strategic and financial acquirers increasingly targeted advisory-led agencies offering deep expertise across public relations, public affairs, and stakeholder engagement, complemented by technology-enabled analytics, monitoring, and insight capabilities. Acquisition strategies were primarily oriented toward expanding geographic reach, increasing exposure to recurring advisory-driven revenue streams, and building integrated communications platforms that combine senior-level strategic counsel, earned media execution, and data-driven decision support.

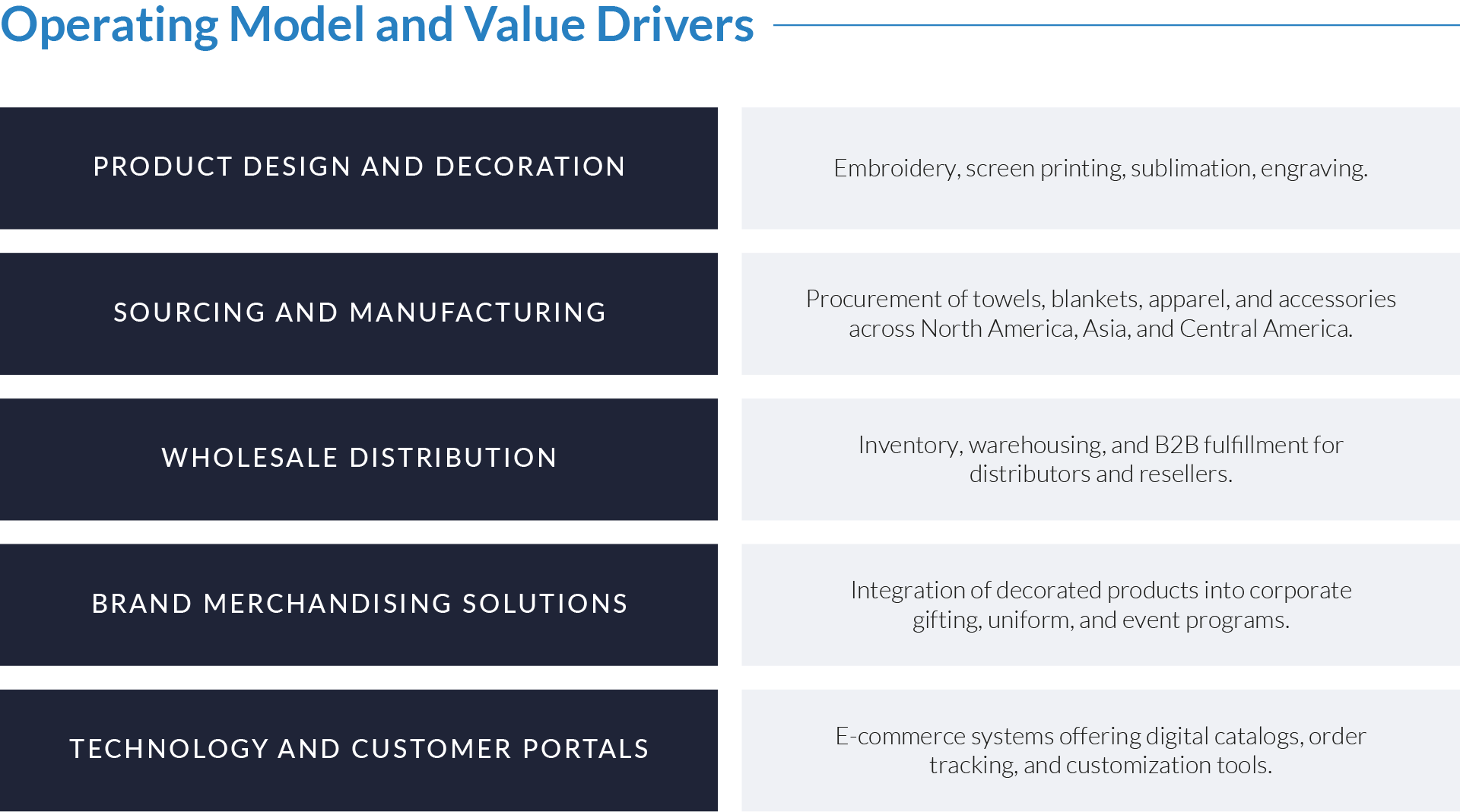

The sector comprises agencies and consultancies supporting blockchain, Web3, and digital asset ecosystems through communications strategy, public affairs, crisis management, and stakeholder engagement, with technology functioning as a service enabler rather than a standalone product. This report analyzes M&A activity and valuation dynamics across the sector, including capital deployment trends, acquirer priorities, and valuation benchmarks such as EV/revenue and EV/EBITDA multiples, while highlighting transactions that reflect continued consolidation, capability expansion, and the emergence of scaled, multi-disciplinary advisory platforms.

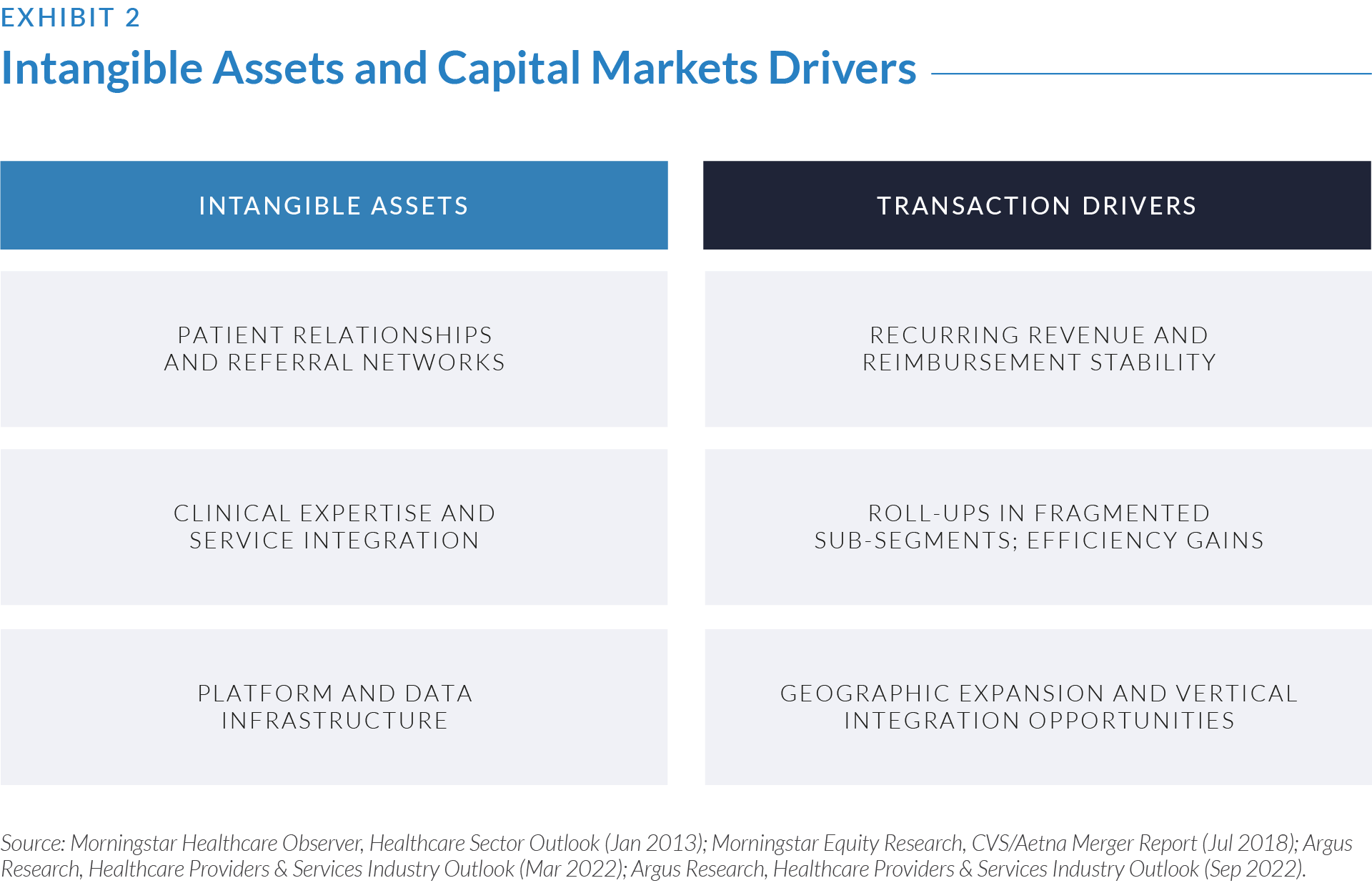

EXHIBIT 1

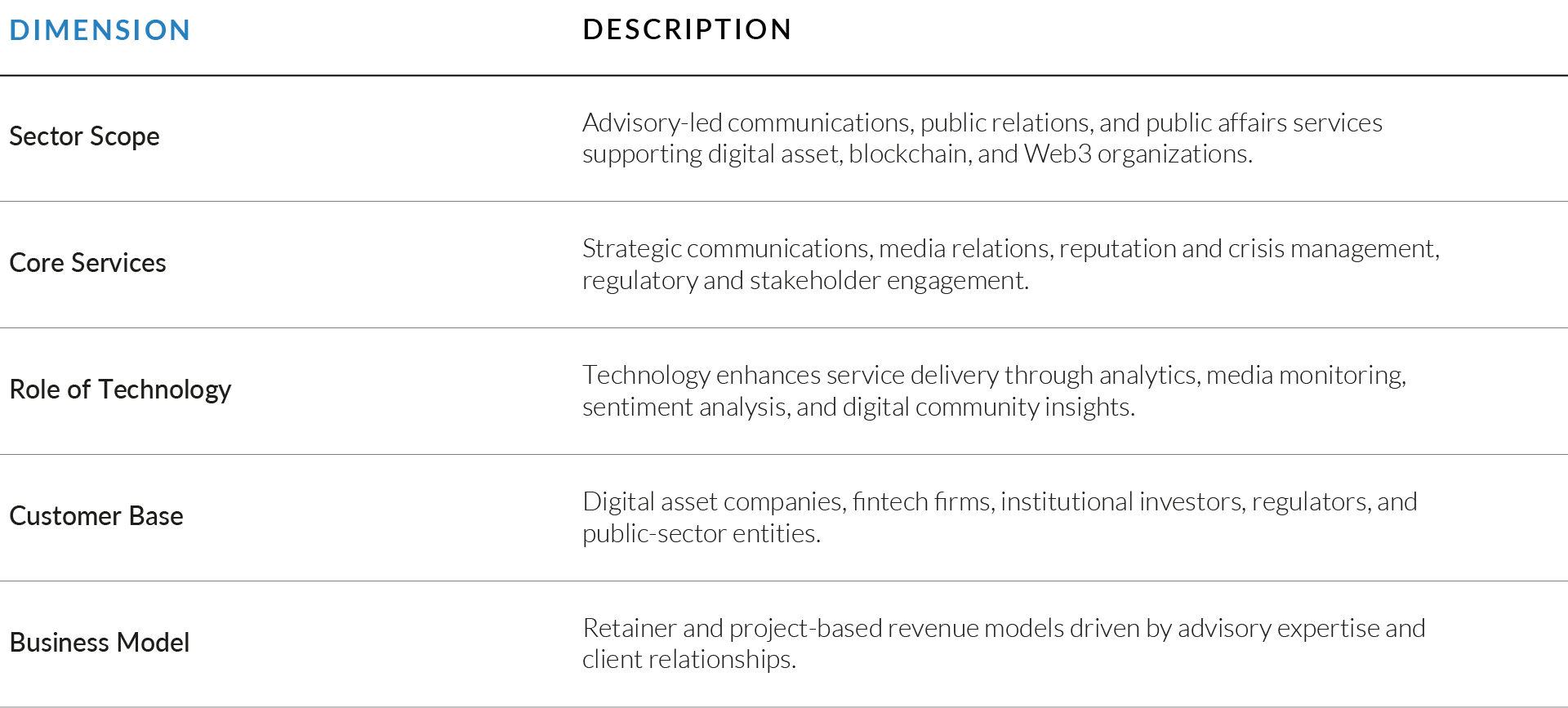

Technology-Enabled Digital Asset Communications Services – Sector Overview

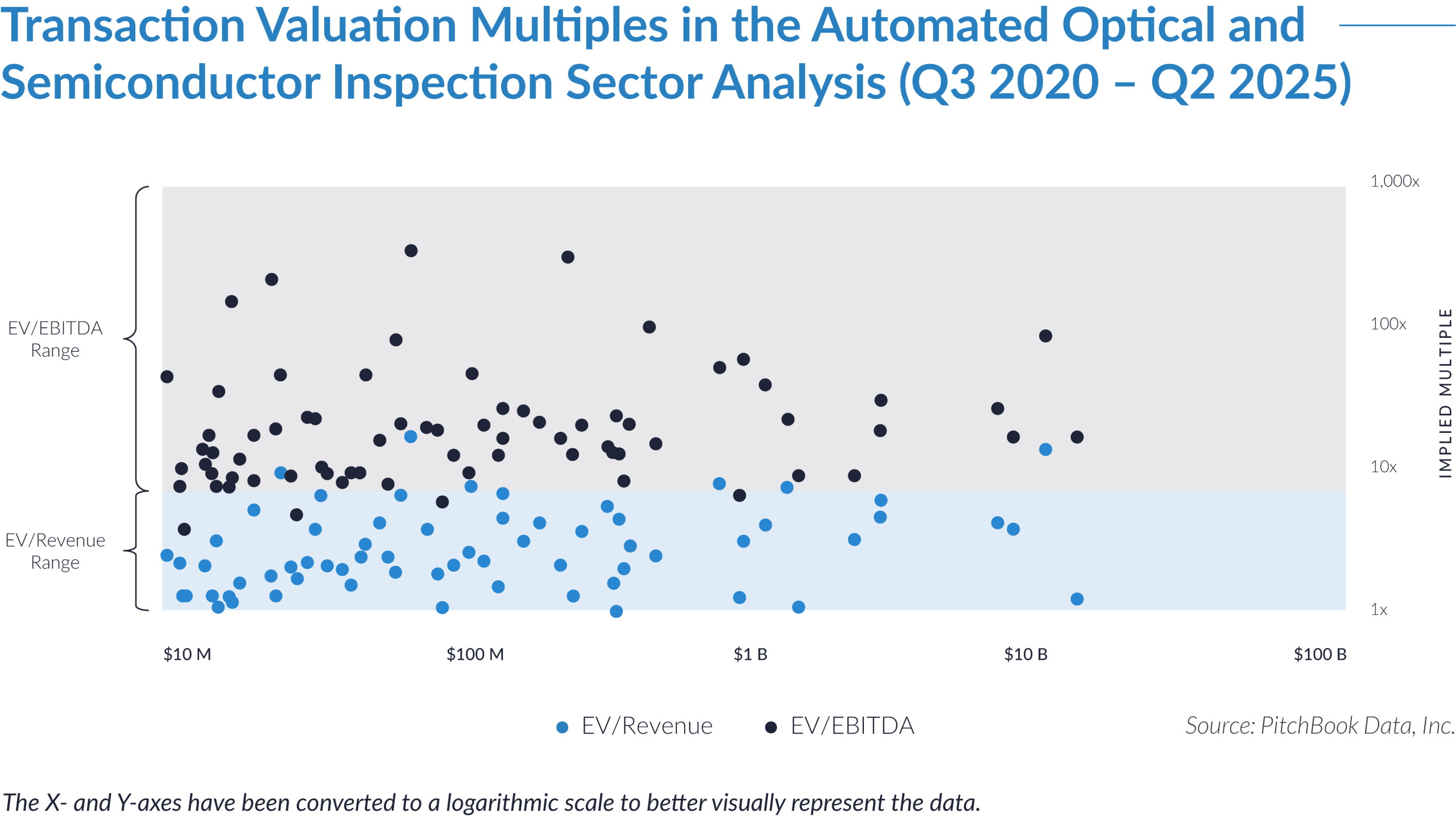

EXHIBIT 2

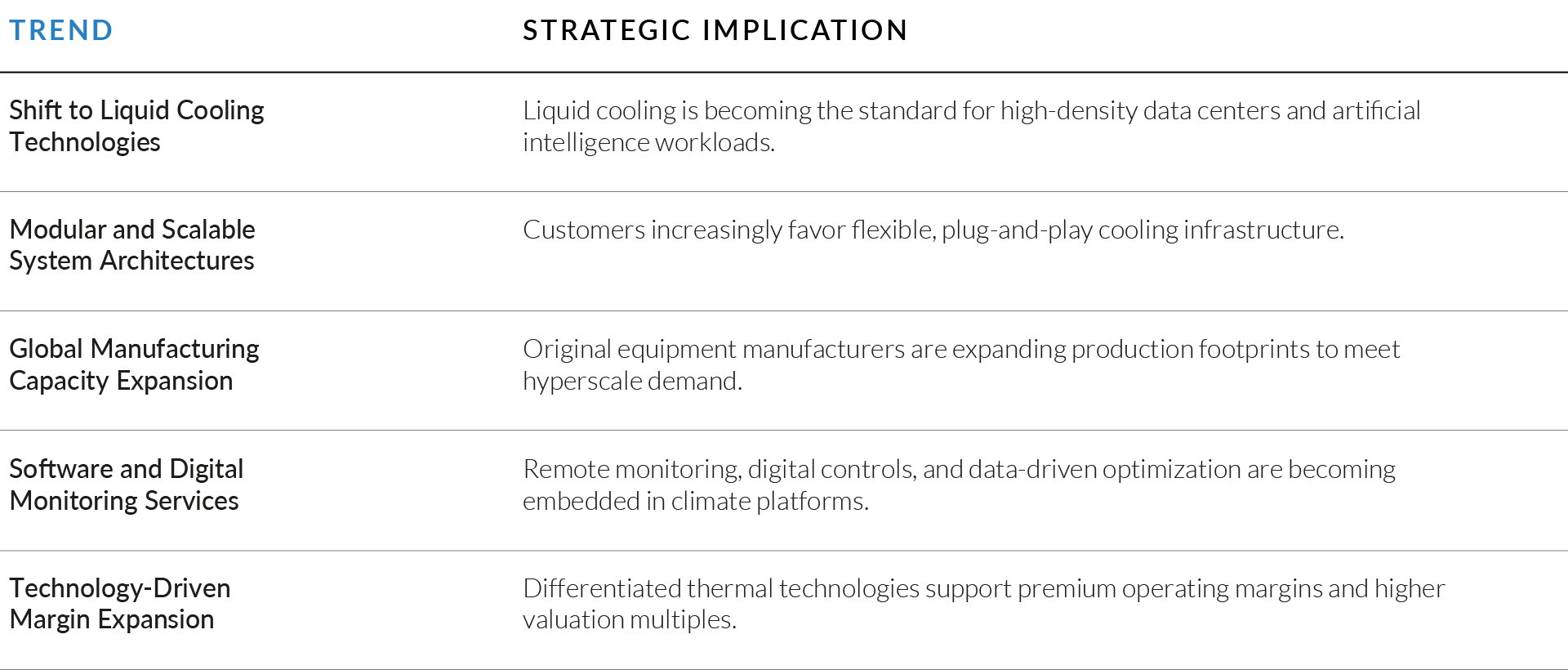

Key Trends Shaping the Sector

Source: PRovoke Media strategic communications industry insights; PRWeek technology and public affairs coverage; Edelman Trust Barometer; Forbes Technology Council Web3 communications commentary; CoinDesk digital asset market structure analysis.

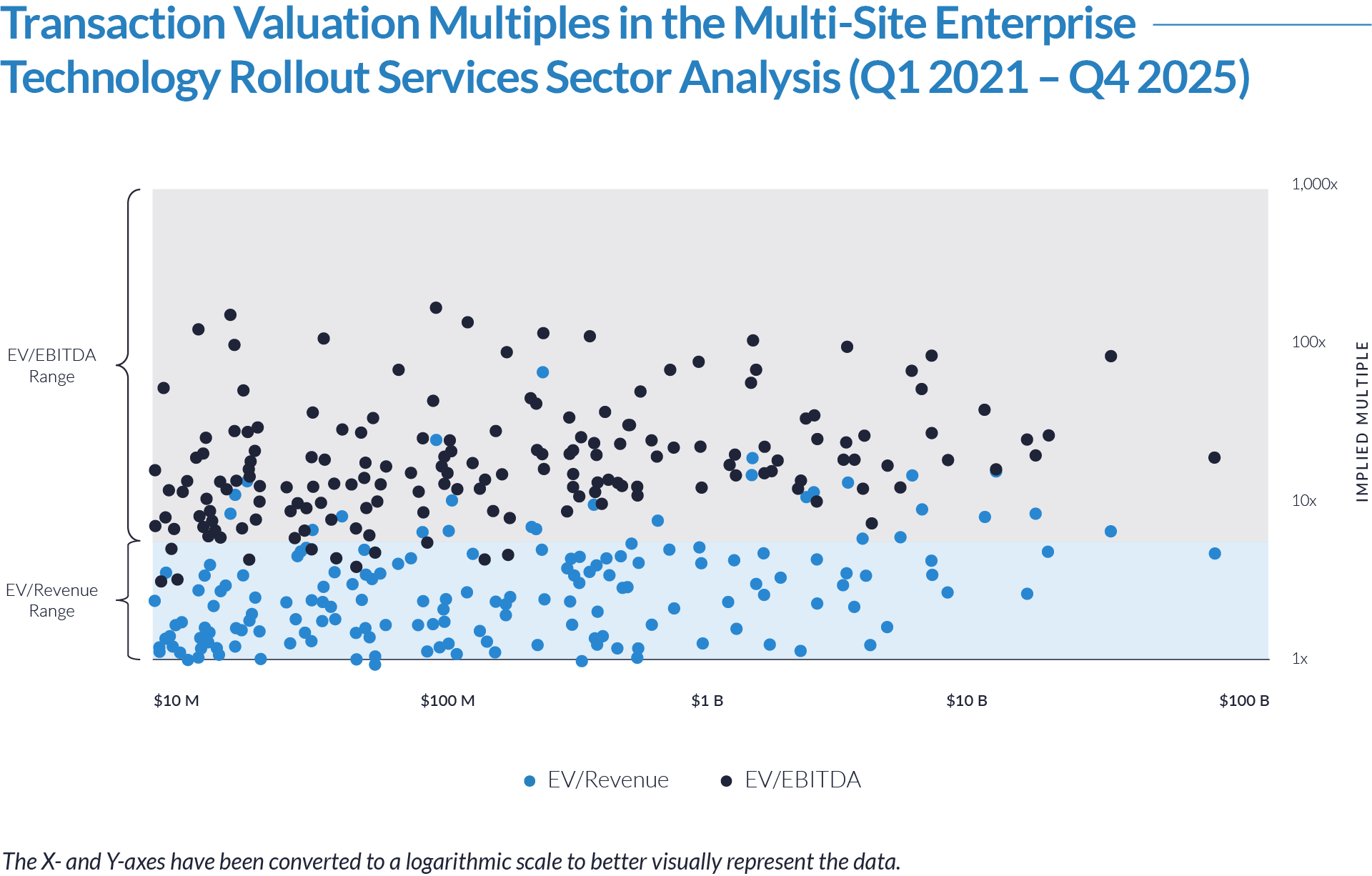

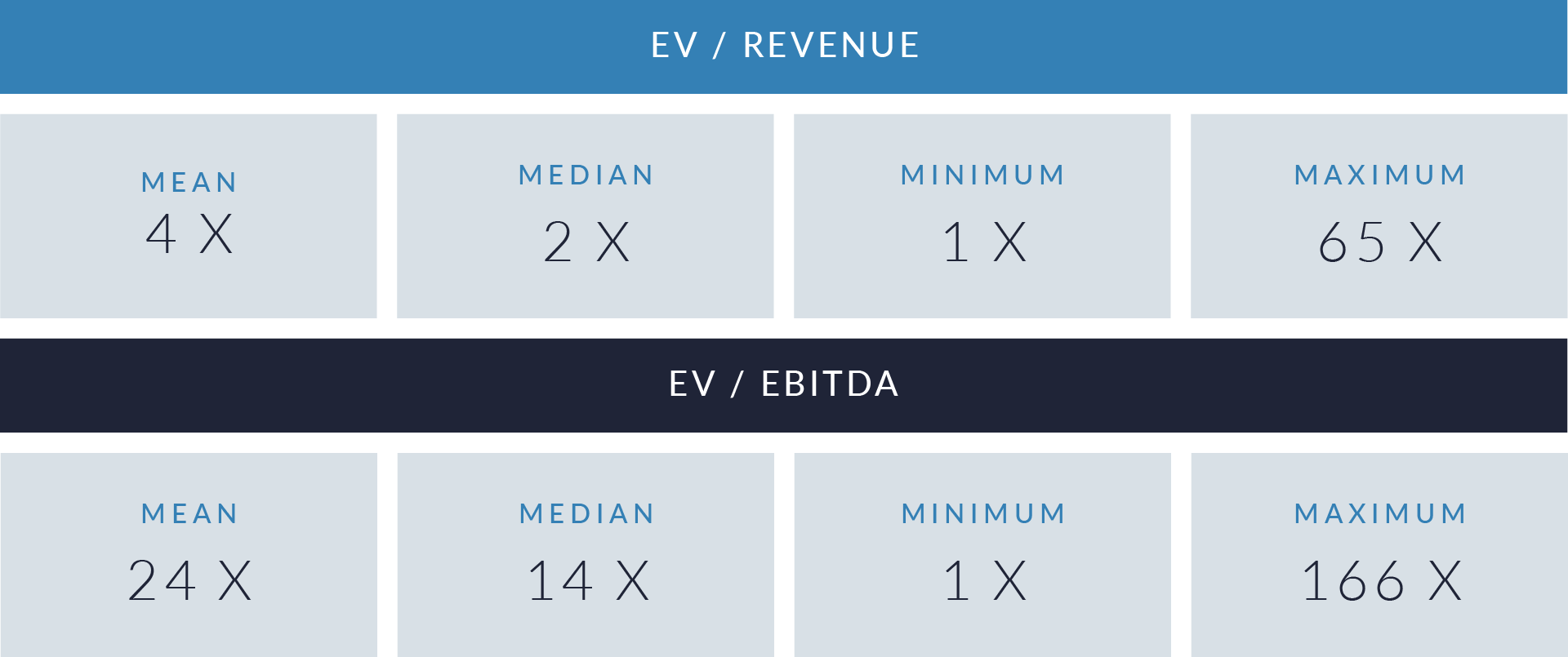

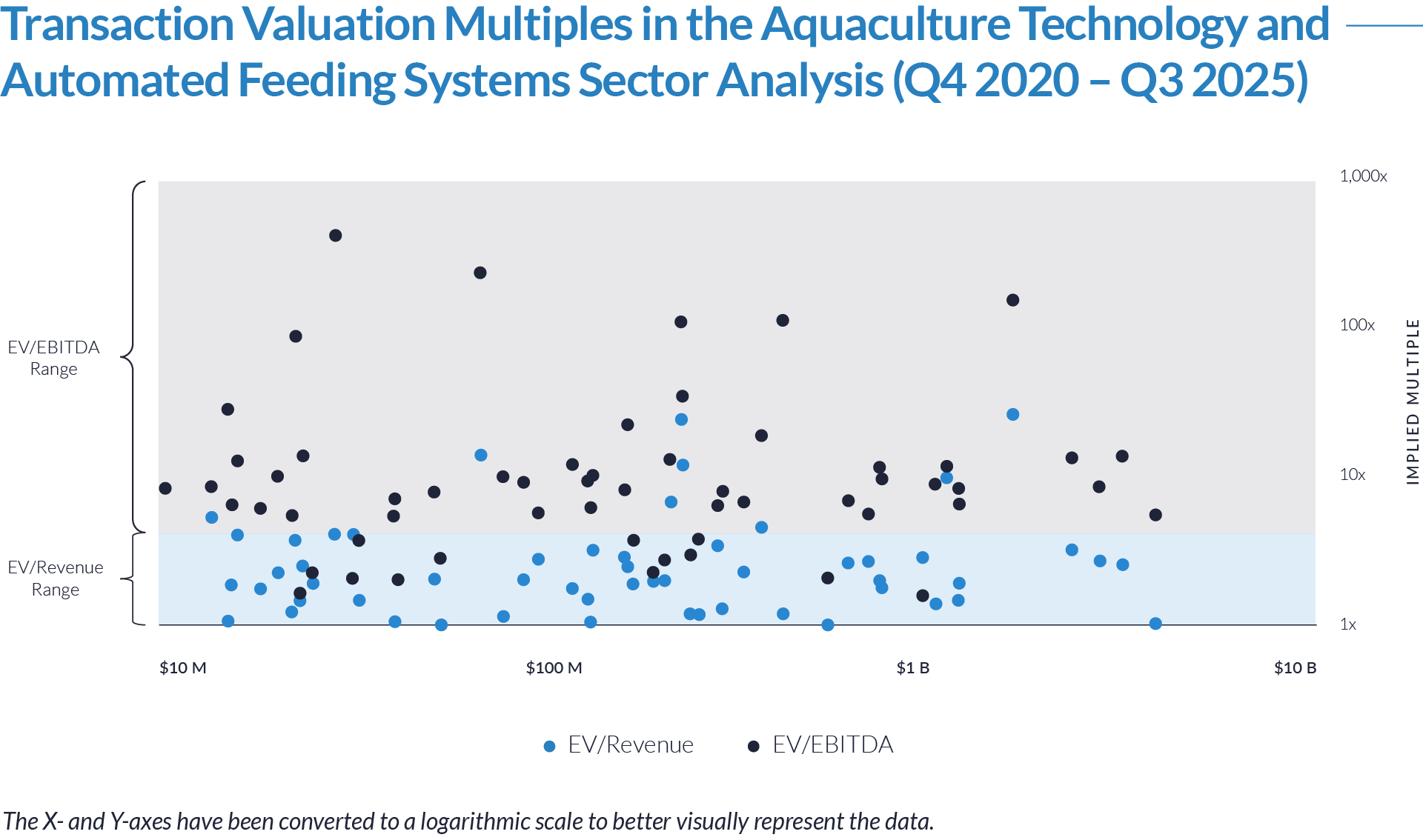

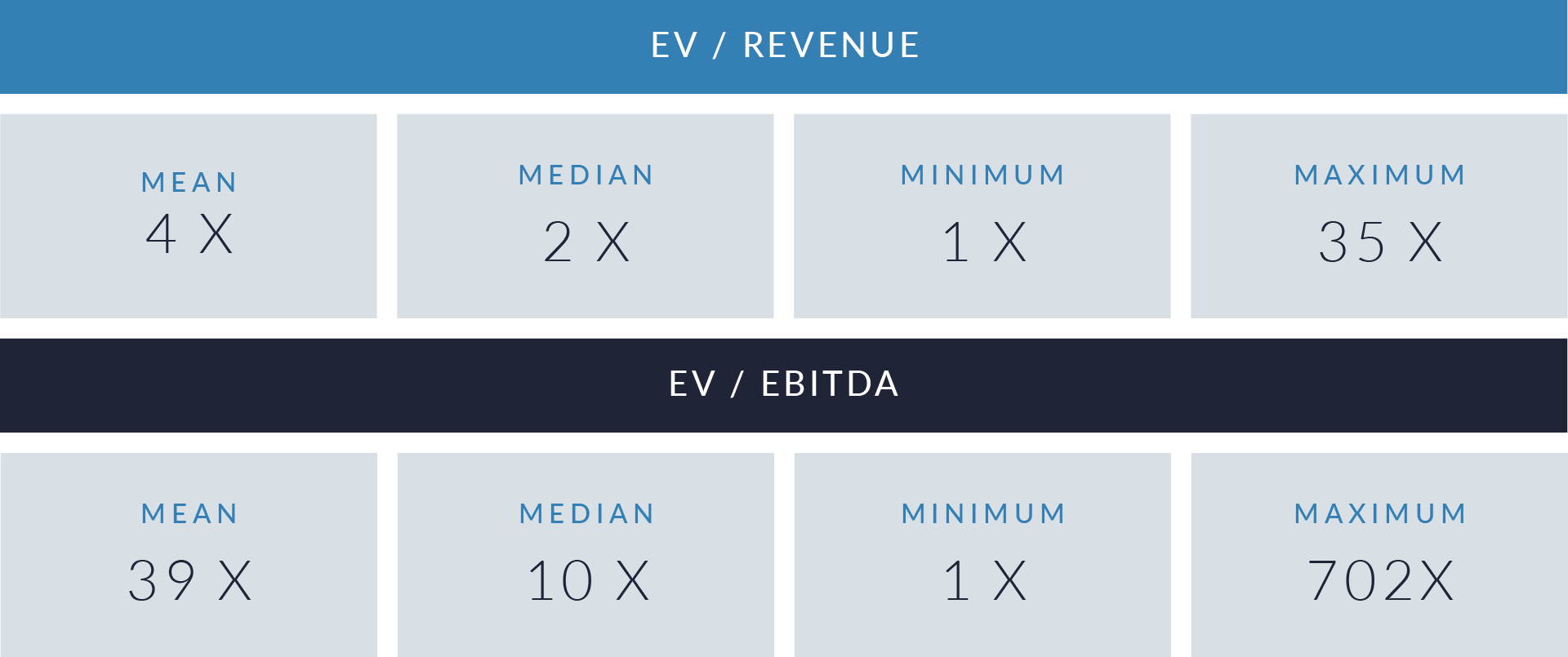

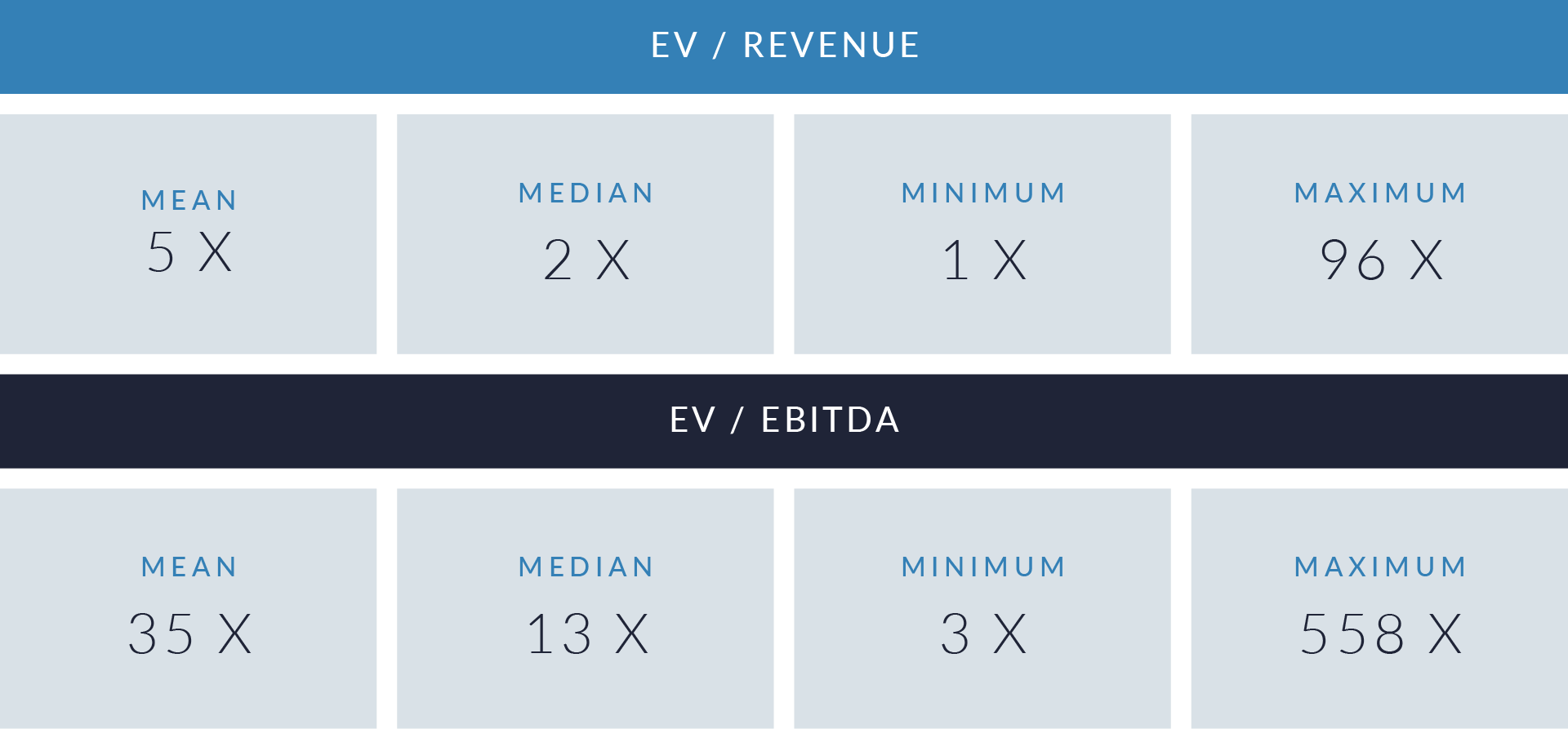

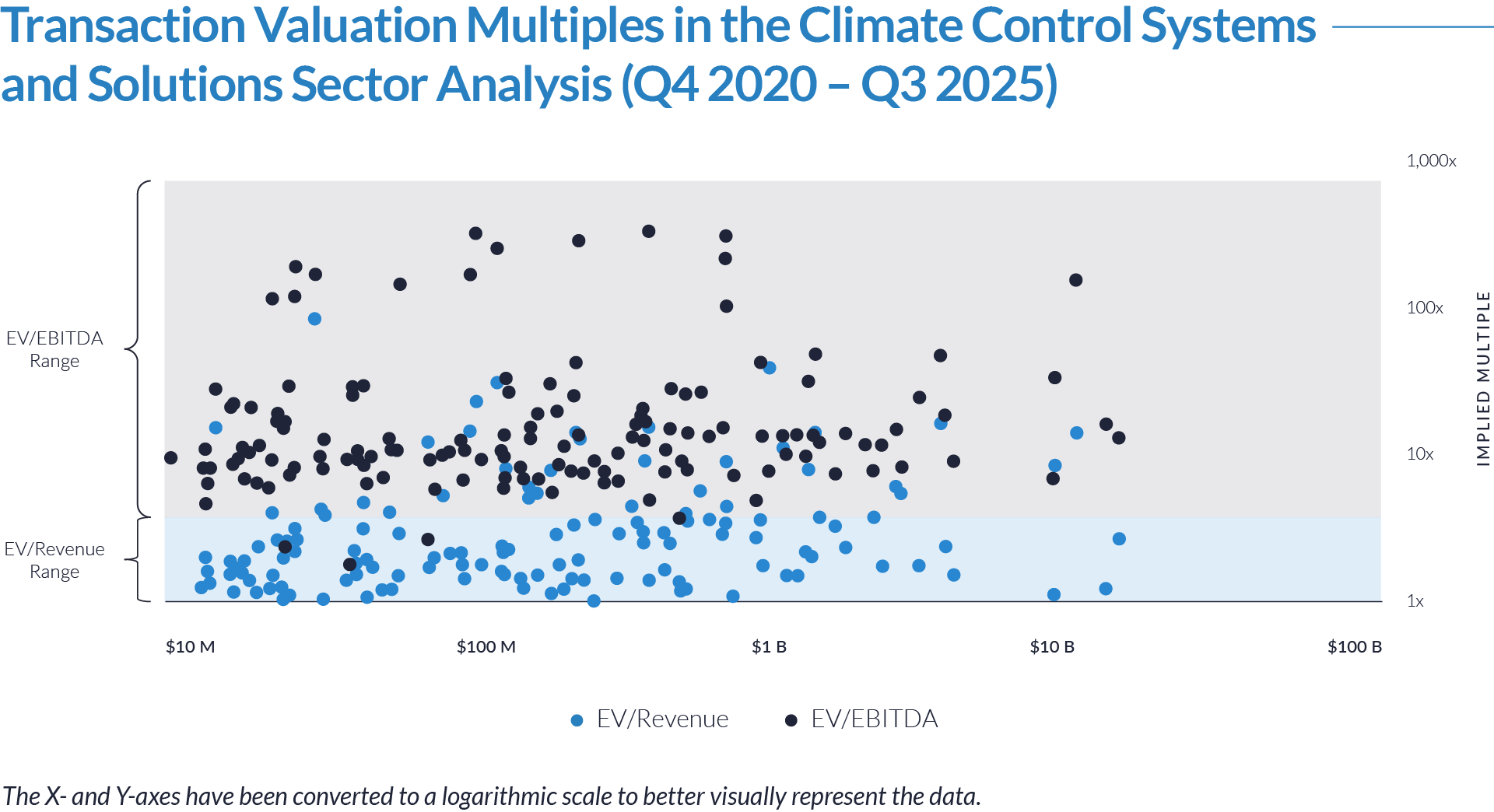

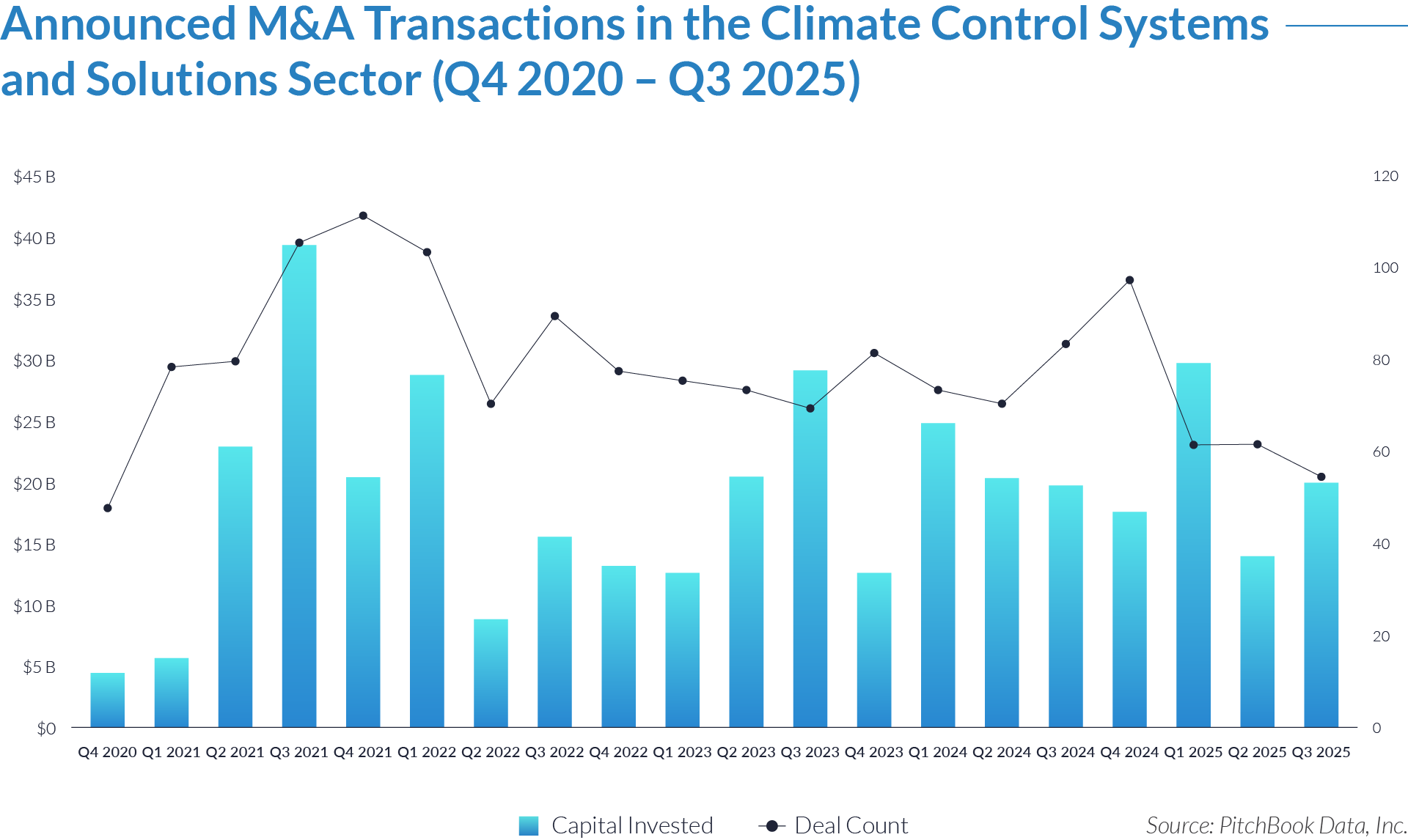

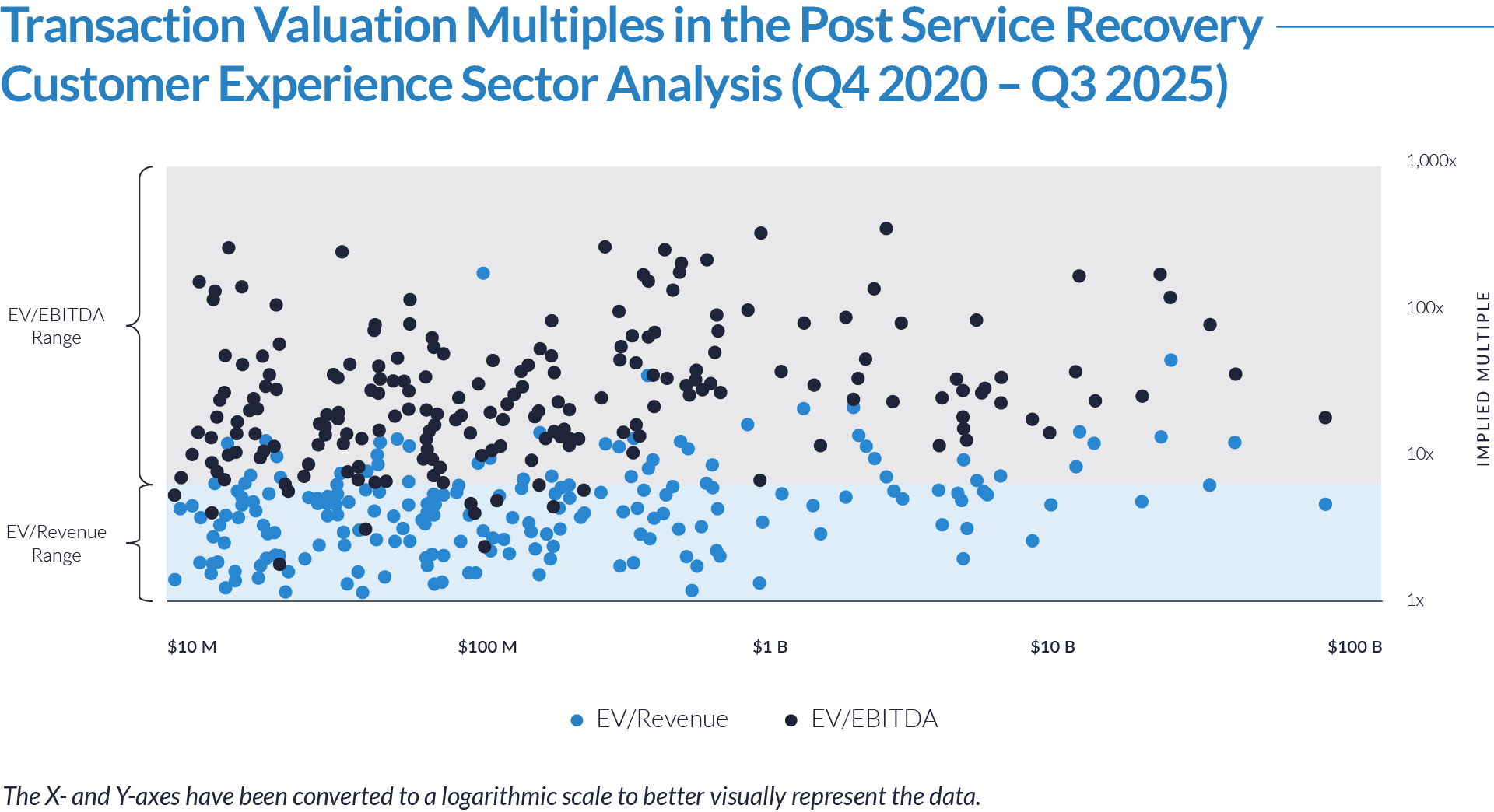

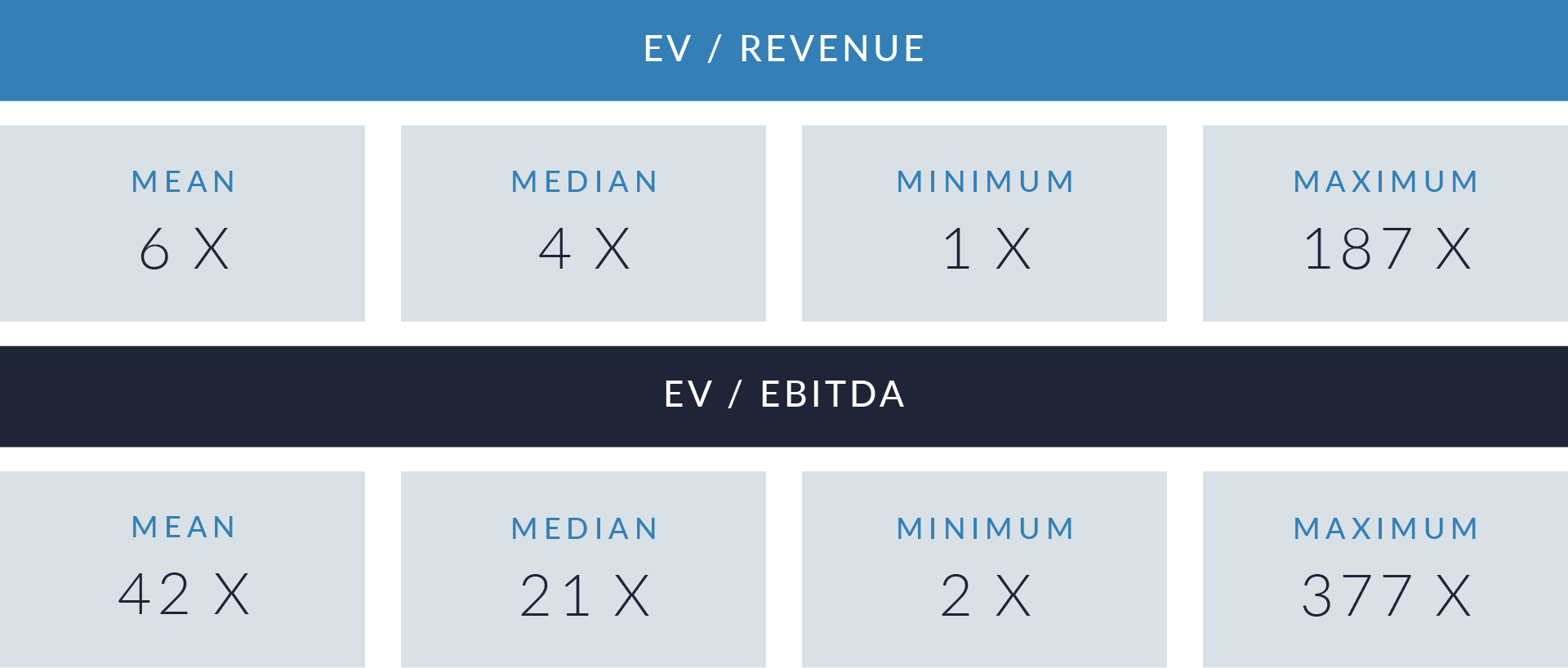

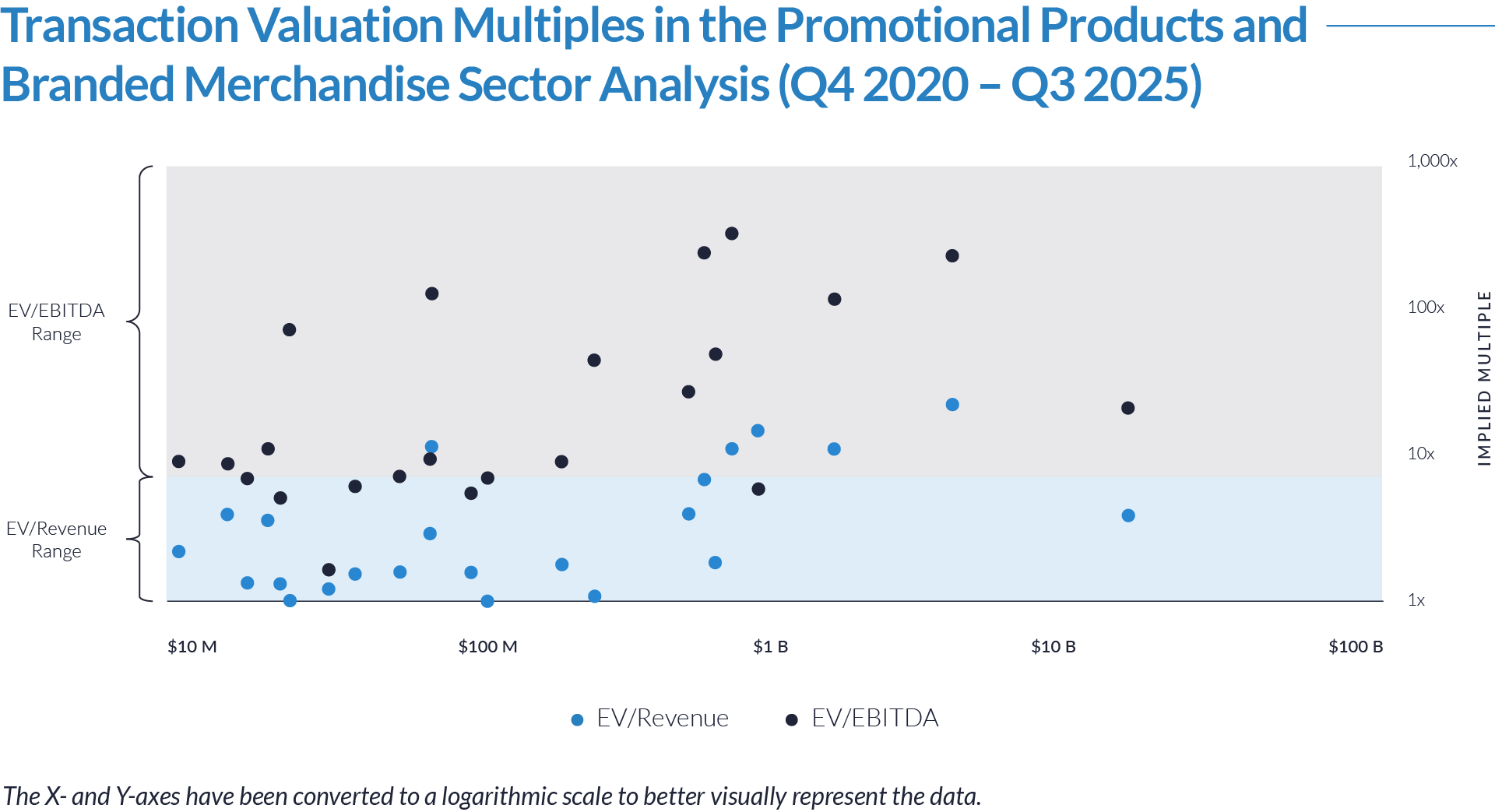

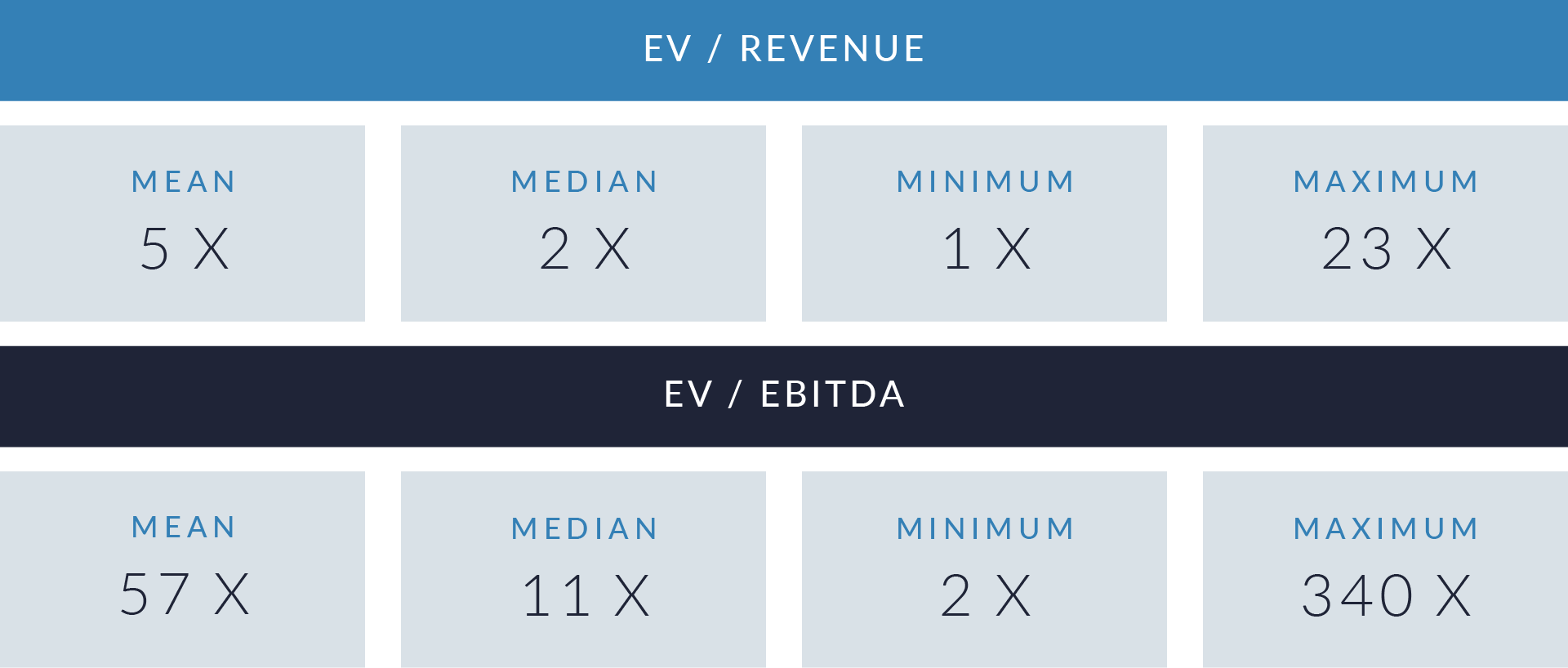

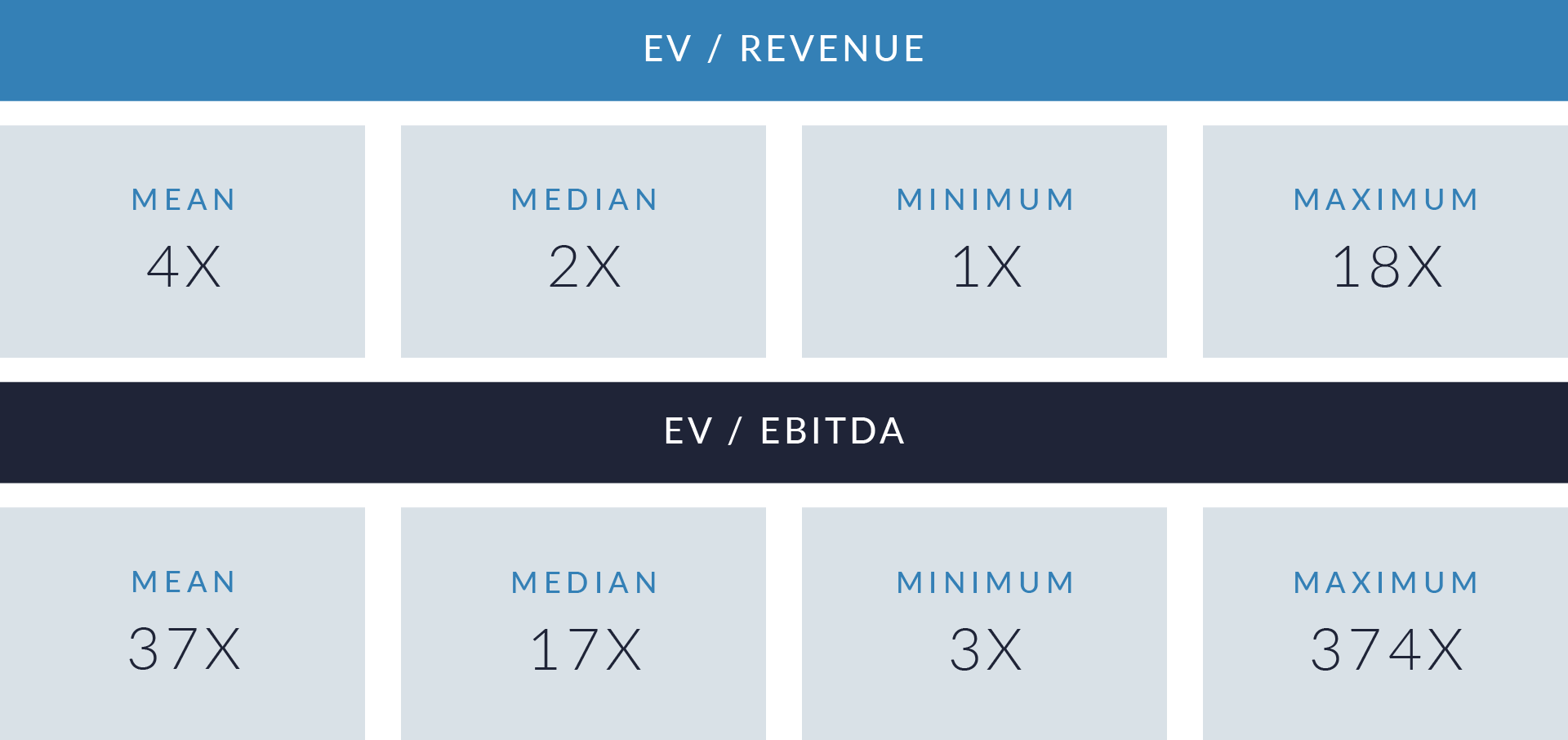

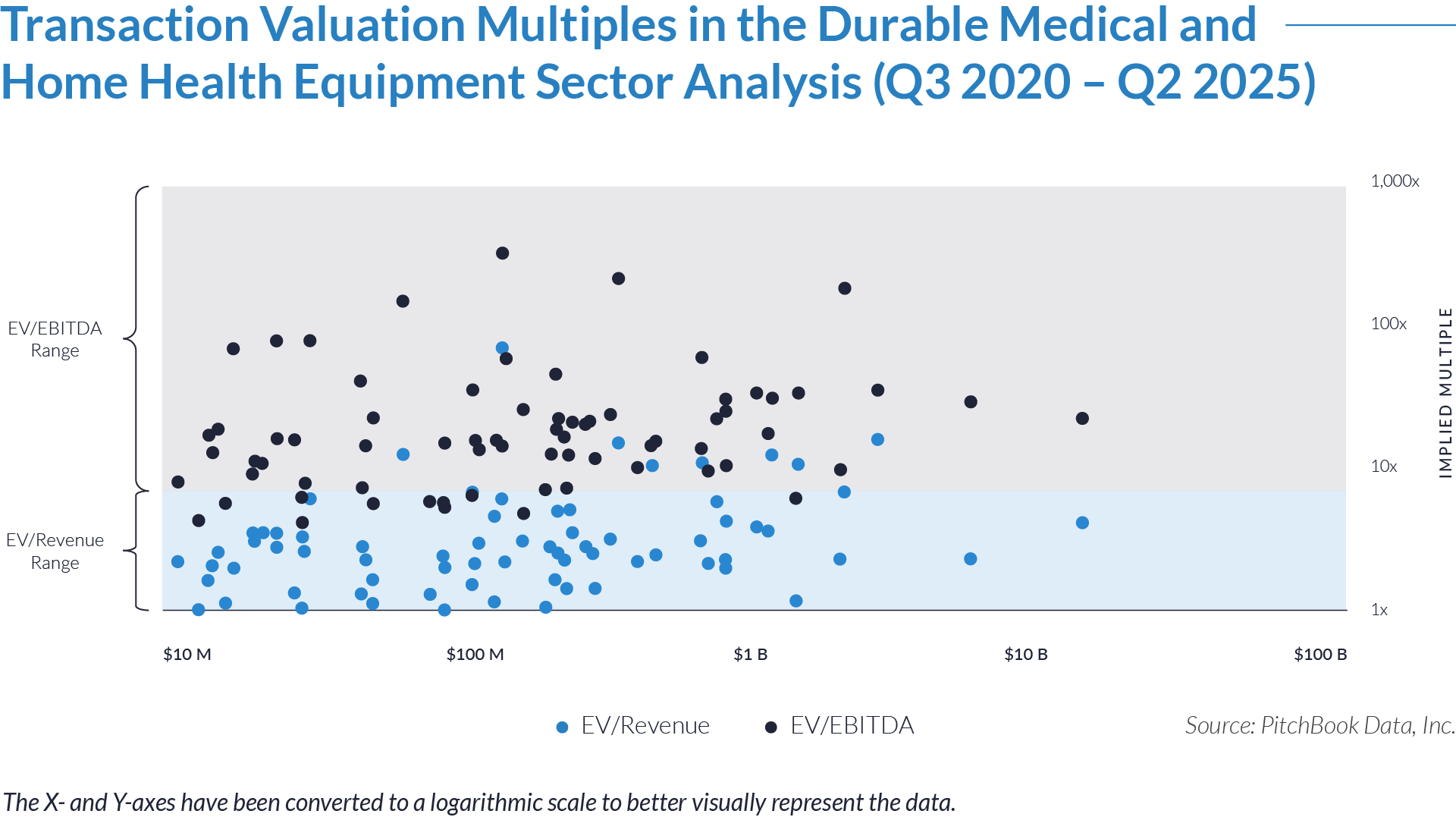

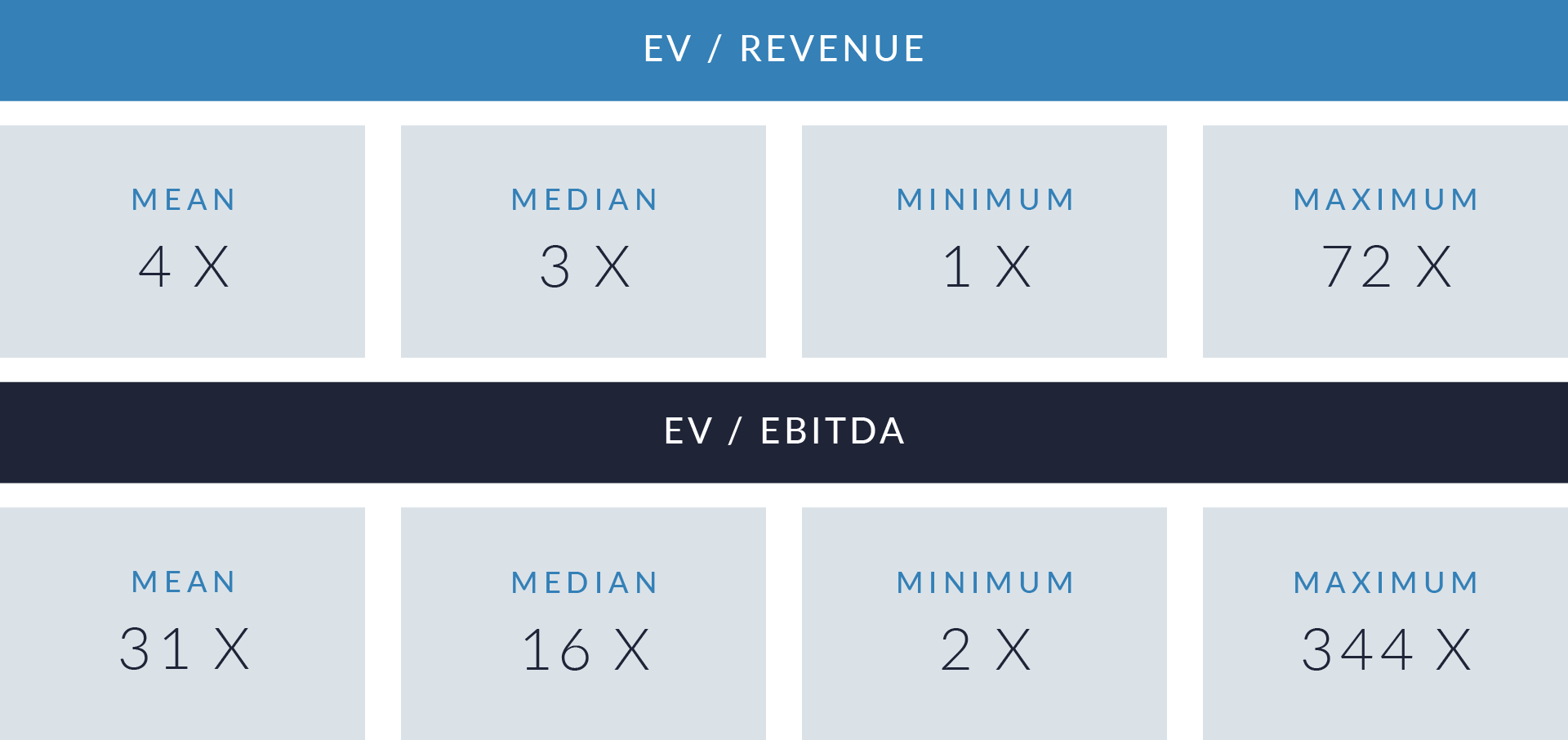

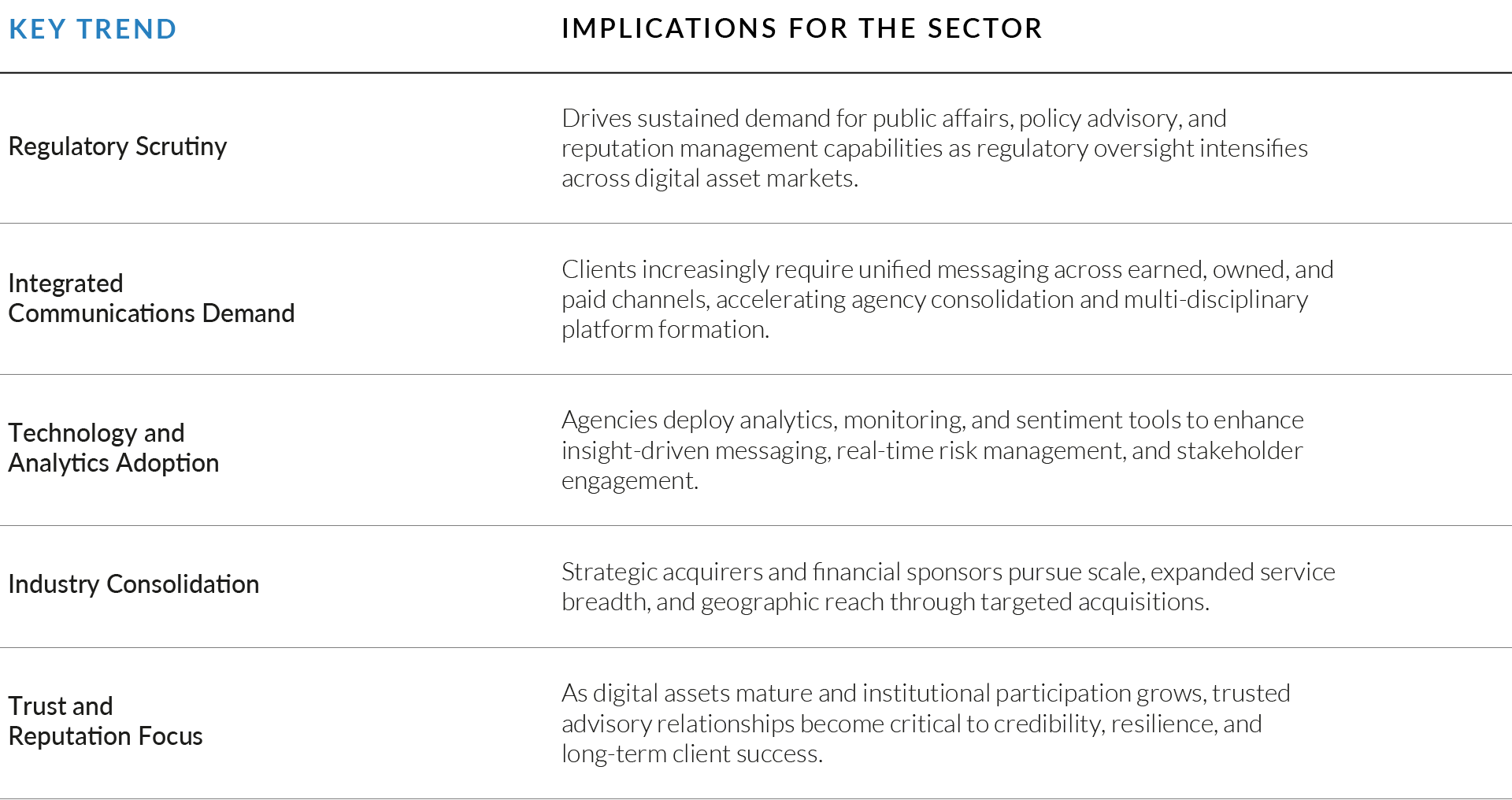

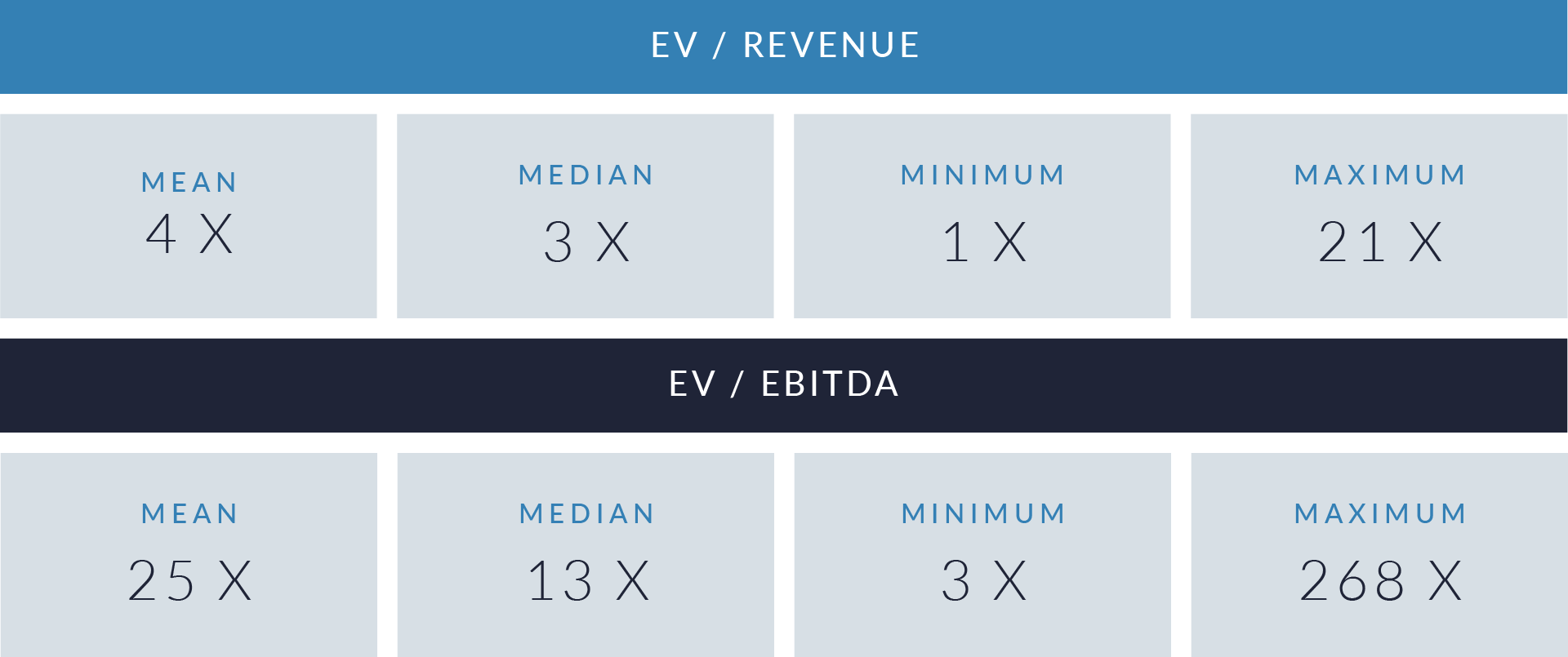

- Valuation multiples are based on a sample set of M&A transactions in the technology-enabled digital asset communications services sector using data collected as of January 23, 2026.

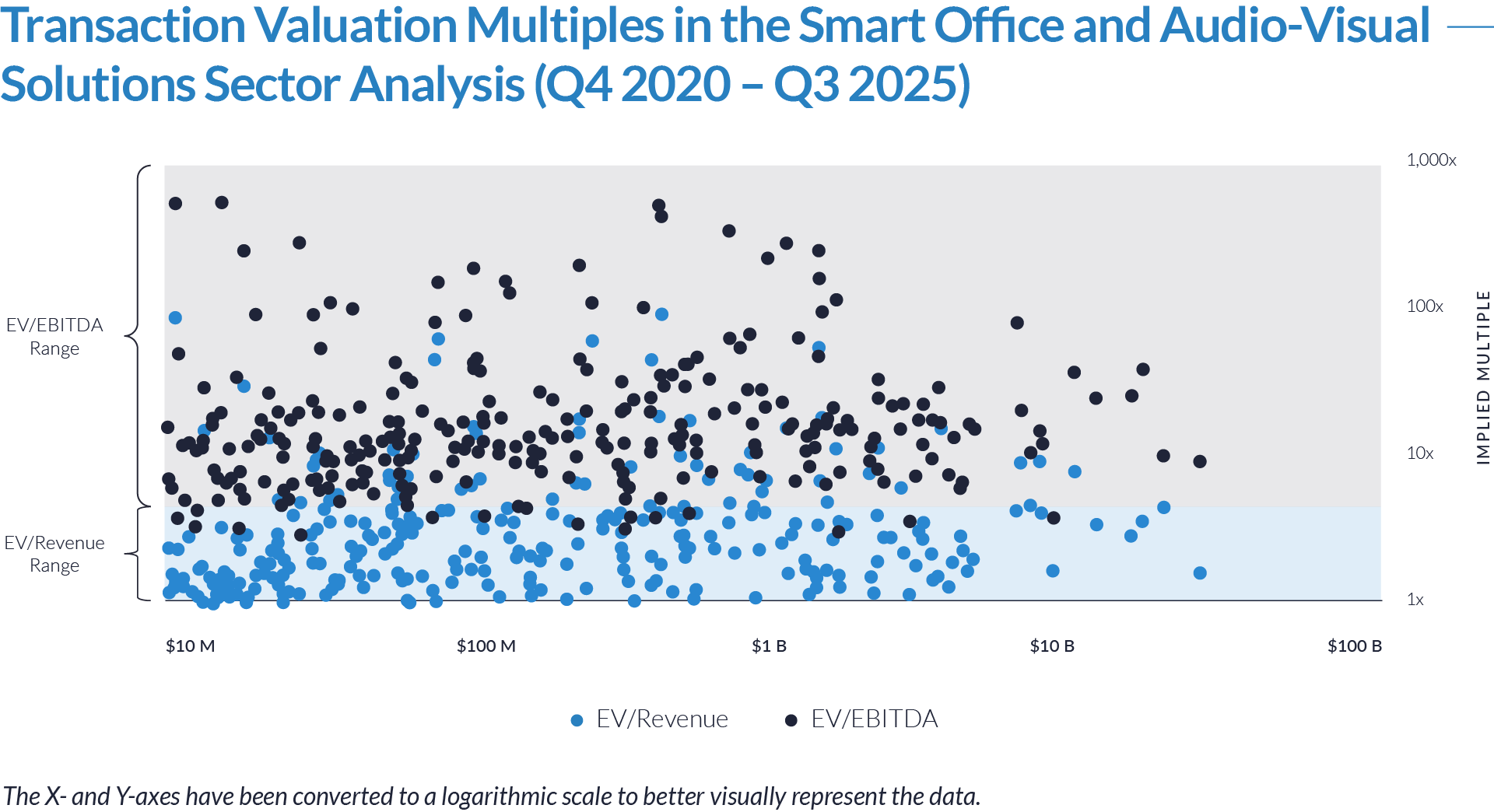

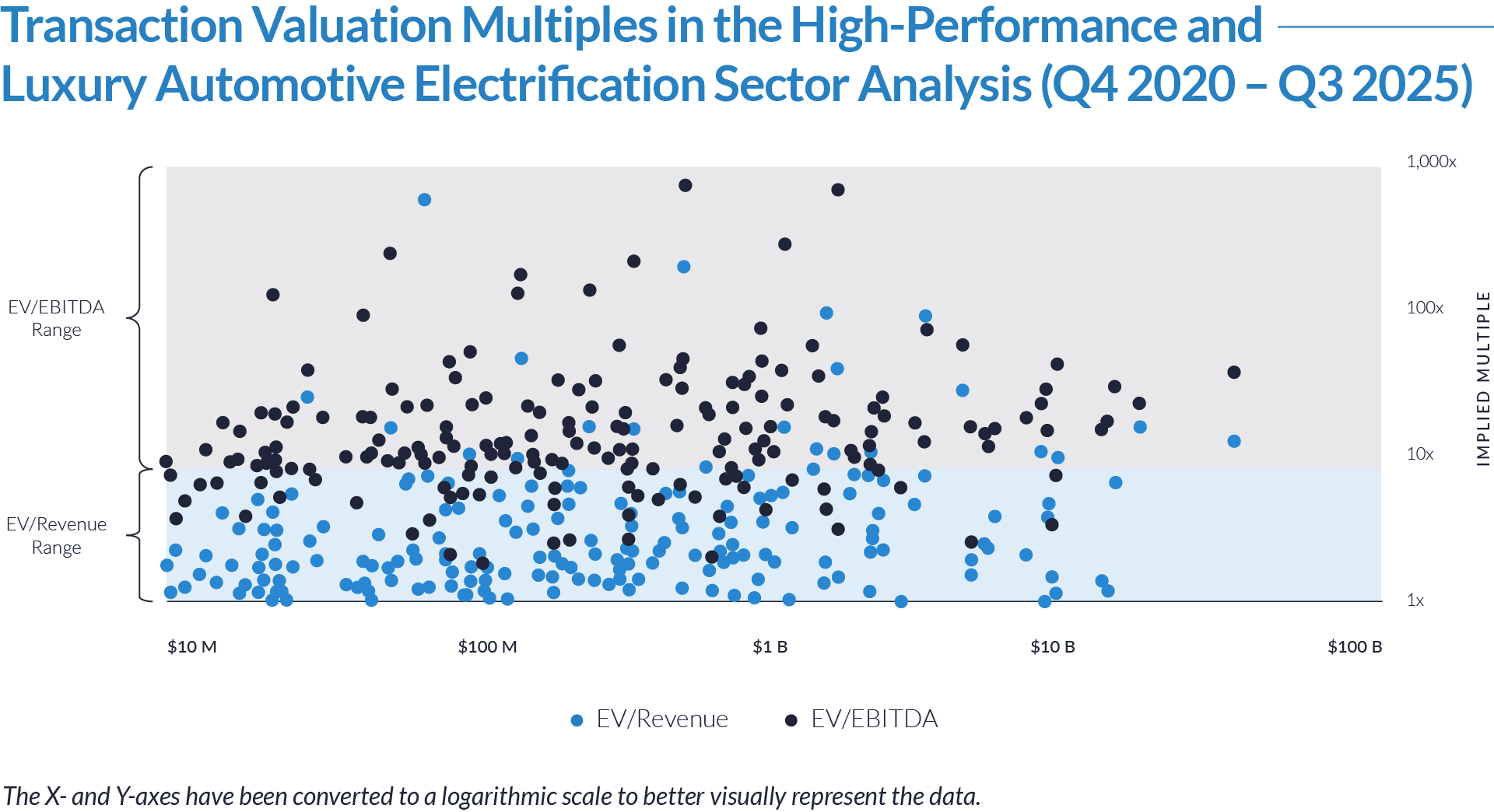

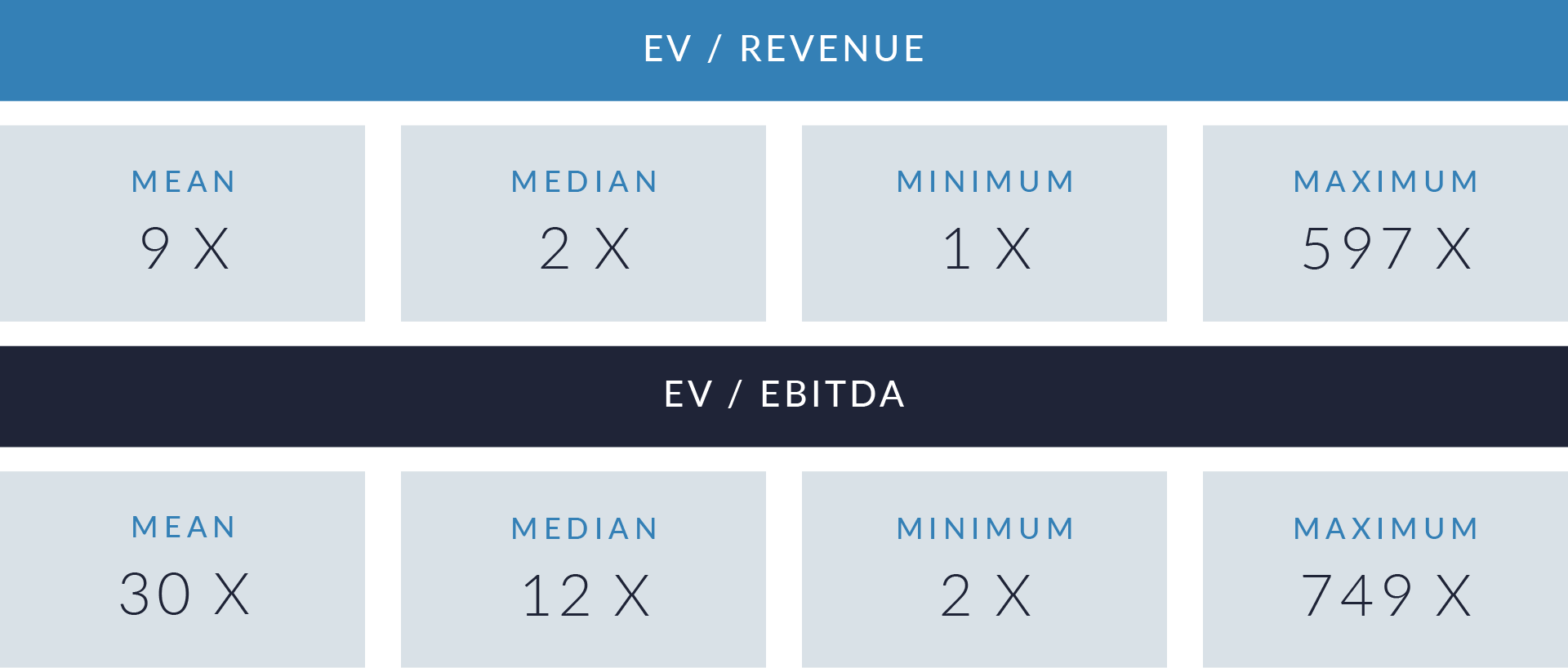

- Transaction valuation multiples across the sector exhibit a wide dispersion, with EV/revenue multiples ranging from approximately 1x to above 20x over the Q1 2021–Q4 2025 period. This spread highlights the sector’s fragmented structure and the premium ascribed to scaled platforms featuring differentiated technology capabilities, blue-chip client rosters, and defensible competitive positioning.

- Premium valuation outcomes are typically achieved by advisory-led firms characterized by strong recurring revenue visibility, exposure to high-growth digital asset clients, and integrated service offerings spanning strategic communications, public affairs, and reputation management. In contrast, lower-multiple transactions are more frequently associated with smaller, founder-led agencies exhibiting limited operating leverage, narrower service scope, or heightened exposure to market cyclicality.

- Elevated and volatile EV/EBITDA multiples reflect both uneven profitability profiles across the sector and buyer willingness to underwrite forward earnings expansion. This is particularly evident where targets demonstrate technology-enabled delivery models, scalability, and strategic relevance to acquirers prioritizing capability enhancement or geographic expansion over near-term margin accretion.

Capital Markets Activities

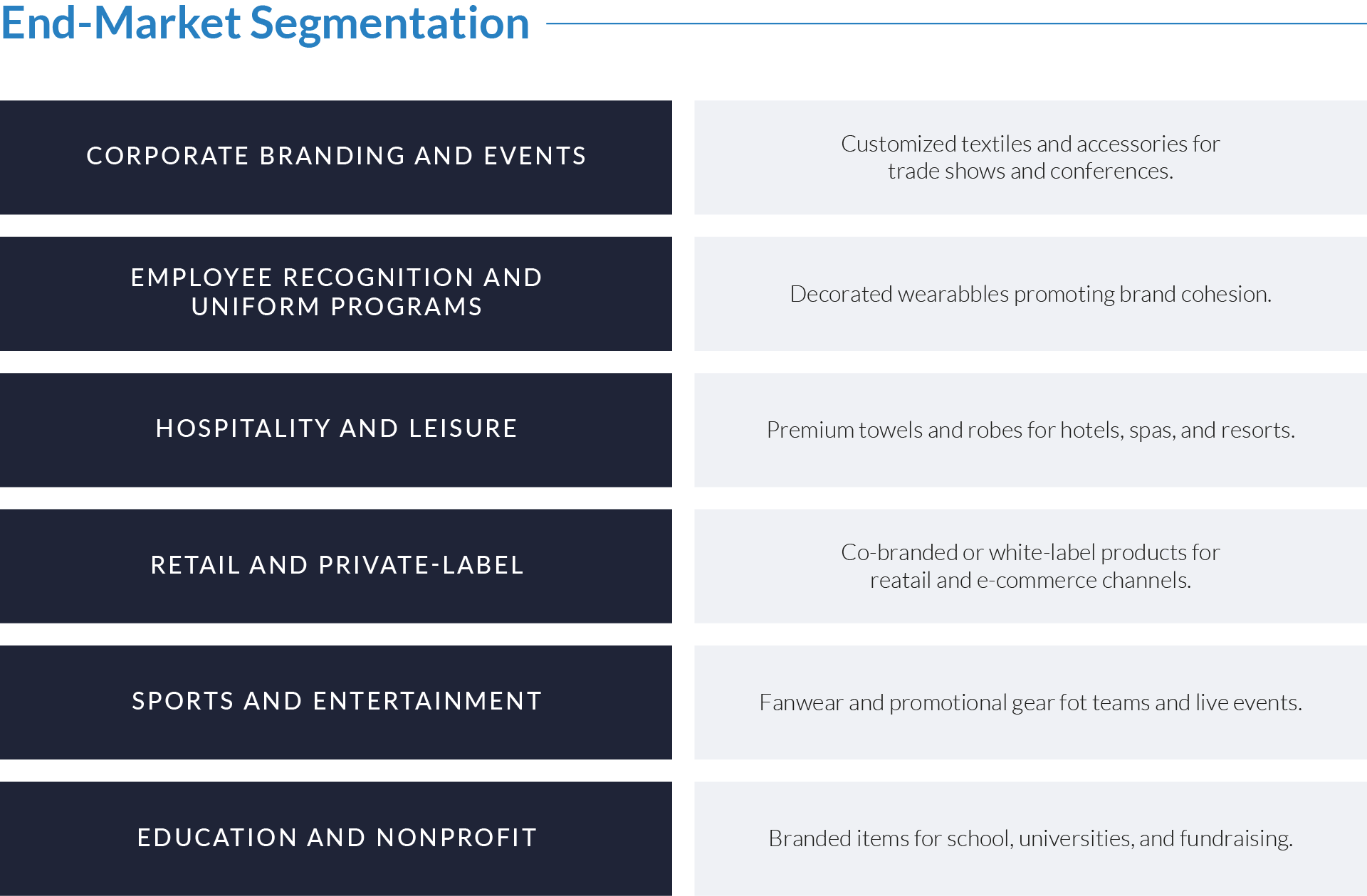

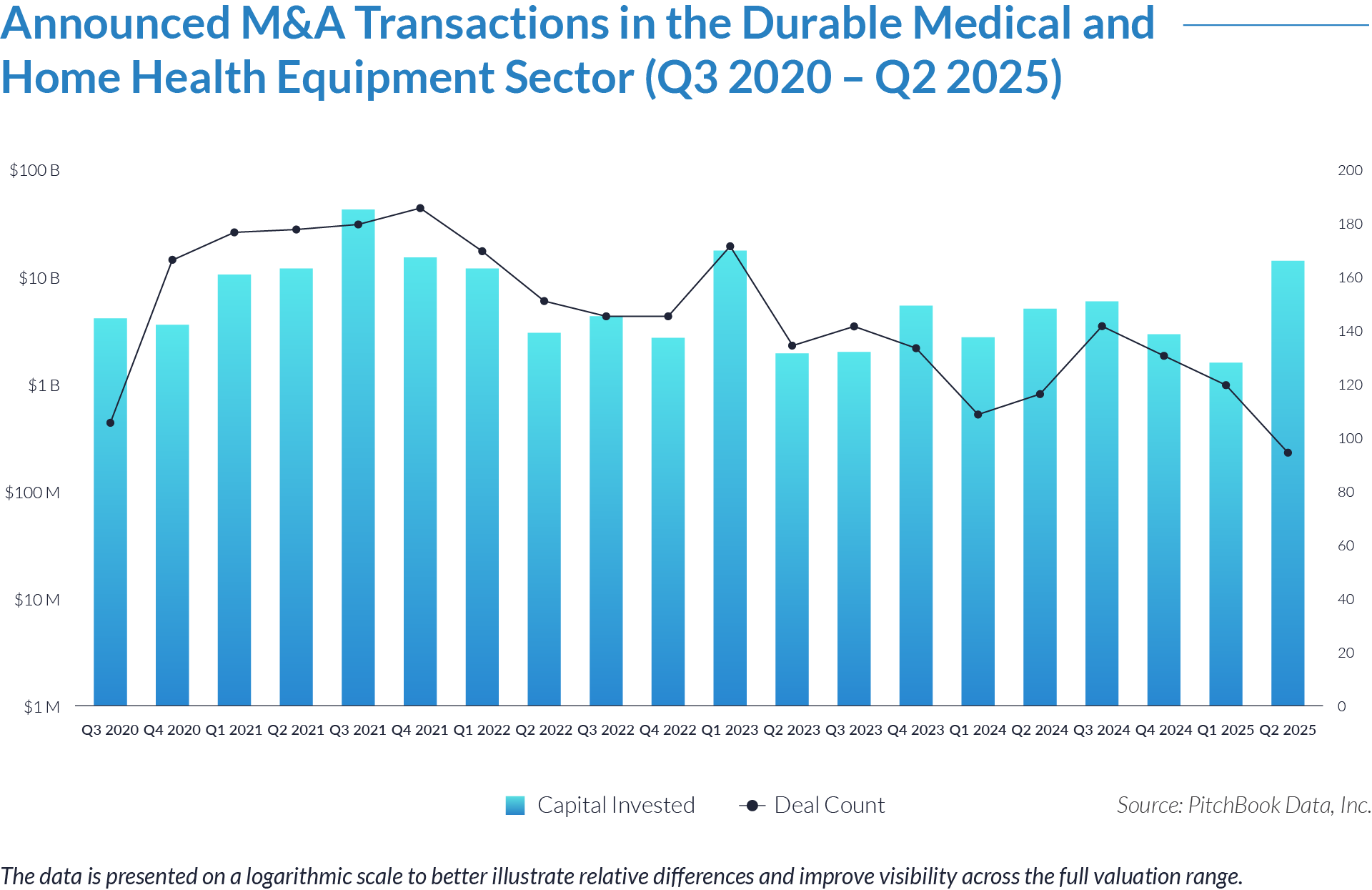

The data highlights transaction activity, capital deployment, and geographic concentration trends within the technology-enabled digital asset communications services sector. Acquirers increasingly target scaled, technology-enabled operators with regulatory fluency, advisory depth, and global communications capabilities, with transactions emphasizing geographic expansion, reputation management expertise, and the ability to deliver integrated, data-driven communications strategies across complex and rapidly evolving markets.

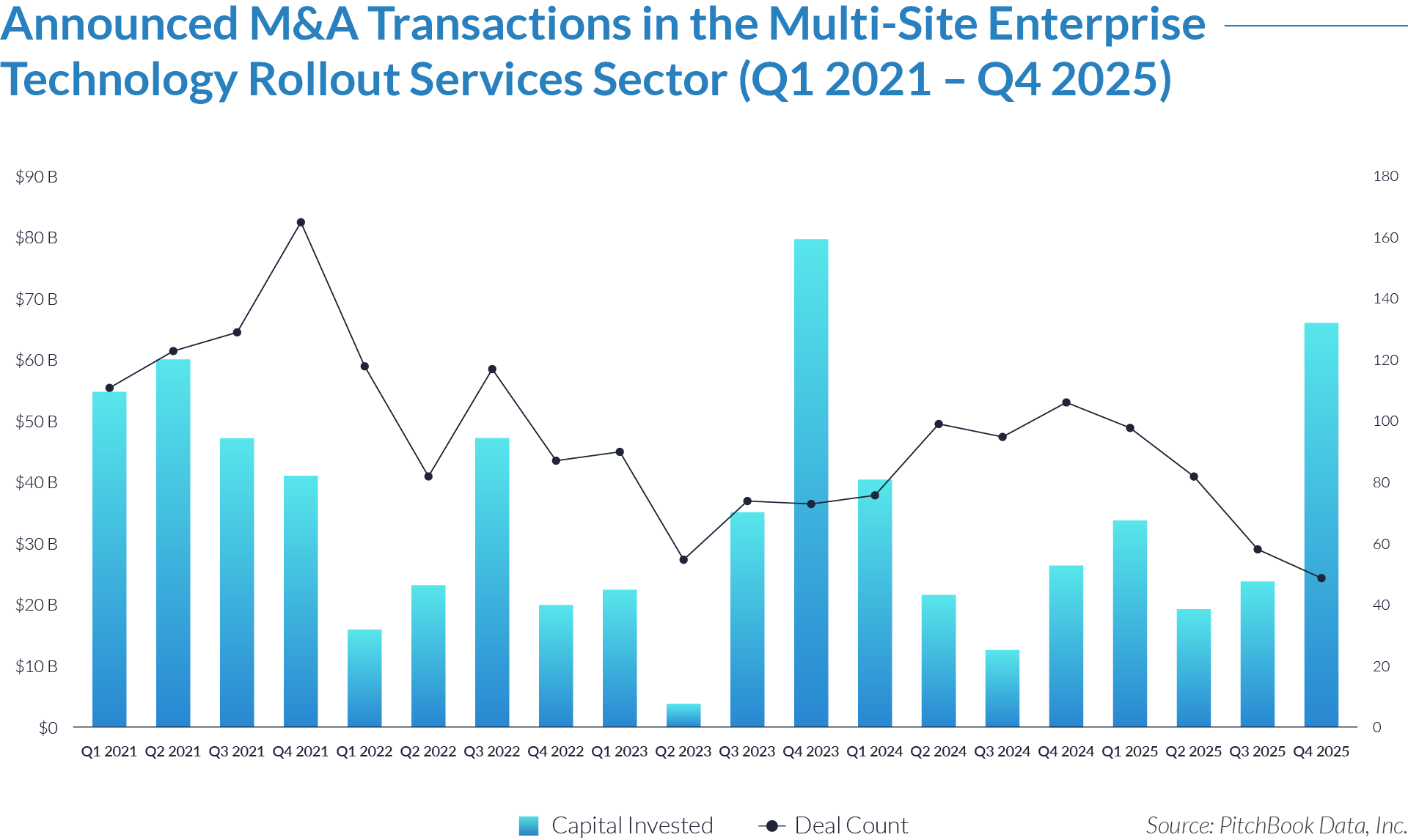

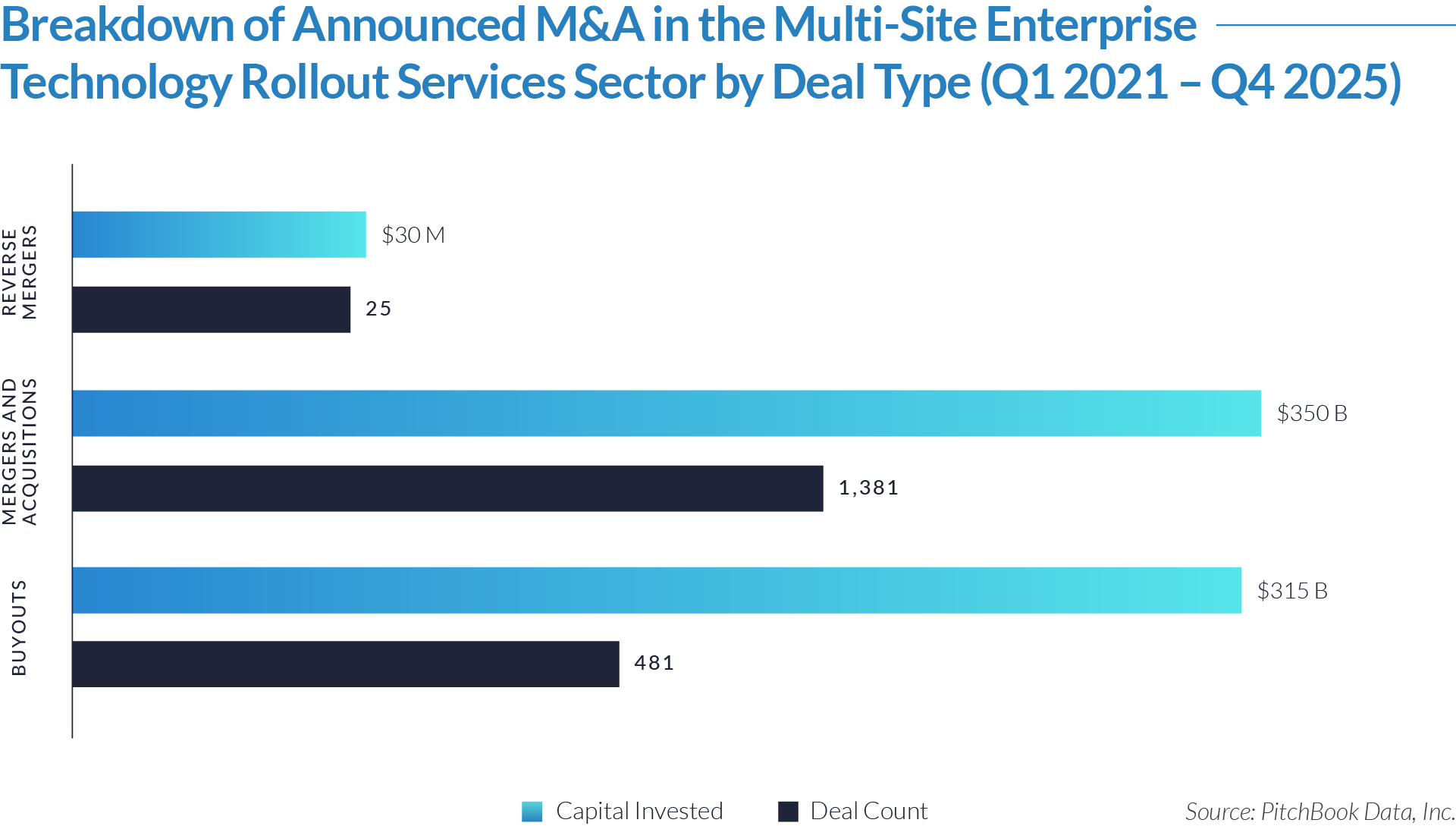

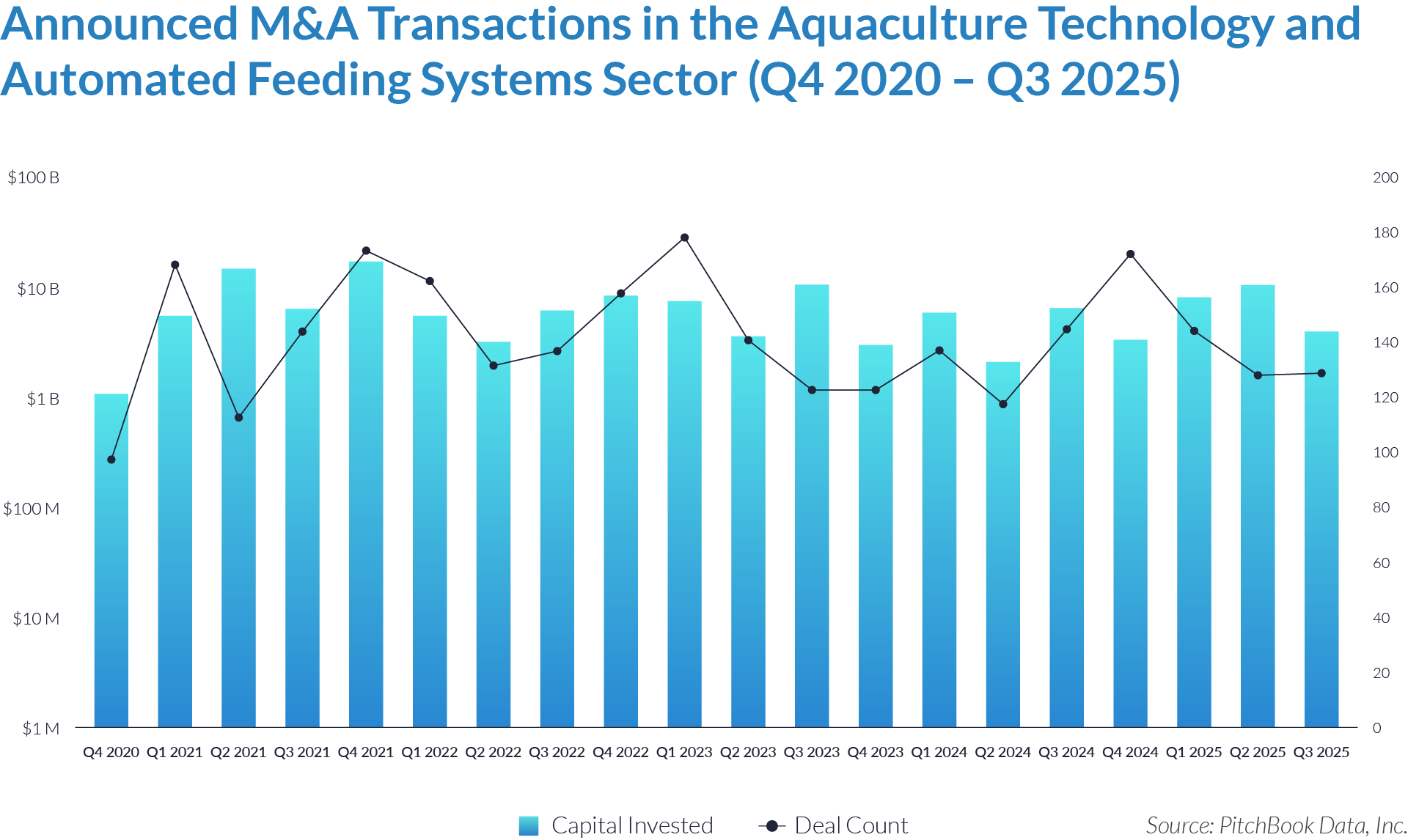

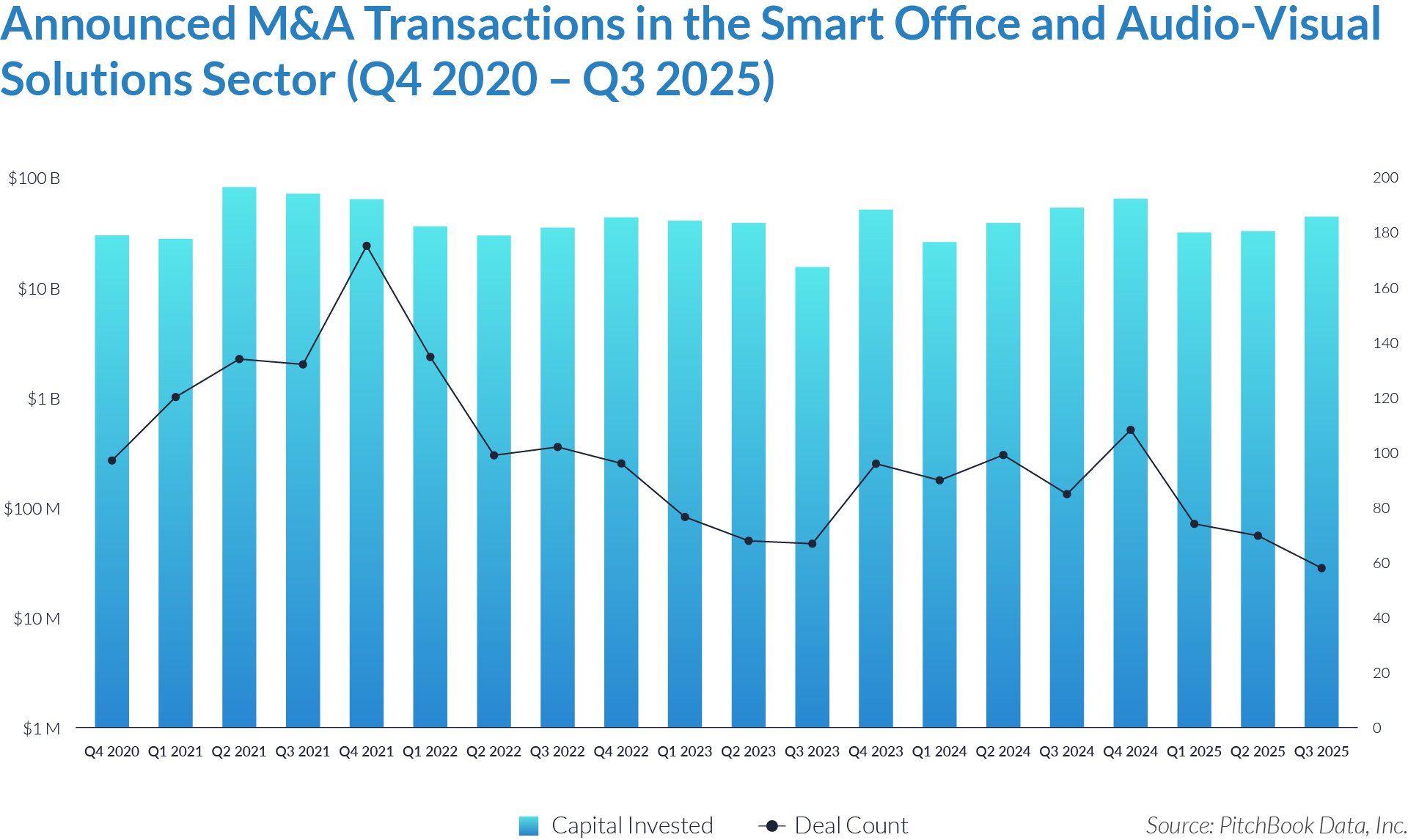

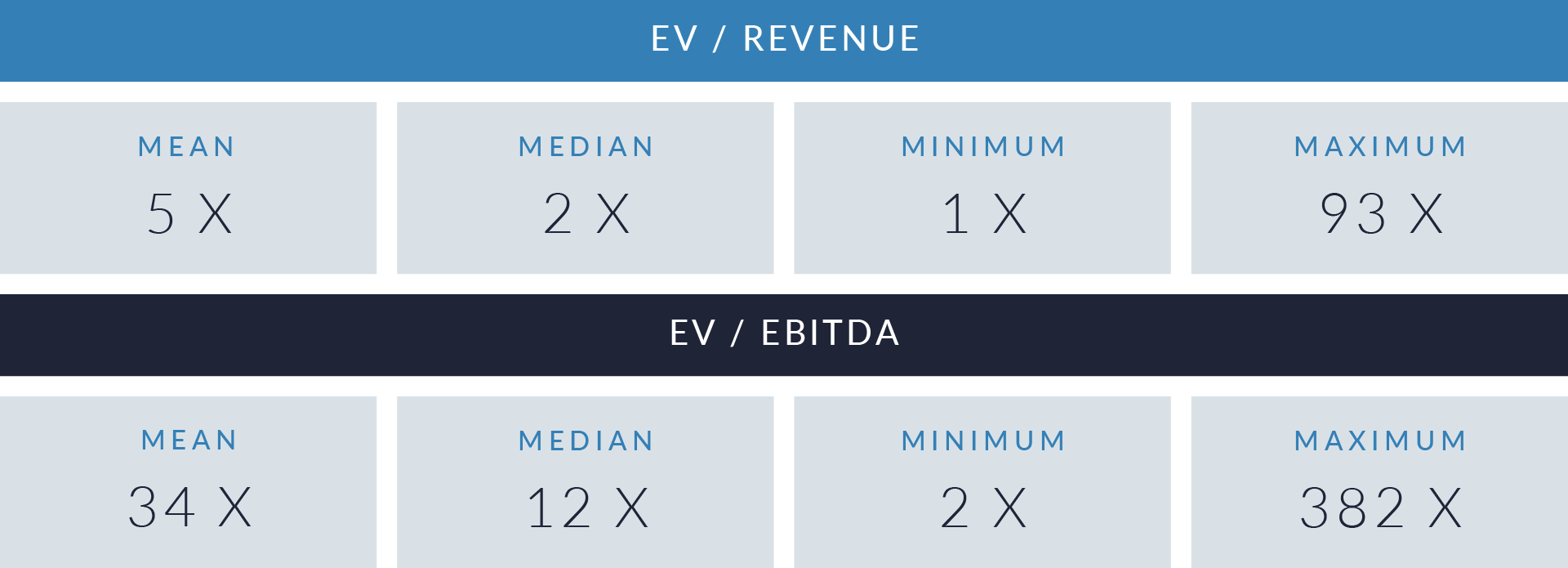

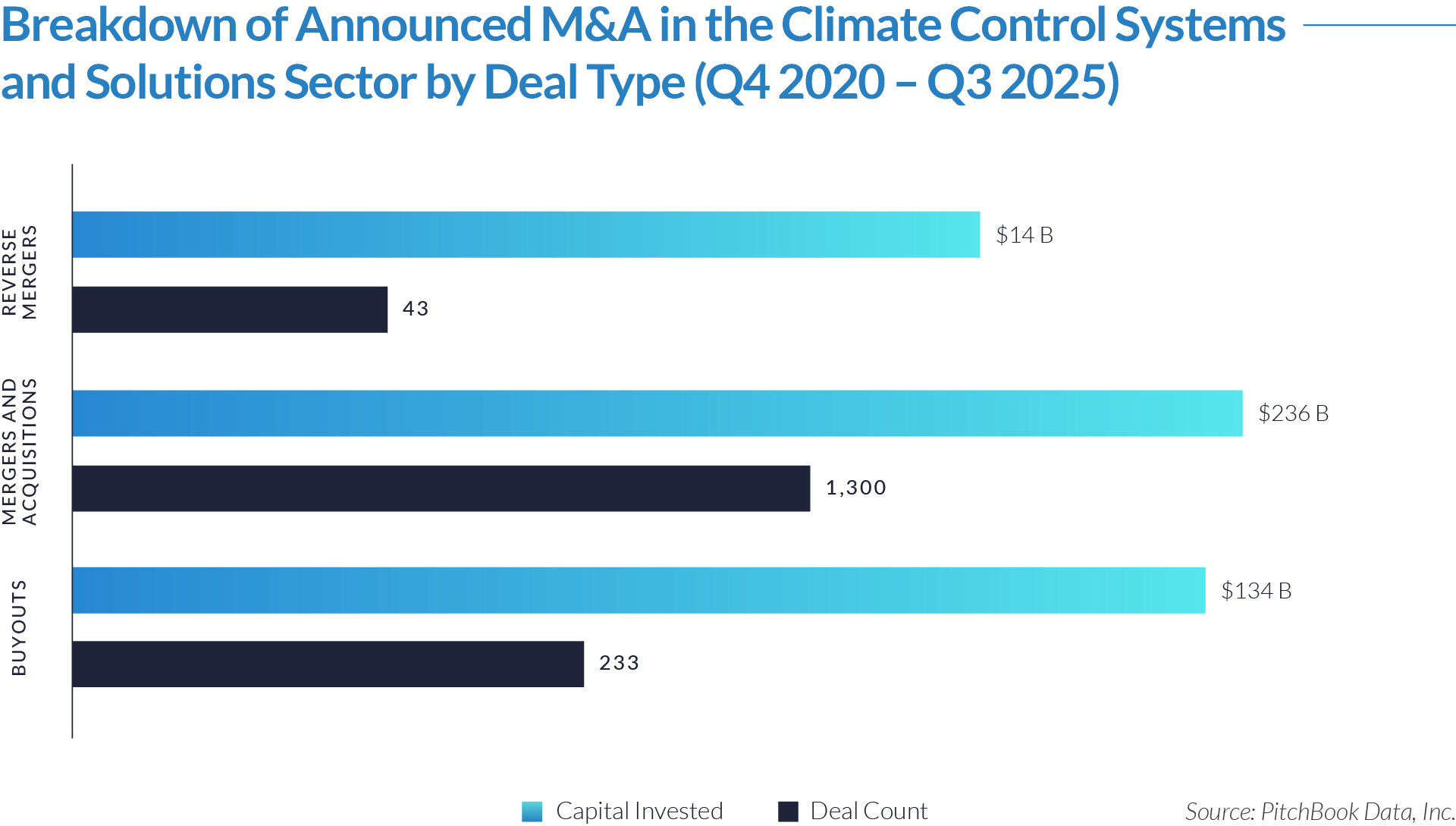

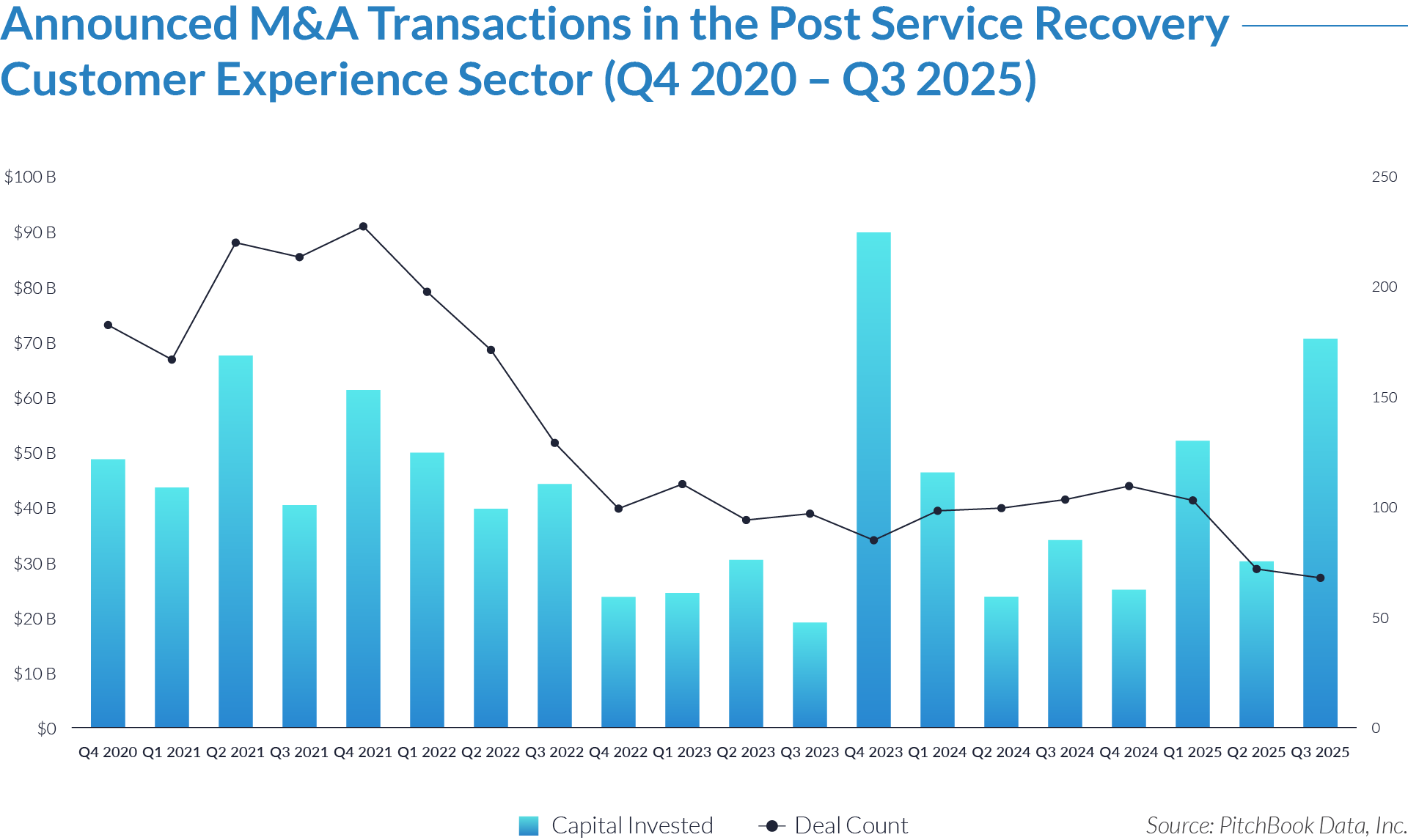

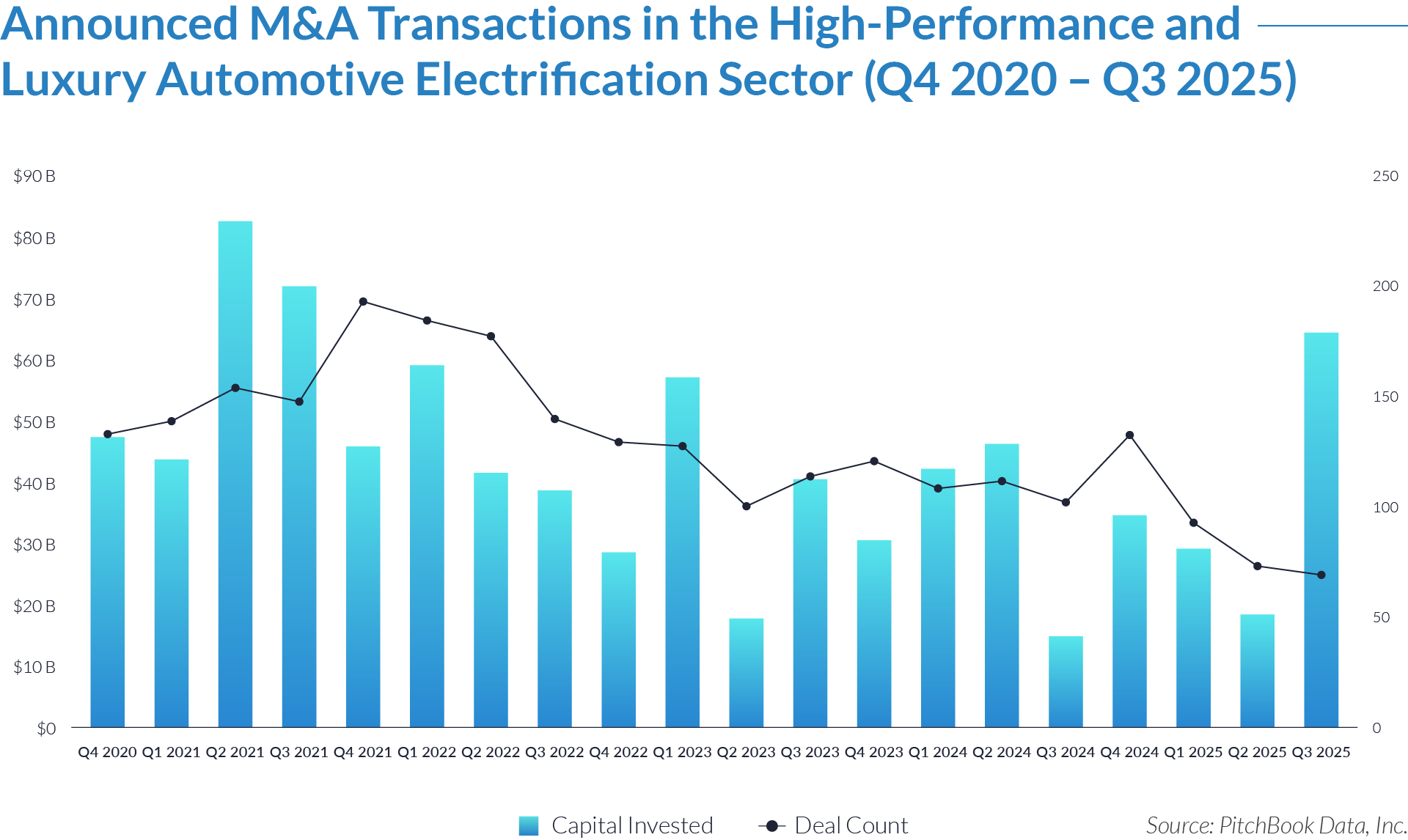

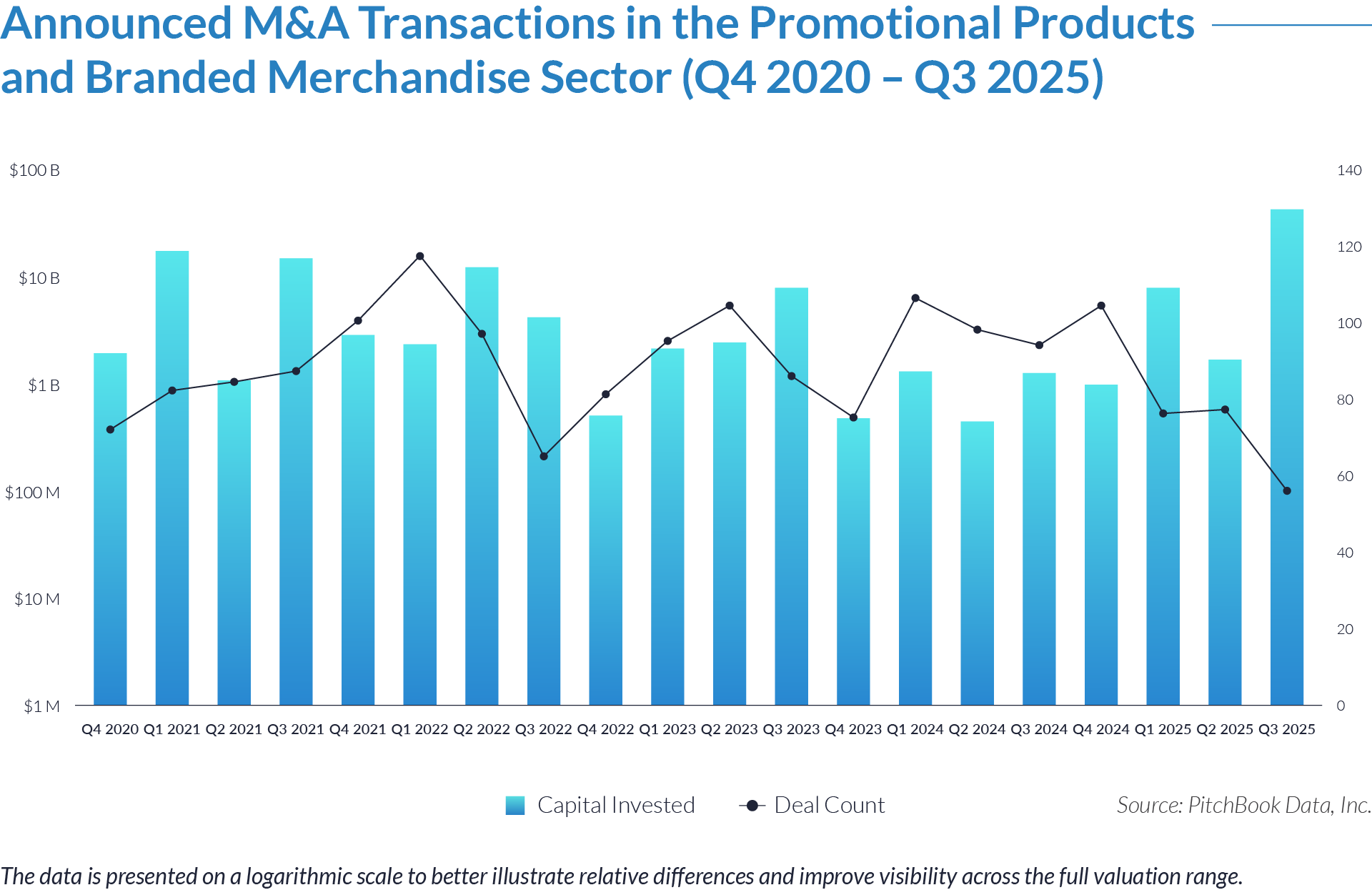

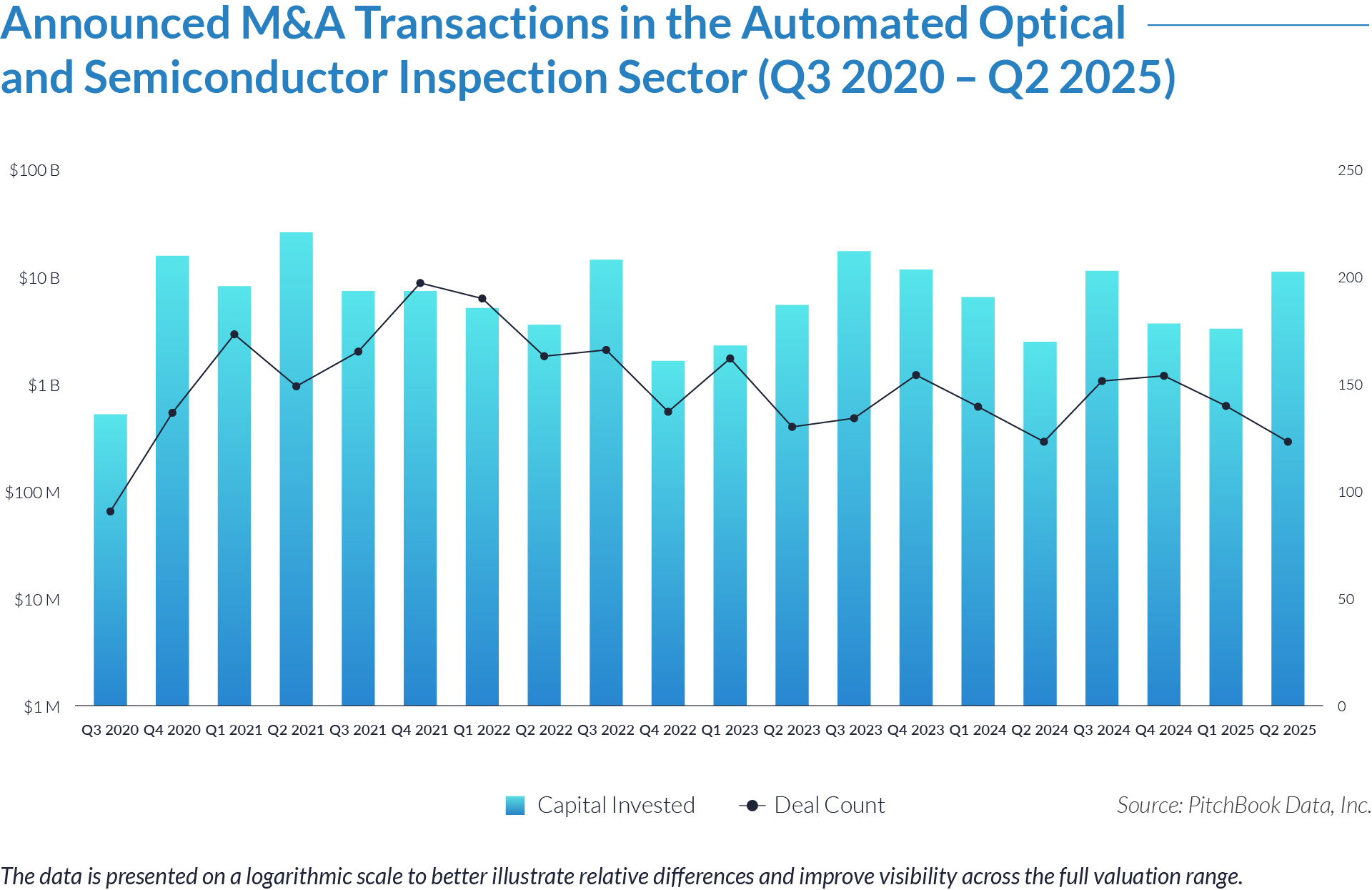

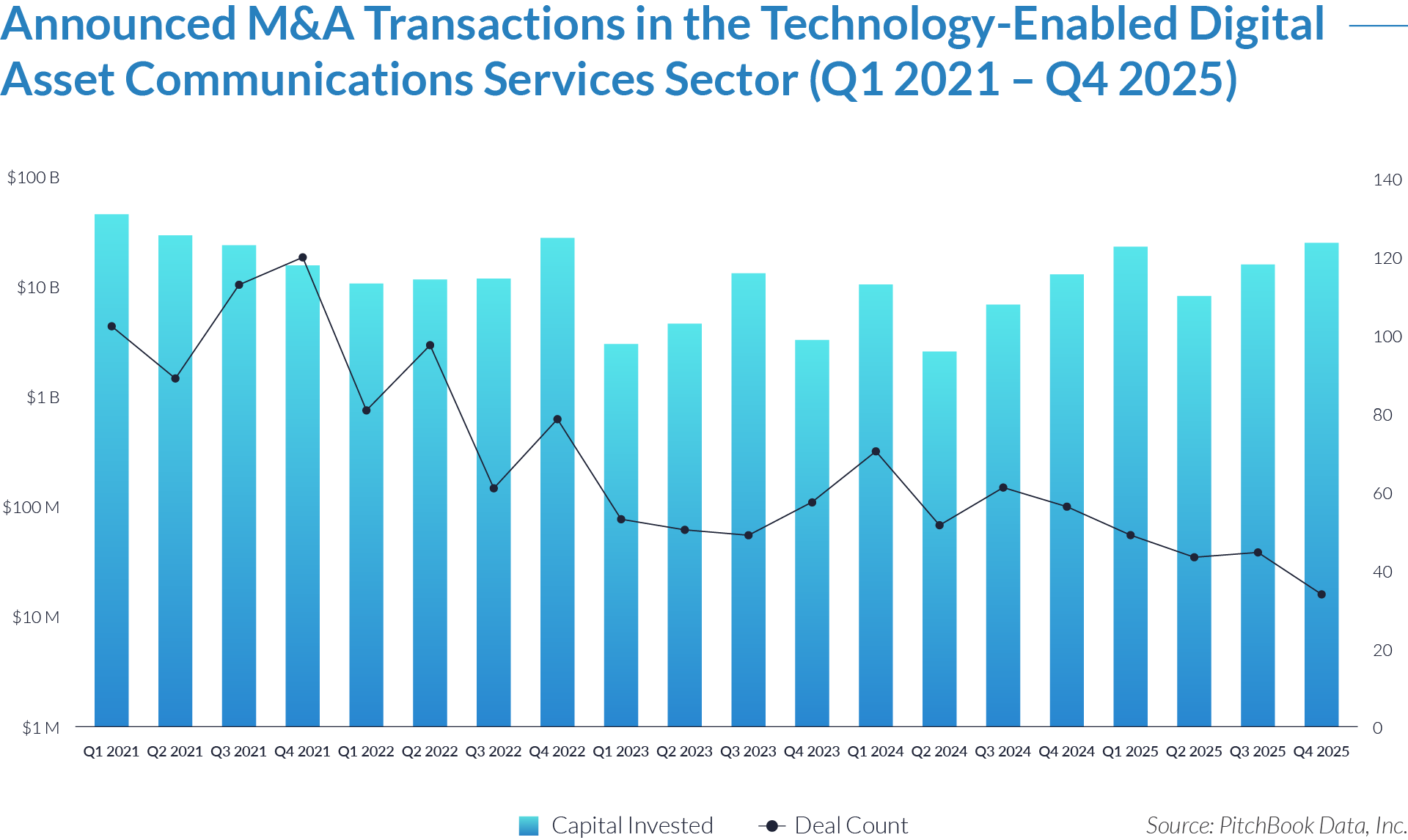

- Over the 20-quarter period from Q1 2021 through Q4 2025, the Technology-Enabled Digital Asset Communications Services sector attracted approximately $287 billion of invested capital across 1,161 M&A transactions, underscoring sustained long-term buyer interest in communications and advisory services supporting digital asset ecosystems.

- Capital deployment and deal activity peaked in 2021, with approximately $42 billion invested in Q1 2021 and a high of 102 transactions in Q4 2021, reflecting early-cycle exuberance and broad-based consolidation across advisory-led agencies.

- Capital deployment moderated through 2022–2023 amid digital asset market volatility and valuation resets. Despite a sharp contraction in average transaction size, deal volumes remained comparatively resilient, signaling continued consolidation through tuck-in acquisitions and capability-driven expansion.

- Investment momentum re-accelerated in late 2024 and throughout 2025, with multiple quarters exceeding $15 billion in capital invested even as deal counts declined to cycle lows. This divergence highlights a shift toward fewer, higher-value transactions, as acquirers increasingly prioritized scaled, differentiated communications platforms with deep digital asset expertise.

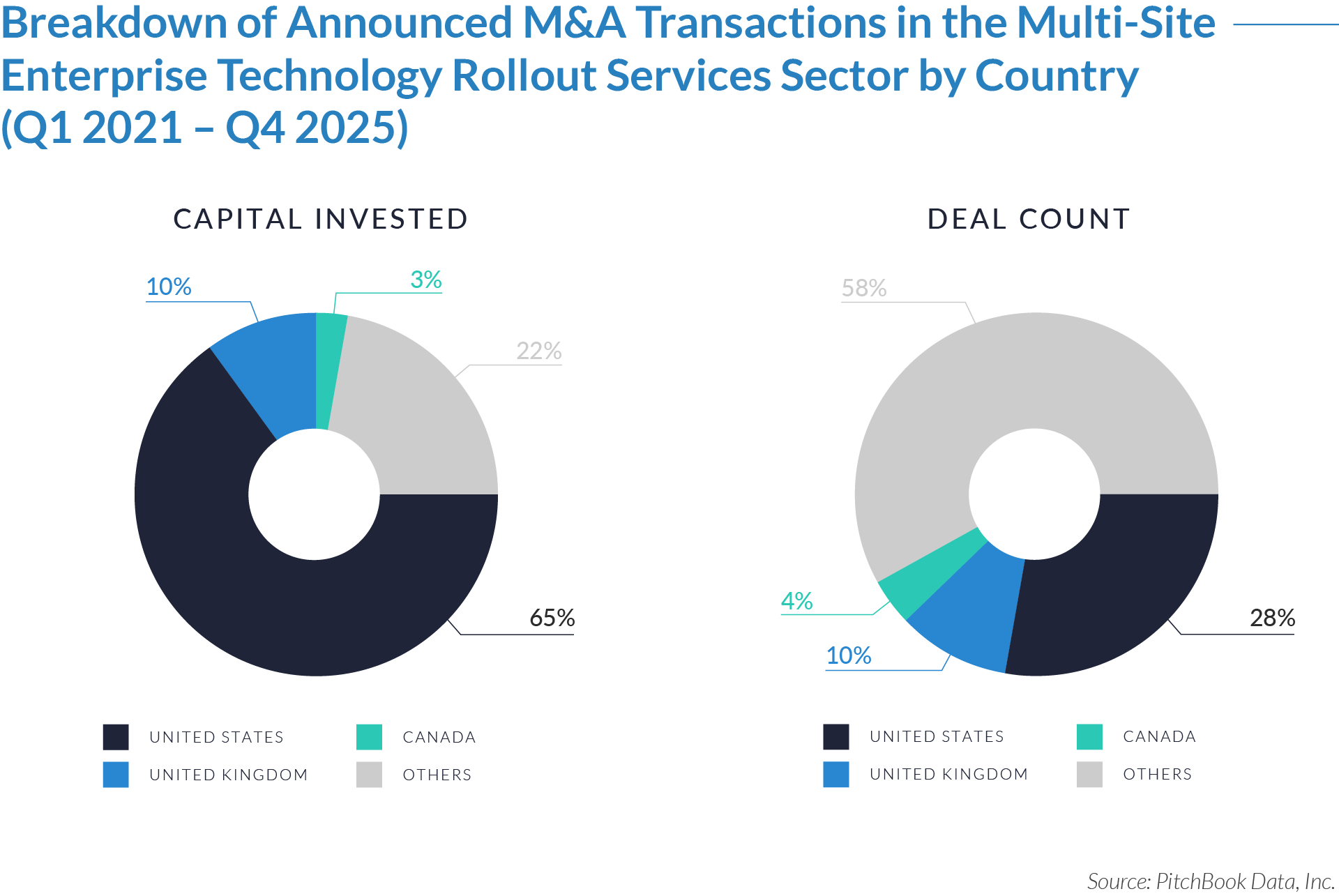

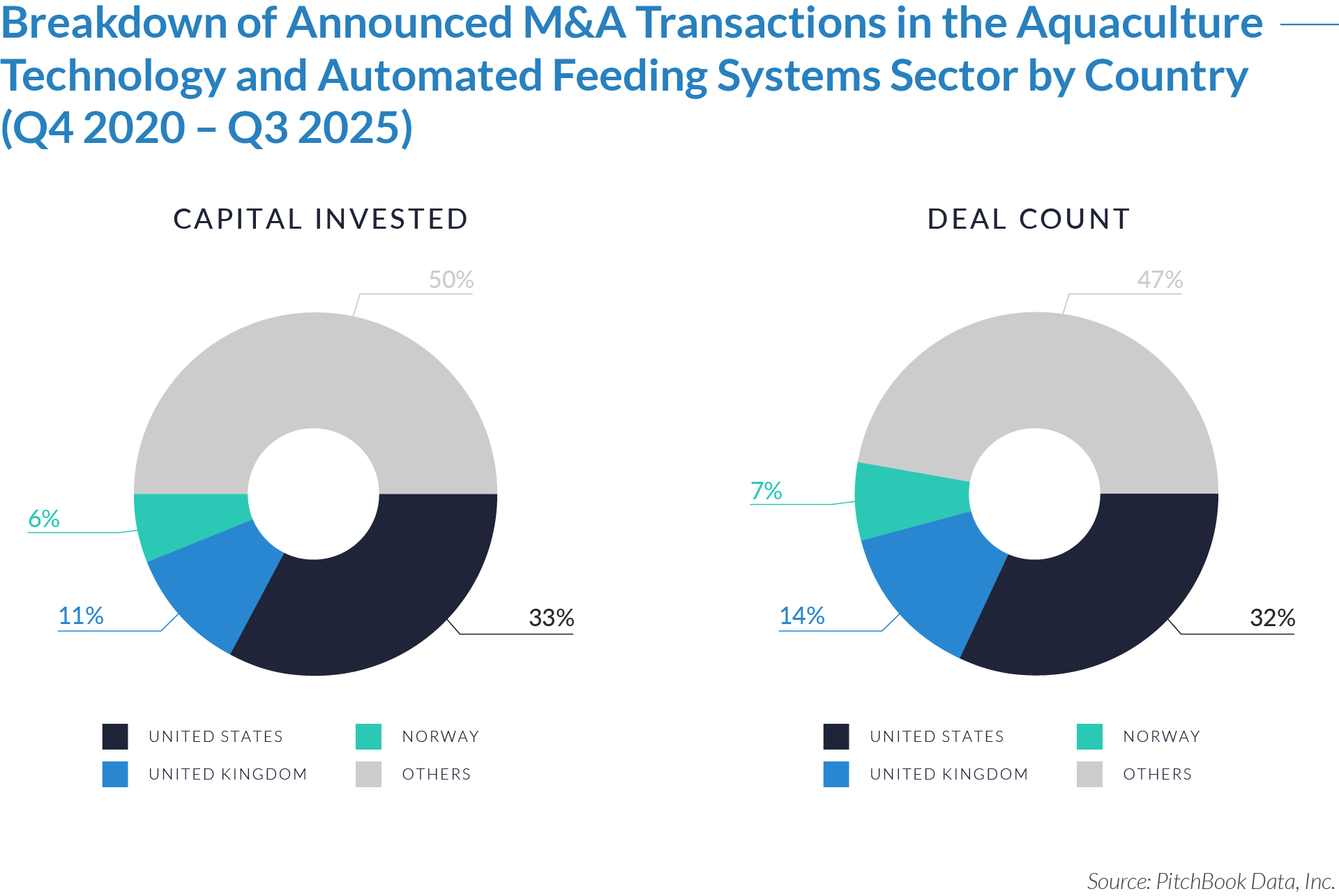

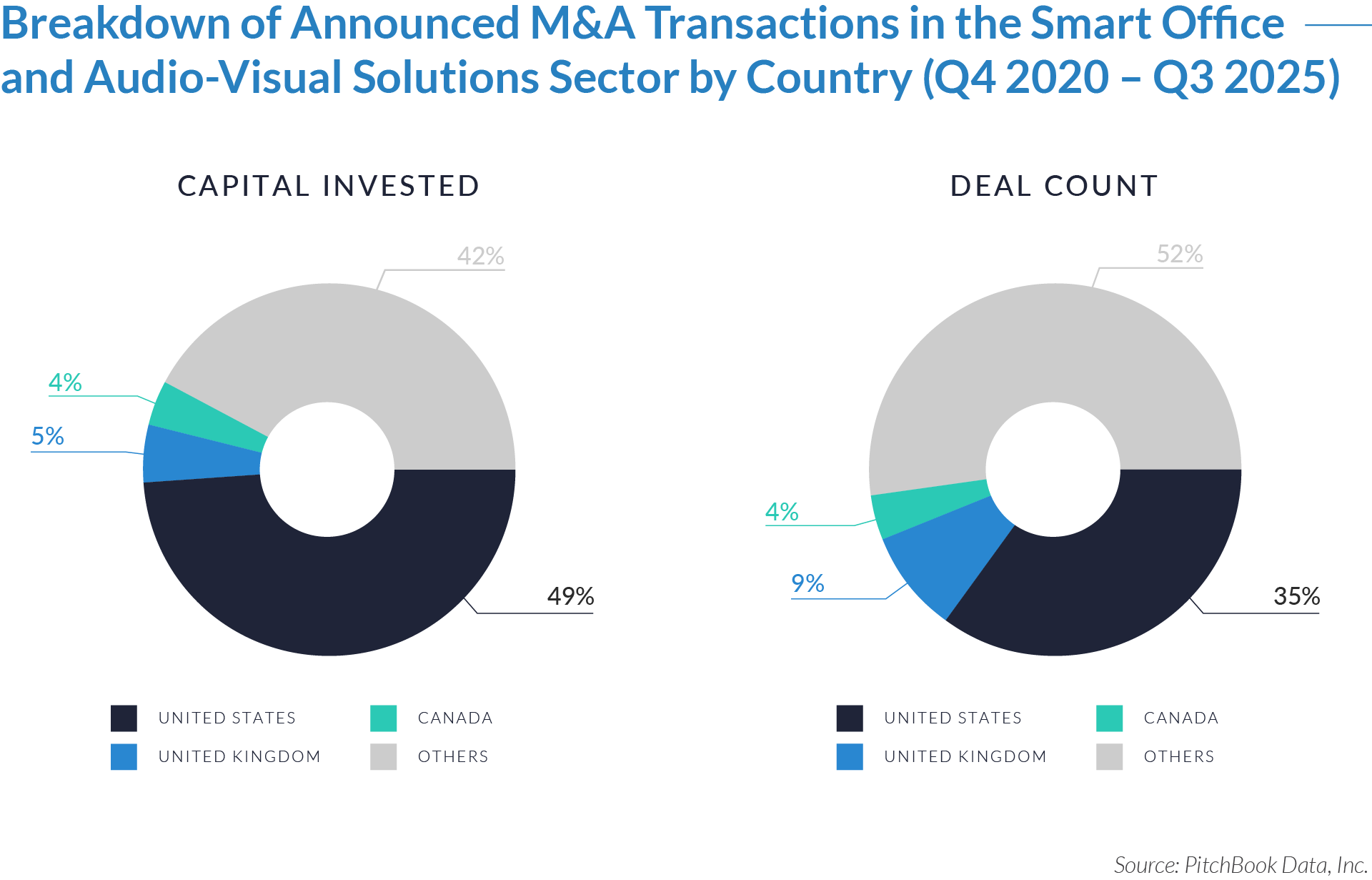

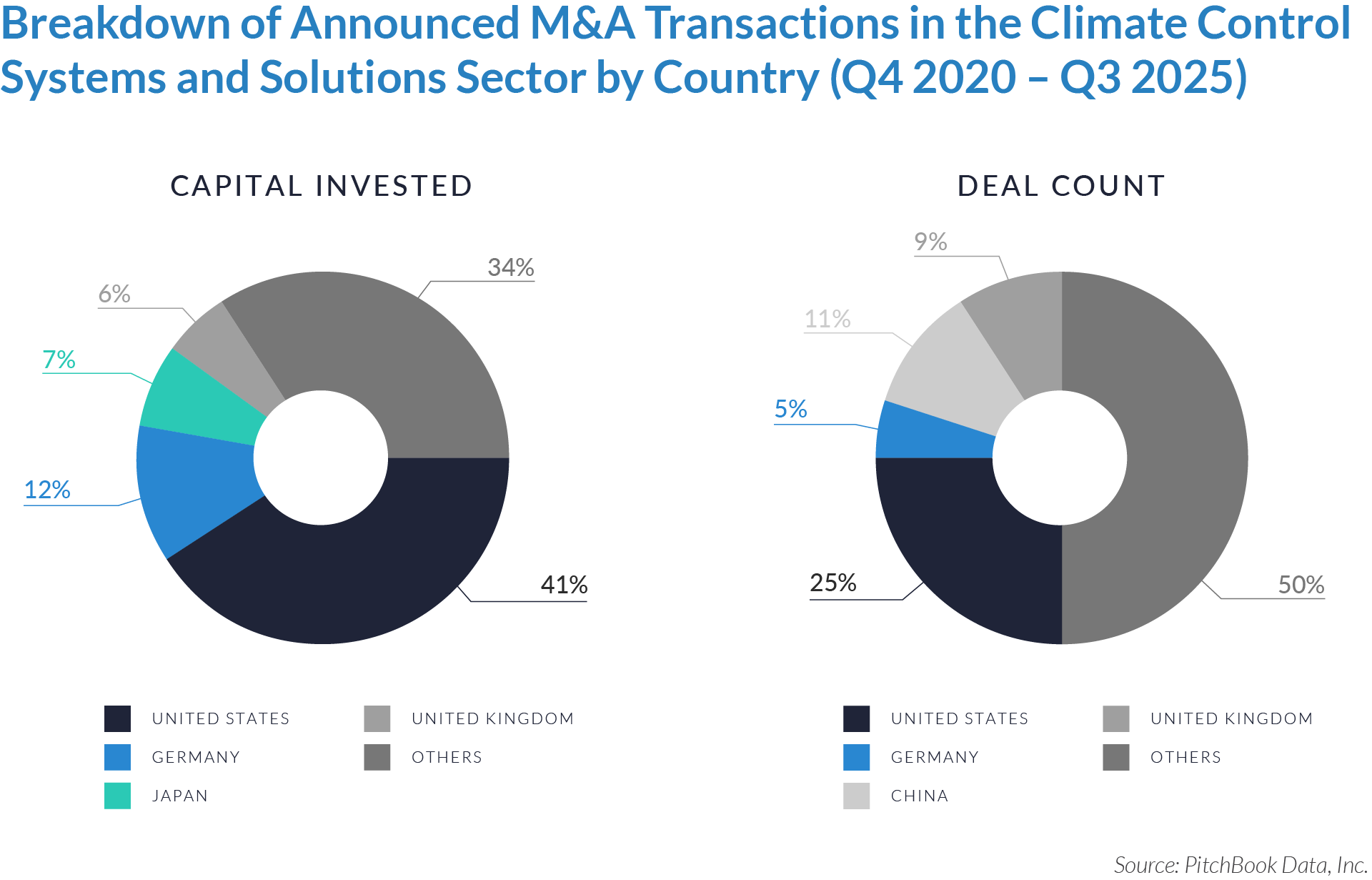

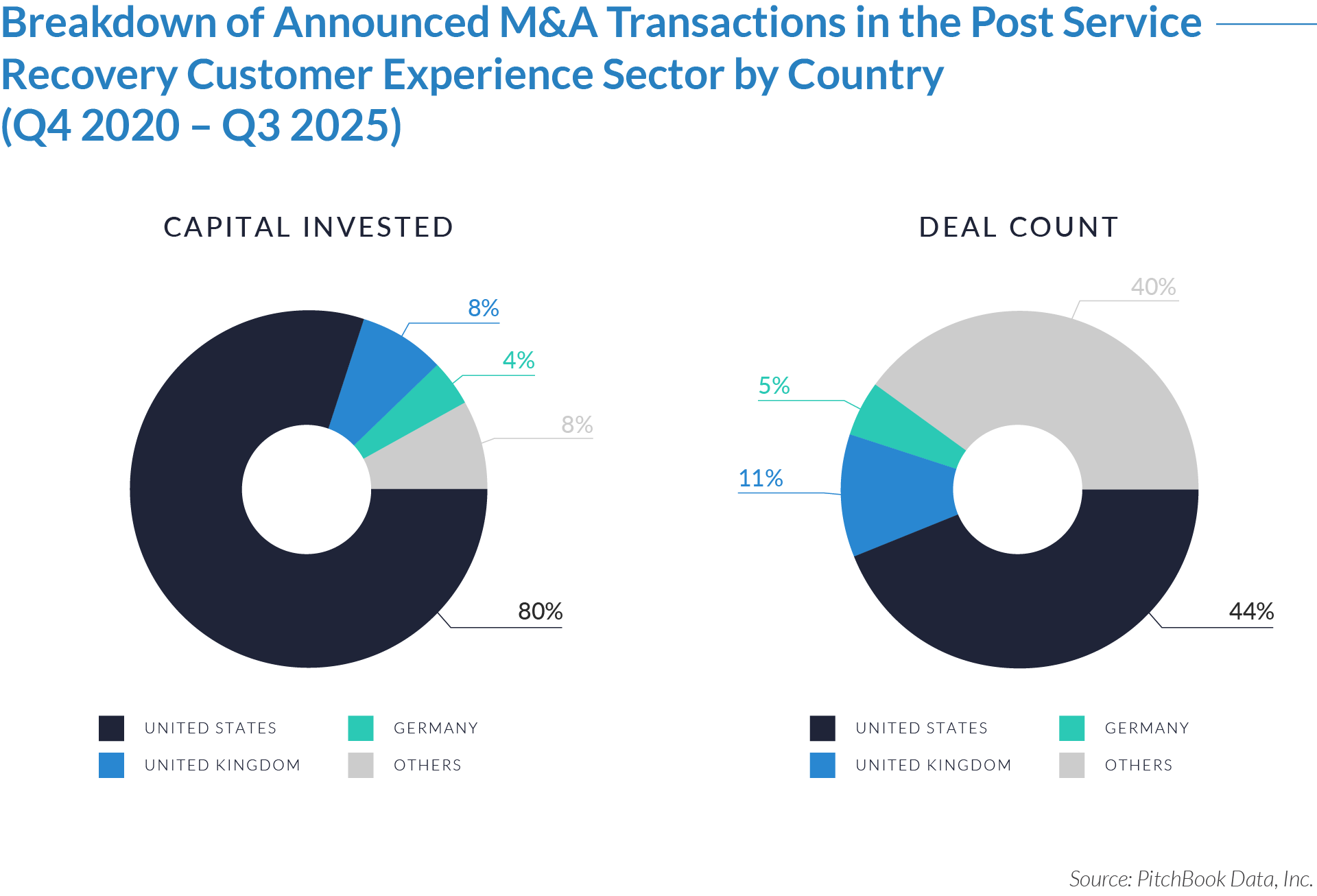

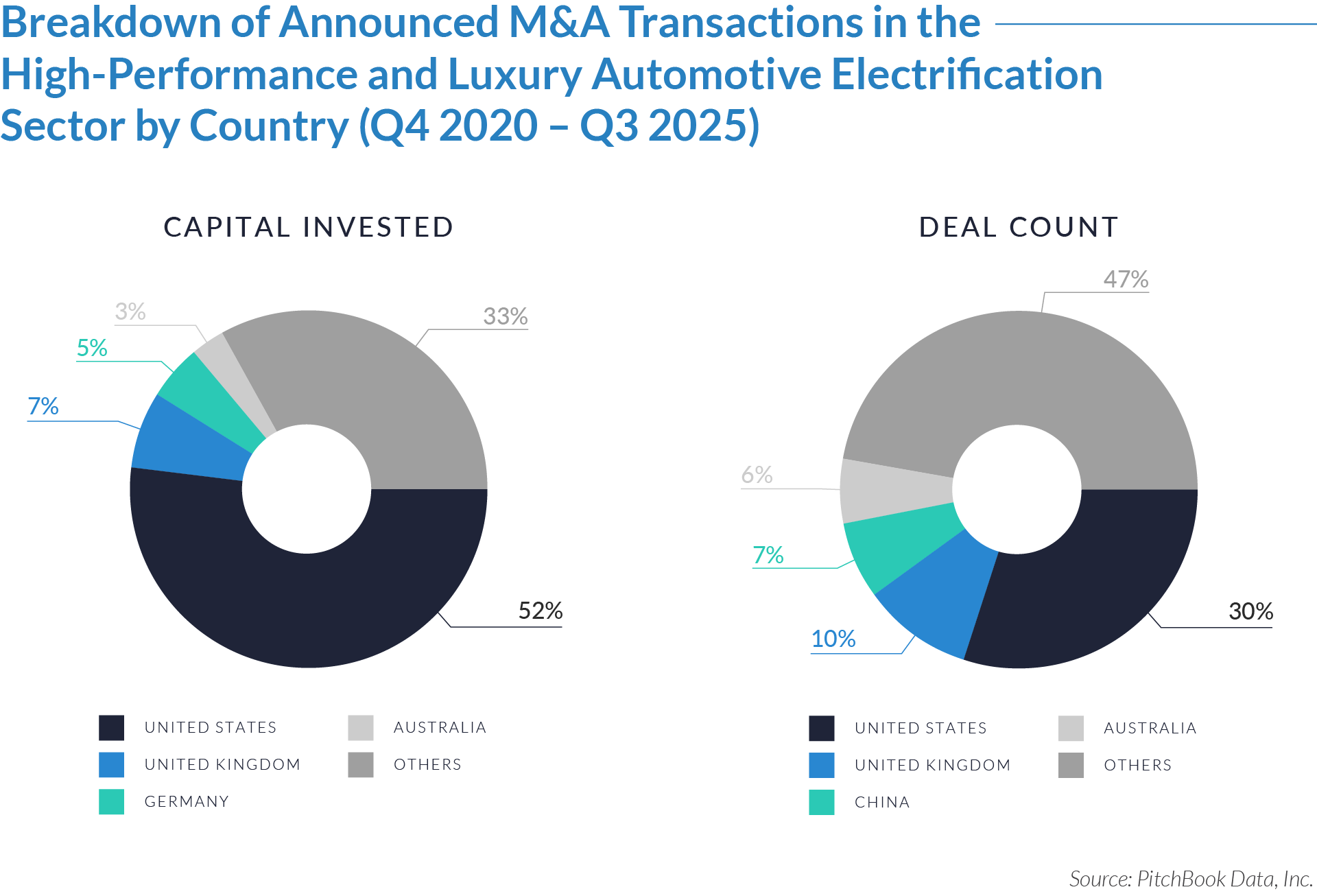

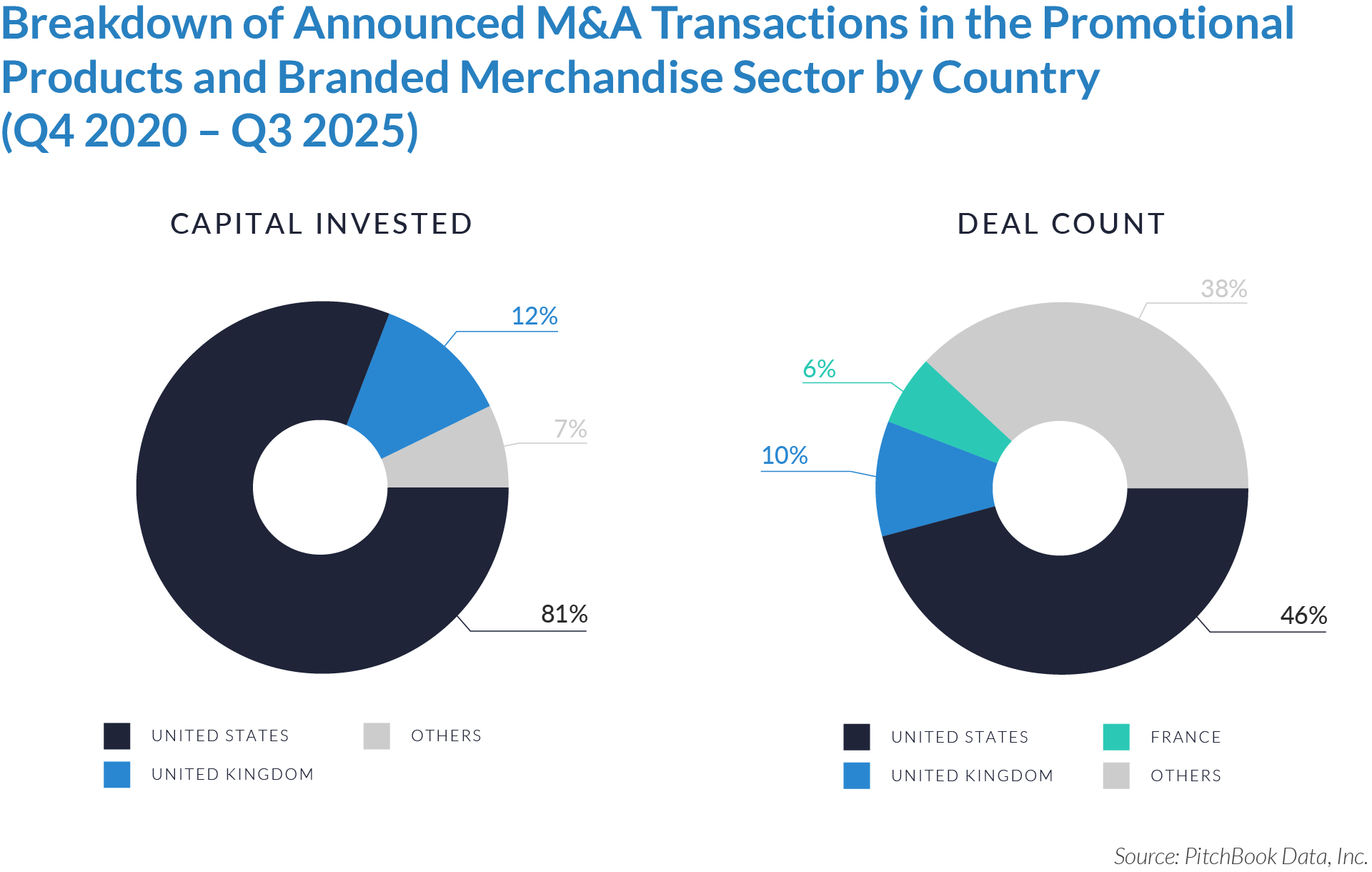

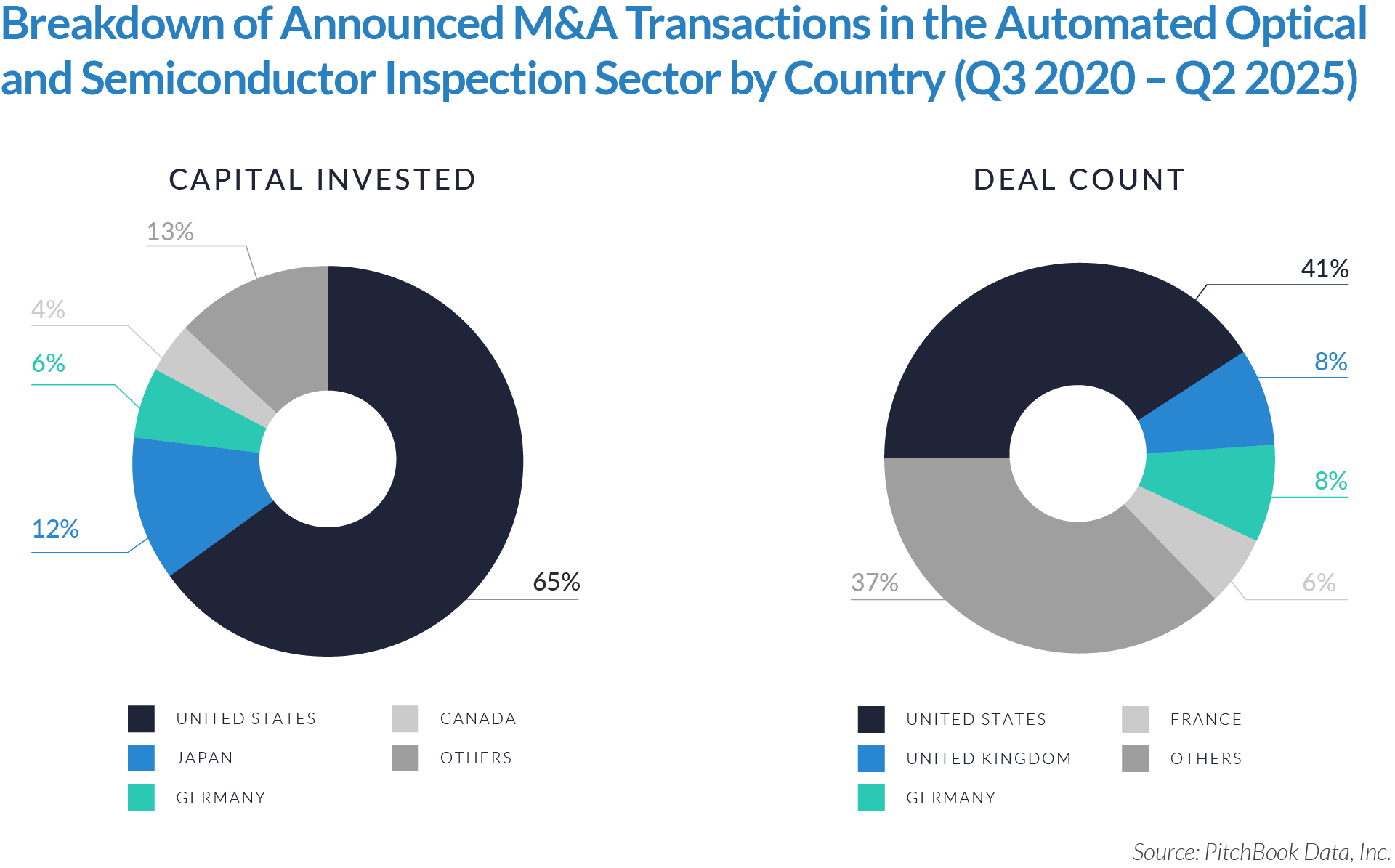

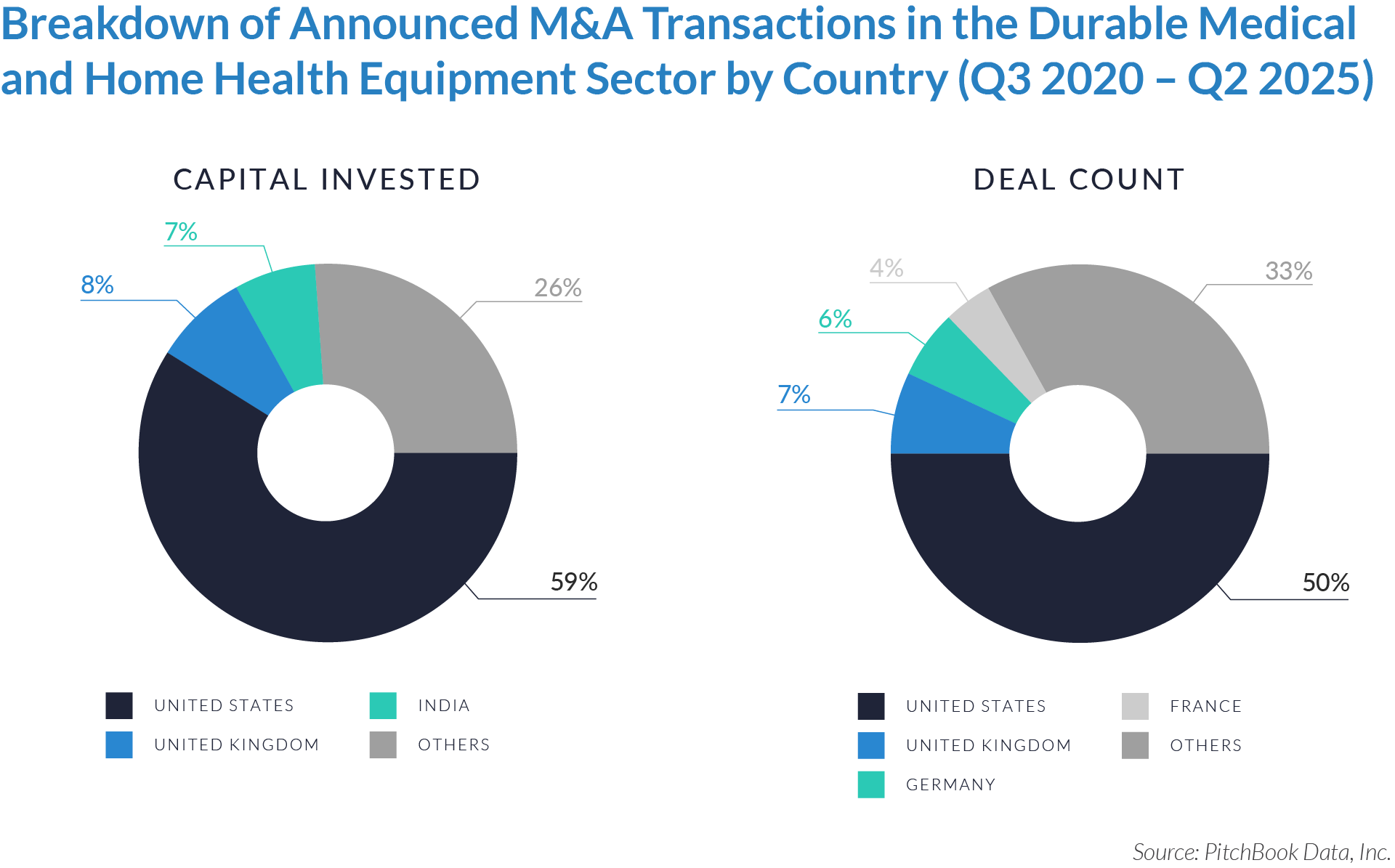

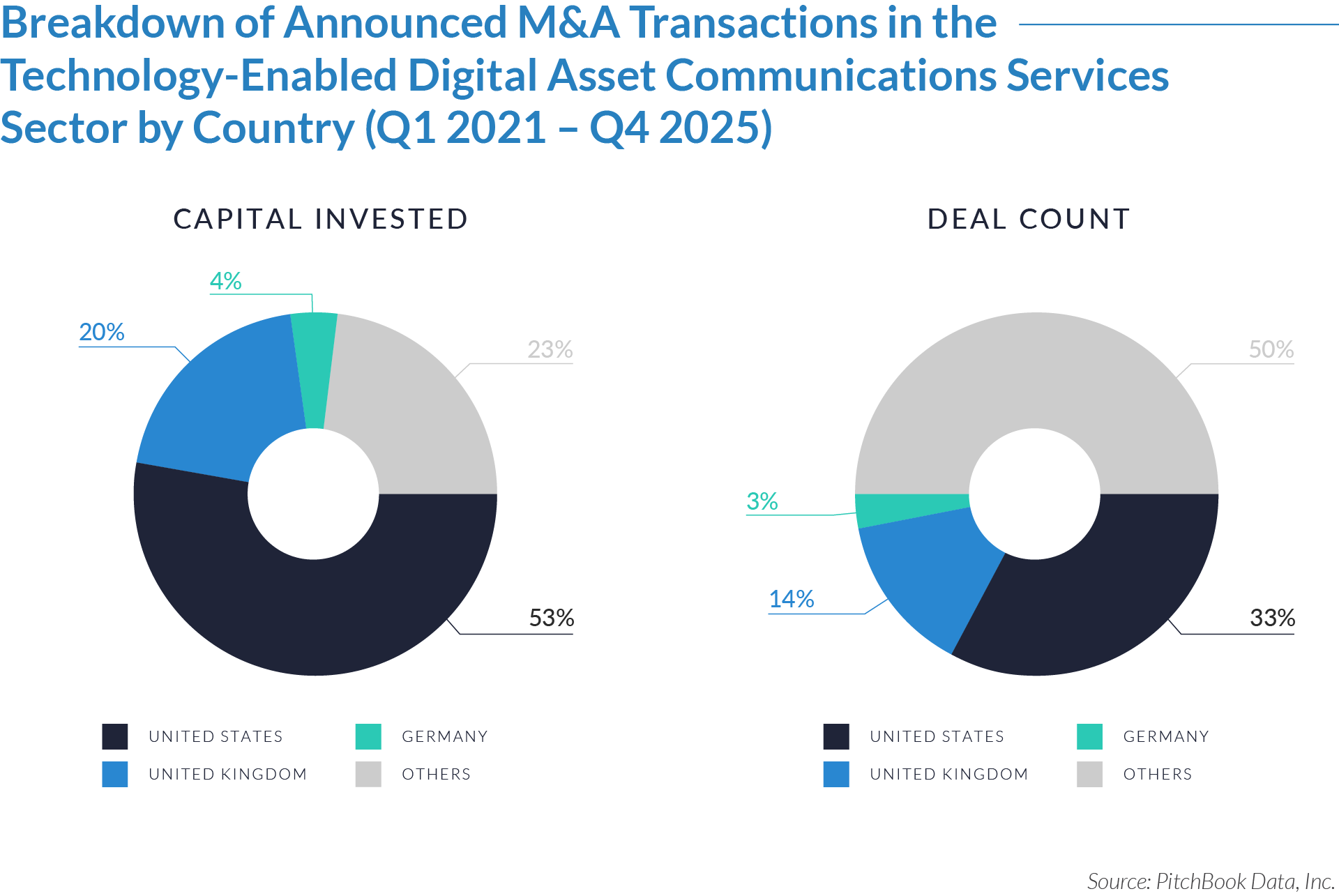

- The United States dominated capital deployment, accounting for approximately 53% of total invested capital and 33% of deal volume, reflecting a concentration of larger, higher-value transactions involving US-headquartered targets. This pattern underscores sustained buyer preference for scaled, technology-enabled, digital asset communications platforms. The US remains the sector’s primary market due to its depth of capital markets, dense concentration of digital asset companies, and outsized regulatory influence, which collectively shape global standards for narrative control, compliance messaging, and stakeholder engagement.

- The United Kingdom accounted for approximately 20% of the total capital invested and 14% of deal count, highlighting its role as a key secondary hub for digital asset communications and public affairs expertise, with activity skewed toward mid-to-large advisory-led platforms. The UK is structurally important to the sector as a global financial and regulatory crossroads, serving as a gateway to EMEA where policy dialogue, institutional trust-building, and cross-border communications are critical to digital asset adoption.

- Other emerging markets and international regions represented approximately 50% of total deal volume but only 23% of invested capital, illustrating a long tail of smaller, localized transactions and continued fragmentation outside core markets. These regions remain strategically important as emerging digital asset ecosystems and sources of future growth, offering consolidation opportunities as global acquirers seek localized expertise, regulatory fluency, and jurisdiction-specific stakeholder engagement capabilities.

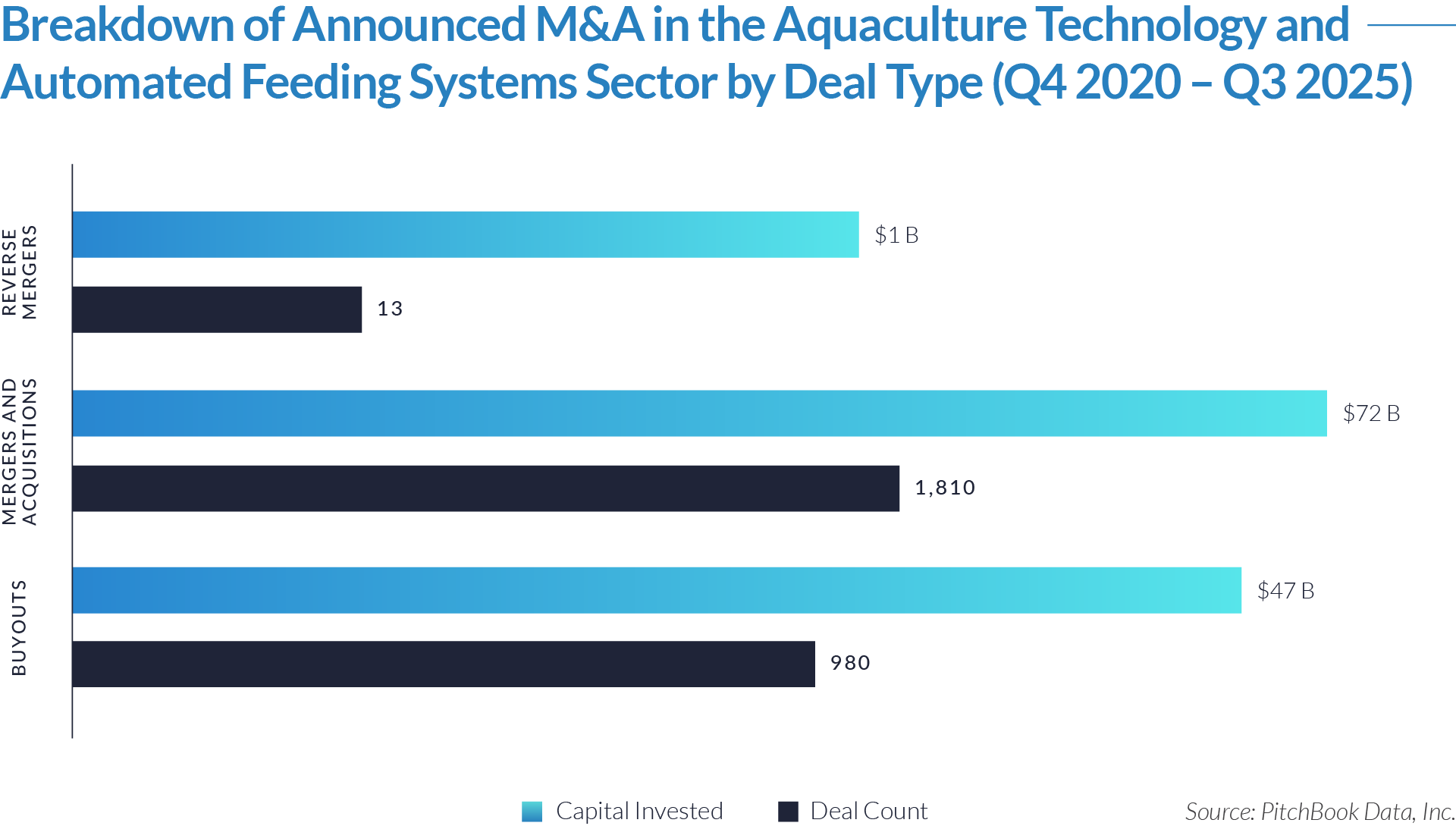

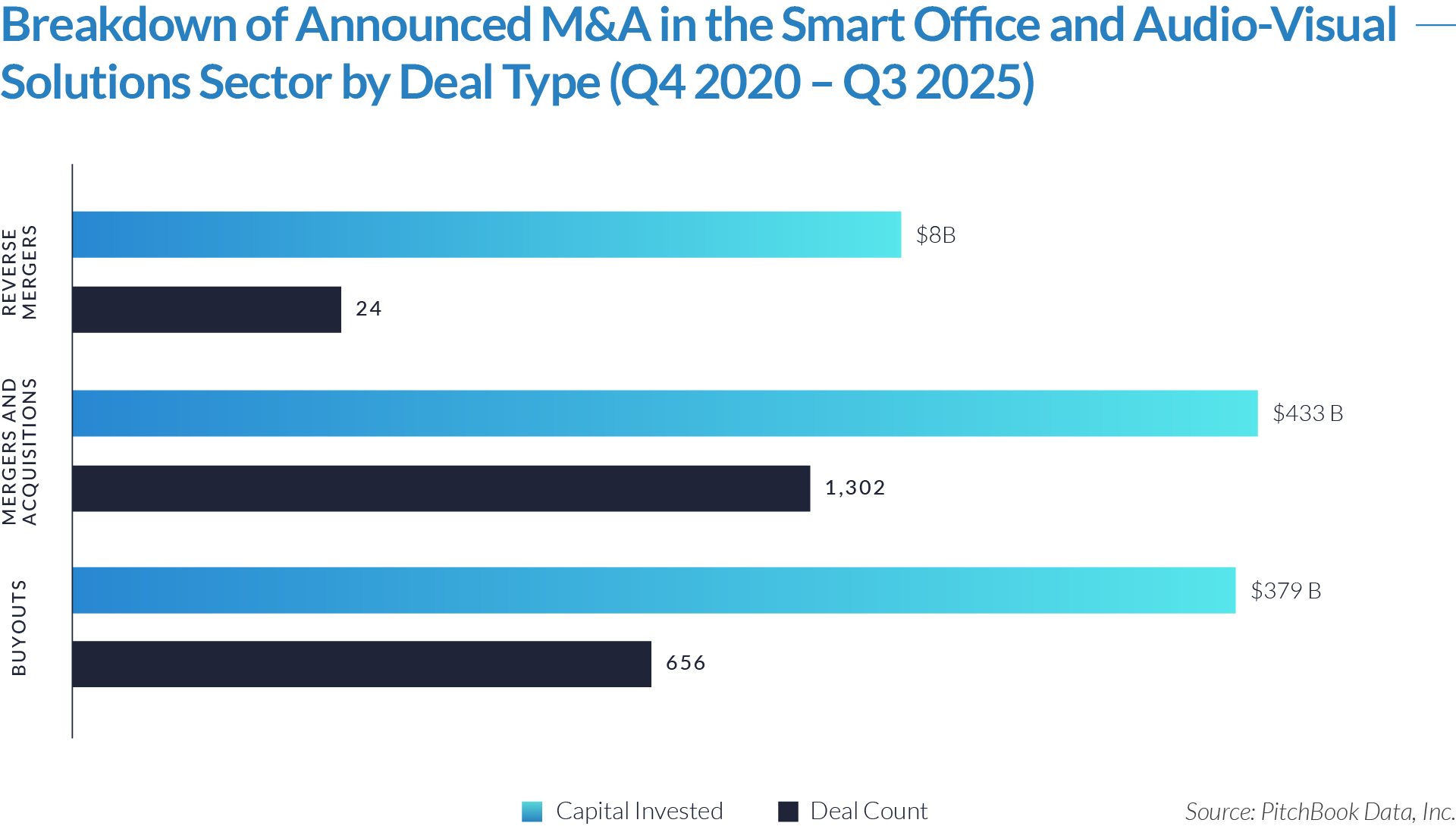

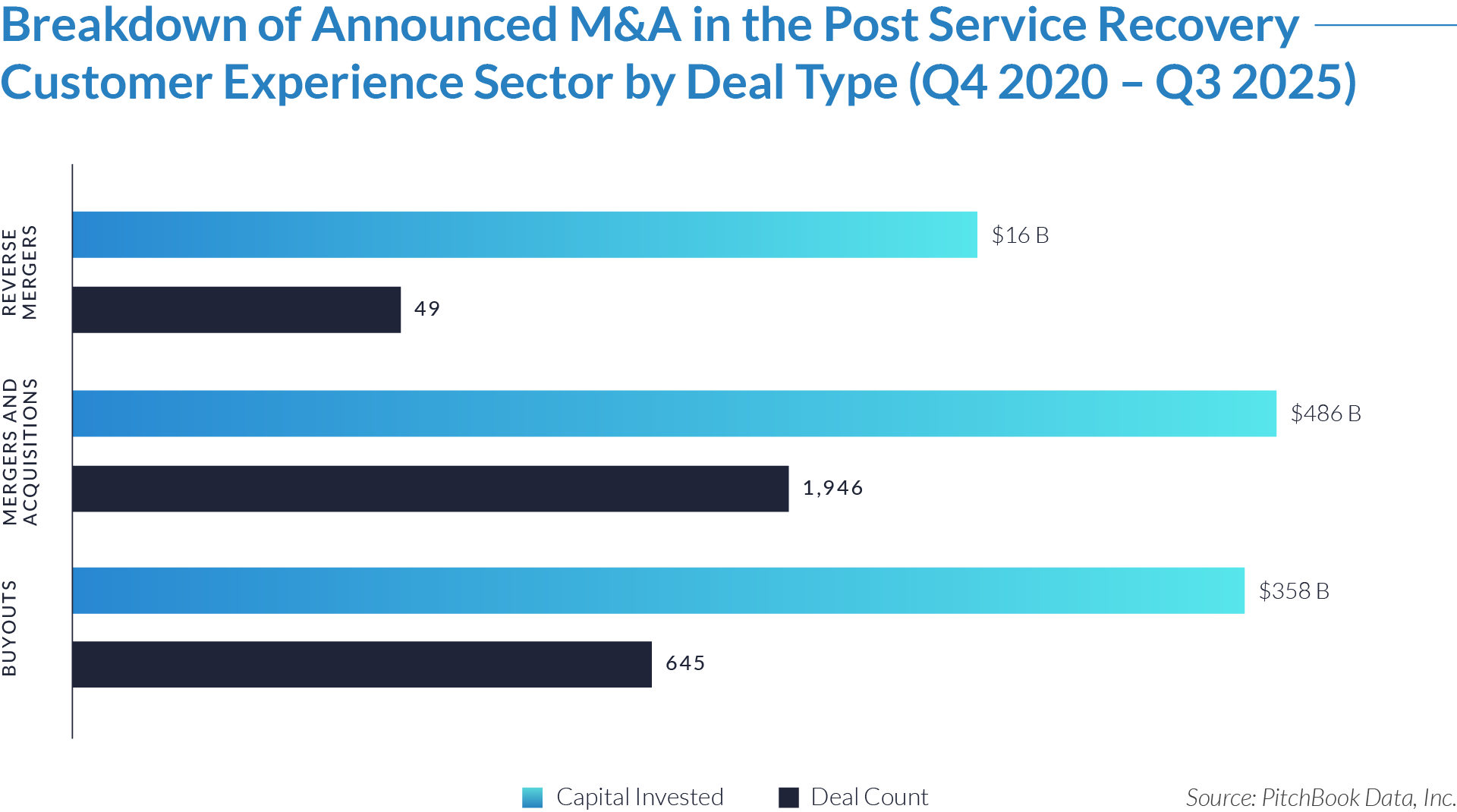

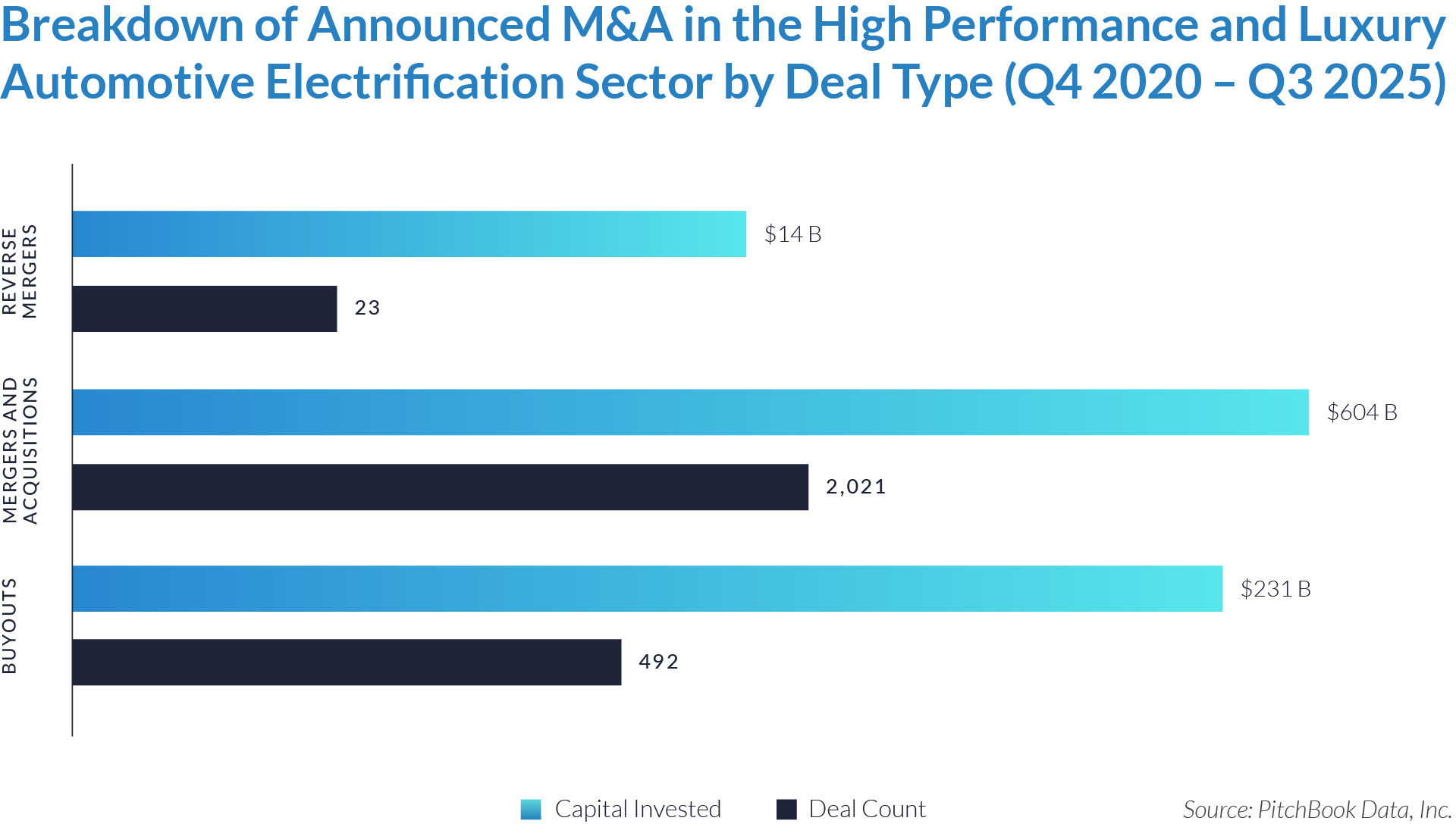

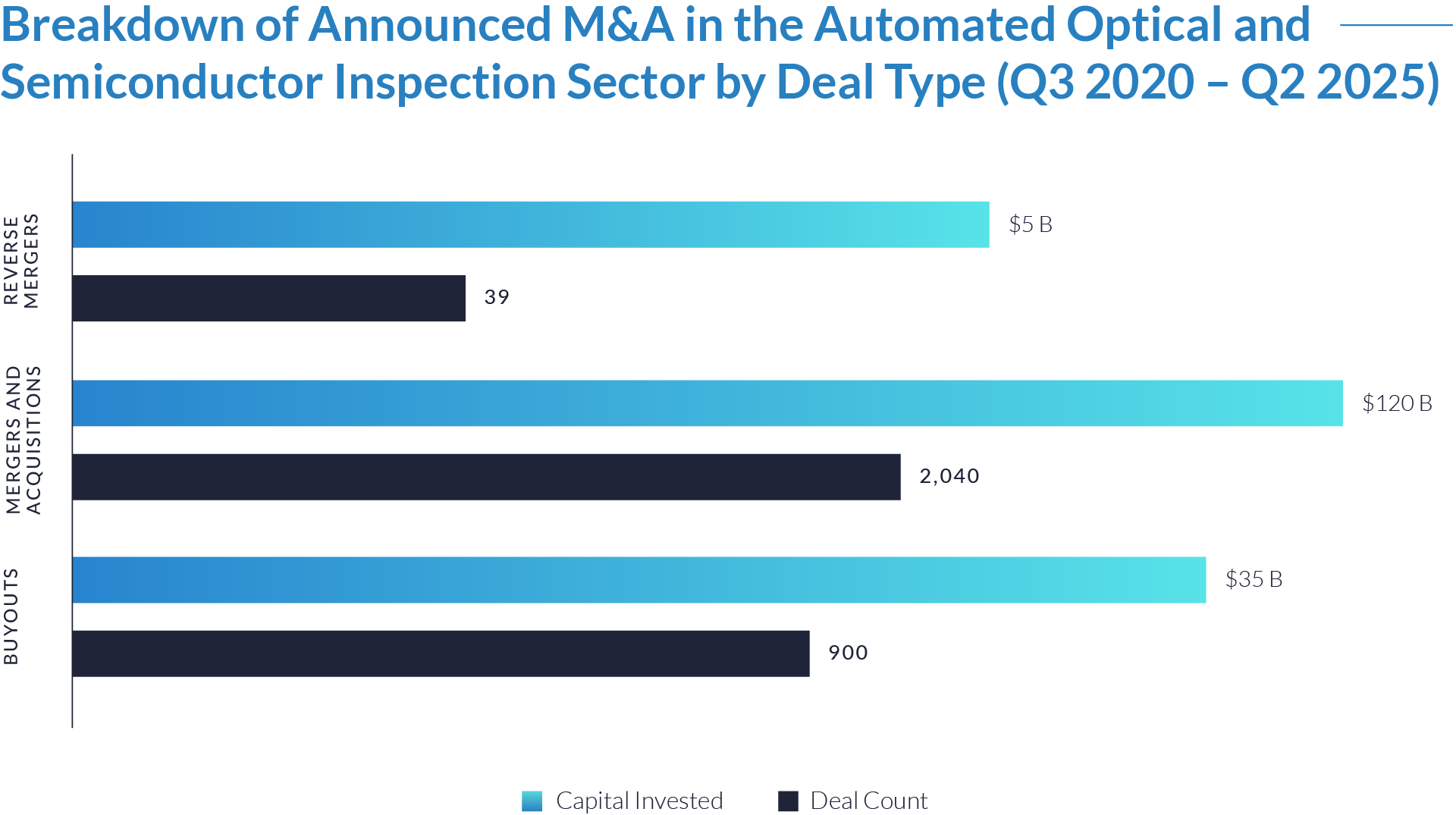

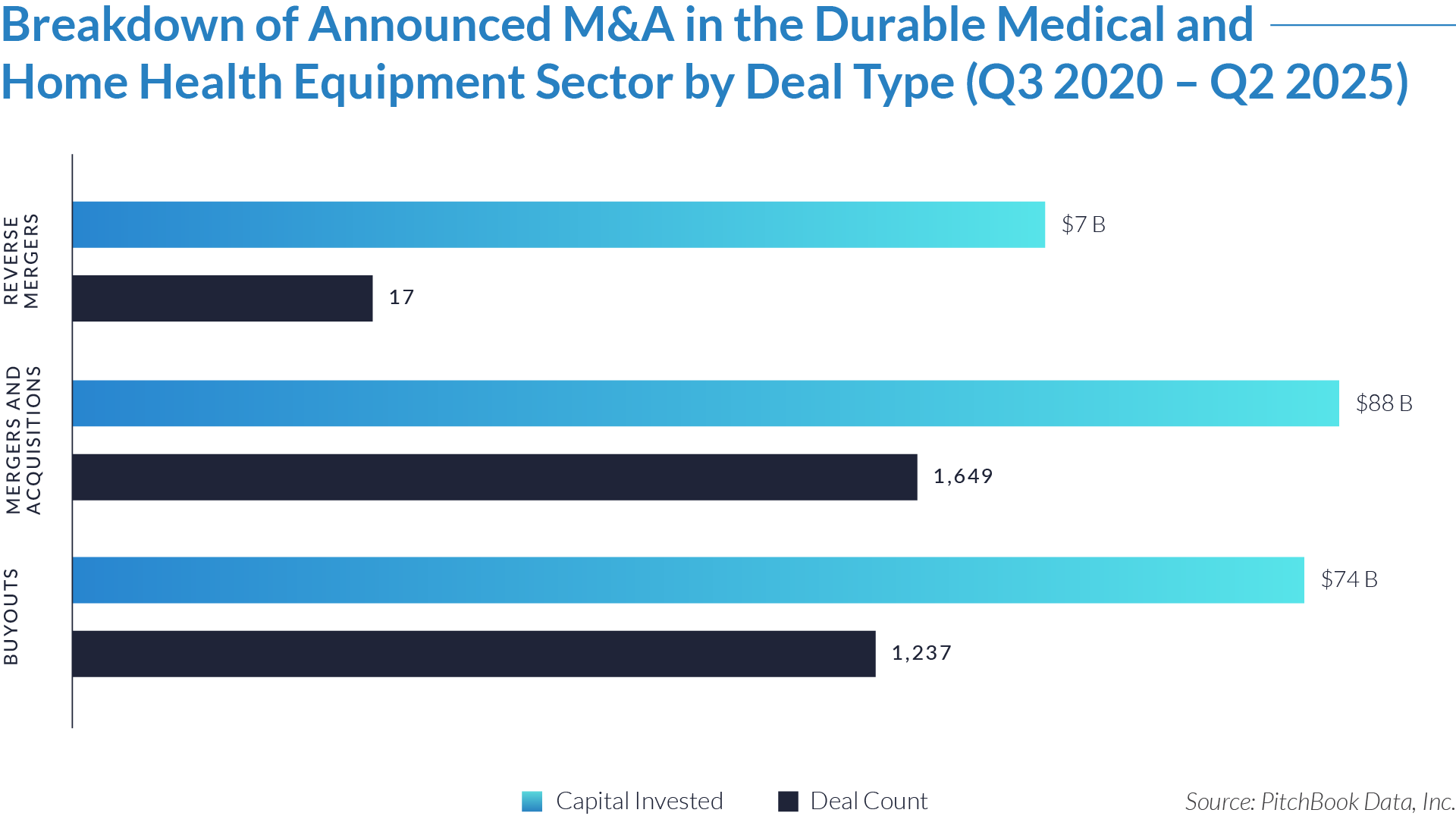

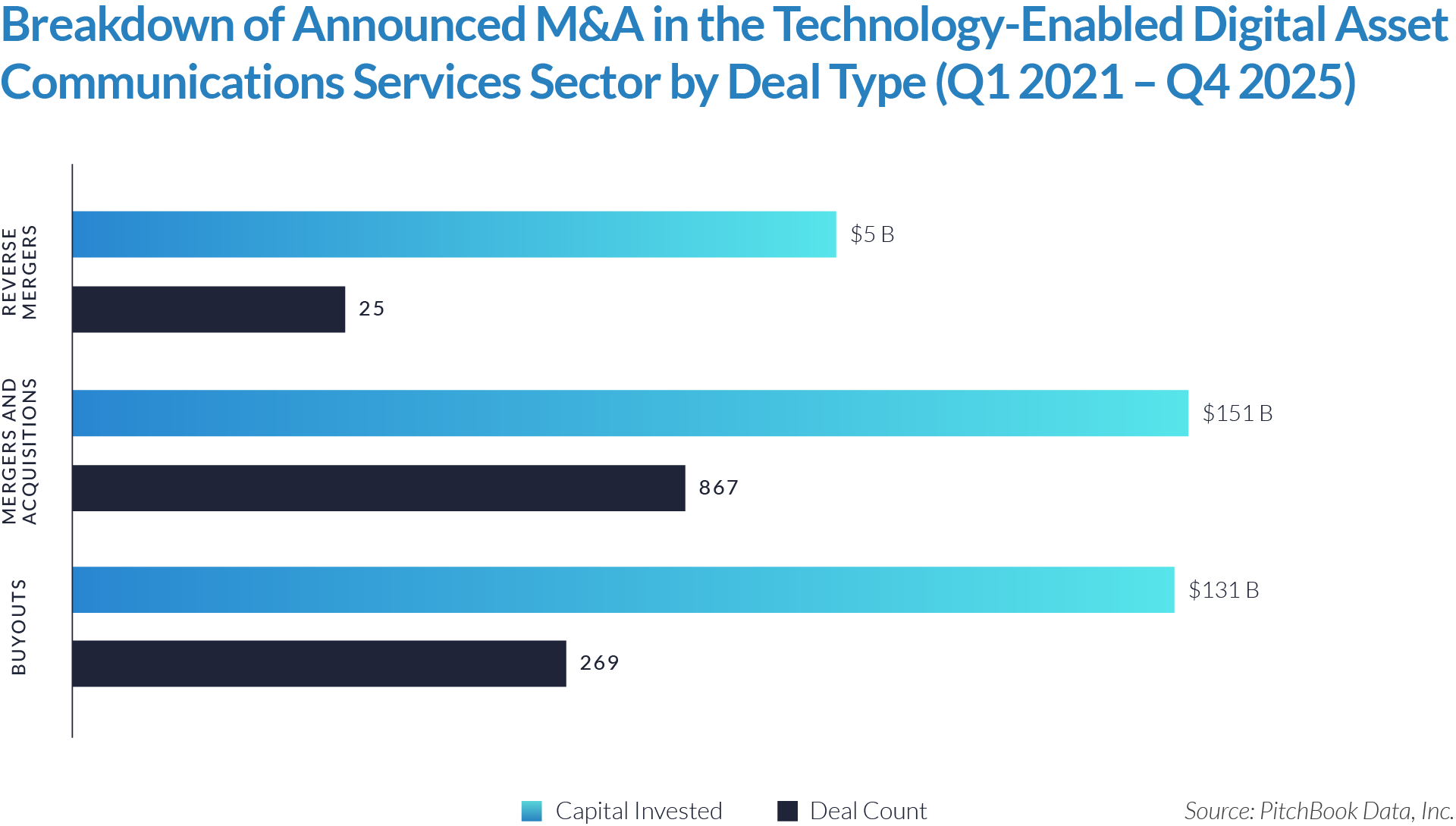

- Mergers and acquisitions accounted for most activity, totaling approximately $151 billion across 867 transactions. This reflects sustained consolidation within the technology-enabled digital asset communications services sector, as strategic acquirers prioritized capability expansion, platform build-out, and increased market scale.

- Buyout transactions represented a significant share of invested capital, with approximately $131 billion deployed across 269 deals. This underscores continued private equity interest in established, cash-generative communications and advisory platforms offering recurring revenue profiles, operational scalability, and technology-enabled service delivery.

- Reverse mergers remained limited in both capital deployment and deal volume, totaling approximately $5 billion across 25 transactions. Their constrained usage suggests these structures were primarily employed for targeted market entry, restructuring, or liquidity-driven objectives, rather than serving as a core pathway for sector-wide consolidation.

M&A Transactions Case Studies

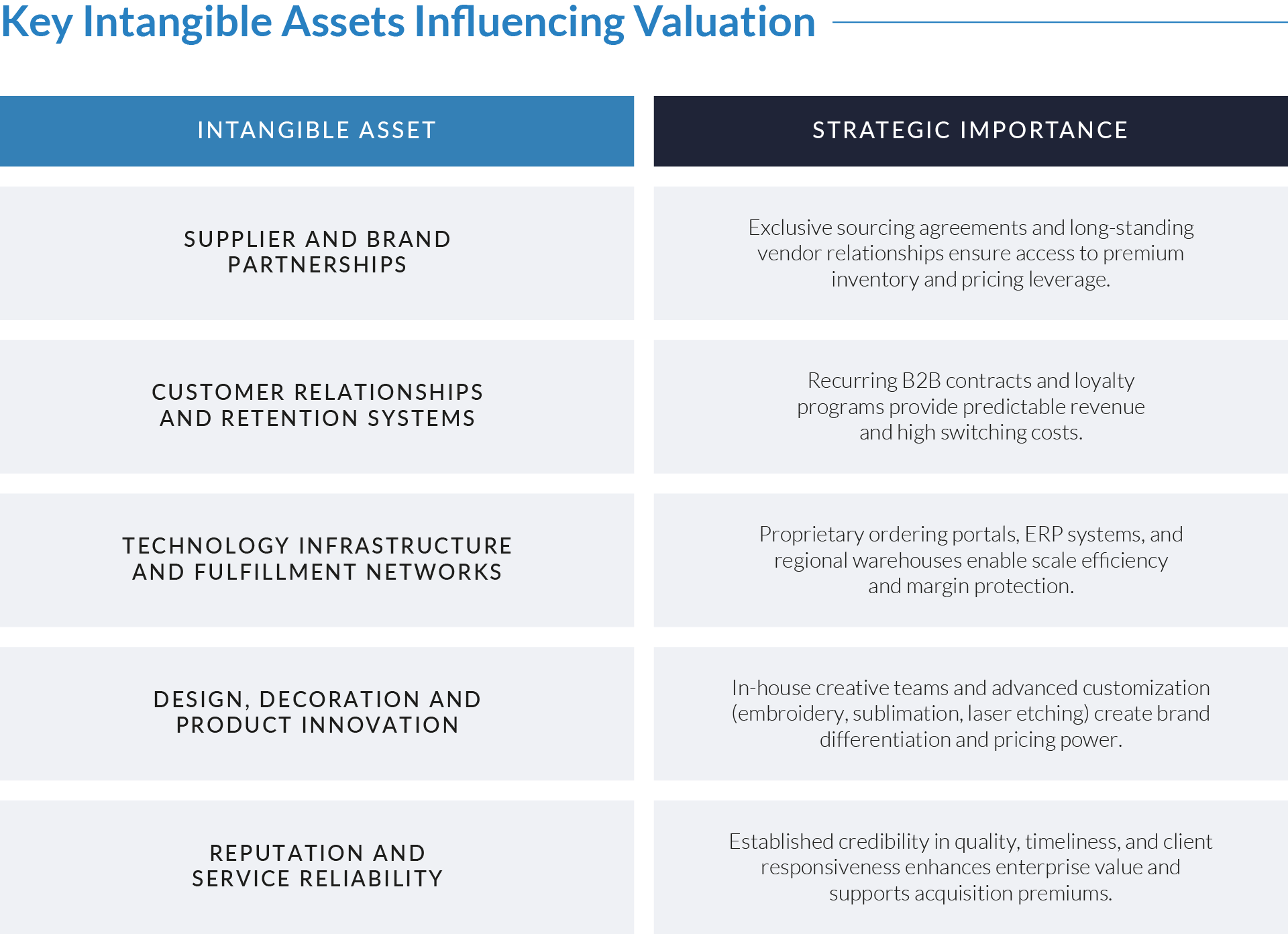

Three transactions in the technology-enabled digital asset communications services sector illustrate how acquirers are investing in advisory-led communications firms to expand capabilities, scale integrated platforms, and deepen client relationships. Buyers are targeting agencies with strong public relations, public affairs, and reputation management expertise, reflecting continued consolidation and an emphasis on building end-to-end, insight-driven communications platforms for clients operating in complex regulatory and reputational environments.

Case Study 01

STATURE PR

Stature PR is a UK-based public relations and strategic communications agency providing advisory-led services across PR, media relations, and reputation management. The firm supports corporate and public-sector clients with earned media strategy, messaging development, and stakeholder communications across traditional and digital channels. Its capabilities include campaign planning, media engagement, and issues-led communications, positioning Stature PR as a specialist earned media and PR advisory provider.

Acquirer

4media Group is a UK-based integrated communications group delivering research-driven strategy and multi-channel communications services. Operating across research, owned, earned, paid, and shared media, the group supports public-sector and corporate clients with data-led communications planning, content development, and stakeholder engagement. 4media Group positions itself as a full-service communications partner, combining insight, strategy, and execution across multiple disciplines.

Transaction Structure

4media Group acquired Stature PR on November 24, 2022, for an undisclosed amount.

Market and Customer Segments Combination

The acquisition integrated Stature PR’s specialist PR and earned media advisory capabilities into 4media Group’s broader communications platform. Stature PR gained access to 4media Group’s established public-sector and corporate client base, while 4media Group expanded its ability to deliver PR-led solutions alongside its existing research, content, and paid media offerings. The combined platform was positioned to deliver more integrated, insight-driven communications strategies across multiple channels.

Acquisition Strategic Rationale

The transaction strengthened 4media Group’s in-house PR and earned media capabilities, enhancing its end-to-end communications offering and reinforcing its integrated agency model. By acquiring a specialist PR firm, 4media Group deepened its advisory expertise, broadened service coverage across the communications lifecycle, and created incremental cross-selling opportunities. The acquisition reflected ongoing consolidation in the communications sector as clients increasingly sought integrated, research-informed solutions delivered by a single strategic partner.

Case Study 02

BEVEL

Bevel is a US-based strategic communications and public relations agency providing advisory-led services across PR, media relations, reputation management, and integrated communications. The firm specializes in serving technology, venture capital, and growth-stage clients through earned media, strategic storytelling, crisis communications, content creation, and brand visibility solutions across traditional and digital channels.

Acquirer

Avenue Z is a Miami-based strategic communications and digital media company founded by Jeffrey Herzog, focused on integrating public relations with digital marketing, data, and technology-enabled media services. The firm pursues an integrated communications platform strategy through organic growth and targeted acquisitions spanning PR, digital media, content marketing, SEO, paid media, and analytics.

Transaction Structure

Avenue Z acquired Bevel in an M&A transaction valued at approximately $75 million, completed on July 6, 2023.

Market and Customer Segments Combination

The acquisition combined Bevel’s specialized strategic communications and public relations capabilities with Avenue Z’s broader digital media and communications platform. Bevel’s advisory-led PR services enhanced Avenue Z’s ability to deliver integrated earned, owned, and paid communications solutions, particularly for technology and venture clients, while expanding the acquirer’s service coverage into strategic PR, brand narrative development, and multi-geography media engagement.

Acquisition Strategic Rationale

The transaction accelerated Avenue Z’s strategy to build an integrated communications and digital marketing services platform. By incorporating Bevel’s PR expertise, Avenue Z strengthened its ability to deliver a full-stack communications offering combining earned media, digital media, content, and analytics for clients seeking unified messaging and brand influence. The acquisition supported Avenue Z’s growth objectives by expanding its service portfolio, scaling advisory capabilities, and positioning the combined entity to deliver cohesive, cross-channel communications outcomes for technology, venture-backed, and growth-oriented clients.

Case Study 03

PAGEFIELD

Pagefield is a UK-based strategic communications and public affairs consultancy providing advisory-led services across reputation management, public policy communications, media relations, and stakeholder engagement. The firm supports corporate, financial, and public-sector clients with issues-led communications, regulatory and political advisory, campaign strategy, and narrative development. Pagefield is recognized for its expertise in high-stakes public affairs and corporate reputation management across traditional and digital channels.

Acquirer

Public Policy Holding Company (“PPHC”) is a UK-listed global public affairs and strategic communications group focused on acquiring and scaling specialist advisory firms. The group operates across government relations, public affairs, corporate communications, and regulatory advisory services, supporting multinational corporates, financial sponsors, and public-sector clients across North America, Europe, the Middle East, and Asia-Pacific.

Transaction Structure

Public Policy Holding Company acquired Pagefield on June 7, 2024, for $24 million.

Market and Customer Segments Combination

The acquisition integrated Pagefield’s UK-based public affairs and strategic communications capabilities into PPHC’s global advisory platform. Pagefield served as a foundational anchor for PPHC’s expansion across Europe, the Middle East, and Africa (EMEA), enhancing the group’s ability to deliver integrated public affairs, reputation management, and policy-driven communications solutions to multinational clients operating in complex regulatory and political environments.

Acquisition Strategic Rationale

The transaction supported PPHC’s strategy of building a scaled, advisory-led public affairs and strategic communications platform through targeted acquisitions of specialist firms. By adding Pagefield, PPHC strengthened its presence in the UK and EMEA, deepened its expertise in public policy and reputation management, and expanded its capacity to support clients navigating political, regulatory, and stakeholder-related challenges. The acquisition reflected continued consolidation within the public affairs and communications sector as clients increasingly seek globally integrated advisory partners with deep local market expertise.

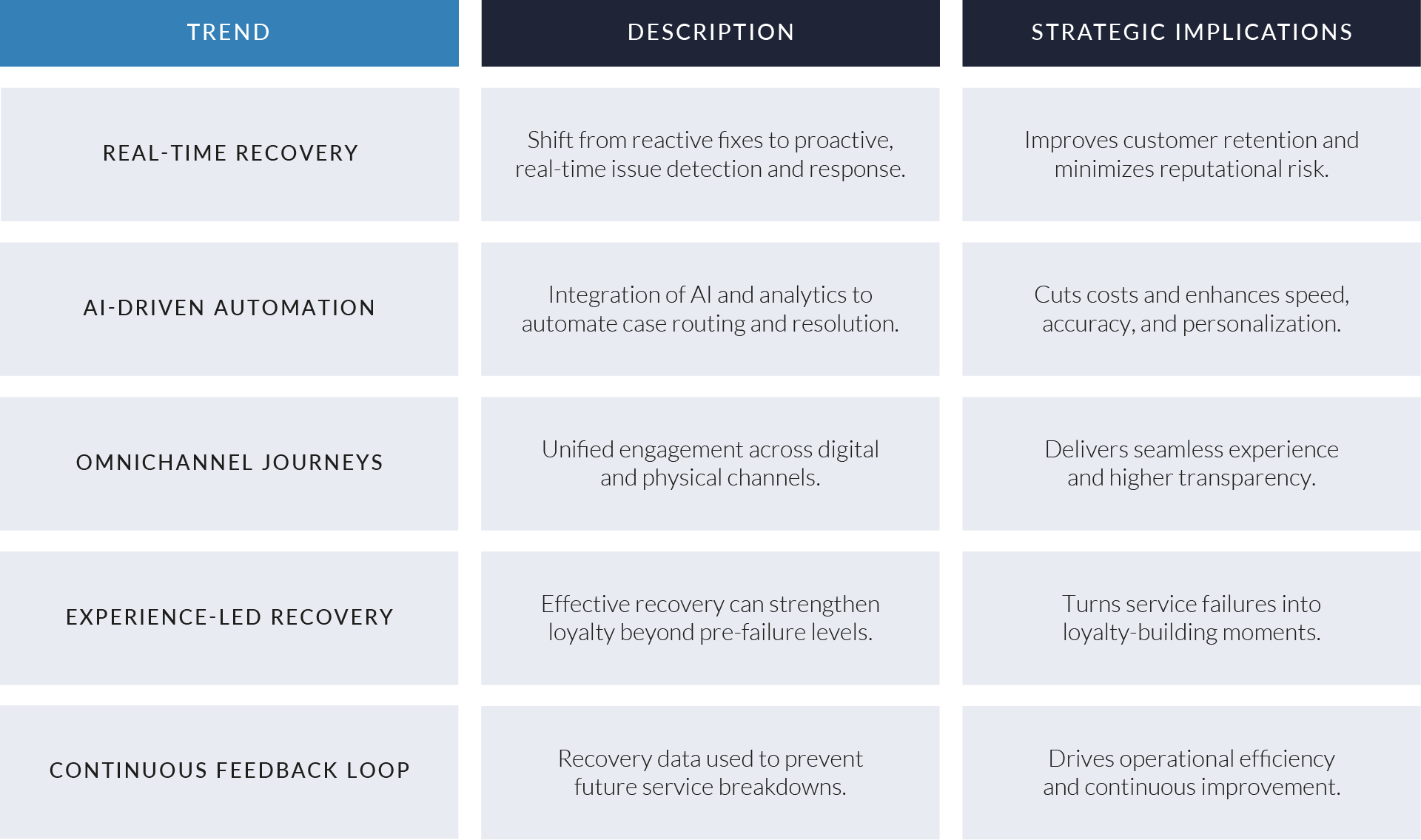

As digital asset markets mature and regulatory and reputational scrutiny intensifies, technology-enabled communications services have shifted from transactional support to a core advisory layer within the digital asset ecosystem. This shift elevates the strategic importance of agencies positioned at the intersection of narrative development, regulatory engagement, and reputation management.

Looking ahead, acquirers are expected to favor scaled, advisory-led communications platforms that embed strategic counsel into long-term client relationships, supported by technology-enabled insight and execution. Providers with regulatory fluency, integrated service capabilities, and resilience across market cycles should remain well positioned as sector consolidation continues.

Source: Research Live, PR Week, Business Wire, PPHC , Pitchbook Data.